Professional Documents

Culture Documents

Bangladesh Securities and Exchange Commission Public Issue Rule 2015 - Edited

Bangladesh Securities and Exchange Commission Public Issue Rule 2015 - Edited

Uploaded by

Shahadat HossainOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bangladesh Securities and Exchange Commission Public Issue Rule 2015 - Edited

Bangladesh Securities and Exchange Commission Public Issue Rule 2015 - Edited

Uploaded by

Shahadat HossainCopyright:

Available Formats

Bangladesh The new public issue

rules 2015 replaced

Securities and the public issue rules

2006

Exchange

Commission

(Public Issue) Published on Dec

31, 2015

Rules, 2015

Dec. 31 2015

Md Sajib Hossain, CFA

Any of

the

following

Fixed price method,

Requirements methods when offered at par

can be

for filing used for value; or

public

application for offering

a public offer Book-building

(R-3) method, when

offered above par

value.

Md Sajib Hossain, CFA

It offers an amount of at least equivalent to 10% of

its paid-up capital (including intended offer) or Tk.

15 crore at par value, whichever is higher and the

minimum existing paid up capital must be Tk. 15

General crore

requirements It has prepared its financial statements in

accordance with the IFRS/IAS

for Public

Offering

It has got cost audit by professional accountants as

per the Companies Act, 1994, if applicable and

audited financial statements by panel auditors.

Md Sajib Hossain, CFA

It has no accumulated retained loss at the time

of application;

It has complied with the provisions of guidelines

General regarding valuation of assets, if any, as published

by the Commission from time to time; and

requirements

for Public The issuer or any of its directors is not a bank

defaulter.

Offering

The issuer/issue has been rated by a credit rating

company registered with the Commission.

Md Sajib Hossain, CFA

• It has been in commercial operation at least

for immediate last 3 (three) years;

• It has made net profit after tax at least for

Additional immediate preceding 2 (two) financial years;

• It has positive net operating cash flow at

requirements least for immediate preceding 2 (two)

financial years;

for fixed price • The issuer/issue has been rated by a credit

method rating company registered with the

Commission;

• At least 35% of the issue has been

underwritten on a firm commitment basis

by the underwriter(s).

Md Sajib Hossain, CFA

• An issuer of a listed securities may make repeat public

offer, subject to compliance with the following

• Information concerning the repeat public offer shall be

Additional disseminated as price sensitive information immediately

upon board decision as well as upon approval at the

requirements general meeting and approval of the Commission

• The proceeds of previous public offer or rights issue, as

for Repeat the case may be, have been utilized fully and relevant

reports were duly submitted to the Commission;

Public Offer • The issue has been fully underwritten on a firm

commitment basis by the underwriter

• The proceeds of previous public offer or rights issue, as

the case may be, have been utilized fully and relevant

reports were duly submitted to the Commission;

Md Sajib Hossain, CFA

Distribution mechanism of securities

having conversion features

• At least 40% of the issue shall be reserved for the existing shareholders

• At least 40% of the issue shall be reserved for Public Offer; and

• Maximum 20% of the issue may be made through private placement

• Provided that the securities so issued shall not be converted either partly or fully before

a minimum period of 2(two) years of issuance.

Md Sajib Hossain, CFA

• General Requirements

• An issuer shall submit the application, to the Commission

for consent along with ten copies of the red-herring

Submission of prospectus/information memorandum, prepared as per

requirements of these Rules

application • Immediate after submission of the application, the issuer

shall post the red-herring

and processing prospectus/prospectus/information memorandum in the

websites of the issuer and the issue manager(s)

thereof (R-4) • All the required documents as per Annexure - A, B, C, D

and G shall be submitted with the application

• The Commission shall verify the application, documents

and primary recommendation of the exchanges

Md Sajib Hossain, CFA

• Additional requirements for book building method

• Conducting road show and submission of application

Submission of • The issuer/issue manager shall send invitation to the

eligible investors, both in writing and through

application publication in at least 5 (five) widely circulated

national dailies, giving at least 10 (ten) working days’

and processing time, to the road show indicating time and venue of

such event.

• The invitation letter shall accompany a red-herring

thereof (R-4) prospectus containing all relevant information

covering the proposed size of the issue and at least 3

(Contd.) (three) years audited financial statements and

valuation report, prepared by the issue manager

without mentioning any indicative price, as per

internationally accepted valuation methods

Md Sajib Hossain, CFA

• Additional requirements for book building method

•

Submission of • Representatives from the exchanges shall present in

the road show as observers and eligible investors

application shall submit their comments and observations

• After completion of the road show, the red-herring

and processing prospectus shall be finalized on the basis of

comments and observations of the EIs participated in

thereof (R-4) the road show

• Consent for bidding to determine the cut-off price: After

(Contd.) examination of the prospectus and relevant documents,

the Commission, if satisfied, shall issue consent to

commence bidding by the eligible investors for

determination of the cut- off price

Md Sajib Hossain, CFA

• Eligible investors shall participate in the electronic bidding

process and submit their intended quantity and price

• No eligible investor shall quote for more than 10% (ten

percent) of the total amount offered to the eligible Investors

and bidding shall be opened for 72 (seventy two) hours round

the clock

Determination • The bidders shall deposit at least 20% (twenty percent) of the

bid amount in advance

of cut off price • The bidders can revise their bids for once, within the bidding

period, up to 20% variation of their first bid price

• After completion of the bidding period, the cut-off price will

be determined at nearest integer of the lowest bid price

• All the eligible investors participating in the bidding shall be

offered to subscribe the securities at the cut-off price. It is

mandatory for EIs bidding at or above the cutoff price to

subscribe up to their intended quantity

• The securities shall be offered to general public for

subscription at an issue price to be fixed at 10% discount (at

nearest integer) from the cut-off price;

Md Sajib Hossain, CFA

• After examination of the draft prospectus and

relevant documents, the Commission, if

satisfied, shall issue consent for raising of capital

from the general public and approve the

Subscription prospectus

• The balance amount of subscription shall be

by the eligible paid by the eligible investors prior to the date of

opening of subscription to the general public

investors • Provided that in case of failure to deposit the

remaining amount by the eligible investors, advance

bid money deposited by them shall be forfeited by

the Commission and the unsubscribed securities

shall be taken up by the underwriters

Md Sajib Hossain, CFA

Price Determination Consideration Under

Public Issue-2015

• The issue manager(s) shall, among others, consider the following methods for

valuation of the securities:

• (i) net asset value at historical or current costs;

• (ii) earning-based-value calculated on the basis of weighted average of net profit

after tax for immediate preceding five years or such shorter period during which the

issuer was in commercial operation;

• (iii) projected earnings for the next three accounting year with rationales of the

projection, if not in commercial operation;

• (iv) average market price per share of similar stocks for the last one year immediately

prior to the offer for common stocks with reference and explanation of the

similarities or in case of repeat public offering, market price per share of common

stock of the issuer for the aforesaid period.

Distribution of securities

Eligible Investors General Public

Methods MF Others NRB Others

Fixed Price 10% 40% 10% 40%

Book Building 10% 50% 10% 30%

Provided that in case of under-subscription in any category by up to 35% in an

initial public offer, the unsubscribed portion of securities shall be taken up by the

underwriter(s):

Further provided that in case of under-subscription in any of categories above 35%,

an initial public offer shall be considered as canceled.

Md Sajib Hossain, CFA

Sufficient copies of prospectus shall

be made available by the issuer so

that any person requesting a copy

Prospectus may receive one

delivery

requirements The issuer shall post the prospectus

(R-8) vetted by the Commission in the

issuer’s website and also put on the

websites of the Commission,

exchanges, and the issue manager

Md Sajib Hossain, CFA

A prospectus may be used to offer the securities until any of the

following events occur, namely

Limitation on There are material changes in any of the information included in the

prospectus; and

the use of the

prospectus (R- Any transaction or event which is material to affect or change the

conditions under which the public offer is being made as per the

9) contents of the prospectus and which should have otherwise been

required to be reported to the Commission

If any of the above events occur, the offer shall stand suspended until

an amendment duly signed by all the directors of the issuer, the chief

executive officers of both the issuer and the issue manager to the

prospectus furnishing the appropriate information has been filed with

and declared effective by the Commission

Md Sajib Hossain, CFA

Ordinary shares of the issuer shall be subject to lock-in, from the date

of issuance of prospectus or commercial operation, whichever comes

later, in the following manner:

All shares held, at the time of according consent to the public offer, by

sponsors, directors and shareholders holding 5% or more shares,

other than alternative investment funds, for 03(three) years;

Lock-in (R-10) All shares allotted, before 02(two) years of according consent to the

public offer, to any person, other than alternative investment funds,

for 03(three) years;

In case any existing sponsor or director of the issuer transfers any

share to any person, other than existing shareholders, within

preceding 12 (twelve) months of submitting an application for raising

of capital or initial public offer (IPO), all shares held by those

transferee shareholders, for 03(three) years

Md Sajib Hossain, CFA

• 25% of the shares allotted to eligible investors,

for 03 (three) months and other 25% of the

shares allotted to them, for 06 (six) months

• All shares held by alternative investment funds,

for 01(one) year; and

• Shares allotted, within two years of according

Lock-in (R-10) consent to the public offer, to any person other

than the shares mentioned in sub-rules (1), (2),

(3), (4), and (5) above, for 01(one) year.

• Provided that ordinary shares converted from any

other type of securities shall also be subject to lock-

in as mentioned above.

Md Sajib Hossain, CFA

The issuer shall appoint one or more

issue manager, registered with the

Bangladesh Securities and Exchange

Commission and

Issue manager

(R-11) The issue manager(s) shall be entitled

to fees and be responsible for the

issue including preparation and

disclosures made in the prospectus,

road show and use of the public issue

proceeds by the issuer

Md Sajib Hossain, CFA

Fees for public offer and listing of securities (R-14)

Types of Fees Fixed Price Method Book Building Methods

Issue Management fees 1% on the public offering or Tk 2% on public offer amount

03.00 mil whichever is lower (including premium) or Tk 5 mil

whichever is lower

Underwriting fees Maximum 1% on 35% of the public Maximum 1% on 35% of the public

offer amount offer amount (including premium)

Application fee for the Tk 50000 (non-refundable) Tk 50000 (non-refundable)

Commission

Consent fees for the .40% on the public offer amount .40% on the public offer

Commission amount

Fees for funds As per relevant rules

Fees for Exchanges As per relevant listing regulation

Other fees As per relevant contracts

Md Sajib Hossain, CFA

On receipt of an application of consent for public

offer from an issuer, the Commission shall review

the said application to ascertain whether it is

complete and acceptable

Approval, In case the said application is incomplete, the

rejection and Commission shall inform the issuer in writing, to

remove the incompleteness/deficiencies, within 40

review (R-15) (forty) working days, after examination of the said

application

If the issuer fails to remove the incompleteness

within the stipulated time, it shall have to file a

fresh application

Md Sajib Hossain, CFA

• The Commission shall issue letter of consent, subject to such

conditions as it may deem fit to specify, within 60 (sixty)

working days of receipt of a complete application, if such

Approval, application is acceptable to the Commission;

• If the application is not acceptable to the Commission, it shall

issue a rejection letter, stating the reasons for such rejection,

rejection and within 60 (sixty) working days of receipt of the last

correspondence

review (R-15) • The issuer, whose application has been rejected by the

Commission, may apply for review to the Commission within

60 (sixty) working days from the date of such rejection, and

(Contd.) the decision of the Commission thereon shall be final;

• The Commission reserves the right to accept or reject any

public issue proposal in its own discretion in the greater

interest of the investors and the capital market as well

Md Sajib Hossain, CFA

Commission

decision shall • Notwithstanding anything contained in these

Rules, in the event of any confusion or

be final on difference of opinion on any matter whatsoever,

the decision of the Commission shall be final

certain matter and binding on all concerned

(R-17)

Md Sajib Hossain, CFA

1. Declaration about responsibilities of

directors, CEO

2. Due diligence certificates by issue

manager

3. Due diligence certificates by underwriter

4. Ratio analysis

Annexure 5. Disclosure requirements in the red herring

prospectus/prospectus

6. Preliminary Information and declarations

7. Availability of Prospectus

8. Table of Contents

9. Executive Summary

Md Sajib Hossain, CFA

• About the issuer

• Corporate directory of the Issuer

• Description of the Issuer

• Summary

Annexure • General Information

(Contd.) • Capital Structure

• Description of Business

• Description of Property

• Plan of Operation and Discussion of

Financial Condition

Md Sajib Hossain, CFA

10. Management’s discussion and analysis of

financial condition and results of

operations

11. Directors and Officers

12. Certain Relationships and Related

Annexure Transactions

13. Executive Compensation

(Contd.) 14. Options granted to Directors, Officers and

Employees

15. Transaction with the Directors and

Subscribers to the Memorandum

16. Ownership of the Company’s Securities

17. Corporate Governance

Md Sajib Hossain, CFA

18. Valuation Report of securities prepared

by the Issue Manager (See)

19. Debt Securities

20. Parties involved and their responsibilities,

as applicable

21. Material contracts

Annexure 22. Outstanding Litigations, Fine or Penalty

(Contd.) 23. Risk Factors and Management’s

Perceptions about the Risks

24. Description of the Issue

25. Use of Proceeds

26. Lock-in

Md Sajib Hossain, CFA

27. Markets for the Securities Being Offered

28. Description of securities outstanding or

being offered

Annexure 29. Financial Statements

30. Credit Rating Report, if applicable

(Contd.) 31. Public Issue Application Procedure

32. Disclosure in abridge version of

prospectus

33. Documents to be filed by the issuer

Md Sajib Hossain, CFA

Any Question ?

Md Sajib Hossain, CFA

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5819)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

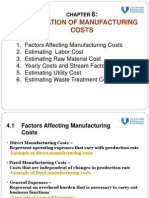

- Chap 6.0 Manufacturing Cost EstimationDocument20 pagesChap 6.0 Manufacturing Cost EstimationIR Ika EtyEtyka DoraNo ratings yet

- Central Executive Committee: Management of Pakistan Sugar Mills Association 2016-17Document63 pagesCentral Executive Committee: Management of Pakistan Sugar Mills Association 2016-17Shahzad AmeenNo ratings yet

- Solution Manual For Macroeconomics 6 e 6th Edition Olivier Blanchard David W JohnsonDocument36 pagesSolution Manual For Macroeconomics 6 e 6th Edition Olivier Blanchard David W Johnsontrojanauricled0mfv100% (45)

- 05 MCQs Payment System and Fee Based ServicesDocument2 pages05 MCQs Payment System and Fee Based ServicesVikashKumarNo ratings yet

- 4) Size of Business Y12 2019 (D)Document11 pages4) Size of Business Y12 2019 (D)CRAZYBLOBY 99No ratings yet

- BDocument3 pagesBAmit KumarNo ratings yet

- Drilling Plan Eases Rules: For PersonalDocument28 pagesDrilling Plan Eases Rules: For PersonalstefanoNo ratings yet

- Break Even Analysis Chapter IIDocument7 pagesBreak Even Analysis Chapter IIAnita Panigrahi100% (1)

- Contract "To Sell" vs. Contract "Of Sale"Document8 pagesContract "To Sell" vs. Contract "Of Sale"Hariette Kim Tiongson100% (1)

- Trainer'S Guide: FIT Uganda LimitedDocument106 pagesTrainer'S Guide: FIT Uganda LimitedSamuel OtaalaNo ratings yet

- Experts Point The Way Forward For Singapore Economic Growth - Yahoo News SingaporeDocument2 pagesExperts Point The Way Forward For Singapore Economic Growth - Yahoo News SingaporeSamuelNo ratings yet

- Credit Balance TheoryDocument2 pagesCredit Balance TheoryUdit AggarwalNo ratings yet

- LCI Form of ContractDocument137 pagesLCI Form of ContractNicolas Gasztych100% (1)

- The Economist Intelligence Unit - Worldwide Cost of Living 2022Document10 pagesThe Economist Intelligence Unit - Worldwide Cost of Living 2022JorgeNo ratings yet

- KemperPriceSheet OilfieldUnions 06SEP15105208Document27 pagesKemperPriceSheet OilfieldUnions 06SEP15105208zanella88No ratings yet

- The Production Possibility Model, Trade, and GlobalizationDocument26 pagesThe Production Possibility Model, Trade, and GlobalizationmarecsNo ratings yet

- Revision - Problem - For - Final - Exam - Part 1Document2 pagesRevision - Problem - For - Final - Exam - Part 120070095No ratings yet

- Wilson Go V. Estate of Late Felisa Tamio de Buenaventura GR No. 211972, Jul 22, 2015Document2 pagesWilson Go V. Estate of Late Felisa Tamio de Buenaventura GR No. 211972, Jul 22, 2015Alvin Ryan KipliNo ratings yet

- UCS 102 Entrepreneurship in Asia W9Document39 pagesUCS 102 Entrepreneurship in Asia W9kentbiibibibiNo ratings yet

- Answer Key ABM2Document6 pagesAnswer Key ABM2Elle Alorra RubenfieldNo ratings yet

- Compendium On GSTDocument5 pagesCompendium On GSTSumit KumarNo ratings yet

- Planning To Buy A PlotDocument2 pagesPlanning To Buy A PlotsarbudeenddNo ratings yet

- Galen 4 ChartsDocument25 pagesGalen 4 ChartsAnonymous rOv67R100% (1)

- Organized By: Kunjal Patel and Urvashi Mandaviya: Presents Param ImrDocument45 pagesOrganized By: Kunjal Patel and Urvashi Mandaviya: Presents Param ImrKunjal Patel BathaniNo ratings yet

- Handout Appendix DCF Valuation 2023Document21 pagesHandout Appendix DCF Valuation 2023Akshay SharmaNo ratings yet

- MB0046 Marketing Management MQPDocument25 pagesMB0046 Marketing Management MQPYash koradia0% (1)

- Chapter 3 Construction Contracts and Boq PDFDocument47 pagesChapter 3 Construction Contracts and Boq PDFMohammed AbdulkhalqNo ratings yet

- Suggested Answers AccountingDocument159 pagesSuggested Answers AccountingKish VNo ratings yet

- Assignment 1Document12 pagesAssignment 1snazrul100% (1)

- CDR KingDocument1 pageCDR KingKaren Pineda CariñoNo ratings yet