Professional Documents

Culture Documents

Chapter 38

Uploaded by

Charlene Mana Salvador0 ratings0% found this document useful (0 votes)

1 views16 pagesOriginal Title

CHAPTER 38.pptx

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

1 views16 pagesChapter 38

Uploaded by

Charlene Mana SalvadorCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 16

Prepared by:

JAN ARNEL LORIA

Public Finance - means the collection

and spending of government funds.

- includes the collection

of taxes, the expenditure of government

money, the preparation of the budget,

the borrowing of foreign loans and the

floating of government bonds.

Money – the life – blood of all nations

- no government can exist or

function without it.

All activities of the government require

funds like the following:

• Education

• Defense

• Peace and order maintenance

• Health and sanitation

• Public works

• Social welfare

• Economic development

Every system has 3 steps:

1) The preparation of the annual budget.

2) The enactment by legislature of the budget

(or appropriations) bill w/c provides for the

revenues and expenses of the government.

3) All government expenses are audited to

prevent extravagant or wasteful use of public

funds.

Budget – a financial statement of the

estimated income and expenses of the

government for the coming fiscal year.

- comes from the French term

bougette meaning “purse”.

- how the government or anyone

earns and spends money.

AIM:

• Encourage systematic and wise use of public funds

• Stop extravagant or wasteful spending in the

government.

Under the Constitution, the following rules are applied

to budget legislation

1) The President prepares the annual budget consultation

with the other government offices.

2) All budget and revenue or tariff bills shall originate in

the House of Representatives.

3) Congress may not increase the budget proposed by the

President.

4) The budget shall be specific, and appropriation items

must refer to specific purposes.

5) A special appropriations bill shall specify its purpose

and must be certified by the National Treasurer that

funds are available for it.

6) No transfer of funds may be made, however, the

President, Senate President, House Speaker, Chief

Justice and heads of the Constitutional Commissions

may augment any items in their respective offices.

7) Discretionary funds shall be supported by appropriate

vouchers.

8) If Congress has failed to pass a budget for the next

fiscal year, the budget for the preceeding year shall

remain in force.

9) The President may veto any particular item in the

budget bill.

The government derives its income from the

following sources:

Taxes paid by the people

Incidental income

Earnings and other credits

Receipts automatically appropriated

Extraordinary income or transfers of funds from special

sources (e.g. foreign loans, foreign aid, etc.)

Residence tax

Income tax

Real property tax

Inheritance and gift taxes

Import duties or tariffs and dues on goods coming into

the country

Licenses and business taxes

Miscellaneous taxes (e.g. gasoline tax, bank interest tax,

energy tax, etc,)

Fines and forfeitures and sales of public domain

Service fees (motor vehicle, registration fee, court fees

and costs, alien registration fee, fiber inspection fee, etc.)

Receipts from sweepstakes ticket sales

Income from rentals of public property

Fees paid for verification of private land surveys

Fees paid for air mail service

Fees paid to the different government board examiners

for various professional services (law, medicine,

engineering, etc.)

Foreign loans secured by the government from abroad

Government bonds

Foreign aid given to the government

The taxation power of the government is limited by the

following rules:

1) The tax shall be for a public purpose. Funds collected

from taxes are public money and must never be used to

enrich public officials or their families and friends.

2) The taxes shall be uniform and fair. Those whose

income is greater shall pay a higher income tax than

those whose income is smaller. There shall be no

exceptions to the payment of taxes.

3) Congress cannot tax properties which are used for

religious, charitable and educational purposes, such as

churches, cemeteries, orphanages and private schools

or universities.

The government is like a family – it has to spend money

for its members and to run the household.

Only the government’s expenses is not like a family

because it runs into billions of pesos.

In fact, the government still has billions of loans to pay

because many times it has to borrow money to meet the

needs of running the country.

Every year, the government expenditures increases.

1) Global inflation which reduced the buying power of the

peso

2) Population increase, which meant more schools and

teachers, more roads, hospitals and social services.

3) The rise in the price of oil from 1973 to 1984, which

made the other prices increase

4) The greed, graft and corruption of the previous

administration of President Marcos, his family and

cronies, who amassed vast sums of ill – gotten wealth

estimated at over $10 billion.

President Marcos, who was in power from 1965 to 1986,

was the only national leader in the world who

singlehandedly borrowed a vast sum of money for his

country.

The Philippines is now the 5th highest debtor country in

the world, after that of Brazil ($ 107billion), Mexico ($ 99

billion), Argentina ($ 50 billion), and Venezuela ($ 33

billion).

The staggering debt of over $ 30 billion is a very serious

economic problem.

The annual interest payment on this huge debt amounts

to about P126 billion alone, which is 40% of the national

budget.

Although much of the money was stolen from the people

by the previous regime, the debt still has to be repaid,

otherwise the country cannot borrow more loans to

finance its economic development and budget deficit.

Furthermore, if the Philippines does not repay these

loans, the country will be blacklisted by foreign

governments and foreign banks would not have lent us

the money if they did not believe in the capacity of our

country to develop.

It is the policy of the government to honor these loans

but at more favorable terms of repayment than

previously given.

You might also like

- Detailed Lesson Plan in English 2Document5 pagesDetailed Lesson Plan in English 2Charlene Mana SalvadorNo ratings yet

- Advisory - ApplicantsDocument2 pagesAdvisory - ApplicantsCharlene Mana SalvadorNo ratings yet

- Table of Contents For SalaryDocument1 pageTable of Contents For SalaryCharlene Mana SalvadorNo ratings yet

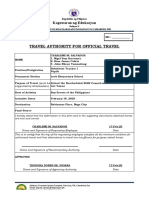

- New Travel Template 10.10.2022Document4 pagesNew Travel Template 10.10.2022Charlene Mana SalvadorNo ratings yet

- 500 S. 2021Document17 pages500 S. 2021Charlene Mana SalvadorNo ratings yet

- Summative MathDocument4 pagesSummative MathSer EdNo ratings yet

- English 4 - ST2 - Q1Document3 pagesEnglish 4 - ST2 - Q1marlon novisioNo ratings yet

- Creative Writing-Short StoryDocument7 pagesCreative Writing-Short StoryCharlene Mana SalvadorNo ratings yet

- Grade 7 Mathematics Entrance ExamDocument4 pagesGrade 7 Mathematics Entrance ExamGrim Warrior85% (52)

- Contact Tracing Form Contact Tracing FormDocument1 pageContact Tracing Form Contact Tracing FormCharlene Mana SalvadorNo ratings yet

- A Detailed Lesson Plan in MTB 1Document10 pagesA Detailed Lesson Plan in MTB 1Charlene Mana SalvadorNo ratings yet

- The Menstrual CycleDocument8 pagesThe Menstrual Cyclemarc7victor7sales100% (1)

- Chapter 38Document16 pagesChapter 38Charlene Mana SalvadorNo ratings yet

- Government CertificateDocument1 pageGovernment CertificateHaffiz AtingNo ratings yet

- Math ReviewerDocument2 pagesMath ReviewerAprianne Manlangit100% (2)

- Line GraphDocument14 pagesLine GraphCharlene Mana SalvadorNo ratings yet

- Opening Prayer For A SeminarDocument1 pageOpening Prayer For A SeminarCharlene Mana SalvadorNo ratings yet

- Writing Feature StoriesDocument23 pagesWriting Feature StoriesCharlene Mana SalvadorNo ratings yet

- Climate ChangeDocument14 pagesClimate ChangeCharlene Mana SalvadorNo ratings yet

- A Detailed Lesson Plan in Mathematics 5Document8 pagesA Detailed Lesson Plan in Mathematics 5Charlene Mana Salvador100% (2)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Explain The Press Complaints CommissionDocument2 pagesExplain The Press Complaints CommissionJavis OtienoNo ratings yet

- 06-04-10 FBI IIR InfoDocument2 pages06-04-10 FBI IIR InfoArizonaMilitiaNo ratings yet

- De Joya Versus Judge Placido Marquez2023099426 PDFDocument1 pageDe Joya Versus Judge Placido Marquez2023099426 PDFMabeth AbarcarNo ratings yet

- Women Empowerment in ManagementDocument3 pagesWomen Empowerment in Managementswatijain22100% (1)

- Joseph F. Dugan v. Arch Ramsay, Director of The Office of Personnel Management, 727 F.2d 192, 1st Cir. (1984)Document10 pagesJoseph F. Dugan v. Arch Ramsay, Director of The Office of Personnel Management, 727 F.2d 192, 1st Cir. (1984)Scribd Government DocsNo ratings yet

- CV For Benard KahwaDocument5 pagesCV For Benard Kahwakagezi andrewNo ratings yet

- 43 Limson Vs CADocument2 pages43 Limson Vs CARia GabsNo ratings yet

- 5 CALAWAG V UP VISAYASDocument5 pages5 CALAWAG V UP VISAYASNichole LusticaNo ratings yet

- Baylosis v. ChavezDocument22 pagesBaylosis v. ChavezCistron ExonNo ratings yet

- Sayson vs. PeopleDocument29 pagesSayson vs. PeopleCHow GatchallanNo ratings yet

- NPRDocument24 pagesNPRmegan-krekorian-741750% (2)

- Prva Dzepna KnjigaDocument2 pagesPrva Dzepna KnjigaleobihNo ratings yet

- United States Court of Appeals For The Third Circuit: Nos. 99-1453, 99-1455 and 99-1458Document8 pagesUnited States Court of Appeals For The Third Circuit: Nos. 99-1453, 99-1455 and 99-1458Scribd Government DocsNo ratings yet

- Case DigestDocument5 pagesCase DigestCharles RiveraNo ratings yet

- Person in Authority: Offended Party Since 152 Amendment Above: 3 Person Aiding APIADocument6 pagesPerson in Authority: Offended Party Since 152 Amendment Above: 3 Person Aiding APIAJoven CamusNo ratings yet

- GR 217777 ORBE Vs MIARALDocument11 pagesGR 217777 ORBE Vs MIARALRuel FernandezNo ratings yet

- Barredo Vs GarciaDocument35 pagesBarredo Vs GarciaCha AbanielNo ratings yet

- Addis Ababa UniversityDocument25 pagesAddis Ababa UniversityW Tinsae ZelalemNo ratings yet

- Development of Medical Services in GeorgiaDocument3 pagesDevelopment of Medical Services in GeorgiaTengiz VerulavaNo ratings yet

- 1 - People vs. Dulay, 681 SCRA 638, G.R. No. 193854 September 24Document13 pages1 - People vs. Dulay, 681 SCRA 638, G.R. No. 193854 September 24Robert Jayson UyNo ratings yet

- Sci-Hub - Removing Barriers in The Way of ScienceDocument4 pagesSci-Hub - Removing Barriers in The Way of Sciencebagus100% (1)

- Cuenca Vs de MontejoDocument5 pagesCuenca Vs de MontejoKim ChanNo ratings yet

- Analysis of Financing Mechanisms and Funding Streams To Enhance Emergency Preparedness: Synthesis ReportDocument142 pagesAnalysis of Financing Mechanisms and Funding Streams To Enhance Emergency Preparedness: Synthesis ReportjankellettNo ratings yet

- Conducto v. Monzon DigestDocument1 pageConducto v. Monzon DigestArlene Q. Samante50% (2)

- International Criminal LawDocument15 pagesInternational Criminal Lawravleen0% (1)

- Zuma V NDPP (2009) NPDDocument115 pagesZuma V NDPP (2009) NPDJames GrantNo ratings yet

- MartinReggi CandidateSurveyDocument3 pagesMartinReggi CandidateSurveyInjustice WatchNo ratings yet

- Jacksonville City Council Members Tommy Hazouri, Garrett Dennis and Brenda Priestly-Jackson Release StatementDocument2 pagesJacksonville City Council Members Tommy Hazouri, Garrett Dennis and Brenda Priestly-Jackson Release StatementActionNewsJaxNo ratings yet

- Bluebooking Quick Reference GuideDocument2 pagesBluebooking Quick Reference GuideEejon PohhstmaahhNo ratings yet

- DeltaX - Growth and Sales Specialist - Job Description - Engg Campus Hiring 2024Document3 pagesDeltaX - Growth and Sales Specialist - Job Description - Engg Campus Hiring 2024Muhammad Aqeel DarNo ratings yet