Professional Documents

Culture Documents

Dupont Analysis (5 Stage)

Uploaded by

Ashish0 ratings0% found this document useful (0 votes)

7 views5 pagesOriginal Title

cipla DUPONT.pptx

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views5 pagesDupont Analysis (5 Stage)

Uploaded by

AshishCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 5

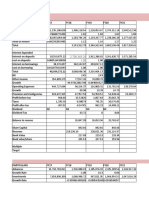

DuPont Analysis ( 5 Stage )

• Tax burden is the proportion of profits retained after paying taxes

• Interest burden shows how interest is affecting profits. If a company

has no debt, the ratio will be 1.

• Operating income margin is the operating income per dollar of sales

• Asset turnover shows asset utilization efficiency

• Equity multiplier shows financial leverage

All in Rs Cr

FY EBIT Sales EBT Net Income Total Assets Total Equity

2013 2038.9 8107.53 2011.86 1507.11 11493.21 8869.52

2014 1856.17 9134.07 1818.34 1388.34 12924 10091.64

2015 1579.29 9776.23 1539.97 1181.09 14505.18 10679.71

2016 1886.6 11887.35 1739.53 1462.3 15239.05 11985.88

2017 1226.14 10637.08 1186.94 974.94 15607.22 12800.51

2018 2000.82 11004.44 1988.92 1468.52 17094.97 14113.52

FY EBIT Margin Interest Burden Tax Burden Asset Turnover Financial Leverage ROE

2013 0.25 0.99 0.75 0.71 1.30 17.0%

2014 0.20 0.98 0.76 0.71 1.28 13.8%

2015 0.16 0.98 0.77 0.67 1.36 11.1%

2016 0.16 0.92 0.84 0.78 1.27 12.2%

2017 0.12 0.97 0.82 0.68 1.22 7.6%

2018 0.18 0.99 0.74 0.64 1.21 10.4%

You might also like

- Business Finance PeTa Shell Vs Petron FinalDocument5 pagesBusiness Finance PeTa Shell Vs Petron FinalFRANCIS IMMANUEL TAYAGNo ratings yet

- Textile Industry Financial Analysis Report (321 Project)Document34 pagesTextile Industry Financial Analysis Report (321 Project)hamnah lateefNo ratings yet

- General Insurance Corporation of IndiaDocument6 pagesGeneral Insurance Corporation of IndiaGukan VenkatNo ratings yet

- Deshbandu LimitedDocument10 pagesDeshbandu LimitedDedar HossainNo ratings yet

- Aftab Auto: Year 2012 2013 2014 2015 2016Document11 pagesAftab Auto: Year 2012 2013 2014 2015 2016Yazdan Ibon KamalNo ratings yet

- Jindal Steel Ratio AnalysisDocument1 pageJindal Steel Ratio Analysismir danish anwarNo ratings yet

- CBRMDocument14 pagesCBRMSurajSinghalNo ratings yet

- Key RatiosDocument6 pagesKey RatiosSumeet ChaurasiaNo ratings yet

- BFS Du Point Analysis BR6 Axis BankDocument27 pagesBFS Du Point Analysis BR6 Axis BankMadhusudhanan RameshkumarNo ratings yet

- Ratio Analysis TamoDocument1 pageRatio Analysis Tamomir danish anwarNo ratings yet

- Year Current RatioDocument13 pagesYear Current Ratiopsana99gmailcomNo ratings yet

- Tata Motors ForetradersDocument18 pagesTata Motors Foretradersguptaasoham24No ratings yet

- Himatsingka Seida LTD.: Ratio Analysis SheetDocument1 pageHimatsingka Seida LTD.: Ratio Analysis SheetNeetesh DohareNo ratings yet

- Titan Co Financial ModelDocument15 pagesTitan Co Financial ModelAtharva OrpeNo ratings yet

- Vardhman Textile Financial Ratio AnalysisDocument6 pagesVardhman Textile Financial Ratio Analysisnishant singhalNo ratings yet

- Yes BankDocument18 pagesYes BankVishalPandeyNo ratings yet

- Financial Accounting and Reporting: The Game of Financial RatiosDocument8 pagesFinancial Accounting and Reporting: The Game of Financial RatiosANANTHA BHAIRAVI MNo ratings yet

- Leverage AnalysisDocument8 pagesLeverage AnalysisShubhangi GargNo ratings yet

- Finance TermpaperDocument12 pagesFinance TermpaperSabiha IslamNo ratings yet

- Federal BankDocument18 pagesFederal BankvishalNo ratings yet

- NAV ComputationDocument130 pagesNAV ComputationamiNo ratings yet

- Financial Management - I SLFI501: AssignmentDocument6 pagesFinancial Management - I SLFI501: AssignmentMahima GirdharNo ratings yet

- Apollo HospitalsDocument18 pagesApollo HospitalsvishalNo ratings yet

- Project of Tata MotorsDocument7 pagesProject of Tata MotorsRaj KiranNo ratings yet

- Group3 - DIY - Garware Wall Ropes - Stock PitchDocument5 pagesGroup3 - DIY - Garware Wall Ropes - Stock PitchBhushanam BharatNo ratings yet

- 4.6 Financial Ratio: Jenis Rasio Keuangan Normal 2018 2019 2020 2021 2022Document3 pages4.6 Financial Ratio: Jenis Rasio Keuangan Normal 2018 2019 2020 2021 2022wulanNo ratings yet

- Yash PapersDocument18 pagesYash PapersVishalPandeyNo ratings yet

- Group - 3 Jayanand, Kanchan, Priyanka, Shukla, Diwakar, VipulDocument32 pagesGroup - 3 Jayanand, Kanchan, Priyanka, Shukla, Diwakar, VipulSiddharth yadiyapurNo ratings yet

- Analysis of Havells 2020 - Writik Saha (20192260)Document32 pagesAnalysis of Havells 2020 - Writik Saha (20192260)writik sahaNo ratings yet

- Narration Sep-08 Sep-09 Sep-10 Sep-11 Sep-12 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18 Trailing Best Case Worst CaseDocument18 pagesNarration Sep-08 Sep-09 Sep-10 Sep-11 Sep-12 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18 Trailing Best Case Worst CasevishalNo ratings yet

- FMCV PresentationDocument12 pagesFMCV PresentationManmeet SinghNo ratings yet

- JSW Energy: Horizontal Analysis Vertical AnalysisDocument15 pagesJSW Energy: Horizontal Analysis Vertical Analysissuyash gargNo ratings yet

- DataDocument11 pagesDataA30Yash YellewarNo ratings yet

- Ratio Project of Atlas and HondaDocument1 pageRatio Project of Atlas and HondaShuja HashmiNo ratings yet

- Narration Mar-10 Mar-11 Mar-12 Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18 Mar-19 Trailing Best Case Worst CaseDocument10 pagesNarration Mar-10 Mar-11 Mar-12 Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18 Mar-19 Trailing Best Case Worst Caseraj chopdaNo ratings yet

- LIC Housing FinDocument18 pagesLIC Housing FinvishalNo ratings yet

- Accounts Termpaper1Document21 pagesAccounts Termpaper1Nisha RialchNo ratings yet

- RanbaxyDocument2 pagesRanbaxyamit_sachdevaNo ratings yet

- Valuation of Bank (Part-3) - Task 21Document10 pagesValuation of Bank (Part-3) - Task 21snithisha chandranNo ratings yet

- Yuken IndiaDocument18 pagesYuken IndiaVishalPandeyNo ratings yet

- VERTICAL LIABILITIES 1Document4 pagesVERTICAL LIABILITIES 1NL CastañaresNo ratings yet

- Hotel Sector AnalysisDocument39 pagesHotel Sector AnalysisNishant DhakalNo ratings yet

- UltraTech CemDocument18 pagesUltraTech CemvishalNo ratings yet

- Investing 5% FinalDocument24 pagesInvesting 5% FinalWijdane BroukiNo ratings yet

- Gross Profit: Forecasted Income StatementDocument2 pagesGross Profit: Forecasted Income StatementMalihaHaqueNo ratings yet

- Case Study of Tata MotorsDocument6 pagesCase Study of Tata MotorsSoumendra RoyNo ratings yet

- Prism Cement LTD.: Structure of Current AssetsDocument2 pagesPrism Cement LTD.: Structure of Current AssetsJaveed Ghany MNo ratings yet

- INfyDocument14 pagesINfyswaroop shettyNo ratings yet

- Apb 30091213 FDocument9 pagesApb 30091213 FNehal Sharma 2027244No ratings yet

- Fin 301 Final Assignment Group Name G 1Document26 pagesFin 301 Final Assignment Group Name G 1Avishake SahaNo ratings yet

- Corporate Finance Submitted To: Prof. Sudhanshu Pani Submitted By: Group 6 - Division J Ganesh Textiles CaseDocument10 pagesCorporate Finance Submitted To: Prof. Sudhanshu Pani Submitted By: Group 6 - Division J Ganesh Textiles CaseYOGESH NISHANTNo ratings yet

- Ratio AnalysisDocument3 pagesRatio AnalysisManasi AjithkumarNo ratings yet

- Project in Credit & Collection: DocumentationDocument7 pagesProject in Credit & Collection: DocumentationAlleynel CoNo ratings yet

- Relaxo Footwear - Updated BSDocument54 pagesRelaxo Footwear - Updated BSRonakk MoondraNo ratings yet

- Oriental BankDocument18 pagesOriental BankvishalNo ratings yet

- Ratio Calculation J K TyresDocument4 pagesRatio Calculation J K TyresAjay PawarNo ratings yet

- Industry Ratio Final Na Final 1 With InterpretationDocument3 pagesIndustry Ratio Final Na Final 1 With InterpretationClaudine Anne AguiatanNo ratings yet

- Narration Mar-09 Mar-10 Mar-11 Mar-12 Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18 Trailing Best Case Worst CaseDocument18 pagesNarration Mar-09 Mar-10 Mar-11 Mar-12 Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18 Trailing Best Case Worst CasevishalNo ratings yet

- Ratio AnalysisDocument6 pagesRatio Analysisamitca9No ratings yet