Professional Documents

Culture Documents

Government and The Economy

Uploaded by

Angela Sao0 ratings0% found this document useful (0 votes)

9 views24 pagesppt

Original Title

Government and the Economy

Copyright

© © All Rights Reserved

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentppt

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

9 views24 pagesGovernment and The Economy

Uploaded by

Angela Saoppt

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 24

-- History of Governmental Involvement

in the Economy

Alexander Hamilton, the first Treasury

Secretary, favored a government role in the

economy.

He wanted a national bank.

He also supported government aid to

commerce so the new American economy

would grow.

Democrats Jefferson and Jackson

Jackson opposed a national bank.

When Jackson was elected President, about

1830, he eliminated it.

But federal intervention on the economy is

nothing new.

There was early support for development of

canals, railroads and land grants.

During the late 19th century, you had laissez-

faire capitalism in the U.S.

Businesses were allowed to grow.

You soon had concentrations in whole

industries like the railroads and oil production.

These concentrations of industries were

known as trusts.

There soon came a movement, the

Progressives, that called for regulation of the

trusts.

Famous progressives were Theodore

Roosevelt, Woodrow Wilson, and California

Governor Hiram Johnson.

There also was a call during the late 19th

century for the regulation of food and drugs.

Upton Sinclair wrote The Jungle.

In the 20th century, Government started

getting much more directly involved in the

economy.

1913 Sixteenth Amendment established an

income tax.

The Federal Reserve System was also set up in

1913. It is our national bank.

Todays style of government intervention in

the economy didnt really start until FDR.

He had his New Deal in the 1930s.

But FDR wanted to run a balanced budget.

This probably led to a slip back into

depression in 1937.

World War II got the U.S. out of the

Depression and set us up as a global economic

powerhouse.

There are two levers of policy the government

can pull to manipulate the economy.

These are 1) Monetary policy by the Fed.

This is manipulation of the money supply.

The other is 2) Fiscal Policy.

This is manipulating taxing and spending

policy.

The Federal Reserve Bank controls the money

supply in the U.S.

The more money in circulation, the lower the

interest rate.

The lower interest rates are, the more money

individuals and banks can borrow and spend.

The more spending, the more economic

activity.

At the top of the Federal Reserve Bank, is the

Federal Reserve Board.

These are 7 members appointed by the

President and confirmed by the Senate for 14

year, staggered terms.

They can only be removed for cause.

They are supposed to overlap presidential

administrations and be independent of the

federal government.

The Chairperson of the Board is also selected

by the President and confirmed by the Senate.

They serve for a four year term.

There is no limit on the number of terms they

can serve.

The current chair, recently appointed, from UC

Berkeley, is Janet Yellen.

Federal Reserve Banks make up the Federal

Reserve System.

There are 12 federal reserve districts, and thus

12 federal reserve banks.

Their headquarters are in major financial

cities, like San Francisco, Dallas, New York and

Philadelphia.

A Federal Reserve Bank is a bankers bank.

Nationally chartered banks (most) must

belong. State chartered financial institutions

can belong if they want to, and most do.

The Fed controls the money supply. It has

four tools to do this.

These are 1) the Discount Rate, 2) the Reserve

requirement it puts on member banks, 3)

Open market operations and 4) setting the

federal funds rate.

The Discount Rate. This is the rate at which

Federal Reserve Banks loan money to member

banks.

The Reserve Requirement is how much cash a

member bank has to have on hand at any one

time.

Open Market Operations The Federal

Reserve Open Market Committee buys and

sells the different kinds of federal bonds

available, mostly Treasury Notes or Bonds.

The Federal Funds rate is the interest rate that

member banks can charge each other to

borrow funds.

Fiscal Policy Taxing and Spending

Theory developed by John Maynard Keynes.

Theory is in good times the government

should run a budget surplus. In bad times, it

runs a deficit.

A deficit is supposed to get the economy

going.

This is to be combined with a loose monetary

policy (expansionist).

In this way, you flatten out the business cycle.

Keynesian Demand Curve

C + I + G + X = GDP

C = All consumption

= All investment

G = All government spending

X = Net exports

GDP = Gross Domestic Product

The government can manipulate C, ,G and X.

You manipulate C by what you do with interest

rates and government spending.

You manipulate by playing with the interest

rate and the levers of the Fed.

You manipulate G by deficit spending or

running a surplus.

Keynesian policy was in favor from 1933 to

1979. Then again from 2008 to the present

under President Obama.

Keynesian philosophy calls for manipulation of

the money supply and taxing and spending to

control the economy.

Recent examples, QE1, QE2, QE3, TARP, Auto

Bailout and President Obamas $800 billion

stimulus bill.

Probably kept us out of depression.

Other Schools of Thought

Laissez Faire Economics Adam Smith and the

Wealth of Nations

Monetarism Milton Friedman from the

University of Chicagos Chicago School of

Economics.

Calls for just increasing the money supply at a

steady rate to accommodate economic growth

(5% per year).

Also Supply Side Economics In vogue from

19802007.

Supply side economics calls for cutting taxes

to stimulate the economy.

Theory is this will increase the base and the

lower tax rate will produce more government

revenue.

Supply side economists also favor less

government regulation of business.

Supply side economics supported by George

Gilder who wrote Wealth and Poverty in

1981.

Also supported by Arthur Laffer. He was from

the Claremont Graduate School in Los

Angeles.

He now teaches at Vanderbilt University in

Tennessee.

Laffer curve and optimum tax rate.

You can have progressive or regressive tax

rates.

Income tax is progressive.

Sales tax is regressive.

These effect the Marginal Propensity to

Consume (MPC) and the Marginal Propensity

to Save (MPS).

Budget Deficits

National Debt

A budget deficit is the difference between

revenue and expenditures by government in a

given year.

The National Debt is the sum of all previous

deficits.

National Debt is currently north of $17.5

trillion dollars.

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Critical Care: Queuing Theory Accurately Models The Need For Critical Care ResourcesDocument6 pagesCritical Care: Queuing Theory Accurately Models The Need For Critical Care ResourcesAngela SaoNo ratings yet

- Sunkara DB Neurological DisordersDocument41 pagesSunkara DB Neurological DisordersAngela SaoNo ratings yet

- Topic 10 AlkynesDocument24 pagesTopic 10 AlkynesAngela SaoNo ratings yet

- Chapter 14Document112 pagesChapter 14Angela SaoNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Advanced Technical Analysis: - Online Live Interactive SessionDocument4 pagesAdvanced Technical Analysis: - Online Live Interactive SessionmahendarNo ratings yet

- Fansubbers The Case of The Czech Republic and PolandDocument9 pagesFansubbers The Case of The Czech Republic and Polandmusafir24No ratings yet

- Win Tensor-UserGuide Optimization FunctionsDocument11 pagesWin Tensor-UserGuide Optimization FunctionsadetriyunitaNo ratings yet

- The Training Toolbox: Forced Reps - The Real Strength SenseiDocument7 pagesThe Training Toolbox: Forced Reps - The Real Strength SenseiSean DrewNo ratings yet

- 221-240 - PMP BankDocument4 pages221-240 - PMP BankAdetula Bamidele OpeyemiNo ratings yet

- 19 Amazing Benefits of Fennel Seeds For SkinDocument9 pages19 Amazing Benefits of Fennel Seeds For SkinnasimNo ratings yet

- Apache Hive Essentials 2nd PDFDocument204 pagesApache Hive Essentials 2nd PDFketanmehta4u0% (1)

- Case AnalysisDocument25 pagesCase AnalysisGerly LagutingNo ratings yet

- Kurukku PadaiDocument4 pagesKurukku PadaisimranNo ratings yet

- Jesus Died: Summary: Jesus Died We Need To Have No Doubt About That. Without Jesus' Death We Would Have NoDocument6 pagesJesus Died: Summary: Jesus Died We Need To Have No Doubt About That. Without Jesus' Death We Would Have NoFabiano.pregador123 OliveiraNo ratings yet

- RubricsDocument1 pageRubricsBeaMaeAntoniNo ratings yet

- AIM Mag Issue 22 April 2010Document98 pagesAIM Mag Issue 22 April 2010Artisans in Miniature95% (19)

- Endzone Trappers Lesson PlanDocument2 pagesEndzone Trappers Lesson Planapi-484665679No ratings yet

- Analog Electronic CircuitsDocument2 pagesAnalog Electronic CircuitsFaisal Shahzad KhattakNo ratings yet

- Problem ManagementDocument33 pagesProblem Managementdhirajsatyam98982285No ratings yet

- The Minecraft Survival Quest ChallengeDocument4 pagesThe Minecraft Survival Quest Challengeapi-269630780100% (1)

- Developing Global LeadersDocument10 pagesDeveloping Global LeadersDeepa SharmaNo ratings yet

- Final Presentation BANK OF BARODA 1Document8 pagesFinal Presentation BANK OF BARODA 1Pooja GoyalNo ratings yet

- On Wallace Stevens - by Marianne Moore - The New York Review of BooksDocument2 pagesOn Wallace Stevens - by Marianne Moore - The New York Review of BooksTuvshinzaya GantulgaNo ratings yet

- Mezbah Uddin Ahmed (173-017-054) Chapter 11Document12 pagesMezbah Uddin Ahmed (173-017-054) Chapter 11riftNo ratings yet

- Tamil and BrahminsDocument95 pagesTamil and BrahminsRavi Vararo100% (1)

- Chhabra, D., Healy, R., & Sills, E. (2003) - Staged Authenticity and Heritage Tourism. Annals of Tourism Research, 30 (3), 702-719 PDFDocument18 pagesChhabra, D., Healy, R., & Sills, E. (2003) - Staged Authenticity and Heritage Tourism. Annals of Tourism Research, 30 (3), 702-719 PDF余鸿潇No ratings yet

- Lite Touch. Completo PDFDocument206 pagesLite Touch. Completo PDFkerlystefaniaNo ratings yet

- Annexure 8: Medical Certificate (To Be Issued by A Registered Medical Practitioner) General ExpectationsDocument1 pageAnnexure 8: Medical Certificate (To Be Issued by A Registered Medical Practitioner) General ExpectationsMannepalli RamakrishnaNo ratings yet

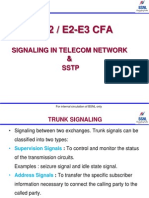

- Signalling in Telecom Network &SSTPDocument39 pagesSignalling in Telecom Network &SSTPDilan TuderNo ratings yet

- Producto Académico #2: Inglés Profesional 2Document2 pagesProducto Académico #2: Inglés Profesional 2fredy carpioNo ratings yet

- Cat4 Test Practice For Year 11 Level GDocument6 pagesCat4 Test Practice For Year 11 Level GJoel OkohNo ratings yet

- Complete PDFDocument495 pagesComplete PDFMárcio MoscosoNo ratings yet

- Becoming FarmersDocument13 pagesBecoming FarmersJimena RoblesNo ratings yet

- Reflection On Harrison Bergeron Society. 21ST CenturyDocument3 pagesReflection On Harrison Bergeron Society. 21ST CenturyKim Alleah Delas LlagasNo ratings yet