Professional Documents

Culture Documents

Ratio Analysis Tamo

Uploaded by

mir danish anwarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ratio Analysis Tamo

Uploaded by

mir danish anwarCopyright:

Available Formats

Ratio Analysis - TATA MOTORS LTD

Years Mar-14 Mar-15 Mar-16 Mar-17 Mar-18 Mar-19 Mar-20 Mar-21 Mar-22 Mar-23 Trend Mean Midian

Sales Growth 13.02% 3.76% -1.23% 8.10% 3.56% -13.54% -4.32% 11.47% 24.25% 5.01% 3.76%

EBITDA Growth 12.58% -2.15% -22.94% 6.32% -21.60% -27.07% 79.50% -23.44% 28.70% 3.32% -2.15%

EBIT Growth 10.32% -19.98% -55.67% -29.86% -189.71% 128.00% -106.02% -1564.91% -65.31% -210.35% -55.67%

Net Profit Growth -6.42% 3.18% -69.54% -79.01% -355.28% 392.87% -82.86% 619.52% -70.90% 39.06% -69.54%

Dividend Growth -100.00% 0.00% -100.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% -22.22% 0.00%

Gross Margin 22.64% 22.91% 24.73% 23.82% 21.65% 19.57% 19.42% 21.81% 19.81% 20.69% 21.70% 21.73%

EBITDA Margin 14.97% 14.91% 14.06% 10.97% 10.79% 8.17% 6.89% 12.93% 8.88% 9.20% 11.18% 10.88%

EBIT Margin 10.21% 9.82% 7.94% 4.33% 3.40% 0.36% -1.32% 3.50% -0.04% 2.01% 4.02% 3.45%

EBT Margin 8.17% 7.98% 6.15% 2.76% 1.79% -1.55% -4.09% 0.26% -3.39% -0.95% 1.71% 1.02%

Net Profit Margin 6.12% 5.07% 5.04% 1.56% 0.30% -0.74% -4.24% -0.76% -4.91% -1.15% 0.63% -0.22%

Sales Exp % Sales 7.67% 8.00% 10.67% 12.85% 10.86% 11.40% 12.53% 8.88% 10.93% 11.49% 10.53% 10.89%

Depretiation % Sales 4.76% 5.09% 6.12% 6.64% 7.39% 7.81% 8.21% 9.43% 8.92% 7.19% 7.15% 7.29%

OperatingIncome % Sales 10.21% 9.82% 7.94% 4.33% 3.40% 0.36% -1.32% 3.50% -0.04% 2.01% 4.02% 3.45%

Return On Capital Employed 18.83% 19.90% 14.62% 8.55% 5.37% 0.65% -1.84% 4.43% -0.06% 3.88% 7.43% 4.90%

Retained Earnings% 95.49% 100.00% 99.51% 100.00% 100.00% 0.00% 0.00% 0.00% 0.00% 0.00% 49.50% 47.74%

Return On Equity % 11.30% 10.28% 9.28% 3.07% 0.48% -1.35% -5.92% -0.96% -7.15% -2.21% 1.68% -0.24%

Self Sustained Growth Rate 10.79% 10.28% 9.24% 3.07% 0.48% 0.00% 0.00% 0.00% 0.00% 0.00% 3.38% 0.24%

Interest Coverage Ratio 5.01x 5.32x 4.44x 2.76x 2.12x 0.19x -0.47x 1.08x -0.01x 0.68x 2.11x 1.60x

Debtor Turnover Ratio 22.02x 20.92x 20.12x 19.16x 14.66x 15.89x 23.37x 19.70x 22.38x 21.98x 20x 21x

Creditor Turnover Ratio 2.53x 2.45x 2.38x 1.98x 2.04x 2.17x 1.96x 1.73x 2.02x 2.23x 2x 2x

Inventory Turnover 8.54x 8.99x 8.36x 7.69x 6.92x 7.74x 6.97x 6.92x 7.90x 8.49x 8x 8x

Fixed Turnover Ratio 3.37x 2.97x 2.55x 2.81x 2.40x 2.71x 2.05x 1.80x 2.01x 2.62x 3x 3x

Capital Turnover Ratio 3.55x 4.68x 3.46x 4.64x 3.06x 5.02x 4.20x 4.52x 6.25x 7.63x 5x 5x

Debtor Days 17 17 18 19 25 23 16 19 16 17 19 18

Payable Days 145 149 154 184 179 168 186 211 181 164 172 174

Inventory Days 43 41 44 47 53 47 52 53 46 43 47 47

Cash Conversion Cycle(indays) -85 -91 -92 -117 -101 -98 -118 -139 -118 -104 -107 -103

CFO/Sales 15.53% 13.50% 13.88% 11.20% 8.18% 6.26% 10.20% 11.61% 5.13% 10.23% 10.57% 10.71%

CFO/Total Assets 16.55% 14.97% 14.40% 11.08% 7.29% 6.18% 8.32% 8.49% 4.34% 10.57% 10.22% 9.53%

CFO/Total Debt 59.61% 48.27% 54.64% 38.42% 26.82% 17.79% 21.34% 20.40% 9.75% 26.39% 32.34% 26.60%

You might also like

- Jindal Steel Ratio AnalysisDocument1 pageJindal Steel Ratio Analysismir danish anwarNo ratings yet

- Tata Motors ForetradersDocument18 pagesTata Motors Foretradersguptaasoham24No ratings yet

- ITC Financial ModelDocument150 pagesITC Financial ModelKaushik JainNo ratings yet

- ITC Financial ModelDocument24 pagesITC Financial ModelKaushik JainNo ratings yet

- Group Members Financial ProjectionsDocument12 pagesGroup Members Financial ProjectionsManmeet SinghNo ratings yet

- 40 StocksDocument50 pages40 StocksTridib SarkerNo ratings yet

- Common Size P&L - VEDANTA LTDDocument20 pagesCommon Size P&L - VEDANTA LTDVANSHAJ SHAHNo ratings yet

- Asian Paint FMVRDocument20 pagesAsian Paint FMVRdeepaksg787No ratings yet

- Cipla Valuation ModelDocument17 pagesCipla Valuation ModelPuneet GirdharNo ratings yet

- Financial Model of Dmart - 5Document4 pagesFinancial Model of Dmart - 5Shivam DubeyNo ratings yet

- Group3 - DIY - Garware Wall Ropes - Stock PitchDocument5 pagesGroup3 - DIY - Garware Wall Ropes - Stock PitchBhushanam BharatNo ratings yet

- Himatsingka Seida LTD.: Ratio Analysis SheetDocument1 pageHimatsingka Seida LTD.: Ratio Analysis SheetNeetesh DohareNo ratings yet

- Financial Performance OverviewDocument102 pagesFinancial Performance Overviewaditya jainNo ratings yet

- ST BK of IndiaDocument42 pagesST BK of IndiaSuyaesh SinghaniyaNo ratings yet

- Understanding Private Bank Fundamentals and RatiosDocument19 pagesUnderstanding Private Bank Fundamentals and RatiosAbhishekNo ratings yet

- 唯品会估值模型Document21 pages唯品会估值模型Yiang QinNo ratings yet

- Portfolio Optimization: BSRM Brac Beximco GP RAKDocument27 pagesPortfolio Optimization: BSRM Brac Beximco GP RAKFarsia Binte AlamNo ratings yet

- FY 13-14 FY 14-15 FY 70-71 FY 71-72 FY 72-73 ActualDocument7 pagesFY 13-14 FY 14-15 FY 70-71 FY 71-72 FY 72-73 ActualramNo ratings yet

- Lumax IndustriesDocument33 pagesLumax IndustriesAshutosh GuptaNo ratings yet

- Marico Financial Model (Final) (Final-1Document22 pagesMarico Financial Model (Final) (Final-1Jayant JainNo ratings yet

- 2022.07.24 - DCF Tutorial Answer KeyDocument18 pages2022.07.24 - DCF Tutorial Answer KeySrikanth ReddyNo ratings yet

- Britannia IndustriesDocument12 pagesBritannia Industriesmundadaharsh1No ratings yet

- BFS Du Point Analysis BR6 Axis BankDocument27 pagesBFS Du Point Analysis BR6 Axis BankMadhusudhanan RameshkumarNo ratings yet

- Apollo Hospitals Enterprise LTDDocument12 pagesApollo Hospitals Enterprise LTDAkash KaleNo ratings yet

- DCF ModelDocument51 pagesDCF Modelhugoe1969No ratings yet

- DCF Trident 2Document20 pagesDCF Trident 2Jayant JainNo ratings yet

- Assignment - F&A For ManagementDocument16 pagesAssignment - F&A For Managementvimalrparmar001No ratings yet

- Imf CDocument12 pagesImf Cerich canaviriNo ratings yet

- TechnoFunda Investing Screener Excel Template - NeDocument37 pagesTechnoFunda Investing Screener Excel Template - NeDaknik CutieTVNo ratings yet

- Sanwaria ConsumDocument12 pagesSanwaria ConsumSk Intekhaf AlamNo ratings yet

- Monthly Weighted Interest Rates Nicaragua 2017-2018Document2 pagesMonthly Weighted Interest Rates Nicaragua 2017-2018Erika SalazarNo ratings yet

- Vinati Organics Ltd financial analysis and key metrics from 2011 to 2020Document30 pagesVinati Organics Ltd financial analysis and key metrics from 2011 to 2020nhariNo ratings yet

- Chamanlal Setia Exports Ltd financial analysis and key metrics over 10 yearsDocument10 pagesChamanlal Setia Exports Ltd financial analysis and key metrics over 10 yearschandrajit ghoshNo ratings yet

- JK Agri GeneticsDocument32 pagesJK Agri GeneticsXicaveNo ratings yet

- Indic AdoresDocument4 pagesIndic AdoresVicit LainezNo ratings yet

- Shriram FinanceDocument14 pagesShriram Financesuraj pNo ratings yet

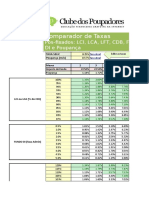

- CP Comparador de Taxas LCI LCA LFT CDB Poupanca FundosDIDocument5 pagesCP Comparador de Taxas LCI LCA LFT CDB Poupanca FundosDIeduardolavratiNo ratings yet

- CG Ratio-Analysis-UnsolvedDocument15 pagesCG Ratio-Analysis-Unsolvedsumit3902No ratings yet

- Narration Mar-09 Mar-10 Mar-11 Mar-12 Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18 Trailing Best Case Worst CaseDocument18 pagesNarration Mar-09 Mar-10 Mar-11 Mar-12 Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18 Trailing Best Case Worst CaseVishalPandeyNo ratings yet

- Vertical Analysis Income StatementDocument1 pageVertical Analysis Income StatementlNo ratings yet

- DCF TemplateDocument21 pagesDCF TemplateShrikant ShelkeNo ratings yet

- Financial Overview5Document8 pagesFinancial Overview5Nishad Al Hasan SagorNo ratings yet

- Ratio Analysis File 2Document4 pagesRatio Analysis File 2MD HAFIZUR RAHMANNo ratings yet

- ModelDocument103 pagesModelMatheus Augusto Campos PiresNo ratings yet

- CMG Postmortem 2018Document9 pagesCMG Postmortem 2018mweng407No ratings yet

- Aliza Rizvi 22010100: Exhibit 8: Assumptions For Discounted Cash Flow AnalysisDocument3 pagesAliza Rizvi 22010100: Exhibit 8: Assumptions For Discounted Cash Flow AnalysisAliza RizviNo ratings yet

- Petron vs Shell Financial AnalysisDocument5 pagesPetron vs Shell Financial AnalysisFRANCIS IMMANUEL TAYAGNo ratings yet

- Base Case - Financial ModelDocument52 pagesBase Case - Financial Modeljuan.farrelNo ratings yet

- CAGR W.R.T First Year: (All Figures in INR Lakhs Unless Stated Otherwise)Document22 pagesCAGR W.R.T First Year: (All Figures in INR Lakhs Unless Stated Otherwise)Garima GulatiNo ratings yet

- Country Risk EXDocument6 pagesCountry Risk EXIfechukwu AnunobiNo ratings yet

- Albermarle Financial ModelDocument38 pagesAlbermarle Financial ModelParas AroraNo ratings yet

- Target FinancialsDocument15 pagesTarget Financialsso_levictorNo ratings yet

- Prima PlasticsDocument46 pagesPrima PlasticsvinamraNo ratings yet

- Avenue SuperDocument18 pagesAvenue SuperVishalPandeyNo ratings yet

- Comprador TaxasDocument4 pagesComprador TaxasRenan MartinelliNo ratings yet

- Narration Mar-14 Mar-15 Mar-16 Mar-17 Mar-18 Mar-19 Mar-20 Mar-21 Mar-22 Mar-23 Trailing Best Case Worst CaseDocument30 pagesNarration Mar-14 Mar-15 Mar-16 Mar-17 Mar-18 Mar-19 Mar-20 Mar-21 Mar-22 Mar-23 Trailing Best Case Worst CaseXicaveNo ratings yet

- ITC Ltd Financial Analysis and Key Ratios from 2010-2020Document10 pagesITC Ltd Financial Analysis and Key Ratios from 2010-2020deepanshuNo ratings yet

- Main YearDocument3 pagesMain YearKe ShuNo ratings yet

- Krakatau Steel A CaseDocument9 pagesKrakatau Steel A CaseFarhan SoepraptoNo ratings yet

- K-Means ClusteringDocument16 pagesK-Means Clusteringjuan carlos gomez lopezNo ratings yet

- GST Revenue Collection May2022Document5 pagesGST Revenue Collection May2022mir danish anwarNo ratings yet

- Python Interview Questions: Click HereDocument72 pagesPython Interview Questions: Click HereKajalNo ratings yet

- Graduate Level Examination 1Document234 pagesGraduate Level Examination 1Rahul sharmaNo ratings yet

- Modern Portfolio Theory and Investment Analysis 9th Edition Elton Test Bank 1Document27 pagesModern Portfolio Theory and Investment Analysis 9th Edition Elton Test Bank 1george100% (42)

- B2 2022 May AnsDocument15 pagesB2 2022 May AnsRashid AbeidNo ratings yet

- Cornerstones of Managerial Accounting Canadian 3rd Edition Mowen Solutions ManualDocument26 pagesCornerstones of Managerial Accounting Canadian 3rd Edition Mowen Solutions ManualKristieKelleyenfm100% (57)

- P1 Accounting ScannerDocument286 pagesP1 Accounting Scannervishal jalan100% (1)

- Cases&Exercises - Chapter 4Document3 pagesCases&Exercises - Chapter 4Barbara AraujoNo ratings yet

- Study - Id75404 - Venture Capital in BrazilDocument32 pagesStudy - Id75404 - Venture Capital in BrazilGuilherme LustosaNo ratings yet

- Reformulation of Financial StatementsDocument30 pagesReformulation of Financial StatementsKatty MothaNo ratings yet

- Survey of Accounting 5Th Edition Edmonds Solutions Manual Full Chapter PDFDocument67 pagesSurvey of Accounting 5Th Edition Edmonds Solutions Manual Full Chapter PDFzanewilliamhzkbr100% (6)

- Analyzing Financing Decisions and Ratios for IDFC FIRST BANKDocument5 pagesAnalyzing Financing Decisions and Ratios for IDFC FIRST BANKMr. Pravar Mathur Student, Jaipuria LucknowNo ratings yet

- Mid-year acquisition consolidated statementDocument4 pagesMid-year acquisition consolidated statementOmolaja IbukunNo ratings yet

- ACCT403-Accounting For InventoryDocument63 pagesACCT403-Accounting For InventoryMary AmoNo ratings yet

- Financial Statement AnalysisDocument40 pagesFinancial Statement AnalysisYucel BozbasNo ratings yet

- Mutual Fund Management Set 5Document6 pagesMutual Fund Management Set 5Kalai NanayamNo ratings yet

- Cheat Sheet For ValuationDocument4 pagesCheat Sheet For ValuationRISHAV BAIDNo ratings yet

- Signed FS Inocycle Technology Group TBK 2018 PDFDocument74 pagesSigned FS Inocycle Technology Group TBK 2018 PDFmichele hazelNo ratings yet

- Capital Budgeting & Cost Analysis: OutlineDocument15 pagesCapital Budgeting & Cost Analysis: OutlineLưu Hồng Hạnh 4KT-20ACNNo ratings yet

- C.A. Foundation Final Accounts For Sole Proprietorship QuestionsDocument2 pagesC.A. Foundation Final Accounts For Sole Proprietorship Questionsgpgaming1693No ratings yet

- Afar - Partnership Formation - BagayaoDocument2 pagesAfar - Partnership Formation - BagayaoRejay VillamorNo ratings yet

- DEPRECIATION2Document9 pagesDEPRECIATION2Darlianne Klyne BayerNo ratings yet

- Payment Schedule Rooftop Solar Project - Casa Bella Gold VerticaDocument17 pagesPayment Schedule Rooftop Solar Project - Casa Bella Gold VerticaKickuNo ratings yet

- Week1 Assignment1Document8 pagesWeek1 Assignment1kireeti415No ratings yet

- FarmFresh - Annual Report 20221Document118 pagesFarmFresh - Annual Report 20221qNo ratings yet

- Dividend Policy Exercise ReviewerDocument1 pageDividend Policy Exercise ReviewerpolxrixNo ratings yet

- Test On Admission of PartnerDocument1 pageTest On Admission of PartnerShrirang ParNo ratings yet

- Income StatementDocument56 pagesIncome StatementEsmer AliyevaNo ratings yet

- Quant Tax Plan - Fact SheetDocument1 pageQuant Tax Plan - Fact Sheetsaransh saranshNo ratings yet

- Advanced Financial Accounting 10th Edition Christensen Solutions Manual DownloadDocument50 pagesAdvanced Financial Accounting 10th Edition Christensen Solutions Manual DownloadCecil Lombardo100% (17)

- Narration Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18Document38 pagesNarration Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18AbhijitChandraNo ratings yet

- Financial Statement AnalysisDocument26 pagesFinancial Statement Analysissagar7No ratings yet

- Cost Accounting OMDocument26 pagesCost Accounting OMJohn CenaNo ratings yet