Professional Documents

Culture Documents

Nisha

Uploaded by

My Social Panda0 ratings0% found this document useful (0 votes)

4 views14 pagesgdwihSKJHDLKAWS

Original Title

nisha ppt

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentgdwihSKJHDLKAWS

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

4 views14 pagesNisha

Uploaded by

My Social PandagdwihSKJHDLKAWS

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 14

NEW TRENDS IN INDIAN BANKING SYSTEM

INTRODUCTION

Today, we are having a fairly well developed banking

system with different classes of banks.

Some of them have engaged in the areas of

consumer credit, credit cards, merchant banking,

internet and phone banking, leasing, mutual funds

etc.

A few banks have already set up subsidiaries for

merchant banking, leasing and mutual funds and

many more are in the process of doingso.

IT IN BANKING

Increasing importance of total bankingautomation

in the Indian BankingIndustry

Used under two different avenues in Bankingused

under two different avenues inBanking

Communication and Connectivity

Business Process Reengineering

TECHNOLOGY IN BANKS

To Transform Financial Services Industry In The Net- worked World

Increased Operation Efficiency, profitability & Productivity

Superior Customer Service

Provide Services / Products Across A Range OfChannels

ToBe Futuristic And Have “Time” Value In All Its Dealings

With Customers

Improved Management/Accountability

Minimal Transaction Cost

Improved Financial Analysis Capabilities.

IT ENABLES -

Sophisticated Product Development

Better Market Infrastructure

Implementation Of Reliable Techniques For Control Of Risks

Helps ToReach Geographically Distant Area

FOCUS ASPECTS OF NEW BANKING SYSTEMS

CORE BANKING SOLUTIONS(CBS)

CUSTOMER RELATIONSHIP MANAGEMENT(CRM)

ELECTRONIC PAYMENT SERVICES (E - CHEQUES )

India, as harbinger to the introduction of e-cheque, the

Negotiable Instruments Act has already been amended to

include; Truncated cheque and E-cheque instruments.

REAL TIME GROSS SETTLEMENT (RTGS)

Introduced in India since March 2004

Is a system through which electronics instructions can be

given by banks to transfer funds from their account to the

account of another bank.

The RTGS system is maintained and operated by the RBI and

provides a means of efficient and faster funds transfer among

banks facilitating their financial operations

Runs on ‘Real Time basis’

ELECTRONIC FUND TRANSFER(EFT)

• Is a system whereby anyone who wants to make payment to

another person/company etc. can approach his bank and

make cash payment or give instructions/authorization to

transfer funds directly from his own account to the bank

account of the receiver/beneficiary.

• RBI is the service provider of EFT.

• ELECTRONIC CLEARING SYSTEM(ECS)

• facility is meant for companies and government departments

to make/receive large volumes of payments rather than for

funds transfers by individuals

ATM’S

Most popular devise in India,

enables the customers to withdraw their money 24 hoursa day 7 days

a week.

ATMs can be used for payment of utility bills, funds transfer between

accounts, deposit of cheques and cash into accounts, balance

enquiry etc.

Tele Banking /Mobile Banking

Do entire non-cash related banking on telephone. Under thisdevise

Automatic Voice Recorder is used for simpler queries andtransactions.

For complicated queries and transactions, manned phone terminals

are used.

POINT OF SALE TERMINAL

Computer terminal that is linked online to the computerized customer

information files in a bank and magnetically encoded plastic transaction

card that identifies the customer to the computer

Electronic Data Interchange (EDI)

Electronic exchange of business documents like purchase order,

invoices, shipping notices, receiving advices etc. in a standard,

computer processed, universally accepted format between trading

partners.

EDI can also be used to transmit financial information andpayments

in electronic form.

FOREIGN DIRECT INVESTMENT (FDI)

• Transfer of technology from overseas countries to the

domestic market

• Ensure better and improved risk management in the

banking sector

• Assures better capitalization

• Offers financial stability in the banking sector in India.

IMPLICATIONS

Quickly responded to the changesin the industry

Re-defined and re-engineered the banking operationsas whole

Customization through leveragingtechnology

Customers can access banking services and do banking transactions any

time and from anyware.

Physical branches is going down.

FUTURE OUTLOOK

Everyone today is convinced that the technology is going to hold the key to

future of banking. The achievements in the banking today would not have

make possible without IT revolution. Therefore, the key point is while changing

to the current environment the banks has to understand properly the trigger

for change and accordingly find out the suitable departure point for the

change.

Although, the adoption of technology in banks continues at a rapid pace,

the concentration is perceptibly more in the metros and urban areas. The

benefit of Information Technology is yet to percolate sufficiently to the

common man living in his rural hamlet. More and more programs and

software in regional languages could be introduced to attract more and

more people from the rural segments also.

THANK YOU

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5806)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Commercial Law (UCC 3, 4, 9)Document23 pagesCommercial Law (UCC 3, 4, 9)Victoria Liu0% (1)

- Valuing Capital Investment ProjectsDocument25 pagesValuing Capital Investment ProjectsMaria Esther Huaypar Escobar0% (1)

- Instructors Manual-Corporate Finance and InvestementDocument146 pagesInstructors Manual-Corporate Finance and InvestementLM_S100% (4)

- Quiz - Home Branch AccountingDocument18 pagesQuiz - Home Branch AccountingJessie MacoNo ratings yet

- EC Corporate Presentation-July 2010Document18 pagesEC Corporate Presentation-July 2010Zeid MassadNo ratings yet

- Teacher: Sellamuthu Prabakaran Student: Juan David Burbano Benavides 1)Document10 pagesTeacher: Sellamuthu Prabakaran Student: Juan David Burbano Benavides 1)BelikovNo ratings yet

- 26 Structured RepoDocument4 pages26 Structured RepoJasvinder JosenNo ratings yet

- Tarjetas Virtuales ESPDocument36 pagesTarjetas Virtuales ESPReinier Hernández AvilaNo ratings yet

- Midterm Exam No. 1Document2 pagesMidterm Exam No. 1Anie Martinez100% (1)

- PAS 27 - Separate Financial StatementsDocument1 pagePAS 27 - Separate Financial StatementsZehra LeeNo ratings yet

- Milagro Excel ExhibitsDocument15 pagesMilagro Excel ExhibitsRazi Ullah0% (1)

- Invoice: To: PT United Tractors TBKDocument1 pageInvoice: To: PT United Tractors TBKnasya zhafiraNo ratings yet

- Mutual Funds: Learning OutcomesDocument39 pagesMutual Funds: Learning OutcomesBAZINGANo ratings yet

- Bir Ruling No. Ot-0339-2020Document5 pagesBir Ruling No. Ot-0339-2020Ren Mar CruzNo ratings yet

- International Finance SyllabusDocument5 pagesInternational Finance Syllabussarathbabu_zeeNo ratings yet

- Undeposited Receipts. 50,000 Postal Money Orders 90,000 Traveler's Checks On Hand 120,000 Money Market Fund 400,000 Utility Deposit Receipt 100,000Document5 pagesUndeposited Receipts. 50,000 Postal Money Orders 90,000 Traveler's Checks On Hand 120,000 Money Market Fund 400,000 Utility Deposit Receipt 100,000Jeric Lagyaban AstrologioNo ratings yet

- General Mathematics: Quarter 2 - Module 9: Different Markets For Stocks and BondsDocument27 pagesGeneral Mathematics: Quarter 2 - Module 9: Different Markets For Stocks and BondsNATHANIEL BORAGAYNo ratings yet

- Solutions To Chapter 10 AssignmentsDocument1 pageSolutions To Chapter 10 AssignmentsWilliam Andrew Gutiera BulaqueñaNo ratings yet

- Troncap orDocument17 pagesTroncap orasma zahidNo ratings yet

- ACC00724 (Accounting For Managers) S2, 2016 Assignment 1 (20 Marks)Document4 pagesACC00724 (Accounting For Managers) S2, 2016 Assignment 1 (20 Marks)Asfawosen DingamaNo ratings yet

- Chapter 6 Review in ClassDocument32 pagesChapter 6 Review in Classjimmy_chou1314No ratings yet

- Citta Di AgricolaDocument10 pagesCitta Di Agricolaivan josephNo ratings yet

- Mobile Banking - Project ReportDocument33 pagesMobile Banking - Project ReportAlpha GamingNo ratings yet

- Accounting EquationsDocument27 pagesAccounting EquationsSrijita ChatterjeeNo ratings yet

- Literature ReviewDocument7 pagesLiterature ReviewGayatriThotakuraNo ratings yet

- Most Important Terms and Conditions: Student Loan SchemeDocument2 pagesMost Important Terms and Conditions: Student Loan SchemeAtharv singh BishtNo ratings yet

- Currency Fluctuations - How They Effect The Economy - InvestopediaDocument5 pagesCurrency Fluctuations - How They Effect The Economy - InvestopediaYagya RajawatNo ratings yet

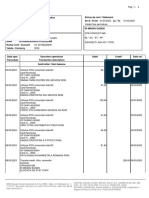

- SV33792220300 2023 03Document4 pagesSV33792220300 2023 03Elena CristinaNo ratings yet

- Vanik Education PVT LTD: GSTIN - 21AAFCV2531H1ZQDocument1 pageVanik Education PVT LTD: GSTIN - 21AAFCV2531H1ZQNRUSINGHA PATRANo ratings yet

- ISO 4217 Currency CodeDocument7 pagesISO 4217 Currency CodeSudhir PandeyNo ratings yet