Professional Documents

Culture Documents

Quant Tax Plan - Fact Sheet

Uploaded by

saransh saranshOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Quant Tax Plan - Fact Sheet

Uploaded by

saransh saranshCopyright:

Available Formats

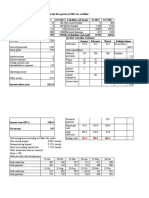

Report As on 22-Nov-2022

Quant Tax Plan(G) - Regular Plan - Growth Option |

Category : Equity : Tax Saving (ELSS) | Benchmark Index : NIFTY 500 - TRI | Fund Manager : Ankit Pande

247.22 2,126.6(Cr.) Expense Ratio 2.62 %

NAV as on 21-Nov-22 AUM as on 31-Oct-22

Turnover Ratio 154 %

Investment Objective Exit Load 0%

To generate Capital Appreciation by investing Lock-in Period 3 Years

predominantly in a well diversified portfolio of Inception Date 31-Mar-00

Equity Shares with growth potential. This

Income may be complemented by possible Return since Inception 15.25 %

dividend and other income. Min. Inv. Lumpsum / SIP ₹ 500 / 500

Fund Type Open Ended

Fund House Quant Mutual Fund

Fund Taxation Equity Oriented

Return (%) (as on 21-Nov-22) Asset Allocation (%)

3 Month 6 Month 1 Year 3 Year 5 Year 10 Year

Fund 5.43 15.75 11.14 37.32 22.11 21.17 2.69

Benchmark Index - - - - - 0.0 97.31

Category Average 1.48 12.96 2.17 19.29 11.25 14.81

Rank within category 2 7 2 1 1 1 0 20 40 60 80 100 120

(in %)

No. of funds in category 57 57 57 57 46 28

Cash&CashEqv. Equity

Returns greater than 1 year have been annualized.

Portfolio Holdings (as on 31-Oct-22) Sector Allocation v/s Category Average

35

Top Holdings Assets % 30

Assets ( % )

25

ITC Ltd. 9.41 20

15

Ambuja Cements Ltd. 9.25 10

5

State Bank Of India 7.55 0

FMCG Financials Energy Construction MediaandCommuni…

Adani Ports and Special E... 7.25

Quant Tax Plan(G) Equity : Tax Saving (ELSS)

Reliance Industries Ltd. 6.87

Patanjali Foods Ltd. 5.29 Portfolio Market Cap Portfolio Summary

NTPC Ltd. 4.71 Fund Cat. Avg. Concentration & Valuation

Kotak Mahindra Bank Ltd. 3.67 Avg. Mkt. Cap (cr.) 1,26,457 1,27,178 Number Of stocks 46

Zee Entertainment Enterpr... 3.15 Large (%) 67.22 57.74 Top 10 stocks (%) 60.17

The Indian Hotels Company... 3.02 Mid (%) 22.28 17.73 Top 5 stocks (%) 40.33

Punjab National Bank 2.4 Small (%) 7.81 18.53 Top 3 stocks (%) 26.21

Maruti Suzuki India Ltd. 2.21 Portfolio P/B Ratio 4.82

Infosys Ltd. 2.07 Portfolio P/E Ratio 38.57

AMC & RTA Debt Profile Credit Quality Breakdown

AMC Quant Money Managers Limited 1 Yr. 1 Yr. Cat. Credit Quality Portfolio (%)

Fund High Low Avg.

Phone 022-6295 5000 Sovereign -

No. of Securities - - - 1

Email help@quant.in AAA -

Mod. Duration - - - -

Website http://www.quant-mutual.com/ AA -

(yrs)

RTA Name KFin Technologies Limited A -

Avg. Maturity - - - -

Email customercare@karvy.com (yrs) Below A -

Yield to Maturity - - - - Default -

(%)

Disclaimer: RV Financial Services Pvt. Ltd. has gathered the data, information, statistics from sources believed to be highly reliable and true. All necessary precautions have been taken to avoid

any error, lapse or insufficiency, however, no representations or warranties are made (express or implied) as to the reliability, accuracy or completeness of such information. The Company

cannot be held liable for any loss arising directly or indirectly from the use of, or any action taken in on, any information appearing herein.

You might also like

- BNP Paribas Substantial Equity Hybrid Fund - Regular Plan - RegularDocument1 pageBNP Paribas Substantial Equity Hybrid Fund - Regular Plan - Regularpdk jyotNo ratings yet

- Capital Growth FundDocument1 pageCapital Growth FundHimanshu AgrawalNo ratings yet

- HDFC Large and Mid Cap Fund Regular PlanDocument1 pageHDFC Large and Mid Cap Fund Regular Plansuccessinvestment2005No ratings yet

- Franklin India Ultra Short Bond Fund - Super Institutional PlanDocument1 pageFranklin India Ultra Short Bond Fund - Super Institutional PlanTimNo ratings yet

- Tata Nifty Midcap 150 Momentum 50 Index Fund Direct PlanDocument1 pageTata Nifty Midcap 150 Momentum 50 Index Fund Direct Planjagdevwasson761No ratings yet

- Peso Powerhouse Fund - Fund Fact Sheet - December - 2020Document2 pagesPeso Powerhouse Fund - Fund Fact Sheet - December - 2020Jayr LegaspiNo ratings yet

- UTI Nifty Index Fund - Regular Plan - Regular: HistoryDocument1 pageUTI Nifty Index Fund - Regular Plan - Regular: HistorySharun JacobNo ratings yet

- Navi Nasdaq 100 Fof Direct PlanDocument1 pageNavi Nasdaq 100 Fof Direct Planrohitgoyal_ddsNo ratings yet

- USAA Growth and Tax Strategy Fund - 2Q '22Document2 pagesUSAA Growth and Tax Strategy Fund - 2Q '22ag rNo ratings yet

- Fundcard: Axis Treasury Advantage Fund - Direct PlanDocument4 pagesFundcard: Axis Treasury Advantage Fund - Direct PlanYogi173No ratings yet

- Fundcard: Edelweiss Low Duration Fund - Direct PlanDocument4 pagesFundcard: Edelweiss Low Duration Fund - Direct PlanYogi173No ratings yet

- ValueResearchFundcard AxisBanking&PSUDebtFund DirectPlan 2017aug13Document4 pagesValueResearchFundcard AxisBanking&PSUDebtFund DirectPlan 2017aug13Jeet MehtaNo ratings yet

- HDFC Opportunities FundDocument1 pageHDFC Opportunities FundManjunath BolashettiNo ratings yet

- ALFM Peso Bond Fund Inc. - 202208Document2 pagesALFM Peso Bond Fund Inc. - 202208Megan CastilloNo ratings yet

- P Smallcap Ar EngDocument43 pagesP Smallcap Ar EngKuanChau YapNo ratings yet

- Icici Prudential Equity and Debt Fund Direct PlanDocument1 pageIcici Prudential Equity and Debt Fund Direct Planrohitgoyal_ddsNo ratings yet

- Icici Prudential Alpha Low Vol 30 Etf FofDocument2 pagesIcici Prudential Alpha Low Vol 30 Etf FofPrateekNo ratings yet

- Legg Mason Value Fund - Dec 2022 PDFDocument2 pagesLegg Mason Value Fund - Dec 2022 PDFJeanmarNo ratings yet

- Maceef FS202212Document10 pagesMaceef FS202212Guan JooNo ratings yet

- Axis Bluechip Fund - Regular: HistoryDocument1 pageAxis Bluechip Fund - Regular: Historysatya1220No ratings yet

- Fundcard: Baroda Pioneer Treasury Advantage Fund - Direct PlanDocument4 pagesFundcard: Baroda Pioneer Treasury Advantage Fund - Direct Planravinandan_pNo ratings yet

- Sbi-Bluechip-Fund Jan 2021Document1 pageSbi-Bluechip-Fund Jan 2021pdk jyotNo ratings yet

- HDFC BlueChip FundDocument1 pageHDFC BlueChip FundKaran ShambharkarNo ratings yet

- SBI Small and Mid Cap Fund FactsheetDocument1 pageSBI Small and Mid Cap Fund Factsheetfinal bossuNo ratings yet

- ALFM Peso Bond FundDocument2 pagesALFM Peso Bond FundkimencinaNo ratings yet

- Mirae Asset Nyse Fang EtfDocument2 pagesMirae Asset Nyse Fang EtfAravind MenonNo ratings yet

- ValueResearchFundcard BarodaPioneerShortTermBondFund DirectPlan 2017may16Document4 pagesValueResearchFundcard BarodaPioneerShortTermBondFund DirectPlan 2017may16Achint KumarNo ratings yet

- ALFM Peso Bond Fund Inc. - 202205 1Document2 pagesALFM Peso Bond Fund Inc. - 202205 1C KNo ratings yet

- INF204K01HY3 - Reliance Smallcap FundDocument1 pageINF204K01HY3 - Reliance Smallcap FundKiran ChilukaNo ratings yet

- Fact Sheet - ICON Flexible Bond Fund (IOBZX)Document2 pagesFact Sheet - ICON Flexible Bond Fund (IOBZX)acie600No ratings yet

- Franklin India Smaller Companies Fund Regular Plan Mutual Fund Value ResearchDocument1 pageFranklin India Smaller Companies Fund Regular Plan Mutual Fund Value ResearchAbhishek GinodiaNo ratings yet

- November 2023 ICEA LION Balanced Fund Fact SheetDocument1 pageNovember 2023 ICEA LION Balanced Fund Fact SheetAndrew MuhumuzaNo ratings yet

- Presentation On ICICI Prudential Bluechip Fund For Dec 2022 (D)Document21 pagesPresentation On ICICI Prudential Bluechip Fund For Dec 2022 (D)Gaurav SharmaNo ratings yet

- HDFC Diversified Equity FundDocument1 pageHDFC Diversified Equity FundMayank RajNo ratings yet

- PIATAFDocument1 pagePIATAFEileen LauNo ratings yet

- HDFC Sec Note - MF Category Analysis - ELSS - Dec 2017-201712121306016401224Document8 pagesHDFC Sec Note - MF Category Analysis - ELSS - Dec 2017-201712121306016401224Aravind SureshNo ratings yet

- P Smallcap Ar EngDocument27 pagesP Smallcap Ar EngxiaokiaNo ratings yet

- Vanguard Global Stock Index FundDocument4 pagesVanguard Global Stock Index FundjorgeperezsidecarshotmailomNo ratings yet

- Polen Growth Fund: Product Profile Investment ObjectiveDocument3 pagesPolen Growth Fund: Product Profile Investment Objectivekaya nathNo ratings yet

- ValueResearchFundcard AxisBanking&PSUDebtFund 2019jan03Document4 pagesValueResearchFundcard AxisBanking&PSUDebtFund 2019jan03fukkatNo ratings yet

- PDSF Ar EngDocument25 pagesPDSF Ar EngSeudonim SatoshiNo ratings yet

- RWC Global Emerging Equity Fund: 30th June 2020Document2 pagesRWC Global Emerging Equity Fund: 30th June 2020Nat BanyatpiyaphodNo ratings yet

- Mfu Indiaeq Acc enDocument4 pagesMfu Indiaeq Acc enAlly Bin AssadNo ratings yet

- LT Tax Advantage FundDocument2 pagesLT Tax Advantage FundDhanashri WarekarNo ratings yet

- ValueResearchFundcard FranklinIndiaUltraShortBondFund SuperInstitutionalPlan DirectPlan 2017oct11Document4 pagesValueResearchFundcard FranklinIndiaUltraShortBondFund SuperInstitutionalPlan DirectPlan 2017oct11jamsheer.aaNo ratings yet

- Blue Chip JulyDocument1 pageBlue Chip JulyPiyushNo ratings yet

- 91 SA Institutional Cautious Managed Fund Factsheet enDocument1 page91 SA Institutional Cautious Managed Fund Factsheet enXola Xhayimpi JwaraNo ratings yet

- Glacier Global Stock Feeder FundDocument2 pagesGlacier Global Stock Feeder FundMarkoNo ratings yet

- Blue Chip Equity Fund: Portfolio AllocationDocument1 pageBlue Chip Equity Fund: Portfolio Allocationshahar2010No ratings yet

- Unit-Linked Fund: Balancer II (Open Fund)Document1 pageUnit-Linked Fund: Balancer II (Open Fund)sandeepNo ratings yet

- LT Emerging Business FundDocument2 pagesLT Emerging Business FundSankalp BaliarsinghNo ratings yet

- Ind Nifty BankDocument2 pagesInd Nifty Bankjayeshrane2107No ratings yet

- Equity Performance Report 09-10-2021Document26 pagesEquity Performance Report 09-10-2021lalit963No ratings yet

- Name Wt. / Stock (%) : Primario FundDocument2 pagesName Wt. / Stock (%) : Primario FundRakshan ShahNo ratings yet

- Dbs SelectDocument20 pagesDbs SelectJIBEESH01No ratings yet

- Sound Investment+Time+Patience Wealth Creation - HDFC Top 100 Fund Leaflet (As On 31st Oct 2022)Document2 pagesSound Investment+Time+Patience Wealth Creation - HDFC Top 100 Fund Leaflet (As On 31st Oct 2022)Rajat GuptaNo ratings yet

- UTI Nifty Fund - Growth31052017Document2 pagesUTI Nifty Fund - Growth31052017Pruthvi KumarNo ratings yet

- Etf Analysis I 42896Document1 pageEtf Analysis I 42896Geeta RawatNo ratings yet

- Name Wt. / Stock (%) : Primario FundDocument2 pagesName Wt. / Stock (%) : Primario FundRakshan ShahNo ratings yet

- Braced for Impact: Reforming Kazakhstan's National Financial Holding for Development Effectiveness and Market CreationFrom EverandBraced for Impact: Reforming Kazakhstan's National Financial Holding for Development Effectiveness and Market CreationNo ratings yet

- Cost AccountingDocument154 pagesCost AccountingNaman SinghNo ratings yet

- The Use of Technical and Fundamental Analysis Kumar NaveenDocument296 pagesThe Use of Technical and Fundamental Analysis Kumar Naveensmeena100% (1)

- Inventory Cases - Sessions 3 & 4Document23 pagesInventory Cases - Sessions 3 & 4akansha.associate.workNo ratings yet

- Faurecia FY2019 Press Release vDEFDocument13 pagesFaurecia FY2019 Press Release vDEFSharmi antonyNo ratings yet

- Thesis On Equity ValuationDocument6 pagesThesis On Equity Valuationmelanieericksonminneapolis100% (2)

- Crude Oil Limited Purchases An Oil Tanker Depot On July PDFDocument1 pageCrude Oil Limited Purchases An Oil Tanker Depot On July PDFTaimur TechnologistNo ratings yet

- 1201 Broadway - Investment Analysis ModelDocument4 pages1201 Broadway - Investment Analysis ModelNoahoodNo ratings yet

- ACCA F3 Financial Accounting INT Solved Past Papers 0107Document283 pagesACCA F3 Financial Accounting INT Solved Past Papers 0107Hasan Ali BokhariNo ratings yet

- aFM12 Preface Solutions ManualDocument6 pagesaFM12 Preface Solutions ManualEngMohamedReyadHelesyNo ratings yet

- Soal Advanced 2 Mid 2018 2019Document2 pagesSoal Advanced 2 Mid 2018 2019dwi davisNo ratings yet

- Idx Monthly January 2021Document194 pagesIdx Monthly January 2021mamanNo ratings yet

- Credit Card BillDocument2 pagesCredit Card Billmohasinkamal421No ratings yet

- Acct 557Document5 pagesAcct 557kihumbae100% (4)

- 8 - June 2018 Module 3.04 (Suggested Solutions)Document16 pages8 - June 2018 Module 3.04 (Suggested Solutions)Faisal MehmoodNo ratings yet

- Case Study Before UTS LD21-20221028051637Document5 pagesCase Study Before UTS LD21-20221028051637Abbas MayhessaNo ratings yet

- TOPIC 4 MR Debentures - 230314 - 081422Document14 pagesTOPIC 4 MR Debentures - 230314 - 081422shivani dholeNo ratings yet

- Depository Receipts Information Guide CitigroupDocument59 pagesDepository Receipts Information Guide Citigroupnsri85No ratings yet

- MO QuestionDocument2 pagesMO Questionlingly justNo ratings yet

- 5th Lecture-Ch. 5Document57 pages5th Lecture-Ch. 5otaku25488No ratings yet

- Rencana Bisnis Business Plan Jasa Content CreatorDocument6 pagesRencana Bisnis Business Plan Jasa Content Creatoryesrun eka setyobudiNo ratings yet

- QA SIPACKS in Business Finance Q3 W1 7Document91 pagesQA SIPACKS in Business Finance Q3 W1 7Roan DiracoNo ratings yet

- CMPC 221 Finals Part 1: Mulitple ChoiceDocument7 pagesCMPC 221 Finals Part 1: Mulitple ChoiceIyarna YasraNo ratings yet

- Financial Statement Group 2 Assignment 1Document4 pagesFinancial Statement Group 2 Assignment 1Bryan LesmadiNo ratings yet

- Equities Crossing Barriers 09jun10Document42 pagesEquities Crossing Barriers 09jun10Javier Holguera100% (1)

- Introduction To Financial Statement AnalysisDocument2 pagesIntroduction To Financial Statement AnalysisTričiaStypayhørliksønNo ratings yet

- Working Capital Management PDFDocument6 pagesWorking Capital Management PDFLeviNo ratings yet

- BS Delhi English 31-01Document26 pagesBS Delhi English 31-01krishna524No ratings yet

- Using Pivot Points For PredictionsDocument2 pagesUsing Pivot Points For PredictionsSIightlyNo ratings yet

- BM 204 2020 Module Investment ApprochesDocument36 pagesBM 204 2020 Module Investment ApprochesPhebieon MukwenhaNo ratings yet

- B40 PDFDocument7 pagesB40 PDFNacer Eddine AliaNo ratings yet