Professional Documents

Culture Documents

Gyan Jyoti - Money Market Instruments2-1

Uploaded by

Ankit KanojiaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Gyan Jyoti - Money Market Instruments2-1

Uploaded by

Ankit KanojiaCopyright:

Available Formats

Money Market Instrument

What is Money Market Instrument ? Features of Money Market Instruments

Money Market is a market where lending and borrowing of funds is being done 1. Promotes Liquidity and Safety of funds .

for min period of 1 day and maximum 365 days (Less than a year) between 2. Helps in Government Monetary Policy & Financial Mobility

banks , Corporates Institutions FIIs ,NBFCs and Mutual Funds Companies 3. Equilibrium between Demand and Supply of funds .

4. Money market assists the short-term fund users to fulfill their needs at a

It gives the Liquidity of funds to Investor with Minimum returns so the very reasonable rate.

Institutions can demand money at the time of any emergency with minimum 5. Facilitates the smooth functioning of Commercial banks and also helps in

benefits . regulating the economy .

Examples of Money Market Instrument

• Call Money - Inter bank market where funds are borrowed and lent for 1 day or less.

• Notice Money - IInter bank market where funds are borrowed and lent for >1 day and upto 14 days .

• Treasury Bills – Issued by RBI and are Zero Risk at present three types of T-Bills (91 D, 182 D & 364 D)

• Cash Management Bills – Issued by RBI issued for less then 91 days only .

• Certificate of Deposits (CDs) – Issued by Commercial Banks and other financial institutions having period from

15days to 1 year with min amount Rs.1 Lacs .

• Commercial Paper –Issued by large corporates and FIs maturity period is min 7days to 1 year

• Commercial Bills –Issued by all India FIs, NBFCs, SCBs, Merchant banks & Mutual funds.

You might also like

- FMS PPT Group5Document22 pagesFMS PPT Group5kalyanikamineniNo ratings yet

- Money Market Its InstrumentsDocument13 pagesMoney Market Its InstrumentsHarsh ThakurNo ratings yet

- Money Market: Security Analysis and Portfolio ManagementDocument23 pagesMoney Market: Security Analysis and Portfolio Managementrahu007einstein56uNo ratings yet

- Unit 1Document64 pagesUnit 1Suneel KumarNo ratings yet

- Money Market InstrumentDocument30 pagesMoney Market Instrumentdont_forgetme2004No ratings yet

- 53336bos42717 cp10Document14 pages53336bos42717 cp10ravinabhimtaNo ratings yet

- CH - 3Document11 pagesCH - 3Jap KhambholiyaNo ratings yet

- Money MarketDocument22 pagesMoney Marketkunaldaga78No ratings yet

- Understanding - Money MarketDocument39 pagesUnderstanding - Money MarketaartipujariNo ratings yet

- Money Market Simplified Easy PowerpointDocument17 pagesMoney Market Simplified Easy PowerpointNitin DawarNo ratings yet

- Biitm-IFSS-Notes Module 2 - SBMDocument33 pagesBiitm-IFSS-Notes Module 2 - SBMshubham kumarNo ratings yet

- Unit 3 Call Money MarketDocument14 pagesUnit 3 Call Money MarketsadathnooriNo ratings yet

- Monetary Economics: Financial SystemDocument25 pagesMonetary Economics: Financial Systemഉണ്ണിക്കുട്ടൻ റിമ്പോച്ചNo ratings yet

- Topic:-Money Market: S.K.School of Business Management H.N.G.Uni, PatanDocument14 pagesTopic:-Money Market: S.K.School of Business Management H.N.G.Uni, PatanchthakorNo ratings yet

- Money Market's InstrumentsDocument20 pagesMoney Market's InstrumentsManmohan Prasad RauniyarNo ratings yet

- Money MarketDocument27 pagesMoney MarketThe State AcademyNo ratings yet

- Money MarketDocument21 pagesMoney MarketHarsha VardhanaNo ratings yet

- Money Market InstrumentsDocument121 pagesMoney Market InstrumentsUmang JagadNo ratings yet

- Money Market Numerical ExamplesDocument14 pagesMoney Market Numerical ExamplesgauravNo ratings yet

- Money Market and Its InstrumentsDocument22 pagesMoney Market and Its InstrumentsRajat SinghNo ratings yet

- Money MarketDocument37 pagesMoney Marketmohamedsafwan0480No ratings yet

- Unit-3 Financial MarketsDocument30 pagesUnit-3 Financial MarketsPiyu VyasNo ratings yet

- Money Market: Dr. Divya Asst. Prof., USMS, GGSIPUDocument27 pagesMoney Market: Dr. Divya Asst. Prof., USMS, GGSIPUHarsh PrakashNo ratings yet

- Instruments in Treasury MarketDocument34 pagesInstruments in Treasury MarketsupriyabhadoriyaNo ratings yet

- The Money Market in IndiaDocument22 pagesThe Money Market in IndiaUpveen TameriNo ratings yet

- IAPM Notes UnitDocument13 pagesIAPM Notes UnitAnjali ShuklaNo ratings yet

- Money MarketDocument25 pagesMoney MarketVaidyanathan RavichandranNo ratings yet

- Financial MarketsDocument60 pagesFinancial MarketssaloniNo ratings yet

- The Fundamentals of Money Market in India: Ashok Kataria Sathya Murthy Ganesh Naik Paresh Natekar Ranjan VarmaDocument23 pagesThe Fundamentals of Money Market in India: Ashok Kataria Sathya Murthy Ganesh Naik Paresh Natekar Ranjan VarmarobinkapoorNo ratings yet

- Banking II Chap 2 Money MarketDocument33 pagesBanking II Chap 2 Money Market2023643626No ratings yet

- Instruments of Money MarketDocument8 pagesInstruments of Money MarketKBC KGFNo ratings yet

- Developing The Money Market in India: Dr. Muhammad ShafiDocument40 pagesDeveloping The Money Market in India: Dr. Muhammad ShafiPradeep KumarNo ratings yet

- Money Market InstrumentsDocument16 pagesMoney Market Instruments6038 Mugilan kNo ratings yet

- Money MarketDocument16 pagesMoney MarketBelikovNo ratings yet

- Money Market by TanishaDocument15 pagesMoney Market by TanishakirtikaNo ratings yet

- By Bhavana Ramya Das Sarunya Amulin.TDocument15 pagesBy Bhavana Ramya Das Sarunya Amulin.TSarunya AmlinNo ratings yet

- Money Market Instruments: Submitted To Submitted byDocument24 pagesMoney Market Instruments: Submitted To Submitted bySukant MakhijaNo ratings yet

- Study Material On Money MarketDocument25 pagesStudy Material On Money MarketPrateek VyasNo ratings yet

- Indian Financial SystemDocument20 pagesIndian Financial SystemDivya JainNo ratings yet

- Unit 4Document35 pagesUnit 4Harshita Kaushik AI002390No ratings yet

- Chapter 13b Investing Surplus FundDocument28 pagesChapter 13b Investing Surplus FundIvy CheekNo ratings yet

- Money MarketsDocument16 pagesMoney MarketsPrateek kunwarNo ratings yet

- The Indian Money Market: Prime AcademyDocument5 pagesThe Indian Money Market: Prime AcademyHardik KharaNo ratings yet

- The Fundamentals of Money Market in IndiaDocument23 pagesThe Fundamentals of Money Market in IndiaShubham MittalNo ratings yet

- Money MarketDocument36 pagesMoney MarketPramod PatjoshiNo ratings yet

- CH 10 NotesDocument11 pagesCH 10 Notesravideva84No ratings yet

- Blackbook Project On Money Market 163426471Document64 pagesBlackbook Project On Money Market 163426471Ashwathi SumitraNo ratings yet

- CH 2 Indian Financial SystemDocument46 pagesCH 2 Indian Financial Systemmaheshbendigeri5945No ratings yet

- Money Market: By: Gaurang Badheka Sem - Iii, MfsDocument13 pagesMoney Market: By: Gaurang Badheka Sem - Iii, MfsGaurang BadhekaNo ratings yet

- Money Market & Its InstrumentsDocument16 pagesMoney Market & Its InstrumentsmanoranjanpatraNo ratings yet

- Money Markets Instruments, Participants in IndiaDocument39 pagesMoney Markets Instruments, Participants in IndiaPiyush KhemkaNo ratings yet

- Definition of Money MarketDocument17 pagesDefinition of Money MarketSmurti Rekha JamesNo ratings yet

- Overview of Indian Financial SystemDocument25 pagesOverview of Indian Financial SystemDr. Meghna DangiNo ratings yet

- IBE Module 6Document29 pagesIBE Module 6Prathik_Shetty_204No ratings yet

- BFM Module C TREASURY MANAGEMENTDocument22 pagesBFM Module C TREASURY MANAGEMENTAnjuRoseNo ratings yet

- Blackbook Project On Money Market 163426471Document66 pagesBlackbook Project On Money Market 16342647104 Chaudhary SohanlalNo ratings yet

- FMR AssignmentDocument15 pagesFMR Assignment20BCF122 KiranNo ratings yet

- Financial Market: by Kushal.S.SDocument15 pagesFinancial Market: by Kushal.S.Srohankoshti86No ratings yet

- The Fundamentals of Money Market in India By: Ms. Anu UPVU Dr. Shakuntala Misra University, LucknowDocument20 pagesThe Fundamentals of Money Market in India By: Ms. Anu UPVU Dr. Shakuntala Misra University, LucknowAnand TripathiNo ratings yet

- Mr. ANKIT KANOJIA PDFDocument1 pageMr. ANKIT KANOJIA PDFAnkit KanojiaNo ratings yet

- Resume AnkitkanojiaDocument3 pagesResume AnkitkanojiaAnkit KanojiaNo ratings yet

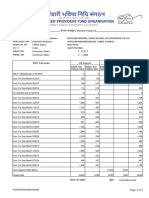

- ANKIT261290Document3 pagesANKIT261290Ankit KanojiaNo ratings yet

- Resume AnkitkanojiaDocument3 pagesResume AnkitkanojiaAnkit KanojiaNo ratings yet

- Objective: Ankit KanojiaDocument3 pagesObjective: Ankit KanojiaAnkit KanojiaNo ratings yet

- Objective: Ankit KanojiaDocument3 pagesObjective: Ankit KanojiaAnkit KanojiaNo ratings yet

- VinuDocument1 pageVinuVamsi Krishna100% (1)

- Objective: Ankit KanojiaDocument3 pagesObjective: Ankit KanojiaAnkit KanojiaNo ratings yet

- LNL Iklcqd /: Employee Share Employer Share Employee Share Employer ShareDocument2 pagesLNL Iklcqd /: Employee Share Employer Share Employee Share Employer ShareAnkit KanojiaNo ratings yet

- Result Intimation - October 2020: Pass Status: LicentiateDocument2 pagesResult Intimation - October 2020: Pass Status: LicentiateAnkit KanojiaNo ratings yet

- This Is To Certify That: Licentiate ExaminationDocument1 pageThis Is To Certify That: Licentiate ExaminationAnkit KanojiaNo ratings yet

- SSC CGL (Tier - 1, 1st Shift) Previous Year Solved Paper - 2011 - Numerical Aptitude - SSCPORTALDocument14 pagesSSC CGL (Tier - 1, 1st Shift) Previous Year Solved Paper - 2011 - Numerical Aptitude - SSCPORTALAnkit KanojiaNo ratings yet

- Objective: Ankit KanojiaDocument3 pagesObjective: Ankit KanojiaAnkit KanojiaNo ratings yet

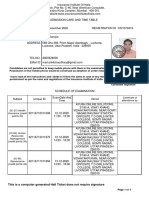

- This Is A Computer Generated Hall Ticket Does Not Require SignatureDocument3 pagesThis Is A Computer Generated Hall Ticket Does Not Require SignatureAnkit KanojiaNo ratings yet

- SSC CGL (Tier - 1) Previous Year Solved Paper - 2010 - English Comprehesion - SSCPORTALDocument12 pagesSSC CGL (Tier - 1) Previous Year Solved Paper - 2010 - English Comprehesion - SSCPORTALAnkit KanojiaNo ratings yet

- CGL Re Exam Paper 333NJ4Document18 pagesCGL Re Exam Paper 333NJ4SwasipaNo ratings yet

- CGL General Intelligence Reasoning Solved Paper Held On 16.05.2010 2nd Sitting WWWW - Sscportal.inDocument6 pagesCGL General Intelligence Reasoning Solved Paper Held On 16.05.2010 2nd Sitting WWWW - Sscportal.inGovindRatateNo ratings yet

- SSC CGL (Tier - 1) Previous Year Solved Paper - 2010 - General Awareness - SSCPORTALDocument11 pagesSSC CGL (Tier - 1) Previous Year Solved Paper - 2010 - General Awareness - SSCPORTALAnkit KanojiaNo ratings yet

- SSC CGL Tier 1 2014 Exam Paper Held On 26 10 2014 Evening Session Booklet No 654SL8 PDFDocument22 pagesSSC CGL Tier 1 2014 Exam Paper Held On 26 10 2014 Evening Session Booklet No 654SL8 PDFAnkit KanojiaNo ratings yet

- CGL Re Exam Paper 000KG1 Held On 27 04 2014Document18 pagesCGL Re Exam Paper 000KG1 Held On 27 04 2014Ankit KanojiaNo ratings yet

- CGL General Intelligence Reasoning Solved Paper Held On 16.05.2010 2nd Sitting WWWW - Sscportal.inDocument6 pagesCGL General Intelligence Reasoning Solved Paper Held On 16.05.2010 2nd Sitting WWWW - Sscportal.inGovindRatateNo ratings yet

- CGL Numerical Aptitude Solved Paper Held On 16.05.2010 2nd Sitting WWWW - Sscportal.inDocument5 pagesCGL Numerical Aptitude Solved Paper Held On 16.05.2010 2nd Sitting WWWW - Sscportal.inGovindRatateNo ratings yet

- Start Download: SSC CGL (Tier - 1, 1st Shift) Previous Year Solved Paper - 2011Document11 pagesStart Download: SSC CGL (Tier - 1, 1st Shift) Previous Year Solved Paper - 2011Ankit KanojiaNo ratings yet

- CGL Re Exam Paper 444OL5 Held On 27 04 2014 Evening PDFDocument18 pagesCGL Re Exam Paper 444OL5 Held On 27 04 2014 Evening PDFAnkit KanojiaNo ratings yet

- Start Download: Convert Any File To A PDF. Get The Free From Doc To PDF App!Document12 pagesStart Download: Convert Any File To A PDF. Get The Free From Doc To PDF App!Ankit KanojiaNo ratings yet

- Start Download Now: SSC CGL (Tier - 1) Previous Year Solved Paper - 2013Document14 pagesStart Download Now: SSC CGL (Tier - 1) Previous Year Solved Paper - 2013Ankit KanojiaNo ratings yet

- SSC CGL (Tier - 1) Previous Year Solved Paper - 2012 - General Awareness - SSCPORTALDocument11 pagesSSC CGL (Tier - 1) Previous Year Solved Paper - 2012 - General Awareness - SSCPORTALAnkit KanojiaNo ratings yet

- Start Download: SSC CGL (Tier - 1, 2nd Shift) Previous Year Solved Paper - 2010Document11 pagesStart Download: SSC CGL (Tier - 1, 2nd Shift) Previous Year Solved Paper - 2010Ankit KanojiaNo ratings yet

- SSC CGL (Tier - 1) Previous Year Solved Paper - 2012 - Quantitative Aptitude - SSCPORTALDocument15 pagesSSC CGL (Tier - 1) Previous Year Solved Paper - 2012 - Quantitative Aptitude - SSCPORTALAnkit KanojiaNo ratings yet

- SSC CGL (Tier - 1, 2nd Shift) Previous Year Solved Paper - 2010 - English Comprehesion - SSCPORTALDocument12 pagesSSC CGL (Tier - 1, 2nd Shift) Previous Year Solved Paper - 2010 - English Comprehesion - SSCPORTALAnkit KanojiaNo ratings yet