Professional Documents

Culture Documents

Fall 2017 Cost Chapter 2 Revision

Uploaded by

Mohamed A. Tawfik0 ratings0% found this document useful (0 votes)

26 views21 pagesFall 2017 Cost Chapter 2 Revision

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentFall 2017 Cost Chapter 2 Revision

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

26 views21 pagesFall 2017 Cost Chapter 2 Revision

Uploaded by

Mohamed A. TawfikFall 2017 Cost Chapter 2 Revision

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 21

Revision

Cost Accounting (1)

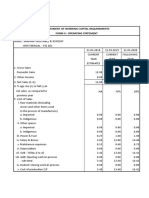

MA Manufacturing company has the following total factory overhead

Activity level

DL-Hours 5,000 7,000

Total Factory Overhead Cost 120,000 144,000

The company has analyzed these costs at 5,000 hours level of activity

Indirect Mat. (Variable) 50,000

Rent (Fixed) 50,000

Maintenance (Mixed) 20,000

Total overhead costs 120,000

Required:

1. Estimate how much of the 144,000 factory overhead cost at the high level

of activity level consists of maintenance cost.

2. What total factory overhead costs would you expect the company to

incur at an activity level of 6,000 DL-Hours

Cost Variable Cost Fixed Cost

Activity Level Respond Zero Response

Cost Per Unit Constant Varies

Cost In Total Varies Constant

Production Level (AL) 1,000 2,000

(DM) … Variable Cost 15.20 15.20

(DL) … Variable Cost 30.50 30.50

(MOH) … Mixed Cost 54.10 37.40

Total= 1,000 × 54.10 = 54,100 Total= 2,000 × 37.40 = 74,800

High-Low Method … for Mixed Cost Only (Total Cost)

And here it’s per unit, so you need to calculate MOH in total

1- Var. Cost = Δ Cost / Δ Activity = ( 74,800 – 54,100 ) / ( 2,000 – 1,000 ) = 20.7 Per Unit

2- Fixed Cost = M = F + VL

74,800 = F + ( 20.7 × 2,000 ) …. F = 33,400

3- Cost Formula: M = 33,400 + 20.7 L

Total Manufacturing Cost = DM + DL + MOH

Total Variable Manufacturing Cost (Per Unit) = Var. DM + Var. DL + Var. MOH

= 15.20 + 30.50 + 20.70 = 66.4 Per Unit

PC 105,000 = DM + DL CC 77,000 = DL + MOH

Traditional income statement Schedule of COGM

Sales 235,000 1- DM

Beg. Mat

Less: Cost of Goods Sold (COGS)

+ Pur.

Beg. Inv. 31,000

- End. Mat.

+ COGM 140,000

DM Used 60,000

COGAS 171,000

- End. Inv. (26,000)

COGS 145,000 2- DL 45,000

Gross Margin (GM) 90,000 3- MOH 32,000

Less: Operating Expenses 1 + 2 + 3 = TMC 137,000

1- Selling Expenses Beg. WIP 27,000

2-Administrative Expenses - End. WIP (24,000)

Total OE =

Net Operating Income COGM 140,000

PC = DM + DL

105,000 =

CC = DL + MOH

77,000 =

TMC = (DM + DL + MOH) OR ( PC + MOH ) OR ( CC + DM)

137,000 = 77,000 + DM (60,000)

137,000 = 105,000 + MOH (32,000)

Note:

Mfg. Cost = Product Cost = Inventorial Cost

TMC = DM + DL + MOH … PC = DM + DL …. CC = DL + MOH

TMC = PC + MOH

TMC = DM + CC

All direct cost considered variable cost

But not all variable cost considered direct cost

Compute COGS:

Beg. FG ***

+ COGM *** (in Manufacturing company)

= COGAS ***

- End. FG (***)

= COGS ***

OR …. Purchases ( in merchandising company )

Schedule of COGM

1- DM

Beg. Materials ***

+ Purchases ***

= Materials Available for Use ***

- End. Materials ( *** )

= DM Used in Production ***

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Ethical Decision Making: Corporate Governance, Accounting, FinanceDocument2 pagesEthical Decision Making: Corporate Governance, Accounting, FinanceMohamed A. TawfikNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Test Bank Chap014Document71 pagesTest Bank Chap014Mohamed A. Tawfik100% (1)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Chapter One: An Overview of Banks and The Financial-Services SectorDocument13 pagesChapter One: An Overview of Banks and The Financial-Services SectorMohamed A. TawfikNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Chapter 5Document37 pagesChapter 5Mohamed A. TawfikNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Rousselot Gelatine: Dedicated To Your SuccessDocument28 pagesRousselot Gelatine: Dedicated To Your SuccessChristopher RiveroNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Walmart Analyst ReportDocument29 pagesWalmart Analyst ReportAlexander Mauricio BarretoNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Assessment of Working Capital Requirements Form Ii: Operating StatementDocument12 pagesAssessment of Working Capital Requirements Form Ii: Operating StatementMD.SAFIKUL MONDALNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Rep V Ca - NatresDocument7 pagesRep V Ca - NatresCes Camello0% (1)

- FAQ International StudentsDocument2 pagesFAQ International StudentsНенадЗекавицаNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Literature ReviewDocument6 pagesLiterature Reviewanon_230550501No ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Accbp 100 Second Exam AnswersDocument5 pagesAccbp 100 Second Exam AnswersAlthea Marie OrtizNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hotel's Room RateDocument9 pagesHotel's Room RatebeeanaclarissaNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- 12 - Diminishing Strike Levels, An Indicator of Industrial PeaceDocument2 pages12 - Diminishing Strike Levels, An Indicator of Industrial PeaceIls DoleNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Resource Based Theory (RBT) - AK S1Document9 pagesResource Based Theory (RBT) - AK S1cholidNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Case Study - Houlihan LokeyDocument57 pagesCase Study - Houlihan Lokeylanmp3100% (8)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Fascination Factor by Mark LevyDocument11 pagesThe Fascination Factor by Mark LevyClsales100% (1)

- The Ideal Essay ST Vs PLTDocument1 pageThe Ideal Essay ST Vs PLTAlisha HoseinNo ratings yet

- Ethical DileemaasDocument46 pagesEthical DileemaasRahul GirdharNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Primary and Secondary Data (UNIT III)Document12 pagesPrimary and Secondary Data (UNIT III)shilpeekumariNo ratings yet

- Session 7 Organization Size, Life Cycle, and DeclineDocument45 pagesSession 7 Organization Size, Life Cycle, and DeclineHameer Saghar SaméjoNo ratings yet

- Supply Chain Management - Darden's RestaurantDocument26 pagesSupply Chain Management - Darden's RestaurantShameen Shazwana0% (1)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- A Study On Financial PerformanceDocument73 pagesA Study On Financial PerformanceDr Linda Mary Simon100% (2)

- HSRPHR3Document1 pageHSRPHR3ѕᴀcнιn ѕᴀιnιNo ratings yet

- Property Surveyor CVDocument2 pagesProperty Surveyor CVMike KelleyNo ratings yet

- AccountingDocument7 pagesAccountingHà PhươngNo ratings yet

- Encyclopaedia Britannica vs. NLRCDocument1 pageEncyclopaedia Britannica vs. NLRCYsabel PadillaNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- DBSV - Asian Consumer DigestDocument119 pagesDBSV - Asian Consumer DigesteasyunittrustNo ratings yet

- Deborah K Chasanow Financial Disclosure Report For 2010Document20 pagesDeborah K Chasanow Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- EY Capital Markets Innovation and The FinTech Landscape Executive SummaryDocument9 pagesEY Capital Markets Innovation and The FinTech Landscape Executive SummaryCrowdfundInsider100% (1)

- Flexible Budget Example With SolutionDocument4 pagesFlexible Budget Example With Solutionchiedza MarimeNo ratings yet

- GB917 2 - Release 2 5 - V2 5Document218 pagesGB917 2 - Release 2 5 - V2 5Artur KiełbowiczNo ratings yet

- Presentation On Facebook Advertising For Business.Document10 pagesPresentation On Facebook Advertising For Business.Joshna ElizabethNo ratings yet

- Masing & Sons Development Corporation (MSDC) V Rogelio (Labor Standards)Document2 pagesMasing & Sons Development Corporation (MSDC) V Rogelio (Labor Standards)Atty. Providencio AbraganNo ratings yet

- EduCBA - Equity Research TrainingDocument90 pagesEduCBA - Equity Research TrainingJatin PathakNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)