Professional Documents

Culture Documents

ABILITY TO PAY THEORY (1) Fiscal

Uploaded by

SubbuLakshmi Sivakumar0 ratings0% found this document useful (0 votes)

33 views12 pagesOriginal Title

ABILITY TO PAY THEORY (1) fiscal.pptx

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

33 views12 pagesABILITY TO PAY THEORY (1) Fiscal

Uploaded by

SubbuLakshmi SivakumarCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 12

APPROACHES TO TAX EQUITY

HOW TO MEASURE ABILITY TO PAY

SUBJECTIVE APPROACH- The sacrifice theory has

been evolved to measure ability to pay.

OBJECTIVE APPROACH-The faculty theory has been

evolved to measure ability to pay.

Implementation of either principle requires a

quantitative measure of ability to pay.

Ability theory tries to measure the ability to pay with the

help of observable measures such as property ,

income ,sizes of family and consumption . These are

known as index of ability to pay.

SUBJECTIVE APPROACH

Estimate the burden felt by the taxpayer or the sacrifice

undergone by him

Each taxpayer should make equal sacrifice, if tax burden is to be

justly distributed

EQUAL SACRIFICE PRINCIPLE

The money burden of taxation should be distributed in such a

manner so that every taxpayer has to incur equal sacrifice

All persons in a similar position should be treated similarly, so

that the horizontal equity is realised

All persons in dissimilar position should be treated dissimilarly

in imposing taxes so that vertical equity, is also obtained

FORMS OF EQUAL SACRIFICE PRINCIPLE

The theory of sacrifice to justice in taxation has

three aspects

EQUAL ABSOLUTE SACRIFICE

EQUAL PROPORTIONAL SACRIFICE

EQUAL MARGINAL SACRIFICE

EQUAL ABSOLUTE SACRIFICE

Equal absolute principle implies that the loss of utility in parting with

income on account of tax should be equal to all taxpayers

Thus, the persons with higher income should pay more than those

who have lower income in such a way that the sacrifice for each

individual is the same, provided that the marginal income utility

schedule has a declining trend

It does not mean that it will lead to progressive taxation if the marginal

income utility schedule is declining

Even a regressive tax, with declining income utility may satisfy the

Principle of Equal Absolute Sacrifice

For e.g., an annual income of Rs.60,000 at 6 percent will pay Rs.3600

as tax, while an income of Rs.10,000 at 7 percent will pay Rs.700 as

tax. This may mean equal sacrifice for both

But this leads to regressive kind of taxation

Hence, most economists have strongly rejected this concept

EQUAL PROPORTIONAL SACRIFICE

It implies that the loss of utility, as a result of tax, should be

proportional to the total income of the tax payers

Here too, an individual with higher income will pay more as a tax than

those who have lower incomes

But the ratio of sacrifice to the income will be the same for all

taxpayers

This can be expressed as

Sacrifice made by A Sacrifice made by B

_________________ = ____________________

Income of A Income of B

Thus, the direct real burden on every taxpayer would be proportionate

to the economic welfare which he derives from the income

A progressive tax structure is possible, as the marginal utility of

money diminishes with the rise in the income

EQUAL MARGINAL SACRIFICE

Taxes should be distributed in accordance with the principle of least

aggregate sacrifice, i.e., the marginal sacrifice imposed by way of

taxation on each taxpayer is equal

The State should not touch the lower income group till the higher

incomes are brought to the level of lower incomes

It implies that the taxation should first be imposed on an individual,

who has the highest income because he will make the least sacrifice

When his income is reduced, by means of taxation to the level of

second richest person in the community, they should both begin to be

taxed because the sacrifice undergone in the payment of last rupee will

now be the same for both

This process should continue till the required amount of revenue is

collected

Equal marginal sacrifice requires what might be called maximum

progression, provided that the marginal income utility declines

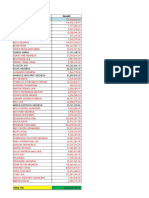

Concepts of Nature of Tax Burden of Taxation

Sacrifice Structure Higher Lower

Income Group Income Group

1.Equal Less progressive Lowest Highest

Absolute

Sacrifice

2. Equal More progressive Higher Lower

Proportional than equal

Sacrifice absolute sacrifice

3.Equal Highly progressive Highest Lowest

Marginal taxation (with tax

Sacrifice exemption for low

income group)

LIMITATIONS OF SUBJECTIVE APPROACH

It is very difficult to equalise the marginal sacrifice of all the

taxpayers, because of the difference in tastes, temperament and

size of family

Sacrifice being a subjective phenomena cannot be exactly

measured by a public authority; it can be realised only by the

person who makes a sacrifice.

Income earned by means of personal service and hard labour

has great utility to an individual than income earned through

wealth and property. These facts have not been taken into account

in the subjective sacrifice approach to measure ability to pay.

It is not possible to measure exactly the declining rate of

marginal utility as income increases. Hence, progression in the

rate of taxation is arbitrarily fixed and does not lead to

equalisation of marginal sacrifice for all.

OBJECTIVE APPROACH

Prof. Seligman has used the term ‘faculty’ to indicate

ability in the objective.

Thus, it is also known as faculty theory of ability to

pay.

The faculty theory takes into account the money value

of the taxable capacity of the taxpayer instead of his

feelings and sufferings.

The faculty theory takes into account various external

factors including the tax-payer’s income and

property, etc., which actually influence the tax-paying

ability of an individual.

INDEX OF ABILITY IN FACULTY THEORY

There are three ways to measure ability to pay of a person

INCOME: Income refers to an amount received by a family

from any activity during a certain period of time including the

value of self owned durable consumer goods. But only net

income should be taken into account.

PROPERTY: The amount of property and accumulated wealth is

also considered, because the level of living of the people is not

only influenced by the income, but also by the accumulated

wealth and property.

CONSUMPTION EXPENDITURE: Prof. Kaldor argued that

the economic well-being of the people depends upon the income

spent, i.e., upon the expenditure rather than upon the income.

Accumulated wealth and property cannot provide satisfaction

until it is used for consumption

DEFECTS IN FACULTY THEORY

A general property-tax is regressive, as it falls more heavily

upon smaller than upon larger property

There is a lack of universality or failure to reach each personal

property

It lacks in uniformity in assessment

It may provide an incentive to dishonesty

It is, thus, obvious that the objective approach plays a

supplementary role to the subjective approach in achieving the

objective of just distribution of the burden of taxation.

Thus it is concluded that subjective approach to measure ability

to pay is not only a useful concept but an ideal one.

In practical life, the scope of its application is very limited and

it is very difficult to achieve this ideal.

You might also like

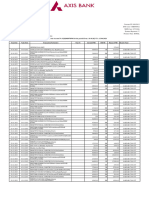

- New Union Bank StatementDocument4 pagesNew Union Bank StatementAshish kumar100% (1)

- Principles of TaxationDocument18 pagesPrinciples of TaxationTessie Cua100% (1)

- Fee RecieptDocument1 pageFee RecieptAnshuNo ratings yet

- Single Resource LTD: Pay AdviceDocument1 pageSingle Resource LTD: Pay AdviceZavache DanaNo ratings yet

- Ability to Pay Principle Justification and MeasurementDocument3 pagesAbility to Pay Principle Justification and MeasurementKyrie AngeloNo ratings yet

- Ability to Pay ApproachDocument4 pagesAbility to Pay ApproachSantosh ChhetriNo ratings yet

- ACC717 Topic 1.TAXATIONDocument29 pagesACC717 Topic 1.TAXATIONJason MaelumaNo ratings yet

- Types and Classifications of TaxesDocument18 pagesTypes and Classifications of TaxesAnonymous ougAoiPZNo ratings yet

- TAXATION001Document31 pagesTAXATION001Boqorka AmericaNo ratings yet

- Canons of TaxationDocument5 pagesCanons of TaxationStudy AllyNo ratings yet

- TAXATION THEORIES AND PRINCIPLESDocument30 pagesTAXATION THEORIES AND PRINCIPLESAPNo ratings yet

- TAXATION AND EFFICIENCYDocument4 pagesTAXATION AND EFFICIENCYkaiserjadonanto007No ratings yet

- Tax Effects on Production and EmploymentDocument10 pagesTax Effects on Production and EmploymentTony LithimbiNo ratings yet

- Tax Theory and ManagementDocument18 pagesTax Theory and Managementomoding benjaminNo ratings yet

- Lectures 1-3Document4 pagesLectures 1-3taskeenzafar921No ratings yet

- Public RevenueDocument90 pagesPublic RevenuekhanjiNo ratings yet

- Taxation and Fiscal PoliciesDocument279 pagesTaxation and Fiscal PoliciesFun DietNo ratings yet

- Optimal Progressivity and Income TaxationDocument10 pagesOptimal Progressivity and Income TaxationSuhas KandeNo ratings yet

- Canons of TaxationDocument11 pagesCanons of Taxationgetahun tesfayeNo ratings yet

- TaxationDocument18 pagesTaxationbruhNo ratings yet

- Using The Various System of Tax Orientation, Initiate A Theoretical Position On Which Tax System Is Best For Your OrganisationDocument10 pagesUsing The Various System of Tax Orientation, Initiate A Theoretical Position On Which Tax System Is Best For Your OrganisationIntroducing New SoundsNo ratings yet

- Understanding Taxation and Tax PrinciplesDocument3 pagesUnderstanding Taxation and Tax PrinciplesKleint BerdosNo ratings yet

- Tax Chapter Two StudentDocument21 pagesTax Chapter Two StudentTasfa ZarihunNo ratings yet

- Advanced Taxation Chapter-2 MaterialDocument48 pagesAdvanced Taxation Chapter-2 MaterialTeweldeNo ratings yet

- Principle of Equity, Uniformity and Progressivity of TaxationDocument3 pagesPrinciple of Equity, Uniformity and Progressivity of TaxationAshera MonasterioNo ratings yet

- Note 02 Canon of Taxation - 20.04.2021Document3 pagesNote 02 Canon of Taxation - 20.04.2021Sumit BainNo ratings yet

- Chapter 4 - TaxationDocument34 pagesChapter 4 - TaxationGlaiza D VillenaNo ratings yet

- Tax Rate Structures (Slide)Document6 pagesTax Rate Structures (Slide)isanNo ratings yet

- TaxationDocument15 pagesTaxationgyytgvyNo ratings yet

- Public Financ and TaxationDocument98 pagesPublic Financ and TaxationEyuel SintayehuNo ratings yet

- TaxationDocument18 pagesTaxationMohammed AjazNo ratings yet

- Fiscal Policy ExplainedDocument24 pagesFiscal Policy ExplainedHasan ShoaibNo ratings yet

- Taxation System in BangladeshDocument12 pagesTaxation System in BangladeshkoheliNo ratings yet

- Introduction to Taxation Principles and ConceptsDocument15 pagesIntroduction to Taxation Principles and ConceptsJarÎnAnJumChôwdhuryNo ratings yet

- Characteristics and Types of TaxationDocument61 pagesCharacteristics and Types of TaxationYoseph KassaNo ratings yet

- Presentation of Taxation - ScribdDocument17 pagesPresentation of Taxation - ScribdAbdellah BelhouariNo ratings yet

- Income Taxes: Agnar Sandmo, Norwegian School of Economics, Bergen, NorwayDocument6 pagesIncome Taxes: Agnar Sandmo, Norwegian School of Economics, Bergen, NorwayAris AmirulNo ratings yet

- Different Taxation Systems - Advantages and DisadvantagesDocument4 pagesDifferent Taxation Systems - Advantages and DisadvantagesGabriella PopovaNo ratings yet

- Taxation TheoryDocument32 pagesTaxation TheoryKaycia HyltonNo ratings yet

- 11 Corporate Duty To Pay Correct TaxesDocument21 pages11 Corporate Duty To Pay Correct TaxesApril Angel Mateo MaribbayNo ratings yet

- ACT 205 - Tax Theory Practice - Lecture 1Document8 pagesACT 205 - Tax Theory Practice - Lecture 1Kaycia HyltonNo ratings yet

- S.6 Ent One NotesDocument47 pagesS.6 Ent One NotesjamesrichardogwangNo ratings yet

- Tax Complience: Introduction and BackgroundDocument13 pagesTax Complience: Introduction and Backgroundally jumanneNo ratings yet

- Subject: Public Finance Course Code: ECON4009 Topic: Introduction To Taxation and Canon of Taxation M.A. Economics (2 Semester)Document15 pagesSubject: Public Finance Course Code: ECON4009 Topic: Introduction To Taxation and Canon of Taxation M.A. Economics (2 Semester)Sushil JindalNo ratings yet

- Factors Determinant Tax Revenue in India: - GROUP 14:-Vijay.A Vijay.G Vinuth.M.N Vikas Nag.VDocument12 pagesFactors Determinant Tax Revenue in India: - GROUP 14:-Vijay.A Vijay.G Vinuth.M.N Vikas Nag.Vbs_sharathNo ratings yet

- Introduction To TaxationDocument28 pagesIntroduction To TaxationpcandohNo ratings yet

- University of Rwanda Huye Campus Principle of Taxation Cat Marketing Departiment MPIRANYA Jean Marie Vianney REG NUMBER: 220009329Document5 pagesUniversity of Rwanda Huye Campus Principle of Taxation Cat Marketing Departiment MPIRANYA Jean Marie Vianney REG NUMBER: 220009329gatete samNo ratings yet

- TAX SYSTEMS EVALUATIONDocument5 pagesTAX SYSTEMS EVALUATIONgatete samNo ratings yet

- School of LawDocument4 pagesSchool of LawSri MuganNo ratings yet

- Tax Equity Principles ExplainedDocument25 pagesTax Equity Principles ExplainedEyob MogesNo ratings yet

- Unit-I Taxation by Prof. Anbalagan ChinniahDocument23 pagesUnit-I Taxation by Prof. Anbalagan ChinniahProf. Dr. Anbalagan ChinniahNo ratings yet

- TOPIC 10 Public FinanceDocument6 pagesTOPIC 10 Public FinancePeter KimaniNo ratings yet

- Ch. 14 - Taxes and Government SpendingDocument25 pagesCh. 14 - Taxes and Government SpendingMr RamNo ratings yet

- Tax Law 0.4Document21 pagesTax Law 0.4Tommy AdemolaNo ratings yet

- JawapanDocument13 pagesJawapanmsfaziah.hartanahNo ratings yet

- Demooji Tax in PracticeDocument2 pagesDemooji Tax in PracticePao AbuyogNo ratings yet

- My Canons of TaxationDocument3 pagesMy Canons of Taxationmarvadomarvellous67No ratings yet

- I. Concept of TaxationDocument7 pagesI. Concept of TaxationYen AneleyNo ratings yet

- Canons of Taxation - EditedDocument5 pagesCanons of Taxation - Editedvaraxiy659No ratings yet

- Easy Tax - Taxation Toolkit For New Zealand Based BusinessesDocument7 pagesEasy Tax - Taxation Toolkit For New Zealand Based BusinessesDaniel HuntNo ratings yet

- Taxaton - EconDocument18 pagesTaxaton - EconJaugan MarkyNo ratings yet

- Unit-III (1)Document22 pagesUnit-III (1)Deepak PantNo ratings yet

- How America was Tricked on Tax Policy: Secrets and Undisclosed PracticesFrom EverandHow America was Tricked on Tax Policy: Secrets and Undisclosed PracticesNo ratings yet

- Weekly Sales Report Almas Stayel ClothingDocument3 pagesWeekly Sales Report Almas Stayel ClothingRoaa KhalilNo ratings yet

- AttbillDocument4 pagesAttbillluis rodriguezNo ratings yet

- Renewal Premium Acknowledgement: Policy DetailsDocument1 pageRenewal Premium Acknowledgement: Policy DetailsTejpal Singh ShekhawatNo ratings yet

- Budget Terminology PDFDocument4 pagesBudget Terminology PDFronNo ratings yet

- Electricity BillDocument1 pageElectricity BillKaranKr67% (3)

- 2307 TemplateDocument4 pages2307 TemplateMarianneRoseBrusolaNo ratings yet

- Acct Statement XX7080 23072023Document34 pagesAcct Statement XX7080 23072023Photoshoot TempleNo ratings yet

- Income Tax Schemes, Accounting Periods, Accounting Methods, and ReportingDocument4 pagesIncome Tax Schemes, Accounting Periods, Accounting Methods, and ReportingColeen BiocalesNo ratings yet

- UK Trade Imports by Post - How To Complete Customs DocumentsDocument11 pagesUK Trade Imports by Post - How To Complete Customs Documentsprincessz_leoNo ratings yet

- Monetarne Finansije - Novac i Novčani SistemiDocument12 pagesMonetarne Finansije - Novac i Novčani SistemiAsmirr9No ratings yet

- Alhambra Cigar & Cig. MFG., Co. v. Collector, 105 Phil 1337...Document3 pagesAlhambra Cigar & Cig. MFG., Co. v. Collector, 105 Phil 1337...BREL GOSIMATNo ratings yet

- 2551QDocument3 pages2551QnelsonNo ratings yet

- Bank Statement Template 27Document2 pagesBank Statement Template 27mohamed elmakhzni100% (1)

- Payment IDR - Mega - Januari 2009 - UPdatedDocument115 pagesPayment IDR - Mega - Januari 2009 - UPdatedirfanafiffudinNo ratings yet

- English Tuition Payment Plan MastersDocument4 pagesEnglish Tuition Payment Plan MastersBatih JuniorNo ratings yet

- GSHMKK00T000N4L: Products Quantity SKU Amount StatusDocument3 pagesGSHMKK00T000N4L: Products Quantity SKU Amount StatusRianaNo ratings yet

- Kunci Jawaban Lab Chapter 3 OverheadDocument3 pagesKunci Jawaban Lab Chapter 3 OverheadRantiyaniNo ratings yet

- The University of Lahore: Regular Fee VoucherDocument1 pageThe University of Lahore: Regular Fee VoucherMuhammad ALINo ratings yet

- Screenshot 2022-08-04 at 12.53.07 PDFDocument1 pageScreenshot 2022-08-04 at 12.53.07 PDFSimi NaomiNo ratings yet

- EBCI Enrollment Application GuideDocument7 pagesEBCI Enrollment Application Guiderandiw37100% (1)

- 2018-2019 Sbi StatementDocument9 pages2018-2019 Sbi StatementPower MuruganNo ratings yet

- 2022 - 2023 School Fees ReceiptDocument1 page2022 - 2023 School Fees Receiptlawal olawunmiNo ratings yet

- INCOMETAX M45 ReviewerDocument15 pagesINCOMETAX M45 ReviewerCaryl Isabel Francisco100% (1)

- S. S. Prasad - Tax Planning & Financial Management, M. Com. Semester IV, Corporate Tax Planning & ManagementDocument9 pagesS. S. Prasad - Tax Planning & Financial Management, M. Com. Semester IV, Corporate Tax Planning & ManagementAmisha Singh VishenNo ratings yet

- Colorado UtilityDocument1 pageColorado Utilitygilton amadadiNo ratings yet

- Form 8453 EMPDocument1 pageForm 8453 EMPKatakuriNo ratings yet

- Bank StatementDocument5 pagesBank Statementtaxlawconsultant022No ratings yet