Professional Documents

Culture Documents

IPE Structures: Production, Finance, Security, Knowledge

Uploaded by

Aj Sobrevega0 ratings0% found this document useful (0 votes)

23 views24 pagesInternational Political Economy Structures

Original Title

Dialnet-ACriticalApplicationOfSecuritizationTheory-5569613

Copyright

© © All Rights Reserved

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentInternational Political Economy Structures

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

23 views24 pagesIPE Structures: Production, Finance, Security, Knowledge

Uploaded by

Aj SobrevegaInternational Political Economy Structures

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 24

IPE Structures: Production,

Finance, Security, Knowledge

Production and Trade

• Trade is always political – Robert Kuttner

• Globalization of production - shift from

concentration to diffusion

• Production moves from developed (e.g. US,

EU, Japan) to developing states (e.g. China,

India)

• Internet – a game changer?

FDI trends

• Global FDI flows jumped 36% in 2015 to an

estimated US$1.7 trillion, their highest level

since the global economic and financial crisis

of 2008-2009

• A surge in FDI targeting developed economies

(+90%) was the principal factor behind the

global rebound (in US, FDI increased 4x)

• Growth was largely due to cross-border

merger and acquisitions (M&As)

FDI trends

• Developing economies saw their FDI reaching

a new high of US$741 billion, 5% higher than

in 2014

• Developing Asia, with its FDI flows surpassing

$0.5T, remained the largest FDI recipient

region in the world, accounting for 1/3 of

global FDI flows

FDI trends

• Flows to transition economies continued to

fall (-54%) as tumbling international

commodities prices & regional conflicts

undercut FDI. Investment in the region’s 2

largest host economies, Russia and

Kazakhstan, fell sharply

• Poorest developing economies are less

dependent on natural resources in terms of

FDI attraction

• Private equity firms less involved in FDI flows

Other notable trends

• FDI by Sovereign Wealth Funds remains small;

SOE TNCs are heavily involved in FDI

• Intl production continues its steady growth;

• TNCs from developing and transition

economies expanded their overseas

operations faster than their developed

country counterparts

China outbound M&A

• Geely bought Swedish carmaker Volvo (2010

for $1.5B) and London Taxi Company (2012)

• Dongfeng Motors bought 13% of French

carmaker PSA Peugeot-Citroen (2014)

• Lenovo acquired IBM (2004 for $1.75B)

• China Investment Corp bought 9.9% of

Morgan Stanley ($5.579B)

• China National Chemical bought Swiss

agrochemical company Syngenta (2016 for

China automobile sector

• JV with foreign companies to produce cars in

China

• China benefit from employment and get

access to technology so their cos can produce

their own

• Why cant foreign car cos say no? China is the

biggest auto market in the world !

JVs

• Guangzhou Automobile Industry Group (GAIC) -

w/Peugeot to produce Peugeot 504 (later

defunct); in 1990s, w/ Honda to produce Accord

and Fit; in 2006, with Toyota to make

Camry; Guangdong is now the center for

manufacturing Japanese car makes in China

• Tianjin Automotive Industry - w/ Daihatsu to

produce Charade (merged with FAW/Toyota JV

later)

JVs

• Shanghai Automotive Industry

Corporation(SAIC) - Volkswagen: Volkswagen

Santana mid-size/compact car

• First Automobile Works -

Volkswagen: Volkswagen Jetta compact car

• Dongfeng Motor Corporation - Citroën: Citroën

Fukang compact car

• Beijing Automotive Industry - Hyundai Motor -

DaimlerChrysler: Jeep Cherokee (XJ)

3 Perspectives on

International trade

• Liberalism – trade is good guided by “invisible

hands”; each state can benefit from law of

comparative advantage; states should limit trade

protection and let market (efficiency) forces run

global economy

• Mercantilism – trade may have harmful effects

that has to be mitigated; hence, protectionism is

needed for infant industries and to achieve

national econ independence and security; state

has a duty to protect its society and businesses

from adverse effects of intl trade

3 Perspectives on

International trade

• Structuralism – trade is a tool of imperialism

(e.g. colonies provide resources and serve as

markets); intl division of labor between core,

periphery and semiperiphery with highest

value given to core states

Evolution in intl trade

• Postwar GATT emphasizing reciprocity and

nondiscrimination

• Mercantilism on the rebound (1960s-70s);

under pressure, states reduced trade barriers

but find ways to support their exports and

limit imports thru strategic trade policies,

NTBs, protectionism

• Uruguay Round and establishment of WTO

(1990s to present) – curb protectionism and

resolve trade disputes

Some important intl trade terms

• Import quotas – limit on goods that can be

imported (there is also an export quota!)

• Export subsidies – measure to effectively

reduce price of export product to make them

more attractive/competitive

• Currency devaluation – attempt to decrease

price of exports and increase price of imports

• NTBs – covers a wide range of measures from

govt health & safety standards, local content,

licensing and labelling requirements

Some important intl trade terms

• Strategic trade practice – efforts to create

comparative advantage by providing subsidies

e.g. R&D to reduce learning curve; often

associated with industrial policies which are

active state intervention to promote certain

patterns of industrial devt

• Dumping – unfair trade practice of selling

products abroad at less cost than at home

• Countervailing trade practice – defensive

measure vs protectionism e.g. anti-dumping law,

countervailing tariffs or quotas

North-South trade issues

• In 1973, G77, a coalition of developing nations in UN,

demanded greater access for their primary goods to

protected N markets

• In 1980s, S incurred huge debt from N & intl lending

institutions; “Washington Consensus” required that

they grow their way out of debt by instituting reforms

– liberalize their trade policies and open doors for FDI;

want to loan? Then follow SAP conditionalities

• Instead of reforming intl econ, financial system, N

prescribed/imposed their notion of devt & devt path to

S

• BRICS NDB and AIIB as win-win alternatives to N-

dominated intl economic order

You might also like

- Pivot Point Trading StrategyDocument8 pagesPivot Point Trading StrategyBadrul 'boxer' Hisham50% (4)

- The Secret CurrencyDocument12 pagesThe Secret CurrencyDavid de LafuenteNo ratings yet

- Trade Theory and DevelopmentDocument28 pagesTrade Theory and Developmentwhatsup_11798No ratings yet

- It S Lit E30 Tiffany Aliche Submix 041621 LDocument10 pagesIt S Lit E30 Tiffany Aliche Submix 041621 LGMG EditorialNo ratings yet

- Import ExportDocument23 pagesImport ExportManish Dev PatelNo ratings yet

- CaiaDocument5 pagesCaiaRohan Haldankar0% (1)

- Ca 2016 PDFDocument33 pagesCa 2016 PDFMelvin OngNo ratings yet

- Injera Production and Export Business PlanDocument50 pagesInjera Production and Export Business PlanTumim84% (44)

- Cartojano RDC RESA Law Nov21Document45 pagesCartojano RDC RESA Law Nov21Law_Portal100% (2)

- IC Generic Purchase Order Template 9181Document3 pagesIC Generic Purchase Order Template 9181DipeshNo ratings yet

- Business Environment: Unit:DDocument52 pagesBusiness Environment: Unit:DPaavni SharmaNo ratings yet

- Ib 1Document23 pagesIb 1Divik TyagiNo ratings yet

- Business Environment: Unit:DDocument52 pagesBusiness Environment: Unit:DPaavni SharmaNo ratings yet

- Ppts Week 6Document27 pagesPpts Week 6Murat BasimtekinNo ratings yet

- International Trade and Finance in The Era of GlobalizationDocument38 pagesInternational Trade and Finance in The Era of GlobalizationMohit GandotraNo ratings yet

- Lecture 1 - Globalisation, International Trade and the Internationalisation of Business (2024)(1)Document29 pagesLecture 1 - Globalisation, International Trade and the Internationalisation of Business (2024)(1)vill hortNo ratings yet

- Foreign Direct InvestmentDocument26 pagesForeign Direct InvestmentFeeldeeaNo ratings yet

- Key Concepts: - Government Intervention Arises in Various FormsDocument12 pagesKey Concepts: - Government Intervention Arises in Various Formsroy_bishawjitNo ratings yet

- International Marketing 15 Edition: The Dynamic Environment of International TradeDocument18 pagesInternational Marketing 15 Edition: The Dynamic Environment of International TradeImraanHossainAyaanNo ratings yet

- Overview of Globalization-Unit 1Document30 pagesOverview of Globalization-Unit 1Chintan RamnaniNo ratings yet

- Trade As An Engine For Growth-Developing EconomiesDocument57 pagesTrade As An Engine For Growth-Developing EconomiesAmit BehalNo ratings yet

- Investment, Trade DevelopmentDocument32 pagesInvestment, Trade Developmentemy anishaNo ratings yet

- ISM Part1 (Updated)Document25 pagesISM Part1 (Updated)Sushant AgrawalNo ratings yet

- Economic Development in Asia Chapter 6 - International Trade and InvestmentDocument40 pagesEconomic Development in Asia Chapter 6 - International Trade and InvestmentJannibee EstreraNo ratings yet

- CH 1 IbmDocument45 pagesCH 1 Ibmtemesgen yohannesNo ratings yet

- Fesf PDFDocument32 pagesFesf PDFameeNo ratings yet

- GBM Module 4Document42 pagesGBM Module 4ShreyaNo ratings yet

- International Business Analysis: Lecture - 2Document30 pagesInternational Business Analysis: Lecture - 2Salahuddin SultanNo ratings yet

- Introduction To International Business: International Business: Strategy, Management, and The New RealitiesDocument94 pagesIntroduction To International Business: International Business: Strategy, Management, and The New RealitieswidedbenmoussaNo ratings yet

- International Institutions: WTO, World Bank and ADBDocument26 pagesInternational Institutions: WTO, World Bank and ADBAkhil DevNo ratings yet

- International Business EnvironmentDocument27 pagesInternational Business EnvironmentRanju katochNo ratings yet

- Globalbusinessenvironment 180812111040 PDFDocument43 pagesGlobalbusinessenvironment 180812111040 PDFAbdul RehmanNo ratings yet

- International BusinessDocument34 pagesInternational Businesskirthi nairNo ratings yet

- International BusinessDocument33 pagesInternational Businessfahad afridiNo ratings yet

- BE3 Global Environment P1.5Document27 pagesBE3 Global Environment P1.5preetNo ratings yet

- Introduction to International Business LectureDocument47 pagesIntroduction to International Business LectureOSRAH VANESSANo ratings yet

- Globalization & International Business: Chapter-1Document43 pagesGlobalization & International Business: Chapter-1Tafsir HossainNo ratings yet

- FinanceDocument4 pagesFinanceBina LimbuNo ratings yet

- Introduction to International Business Strategy and ManagementDocument35 pagesIntroduction to International Business Strategy and ManagementSuchitra PotterNo ratings yet

- Business GlobalizationDocument2 pagesBusiness GlobalizationShreejan PandeyNo ratings yet

- Introduction to International EconomicsDocument316 pagesIntroduction to International EconomicsabcdNo ratings yet

- International Financial Management GuideDocument21 pagesInternational Financial Management Guidebharti_peshwaniNo ratings yet

- Understanding the Economic and Political Importance of Multinational CorporationsDocument27 pagesUnderstanding the Economic and Political Importance of Multinational CorporationsHong HiroNo ratings yet

- International ManagementDocument17 pagesInternational ManagementMartina Clarke GarciaNo ratings yet

- LPG and the Indian Economy: An Analysis of Liberalization, Privatization and GlobalizationDocument40 pagesLPG and the Indian Economy: An Analysis of Liberalization, Privatization and Globalizationsowmya sNo ratings yet

- International Financial Management 1Document7 pagesInternational Financial Management 1Kundan KarnNo ratings yet

- CH 01 Introd. To InternationalDocument15 pagesCH 01 Introd. To InternationalManish JangidNo ratings yet

- Foreign Direct InvestmentDocument53 pagesForeign Direct InvestmentSoumendra RoyNo ratings yet

- Fundamentals of TradeDocument15 pagesFundamentals of TradeVishal GayakwadNo ratings yet

- International Financial Management 1Document37 pagesInternational Financial Management 1shreyaaamisraNo ratings yet

- Module I International BusinessDocument21 pagesModule I International BusinessAshok Yadav100% (1)

- EContent 11 2024 01 17 16 02 04 IWTOUNITIIIpptx 2023 12 18 08 44 21Document40 pagesEContent 11 2024 01 17 16 02 04 IWTOUNITIIIpptx 2023 12 18 08 44 21Neha SukhdevNo ratings yet

- 2.3 IbmDocument50 pages2.3 IbmSoundarya S ANo ratings yet

- International Business UNIT IDocument47 pagesInternational Business UNIT ISharanya KaparthiNo ratings yet

- Theories of Inter. Part 2Document19 pagesTheories of Inter. Part 2Sandesh AcharyaNo ratings yet

- International Business and GlobalisationDocument24 pagesInternational Business and GlobalisationhemantbaidNo ratings yet

- International Business Environment Group 2Document27 pagesInternational Business Environment Group 2TrixieJoy TaglucopNo ratings yet

- Chapter 7 COMM 211Document12 pagesChapter 7 COMM 211madison dworskyNo ratings yet

- Business Environment Unit VDocument14 pagesBusiness Environment Unit VRAVI KUMARNo ratings yet

- Global Economic Environment L-1 &2: Dr. Rashmi AhujaDocument30 pagesGlobal Economic Environment L-1 &2: Dr. Rashmi AhujaFiyanshu TambiNo ratings yet

- Module 1 - GlobalizationDocument22 pagesModule 1 - GlobalizationLithesh GrNo ratings yet

- Introduction to International Business2024Document32 pagesIntroduction to International Business2024ayomide.akanjiNo ratings yet

- International Marketing FundamentalsDocument127 pagesInternational Marketing FundamentalsStar RaghuNo ratings yet

- ChapFour PPT TradeDocument32 pagesChapFour PPT Tradebashatigabu100% (1)

- Part-1. International Business-An OverviewDocument20 pagesPart-1. International Business-An OverviewAmIt SinhaNo ratings yet

- Steepled - PPT 2 PDFDocument13 pagesSteepled - PPT 2 PDFAditi AgarwalNo ratings yet

- G.R. No. 79538Document5 pagesG.R. No. 79538Aj SobrevegaNo ratings yet

- ALSL-Outline GRM v1Document8 pagesALSL-Outline GRM v1Sabrina Frances Dela VegaNo ratings yet

- Plaintiff-Appellee Accused-Appellant: People of The Philippines, AaaDocument9 pagesPlaintiff-Appellee Accused-Appellant: People of The Philippines, AaaAj SobrevegaNo ratings yet

- LBP vs. Prado Verde Corp.Document2 pagesLBP vs. Prado Verde Corp.Aj SobrevegaNo ratings yet

- Spouses Violago vs. BA Finance - Arenal PDFDocument1 pageSpouses Violago vs. BA Finance - Arenal PDFAj SobrevegaNo ratings yet

- Batangas Laguna Tayabas Bus Company Inc. v. BitangaDocument13 pagesBatangas Laguna Tayabas Bus Company Inc. v. BitangaAj SobrevegaNo ratings yet

- Republic V CADocument6 pagesRepublic V CAAj SobrevegaNo ratings yet

- Philippine Supreme Court Jurisprudence: Home Law Firm Law Library Laws JurisprudenceDocument49 pagesPhilippine Supreme Court Jurisprudence: Home Law Firm Law Library Laws JurisprudenceAj SobrevegaNo ratings yet

- G.R. No. 159308 - REPUBLIC OF THE PHILIPPINES ETC. v. PAGADIAN CITY TIMBER CO. INCDocument18 pagesG.R. No. 159308 - REPUBLIC OF THE PHILIPPINES ETC. v. PAGADIAN CITY TIMBER CO. INCAj SobrevegaNo ratings yet

- G.R. No. 5987 April 7, 1911 - CITY OF MANILA v. GEORGE M. LACK - 019 Phil 324 - Home of ChanRobles Virtual Law LibraryDocument11 pagesG.R. No. 5987 April 7, 1911 - CITY OF MANILA v. GEORGE M. LACK - 019 Phil 324 - Home of ChanRobles Virtual Law LibraryAj SobrevegaNo ratings yet

- Lu Do V AznarDocument14 pagesLu Do V AznarAj SobrevegaNo ratings yet

- V-GENT v. MORNING STAR TRAVELDocument7 pagesV-GENT v. MORNING STAR TRAVELAj SobrevegaNo ratings yet

- Insular V PNBDocument2 pagesInsular V PNBAj SobrevegaNo ratings yet

- Agency Contract Void Without Special Power of AttorneyDocument6 pagesAgency Contract Void Without Special Power of AttorneyAj SobrevegaNo ratings yet

- G.R. No. 152356 - San Miguel Corporation v. Mandaue Packing Products Plants-San Packaging Products - San Miguel Corporation Monthlies Rank and File UnionDocument21 pagesG.R. No. 152356 - San Miguel Corporation v. Mandaue Packing Products Plants-San Packaging Products - San Miguel Corporation Monthlies Rank and File UnionAj SobrevegaNo ratings yet

- Pan Am Not Liable for Unconfirmed Flight TicketsDocument14 pagesPan Am Not Liable for Unconfirmed Flight TicketsAj SobrevegaNo ratings yet

- G.R. No. 5930 April 5, 1911 - UNITED STATES v. LEOCADIO PAJARILLO, ET AL. 019 Phil 288 - Home of ChanRobles Virtual Law LibraryDocument18 pagesG.R. No. 5930 April 5, 1911 - UNITED STATES v. LEOCADIO PAJARILLO, ET AL. 019 Phil 288 - Home of ChanRobles Virtual Law LibraryAj SobrevegaNo ratings yet

- G.R. No. L-48176Document7 pagesG.R. No. L-48176Aj SobrevegaNo ratings yet

- Sps Gaza Vs Lim - 126863 - January 16, 2003 - J. Sandoval-Gutierrez - Third DivisionDocument7 pagesSps Gaza Vs Lim - 126863 - January 16, 2003 - J. Sandoval-Gutierrez - Third DivisionAj SobrevegaNo ratings yet

- PPL V SudoyDocument4 pagesPPL V SudoyAj SobrevegaNo ratings yet

- Phil Trust Co V RiveraDocument1 pagePhil Trust Co V RiveraAj SobrevegaNo ratings yet

- G.R. No. L-7651Document2 pagesG.R. No. L-7651Aj SobrevegaNo ratings yet

- Supreme Court Ruling on Employer Liability for Acts of EmployeesDocument7 pagesSupreme Court Ruling on Employer Liability for Acts of EmployeesAj SobrevegaNo ratings yet

- G.R. No. 150128Document4 pagesG.R. No. 150128Aj SobrevegaNo ratings yet

- Macke V CampsDocument2 pagesMacke V CampsAj SobrevegaNo ratings yet

- Orient Air v. CADocument5 pagesOrient Air v. CAAj SobrevegaNo ratings yet

- G.R. No. 148106 PDFDocument3 pagesG.R. No. 148106 PDFAj SobrevegaNo ratings yet

- G.R. No. L-68555 - PRIME WHITE CEMENT CORP. vs. INTERMEDIATE APPELLATE COURT, ET ALDocument11 pagesG.R. No. L-68555 - PRIME WHITE CEMENT CORP. vs. INTERMEDIATE APPELLATE COURT, ET ALAj SobrevegaNo ratings yet

- Maricalum CaseDocument107 pagesMaricalum CaseAj SobrevegaNo ratings yet

- Pimentel v. Ermita ruling on acting presidential appointmentsDocument11 pagesPimentel v. Ermita ruling on acting presidential appointmentsAj SobrevegaNo ratings yet

- FUNDAMENTALS OF CASUALTY ACTUARIAL SCIENCE - CHAPTER 5 - Casualty PDFDocument120 pagesFUNDAMENTALS OF CASUALTY ACTUARIAL SCIENCE - CHAPTER 5 - Casualty PDFRafael Xavier Botelho0% (1)

- Level 2 CisiDocument20 pagesLevel 2 CisiSukruth GupthaNo ratings yet

- Ekonomisti EnglishDocument42 pagesEkonomisti Englishnihilisticpig100% (2)

- Accounting Standards Saudi Arabia InsuranceDocument8 pagesAccounting Standards Saudi Arabia InsurancecateNo ratings yet

- Swarnarik Chatterjee 23405018005 CA1 Management AccountingDocument5 pagesSwarnarik Chatterjee 23405018005 CA1 Management AccountingRik DragneelNo ratings yet

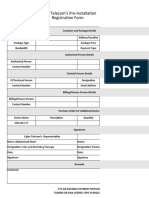

- Pre-Installation Registration FormDocument5 pagesPre-Installation Registration FormMustafa NazariNo ratings yet

- Financial Statement As of February 2018Document12 pagesFinancial Statement As of February 2018Jaijai Travel and ToursNo ratings yet

- LNPCN ReportDocument9 pagesLNPCN ReportKeesha ApolinarioNo ratings yet

- Contemporary Financial Management 13th Edition Moyer Test BankDocument25 pagesContemporary Financial Management 13th Edition Moyer Test BankHannahMendozaxznr100% (58)

- Herbalife Investor Presentation August 2016 PDFDocument38 pagesHerbalife Investor Presentation August 2016 PDFAla BasterNo ratings yet

- Summary of Key Aspects of IFRS 3Document3 pagesSummary of Key Aspects of IFRS 3Ericha MutiaNo ratings yet

- NLDocument8 pagesNLabcdef1985No ratings yet

- BFBV Course OutlineDocument7 pagesBFBV Course OutlinePuneet Garg100% (1)

- NBFC Sector ReportDocument8 pagesNBFC Sector Reportpawankaul82No ratings yet

- MFRS 133 Earnings Per SharesDocument53 pagesMFRS 133 Earnings Per SharesHANIS ATHIRAH MOHD KHAIRINo ratings yet

- Match The Concepts With Their Definitions. Look at The ExampleDocument2 pagesMatch The Concepts With Their Definitions. Look at The ExampleJenny Zulay SUAREZ SOLANO100% (1)

- Evaluating Internal Audit PerformanceDocument92 pagesEvaluating Internal Audit Performancenisrina jaesaNo ratings yet

- Solution Manual For Principles of Cost Accounting 17th EditionDocument36 pagesSolution Manual For Principles of Cost Accounting 17th Editionsea.apesavvy6k368100% (45)

- Colegio de Calumpit financial quiz answersDocument2 pagesColegio de Calumpit financial quiz answersCyrus SantosNo ratings yet

- A Message From The Secretary of The TreasuryDocument26 pagesA Message From The Secretary of The TreasurylosangelesNo ratings yet

- Summer Training On Training & Development in BHELDocument81 pagesSummer Training On Training & Development in BHELjitendra maheshwari83% (18)

- Combining PCR With IV Is A Clever Way of Viewing ItDocument17 pagesCombining PCR With IV Is A Clever Way of Viewing ItKamNo ratings yet