Professional Documents

Culture Documents

Final Pos - 19-12-2017

Uploaded by

Archu NakshatraOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Final Pos - 19-12-2017

Uploaded by

Archu NakshatraCopyright:

Available Formats

POWER OF SAVINGS

A fixed notional amount of Rs.1000 per month since December 2005 till December 2017 is

invested in Equity shares (Infosys and Reliance Power), Mutual fund (HDFC Prudence),

Bank Fixed Deposits (SBI), Gold and Foreign currency (USD against INR).The annual

average absolute returns are calculated to identify the most beneficial investment scheme.

S T O C K P R IC E

INFOSYS – EQUITY SHARE

1200 RELIANCE POWER LIMITED – EQUITY SHARE

250.00

1000

200.00

800

STOCK PRICE

150.00

600

100.00

400

50.00

200

0.00

0 11/02/ 01/12/ 01/12/ 01/12/ 01/12/ 03/12/ 02/12/ 01/12/ 01/12/ 01/12/ 01/12/

00

5

0 0 6 0 0 7 0 0 8 0 0 9 0 1 0 0 1 1 01 2 0 1 3 0 1 4 0 1 5 0 1 6 0 1 7 2008 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

2 /2 2 /2 2 /2 2 /2 2 /2 2 /2 2 /2 2 /2 2 /2 2 /2 2 /2 2 /2 2 /2

/1 /1 /1 /1 /1 /1 /1 /1 /1 /1 /1 /1 /1

01 01 03 01 01 01 01 YEAR 03 02 01 01 01 01 SINCE FEB 2008

YEAR

Total No of Shares bought 234.85 Total No of Shares bought 2,150.20

Market price as on Market price as on

04-12-2017 ₹ 986.00 04-12-2017 ₹ 36.65

Total Value of investments ₹ 2,31,563.79 Total Value of investments ₹ 78,804.67

Total amount invested ₹ 1,45,000.00 Total amount invested ₹ 1,19,000.00

Absolute returns ₹ 86,563.79 Absolute returns ₹ -40,195.33

Absolute Returns % 59.70% Absolute Returns % -33.78%

Average Absolute returns % 4.97% Average Absolute returns % -2.81%

FD Interest rate at Rate of 10g at

SBI – FD INTEREST RATES

10.00

8.00

INTEREST RATES

6.00

4.00

2.00

-

0 5 0 6 0 7 0 8 0 9 1 0 1 1 1 2 1 3 1 4 1 5 1 6 1 7

20 20 20 20 20 20 20 20 20 20 20 20 20

1 2. 1 2. 1 2. 1 2. 1 2. 1 2. 1 2. 1 2. 1 2. 1 2. 1 2. 1 2. 1 2.

0 1. 0 1. 0 1. 0 1. 0 1. 0 1. 0 1. 0 1. 0 1. 0 1. 0 1. 0 1. 0 1.

YEAR

Initial Amount Invested ₹ 1,000.00 Total Gold bought (in grams) 80.56

Interest rate as on 04-12-2017 6.25% Rate of 10g Gold as on 04-12-2017 ₹ 29,025.00

Maturity amount as on Rate of 1g Gold as on 04-12-2017 ₹ 2,902.50

04-12-2017 ₹ 2,38,540.75 Total Value of investments ₹ 2,33,829.53

Total amount invested ₹ 1,45,000.00 Total amount invested ₹ 1,45,000.00

Absolute returns ₹ 93,540.75 Absolute returns ₹ 88,829.53

Absolute Returns % 64.51% Absolute Returns % 61.26%

Average Absolute returns % 5.38% Average Absolute Returns % 5.11%

POWER OF SAVINGS

Akshay Sharma | Archanaa M | Monisa A | Ravi Baroliya | Saurav Chowdhury

FINANCIAL MARKETS– Prof. Rajnikant Trivedi

IN R A G A IN S T U S D USD against INR

BSE SENSEX

35000

30000

FOREIGN EXCHANGE – US DOLLARS

80 25000

70 20000

BSE PRICE

60

50 15000

40 10000

30

5000

20

10 0

0

0 0 5 0 0 6 0 0 7 0 0 8 0 0 9 0 1 0 0 1 1 0 1 2 0 1 3 01 4 0 1 5 0 1 6 01 7

01/12 01/12 03/12 01/12 01/12 01/12 01/12 03/12 02/12 01/12 01/12 01/12 01/12 /2 /2

/2005 /2006 /2007 /2008 /2009 /2010 /2011 /2012 /2013 /2014 /2015 /2016 /2017 2 2 2 /2 2 /2 2 /2 2 /2 2 /2 2 /2 2 /2 2 /2 2 /2 2 /2 2 /2

/1 /1 /1 /1 /1 /1 /1 /1 /1 /1 /1 /1 /1

01 01 03 01 01 01 01 03 02 01 01 01 01

YEAR YEAR

Total No of USD bought $ 2,806.11 Total No of Units bought 8.20

INR value of 1 USD as on Price of BSE Sensex as on

07-12-17 ₹ 64.53 04-12-17 ₹ 32,869.71

Total Value of investments ₹ 1,81,078.56 Total Value of investments ₹ 2,69,374.66

Total amount invested ₹ 1,45,000.00 Total amount invested ₹ 1,45,000.00

Absolute returns ₹ 36,078.56 Absolute returns ₹ 1,24,374.66

Absolute Returns % 24.88% Absolute Returns % 85.78%

Average Absolute Returns % 2.07% Average Absolute returns % 7.15%

COMPARATIVE ANALYSIS

HDFC - PRUDENCE FUND Percentage of

600.00 Percentage of Average

Absolute Absolute Absolute

500.00

Returns Returns returns

NAV (Net Asset Value)

400.00

Infosys ₹ 86,563 59.70% 4.97%

300.00

Reliance Power ₹ -40,195 -33.78% -2.81%

200.00

SBI ₹ 93,540 64.51% 5.38%

100.00

HDFC - MF ₹ 2,61,743 180.51% 15.04%

-

0 0 5 0 0 6 0 0 7 0 0 8 0 0 9 0 1 0 01 1 0 1 2 0 1 3 0 1 4 0 1 5 0 1 6 0 1 7 GOLD ₹ 88,829 61.26% 5.11%

2 2 2 2 2 2 2 2 2 2 2 2 2

1 2/ 1 2/ 1 2/ 1 2/ 1 2/ 1 2/ 1 2/ 1 2/ 1 2/ 1 2/ 1 2/ 1 2/ 1 2/

01

/

01

/

03

/

01

/

01

/

01

/

01

/

03

/

02

/

01

/

01

/

01

/

01

/ BSE Sensex ₹ 1,24,374 85.78% 7.15%

YEAR

Forex - USD ₹ 36,078 24.88% 2.07%

Percentage of Absolute Returns

Total No of Units bought 793.18 200.00%

180.51%

NAV as on 15-12-2017 ₹ 512.80

150.00%

Total Value of investments ₹ 4,06,743.64

Total amount invested ₹ 1,45,000.00 100.00% 85.78%

59.70% 64.51% 61.26%

Absolute returns ₹ 2,61,743.64 50.00%

24.88%

RELIANC

Absolute Returns % 180.51% 0.00%

E POWER

INFOSYS SBI GOLD BSE FOREX HDFC - MF

Average Absolute returns % 15.04% SENSEX

-50.00% -33.78% USD

INFERENCE

Comparing the percentage of annual average absolute returns of all the above, the returns through mutual

funds is higher and more beneficial for investment. It is practically possible to invest an amount as low as

possible of Rs.1000 per month to create a long term wealth.

POWER OF SAVINGS

Akshay Sharma | Archanaa M | Monisa A | Ravi Baroliya | Saurav Chowdhury

FINANCIAL MARKETS– Prof. Rajnikant Trivedi

You might also like

- Detalle Medidas VanosDocument1 pageDetalle Medidas VanosCharlie WittmanNo ratings yet

- SuperStore DashboardDocument124 pagesSuperStore DashboardTaner AksoyNo ratings yet

- Recent Problems Related To The Identification of Shallow Gas D Lundqvist StatoilDocument31 pagesRecent Problems Related To The Identification of Shallow Gas D Lundqvist StatoilSofyan DarmawanNo ratings yet

- ETF Impact On Gold Market 6cDocument4 pagesETF Impact On Gold Market 6cbebinmathewNo ratings yet

- Schedule of Doors: D 01 D 02 D 03 D 04 D 05 D 06 D 07Document1 pageSchedule of Doors: D 01 D 02 D 03 D 04 D 05 D 06 D 07christian de leonNo ratings yet

- LayoutDocument1 pageLayoutAshraf alZeidyNo ratings yet

- Research PaperDocument23 pagesResearch PaperbhaskkarNo ratings yet

- Radisys & S&P 500: Figure - Market Reaction TargetDocument1 pageRadisys & S&P 500: Figure - Market Reaction TargetYASH CHAUDHARYNo ratings yet

- Boutique: Common Room Kitchen Cyber Conference Room Electrical ShopDocument1 pageBoutique: Common Room Kitchen Cyber Conference Room Electrical Shopchristine okeyoNo ratings yet

- Range Error CT Coupler I 0,5% Range Error CT Coupler II 0,5%Document1 pageRange Error CT Coupler I 0,5% Range Error CT Coupler II 0,5%Scott Parker AncNo ratings yet

- SOBC July December 2022Document37 pagesSOBC July December 2022Fahad MagsiNo ratings yet

- Ground Floor 1:100Document1 pageGround Floor 1:100Delfino Bernardo ViegasNo ratings yet

- Septic Tank Detail: Scale: 1:35 MTSDocument1 pageSeptic Tank Detail: Scale: 1:35 MTSJovelyn LaceaNo ratings yet

- Illustration 1.1: Grande Trek: Account Balances 1 October, 2020Document7 pagesIllustration 1.1: Grande Trek: Account Balances 1 October, 2020J DashNo ratings yet

- Pdfjoiner PDFDocument18 pagesPdfjoiner PDFJuan CastañedaNo ratings yet

- Manhole S1Document1 pageManhole S1janmichael0133No ratings yet

- Chart BDocument6 pagesChart Bangela selvianaNo ratings yet

- Denah Tangga: Downlight Switch - 1 Seri Switch-2 Seri Outlet TV MCB Box Ac - Supply UnitDocument1 pageDenah Tangga: Downlight Switch - 1 Seri Switch-2 Seri Outlet TV MCB Box Ac - Supply UnitIrfan WafiNo ratings yet

- Cargador Lovol FL936H PDFDocument7 pagesCargador Lovol FL936H PDFJhon Alexis Cardona Herrera100% (1)

- PQT FTP MPL 101xDocument1 pagePQT FTP MPL 101xgokul hrishikeshNo ratings yet

- Provider Productivity - December 17 MTDDocument6 pagesProvider Productivity - December 17 MTDyousofhosseini9877No ratings yet

- ITC Financial ModelDocument123 pagesITC Financial ModelNareshNo ratings yet

- Adrian CienfuegosDocument4 pagesAdrian CienfuegosyordanNo ratings yet

- Manhole and Box Culvert Typical ModelDocument1 pageManhole and Box Culvert Typical ModelJesse GarciaNo ratings yet

- 2bedroom ApartmentsDocument1 page2bedroom ApartmentsBoniface MarwaNo ratings yet

- Third FloorDocument1 pageThird FloorRaghvendra ShrivastavaNo ratings yet

- Chart B.EngDocument3 pagesChart B.Engangela selvianaNo ratings yet

- Floor Plan 1:100: Chasmat Design AgenciesDocument1 pageFloor Plan 1:100: Chasmat Design Agenciescharler kinyuajNo ratings yet

- Accomodation BlockDocument5 pagesAccomodation BlockAnonymous CPEha1db7UNo ratings yet

- Denah Kasar Rumah SiantanDocument1 pageDenah Kasar Rumah SiantanGuntur GamaraNo ratings yet

- 5/10/2023 176Document1 page5/10/2023 176mahmoud faroukNo ratings yet

- Credit Card - Birds Eye ViewDocument3 pagesCredit Card - Birds Eye ViewharryadenNo ratings yet

- Project Name:: 50mm Door FrameDocument1 pageProject Name:: 50mm Door FrameAnutosh BajpaiNo ratings yet

- Aloyo 002Document1 pageAloyo 002Raila SilvesterNo ratings yet

- Conjunto Final Fresco 1Document1 pageConjunto Final Fresco 1saul guillenNo ratings yet

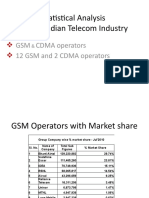

- Statistical Analysis of The Indian Telecom Industry: GSM CDMA Operators 12 GSM and 2 CDMA OperatorsDocument18 pagesStatistical Analysis of The Indian Telecom Industry: GSM CDMA Operators 12 GSM and 2 CDMA OperatorsSubaash KumaraswamyNo ratings yet

- Side ViewDocument1 pageSide View7mrcvengadesh28No ratings yet

- Sales Pitch FinalDocument5 pagesSales Pitch Final许浩江No ratings yet

- Discofuse EditsDocument1 pageDiscofuse Editspmfcyjf9No ratings yet

- Chapter 4 Business Combination Solution ManualDocument19 pagesChapter 4 Business Combination Solution ManualMaxineNo ratings yet

- Topografico Rumorosa25Document1 pageTopografico Rumorosa25alex.medina2krNo ratings yet

- 2023 4 Trial BalanceDocument4 pages2023 4 Trial BalanceAhmad SyafeiNo ratings yet

- Monthly Demand For Cellphones (In Thousands) Month Demand ItemDocument5 pagesMonthly Demand For Cellphones (In Thousands) Month Demand ItemPravina MoorthyNo ratings yet

- Monthly Demand For Cellphones (In Thousands) Month Demand ItemDocument5 pagesMonthly Demand For Cellphones (In Thousands) Month Demand ItemPravina MoorthyNo ratings yet

- Ground Floor Plan Second Floor Plan Roof Plan: Fin. Flr. LineDocument1 pageGround Floor Plan Second Floor Plan Roof Plan: Fin. Flr. Linejohnalfred051801No ratings yet

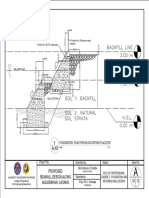

- Proposed Seawall Design Along Aguadahan, Laoang 10 12Document1 pageProposed Seawall Design Along Aguadahan, Laoang 10 12Niño Anthony PetalboNo ratings yet

- PH M Chí VinhDocument9 pagesPH M Chí Vinhhulk alanNo ratings yet

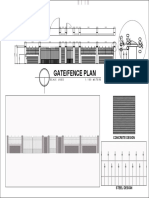

- Gate/Fence Plan: Spot DetailsDocument1 pageGate/Fence Plan: Spot Detailsjeyj petrolaNo ratings yet

- Sure Repair ShopDocument37 pagesSure Repair ShopJonathan SantosNo ratings yet

- FRARADAYDocument3 pagesFRARADAYTitoFloresRubenNo ratings yet

- Stock Market Indicators: S&P 500 Buybacks & Dividends: Yardeni Research, IncDocument11 pagesStock Market Indicators: S&P 500 Buybacks & Dividends: Yardeni Research, IncchristiansmilawNo ratings yet

- Session 4 FSET and SCFDocument9 pagesSession 4 FSET and SCFdone manNo ratings yet

- Schematic and Survey Plot: Well Name: Sample 11 - Full DataDocument1 pageSchematic and Survey Plot: Well Name: Sample 11 - Full DatamihirpritiNo ratings yet

- Ultimate Bearing Capacity Variation: B B B/B NCQ QuDocument2 pagesUltimate Bearing Capacity Variation: B B B/B NCQ Quleonard dela cruzNo ratings yet

- GseducationalversionDocument2 pagesGseducationalversionkevin cuencaNo ratings yet

- Presentation1 BARONET MANSIONDocument11 pagesPresentation1 BARONET MANSIONTarisha JanwaniNo ratings yet

- Ie DataDocument76 pagesIe Dataerik prambudhiNo ratings yet

- Denah lt.1Document1 pageDenah lt.1MineNo ratings yet

- Uwhwbwbadobe Scan 19 Oct 2023 9 50Document1 pageUwhwbwbadobe Scan 19 Oct 2023 9 50aeoohbtzeNo ratings yet

- Unit - X (Macro Economics)Document15 pagesUnit - X (Macro Economics)Omisha SinghNo ratings yet

- Unit 1 MCQDocument7 pagesUnit 1 MCQHan Nwe OoNo ratings yet

- Elements of Financial StatementsDocument6 pagesElements of Financial StatementsAngelAnneDeJesus86% (7)

- Activity - Home Office, Branch Accounting & Business Combination (REVIEWER MIDTERM)Document11 pagesActivity - Home Office, Branch Accounting & Business Combination (REVIEWER MIDTERM)Paupau100% (1)

- Expendable Net AssetsDocument4 pagesExpendable Net AssetsSyed Muhammad Ali SadiqNo ratings yet

- What Are The Features of The IstisnaDocument4 pagesWhat Are The Features of The IstisnaanassaleemNo ratings yet

- BES171 Financial Inclusion1 Jandhan Small Savings SchemesDocument29 pagesBES171 Financial Inclusion1 Jandhan Small Savings Schemesroy lexterNo ratings yet

- CA. Nitin Goel: CanitinDocument4 pagesCA. Nitin Goel: CanitinSri AssociatesNo ratings yet

- Bill of LadingDocument1 pageBill of LadingboyNo ratings yet

- Richard Bage 0191PGM010 - Strategic Management Assignment - IVDocument2 pagesRichard Bage 0191PGM010 - Strategic Management Assignment - IVRICHARD BAGENo ratings yet

- Contract Eng 1 1Document31 pagesContract Eng 1 1100No ratings yet

- Discretionary Housing Payment Application Form: WWW - Northtyneside.gov - UkDocument8 pagesDiscretionary Housing Payment Application Form: WWW - Northtyneside.gov - UkTyra AtkinsonNo ratings yet

- Limitations of Market SegmentationDocument6 pagesLimitations of Market SegmentationIQRA YOUSAFNo ratings yet

- Borrower (S) Commitment Letter: Revised March 2016Document4 pagesBorrower (S) Commitment Letter: Revised March 2016Noor Azah AdamNo ratings yet

- AgreementDocument2 pagesAgreementralvan WilliamsNo ratings yet

- DepreciationDocument20 pagesDepreciationRan HorngNo ratings yet

- Chapter 4 - Understanding The Global Context of BusinessDocument34 pagesChapter 4 - Understanding The Global Context of BusinessMarwan BakrNo ratings yet

- Chapter - 3 J Marathon Advisory Services PVT LTDDocument5 pagesChapter - 3 J Marathon Advisory Services PVT LTDPriyanka DixitNo ratings yet

- Olmstead Corporation S Capital Structure Is As Follows The Following Additional InformationDocument1 pageOlmstead Corporation S Capital Structure Is As Follows The Following Additional InformationHassan JanNo ratings yet

- Chapter 1Document7 pagesChapter 1Javar LumaranNo ratings yet

- Ank ResumeDocument2 pagesAnk ResumeGouresh ChauhanNo ratings yet

- Acc 301 Corporate Finance - Lectures Two - ThreeDocument17 pagesAcc 301 Corporate Finance - Lectures Two - ThreeFolarin EmmanuelNo ratings yet

- Electricity Bill: Consumption Data Billing DetailsDocument1 pageElectricity Bill: Consumption Data Billing DetailsCliff Mokua100% (3)

- Activity Template - Project CharterDocument3 pagesActivity Template - Project CharterHIMANSHU SHARMANo ratings yet

- Approval of Calibration Certificates and Permissible Error Limits - A Process ApproachDocument4 pagesApproval of Calibration Certificates and Permissible Error Limits - A Process ApproachProvedor AnalistaNo ratings yet

- Ebook Ebook PDF Principles of Managerial Finance Brief Global Edition 15th Edition PDFDocument42 pagesEbook Ebook PDF Principles of Managerial Finance Brief Global Edition 15th Edition PDFrosalie.ashworth789100% (38)

- GST 307Document300 pagesGST 307Lawal OlanrewajuNo ratings yet

- 08 Bond InvestmentDocument3 pages08 Bond InvestmentAllegria Alamo100% (1)

- Social Studies 10Document9 pagesSocial Studies 10Tanmay Jindal100% (1)

- MACD-Histogram: MACD: (12-Day EMA - 26-Day EMA)Document11 pagesMACD-Histogram: MACD: (12-Day EMA - 26-Day EMA)kunsridhar8901No ratings yet