Professional Documents

Culture Documents

Al Kafalah: Raja Khalid Al Jabbar Acounting 17

Uploaded by

niswachaira990 ratings0% found this document useful (0 votes)

36 views8 pagesakad alkafalah by Raja Khalid

Original Title

3 Task_3_akad Al Kafalah

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentakad alkafalah by Raja Khalid

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

36 views8 pagesAl Kafalah: Raja Khalid Al Jabbar Acounting 17

Uploaded by

niswachaira99akad alkafalah by Raja Khalid

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 8

AL KAFALAH

RAJA KHALID AL JABBAR

ACOUNTING 17

AL-KAFALAH DEFINITION

• Kafalah (guaranty) is a guarantee of expenses

or dependents given by the insurer (kafil) to a

third party to fulfill the obligations of a second

party or borne (makful).

• The term kafalah in banking practice today is a

guarantee given by the insurer (kafil) to a third

party in order to fulfill the obligation that is

borne (makful ‘anhu) if the party that is

covered is injured or defaulted

FOUNDATION OF SHARIA LAW

• Legal basis of kafalah can be learned from the

Qur'an, Al-Hadist and Ijma.

• In the Qur'an there is a section that tells the

Prophet Joseph, namely Al-Qur'an Surat Yusuf:

72 which means:

"The callers exclaimed," We lost the King's trophy, anyone who can

return it will get food (as heavy as the burden of the camel) and I guarantee

it. "(Q.S. Yusuf: 72).

UNDERSTAND KAFALAH

Pillars of Kafalah according to most

scholars are:

1. Guarantor (dhomin / kafiil)

2. Guaranteed goods / debt (Madhum)

3. Parties guaranteed (makful ‘anhu or madhum‘

anhu)

4. Sighah contract.

TYPES OF KAFALAH

• Kafalah bin Nasf.

• Kafalah Bil-Maal

• Kafalah Bit Talim

• Kafalah Al-Munjazaah.

AKAD KAFALAH

• Akad Sharih means openly, using the word

"guarantee" or synonym.

• Contract Kinayah means not using the word

"guarantee" or for example, but it can be

understood from his words, he is a guarantor.

TERMS OF KAFALAH

• Guarantor Terms (Kafiil).

• Requirements for Debt People (Makful ‘Anhu

/ Ashiil)

• Conditions for Debt People (Makful Lahu)

• Terms of the Goods to be Made Guaranteed

(Makful Bih)

APPLICATION IN BANKING

TRANSACTIONS

• The function of kafalah is the provision of

guarantees by the bank for the parties

involved to run their business more secure

and secure, so that there is certainty in trying

/ transacting, because with this guarantee the

bank means taking over the risks / obligations

of the customer, if the customer defaults its

obligations.

You might also like

- Islamic Law of Business: International Islamic University, Islamabad Faculty of Management SciencesDocument14 pagesIslamic Law of Business: International Islamic University, Islamabad Faculty of Management SciencesMuhammad BilawalNo ratings yet

- Al-Kafalah (Isb458 - Advance Fiqh Muamalat)Document14 pagesAl-Kafalah (Isb458 - Advance Fiqh Muamalat)Zylorg --No ratings yet

- KafalahDocument6 pagesKafalahareep94No ratings yet

- Al Kafalah Assignment Ctu 351 PDFDocument16 pagesAl Kafalah Assignment Ctu 351 PDFPiqsamNo ratings yet

- Al KafalahDocument19 pagesAl KafalahMahyuddin KhalidNo ratings yet

- Mahyuddin Khalid Emkay@salam - Uitm.edu - MyDocument19 pagesMahyuddin Khalid Emkay@salam - Uitm.edu - MyZatil AqmarNo ratings yet

- 4175 973 10197 1 10 20170714 PDFDocument22 pages4175 973 10197 1 10 20170714 PDFZaber AminNo ratings yet

- KafalahDocument16 pagesKafalahAndroidAPT ChannelNo ratings yet

- Suretyship. Regards To A Claim". - Legality: Prophet (S.a.w) SaidDocument8 pagesSuretyship. Regards To A Claim". - Legality: Prophet (S.a.w) Saidamelia stephanieNo ratings yet

- KafalahDocument5 pagesKafalahNur IskandarNo ratings yet

- Al WakalahDocument12 pagesAl WakalahMahyuddin Khalid100% (3)

- Islamic Concept of RibaDocument10 pagesIslamic Concept of RibaNaseer MalikNo ratings yet

- The Concept of Wa'ad in Islamic Financial ContractsDocument12 pagesThe Concept of Wa'ad in Islamic Financial ContractsKamal Laamrani100% (1)

- Understanding key Islamic finance concepts of Wakalah, Rahn and KafalahDocument5 pagesUnderstanding key Islamic finance concepts of Wakalah, Rahn and KafalahBAIQ SANDI KARTIKA SARINo ratings yet

- Al QardhDocument17 pagesAl QardhMahyuddin KhalidNo ratings yet

- Wa'ad PDFDocument61 pagesWa'ad PDFZatil AqmarNo ratings yet

- Other ServicesDocument15 pagesOther ServicesMahyuddin KhalidNo ratings yet

- Diff BTWN Ins N TakafalDocument19 pagesDiff BTWN Ins N TakafalAli AmranNo ratings yet

- Pengertian Wakalah Dalam Konsep Islam - Ms.enDocument5 pagesPengertian Wakalah Dalam Konsep Islam - Ms.enBAIQ SANDI KARTIKA SARINo ratings yet

- RIBA and It's TypesDocument10 pagesRIBA and It's Typesfaisalconsultant100% (2)

- Glossary of Islamic finance key termsDocument27 pagesGlossary of Islamic finance key termsbnmjgcNo ratings yet

- Wa'adDocument45 pagesWa'adAtikah Jumat100% (1)

- Introduction To Various Major Transactions in Islamic Law: Basic Operation of Interest Banking SystemDocument17 pagesIntroduction To Various Major Transactions in Islamic Law: Basic Operation of Interest Banking SystemZalikha HassimNo ratings yet

- Istisna': in Islamic Banking: Concept and ApplicationDocument10 pagesIstisna': in Islamic Banking: Concept and ApplicationMr BalochNo ratings yet

- Chapter 8 - Gratitious ContractDocument52 pagesChapter 8 - Gratitious ContractsafiyaainnurNo ratings yet

- Al-Bai Bithaman Ajil The Shari'ah and Legal Issues On Its Application As A Financing Facility: The Malaysian ExperienceDocument22 pagesAl-Bai Bithaman Ajil The Shari'ah and Legal Issues On Its Application As A Financing Facility: The Malaysian ExperienceFaizalAhamadNo ratings yet

- International Islamic University Islamabad: Sir Akbar KhanDocument14 pagesInternational Islamic University Islamabad: Sir Akbar KhanualiiNo ratings yet

- IjarahDocument36 pagesIjarahJelena Cienta100% (1)

- Aaoifi Mohamed SaidDocument15 pagesAaoifi Mohamed Saidmohamed said omarNo ratings yet

- SalamDocument40 pagesSalamIzhar MuslihNo ratings yet

- The Legal Status of Ju - Alah Contract in Islamic Commercial Law - Its Applications in Modern Islamic Finance IndustryDocument15 pagesThe Legal Status of Ju - Alah Contract in Islamic Commercial Law - Its Applications in Modern Islamic Finance IndustryAhmad JafarNo ratings yet

- Status of Ribah in Islamic and Legal System of PakistanDocument15 pagesStatus of Ribah in Islamic and Legal System of PakistanYasir MardanzaiNo ratings yet

- The 14 Questions of Federal Shariah Court and The Answers TheretoDocument42 pagesThe 14 Questions of Federal Shariah Court and The Answers TheretoImran LatifNo ratings yet

- RibaanditsprohibitionDocument0 pagesRibaanditsprohibitionMaham SohailNo ratings yet

- Type of Kafalah - Docx1Document1 pageType of Kafalah - Docx1Mohamed ThiernoNo ratings yet

- Riba and Its ProhibitionDocument22 pagesRiba and Its ProhibitionwandaNo ratings yet

- Istisna in Islamic Banking Concept and Application (MS 99-108)Document10 pagesIstisna in Islamic Banking Concept and Application (MS 99-108)johzyNo ratings yet

- Al Rahn and Mortgage in Islamic Home FinancingDocument13 pagesAl Rahn and Mortgage in Islamic Home FinancingAmine ElghaziNo ratings yet

- Article Review On Waad - Short Essay - FinalDocument15 pagesArticle Review On Waad - Short Essay - FinalMd.Akther Uddin100% (1)

- Islamic Finance TermsDocument30 pagesIslamic Finance TermsKhairun Najmi SaripudinNo ratings yet

- New Microsoft PowerPoint PresentationDocument18 pagesNew Microsoft PowerPoint Presentationmusaraza890No ratings yet

- Riba, Islamic Financing vs Conventional FinancingDocument20 pagesRiba, Islamic Financing vs Conventional FinancingmillimilNo ratings yet

- Salam & Istisna: Key Concepts and ApplicationsDocument30 pagesSalam & Istisna: Key Concepts and ApplicationsMUHAMMAD TALATNo ratings yet

- Bay' Al-'InahDocument14 pagesBay' Al-'InahMahyuddin Khalid100% (1)

- New Microsoft Word DocumentDocument4 pagesNew Microsoft Word DocumentTuah RangerNo ratings yet

- MPRA Paper 67711Document8 pagesMPRA Paper 67711Nuratiah ZakariaNo ratings yet

- 6. Theory of Contract (3 Pillars) (9)Document59 pages6. Theory of Contract (3 Pillars) (9)Fya NielNo ratings yet

- Al IjarahDocument24 pagesAl IjarahMahyuddin Khalid100% (3)

- Contract in Islamic Finance and Banking.: BWSS 2093Document49 pagesContract in Islamic Finance and Banking.: BWSS 2093otaku himeNo ratings yet

- Ifqglossary 5Document14 pagesIfqglossary 5Mrudula GummuluriNo ratings yet

- Wadi'ahDocument5 pagesWadi'ahNajib HilmiNo ratings yet

- 2 - Definitions of 'Aqd, Tasarruf, Iltizam, Wa'ad and Their Differences - Updated 231024-1Document13 pages2 - Definitions of 'Aqd, Tasarruf, Iltizam, Wa'ad and Their Differences - Updated 231024-1farahnabilah2215030No ratings yet

- Mahyuddin Khalid Emkay@salam - Uitm.edu - MyDocument13 pagesMahyuddin Khalid Emkay@salam - Uitm.edu - MyEmynorfatinahNo ratings yet

- Hedging Mechanisms in Islamic Financial Operations: Dr. Muíammad Ñalê ElgarêDocument21 pagesHedging Mechanisms in Islamic Financial Operations: Dr. Muíammad Ñalê ElgarêLynaNo ratings yet

- Islamic LawDocument2 pagesIslamic Lawshahbazfj321No ratings yet

- Bay' Al-SalamDocument22 pagesBay' Al-SalamMahyuddin Khalid100% (2)

- Fiqih Muamalah - Istishna PDFDocument18 pagesFiqih Muamalah - Istishna PDFCherry Blasoom100% (1)

- Islamic finance glossary guideDocument29 pagesIslamic finance glossary guideMrudula GummuluriNo ratings yet

- Perception and Individual Decision Making by Niswatun ChairaDocument4 pagesPerception and Individual Decision Making by Niswatun Chairaniswachaira99No ratings yet

- Master Budget EXAMPLE AjaniDocument12 pagesMaster Budget EXAMPLE Ajaniniswachaira99No ratings yet

- CH 18Document132 pagesCH 18Ghaly Abrarian PutraNo ratings yet

- CH 18Document132 pagesCH 18Ghaly Abrarian PutraNo ratings yet

- Sesi I Outlook 2019 Bahan Paparan Anton Gunawan PDFDocument51 pagesSesi I Outlook 2019 Bahan Paparan Anton Gunawan PDFWafer on my vanilla yayNo ratings yet

- Ramadan EnglishDocument1 pageRamadan Englishniswachaira99No ratings yet

- Ramadan EnglishDocument1 pageRamadan Englishniswachaira99No ratings yet

- Whatsapp Download Protect-1Document2 pagesWhatsapp Download Protect-1jaisoumya567No ratings yet

- Communication Plan September 27Document24 pagesCommunication Plan September 27Rosemarie T. BrionesNo ratings yet

- SHEQ Monthly Report SummaryDocument17 pagesSHEQ Monthly Report SummaryArif NugrohoNo ratings yet

- Homework 2Document3 pagesHomework 2Tú QuyênNo ratings yet

- Group assignment on financial analysis of projects A, B, C and DDocument62 pagesGroup assignment on financial analysis of projects A, B, C and DSameer AsifNo ratings yet

- Experienced Hospitality Professional Seeking New OpportunitiesDocument2 pagesExperienced Hospitality Professional Seeking New OpportunitiesValeria SpasovaNo ratings yet

- Sas#20 Bam242Document9 pagesSas#20 Bam242Everly Mae ElondoNo ratings yet

- 2021 Remaining Ongoing CasesDocument2,517 pages2021 Remaining Ongoing CasesJulia Mar Antonete Tamayo AcedoNo ratings yet

- OD Interventions PDFDocument11 pagesOD Interventions PDFimranpathan30100% (3)

- Pre ProductionDocument2 pagesPre ProductionRajrupa SahaNo ratings yet

- List of Key Indian Office HoldersDocument15 pagesList of Key Indian Office HoldersRohit KumarNo ratings yet

- MBA Akshay Arora: SAP ID:80511020627 - : Akshay - Arora27@nmims - Edu.in - Age: 23Document2 pagesMBA Akshay Arora: SAP ID:80511020627 - : Akshay - Arora27@nmims - Edu.in - Age: 23gautam keswaniNo ratings yet

- Impact of The Civil Rights Movement On Human ServicesDocument15 pagesImpact of The Civil Rights Movement On Human ServicesRacial Equity, Diversity and InclusionNo ratings yet

- Becoming an Operations Consultant in 40 StepsDocument2 pagesBecoming an Operations Consultant in 40 StepsNicolae NistorNo ratings yet

- Marcopper Mining CorpDocument7 pagesMarcopper Mining CorpChristine Ivy Delos SantosNo ratings yet

- Befa Question BankDocument9 pagesBefa Question Bank20bd1a6655No ratings yet

- Aditya AS 22 23 2134Document1 pageAditya AS 22 23 2134Aditya AmbwaniNo ratings yet

- Chapter 9: Legal Challenges of Entrepreneurial Ventures: True/FalseDocument6 pagesChapter 9: Legal Challenges of Entrepreneurial Ventures: True/Falseelizabeth bernalesNo ratings yet

- ES 301 Assignment #1 engineering economy problems and solutionsDocument2 pagesES 301 Assignment #1 engineering economy problems and solutionsErika Rez LapatisNo ratings yet

- Polaroid Corporation: Group MembersDocument7 pagesPolaroid Corporation: Group MemberscristinahumaNo ratings yet

- Chapter 9 Intercompany Bond Holdings and Miscellaneous Topics-Consolidated Financial StatementsDocument45 pagesChapter 9 Intercompany Bond Holdings and Miscellaneous Topics-Consolidated Financial StatementsAchmad RizalNo ratings yet

- Understanding Cryptocurrencies: Bitcoin, Ethereum, and Altcoins As An Asset ClassDocument24 pagesUnderstanding Cryptocurrencies: Bitcoin, Ethereum, and Altcoins As An Asset ClassCharlene KronstedtNo ratings yet

- ABS ISPS Company - Vessel Audit ChecklistDocument1 pageABS ISPS Company - Vessel Audit ChecklistredchaozNo ratings yet

- C&I JSA 09 GeneralDocument1 pageC&I JSA 09 Generalamit kumarNo ratings yet

- Analysis of Competitiveness of The Agribusiness Sector Companies Using Porter'S Five ForcesDocument11 pagesAnalysis of Competitiveness of The Agribusiness Sector Companies Using Porter'S Five ForceseryNo ratings yet

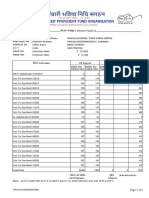

- Member Passbook DetailsDocument2 pagesMember Passbook DetailsNaveen SinghNo ratings yet

- Goodwill 23.3.23Document1 pageGoodwill 23.3.2308 Ajay Halder 11- CNo ratings yet

- Optional: Service BulletinDocument8 pagesOptional: Service BulletinDaniil SerovNo ratings yet

- Your Results For "Quick Quiz (Open Access) "Document2 pagesYour Results For "Quick Quiz (Open Access) "Manuel CornejoNo ratings yet

- Starbuck Case: Part 1Document5 pagesStarbuck Case: Part 1Linh Ho Vu KhanhNo ratings yet