Professional Documents

Culture Documents

The Chicago Board of Trade And: Market Profile Keys For Traders and Investors

Uploaded by

11sudha0 ratings0% found this document useful (0 votes)

58 views37 pagesmp1

Original Title

mp

Copyright

© © All Rights Reserved

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentmp1

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

58 views37 pagesThe Chicago Board of Trade And: Market Profile Keys For Traders and Investors

Uploaded by

11sudhamp1

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 37

The Chicago Board of Trade® and

WindoTrader® Corporation present:

Market Profile® Keys for

Traders and Investors

Market Profile® is a registered trademark of the Chicago Board of Trade®

2003 - ALL RIGHTS RESERVED

The following information is offered as an abridged

edition of the Market Profile® Basic User’s Guide

available through the WINdoTRADEr® website at:

www.windotrader.com

WindoTrader® Corporation thanks the Chicago

Board of Trade® for it’s support in creating the

Market Profile® Basic User’s Guide.

CBoT® Market Profile®

The Market Profile® was developed in the early 1980's by

The Chicago Board of Trade® and Peter Steidlmayer as

an analytical decision support tool to organize and display

market generated information.

The Market Profile's® key components are time, price,

and volume which are then combined and displayed in a

statistical distribution much like a normal bell-shaped

curve to reveal pricing patterns and value.

CBoT® Market Profile® (con’t)

The Market Profile® is not a trading system. It does not

give buy, sell, entry, exit, overbought or oversold

indicators. The trader makes trading decisions based on

an independent evaluation of market price and value

information.

The Market Profile® trader, through study and

experience, can learn to identify the market's underlying

dynamics and structure (trending versus trading range)

and then initiate, manage and exit trades accordingly.

This differs from typical technical analysis which usually

measures price movement.

What is the Market Profile®?

The Market Profile is:

• A structure for organizing a developing market.

• A horizontal and vertical display of the dynamic

process of market activity.

• A visual display of the market’s current ‘value’ or ‘fair’

price range.

What is the Market Profile®? (con’t)

The Market Profile is:

• A decision support tool to help traders better understand

the ‘present’ condition of the market.

• A tool for recording the market’s current activity

through the organization of time, price, and volume.

• A graphic reflection of all market participant opinions.

The Market’s Auction Process

The market’s auction process translates countless supply

and demand factors into the market’s current price.

The market’s current price is determined through the

market’s own price discovery or bid-offer auction

process. Basically, the market auctions up until there are

no more buyers, and down until there are no more sellers.

This is known as a ‘dual auction’ process which means

the end of an ‘up’ auction is the beginning of a ‘down’

auction and vice versa.

The Market’s Auction Process (con’t)

More specifically, the market moves directionally seeking an opposing

directional response resulting in the initial directional move being stopped.

Understanding this auction process through the use of market ‘tools’ such as

the Market Profile® allows traders and investors to identify and effectively

respond to the market’s ‘continuation or change’ scenarios.

A key factor in identifying potential ‘continuation or change’ scenarios is

the Market Profile’s vertical and horizontal display of the market’s own

current activity and it’s current price / value relationships.

Following are several ‘Keys’ to understanding the benefits of using the

Market Profile® as a ‘tool’ in your trading and / or investing toolkit.

Market Profile® ‘Keys’

Direction Tails/Single Prints

Initial Balance Trading Ranges

Point of Control Trends

Range Extension Volume

Direction

•Understanding the market's

CURRENT directional bias and

STRENGTH of that bias.

•Auctions up until buying is

exhausted.

•Auctions down until selling is

exhausted.

Direction

Initial Balance

•Range established during the

first two periods of trade.

•Above average Initial Balance

range projects potential trading

range session.

•Below average Initial Balance

range projects potential trending

session.

Initial Balance

Point of Control

•Point of Control – Longest line

of letters (TPO’s) or most

common price.

•Highlights area of highest

market activity during current

trading session.

Point of Control

Range Extension

•Price trading beyond initial

balance high and / or low.

•No range extension usually means

the short-term trader is in control

of the market.

•Range extension usually means

longer-term trader in control of the

market.

Range Extension

Tails and Single Prints

•A Tail - Consecutive single prints at

either a high or low extreme.

•Buying Tail - Formed by market

moving lower and buyers entering

the market aggressively.

•Selling Tail - Formed by market

moving higher and sellers entering

the market aggressively.

Tails and Single Prints (con’t.)

• Spikes are tails occurring in the last period of the

session and are potential keys to trading the

following session’s open.

• Single prints are found between distributions in a

trading session.

• The length / range of the tail or single print is

usually an indication of the potential ‘strength’ of

the tail or single print.

Sell Tail and Buy Tail

Single Prints

Trading Range

•A narrow range of prices that

persists through time.

•Initial balance range usually

greater than average.

•Confirmed balance edges create

risk and opportunity.

•A trading range is defined by

trader’s timeframe.

Trading Range

Trading Range (con’t.)

• Primarily a short-term trader’s market.

• Usually characterized by little or no participation by

the longer-term trader.

• One key to trading a trading range is to be patient and

wait for the market to ‘challenge’ the extremes and

then enter on a failure to break-out of the range.

• More trading opportunities with limited potential.

Trends

•A market moving with clear,

sustained direction.

•Divergence of price away from

value.

•Trends are defined by the

trader’s timeframe.

Trends

Trends (con’t.)

• A trending market moves directionally until it finds

‘value’ or a ‘fair price’ and trade is shut-off by an

opposite response.

• Trends are usually ‘telegraphed’ by a narrow Initial

Balance or news.

• Trade location is usually secondary to trade execution.

• Monitoring Value Area changes is key to trading

trends.

Value

• Value is identified by price acceptance, i.e., a price

zone where the market trades over time.

• Unfair or rejected price is where market spent minimal

time trading, i.e., tails / single prints.

• Price x Time = Value !

Value Area

• The value area is that area / zone where approximately

70% (1 standard deviation) of the session’s volume

was recorded.

• The value area - where two-sided trade primarily

occurred.

• A key measure of overall current market activity.

• Value area range is one key to trading range activity

or trending activity.

Value Area (con’t.)

• Market opening and trading above value area favors

higher prices.

• Market opening and trading below value area favors

lower prices.

• Many times the directional bias of the market can be

determined by the TPO count.

Value Area

Volume

• A primary measure of the overall ‘quality’ of the

current market activity.

• Reading volume through volume relationships, i.e.,

greater than, less than, or equal to previous volumes.

• Convergence versus divergence relationships between

price and volume.

Volume (con’t)

•High volume areas tend to

attract market activity.

•Low volume areas tend to reject

market activity.

•Volume is best interpreted over

time and in relation to average

volume.

Low Volume

High Volume

Market Profile® Trading Principles

• Know when the market is in a trading range or trending mode

and trade accordingly.

• Continually monitor value area development, value area

placement, reference points and volume.

• Understand what’s happening and why it’s happening!

• Understand what’s not happening and why it’s not happening!

Windotrader® Corporation, again, thanks the Chicago Board

of Trade® for it’s support in creating both editions of the

Market Profile® Basic User’s Guide.

To view the unabridged version and attend a narrated

presentation of the Market Profile® Basic User’s Guide,

please go to:

www.windotrader.com

You might also like

- Option Market Making : Part 1, An Introduction: Extrinsiq Advanced Options Trading Guides, #3From EverandOption Market Making : Part 1, An Introduction: Extrinsiq Advanced Options Trading Guides, #3No ratings yet

- Lifespan Investing: Building the Best Portfolio for Every Stage of Your LifeFrom EverandLifespan Investing: Building the Best Portfolio for Every Stage of Your LifeNo ratings yet

- Exchange Rate Determination Puzzle: Long Run Behavior and Short Run DynamicsFrom EverandExchange Rate Determination Puzzle: Long Run Behavior and Short Run DynamicsNo ratings yet

- Microstructure Stock MarketDocument10 pagesMicrostructure Stock Marketmirando93No ratings yet

- Advanced MP Manual RezaDocument33 pagesAdvanced MP Manual RezaAyman erNo ratings yet

- Session 13-WTC PPT (Apr 01, 2019)Document30 pagesSession 13-WTC PPT (Apr 01, 2019)abimalainNo ratings yet

- Algo Trading Case StudyDocument2 pagesAlgo Trading Case Studyreev011No ratings yet

- Game Plan: Scenario 1 - Highs Made First Price Breaks Yesterday's Highs Unable To SustainDocument4 pagesGame Plan: Scenario 1 - Highs Made First Price Breaks Yesterday's Highs Unable To SustainRICARDO100% (1)

- MZL - Elliott Wave FractalsDocument5 pagesMZL - Elliott Wave FractalsMochamad Adhitya Ray100% (1)

- Trading Playbook - CL - ExternalDocument39 pagesTrading Playbook - CL - Externalshanghaiboy2015No ratings yet

- What Is VolumeDocument9 pagesWhat Is VolumeRahul Chaturvedi100% (1)

- AMT Auction Market Theory Unfluffed ReportDocument12 pagesAMT Auction Market Theory Unfluffed ReportOmar GarcíaNo ratings yet

- OrderFlow Charts and Notes 12th Oct 17 - VtrenderDocument4 pagesOrderFlow Charts and Notes 12th Oct 17 - VtrenderSinghRaviNo ratings yet

- How To Use IGCS in Your Trading PDFDocument11 pagesHow To Use IGCS in Your Trading PDFNil DorcaNo ratings yet

- LocatinDocument9 pagesLocatinivolatNo ratings yet

- Algo Trading Intro 2013 Steinki Session 8 PDFDocument21 pagesAlgo Trading Intro 2013 Steinki Session 8 PDFMichael ARKNo ratings yet

- Sectors and Styles: A New Approach to Outperforming the MarketFrom EverandSectors and Styles: A New Approach to Outperforming the MarketRating: 1 out of 5 stars1/5 (1)

- Orderflow AbstractDocument2 pagesOrderflow AbstractpostscriptNo ratings yet

- December 17 at 3:00-5:30pm PST: Session 14Document38 pagesDecember 17 at 3:00-5:30pm PST: Session 14Lê Duy ThanhNo ratings yet

- An Empirical Detection of High Frequency Trading StrategiesDocument35 pagesAn Empirical Detection of High Frequency Trading Strategiesdoc_oz3298No ratings yet

- WTPC Sept Dec2019 11.26.2019Document20 pagesWTPC Sept Dec2019 11.26.2019Duy DangNo ratings yet

- HFT Bibliography 2015Document59 pagesHFT Bibliography 2015ZerohedgeNo ratings yet

- Darryl Shen - OrderImbalanceStrategy PDFDocument70 pagesDarryl Shen - OrderImbalanceStrategy PDFmichaelguan326No ratings yet

- Maker TakerDocument50 pagesMaker TakerEduardo TocchettoNo ratings yet

- Order FlowDocument71 pagesOrder FlowNguyen Anh QuanNo ratings yet

- Wyckoff Trading Course (WTC) : March 11Document14 pagesWyckoff Trading Course (WTC) : March 11MtashuNo ratings yet

- Session 03-WTC PPT (January 21, 2019)Document23 pagesSession 03-WTC PPT (January 21, 2019)MtashuNo ratings yet

- MR MarketDocument64 pagesMR MarketIan CarrNo ratings yet

- Liquidity and Asset PricesDocument74 pagesLiquidity and Asset PricesHiru RodrigoNo ratings yet

- JPM Flows Liquidity 2016-10-07 2145906Document18 pagesJPM Flows Liquidity 2016-10-07 2145906chaotic_pandemoniumNo ratings yet

- Enterprise Risk Analytics for Capital Markets: Proactive and Real-Time Risk ManagementFrom EverandEnterprise Risk Analytics for Capital Markets: Proactive and Real-Time Risk ManagementNo ratings yet

- The Profitable Art and Science of Vibratrading: Non-Directional Vibrational Trading Methodologies for Consistent ProfitsFrom EverandThe Profitable Art and Science of Vibratrading: Non-Directional Vibrational Trading Methodologies for Consistent ProfitsNo ratings yet

- COT Indicators - COT Indicator Suite For MetaTrader - MT4 - MT5Document1 pageCOT Indicators - COT Indicator Suite For MetaTrader - MT4 - MT5Shahbaz SyedNo ratings yet

- Dow TheoryDocument17 pagesDow TheoryrahmathahajabaNo ratings yet

- Gamma Vanna and Higher Greek Exposure - Compiling The Dealer Order BookDocument9 pagesGamma Vanna and Higher Greek Exposure - Compiling The Dealer Order BookArnaud FreycenetNo ratings yet

- Using Quantstrat To Evaluate Intraday Trading Strategies - Humme and Peterson - 2013 - SlidesDocument78 pagesUsing Quantstrat To Evaluate Intraday Trading Strategies - Humme and Peterson - 2013 - SlidesGallo Solaris100% (1)

- Limit Order BookDocument48 pagesLimit Order BookSyroes NouromidNo ratings yet

- Market Microstructure PDFDocument13 pagesMarket Microstructure PDFHarun Ahad100% (2)

- OrderFlow Charts and Notes 20th Sept 17 - VtrenderDocument9 pagesOrderFlow Charts and Notes 20th Sept 17 - VtrenderSinghRaviNo ratings yet

- Session 12-WTC PPT (Mar 25, 2019)Document32 pagesSession 12-WTC PPT (Mar 25, 2019)MtashuNo ratings yet

- Managing Risk OrdersDocument31 pagesManaging Risk OrdersChristian Nicolaus MbiseNo ratings yet

- OrderFlow Charts and Notes 27th Sept 17 - VtrenderDocument12 pagesOrderFlow Charts and Notes 27th Sept 17 - VtrenderSinghRaviNo ratings yet

- November 26 at 3:00-5:30pm PST: Selection 1. Bias Game 2. Anatomy of A Trade (TTD) 3. Q&A 4. Market Update 5. Exercise #7Document19 pagesNovember 26 at 3:00-5:30pm PST: Selection 1. Bias Game 2. Anatomy of A Trade (TTD) 3. Q&A 4. Market Update 5. Exercise #7Duy Dang100% (1)

- PivotPointPresentation P1MarketAuctionTheoryDocument28 pagesPivotPointPresentation P1MarketAuctionTheoryManik AroraNo ratings yet

- Delta and GammaDocument69 pagesDelta and GammaHarleen KaurNo ratings yet

- Gom Order FlowDocument12 pagesGom Order Flownicolo bagiNo ratings yet

- Market Liquidity and Its Risk - An OverviewDocument40 pagesMarket Liquidity and Its Risk - An OverviewSebastian Stange100% (20)

- Verifying Your TradeDocument18 pagesVerifying Your Tradepham terik100% (1)

- Zero Hold Time - FAQs PDFDocument4 pagesZero Hold Time - FAQs PDFJorge LuisNo ratings yet

- Disclaimer: Gamma ExposureDocument8 pagesDisclaimer: Gamma ExposureArsh JosanNo ratings yet

- MP KepplerDocument35 pagesMP KepplerBzasri Rao100% (1)

- Chartered Market Technician (CMT) Program Level 3 - Spring 2010Document3 pagesChartered Market Technician (CMT) Program Level 3 - Spring 2010Foru FormeNo ratings yet

- How To Use Pivot Point in Intraday Trading?Document3 pagesHow To Use Pivot Point in Intraday Trading?vvpvarunNo ratings yet

- Hot Money 30jan2019Document5 pagesHot Money 30jan201911sudhaNo ratings yet

- How Does Market Profile Incorporate The Context?Document3 pagesHow Does Market Profile Incorporate The Context?11sudhaNo ratings yet

- Market Profile NotesDocument5 pagesMarket Profile Notesbinujames100% (1)

- Value Are A BasicsDocument5 pagesValue Are A Basics11sudha100% (1)

- Market Profile NotesDocument5 pagesMarket Profile Notesbinujames100% (1)

- QuizDocument2 pagesQuiz11sudhaNo ratings yet

- TC2013-Jay - Market ProfileDocument29 pagesTC2013-Jay - Market Profilearjbak60% (5)

- SupDocument1 pageSup11sudhaNo ratings yet

- Market ProfileDocument17 pagesMarket ProfileSanjay Jaiswal88% (8)

- Market ProfileDocument17 pagesMarket ProfileSanjay Jaiswal88% (8)

- Nsebank Kotakbank - Ns Hdfcbank - Ns Icicibank - Ns Indusindbk - Ns Sbin - Ns Axisbank - Ns Yesbank - Ns Canbk - Ns Rblbank - NsDocument1 pageNsebank Kotakbank - Ns Hdfcbank - Ns Icicibank - Ns Indusindbk - Ns Sbin - Ns Axisbank - Ns Yesbank - Ns Canbk - Ns Rblbank - Ns11sudhaNo ratings yet

- Technical Analysis Candlestick Pattern Point & Figure Harmonic Pattern Wave Theory Neo Wave Trend Line Gap Fibonacci TheoryDocument1 pageTechnical Analysis Candlestick Pattern Point & Figure Harmonic Pattern Wave Theory Neo Wave Trend Line Gap Fibonacci Theory11sudhaNo ratings yet

- The Chicago Board of Trade And: Market Profile Keys For Traders and InvestorsDocument37 pagesThe Chicago Board of Trade And: Market Profile Keys For Traders and Investors11sudhaNo ratings yet

- Trap 1Document1 pageTrap 111sudhaNo ratings yet

- Technical Analysis Harmonic Gartley Bat Shark Ab CDDocument1 pageTechnical Analysis Harmonic Gartley Bat Shark Ab CD11sudhaNo ratings yet

- OptionDocument1 pageOption11sudhaNo ratings yet

- Nava Graha Peeda Hara StotramDocument3 pagesNava Graha Peeda Hara Stotram11sudhaNo ratings yet

- Head & Shoulder Triangle RectangleDocument1 pageHead & Shoulder Triangle Rectangle11sudhaNo ratings yet

- TrapDocument1 pageTrap11sudhaNo ratings yet

- Volume Spread AnalysisDocument1 pageVolume Spread Analysis11sudhaNo ratings yet

- Vs 1Document1 pageVs 111sudhaNo ratings yet

- Bul Call Spread Bear Put SpreadDocument1 pageBul Call Spread Bear Put Spread11sudhaNo ratings yet

- CandleDocument1 pageCandle11sudhaNo ratings yet

- Swing Trading Momentum Trading Positional Trading Intraday TradingDocument1 pageSwing Trading Momentum Trading Positional Trading Intraday Trading11sudhaNo ratings yet

- ChartDocument1 pageChart11sudhaNo ratings yet

- FibonacciDocument1 pageFibonacci11sudhaNo ratings yet

- Technical AnalysisDocument1 pageTechnical Analysis11sudhaNo ratings yet

- TechnicalDocument1 pageTechnical11sudhaNo ratings yet

- New Text DocumentDocument1 pageNew Text Document11sudhaNo ratings yet

- Oops MCQ (Unit-1)Document7 pagesOops MCQ (Unit-1)Jee Va Ps86% (14)

- Fraction Selection BrochureDocument2 pagesFraction Selection Brochureapi-186663124No ratings yet

- P22Document9 pagesP22Aastha JainNo ratings yet

- Europe MapDocument13 pagesEurope MapNguyên ĐỗNo ratings yet

- Beyond Investment: The Power of Capacity-Building SupportDocument44 pagesBeyond Investment: The Power of Capacity-Building SupportLaxNo ratings yet

- Dissertation Conflit Israelo PalestinienDocument7 pagesDissertation Conflit Israelo PalestinienPaySomeoneToWriteAPaperForMeUK100% (2)

- Business Studies Project 1Document16 pagesBusiness Studies Project 1MANOJ CHAVANNo ratings yet

- 2006 Estes Model Rocketry CatalogDocument44 pages2006 Estes Model Rocketry CatalogMisesWasRightNo ratings yet

- Cognitive Factors in LearningDocument3 pagesCognitive Factors in LearningNad DeYnNo ratings yet

- How My Brother Leon Brought Home A WifeDocument16 pagesHow My Brother Leon Brought Home A Wifefusha23No ratings yet

- Yogesh Kadam (ABC)Document5 pagesYogesh Kadam (ABC)vipin HNo ratings yet

- SoA DMI0037464664 130615102023Document2 pagesSoA DMI0037464664 130615102023sabkipolkholdeNo ratings yet

- Rural MarketingDocument25 pagesRural MarketingMohd. Farhan AnsariNo ratings yet

- Afternoon Quiz Set 4Document66 pagesAfternoon Quiz Set 4pchakkrapani100% (1)

- PIRCHLDocument227 pagesPIRCHLapi-3703916No ratings yet

- Turkey GO (896-22)Document1 pageTurkey GO (896-22)shrabon001No ratings yet

- 46GA On Designers For CEED, UCEED and NID - Stuff You LookDocument3 pages46GA On Designers For CEED, UCEED and NID - Stuff You LookReshmi Varma100% (1)

- Distress Manual PDFDocument51 pagesDistress Manual PDFEIRINI ZIGKIRIADOUNo ratings yet

- Agencies Engaged in Construction Inspection, Testing, or Special InspectionDocument10 pagesAgencies Engaged in Construction Inspection, Testing, or Special InspectionharryNo ratings yet

- FAME - Teachers' Material TDocument6 pagesFAME - Teachers' Material TBenny PalmieriNo ratings yet

- Inkubator TransportDocument8 pagesInkubator TransportYassarNo ratings yet

- Prologue: Managerial Accounting and The Business EnvironmentDocument156 pagesPrologue: Managerial Accounting and The Business EnvironmentMarcus MonocayNo ratings yet

- Date CalcDocument8 pagesDate CalcPaolaNo ratings yet

- XDM-100 IOM SDH A00 4-5 enDocument334 pagesXDM-100 IOM SDH A00 4-5 endilipgulatiNo ratings yet

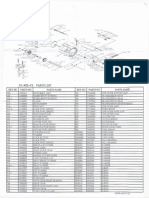

- Okuma CL302L Parts List & ManualDocument3 pagesOkuma CL302L Parts List & Manualcoolestkiwi100% (1)

- Phy Interface Pci Express Sata Usb31 Architectures Ver43 PDFDocument99 pagesPhy Interface Pci Express Sata Usb31 Architectures Ver43 PDFRaj Shekhar ReddyNo ratings yet

- Wind Generator Home Made Axial Flux Alternator How It WorksDocument15 pagesWind Generator Home Made Axial Flux Alternator How It Workssmajla123No ratings yet

- Wall FootingDocument4 pagesWall FootingMunthir NumanNo ratings yet

- PRACTICES AND CHALLENGES IN THE IMPLEMENTATION OF BASIC EDUCATION LEARNING CONTINUITY PLAN-Authored By: Reynaldo C. CruzDocument71 pagesPRACTICES AND CHALLENGES IN THE IMPLEMENTATION OF BASIC EDUCATION LEARNING CONTINUITY PLAN-Authored By: Reynaldo C. CruzInternational Intellectual Online PublicationsNo ratings yet

- Eligibility Conditions: Advertisement For Regular Commission in Pakistan Army Through 136 Pma Long CourseDocument5 pagesEligibility Conditions: Advertisement For Regular Commission in Pakistan Army Through 136 Pma Long CourseHusnain IshtiaqNo ratings yet