Professional Documents

Culture Documents

Unit 2 FD

Uploaded by

ASHISH KUMAR0 ratings0% found this document useful (0 votes)

14 views34 pagesCopyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

14 views34 pagesUnit 2 FD

Uploaded by

ASHISH KUMARCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 34

Financial Decision

Sources of financing - capital structure -

Factors determining capital structure - liquidity

and capital structure - profitability and capital

structure - Calculation of E.P.S - Concepts of

leverages - operating leverages - financial

leverages - combined leverages.

Financial Decision

• The Financing Decision is yet another crucial

decision made by the financial manager

relating to the financing-mix of an

organization. It is concerned with the

borrowing and allocation of funds required for

the investment decisions.

• The financing decision involves two sources from where

the funds can be raised:

– using a company’s own money, such as share capital, retained

earnings, or

– borrowing funds from the outside in the form debenture,

loan, bond, etc.

• The objective of financial decision is to maintain an

optimum capital structure, i.e. a proper mix of debt and

equity, to ensure the trade-off between the risk and

return to the shareholders.

• The Debt-Equity Ratio helps in determining the

effectiveness of the financing decision made by the

company. While taking the financial decisions, the finance

manager has to take the following points into consideration:

1. The Risk involved in raising the funds. The risk is

higher in the case of debt as compared to the

equity.

2. The Cost involved in raising the funds. The manager

chose the source with minimum cost.

3. The Level of Control, the shareholders, want in the

organization also determines the composition of

capital structure. They usually prefer the borrowed

funds since it does not dilute the ownership.

4. The Cash Flow from the operations of the business

also determines the source from where the funds

shall be raised. High cash flow enables to borrow

debt as interest can be easily paid.

5. The Floatation Cost such as broker’s commission,

underwriters fee, involved in raising the securities also

determines the source of fund. Thus, securities with

minimum cost must be chosen.

• Thus, a company should make a judicious decision

regarding from where, when, how the funds shall be

raised, since, more use of equity will result in the dilution

of ownership and whereas, higher debt results in higher

risk, as fixed cost in the form of interest is to be paid on

the borrowed funds.

Capital Structure

• Capital structure means the mixture of share

capital and other long term liabilities.

• Capital Structure is referred to as the ratio of

different kinds of securities raised by a firm as

long-term finance.

• Type of securities to be issued are equity shares,

preference shares and long term borrowings

(Debentures).

• Relative ratio of securities can be determined by

process of capital gearing. On this basis, the

companies are divided into two-

– Highly geared companies - Those companies whose

proportion of equity capitalization is small.

– Low geared companies - Those companies whose

equity capital dominates total capitalization.

Example

• There are two companies A and B. Total capitalization

amounts to be Rs. 2,00,000 in each case.

• The ratio of equity capital to total capitalization in

company A is Rs. 50,000, while in company B, ratio of

equity capital is Rs. 1,50,000 to total capitalization,

i.e, in Company A, proportion is 25% and in company

B, proportion is 75%. In such cases, company A is

considered to be a highly geared company and

company B is low geared company.

PATTERNS OF CAPITAL STRUCTURE

• In case of a Business Entity the capital structure

may be of any of the following four patterns:

1. Capital structure with equity shares only

2. Capital structure with both equity and preference

shares

3. Capital structure with equity shares and debentures

4. Capital structure with equity shares, preference

shares and debentures

Factors Determining Capital Structure

• Degree of control - In a company, it is the directors who

are so called elected representatives of equity

shareholders.

– These members have got maximum voting rights in a concern

as compared to the preference shareholders and debenture

holders. Preference shareholders have reasonably less voting

rights while debenture holders have no voting rights.

– If the company’s management policies are such that they

want to retain their voting rights in their hands, the capital

structure consists of debenture holders and loans rather than

equity shares.

• Flexibility of financial plan- In an enterprise, the

capital structure should be such that there is both

contractions as well as relaxation in plans.

Debentures and loans can be refunded back as

the time requires. While equity capital cannot be

refunded at any point which provides rigidity to

plans.

– Therefore, in order to make the capital structure

possible, the company should go for issue of

debentures and other loans.

• Choice of investors- The company’s policy

generally is to have different categories of

investors for securities. Therefore, a capital

structure should give enough choice to all kind

of investors to invest. Bold and adventurous

investors generally go for equity shares and

loans and debentures are generally raised

keeping into mind conscious investors.

• Capital market condition- In the lifetime of

the company, the market price of the shares

has got an important influence. During the

depression period, the company’s capital

structure generally consists of debentures and

loans. While in period of boons and inflation,

the company’s capital should consist of share

capital generally equity shares.

• Period of financing- When company wants to raise

finance for short period, it goes for loans from banks

and other institutions; while for long period it goes

for issue of shares and debentures.

• Cost of financing- In a capital structure, the company

has to look to the factor of cost when securities are

raised. It is seen that debentures at the time of profit

earning of company prove to be a cheaper source of

finance as compared to equity shares where equity

shareholders demand an extra share in profits.

• Size of a company- Small size business firms

capital structure generally consists of loans

from banks and retained profits. While on the

other hand, big companies having goodwill,

stability and an established profit can easily go

for issuance of shares and debentures as well

as loans and borrowings from financial

institutions. The bigger the size, the wider is

total capitalization.

Financial Structure and Capital Structure

Leverages

• What is 'Leverage'

• Leverage is the use of various financial

instruments or borrowed capital, such as margin,

to increase the potential return of an investment.

• The amount of debt used to finance a firm's

assets. A firm with significantly more debt than

equity is considered to be highly leveraged.

• Leverage is a practice which can help a

business drive up its gains / losses.

• If a firm has fixed expenses in P/L account or

debt in capital structure, the firm is said to be

levered.

• In finance, leverage is very closely related to

fixed expenses.

• We can safely state that by the introduction of expenses

which are fixed in nature, we are leveraging a firm.

• By fixed expenses, we refer to the expenses, the amount

of which remains unchanged irrespective of the activity

of the business.

• For example, an amount of investment made in fixed

assets or interest paid on loans does not change with a

normal change in a number of sales. Neither they

decrease with a decrease in sales and nor they increase

with an increase in sales.

• There is a different basis for classifying business

expenses.

• For our convenience, let us classify fixed

expenses into operating fixed expenses such as

depreciation on fixed expenses, salaries etc, and

financial fixed expenses such as interest and

dividend on preference shares.

• Similar to them, leverages are also of two types

– financial leverage and operating leverage.

• Financial Leverage: Financial leverage is a

leverage created with the help of debt

component in the capital structure of a

company.

• Higher the debt, higher would be the financial

leverage because with higher debt comes the

higher amount of interest that needs to be

paid.

• Leverage can be both good and bad for a

business depending on the situation. If a firm

is able to generate a higher return on

investment (ROI) than the interest rate it is

paying, leverage will have its positive effect

shareholder’s return. The darker side is that if

the said situation is opposite, higher leverage

can take a business to a worst situation like

bankruptcy.

• Operating Leverage: Operating leverage, just

like the financial leverage, is a result of

operating fixed expenses.

• Higher the fixed expense, higher is the

operating leverage. Like the financial leverage

had an impact on the shareholder’s return or

say earnings per share, operating leverage

directly impacts the operating profits (Profits

before Interest and Taxes (PBIT/EBIT)).

You might also like

- Transporter Declaration Format For Non Deduction of Tds in PDFDocument1 pageTransporter Declaration Format For Non Deduction of Tds in PDFASHISH KUMAR67% (3)

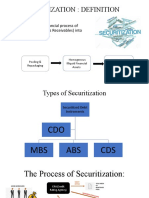

- SECURITIZATIONDocument5 pagesSECURITIZATIONASHISH KUMARNo ratings yet

- SA Summary Session2 Group2Document2 pagesSA Summary Session2 Group2ASHISH KUMARNo ratings yet

- IIMBG SA Group 3 Project DetailsDocument7 pagesIIMBG SA Group 3 Project DetailsASHISH KUMARNo ratings yet

- Pricing Strips and Term StructureDocument5 pagesPricing Strips and Term StructureASHISH KUMARNo ratings yet

- Fundamental of Business Intelligence.Document5 pagesFundamental of Business Intelligence.ASHISH KUMARNo ratings yet

- Unit 5 CMDocument22 pagesUnit 5 CMASHISH KUMARNo ratings yet

- Safal Niveshak Stock Analysis Excel (Ver. 3.0) : How To Use This SpreadsheetDocument32 pagesSafal Niveshak Stock Analysis Excel (Ver. 3.0) : How To Use This SpreadsheetASHISH KUMARNo ratings yet

- Relieving LetterDocument1 pageRelieving LetterASHISH KUMAR100% (1)

- Unit 3 ID - CBDocument62 pagesUnit 3 ID - CBASHISH KUMARNo ratings yet

- Unit 1 FMDocument42 pagesUnit 1 FMASHISH KUMARNo ratings yet

- Powerpoint Templates Powerpoint TemplatesDocument30 pagesPowerpoint Templates Powerpoint TemplatesASHISH KUMARNo ratings yet

- Electronic PaymentsDocument60 pagesElectronic PaymentsASHISH KUMARNo ratings yet

- Unit 4 WCDocument59 pagesUnit 4 WCASHISH KUMARNo ratings yet

- Unit-4: Information SystemsDocument63 pagesUnit-4: Information SystemsASHISH KUMARNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5796)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Sample of Exegesis PDFDocument31 pagesSample of Exegesis PDFJoFerNo ratings yet

- De Rama Vs Court of AppealsDocument2 pagesDe Rama Vs Court of AppealsPhilip VistalNo ratings yet

- English For Economics IDocument57 pagesEnglish For Economics IVanadira SekadauNo ratings yet

- Abayon V HRET DigestDocument2 pagesAbayon V HRET DigestDenise DuriasNo ratings yet

- 2.2. Graham CookDocument9 pages2.2. Graham Cookamin138irNo ratings yet

- Garba 2Document9 pagesGarba 2abhisayNo ratings yet

- ML ManualDocument42 pagesML ManualRafa AnanNo ratings yet

- PP Approval Details - B Channel - 2019Document80 pagesPP Approval Details - B Channel - 2019aman3327No ratings yet

- Guide To SyncsortDocument41 pagesGuide To SyncsortShasidhar ReddyNo ratings yet

- Intercellular Communication and Signal TransductionDocument20 pagesIntercellular Communication and Signal TransductionBerkaahh ShoppNo ratings yet

- E Commerce WikipediaDocument20 pagesE Commerce WikipediaUmer AhmedNo ratings yet

- Kinetic Molecular TheoryDocument34 pagesKinetic Molecular TheoryzaneNo ratings yet

- 40 RP Vs SalemDocument3 pages40 RP Vs SalemVanityHughNo ratings yet

- Katarungang Pambarangay - WikipediaDocument13 pagesKatarungang Pambarangay - WikipediaLyn Vyctoria Tarape NaturaNo ratings yet

- Factors Influencing Accounting Course Choice of First Year Accounting Students in UmdcDocument7 pagesFactors Influencing Accounting Course Choice of First Year Accounting Students in UmdcNiñaNo ratings yet

- PRATICE TEST Parts of SpeechDocument7 pagesPRATICE TEST Parts of Speechamin 99No ratings yet

- CrlmaDocument5 pagesCrlmaBibhutiranjan SwainNo ratings yet

- RE GCSE - Important Updates Year 10 Spring 2022Document11 pagesRE GCSE - Important Updates Year 10 Spring 2022nkznghidsnidvNo ratings yet

- En1992 2 ManualDocument86 pagesEn1992 2 ManualMarian Dragos100% (1)

- Clinical Bacteriology: Fawad Mahmood M.Phil. Medical Laboratory SciencesDocument8 pagesClinical Bacteriology: Fawad Mahmood M.Phil. Medical Laboratory SciencesFawad SawabiNo ratings yet

- Contempo Module 5 8 PDF SoftDocument16 pagesContempo Module 5 8 PDF SoftjessaNo ratings yet

- Sources of International LawDocument7 pagesSources of International LawJonathan Valencia0% (1)

- Materi Lanjutan Chapter 7 Kelas 7 Genap, 2021 OKDocument3 pagesMateri Lanjutan Chapter 7 Kelas 7 Genap, 2021 OKAris NdunNo ratings yet

- Leadership Theory PracticeDocument77 pagesLeadership Theory Practice0913314630No ratings yet

- Signal Molecule TrackerDocument4 pagesSignal Molecule Trackerarman_azad_2No ratings yet

- Anansi The SpiderDocument2 pagesAnansi The SpiderStefanie FleenorNo ratings yet

- 109,261,760 Which Makes Up T: Largest Cities in The PhilippinesDocument5 pages109,261,760 Which Makes Up T: Largest Cities in The Philippinescayla mae carlosNo ratings yet

- Ridgerunner - Deborah Christian 2011Document2 pagesRidgerunner - Deborah Christian 2011Knightsbridge~No ratings yet

- Provisions Section 41. Appointment of Receiver.: EstateDocument2 pagesProvisions Section 41. Appointment of Receiver.: EstateMartin Tongco FontanillaNo ratings yet

- Latin Amierca and The Caribbean Choice Board Project Instructions 2016Document3 pagesLatin Amierca and The Caribbean Choice Board Project Instructions 2016api-234947020100% (1)