Professional Documents

Culture Documents

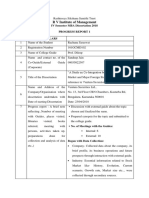

Draft Progress Report I

Uploaded by

Srinivas Cna0 ratings0% found this document useful (0 votes)

5 views6 pageshi

Original Title

Draft Progress Report I (1)

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documenthi

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views6 pagesDraft Progress Report I

Uploaded by

Srinivas Cnahi

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 6

Global Depository Receipt (GDR)

What is GDR ?

A Global Depository Receipt (GDR), also known as

International Depository Receipt (IDR), is a certificate issued by

a depository bank, which purchases shares of foreign companies and

deposits it on the account.

GDRs represent ownership of an underlying number of shares of a

foreign company and are commonly used to invest in companies

from developing .

Prices of global depositary receipt are based on the values of related

shares, but they are traded and settled independently of the underlying

share.

Typically, 1 GDR is equal to 10 underlying shares, but any ratio can be

used. It is a negotiable instrument which is denominated in some freely

convertible currency.

GDRs enable a company, the issuer, to access investors in capital markets

outside of its home country.

Several international banks issue GDRs, such as JPMorgan Chase,

Citigroup, Deutsche Bank, The Bank of New York Mellon.

GDRs are often listed in the Frankfurt Stock Exchange, Luxembourg

Stock Exchange, and the London Stock Exchange, where they are traded

on the International Order Book (IOB).

Characteristics Of GDR

1. It is an unsecured security

2. It may be converted into number of shares

3. Interest and redemption price is public in foreign agency

4. It is listed and traded in the stock exchange

Advantages of GDR to issuing company

1. Accessibility to foreign capital markets

2. Increase in visibility of the issuing company

3. Rise in the capital because of foreign investor

Advantages of GDR to investor

Helps in diversification, hence reducing risk

More transparency since competitor’s securities can be compared

Prompt dividend and capital gain payments

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Date Close Price OF INFOSYS: ReturnsDocument4 pagesDate Close Price OF INFOSYS: ReturnsSrinivas CnaNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Mba Dissertation: 2 Progress ReportDocument2 pagesMba Dissertation: 2 Progress ReportSrinivas CnaNo ratings yet

- A Project Report On Equity Analysis On Indian IT Sector DasdDocument101 pagesA Project Report On Equity Analysis On Indian IT Sector DasdRamawatar Tawaniya100% (1)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- 15299235818651UwxzJ80qzhuec8G PDFDocument9 pages15299235818651UwxzJ80qzhuec8G PDFSrinivas CnaNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Synopsis Change Topic 1Document11 pagesSynopsis Change Topic 1Srinivas CnaNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Date Close Price OF INFOSYS: ReturnsDocument4 pagesDate Close Price OF INFOSYS: ReturnsSrinivas CnaNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Draft Progress Report IDocument2 pagesDraft Progress Report ISrinivas CnaNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Volatality in Indian Stock MarketDocument79 pagesVolatality in Indian Stock MarketSrinivas CnaNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- A Study On Inventory Management and Cost Control Procedure at Toyota Kirloskar Auto Parts ."Document7 pagesA Study On Inventory Management and Cost Control Procedure at Toyota Kirloskar Auto Parts ."Srinivas CnaNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Volatility Indian Stock MarketDocument89 pagesVolatility Indian Stock Marketd_r_patel100% (1)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Volatality in Stock MarketDocument16 pagesVolatality in Stock Marketpratik tanna0% (1)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- 17kxcmd024 Divya ADocument30 pages17kxcmd024 Divya ASrinivas CnaNo ratings yet

- Ilovepdf MergedDocument9 pagesIlovepdf MergedSrinivas CnaNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Draft Progress Report IDocument2 pagesDraft Progress Report ISrinivas CnaNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- "The Current Account Deficit in European Emerging Market: Mini Project OnDocument10 pages"The Current Account Deficit in European Emerging Market: Mini Project OnSrinivas CnaNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Synopsis: Submitted in Partial Fulfillment of The Requirements For The Award of The Degree ofDocument3 pagesSynopsis: Submitted in Partial Fulfillment of The Requirements For The Award of The Degree ofSrinivas CnaNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Synopsis: Submitted in Partial Fulfillment of The Requirements For The Award of The Degree ofDocument3 pagesSynopsis: Submitted in Partial Fulfillment of The Requirements For The Award of The Degree ofSrinivas CnaNo ratings yet

- Mini Project On: "The Current Account Deficit in European Emerging MarketDocument30 pagesMini Project On: "The Current Account Deficit in European Emerging MarketSrinivas CnaNo ratings yet

- The Foreign Exchange MarketDocument11 pagesThe Foreign Exchange MarketSrinivas CnaNo ratings yet

- Sample Synopsis PDFDocument10 pagesSample Synopsis PDFSrinivas CnaNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)