Professional Documents

Culture Documents

Loan scam hints at shady mid-cap deals and MOIL IPO oversubscribed 56 times

Uploaded by

shagunsangar0 ratings0% found this document useful (0 votes)

5 views18 pagesThe document discusses several topics:

1) A loan scam involving bribes at a financial services company that led to arrests.

2) Heavy oversubscription of MOIL's IPO, with retail portion subscribed 28 times.

3) Concerns about undisclosed funds from abroad entering Indian companies through private placements and opaque investment vehicles.

4) Arrest of former LIC Housing Finance CEO and bankers for taking bribes to approve loans worth hundreds of crores.

Original Description:

Original Title

nov 29-dec4

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document discusses several topics:

1) A loan scam involving bribes at a financial services company that led to arrests.

2) Heavy oversubscription of MOIL's IPO, with retail portion subscribed 28 times.

3) Concerns about undisclosed funds from abroad entering Indian companies through private placements and opaque investment vehicles.

4) Arrest of former LIC Housing Finance CEO and bankers for taking bribes to approve loans worth hundreds of crores.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views18 pagesLoan scam hints at shady mid-cap deals and MOIL IPO oversubscribed 56 times

Uploaded by

shagunsangarThe document discusses several topics:

1) A loan scam involving bribes at a financial services company that led to arrests.

2) Heavy oversubscription of MOIL's IPO, with retail portion subscribed 28 times.

3) Concerns about undisclosed funds from abroad entering Indian companies through private placements and opaque investment vehicles.

4) Arrest of former LIC Housing Finance CEO and bankers for taking bribes to approve loans worth hundreds of crores.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 18

Some of the week pick’s

Loan scam hints at shady mid-

cap deals

A 160-FOLD rise in a stocks price in four

years without analysts tracking it and few

funds owning it should have triggered

alarm bells at the surveillance

departments of stock exchanges and the

market regulator.It did not.That was

Money Matters Financial Services,the

company in the thick of the bribes-for-

loans scandal that has led to the arrest of

eight executives,including its chief.

Many local fund managers were of the

view that the issue was hugely

overpriced,compared to competitors with

similar business models,and so avoided

investing in it.

Some of those who are associated with

the market for private placement talk in

private of kickbacks being paid in share

placements of some small- and mid-sized

companies,and how some of the overseas

investors participating in the placements

merely act as fronts for promoters to

plough back unaccounted funds

abroad,into their companies.

MOIL IPO retail subscription 28

times, total 56.29 times

The initial public offering (IPO) of

manganese miner MOIL was bid 55 times

the offer, the highest for an IPO since May

2009.

The Rs 1,238-crore share sale drew

investors from the institutions and

individual investors alike

The 3.36 crore equity share issue was

subscribed more than 49 times in the

portion reserved for institutions , data from

stock exchanges show.

The portion reserved for wealthy, or high

net worth individuals , was bid 143 times,

while the retail portion, where limit was

doubled to Rs 2 lakh per application was

subscribed more than 28 times.

Most of the bids were at the top end of the

Rs 340-375 a share price band.

The government sold the MOIL shares in a

price band of Rs 340-375 and promised a

5% discount to retail investors and the

company staff of 6,734.

The government has raised over Rs 21,000

crore this fiscal selling shares including in

companies such as Power Grid Corp.

PNs- PNs are contracts issued by foreign

institutional investors,or FIIs,registered with

Sebi,to their offshore clients wanting to invest in

Indian shares.

These offshore clients either cannot meet the

eligibility norms to invest in India,or do not want

to register with Sebi for some reason.Such PNs

enable the overseas investors to buy Indian

equities through the FII without their identity

being revealed.

2007- Sebi chairman M Damodaran had put restrictions

on PN issuances by FIIs and eased norms to encourage

overseas investors to register with the Sebi director.But

those restrictions were reversed the following year amid

the global financial crisis,when FIIs sold Indian shares in

a big way.While investments through PNs as a

proportion of overall foreign portfolio investments are

now less than 15%,compared with over 50% in

2007,brokers and fund managers say it is mostly the

illegal funds of resident Indians that come in through this

route.

QIPs and even FCCBs (foreign currency

convertible bonds) are routinely used by

promoters to bring back illegal money parked

abroad.

This practice is widely prevalent in global

depository receipts,or GDRs,where many

unknown companies choose to list on illiquid

markets,and where the anonymous investors are

affiliates of the promoter group.

Fifty-four companies have raised over $5.5

billion through QIPs till October,according

to Prime Database.Given the buoyant

sentiment,which prevailed in the stock

market for much of this year,almost every

single placement was heavily subscribed.

Court rejects bail to loan-scam

accused

REJECTING bail applications from all the eight accused

in the bribe-for-loans case

The persons arrested by the Central Bureau of

Investigation (CBI) include former CEO of LIC Housing

Finance Ramachandran Nair,Naresh K Chopra

(secretary,investment,LIC),RN Tayal (general

manager,Bank of India),Maninder Singh Johar

(director,Central Bank of India),Venkoba Gujjal (deputy

general manager,Punjab National Bank),besides Rajesh

Sharma,chairman of Mumbai-based firm Money Matters

and two of its employees Suresh Gattani and Sanjay

Sharma.

RR Nair,former CEO of LIC Housing Finance,

Nair,according to CBI,took bribes to clear loans

worth 470 crore for the three realtors.Nair and

senior officials from three state-run banks were

arrested by the CBI last week for taking bribes

from Money Matters Financial Services

CBI lawyer Eijaz Khan said that Nair took bribes

for sanctioning a loan worth 200 crore to DB

Realty.He said Nair also accepted bribes for

clearing another loans worth 200 crore to Mantri

and 70 crore to Entertainment World.

VK Sharma,who took charge as the CEO of LIC Housing Finance

According to news agencies,LIC Housing

Finance said on Monday that loans worth 389

crore issued by it were under probe by CBI.It

also said the outstanding loans under scrutiny by

CBI were performing and the value of securities

against the loans was over 1,000 crore.

Senior officials of Central Bank of India,Punjab

National Bank and Bank of India for allegedly

accepting bribes for sanctioning loans.

Gainers

%

Grou Prev Close Current Price

Company Chan

p (Rs) (Rs)

ge

BGR Energy

A 577.55 746.75 + 29.30

Systems

Shree Renuka

A 76.15 91.15 + 19.70

Sugars

Adani Enterprises Lt A 584.70 672.20 + 14.96

Suzlon Energy Ltd. A 45.35 51.70 + 14.00

HDIL A 178.45 203.25 + 13.90

Losers

%

Grou Prev Close Current Price

Company Chang

p (Rs) (Rs)

e

Welspun Corp A 209.20 160.30 -23.37

Hero Honda Motor A 1,936.40 1,832.45 -5.37

Coromandel

A 586.35 556.05 -5.17

Internati

Reliance Infrastruct A 871.55 836.70 -4.00

Marico Ltd. A 131.65 127.25 -3.34

You might also like

- Spot - Future) (Ending-Beginning)Document8 pagesSpot - Future) (Ending-Beginning)DR LuotanNo ratings yet

- A Case Study On JVG ScandalDocument4 pagesA Case Study On JVG ScandalManish Singh100% (1)

- Virat Alloys Business Acquisition and Recapitalisation Plan of Sembule Steel Mills 22nd April 2013Document97 pagesVirat Alloys Business Acquisition and Recapitalisation Plan of Sembule Steel Mills 22nd April 2013InfiniteKnowledgeNo ratings yet

- Managing Working Capital and Cash FlowDocument8 pagesManaging Working Capital and Cash FlowEnelrejLeisykGarillos100% (1)

- Forward Rate AgreementDocument8 pagesForward Rate AgreementNaveen BhatiaNo ratings yet

- Ethical Issues in Banking, Telecom, Infrastructure and Public Distribution SystemsDocument8 pagesEthical Issues in Banking, Telecom, Infrastructure and Public Distribution SystemsAnkita AlweNo ratings yet

- Devyani International IPO previewDocument12 pagesDevyani International IPO previewgbNo ratings yet

- 777HDFC LTD How To Build Research ReportDocument7 pages777HDFC LTD How To Build Research Reportgaurav gargNo ratings yet

- Submitted To: Miss Svati Goyal Submitted By: Vibhu Babbar Roll No. A12 (10901344)Document25 pagesSubmitted To: Miss Svati Goyal Submitted By: Vibhu Babbar Roll No. A12 (10901344)Vibhu BabbarNo ratings yet

- FivestarDocument8 pagesFivestarAnkit KumarNo ratings yet

- Incred Financial Services Limited Press+ReleaseDocument7 pagesIncred Financial Services Limited Press+ReleaseGautam MehtaNo ratings yet

- FINM506 Course Details and Key Concepts on Primary Market OperationsDocument27 pagesFINM506 Course Details and Key Concepts on Primary Market OperationsChaitanya GembaliNo ratings yet

- Case Study of Satyam ScamDocument22 pagesCase Study of Satyam ScamAnubhav JainNo ratings yet

- BS Case StudiesDocument6 pagesBS Case StudiesAnisha RohatgiNo ratings yet

- Initial Public OfferingsDocument15 pagesInitial Public OfferingsHarsh SudNo ratings yet

- BAJAJ FINANCE MARKET LEADER IN BFSI SECTORDocument5 pagesBAJAJ FINANCE MARKET LEADER IN BFSI SECTORwph referenceNo ratings yet

- Smallcap PearlsDocument3 pagesSmallcap PearlsHarshika MehtaNo ratings yet

- SBI Securities Morning Update - 21-10-2022Document5 pagesSBI Securities Morning Update - 21-10-2022deepaksinghbishtNo ratings yet

- Infrastructure Leasing and Financial Services (Il & FS) Revival CaseDocument5 pagesInfrastructure Leasing and Financial Services (Il & FS) Revival CaseGokul GokulNo ratings yet

- FM Cia 1.1 - 2123531Document15 pagesFM Cia 1.1 - 2123531Rohit GoyalNo ratings yet

- Home First Finance IPO detailsDocument8 pagesHome First Finance IPO detailstoonsagarNo ratings yet

- Ian Renewable Energy Development Agency Limited - IPO NoteDocument11 pagesIan Renewable Energy Development Agency Limited - IPO NotedeepaksinghbishtNo ratings yet

- Insider Trading: Mohammed Imdad Mousam Ku Roy Rahul Pandey Abdul Noor Abdul HaiDocument28 pagesInsider Trading: Mohammed Imdad Mousam Ku Roy Rahul Pandey Abdul Noor Abdul HaiMousam RoyNo ratings yet

- Case StudyDocument4 pagesCase StudyRushabh ShahNo ratings yet

- Financial Services in India: Sector AnalysisDocument10 pagesFinancial Services in India: Sector AnalysisVIJETA JOGUNo ratings yet

- Shree CementDocument8 pagesShree CementVidhu GoelNo ratings yet

- Financial Statement Analysis: Draft For ReviewDocument21 pagesFinancial Statement Analysis: Draft For ReviewDisha RupaniNo ratings yet

- Yatra Online to Go Public Via Reverse Merger with Terrapin SPACDocument11 pagesYatra Online to Go Public Via Reverse Merger with Terrapin SPACshubhamNo ratings yet

- Latent View Analytics Limited Ipo: All You Need To Know AboutDocument7 pagesLatent View Analytics Limited Ipo: All You Need To Know AboutPeterNo ratings yet

- Macr Important Questions 2020Document4 pagesMacr Important Questions 2020Abhishek Daniel100% (1)

- JETIR2302348Document10 pagesJETIR2302348Krishna ReddyNo ratings yet

- Ruchi Soya Is One of The Largest Manufacturers of Edible Oil in India. Ruchi Soya IndustriesDocument3 pagesRuchi Soya Is One of The Largest Manufacturers of Edible Oil in India. Ruchi Soya IndustriesHarshit GuptaNo ratings yet

- SLR Metaliks Limited: Summary of Rated InstrumentDocument4 pagesSLR Metaliks Limited: Summary of Rated Instrumentvinay durgapalNo ratings yet

- SBI Securities Morning Update - 28-11-2022Document7 pagesSBI Securities Morning Update - 28-11-2022deepaksinghbishtNo ratings yet

- Rotomac Bank FraudDocument8 pagesRotomac Bank FraudAnand Christudas100% (3)

- IPO Grading: Muthoot Finance LimitedDocument16 pagesIPO Grading: Muthoot Finance LimitedDolly DodhiaNo ratings yet

- Mergers & Acquisition: As A Strategic Concept: Submitted To: Prof. Rajan GDocument51 pagesMergers & Acquisition: As A Strategic Concept: Submitted To: Prof. Rajan GRam AgrawalNo ratings yet

- Ivrcl: Uttam Galva SteelDocument3 pagesIvrcl: Uttam Galva SteelKanav GuptaNo ratings yet

- Trident Ltd18 Jan 2019Document3 pagesTrident Ltd18 Jan 2019darshanmaldeNo ratings yet

- Citibank FraudDocument6 pagesCitibank FraudSahil ChhabraNo ratings yet

- Case Study of Satyam ScamDocument34 pagesCase Study of Satyam Scamshubhendra8967% (15)

- Private Equity Is Money Invested in Companies That Are Not: NasdaqDocument10 pagesPrivate Equity Is Money Invested in Companies That Are Not: Nasdaqneha4301No ratings yet

- Advances To Deposit RatioDocument1 pageAdvances To Deposit RatioAnirudh ShrivastavaNo ratings yet

- PNB Project Sahil Khurana-1Document67 pagesPNB Project Sahil Khurana-1PraveenNo ratings yet

- RepotDocument9 pagesRepotFarooq HaiderNo ratings yet

- Assignment-1 Yes BankDocument5 pagesAssignment-1 Yes BankUtkarsh SinghNo ratings yet

- FEL ReportDocument14 pagesFEL ReportAteeque MohdNo ratings yet

- SBI Securities Morning Update - 09-01-2023Document7 pagesSBI Securities Morning Update - 09-01-2023deepaksinghbishtNo ratings yet

- CG Class1Document42 pagesCG Class1OSPITA KUNDUNo ratings yet

- Corporate Finance II ADocument56 pagesCorporate Finance II AUjjval YadavNo ratings yet

- Capital Structure & Financial Leverage Analysis of Software IndustryDocument13 pagesCapital Structure & Financial Leverage Analysis of Software Industryanuj surana100% (1)

- Everything you need to know about Sansera Engineering Limited's IPODocument8 pagesEverything you need to know about Sansera Engineering Limited's IPOarjun aNo ratings yet

- Sectorwise Distribution in The PortfolioDocument15 pagesSectorwise Distribution in The PortfolioAnkush GuptaNo ratings yet

- Two Wheelers - Dealer Survey ReportDocument8 pagesTwo Wheelers - Dealer Survey Reportticktick100% (3)

- Satyam FinalDocument58 pagesSatyam FinalSmriti Gupta100% (5)

- Indian Railway Finance Corporation LTD IPO: All You Need To Know AboutDocument7 pagesIndian Railway Finance Corporation LTD IPO: All You Need To Know Aboutbest commentator barackNo ratings yet

- The IPO Rush in IndiaDocument6 pagesThe IPO Rush in IndiacoolNo ratings yet

- Banking: Performance OverviewDocument7 pagesBanking: Performance OverviewAKASH BODHANINo ratings yet

- Reforms, Opportunities, and Challenges for State-Owned EnterprisesFrom EverandReforms, Opportunities, and Challenges for State-Owned EnterprisesNo ratings yet

- Asia Small and Medium-Sized Enterprise Monitor 2021: Volume I—Country and Regional ReviewsFrom EverandAsia Small and Medium-Sized Enterprise Monitor 2021: Volume I—Country and Regional ReviewsNo ratings yet

- Securitization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsFrom EverandSecuritization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsNo ratings yet

- Redefining Strategic Routes to Financial Resilience in ASEAN+3From EverandRedefining Strategic Routes to Financial Resilience in ASEAN+3No ratings yet

- Realizing the Potential of Public–Private Partnerships to Advance Asia's Infrastructure DevelopmentFrom EverandRealizing the Potential of Public–Private Partnerships to Advance Asia's Infrastructure DevelopmentNo ratings yet

- Microsoft Excel Sheet For Calculating (Money) Future Value, Present Value, Future Value of Annuity, FVA Due, Present Value of Annuity, PVA Due, Unequal Cash FlowsDocument8 pagesMicrosoft Excel Sheet For Calculating (Money) Future Value, Present Value, Future Value of Annuity, FVA Due, Present Value of Annuity, PVA Due, Unequal Cash FlowsVikas AcharyaNo ratings yet

- Impact of Capital Structure On Firms Financial PerformanceDocument15 pagesImpact of Capital Structure On Firms Financial PerformanceArunallNo ratings yet

- Managing Uncertainty During A Global PandemicDocument6 pagesManaging Uncertainty During A Global PandemicJuvy AguirreNo ratings yet

- Memorandum of UnderstandingDocument2 pagesMemorandum of UnderstandingAnmolNo ratings yet

- Customer Satisfaction towards RTGS & NEFTDocument70 pagesCustomer Satisfaction towards RTGS & NEFTRajibKumar100% (1)

- Measuring The Cost of LivingDocument4 pagesMeasuring The Cost of LivingAmna NawazNo ratings yet

- Condonation or RemissionDocument6 pagesCondonation or RemissionRhon Mhiel RomanoNo ratings yet

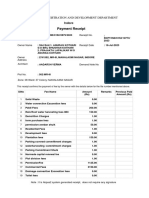

- Payment Receipt: Urban Administration and Development DepartmentDocument2 pagesPayment Receipt: Urban Administration and Development Departmentaadarsh vermaNo ratings yet

- Lower-of-Cost-or-Market Valuation IssuesDocument31 pagesLower-of-Cost-or-Market Valuation Issuesalice123h21No ratings yet

- Bibf Course Catalogue 2012 PDFDocument370 pagesBibf Course Catalogue 2012 PDFImad Mkanna100% (1)

- NH Retirement System Pensions 2018Document1,510 pagesNH Retirement System Pensions 2018portsmouthherald33% (3)

- Introduction Historical Background: The Law Relating To Banking, As WeDocument125 pagesIntroduction Historical Background: The Law Relating To Banking, As WeBalaji Rao N100% (2)

- Different Between Conventional Economics & Islamic EconomicsDocument1 pageDifferent Between Conventional Economics & Islamic EconomicsFieza Kyrana100% (2)

- Summer Training Project Report Derivatives in The Stock MarketDocument42 pagesSummer Training Project Report Derivatives in The Stock Marketprashant purohitNo ratings yet

- A Study On The Impact of Project Management Strategy On Real EstateDocument72 pagesA Study On The Impact of Project Management Strategy On Real EstateTasmay Enterprises100% (1)

- Financial Accounting Theory (Sem V) PDFDocument4 pagesFinancial Accounting Theory (Sem V) PDFHarshal JainNo ratings yet

- Tax Avoidance Strategies in ChinaDocument12 pagesTax Avoidance Strategies in Chinakelas cNo ratings yet

- MBA Investment Portfolio Management AssignmentDocument4 pagesMBA Investment Portfolio Management AssignmentDeepanshu Arora100% (1)

- Lic PDFDocument1 pageLic PDFAMIT KUMARNo ratings yet

- ExercisesDocument3 pagesExercisesrhumblineNo ratings yet

- 第十章選擇題Document2 pages第十章選擇題yihsuan huangNo ratings yet

- Dacion en PagoDocument2 pagesDacion en Pagohailglee1925No ratings yet

- MBA Course Papers at ManonmaniDocument39 pagesMBA Course Papers at ManonmaniGopi KrishzNo ratings yet

- Cost Dynamics - Elements and ClassificationDocument4 pagesCost Dynamics - Elements and ClassificationBrian OmbatiNo ratings yet

- Dev't Planning - I Chap OneDocument20 pagesDev't Planning - I Chap Oneferewe tesfayeNo ratings yet

- Eobi Loan RegDocument6 pagesEobi Loan RegEOBI FEDERATION100% (1)