Professional Documents

Culture Documents

Transporter Declaration Format For Non Deduction of Tds in PDF

Uploaded by

ASHISH KUMAROriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Transporter Declaration Format For Non Deduction of Tds in PDF

Uploaded by

ASHISH KUMARCopyright:

Available Formats

To,

Name of the Payer

Address of the Payer

Declaration Under Section 194C (6) For Non–Deduction of TDS

I, Name of vehicles owner, Proprietor/ Partner/ Director of M/s Name of the company or firm and address

of the company, (hereinafter “The Contractor”) do hereby make the following declaration as required

by sub section (6) of section 194C of the Income Tax, 1961 for receiving payments from the payer

without deduction of tax deduction at source (TDS).

1. That name of party authorized to make this declaration in the capacity as proprietor/ partner/ Director.

2. That the contractor is engaged by the payer for hiring or leasing of goods carriage for its business.

3. That I have not own more than ten goods carriage vehicles as on date.

4. That if the number of goods carriages owned by the contractor exceeds ten at any time during the

previous year 2015-16 (01-04-2015 to 31-03-2016), the contractor shall forthwith, in writing intimate the

prater of this fact.

5. That the Income Tax Permanent account number (PAN) of the contractor is PAN of Payee .A self-

attested photocopy of the same is furnished to the payer along with this declaration.

Place: Sign

Dated: (Name of Declarant)

Verification

I ________________do hereby verify that the contents of paragraphs one to five above are true to my

own knowledge and belief and no part of it is false and noting material has been concealed in it.

Place: Sign

Dated: (name of Declarant)

You might also like

- Declaration Us 194CDocument1 pageDeclaration Us 194CSushant Ghadi0% (1)

- Declaration Under Section 194CDocument1 pageDeclaration Under Section 194Cwasim bari50% (2)

- Consignment InvoiceDocument4 pagesConsignment InvoiceSky JarielNo ratings yet

- Guide Shop Act PDFDocument2 pagesGuide Shop Act PDFSudhir KotkarNo ratings yet

- Tally Prime 3.0 Webinar - 18bf4a4f f080 4ec4 9e9e 6111caa63d6bDocument44 pagesTally Prime 3.0 Webinar - 18bf4a4f f080 4ec4 9e9e 6111caa63d6bn8098654No ratings yet

- Letter For Releasing Security MoneyDocument2 pagesLetter For Releasing Security MoneyKashifntcNo ratings yet

- 05 - Working Capital Management (Notes)Document8 pages05 - Working Capital Management (Notes)Cheezuu DyNo ratings yet

- Format of Due Diligence CertificateDocument2 pagesFormat of Due Diligence CertificaterachkamatNo ratings yet

- Fabric Stores ProceduresDocument3 pagesFabric Stores ProceduresLM MuhammadNo ratings yet

- Equipment Rental Agreement TemplateDocument3 pagesEquipment Rental Agreement Templatemohamed hussien100% (1)

- MSME DeclarationDocument1 pageMSME DeclarationMohammed KhatibNo ratings yet

- ESIC Conribution Transfer Letter PDFDocument2 pagesESIC Conribution Transfer Letter PDFPrashant BedaseNo ratings yet

- Absorption and Direct CostingDocument12 pagesAbsorption and Direct Costingastra_per_asperaNo ratings yet

- Service Level AgreementDocument14 pagesService Level AgreementGeraldineNo ratings yet

- (Company Name) : CertificateDocument2 pages(Company Name) : CertificateJuwita ItaNo ratings yet

- Freelance - Recruitment - Shivani AgarwalDocument4 pagesFreelance - Recruitment - Shivani AgarwalNehal singhNo ratings yet

- CAT Technology Inc - Subcontract AgreementDocument6 pagesCAT Technology Inc - Subcontract AgreementLokesh NKNo ratings yet

- Accounts Payable AssessmentDocument2 pagesAccounts Payable AssessmentbeatriceNo ratings yet

- Test Request Form For Arvind Life Style: CIN: U72501KA1996PTC020653Document2 pagesTest Request Form For Arvind Life Style: CIN: U72501KA1996PTC020653Gaurav RawatNo ratings yet

- Format Rent AgreementDocument2 pagesFormat Rent Agreementamit kumarNo ratings yet

- Agreement of Boys HostelDocument5 pagesAgreement of Boys HostelyeshumasihNo ratings yet

- HR Management and IT Systems Services AgreementDocument19 pagesHR Management and IT Systems Services Agreementwaqastariq77_7812164No ratings yet

- 2307Document16 pages2307Marjorie JotojotNo ratings yet

- Purchase OrderDocument1 pagePurchase OrderEvgeniy GodovanetsNo ratings yet

- Zudio LOIDocument11 pagesZudio LOIYash ChhabraNo ratings yet

- TallyDocument77 pagesTallyPawan SinghNo ratings yet

- Business Contract - Shoe GuruDocument4 pagesBusiness Contract - Shoe Guruapi-491139136No ratings yet

- Chart of AccountsDocument4 pagesChart of AccountsmakahiyaNo ratings yet

- Capital Request and Justification FormDocument2 pagesCapital Request and Justification FormKishanNo ratings yet

- FAQ On FDIDocument14 pagesFAQ On FDIParas ShahNo ratings yet

- Agreement For The Supply of IT ServicesDocument10 pagesAgreement For The Supply of IT ServicesVíctor Vila GómezNo ratings yet

- Statutory AuditDocument2 pagesStatutory AuditKalyani PhadkeNo ratings yet

- Request Letter To The Bank ManagerDocument1 pageRequest Letter To The Bank ManagerFroilan Dangatan TaclawanNo ratings yet

- Basic Steps Involved in ProcurementDocument10 pagesBasic Steps Involved in ProcurementBilal AliNo ratings yet

- Form F PDFDocument2 pagesForm F PDFSatish Sati100% (1)

- Service Contract Proposal Template - IT PattanaDocument14 pagesService Contract Proposal Template - IT PattanaDuncan NgachaNo ratings yet

- The The The The The: Published by AuthorityDocument92 pagesThe The The The The: Published by Authorityrahulchow2No ratings yet

- Debit Note and Credit NoteDocument8 pagesDebit Note and Credit NoteShanmughadas K GNo ratings yet

- Payment VoucherDocument1 pagePayment VoucherMeister PrabaNo ratings yet

- Night Shit Decalartion FormDocument2 pagesNight Shit Decalartion Formdivya100% (1)

- Software Development AgreementDocument3 pagesSoftware Development AgreementMohamed NakhlawyNo ratings yet

- Supplementary Agreement SarfaesiDocument2 pagesSupplementary Agreement Sarfaesiraj sahilNo ratings yet

- Module 5 - Inventory ManagementDocument26 pagesModule 5 - Inventory Managementmarie_luy1827100% (1)

- Agreement FormDocument8 pagesAgreement FormCamera Alaul100% (1)

- Specimen Copy of Declaration Regarding Registration Under The MSMED Act For Section 43B (H) of Income Tax ActDocument2 pagesSpecimen Copy of Declaration Regarding Registration Under The MSMED Act For Section 43B (H) of Income Tax ActMahavir KapsheNo ratings yet

- Forms Cesc FormsDocument6 pagesForms Cesc FormsAnupam DasNo ratings yet

- 49 - Fixed Assets Register FormatDocument2 pages49 - Fixed Assets Register FormatAmandeep Singh Manku100% (1)

- Tenancy ContractDocument4 pagesTenancy ContractBen KenNo ratings yet

- GST On Construction Done For Landlords Under Joint Development Agreement PDFDocument7 pagesGST On Construction Done For Landlords Under Joint Development Agreement PDFAman JainNo ratings yet

- Audit Management Software SystemDocument17 pagesAudit Management Software SystemVidip SinghNo ratings yet

- Authority Letter To Collect Documents PDFDocument1 pageAuthority Letter To Collect Documents PDFvishnnu9696969No ratings yet

- City and County of San FranciscoDocument6 pagesCity and County of San FranciscoSFGovNo ratings yet

- 1 Application Development Agreement: Page 1 of 11Document11 pages1 Application Development Agreement: Page 1 of 11Umair JavedNo ratings yet

- Contents of An Interim Financial Report: Unit OverviewDocument5 pagesContents of An Interim Financial Report: Unit OverviewRITZ BROWNNo ratings yet

- GSTDocument40 pagesGSTdurairajNo ratings yet

- Assets Assignment FormDocument1 pageAssets Assignment FormMurali YNo ratings yet

- Undertaking Raw Flat 19082016Document2 pagesUndertaking Raw Flat 19082016Adarsh TanejaNo ratings yet

- Taxguru - in-gST On Travel Agents Tour OperatorsDocument10 pagesTaxguru - in-gST On Travel Agents Tour OperatorsKSeegurNo ratings yet

- Letter of Intent - TemplateDocument3 pagesLetter of Intent - TemplateHicham faresNo ratings yet

- Declaration Under Section 194CDocument1 pageDeclaration Under Section 194CsuratNo ratings yet

- SA Summary Session2 Group2Document2 pagesSA Summary Session2 Group2ASHISH KUMARNo ratings yet

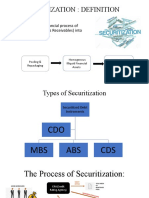

- SECURITIZATIONDocument5 pagesSECURITIZATIONASHISH KUMARNo ratings yet

- Pricing Strips and Term StructureDocument5 pagesPricing Strips and Term StructureASHISH KUMARNo ratings yet

- Fundamental of Business Intelligence.Document5 pagesFundamental of Business Intelligence.ASHISH KUMARNo ratings yet

- IIMBG SA Group 3 Project DetailsDocument7 pagesIIMBG SA Group 3 Project DetailsASHISH KUMARNo ratings yet

- Relieving LetterDocument1 pageRelieving LetterASHISH KUMAR100% (1)

- Unit 5 CMDocument22 pagesUnit 5 CMASHISH KUMARNo ratings yet

- Unit 3 ID - CBDocument62 pagesUnit 3 ID - CBASHISH KUMARNo ratings yet

- Safal Niveshak Stock Analysis Excel (Ver. 3.0) : How To Use This SpreadsheetDocument32 pagesSafal Niveshak Stock Analysis Excel (Ver. 3.0) : How To Use This SpreadsheetASHISH KUMARNo ratings yet

- Unit 1 FMDocument42 pagesUnit 1 FMASHISH KUMARNo ratings yet

- Unit 4 WCDocument59 pagesUnit 4 WCASHISH KUMARNo ratings yet

- Powerpoint Templates Powerpoint TemplatesDocument30 pagesPowerpoint Templates Powerpoint TemplatesASHISH KUMARNo ratings yet

- Electronic PaymentsDocument60 pagesElectronic PaymentsASHISH KUMARNo ratings yet

- Unit-4: Information SystemsDocument63 pagesUnit-4: Information SystemsASHISH KUMARNo ratings yet