Professional Documents

Culture Documents

Marginal Costing for Decision Making

Uploaded by

Shreya goel esq jva.ca.del100%(1)100% found this document useful (1 vote)

3K views25 pagesOriginal Title

MA Unit - 4 Marginal Costing and Decision Making.ppt

Copyright

© © All Rights Reserved

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

100%(1)100% found this document useful (1 vote)

3K views25 pagesMarginal Costing for Decision Making

Uploaded by

Shreya goel esq jva.ca.delCopyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 25

BSN622

MANAGEMENT ACCOUNTING

Unit – 4 :

Marginal Costing and Decision Making

Dr. ASHOK KUMAR

dr.ashok@shobhituniversity.ac.in

Dr. Ashok Kumar, 1

Shobhit Deemed University

Marginal Costing

Marginal costing, as one of the tools of management

accounting helps management in making certain

decisions.

It provides management with information regarding

the behavior of costs and the incidence of such costs

on the profitability of an undertaking.

Marginal costing is defined as “the ascertainment of

marginal costs and of the effect on profit of changes

in volume or type of output by differentiating

between fixed costs and variable costs”.

Dr. Ashok Kumar, 2

Shobhit Deemed University

Marginal Costing

Marginal costing is one of the special

techniques of costing used for analyzing and

interpreting cost data for the purpose of

assessing the profitability or otherwise of

product, process, department or cost center.

Dr. Ashok Kumar, 3

Shobhit Deemed University

Marginal Cost

The technique of marginal costing is related to

the concept of marginal cost. According to CIMA

London, “Marginal cost means the amount at any

given volume of output by which aggregate cost

are changed if the volume of output is increased

or decreased by one unit.”

Thus, marginal cost is the amount by which total

cost changes when there is a change in output by

one unit. Marginal cost per unit remains

unchanged irrespective of level of output.

Dr. Ashok Kumar, 4

Shobhit Deemed University

Marginal Cost

Marginal cost is also termed as variable cost

because within the capacity of organization, an

increase of one unit of production will cause an

increase in variable cost only.

The marginal cost is the sum total of direct

material cost, direct labour cost, variable direct

expenses, and all variable overheads. Marginal

cost is the same as the variable cost.

Dr. Ashok Kumar, 5

Shobhit Deemed University

Marginal Costing

According to CIMA London, “Marginal costing is

a technique where only the variable costs are

charged to the cost units, the fixed cost

attributable being written off in full against the

contribution for that period.”

It implies that Marginal costing is a technique

of costing which distinguishes between fixed

cost and variable cost. In marginal costing only

the variable costs are charged to the cost units.

Therefore marginal costing is also termed as

‘variable costing’.

Dr. Ashok Kumar, 6

Shobhit Deemed University

Features of Marginal Costing

1. Marginal costing is not a method of costing just

as job costing, process costing, etc. it is a

special technique for managerial decision

making.

2. Marginal costing necessitates the segregation of

costs into fixed costs and variable costs. Semi

variable costs are also segregated into fixed

costs and variable costs.

3. In marginal costing only the variable costs are

taken into account for computing cost of

production and value of stock.

Dr. Ashok Kumar, 7

Shobhit Deemed University

Features of Marginal

Costing…

4. Fixed costs are charged to profit and loss

account of the period for which costs are

incurred.

5. The profitability of the product or department is

ascertained in terms of marginal contribution,

i.e. sales value – variable costs.

Dr. Ashok Kumar, 8

Shobhit Deemed University

Difference between Marginal

Costing and Absorption Costing

1. Segregation of costs into fixed and variable

costs: Marginal costing considered variable costs

as cost of production and therefore, requires

segregation of costs into fixed and variable. On the

other hand, under absorption costing , all costs are

allocated to precuts. Hence there is no need of

segregation of costs into fixed and variable costs.

2. Cost element in product cost : Under absorption

costing, fixed overheads are added to the cost of

production whereas under marginal costing, fixed

costs are not included in the cost of production.

Dr. Ashok Kumar, 9

Shobhit Deemed University

Difference between Marginal

Costing and Absorption Costing …

3. Inventory Values : Under marginal costing, the value

of inventories is comparatively lower as inventories are

the valued in the term of variable costs only. Under

absorptions costing , the value inventories is

comparatively higher because inventories are valued

at total cost, i.e variable as well as fixed costs.

4. Profit : The term profit, under the absorptions costing

is the difference between sales and cost of goods sold.

Under marginal costing, the term profit, in a broader

perspective, is known as contributions margin which is

excess of sales over variable cost of goods sold.

Dr. Ashok Kumar, 10

Shobhit Deemed University

Difference between Marginal

Costing and Absorption Costing

5. Effect of increase or decrease in inventories

: In inventories increase during the period,

absorption costing will reveal more profit than

marginal costing. When inventories decrease,

absorption costing will reported lesser profits

than marginal costing.

6. Suitability : Absorption costing is not suitable

for decision-making whereas marginal costing is

suitable for decision-making.

Dr. Ashok Kumar, 11

Shobhit Deemed University

Advantages of Marginal

Costing

1. Easy and simple: marginal costing technique is

very easy and simple to understand and to

operate. Marginal cost remains the same per unit

of production irrespective of the volume of

production and fixed costs are totally ignored./

2. Simplification of Overhead treatment :

Marginal costing technique does away with the

need for all allocation, apportionment and

absorption of fixed overheads, thereby, eliminating

th problem of over or under absorption of

overheads. Thus , marginal costing simplifies the

overhead recovery system.

Dr. Ashok Kumar, 12

Shobhit Deemed University

Advantages of Marginal

Costing…

3. Cost Control: Marginal costing facilitates the

control over cost. By avoiding arbitrary

allocation of fixed overhead, the management

can concentrate on controlling marginal cost.

4. Helpful in Profit Planning : Marginal costing

enables the management to plan for future

profits by providing data in a manner showing

cost-volume-profit relationship. Marginal

costing helps in break-even-analysis which is

related to profit planning.

Dr. Ashok Kumar, 13

Shobhit Deemed University

Advantages of Marginal

Costing…

5. Aid to Management : Marginal costing is an aid to

management in taking many important decisions

such as pricing, make or buy, selecting the most

profitable product mix, accepting orders at low

price, reduction of price in times of competition of

depression, itc. It helps the management in

evaluating the profitability of alternative operations.

6. Compatibility with Standard Costing and

Budgeting : Marginal costing can conveniently be

combined with budgetary control and standard

costing technique, thereby, making it all the more

useful.

Dr. Ashok Kumar, 14

Shobhit Deemed University

Uses and Applications of

Marginal Costing

1. Maintaining a desired level of profit : The

industries may have to reduce the price of its products

on of government regulations, competition, etc. The

volume of sales needed to have a desired level of

profits can be ascertained by the marginal costing

technique.

2. Level of Activity planning : When the management

is considering different levels of production are selling

activities to decide optimum level of activity,. The

technique of marginal costing is helpful to the

management. The optimum level of activity will be

activity whereas contribution per unit is the maximum.

Dr. Ashok Kumar, 15

Shobhit Deemed University

Uses and Applications of

Marginal Costing

3. Selection of Optimum Sales Mix : When a firm

produces more than one product, it has to decide

the product mix which will give maximum profits.

The best product mix is that which yield give

maximum contribution which can easily be

ascertained with the help of marginal costing

4. Alternative Methods of Production : Where

there are alternative method of production, say,

hand work or machine work, the management has

to ascertain the method which gives the greater

contribution. Marginal costing is helpful in such

decision making.

Dr. Ashok Kumar, 16

Shobhit Deemed University

Uses and Applications of

Marginal Costing

5. Make or Buy Decision: The technique of marginal

costing is also applied when management has too decide

whether to make a product/component or buy it from

outside. The management will compare the marginal cost

of manufacturing the precut which compare the marginal

cost of manufacturing the product with is purchase price.

6. Operate of Shut-down Decision: If the sales of the

product is not adequate enough to cover fixed costs, the

management may decide whether to shut down the

production of the product temporarily or continue.

Marginal costing helps the management in such decision-

making.

Dr. Ashok Kumar, 17

Shobhit Deemed University

7. Introduction of a New Product: When a firm

intends to introduce a new product in the market

to make use of the available facilities or to capture

a new market, it takes the helps of marginal

costing technique . The decision to do so centers

round the profitability of the new products, i.e.

whether it could contribute something towards the

fixed costs and profits.

8. Accepting price less than total cost: During

normal circumstances, price is fixed on the basis of

the total cost. But under abnormal conditions, the

prices may be fixed below the total cost. Marginal

costing technique helps the management in taking

such a decision . If selling price is equal to or more

than marginal cost, the firm may accepts a price

than the total cost.

Dr. Ashok Kumar, 18

Shobhit Deemed University

CVP Analysis

Breakeven analysis is the study of the

relationship between selling prices, sales

volumes, fixed costs, variable costs and

profits at various levels of activity.

Cost–volume–profit (CVP) analysis is defined

in CIMA’s Official Terminology as ‘the study

of the effects on future profit of changes in

fixed cost, variable cost, sales price,

quantity and mix’.

CVP Analysis

A fixed cost is one that is independent of the level of

sales; rather, it is related to the passage of time. Examples

of fixed costs include rent, salaries and insurance.

A variable cost is one that is directly related to the level of

sales, such as cost of goods sold and commissions.

This categorisation of costs into “variable” and “fixed”

elements and their relationship with sales and profits has

been developed as “break-even analysis”. This break even

analysis is also known as Cost–volume– profit (CVP)

analysis.

USES OF COST-VOLUME-PROFIT ANALYSIS

1. C.V.P. analysis helps in forecasting costs and profits as a result of

change in volume.

2. It helps fixing a sales volume level to earn or cover a given revenue,

return on capital employed, or rate of dividend.

3. It assists determination of effect of change in volume due to plant

expansion or acceptance of an order, with or without increase in costs

or in other words a quantum of profit to be obtained can be determined

with change in volume of sales.

4. C.V.P. analysis helps in determining relative profitability of each

product, line, project or profit plan.

5. Through cost volume-profit analysis inter-firm comparison of

profitability can be done intelligently.

USES OF COST-VOLUME-PROFIT ANALYSIS

6. It helps in determining cash requirements at a desired

volume of output, with the help of cash break- even charts.

7. Break-even analysis emphasises the importance of capacity

utilisation for achieving economy.

8. From break-even analysis during severe recession, the

comparative effects of a shut down or continued operation

at a loss is indicated.

9. The effect on total cost of a change in the fixed over-head is

more clearly demonstrated through break-even analysis and

cost- volume-profit charts.

Contribution

Contribution is the difference between sales and variable

cost. Or Contribution is the difference between selling price

and variable cost of sales.

(i) Selling price containing profit:

Contribution = Fixed cost + Profit

(ii) Selling price at cost:

Contribution = Fixed cost

(iii)Selling price at loss:

Contribution = Fixed cost - Loss

Contribution = Sales - Variable Cost

Contribution = Profit + Fixed Cost

MARGINAL COST EQUATION

As we know: Sales-Cost= Profit

or Sales- (Fixed cost + Variable cost)= Profit

or Sales- Variable cost= Fixed cost + Profit

It is known as marginal cost equation. We can convey it

as under:

S-V=F+P

Where S = Sales V= Variable cost F= Fixed cost

P= Profit

PROFIT-VOLUME RATIO

(P/V Ratio)

The ratio or percentage of contribution margin to

sales is known as P/V ratio. This ratio is also

known as marginal income ratio, contribution to

sales ratio, or variable profit ratio.

P/V ratio, usually expressed as a percentage, is

the rate at which profit increases with the

increase in volume.

The formulae for P/V ratio are:

P / V ratio = Marginal Contribution

Sales

You might also like

- Inter Process ProfitsDocument10 pagesInter Process ProfitsKella Pradeep100% (1)

- Problems LeverageDocument20 pagesProblems LeverageMadhav RajbanshiNo ratings yet

- Performa of Final AccountDocument3 pagesPerforma of Final AccountIndu GuptaNo ratings yet

- Proforma of A Reconciliation StatementDocument5 pagesProforma of A Reconciliation StatementAtul Mumbarkar50% (2)

- List of Topics For Cost Accounting Assignments - Sem V - AY 2021-22-1Document2 pagesList of Topics For Cost Accounting Assignments - Sem V - AY 2021-22-1Manan Shah0% (1)

- Clause - 49Document18 pagesClause - 49Manish AroraNo ratings yet

- Unit 1Document134 pagesUnit 1Laxmi Rajput100% (3)

- What is TDS? Advance Tax and ProblemsDocument8 pagesWhat is TDS? Advance Tax and ProblemsNishantNo ratings yet

- Financial Management (I-Mba V) Important Questions (Module 1&3) (I.e. Asked in GTU Question Papers)Document2 pagesFinancial Management (I-Mba V) Important Questions (Module 1&3) (I.e. Asked in GTU Question Papers)Sabhaya Chirag100% (2)

- Accounts of Non Trading OrganisationDocument13 pagesAccounts of Non Trading OrganisationMahesh Kumar100% (2)

- Lease vs Buy Machinery: 6 Factors to ConsiderDocument2 pagesLease vs Buy Machinery: 6 Factors to Consider29_ramesh17050% (2)

- Scope of International AccountingDocument22 pagesScope of International AccountingMr. Rain Man100% (2)

- Small Industries Development OrganisationDocument22 pagesSmall Industries Development OrganisationShabaz Ahamed60% (5)

- CALL MONEY MARKET: SHORT-TERM BANK FUNDINGDocument24 pagesCALL MONEY MARKET: SHORT-TERM BANK FUNDINGiyervsrNo ratings yet

- Application of Break Even AnalysisDocument6 pagesApplication of Break Even AnalysisSamarjit Chatterjee0% (1)

- Investment Management NotesDocument40 pagesInvestment Management NotesSiddharth Ingle100% (1)

- Scope and Nature of MarketingDocument4 pagesScope and Nature of MarketingAbhijit Dhar100% (1)

- Financial ManagementDocument17 pagesFinancial ManagementANAND100% (1)

- Weaknesses of Stock Market of IndiaDocument2 pagesWeaknesses of Stock Market of Indiachronicler92100% (1)

- Methods and Types of CostingDocument2 pagesMethods and Types of CostingCristina Padrón PeraltaNo ratings yet

- Divisible ProfitDocument5 pagesDivisible ProfitAzhar Ahmed SheikhNo ratings yet

- Cost AscertainmentDocument36 pagesCost AscertainmentParamjit Sharma100% (6)

- Assessment of Partnership Firm.Document9 pagesAssessment of Partnership Firm.Safa100% (3)

- A Detailed Project On Secondary Market.Document40 pagesA Detailed Project On Secondary Market.Jatin Anand100% (1)

- New Issue MarketDocument13 pagesNew Issue MarketKanivarasi Hercule100% (2)

- Financial Management - 2 marks questions and answers on levered vs unlevered firms, Modigliani Miller, cost of capitalDocument2 pagesFinancial Management - 2 marks questions and answers on levered vs unlevered firms, Modigliani Miller, cost of capitalKumara Kannan Rengasamy100% (4)

- Naresh Chandra Committe, PresentationDocument14 pagesNaresh Chandra Committe, Presentationrjruchirocks100% (9)

- Leverage Notes by CA Mayank Kothari SirDocument48 pagesLeverage Notes by CA Mayank Kothari Sirbinu100% (2)

- Difference Between Tax PlanningDocument2 pagesDifference Between Tax PlanningBiswaranjan Satpathy100% (1)

- Cost Accounting IntroductionDocument47 pagesCost Accounting IntroductionAkanksha GuptaNo ratings yet

- Practical Problems On CustomsDocument13 pagesPractical Problems On Customsnousheen riya67% (3)

- Marginal Costing and Its Application - ProblemsDocument5 pagesMarginal Costing and Its Application - ProblemsAAKASH BAIDNo ratings yet

- Reconciliation of Cost-Financial CostingDocument24 pagesReconciliation of Cost-Financial CostingParamjit Sharma100% (6)

- Tandon Committee RecommendationsDocument2 pagesTandon Committee RecommendationsPrincess Suganya80% (5)

- Risk Analysis in Capital Bud PDFDocument32 pagesRisk Analysis in Capital Bud PDFbinu100% (1)

- 6 Basic Principles of Managerial EconomicsDocument6 pages6 Basic Principles of Managerial EconomicsDr Jerry John100% (2)

- Chapter 4: LeverageDocument15 pagesChapter 4: LeverageSushant MaskeyNo ratings yet

- Course Name: 2T7 - Cost AccountingDocument56 pagesCourse Name: 2T7 - Cost Accountingjhggd100% (1)

- 19732ipcc CA Vol2 Cp3Document43 pages19732ipcc CA Vol2 Cp3PALADUGU MOUNIKANo ratings yet

- Functions of A SalesmanDocument2 pagesFunctions of A SalesmanpilotNo ratings yet

- Financial Leverage QuestionsDocument2 pagesFinancial Leverage QuestionsjeganrajrajNo ratings yet

- MBA Sem-I Presentation on Law of Variable ProportionsDocument14 pagesMBA Sem-I Presentation on Law of Variable ProportionsKanika AggarwalNo ratings yet

- Tax Planning With Reference To New Business - LocationDocument20 pagesTax Planning With Reference To New Business - Locationasifanis40% (5)

- Capital Structure TheoriesDocument2 pagesCapital Structure TheoriesTHEOPHILUS ATO FLETCHERNo ratings yet

- Objectives & Functions of IDBI BankDocument2 pagesObjectives & Functions of IDBI BankParveen SinghNo ratings yet

- Essentials of Effective Business Correspondence:: Submitted byDocument25 pagesEssentials of Effective Business Correspondence:: Submitted byF12 keshav yogiNo ratings yet

- Law of Variable ProportionsDocument10 pagesLaw of Variable ProportionsTarang DoshiNo ratings yet

- LIST OF INDIAN ACCOUNTING AND COST STANDARDSDocument2 pagesLIST OF INDIAN ACCOUNTING AND COST STANDARDSrahi4nzNo ratings yet

- Understanding Integrated vs Non-Integrated Accounting SystemsDocument20 pagesUnderstanding Integrated vs Non-Integrated Accounting Systemsrabi_kungle0% (2)

- Investment Management NotesDocument75 pagesInvestment Management NotesArjun Nayak100% (2)

- Tax Provisions for FTZ, Infrastructure & Backward AreasDocument22 pagesTax Provisions for FTZ, Infrastructure & Backward Areaspadum chetry86% (7)

- Characteristics of Marginal CostingDocument2 pagesCharacteristics of Marginal CostingLJBernardoNo ratings yet

- Lecture Notes On Financial ForecastingDocument7 pagesLecture Notes On Financial Forecastingpalkee100% (3)

- Consumer Protection Act Key ProvisionsDocument4 pagesConsumer Protection Act Key ProvisionsPrinceSingh198No ratings yet

- Assessment of CompaniesDocument5 pagesAssessment of Companiesmohanraokp22790% (1)

- C.A IPCC Capital BudgetingDocument51 pagesC.A IPCC Capital BudgetingAkash Gupta100% (4)

- Cost SheetDocument29 pagesCost Sheetnidhisanjeet0% (1)

- MA Unit - 4 Marginal Costing and Decision MakingDocument25 pagesMA Unit - 4 Marginal Costing and Decision MakingShreya goel esq jva.ca.delNo ratings yet

- Program vs Performance BudgetsDocument13 pagesProgram vs Performance BudgetsRahul SharmaNo ratings yet

- Marginal Costing Concepts ExplainedDocument21 pagesMarginal Costing Concepts ExplainedGauravsNo ratings yet

- Numericals of Economic Order QuantityDocument5 pagesNumericals of Economic Order QuantityShreya goel esq jva.ca.del0% (1)

- Numericals of Economic Order QuantityDocument5 pagesNumericals of Economic Order QuantityShreya goel esq jva.ca.del0% (1)

- Assignment Questions of FMDocument1 pageAssignment Questions of FMShreya goel esq jva.ca.delNo ratings yet

- MA Unit - 4 Marginal Costing and Decision MakingDocument25 pagesMA Unit - 4 Marginal Costing and Decision MakingShreya goel esq jva.ca.delNo ratings yet

- Assignment Questions of FMDocument1 pageAssignment Questions of FMShreya goel esq jva.ca.delNo ratings yet

- Cash ManagementDocument21 pagesCash ManagementShreya goel esq jva.ca.delNo ratings yet

- Chapter 5Document37 pagesChapter 5Glydel Ann MercadoNo ratings yet

- Cash ManagementDocument21 pagesCash ManagementShreya goel esq jva.ca.delNo ratings yet

- Sample Substantive Procedures AllDocument13 pagesSample Substantive Procedures AllCris LuNo ratings yet

- Solvency Ratio AnalysisDocument20 pagesSolvency Ratio AnalysispappunaagraajNo ratings yet

- ITRODocument15 pagesITROapi-3715493No ratings yet

- IND AS 36 PDFDocument83 pagesIND AS 36 PDFPranjul AgrawalNo ratings yet

- Patrocinio TransactionsDocument4 pagesPatrocinio TransactionsancooooNo ratings yet

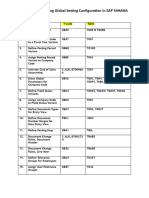

- Ledgers - SAP DocumentationDocument2 pagesLedgers - SAP DocumentationSrinivas MsrNo ratings yet

- Chapter 23 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document29 pagesChapter 23 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- Fundamentals of Accountancy, Business, and Management 1: Quarter 4 - Module 2Document23 pagesFundamentals of Accountancy, Business, and Management 1: Quarter 4 - Module 2Edna MingNo ratings yet

- Evaluating Operating and Financial PerformanceDocument33 pagesEvaluating Operating and Financial PerformanceAbhi PatelNo ratings yet

- Readymade Chappathi Project ReportDocument13 pagesReadymade Chappathi Project ReportachusmohanNo ratings yet

- ACC307 1 Material Unit 4Document58 pagesACC307 1 Material Unit 4Umaid FaisalNo ratings yet

- Audit Long-Term Debt, Investments, EquityDocument48 pagesAudit Long-Term Debt, Investments, EquitysamaanNo ratings yet

- AccountingDocument5 pagesAccountingMarinie CabagbagNo ratings yet

- College Accounting A Contemporary Approach 4th Edition Haddock ISBN Test BankDocument16 pagesCollege Accounting A Contemporary Approach 4th Edition Haddock ISBN Test Bankeddie100% (21)

- Costing ConceptsDocument16 pagesCosting ConceptskrimishaNo ratings yet

- Answers COST OF CAPITAL ExercisesDocument8 pagesAnswers COST OF CAPITAL Exercisesjanine fernandez100% (1)

- Discounted Cash Flow Valuation ExcelDocument8 pagesDiscounted Cash Flow Valuation ExcelGomv ConsNo ratings yet

- Midterms Reviewer 2007Document7 pagesMidterms Reviewer 2007Edison San JuanNo ratings yet

- Financial Statement AnalysisDocument44 pagesFinancial Statement AnalysisMahmoud ZizoNo ratings yet

- Finance 5Document3 pagesFinance 5Jheannie Jenly Mia SabulberoNo ratings yet

- Harnessing Opportunity Through PerformanceDocument22 pagesHarnessing Opportunity Through PerformanceARKAJYOTI BASUNo ratings yet

- 2nd Grading Exam - 2Document15 pages2nd Grading Exam - 2Amie Jane MirandaNo ratings yet

- MCQ Accounts With AnswersDocument70 pagesMCQ Accounts With AnswersPrashant Nayyar100% (1)

- Long-Term Construction ContractsDocument12 pagesLong-Term Construction Contractsblackphoenix303No ratings yet

- Ravi's Trading and Profit & Loss AccountDocument6 pagesRavi's Trading and Profit & Loss AccountBlaze MysticNo ratings yet

- PFRS for Small Entities at a GlanceDocument49 pagesPFRS for Small Entities at a GlanceJerico CelesteNo ratings yet

- Calculating Partnership Profits and BonusesDocument5 pagesCalculating Partnership Profits and BonusesRoselle Jane LanabanNo ratings yet

- SAP FI Financial Accounting Global Setting 1691089274Document5 pagesSAP FI Financial Accounting Global Setting 1691089274Jenneey D RajaniNo ratings yet

- Inventories Problems To DiscussDocument6 pagesInventories Problems To Discusskeisha santosNo ratings yet

- Furniture FinancialDocument66 pagesFurniture FinancialLewi BestNo ratings yet