Professional Documents

Culture Documents

Unit 5 CM

Uploaded by

ASHISH KUMAR0 ratings0% found this document useful (0 votes)

23 views22 pagesCopyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

23 views22 pagesUnit 5 CM

Uploaded by

ASHISH KUMARCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 22

Unit-5 Management of Cash

Meaning of cash - motives for holding cash -

Objectives of cash - management of cash -

Basic problems - preparations of cash budgets

• "Cash, like the blood stream in the human

body, gives vitality and strength to a business

enterprises”. Though cash hold the smallest

portion of total current assets.

• However, "Cash is both the beginning and end

of working capital cycle - cash, inventories,

receivables and cash.”' it is the cash, which

keeps the business going.

• Hence, every enterprise has to hold necessary

cash for its existence.‖

• Moreover, "Steady and healthy circulation of

cash throughout the entire business

operations is the basis of business solvency."

• Cash may be interpreted under two concepts.

1. In narrow sense, "Cash is very important business

asset, but although coin and paper currency can

be inspected and handled, the major part of the

cash of most enterprises is in the form of bank

checking accounts, which represent claims to

money rather than tangible property."

2. In broader sense, "Cash consists of legal tender,

cheques, bank drafts, money orders and demand

deposits in banks.

• "The concept of cash management is not new

and it has acquired a greater significance in

the modern world of business due to change

that took place in the conduct of business and

ever increasing difficulties and the cost of

borrowing."

MEANING AND DEFINITION:

• The term cash management refers to the

management of cash resource in such a way

that generally accepted business objectives

could be achieved.

Cash Management:

• It is the management of cash resource in such a

way that the objectives of business could be

achieved.

• Cash helps to establish equilibrium between

profitability and liquidity and ensures

undisturbed functioning of a firm. This in turn

facilitates a firm towards attaining its business

objectives.

• The basic objectives of cash management are:

Objectives of Cash Management

• To achieve the above objectives, proper planning

and forecast of cash flows is needed which is

presented in the form of cash budget. Effective cash

management requires proper management of cash

inflows and outflows which entails:

1. Improving cash flows forecasts

2. Synchronization of cash inflows and outflows

3. Acceleration of collections

4. Getting funds available where ever they are required

5. Control of cash disbursements

What is the difference between Money and

Near-Money?

• 1. Definition:

– Money consists of coins, currency notes and demand

deposits of the banks. Near-money, on the other hand,

includes the financial assets, like time-deposits, bills of

exchange, bond, shares, etc.

• 2. Liquidity:

– Money possesses 100 per cent liquidity; i.e., it is

perfectly liquid or can be readily acceptable as a means

of payment. Near-money lacks 100 per cent liquidity, i.e.,

it involves time cost for its conversion into money.

• 3. Function:

– Money serves as a unit of account or a common measure

of value. All prices are expressed in terms of money. Near-

money on the other hand, does not perform such

functions. Rather, its own value is expressed in terms of

money.

• 4. Use in Transactions:

– Money is directly used for making transactions. Near-

money, on the other hand, is an indirect medium of

exchange; it has to be first converted into ready money

and then used for transactions.

• 5. Income-Yielding Quality:

– Money is not an income-yielding asset. On the

contrary, near-money assets are income yielding

assets.

Motives for Holding Cash:

• Though cash as an asset, does not earn any

return for the business. It is the most liquid

financial asset.

• It is a non interest earning financial asset. But

cash should be held by every firm to meet its

routine expenditures.

• According to John Maynard Keynes, a renowned

economist, the motives of holding cash are as

follows:

1. Transactions Motive:

• Cash is needed to meet day-to-day cash needs

in the routine course of business.

• An enterprise needs cash on day–to-day basis

for making payment for the purchase of raw

materials, components, payment of wages to

the labour, salaries to staff, taxes to the

government, interest on loans, etc. Without

cash, a firm cannot operate. All general

operating expenses are paid in cash.

• A firm receives cash from cash sales, collections from

debtors, return on investments etc. But there is not

perfect synchronization between cash inflows and

outflows.

• It means, cash inflows may not always be equal to inflows.

• At times, cash payments might be more than receipts

while at other times receipts may exceed payments.

• To ensure that the firm can meet its obligations when

payments become due at times when the disbursements

are in excess of the current receipts, it must have an

adequate cash balance. This requirement of cash balances

to meet routine cash needs is known as the transaction

motive.

2. Precautionary Motive:

• Cash held to meet the unforeseen and unexpected

situations like strikes, lock outs, sudden increase in

the cost of raw materials etc. is known as

precautionary motive for holding cash.

• One can never be 100% sure about the future. It is

not possible to predict everything about the future in

advance.

• Thus, cash balance over and above what is required

is always held by the firm to meet any unforeseen

contingencies and to avoid breakdown of production.

• The amount of cash balance under precautionary motive

is influenced by two factors -

– a. Availability of Short Term Credit - If the firm cannot borrow

required cash balances at a short-notice, it will need

comparatively greater cash balances to meet contingencies

and unforeseen situations or vice versa.

– b. Predictability of Cash Flows - The more predictable the cash

flow, the lesser the need for such cash balances and vice versa.

• Precautionary cash balances are generally invested in

marketable securities with the objective of earning

profits.

3. Speculative Motive:

• Firms would hold cash to exploit the potential

profitable opportunities as and when they

arise. This motive of holding cash is known as

speculative motive.

• For example, the firm might expect that the

price of a certain material or a component to

fall in the future, then, the firm can delay the

purchases and make purchases in future when

the price actually declines.

• A firm might expect the prices to rise, and then

the firm would like to grab that opportunity to

purchase the material at a heavy discount, if

paid in cash immediately.

• Similarly, in the hope of buying securities when

the interest rate is expected to decline, the

firm will hold cash. By and large, firms rarely

holds large amount of cash for speculative

purposes.

4. Compensation Motive:

• Customers are required to maintain a minimum

cash balance at the bank. This balance cannot be

used by the customers for transaction purposes.

• This minimum cash balance may vary from Rs 1,000

to Rs 10,000. This amount remains as a permanent

balance with the bank as long as the current

account is operative.

• Cash balances are held by the firms to compensate

banks for providing certain services and loans.

You might also like

- WCM - Unit 2 Cash ManagementDocument51 pagesWCM - Unit 2 Cash ManagementkartikNo ratings yet

- International Cash ManagementDocument36 pagesInternational Cash Managementharshnika100% (1)

- Chapter-3 Managing Cash and Marketable SecuritiesDocument9 pagesChapter-3 Managing Cash and Marketable SecuritiesSintu TalefeNo ratings yet

- Cash ManagementDocument16 pagesCash ManagementAppy9No ratings yet

- FM Cash ManagementDocument41 pagesFM Cash ManagementDimpol MagsalayNo ratings yet

- Cash ManagementDocument11 pagesCash ManagementWonde Biru100% (1)

- Chapter Five Fa IDocument17 pagesChapter Five Fa IzemeNo ratings yet

- Cash Management NotesDocument28 pagesCash Management Notesabhishek khodNo ratings yet

- Analysis of Cash and Liquidity Management: Chapter-IVDocument36 pagesAnalysis of Cash and Liquidity Management: Chapter-IVM. Wasif Chauhdary100% (1)

- Cash and Marketable Securities ManagementDocument15 pagesCash and Marketable Securities ManagementKim Maderazo EngallaNo ratings yet

- EFIN542 U12 T02 PowerPointDocument78 pagesEFIN542 U12 T02 PowerPointcustomsgyanNo ratings yet

- Sbi BankDocument58 pagesSbi BankAnnu Kesharwani AKNo ratings yet

- Cash and Marketable SecurityDocument22 pagesCash and Marketable SecurityTanoli CreationNo ratings yet

- Data Base Management DataflowDocument49 pagesData Base Management DataflowGhanShyam ParmarNo ratings yet

- WC Management 2Document5 pagesWC Management 2RonakNo ratings yet

- Chapter 12 Cash ManagementDocument4 pagesChapter 12 Cash ManagementbibekNo ratings yet

- Cash Management2Document6 pagesCash Management2kulvitkaurNo ratings yet

- FM ProjectDocument55 pagesFM ProjectSruthi Nair100% (1)

- Cash MGMTDocument28 pagesCash MGMTKarthik ParmarNo ratings yet

- Cash Management Problrms SolvedDocument42 pagesCash Management Problrms SolvedKarthikNo ratings yet

- Cash ManagementDocument9 pagesCash ManagementJyotirmaya MishraNo ratings yet

- 7 Cash Management and Its ModelDocument28 pages7 Cash Management and Its Modelgita bcNo ratings yet

- Cash ManagementDocument13 pagesCash ManagementNeeraj NamanNo ratings yet

- Presented By:-Rajesh-278 Raghav-277Document17 pagesPresented By:-Rajesh-278 Raghav-277Din Rose GonzalesNo ratings yet

- Cash ManagementDocument19 pagesCash ManagementShashank ShashuNo ratings yet

- Working Capital and Cash ManagementDocument40 pagesWorking Capital and Cash ManagementHannah Jane Arevalo LafuenteNo ratings yet

- Cash Management: Chapter - 6Document23 pagesCash Management: Chapter - 6HariNo ratings yet

- Cash ManagementDocument58 pagesCash ManagementPranav ChandraNo ratings yet

- Management of CashDocument14 pagesManagement of Cashfrw dm100% (1)

- Welcome To Our Presentation: Topic: Management of Cash & Marketable SecuritiesDocument23 pagesWelcome To Our Presentation: Topic: Management of Cash & Marketable SecuritiesAkash BhowmikNo ratings yet

- An Analysis On Cash Management at Standard PolymersDocument20 pagesAn Analysis On Cash Management at Standard PolymersSathish BillaNo ratings yet

- 1 Fin ManagementDocument93 pages1 Fin ManagementZerry PadillaNo ratings yet

- Petty Cash Cash EquivalentsDocument3 pagesPetty Cash Cash EquivalentsBurhan Al Messi100% (1)

- Unit 3 Cash ManagementDocument25 pagesUnit 3 Cash ManagementrehaarocksNo ratings yet

- Balance Cash Holding Teaching MaterialDocument18 pagesBalance Cash Holding Teaching MaterialAbdi Mucee TubeNo ratings yet

- By Zohaib Javed Satti MBA-6Document22 pagesBy Zohaib Javed Satti MBA-6Zohaib Javed SattiNo ratings yet

- Cash ManagementDocument60 pagesCash ManagementAlif Khan100% (1)

- Balance Cash HoldingDocument4 pagesBalance Cash HoldingTilahun S. KuraNo ratings yet

- KAMAL SAINI Project ReportDocument63 pagesKAMAL SAINI Project Reportpc498604No ratings yet

- Assignment of Management of Working Capital On Cash ManagementDocument7 pagesAssignment of Management of Working Capital On Cash ManagementShubhamNo ratings yet

- Cash Management by Debobrata MajumdarDocument24 pagesCash Management by Debobrata MajumdarDebobrata MajumdarNo ratings yet

- Topic 4 - Cash Management & Marketable SecuritiesDocument7 pagesTopic 4 - Cash Management & Marketable SecuritiesZURINA ABDUL KADIRNo ratings yet

- Business FinanceDocument12 pagesBusiness Financesanskritibharti8No ratings yet

- Malinab Aira Bsba FM 2-2 Activity 7 Cash and Marketable...Document7 pagesMalinab Aira Bsba FM 2-2 Activity 7 Cash and Marketable...Aira MalinabNo ratings yet

- Ch02-Cash Inflow OutFlowDocument45 pagesCh02-Cash Inflow OutFlowismat arteeNo ratings yet

- Cost Accounting - MidhunDocument17 pagesCost Accounting - MidhunmidhunNo ratings yet

- Cash Management Cash ManagementDocument60 pagesCash Management Cash ManagementGlenn TaduranNo ratings yet

- Review of LiteratureDocument6 pagesReview of Literaturedominic wurdaNo ratings yet

- Cash Management Varun 10808154 Project OnDocument24 pagesCash Management Varun 10808154 Project Ondont_forgetme2004No ratings yet

- Cash MGTDocument24 pagesCash MGTChisom NmekaraonyeNo ratings yet

- Working Capital Management: A PerspectiveDocument21 pagesWorking Capital Management: A PerspectiveSanthosh Philip GeorgeNo ratings yet

- Cash Management BLACKBOOKDocument56 pagesCash Management BLACKBOOKxerox 123No ratings yet

- Project 01Document54 pagesProject 01Chaitanya FulariNo ratings yet

- ChapterDocument26 pagesChapterHeather NealNo ratings yet

- Presentation 1Document12 pagesPresentation 1meditation channelNo ratings yet

- Cash Management ChapterDocument21 pagesCash Management ChapterArfan MehmoodNo ratings yet

- Word Doc of CashDocument17 pagesWord Doc of CashHema SayamNo ratings yet

- Marketing Hubspot CustomerDocument1 pageMarketing Hubspot CustomerASHISH KUMARNo ratings yet

- Transporter Declaration Format For Non Deduction of Tds in PDFDocument1 pageTransporter Declaration Format For Non Deduction of Tds in PDFASHISH KUMAR67% (3)

- SA Summary Session2 Group2Document2 pagesSA Summary Session2 Group2ASHISH KUMARNo ratings yet

- Investment Calculator - Ankur WarikooDocument3 pagesInvestment Calculator - Ankur WarikooDivya RaghuvanshiNo ratings yet

- Transporter Declaration Format For Non Deduction of Tds in PDFDocument1 pageTransporter Declaration Format For Non Deduction of Tds in PDFASHISH KUMAR67% (3)

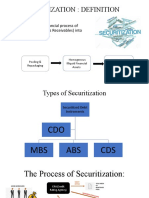

- SECURITIZATIONDocument5 pagesSECURITIZATIONASHISH KUMARNo ratings yet

- Pricing Strips and Term StructureDocument5 pagesPricing Strips and Term StructureASHISH KUMARNo ratings yet

- 1 1CICI Bank DDM My: Io008 GG 29030 529986Document1 page1 1CICI Bank DDM My: Io008 GG 29030 529986ASHISH KUMARNo ratings yet

- IIMBG SA Group 3 Project DetailsDocument7 pagesIIMBG SA Group 3 Project DetailsASHISH KUMARNo ratings yet

- Relieving LetterDocument1 pageRelieving LetterASHISH KUMAR100% (1)

- Fundamental of Business Intelligence.Document5 pagesFundamental of Business Intelligence.ASHISH KUMARNo ratings yet

- Unit 3 ID - CBDocument62 pagesUnit 3 ID - CBASHISH KUMARNo ratings yet

- Finance Budget - Ankur WarikooDocument26 pagesFinance Budget - Ankur WarikooSimanta KeotNo ratings yet

- Safal Niveshak Stock Analysis Excel (Ver. 3.0) : How To Use This SpreadsheetDocument32 pagesSafal Niveshak Stock Analysis Excel (Ver. 3.0) : How To Use This SpreadsheetASHISH KUMARNo ratings yet

- Declaration 194C NoTDSTransporterDocument1 pageDeclaration 194C NoTDSTransporternitinnawar100% (2)

- Unit 2 FDDocument34 pagesUnit 2 FDASHISH KUMARNo ratings yet

- Unit 4 WCDocument59 pagesUnit 4 WCASHISH KUMARNo ratings yet

- Unit-4: Information SystemsDocument63 pagesUnit-4: Information SystemsASHISH KUMARNo ratings yet

- Powerpoint Templates Powerpoint TemplatesDocument30 pagesPowerpoint Templates Powerpoint TemplatesASHISH KUMARNo ratings yet

- Unit 7 DDDocument34 pagesUnit 7 DDASHISH KUMARNo ratings yet

- Unit 1 FMDocument42 pagesUnit 1 FMASHISH KUMARNo ratings yet

- Electronic PaymentsDocument60 pagesElectronic PaymentsASHISH KUMARNo ratings yet

- Tamweel Sukuk ProspectusDocument187 pagesTamweel Sukuk ProspectusNipun AgrawalNo ratings yet

- AGICL AXIS BANK Statement MO SEP 2016 PDFDocument6 pagesAGICL AXIS BANK Statement MO SEP 2016 PDFSagar AsatiNo ratings yet

- Cars 24Document6 pagesCars 24Manish Prabhat100% (1)

- Chapter 3 Analysis of TransactionsDocument70 pagesChapter 3 Analysis of TransactionsJessa Mae GomezNo ratings yet

- Account History Report2Document2 pagesAccount History Report2PrintMASS BestNo ratings yet

- Partnerships: Income Taxation A. Income Taxation 1. Income Tax Systems A) Global Tax SystemDocument11 pagesPartnerships: Income Taxation A. Income Taxation 1. Income Tax Systems A) Global Tax Systemroselleyap20No ratings yet

- Online Fees Payment System For MakerereDocument59 pagesOnline Fees Payment System For MakerereKamyaGrakaWilly100% (3)

- Truth and Lending ActDocument2 pagesTruth and Lending ActmarkNo ratings yet

- ICICI Bank Saving Account Signed Acknowledgement X7XXXXXX7Document15 pagesICICI Bank Saving Account Signed Acknowledgement X7XXXXXX7Deep GaurNo ratings yet

- Cuscal Annual Report 2019Document88 pagesCuscal Annual Report 2019ShakespeareWallaNo ratings yet

- AIG Jumbo Underwriting GuidelinesDocument70 pagesAIG Jumbo Underwriting GuidelinesHelloNo ratings yet

- Business Processes, Data Modeling and Information Systems: Multiple-Choice QuestionsDocument13 pagesBusiness Processes, Data Modeling and Information Systems: Multiple-Choice Questionsncbzkr zkrncbNo ratings yet

- STCPAY Merchant 2019 06 11Document16 pagesSTCPAY Merchant 2019 06 11AliNo ratings yet

- Practical Accounting 2 - SyllabusDocument3 pagesPractical Accounting 2 - SyllabusMaylene Salac Alfaro100% (1)

- Motion For ReconsiderationDocument6 pagesMotion For ReconsiderationJayran Bay-an100% (4)

- Statement Emilija FinalDocument4 pagesStatement Emilija FinalKris TheVillainNo ratings yet

- IFRS 15 Revenue From Contracts With Customers (2021)Document20 pagesIFRS 15 Revenue From Contracts With Customers (2021)Tawanda Tatenda HerbertNo ratings yet

- Question P8-1A: Cafu SADocument29 pagesQuestion P8-1A: Cafu SAMashari Saputra100% (1)

- Secure - Docs - The Amazing Formula For Creating WealthDocument288 pagesSecure - Docs - The Amazing Formula For Creating Wealthinstantdownloader100% (1)

- Customer Complaint Creation PDFDocument10 pagesCustomer Complaint Creation PDFPiyush BoseNo ratings yet

- Accounting Notes Module - 1Document16 pagesAccounting Notes Module - 1Bheemeswar ReddyNo ratings yet

- Excel Skills - Cashbook & Bank Reconciliation TemplateDocument17 pagesExcel Skills - Cashbook & Bank Reconciliation TemplateAnonymous 5z7ZOpNo ratings yet

- Coke Vending Machine - Price DifferentiationDocument6 pagesCoke Vending Machine - Price DifferentiationSubrata Dass50% (2)

- MCB Internship ReportDocument132 pagesMCB Internship ReportSohail KhanNo ratings yet

- Credit CardsDocument69 pagesCredit CardsVaibhav JainNo ratings yet

- Inventory Transaction Interface ManagersDocument55 pagesInventory Transaction Interface ManagersAbhishekNo ratings yet

- Lanka ClearDocument19 pagesLanka ClearRajithaNo ratings yet

- CbloDocument6 pagesCbloPojigiNo ratings yet

- Myob Quiz PDFDocument8 pagesMyob Quiz PDFGita Puspitasari67% (3)

- Daily Cash Blotter: GLOW Fruity VegesDocument15 pagesDaily Cash Blotter: GLOW Fruity Vegesadrian lozanoNo ratings yet