Professional Documents

Culture Documents

International Cash Management

Uploaded by

mary aligmayo0 ratings0% found this document useful (0 votes)

72 views20 pagesFinman

Original Title

International-Cash-Management

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentFinman

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

72 views20 pagesInternational Cash Management

Uploaded by

mary aligmayoFinman

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 20

International Cash Management

Centralized Cash Management

• While each subsidiary is managing its own working capital, a

centralized cash management group is needed to monitor, and

possibly manage, the parent-subsidiary and intersubsidiary cash

flows.

• International cash management can be segmented into two functions:

• optimizing cash flow movements, and

• investing excess cash.

Centralized Cash Management

• The centralized cash management division of an MNC cannot always

accurately forecast the events that may affect parent- subsidiary or

intersubsidiary cash flows.

• It should, however, be ready to react to any event by considering

• any potential adverse impact on cash flows, and

• how to avoid such adverse impacts.

Techniques to Optimize Cash Flows

Accelerating Cash Inflows

• The more quickly the cash inflows are received, the more quickly they

can be invested or used for other purposes.

• Common methods include the establishment of lockboxes around the

world (to reduce mail float) and preauthorized payments (direct

charging of a customer’s bank account).

Techniques to Optimize Cash Flows

Minimizing Currency Conversion Costs

• Netting reduces administrative and transaction costs through the

accounting of all transactions that occur over a period to determine

one net payment.

• A bilateral netting system involves transactions between two units,

while a multilateral netting system usually involves more complex

interchanges.

Techniques to Optimize Cash Flows

Managing Blocked Funds

• A government may require that funds remain within the country in

order to create jobs and reduce unemployment.

• The MNC should then reinvest the excess funds in the host country,

adjust the transfer pricing policy (such that higher fees have to be

paid to the parent), borrow locally rather than from the parent, etc.

Techniques to Optimize Cash Flows

Managing Intersubsidiary Cash Transfers

• A subsidiary with excess funds can provide financing by paying for its

supplies earlier than is necessary. This technique is called leading.

• Alternatively, a subsidiary in need of funds can be allowed to lag its

payments. This technique is called lagging.

Complications in Optimizing Cash Flows

Company-Related Characteristics

• When a subsidiary delays its payments to the other subsidiaries, the other

subsidiaries may be forced to borrow until the payments arrive.

Government Restrictions

• Some governments may prohibit the use of a netting system, or periodically

prevent cash from leaving the country.

Complications in Optimizing Cash Flows

Characteristics of Banking Systems

• The abilities of banks to facilitate cash transfers for MNCs may vary among

countries.

• The banking systems in different countries usually differ too.

Investing Excess Cash

• Excess funds can be invested in domestic or foreign short-term

securities, such as Eurocurrency deposits, bills, and commercial

papers.

• Sometimes, foreign short-term securities have higher interest rates.

However, firms must also account for the possible exchange rate

movements.

Investing Excess Cash

Centralized Cash Management

• Centralized cash management allows for more efficient usage of funds

and possibly higher returns.

• When multiple currencies are involved, a separate pool may be

formed for each currency. The investment securities may also be

denominated in the currencies that will be needed in the future.

Investing Excess Cash

Determining the Effective Yield

• The effective rate for foreign investments

rf = ( 1 + if ) ( 1 + ef ) – 1

where if = the quoted interest rate on the investment

ef = the % D in the spot rate

• If the foreign currency depreciates over the investment period, the

effective yield will be less than the quoted rate.

Investing Excess Cash

Implications of Interest Rate Parity (IRP)

• A foreign currency with a high interest rate will normally exhibit a

forward discount that reflects the differential between its interest rate

and the investor’s home interest rate.

• However, short-term foreign investing on an uncovered basis may still

result in a higher effective yield.

Investing Excess Cash

Use of the Forward Rate as a Forecast

• If IRP exists, the forward rate can be used as a break-even point to

assess the short-term investment decision.

• The effective yield will be higher if the spot rate at maturity is more

than the forward rate at the time the investment is undertaken, and

vice versa.

Investing Excess Cash

Use of Exchange Rate Forecasts

• Given an exchange rate forecast, the expected effective yield of a

foreign investment can be computed, and then compared with the

local investment yield.

• It may be useful to use probability distributions instead of point

estimates, or to compute the break-even exchange rate that will

equate foreign and local yields.

Investing Excess Cash

Diversifying Cash Across Currencies

• If an MNC is not sure of how exchange rates will change over time, it

may prefer to diversify its cash among securities that are

denominated in different currencies.

• The degree to which such a portfolio will reduce risk depends on the

correlations among the currencies.

Investing Excess Cash

Use of Dynamic Hedging to Manage Cash

• Dynamic hedging refers to the strategy of hedging when the

currencies held are expected to depreciate, and not hedging when

they are expected to appreciate.

• The overall performance is dependent on the firm’s ability to

accurately forecast the direction of exchange rate movements.

Topic Review

• Techniques to Optimize Cash Flows

• Accelerating Cash Inflows

• Minimizing Currency Conversion Costs

• Managing Blocked Funds

• Managing Intersubsidiary Cash Transfers

• Complications in Optimizing Cash Flows

• Company-Related Characteristics

• Government Restrictions

• Characteristics of Banking Systems

Topic Review

• Investing Excess Cash

• How to Invest Excess Cash

• Centralized Cash Management

• Determining the Effective Yield

• Implications of Interest Rate Parity

• Use of the Forward Rate as a Forecast

• Use of Exchange Rate Forecasts

• Diversifying Cash Across Currencies

• Use of Dynamic Hedging to Manage Cash

Topic Review

• Impact of International Cash Management on an MNC’s Value

You might also like

- Liquidity ManagementDocument41 pagesLiquidity Managementsmita87No ratings yet

- Red Flag Report PDFDocument33 pagesRed Flag Report PDFAnurag JagnaniNo ratings yet

- Msq01 Overview of The Ms Practice by The CpaDocument9 pagesMsq01 Overview of The Ms Practice by The CpaAnna Marie75% (8)

- LiquidityDocument26 pagesLiquidityPallavi RanjanNo ratings yet

- Cash Management PresentationDocument28 pagesCash Management Presentationmailwalia100% (3)

- Chapter 18 Test BankDocument50 pagesChapter 18 Test BankDillon MurphyNo ratings yet

- Cash Management Training Manual v2Document17 pagesCash Management Training Manual v2Prasad RajashekarNo ratings yet

- Treasury and Fund Management in BanksDocument40 pagesTreasury and Fund Management in Bankseknath2000100% (2)

- Fixed Income & Interest Rate DerivativesDocument64 pagesFixed Income & Interest Rate DerivativeskarthikNo ratings yet

- Ap Receivables Quizzer507Document20 pagesAp Receivables Quizzer507Jean Tan100% (1)

- Ap Receivables Quizzer507Document20 pagesAp Receivables Quizzer507Jean Tan100% (1)

- Work Experience Certificate: Murshed Alom Amdaul HaqueDocument1 pageWork Experience Certificate: Murshed Alom Amdaul HaqueshuzonksbdNo ratings yet

- Capital Budgeting-Theory and NumericalsDocument47 pagesCapital Budgeting-Theory and Numericalssaadsaaid50% (2)

- Treasury Management FunctionDocument26 pagesTreasury Management FunctionKiran MehfoozNo ratings yet

- Revised Edition Entrepreneurship A Level Revision NotesDocument128 pagesRevised Edition Entrepreneurship A Level Revision NotesDuete Emma85% (48)

- Mba-Finance Project (A STUDY ON INVESTORS ATTITUDE AND KNOWLEDGE TOWARDS INVESTMENT OPTIONS AVAILABEL IN INDIA - WITH SPECIAL REFERENCE TO UAE BASED NRIs)Document116 pagesMba-Finance Project (A STUDY ON INVESTORS ATTITUDE AND KNOWLEDGE TOWARDS INVESTMENT OPTIONS AVAILABEL IN INDIA - WITH SPECIAL REFERENCE TO UAE BASED NRIs)venu84% (32)

- HOMELOANSanctionLetter PDFDocument5 pagesHOMELOANSanctionLetter PDFanon_311324903No ratings yet

- International Financial Management 9Document38 pagesInternational Financial Management 9胡依然100% (3)

- International Cash ManagementDocument28 pagesInternational Cash Managementdadali.enterprise6123100% (1)

- Cash Management by Group 9Document15 pagesCash Management by Group 9Noel GeorgeNo ratings yet

- Chapter Review International Cash Management: Cash Flow Analysis: Subsidiary PerspectiveDocument7 pagesChapter Review International Cash Management: Cash Flow Analysis: Subsidiary PerspectiveWi SilalahiNo ratings yet

- EFIN542 U12 T02 PowerPointDocument78 pagesEFIN542 U12 T02 PowerPointcustomsgyanNo ratings yet

- Short Term Financial Management in a Multinational CorporationDocument46 pagesShort Term Financial Management in a Multinational Corporationhaidersyed060% (2)

- Group Members: Bijay Shrestha Bebina Arjyal Sadikshya Dahal Priyanka Roniyar Sanjay Thakur Swikar DahalDocument35 pagesGroup Members: Bijay Shrestha Bebina Arjyal Sadikshya Dahal Priyanka Roniyar Sanjay Thakur Swikar Dahalharrykey JohnNo ratings yet

- Liq - Forex Risk.4Document30 pagesLiq - Forex Risk.4Namrata VikamNo ratings yet

- treasurymanagement-170513010523-convertedDocument66 pagestreasurymanagement-170513010523-convertedshubhamgaurNo ratings yet

- International Cash Management: South-Western/Thomson Learning © 2006Document29 pagesInternational Cash Management: South-Western/Thomson Learning © 2006Letchuman DheivendranNo ratings yet

- Multinational Corporations and Global Financial Environment: Facilities in More Than One CountryDocument11 pagesMultinational Corporations and Global Financial Environment: Facilities in More Than One CountryANH NGUYEN DANG QUENo ratings yet

- Cost Accounting - MidhunDocument17 pagesCost Accounting - MidhunmidhunNo ratings yet

- Mats Institute of Management & Entreprenuership: An Assignment On "Intrnational Finance"Document7 pagesMats Institute of Management & Entreprenuership: An Assignment On "Intrnational Finance"saiko6No ratings yet

- Financial Management in The International BusinessDocument42 pagesFinancial Management in The International BusinessRobo ClassyNo ratings yet

- Cash & Marketable SecuritiesDocument40 pagesCash & Marketable SecuritiesadekramlanNo ratings yet

- Treasury Department: The Treasury Department Is Responsible For A Company ' S LiquidityDocument32 pagesTreasury Department: The Treasury Department Is Responsible For A Company ' S LiquidityHanzo vargasNo ratings yet

- Introduction To FinanceDocument17 pagesIntroduction To FinanceNicole Ayesha D'SilvaNo ratings yet

- MNC FinanceDocument15 pagesMNC FinancedeoredevangiNo ratings yet

- Management of Cash Flows and BalancesDocument23 pagesManagement of Cash Flows and BalancesLyrics Nepal 752No ratings yet

- Cash Management Problrms SolvedDocument42 pagesCash Management Problrms SolvedKarthikNo ratings yet

- Lecture Note 1 2Document163 pagesLecture Note 1 2Đỗ Thủy Tiên NguyễnNo ratings yet

- Capital BudgetingDocument15 pagesCapital BudgetingAishvarya PujarNo ratings yet

- International cash management overviewDocument8 pagesInternational cash management overviewRitik SinghNo ratings yet

- Cash Management Varun 10808154 Project OnDocument24 pagesCash Management Varun 10808154 Project Ondont_forgetme2004No ratings yet

- Exchange Rate Risk HedgingDocument16 pagesExchange Rate Risk HedgingMehul DubeyNo ratings yet

- By Zohaib Javed Satti MBA-6Document22 pagesBy Zohaib Javed Satti MBA-6Zohaib Javed SattiNo ratings yet

- Global Financial Reporting StandardsDocument42 pagesGlobal Financial Reporting StandardsJay ModiNo ratings yet

- Managing Working Capital GloballyDocument13 pagesManaging Working Capital GloballyNikhil Mukhi100% (1)

- International Project AppraisalDocument37 pagesInternational Project Appraisalpriyakiran_19_48218633% (3)

- Cash Management: Reported By: Josephine P. JimenezDocument21 pagesCash Management: Reported By: Josephine P. JimenezPYNJIMENEZNo ratings yet

- Ch02-Cash Inflow OutFlowDocument45 pagesCh02-Cash Inflow OutFlowismat arteeNo ratings yet

- Cash ManagementDocument25 pagesCash ManagementEvangelineNo ratings yet

- 3.3 Cash ManagementDocument23 pages3.3 Cash ManagementjayantkNo ratings yet

- Cash Flow OptimizationDocument41 pagesCash Flow OptimizationDimpol MagsalayNo ratings yet

- Cash Management: Viji-0921614 Vinay-0921615 Amrutha-0921616 Nita-0921628 Vaishnavi-0921635Document26 pagesCash Management: Viji-0921614 Vinay-0921615 Amrutha-0921616 Nita-0921628 Vaishnavi-0921635brainvinNo ratings yet

- Into To Treasury & Risk Management - FinalDocument21 pagesInto To Treasury & Risk Management - FinalGaurav AgrawalNo ratings yet

- Ferrer-Study Notes-Chapter 4Document4 pagesFerrer-Study Notes-Chapter 4Ciara FerrerNo ratings yet

- Exchange Rate Risk Management TechniquesDocument20 pagesExchange Rate Risk Management TechniquesDiya NaNo ratings yet

- Treasury ManagementDocument37 pagesTreasury ManagementDeepak OswalNo ratings yet

- ICF Group 3 Working CapitalDocument130 pagesICF Group 3 Working CapitalAnkit KalraNo ratings yet

- FINANCIAL MANAGEMENT MAXIMIZATIONDocument74 pagesFINANCIAL MANAGEMENT MAXIMIZATIONGaganGabrielNo ratings yet

- Working Capital Management (2015)Document62 pagesWorking Capital Management (2015)AJNo ratings yet

- Liquid FundsDocument13 pagesLiquid FundsAsim IqbalNo ratings yet

- Unit 5 CMDocument22 pagesUnit 5 CMASHISH KUMARNo ratings yet

- Commercial Banks Structure FunctionsDocument65 pagesCommercial Banks Structure FunctionsPankaj ChauhanNo ratings yet

- 9 DRM Risk ManagementDocument15 pages9 DRM Risk ManagementPrasanjit BiswasNo ratings yet

- Foreign Exchange ExposureDocument29 pagesForeign Exchange ExposurebhargaviNo ratings yet

- Cycle 6 TM Session 2Document97 pagesCycle 6 TM Session 2abdulkadir mohamedNo ratings yet

- Working Capital ManagementDocument52 pagesWorking Capital ManagementPrashanth GowdaNo ratings yet

- Bentral Banking and Monetary PolicyDocument22 pagesBentral Banking and Monetary PolicyZerebiiNo ratings yet

- Decoding DCF: A Beginner's Guide to Discounted Cash Flow AnalysisFrom EverandDecoding DCF: A Beginner's Guide to Discounted Cash Flow AnalysisNo ratings yet

- Partnership Formation and Capital AdjustmentsDocument12 pagesPartnership Formation and Capital AdjustmentsYenNo ratings yet

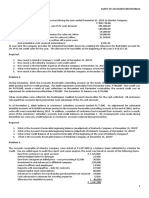

- Financial Accounting 1Document13 pagesFinancial Accounting 1mary aligmayoNo ratings yet

- Standard Costs and Variance AnalysisDocument14 pagesStandard Costs and Variance Analysisboen jayme0% (1)

- Auditing TheoryDocument9 pagesAuditing TheoryYenelyn Apistar CambarijanNo ratings yet

- Roselle Winery Marketing PlanDocument3 pagesRoselle Winery Marketing Planmary aligmayoNo ratings yet

- Currency Derivatives ProblemsDocument1 pageCurrency Derivatives Problemsmary aligmayoNo ratings yet

- Auditing TheoryDocument9 pagesAuditing TheoryYenelyn Apistar CambarijanNo ratings yet

- Currency DerivativesDocument32 pagesCurrency Derivativesmary aligmayoNo ratings yet

- An Overview of Forward and Futures TradingDocument30 pagesAn Overview of Forward and Futures Tradingmary aligmayoNo ratings yet

- Financial AccountingDocument24 pagesFinancial Accountingmary aligmayoNo ratings yet

- Data Structures CAATTs ExtractionDocument33 pagesData Structures CAATTs Extractionmary aligmayoNo ratings yet

- An Overview of Forward and Futures TradingDocument30 pagesAn Overview of Forward and Futures Tradingmary aligmayoNo ratings yet

- Analyzing Financial RatiosDocument37 pagesAnalyzing Financial Ratiosvajajayk100% (1)

- Macroeconomics policies and choicesDocument3 pagesMacroeconomics policies and choicesmary aligmayoNo ratings yet

- Finman 3 Multiple Choice. Identify The Letter of The Choice That Best Completes The Statement or Answers The QuestionsDocument3 pagesFinman 3 Multiple Choice. Identify The Letter of The Choice That Best Completes The Statement or Answers The Questionsmary aligmayoNo ratings yet

- CHAPTER 1 Caselette - Accounting CycleDocument51 pagesCHAPTER 1 Caselette - Accounting Cyclemjc24No ratings yet

- AUDITING in An IT ENVIRONMENTDocument5 pagesAUDITING in An IT ENVIRONMENTyram shinNo ratings yet

- Property, Plant, and EquipmentDocument3 pagesProperty, Plant, and EquipmentIzza Mae Rivera KarimNo ratings yet

- Computer-Aided Audit Tools and Techniques: Randy T. ManzanoDocument34 pagesComputer-Aided Audit Tools and Techniques: Randy T. Manzanomary aligmayoNo ratings yet

- AUDITING in An IT ENVIRONMENTDocument5 pagesAUDITING in An IT ENVIRONMENTyram shinNo ratings yet

- IT GovernanceDocument32 pagesIT Governancemary aligmayoNo ratings yet

- Audit of Accounts ReceivablesDocument5 pagesAudit of Accounts ReceivablesIzza Mae Rivera KarimNo ratings yet

- InventoryDocument4 pagesInventoryIzza Mae Rivera KarimNo ratings yet

- Accounting ChangesDocument3 pagesAccounting Changesmary aligmayoNo ratings yet

- Single Entry SystemDocument6 pagesSingle Entry SystemRandy ManzanoNo ratings yet

- Luzon Development Bank: Published Balance SheetDocument2 pagesLuzon Development Bank: Published Balance SheetThinkingPinoyNo ratings yet

- DEAF CircularDocument48 pagesDEAF CircularNikita SalunkheNo ratings yet

- Order in The Matter of Steelco Gujarat LimitedDocument4 pagesOrder in The Matter of Steelco Gujarat LimitedShyam SunderNo ratings yet

- Indian Banking StructureDocument20 pagesIndian Banking Structureneha16septNo ratings yet

- Bank Secrecy Act & Anti Money Laundering HandbookDocument367 pagesBank Secrecy Act & Anti Money Laundering Handbook83jjmackNo ratings yet

- Ragasa 07 Activity 2Document2 pagesRagasa 07 Activity 2EMILY M. RAGASANo ratings yet

- BRACDocument38 pagesBRACMahmudur Rahman100% (3)

- (Creditcoin) White PaperDocument31 pages(Creditcoin) White PaperMantas JeyNo ratings yet

- Md. Tabrez Bin Mahbub PDFDocument112 pagesMd. Tabrez Bin Mahbub PDFAtia SultanaNo ratings yet

- Salary Dost Credit Policy: Loan Limit and TenureDocument11 pagesSalary Dost Credit Policy: Loan Limit and TenureAlpesh KuleNo ratings yet

- Mis605 - Arora - Tanvee - Assessment 1Document11 pagesMis605 - Arora - Tanvee - Assessment 1Abhilasha Dahiya50% (2)

- Allied Bank Limited Internship ReportDocument77 pagesAllied Bank Limited Internship ReportMuhammadUmairNo ratings yet

- Corporate Governance in BanksDocument39 pagesCorporate Governance in BanksnickyparekhNo ratings yet

- Impact of Digitalization On Indian Rural Banking Customer: With Reference To Payment SystemsDocument11 pagesImpact of Digitalization On Indian Rural Banking Customer: With Reference To Payment SystemsNikhil RajNo ratings yet

- Construction Cost ReviewDocument11 pagesConstruction Cost ReviewkrmcharigdcNo ratings yet

- Ch-5 Cash BookDocument19 pagesCh-5 Cash Bookvel gadgetsNo ratings yet

- Insurance Case StudyDocument13 pagesInsurance Case StudyWole OgundareNo ratings yet

- List of Business Transactions (Edited) : The Rose and Flower Owned by Rose GreenDocument2 pagesList of Business Transactions (Edited) : The Rose and Flower Owned by Rose GreenhootanNo ratings yet

- The Cooperator MAY 2021 PDFDocument38 pagesThe Cooperator MAY 2021 PDFS RaghuvanshiNo ratings yet

- ST4125680 SignedfinalDocument22 pagesST4125680 SignedfinalSathish KumarNo ratings yet

- Credit Management - Reading MaterialsDocument10 pagesCredit Management - Reading Materialsmesba_17No ratings yet

- Orchard Bank 288451024 - AgreementNPI2701ADocument15 pagesOrchard Bank 288451024 - AgreementNPI2701AKestrel1940No ratings yet

- Account Summary: MalaysiaDocument4 pagesAccount Summary: MalaysiaOmar MuhdNo ratings yet

- An Analysis On The Mobile Payment Industry in China and Its Implications To MalaysiaDocument19 pagesAn Analysis On The Mobile Payment Industry in China and Its Implications To MalaysiaGlobal Research and Development ServicesNo ratings yet