Professional Documents

Culture Documents

Chapter 2: Basic Microeconomic Tools 1

Chapter 2: Basic Microeconomic Tools 1

Uploaded by

muhammad firmanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 2: Basic Microeconomic Tools 1

Chapter 2: Basic Microeconomic Tools 1

Uploaded by

muhammad firmanCopyright:

Available Formats

Basic Microeconomic Tools

Chapter 2: Basic Microeconomic 1

Tools

Efficiency and Market Performance

Contrast two polar cases

perfect competition

monopoly

What is efficiency?

no reallocation of the available resources makes one

economic agent better off without making some other

economic agent worse off

example: given an initial distribution of food aid will

trade between recipients improve efficiency?

Chapter 2: Basic Microeconomic 2

Tools

Focus on profit maximizing behavior of firms

Take as given the market demand curve

$/unit Maximum willingness

to pay

Equation: A

Constant

P = A - B.Q

P1 slope

linear

demand

Demand

Importance of:

time

Q1 A/B Quantity

short-run vs. long-run

willingness to pay At price P1 a consumer

will buy quantity Q1

Chapter 2: Basic Microeconomic 3

Tools

Perfect Competition

Firms and consumers are price-takers

Firm can sell as much as it likes at the ruling market price

do not need many firms

do need the idea that firms believe that their actions will not affect

the market price

Therefore, marginal revenue equals price

To maximize profit a firm of any type must equate marginal

revenue with marginal cost

So in perfect competition price equals marginal cost

Chapter 2: Basic Microeconomic 4

Tools

MR = MC

Profit is p(q) = R(q) - C(q)

Profit maximization: dp/dq = 0

This implies dR(q)/dq - dC(q)/dq = 0

But dR(q)/dq = marginal revenue

dC(q)/dq = marginal cost

So profit maximization implies MR = MC

Chapter 2: Basic Microeconomic 5

Tools

Perfect competition: an illustration

The supply curve moves to the right With market demand D2

(a) The Firm (b)With

andmarket

The marketdemand

Industry supplyDS11

Price falls and market supply

equilibrium price is S1P1

With market price PC

$/unit equilibrium

$/unitprofits exist

Entry continues while price isis Q

and quantity P1C

the firm maximizes

and quantity is QCthat

Now assume

profit by setting Existing

Long-run

MC equilibrium

firms maximize is restored

MR (= PC) = MC and demand

atprofits

price Pby

C and supply curve S2

increasing S1 to

D1 increases

producing quantity qc output

AC to q1 D2

P1 P1 S2

Excess profits induce

PC

PC

new firms to enter

the market D2

qc q1 Quantity QC Q1 QC Quantity

Chapter 2: Basic Microeconomic 6

Tools

Perfect competition: additional points

Derivation of the short-run supply curve

this is the horizontal summation of the individual firms

marginal cost curves

$/unit Firm 3

Firm 1

Example 1: Three firms

Firm 2

Firm 1: qMC

= MC/4

= 4q +- 82

q1+q2+q3

Firm 2: qMC

= MC/2

= 2q +- 84

Firm 3: qMC

= MC/6

= 6q +- 84/3

Invert these

8

Aggregate: Q= q1+q2+q3

= 11MC/12 - 22/3

MC = 12Q/11 + 8 Quantity

Chapter 2: Basic Microeconomic 7

Tools

Example 2: Eighty firms $/unit Firm i

Each firm: qMC

= MC/4

= 4q +- 82

Invert these

Aggregate: Q= 80q

Aggregate

= 20MC - 160

8

MC = Q/20 + 8

Quantity

Definition of normal profit

not the same as zero profit

implies that a firm is making the market return on the assets

employed in the business

Chapter 2: Basic Microeconomic 8

Tools

Monopoly

The only firm in the market

market demand is the firms demand

output decisions affect market clearing price

At price P1

consumers Marginal revenue from a

$/unit

buy quantity change in price is the

Loss of revenue from the

net addition to revenue

Q1 reduction in price of units

generated by the price

currently being sold (L)

P1 change = G - L

L Gain in revenue from the sale

P2 of additional units (G)

At price P2

consumers G

buy quantity Demand

Q2 Q1 Q2

Quantity

Chapter 2: Basic Microeconomic 9

Tools

Monopoly (cont.)

Derivation of the monopolists marginal revenue

Demand: P = A - B.Q $/unit

Total Revenue: TR = P.Q = A.Q - B.Q2 A

Marginal Revenue: MR = dTR/dQ

MR = A - 2B.Q

With linear demand the marginal

Demand

revenue curve is also linear with

the same price intercept

but twice the slope of the demand Quantity

curve MR

Chapter 2: Basic Microeconomic 10

Tools

Monopoly and Profit Maximization

The monopolist maximizes profit by equating marginal

revenue with marginal cost

This is a two-stage process

Stage 1: Choose output where MR = MC

$/unit

This gives output QM

Output by the

monopolist isStage

less 2: Identify the market clearing price

MC

than the perfectly

This gives price PM

competitive

PM output

AC QC MR is less than price

Price is greater than MC: loss of

Profit

efficiency

ACM Price is greater than average cost

Demand

MR

Positive economic profit

QM QC Quantity Long-run equilibrium: no entry

Chapter 2: Basic Microeconomic 11

Tools

Profit today versus profit tomorrow

Money today is not the same as money tomorrow

need way to convert tomorrows money into todays

important since firms make decisions over time

is it better to make profit now or invest for future profit?

how should investment in durable assets be judged?

sacrificing profit today imposes a cost

is this cost justified?

Techniques from financial markets can be applied

the concept of discounting and present value

Chapter 2: Basic Microeconomic 12

Tools

The concept of discounting

Take a simple example:

you have $1,000

this can be deposited in the bank at 5% per annum interest

or it can be loaned to a start-up company for one year

how much will the start-up have to contract to repay?

$1,000 x (1 + 5/100) = $1,000 x 1.05 = $1,050

More generally:

you have a sum of money Y

can generate an interest rate r per annum (in the example r = 0.05)

so it will grow to Y(1 + r) in one year

but then Y today trades for Y(1 + r) in one years time

Chapter 2: Basic Microeconomic 13

Tools

Put this another way:

assume an interest rate of 5% per annum

the start-up contracts to pay me $1,050 in one years time

how much do I have to pay for that contract today?

Answer: $1,000 since this would grow to $1,050 in one year

so in these circumstances $1,050 in one year is worth $1,000 today

the current price of the contract is $1,050/1.05 = $1,000

the present value of $1,050 in one years time at 5% is $1,000

More generally

the present value of Z in one year at interest rate r is Z/(1 + r)

The discount factor is defined as R = 1/(1 + r)

The present value of Z in one year is then R.Z

Chapter 2: Basic Microeconomic 14

Tools

What if the loan is for two years?

How much must start-up promise to repay in two years time?

$1,000 grows to $1,050 in one year

the $1,050 grows to $1,102.50 in a further year

so the contract is for $1,102.50

note: $1,102.50 = $1,000 x 1.05 x 1.05 = $1,000 x 1.052

More generally

a loan of Y for 2 years at interest rate r grows to Y(1 + r)2 = Y/R2

Y today grows to Y/R2 in 2 years

a loan of Y for t years at interest rate r grows to Y(1 + r)t = Y/Rt

Y today grows to Y/Rt in t years

Put another way

the present value of Z received in 2 years time is R2Z

the present value of Z received in t years time is RtZ

Chapter 2: Basic Microeconomic 15

Tools

Now consider how to evaluate an investment project

generates Z1 net revenue at the end of year 1

Z2 net revenue at the end of year 2

Z3 net revenue at the end of year 3 and so on for T years

What are the net revenues worth today?

Present value of Z1 is RZ1

Present value of Z2 is R2Z2

Present value of Z3 is R3Z3 ...

Present value of ZT is RTZT

so the present value of these revenue streams is:

PV = RZ1 + R2Z2 + R3Z3 + + RTZT

Chapter 2: Basic Microeconomic 16

Tools

Two special cases can be considered

Case 1: The net revenues in each period are identical

Z1 = Z2 = Z3 = = ZT = Z

Then the present value is:

Z

PV = (R - RT+1)

(1 - R)

Case 2: These net revenues are constant and perpetual

Then the present value is:

R

PV = Z = Z/r

(1 - R)

Chapter 2: Basic Microeconomic 17

Tools

Present value and profit maximization

Present value is directly relevant to profit maximization

For a project to go ahead the rule is

the present value of future income must at least cover the present

value of the expenses in establishing the project

The appropriate concept of profit is profit over the lifetime

of the project

The application of present value techniques selects the

appropriate investment projects that a firm should

undertake to maximize its value

Chapter 2: Basic Microeconomic 18

Tools

Efficiency and Surplus

Can we reallocate resources to make some individuals

better off without making others worse off?

Need a measure of well-being

consumer surplus: difference between the maximum amount a

consumer is willing to pay for a unit of a good and the amount

actually paid for that unit

aggregate consumer surplus is the sum over all units consumed and

all consumers

producer surplus: difference between the amount a producer

receives from the sale of a unit and the amount that unit costs to

produce

aggregate producer surplus is the sum over all units produced and

all producers

total surplus = consumer surplus + producer surplus

Chapter 2: Basic Microeconomic 19

Tools

Efficiency and surplus: illustration

$/unit

The demand curve measures the

Competitive

willingness to pay for each unit

Consumer surplus is the area Supply

between the demand curve and the

equilibrium price

Consumer

Equilibrium occurs

The supply curve measures the surplus

PC where supply equals

marginal cost of each unit demand: price PC

Producer

Producer surplus is the area quantity QC

surplus

between the supply curve and the

equilibrium price

Demand

Aggregate surplus is the sum of

consumer surplus and producer surplus

The competitive equilibrium is QC Quantity

efficient

Chapter 2: Basic Microeconomic 20

Tools

Illustration (cont.)

Assume that a greater quantity QG $/unit

is traded The net effect is a Competitive

Price falls to PG reduction in total Supply

surplus

Producer surplus is now a positive

part

and a negative part

PC

Consumer surplus increases PG

Part of this is a transfer from

producers Demand

Part offsets the negative producer

surplus

QC QG Quantity

Chapter 2: Basic Microeconomic 21

Tools

Deadweight loss of Monopoly

$/unit

Assume that the industry is

monopolized Competitive

The monopolist sets MR = MC to Supply

give output QM This is the deadweight

loss of monopoly

The market clearing price is PM

PM

Consumer surplus is given by this

area

And producer surplus is given by PC

this area

The monopolist produces less Demand

surplus than the competitive

industry. There are mutually

beneficial trades that do not take QM QC MR Quantity

place: between QM and QC

Chapter 2: Basic Microeconomic 22

Tools

Deadweight loss of Monopoly (cont.)

Why can the monopolist not appropriate the deadweight

loss?

Increasing output requires a reduction in price

this assumes that the same price is charged to everyone.

The monopolist creates surplus

some goes to consumers

some appears as profit

The monopolist bases her decisions purely on the surplus

she gets, not on consumer surplus

The monopolist undersupplies relative to the competitive

outcome

The primary problem: the monopolist is large relative to

the market

Chapter 2: Basic Microeconomic 23

Tools

A Non-Surplus Approach

Take a simple example

Monopolist owns two units of a valuable good

There are 50,000 potential buyers

Reservation prices:

Number of Buyers Reservation Price

First 200 $50,000

Next 40,000 $30,000

Last 9,800 $10,000

Both units will be sold at $50,000; no deadweight loss

Why not? Monopolist is small relative to the market.

Chapter 2: Basic Microeconomic 24

Tools

Example (cont.)

Monopolist has 200 units

Reservation prices:

Number of Buyers Reservation Price

First 100 $50,000

Next 40,000 $15,000

Last 9,900 $10,000

Now there is a loss of efficiency and so deadweight loss

no matter what the monopolist does.

Chapter 2: Basic Microeconomic 25

Tools

You might also like

- Essential Graphs For MicroeconomicsDocument12 pagesEssential Graphs For MicroeconomicsSayed Tehmeed AbbasNo ratings yet

- Cheat Sheet PMDocument2 pagesCheat Sheet PMhanifakihNo ratings yet

- CPA Review Notes 2019 - BEC (Business Environment Concepts)From EverandCPA Review Notes 2019 - BEC (Business Environment Concepts)Rating: 4 out of 5 stars4/5 (9)

- Chapter 1 Fundamentals of Managerial Economics PDFDocument25 pagesChapter 1 Fundamentals of Managerial Economics PDFNeni BangunNo ratings yet

- Applied Corporate Finance. What is a Company worth?From EverandApplied Corporate Finance. What is a Company worth?Rating: 3 out of 5 stars3/5 (2)

- Data Mining in The Insurance Industry - Solving Business Problems Using SAS Enterprise Miner SoftwareDocument20 pagesData Mining in The Insurance Industry - Solving Business Problems Using SAS Enterprise Miner SoftwareShehan1No ratings yet

- Black Soldier Fly Larvae-Based Fish Feed Production Financial Feasibility and Acceptability AnalysisDocument117 pagesBlack Soldier Fly Larvae-Based Fish Feed Production Financial Feasibility and Acceptability AnalysisjayaniNo ratings yet

- Social Cost Benefit AnalysisDocument60 pagesSocial Cost Benefit AnalysisAmmrita SharmaNo ratings yet

- Module 4 PARTNERSHIP LiquidationFEB 2021Document53 pagesModule 4 PARTNERSHIP LiquidationFEB 2021Grace RoqueNo ratings yet

- IBDP Economic HL Chapter 7 NotesDocument8 pagesIBDP Economic HL Chapter 7 NotesAditya Rathi100% (1)

- HSBC 1billon Euro e Clear 16 Pages of SBLC 62+2% LoiDocument12 pagesHSBC 1billon Euro e Clear 16 Pages of SBLC 62+2% LoiKaran LA100% (2)

- PLCR TutorialDocument2 pagesPLCR TutorialSyed Muhammad Ali SadiqNo ratings yet

- Assessment ProcessDocument2 pagesAssessment ProcessAltheaVergaraNo ratings yet

- Corporation Liquidation NotesDocument7 pagesCorporation Liquidation Notesiptrcrml100% (1)

- Industrial EconomicsDocument20 pagesIndustrial Economicsjayani67% (6)

- 2013 A Level H2 Essays PDFDocument28 pages2013 A Level H2 Essays PDFKatie Bell100% (2)

- Managerial Economics & Business StrategyDocument23 pagesManagerial Economics & Business StrategySuryadyDarsonoNo ratings yet

- Cost-Benefit Analysis: Public EconomicsDocument48 pagesCost-Benefit Analysis: Public EconomicsPooja GuptaNo ratings yet

- Economics For Managers: Session 1 The Fundamentals of Managerial EconomicsDocument24 pagesEconomics For Managers: Session 1 The Fundamentals of Managerial EconomicsVipulNo ratings yet

- Capital: Microeconomic TheoryDocument67 pagesCapital: Microeconomic TheoryJennifer Gabrielle IrawanNo ratings yet

- Topic2 CompDocument18 pagesTopic2 CompirelandtharunNo ratings yet

- Project Management - Lecturenote - C2 Business CaseDocument58 pagesProject Management - Lecturenote - C2 Business CaseTâm ĐặngNo ratings yet

- MONOPOLY Market Spring 2022Document50 pagesMONOPOLY Market Spring 2022Abid SunnyNo ratings yet

- Engineering EconDocument11 pagesEngineering Econkeeno manzanoNo ratings yet

- Perfect Competition Long Run: Chapter 10-2Document17 pagesPerfect Competition Long Run: Chapter 10-2subhasispanda18No ratings yet

- Chapter 2 - How To Calculate Present ValuesDocument36 pagesChapter 2 - How To Calculate Present ValuesDeok NguyenNo ratings yet

- How To Calculate Present Values: Principles of Corporate FinanceDocument41 pagesHow To Calculate Present Values: Principles of Corporate FinanceSalehEdelbiNo ratings yet

- ECON 251: Exam 2 Review: Spring 2020 Kelly BlanchardDocument21 pagesECON 251: Exam 2 Review: Spring 2020 Kelly Blanchardbrinda mehtaNo ratings yet

- MIT14 01F18 Lec18 25Document11 pagesMIT14 01F18 Lec18 25midorima shintaroNo ratings yet

- MGMT-5245 Managerial Economics: Market Power: MonopolyDocument22 pagesMGMT-5245 Managerial Economics: Market Power: MonopolyYining LiuNo ratings yet

- Economics 2004-06: Section 2: Microeconomics Higher 2.1 Markets 2.2.3 Income Elasticity of DemandDocument22 pagesEconomics 2004-06: Section 2: Microeconomics Higher 2.1 Markets 2.2.3 Income Elasticity of DemandAn-An PhitakchatchawalNo ratings yet

- Managerial Economics L2: Dr. Rashmi AhujaDocument26 pagesManagerial Economics L2: Dr. Rashmi AhujaPrakhar SahayNo ratings yet

- Monopoly PDFDocument12 pagesMonopoly PDFzofuNo ratings yet

- Econ203 Lab 081Document36 pagesEcon203 Lab 081api-235832666No ratings yet

- Introduction and Micro ReviewDocument20 pagesIntroduction and Micro ReviewBrett FerchNo ratings yet

- Chap 09Document8 pagesChap 09Thabo MojavaNo ratings yet

- CheckDocument15 pagesChecksunwukong0% (1)

- Equity ValuationDocument36 pagesEquity ValuationANo ratings yet

- Increase in Demand and SupplyDocument9 pagesIncrease in Demand and SupplyJon LeinsNo ratings yet

- ECON3101 Review Questions For Midterm 2015 AnswersDocument6 pagesECON3101 Review Questions For Midterm 2015 AnswersHung LyNo ratings yet

- Chapter 1Document35 pagesChapter 1Nidhi HiranwarNo ratings yet

- Chapter 2Document29 pagesChapter 2ebrahimnejad64No ratings yet

- Gyaan Kosh: Global EconomicsDocument19 pagesGyaan Kosh: Global EconomicsU KUNALNo ratings yet

- E Commerce 3Document22 pagesE Commerce 3Farai George ShavaNo ratings yet

- Market and Pricing - Perfect Competition and MonopolyDocument35 pagesMarket and Pricing - Perfect Competition and Monopolychandel08No ratings yet

- Indian Financial Markets - IITBHU Unit1 Oct 2023 Ver f4Document120 pagesIndian Financial Markets - IITBHU Unit1 Oct 2023 Ver f4rajatprajapati2121No ratings yet

- Business Economics Assignment - JIB 60Document4 pagesBusiness Economics Assignment - JIB 60Hiền Trang LêNo ratings yet

- Revision MidtermDocument12 pagesRevision MidtermKim NgânNo ratings yet

- Factor Market and Production MarketDocument43 pagesFactor Market and Production MarketMmapontsho Tshabalala100% (1)

- Chapter 2 - Interest Rates - SDocument117 pagesChapter 2 - Interest Rates - STuong Vi Nguyen PhanNo ratings yet

- 12 Key Diagrams For As EconomicsDocument13 pages12 Key Diagrams For As EconomicsAmaan RashidNo ratings yet

- Impt TopicDocument7 pagesImpt TopicAcceleration ExNo ratings yet

- FMG 22-IntroductionDocument22 pagesFMG 22-IntroductionPrateek GargNo ratings yet

- Krugman Unit Three Modules 10-15Document76 pagesKrugman Unit Three Modules 10-15derengungorNo ratings yet

- Macro NotesDocument43 pagesMacro Notes266818No ratings yet

- MONOPOLYDocument29 pagesMONOPOLYSidney GrangerNo ratings yet

- The Fundamentals of Managerial Economics: Dr. Abdullah M. Al-AnsiDocument30 pagesThe Fundamentals of Managerial Economics: Dr. Abdullah M. Al-AnsiEbrar AnsiNo ratings yet

- Social Cost Benefit AnalysisDocument44 pagesSocial Cost Benefit AnalysisAnshul ShuklaNo ratings yet

- Cost Benefit Analysis L5Document6 pagesCost Benefit Analysis L5EllaNo ratings yet

- Mail To Reg Stud 72232 610769 20230904 062954 670Document39 pagesMail To Reg Stud 72232 610769 20230904 062954 670UshaNo ratings yet

- Production: Dr. Jofrey R. CamposDocument24 pagesProduction: Dr. Jofrey R. Camposfull sunNo ratings yet

- Financial Aspect Strategic MarketingDocument17 pagesFinancial Aspect Strategic MarketingZee SheeNo ratings yet

- Unit 1 NotesDocument13 pagesUnit 1 NotesLluisGuillemBoludaNo ratings yet

- CH 17Document67 pagesCH 17Costi CalapodNo ratings yet

- The Fundamentals of Managerial Economics: Session 1Document46 pagesThe Fundamentals of Managerial Economics: Session 1Reju RajasekharanNo ratings yet

- Sample - Business-Economics-V-ST-jqxi8aDocument8 pagesSample - Business-Economics-V-ST-jqxi8asushainkapoor photoNo ratings yet

- FM03 Debt 0831Document68 pagesFM03 Debt 0831Kenneth KwokNo ratings yet

- The Links Between Labour-Market Experiences and Health: Towards A Research FrameworkDocument29 pagesThe Links Between Labour-Market Experiences and Health: Towards A Research FrameworkjayaniNo ratings yet

- EPA Outlets of CompostDocument83 pagesEPA Outlets of CompostjayaniNo ratings yet

- EVALUATIONOFTHEECONOMICSOCIALANDBIOLOGICALFEASIBILITYOFBIOCONVERTINGFOODWASTESWITHTHEBLACKSOLDIERFLYHermetiaillucensDocument186 pagesEVALUATIONOFTHEECONOMICSOCIALANDBIOLOGICALFEASIBILITYOFBIOCONVERTINGFOODWASTESWITHTHEBLACKSOLDIERFLYHermetiaillucensjayaniNo ratings yet

- Public Economics Tax IncidenceDocument38 pagesPublic Economics Tax IncidencejayaniNo ratings yet

- Io-Exercises ImportantDocument33 pagesIo-Exercises ImportantjayaniNo ratings yet

- Externalities: AGEC689: Economic Issues and Policy Implications of Homeland SecurityDocument5 pagesExternalities: AGEC689: Economic Issues and Policy Implications of Homeland SecurityjayaniNo ratings yet

- Theory of Consumer BehaviourDocument56 pagesTheory of Consumer BehaviourjayaniNo ratings yet

- Econ 350 Chapter05Document68 pagesEcon 350 Chapter05jayaniNo ratings yet

- Advertising: Industrial Organization: Contemporary Theory & PracticeDocument32 pagesAdvertising: Industrial Organization: Contemporary Theory & PracticejayaniNo ratings yet

- Accounting PointsDocument4 pagesAccounting PointsLovely IñigoNo ratings yet

- Advance Loss of ProfitDocument2 pagesAdvance Loss of ProfitHITESHNo ratings yet

- Warren B. Sheinkopf v. John K.P. Stone Iii, Etc., 927 F.2d 1259, 1st Cir. (1991)Document18 pagesWarren B. Sheinkopf v. John K.P. Stone Iii, Etc., 927 F.2d 1259, 1st Cir. (1991)Scribd Government DocsNo ratings yet

- Tax Assessment ManualDocument294 pagesTax Assessment ManualPrudvi RajNo ratings yet

- Emerging Market Corporate Bonds - A Scoring System: 'New York University, 2sa/omon Brothers IncDocument10 pagesEmerging Market Corporate Bonds - A Scoring System: 'New York University, 2sa/omon Brothers IncAlmaliyana BasyaibanNo ratings yet

- Cost of CapitalDocument26 pagesCost of CapitalShaza NaNo ratings yet

- Capital MarketDocument2 pagesCapital MarketAnsel SotnasNo ratings yet

- Survey Report On Sole ProprietorDocument40 pagesSurvey Report On Sole Proprietorjoywin0% (1)

- Poa Revision - Book of Original Entry CSEC REVISIONDocument4 pagesPoa Revision - Book of Original Entry CSEC REVISIONnikeiraawer1No ratings yet

- Instructure Investor PresentationDocument19 pagesInstructure Investor Presentationdont-wantNo ratings yet

- The NASDAQ Stock MarketDocument3 pagesThe NASDAQ Stock MarketlulavmizuriNo ratings yet

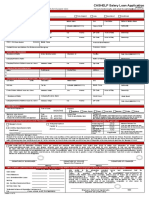

- Aub Salary Application FormDocument2 pagesAub Salary Application FormRaymund Platilla50% (2)

- Current AccountsDocument21 pagesCurrent AccountsSupriyo SenNo ratings yet

- Public Spending by UK Government DepartmentDocument1 pagePublic Spending by UK Government DepartmentSimonRogersGuardianNo ratings yet

- Quality Irrigation: Fifty One Thousand Thirty Rupees OnlyDocument1 pageQuality Irrigation: Fifty One Thousand Thirty Rupees OnlyAfzalpatelNo ratings yet

- Class 12 Syllabus 2019-2020 IscDocument4 pagesClass 12 Syllabus 2019-2020 IscPIYA CHAKRABORTY100% (1)

- New Table of ContentsDocument4 pagesNew Table of ContentsSuvro AvroNo ratings yet

- Advanced Financial Accounting and Reporting: ConceptualDocument6 pagesAdvanced Financial Accounting and Reporting: ConceptualYeji BabeNo ratings yet

- Red BullDocument28 pagesRed Bullbero50No ratings yet

- Behavioral FinanceDocument48 pagesBehavioral FinancehetalNo ratings yet

- 1 - Finance Short NotesDocument12 pages1 - Finance Short NotesSudhanshu PatelNo ratings yet

- Chapter 5 - RevisionDocument13 pagesChapter 5 - RevisionActOn Business Solutions (Simplifying Business)No ratings yet

- HBS Finance Basics Course NotesDocument16 pagesHBS Finance Basics Course NotesAlice JeanNo ratings yet

- RDO No. 58 - Batangas CityDocument377 pagesRDO No. 58 - Batangas Cityattyjecky100% (2)