Professional Documents

Culture Documents

IAS-36 Impairment of Assets

Uploaded by

HunairArshad0 ratings0% found this document useful (0 votes)

18 views13 pagesThis document discusses IAS 36 Impairment of Assets. It provides guidance on calculating the recoverable amount of assets and cash generating units and recognizing impairment losses. Key points include:

- The recoverable amount of an asset is the higher of its fair value less costs to sell or its value in use defined as the present value of future cash flows.

- If an asset's carrying amount is greater than its recoverable amount, an impairment loss is recognized for the difference.

- For a cash generating unit, if the carrying amount including goodwill exceeds the recoverable amount, the impairment loss is first allocated to goodwill then proportionately to other assets.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document discusses IAS 36 Impairment of Assets. It provides guidance on calculating the recoverable amount of assets and cash generating units and recognizing impairment losses. Key points include:

- The recoverable amount of an asset is the higher of its fair value less costs to sell or its value in use defined as the present value of future cash flows.

- If an asset's carrying amount is greater than its recoverable amount, an impairment loss is recognized for the difference.

- For a cash generating unit, if the carrying amount including goodwill exceeds the recoverable amount, the impairment loss is first allocated to goodwill then proportionately to other assets.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

18 views13 pagesIAS-36 Impairment of Assets

Uploaded by

HunairArshadThis document discusses IAS 36 Impairment of Assets. It provides guidance on calculating the recoverable amount of assets and cash generating units and recognizing impairment losses. Key points include:

- The recoverable amount of an asset is the higher of its fair value less costs to sell or its value in use defined as the present value of future cash flows.

- If an asset's carrying amount is greater than its recoverable amount, an impairment loss is recognized for the difference.

- For a cash generating unit, if the carrying amount including goodwill exceeds the recoverable amount, the impairment loss is first allocated to goodwill then proportionately to other assets.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 13

IAS-36 Impairment of Assets

(Tangible and Intangible)

Objective

Ensures assets are carried at no more than Recoverable amount(RA)

Defines how to calculate Recoverable amount(RA)

How to calculate?

Single Assets

If Carrying Amount(CA) > Recoverable Amount(RA)

CA-RA=Impairment Loss(IL)

10m- 8m =2m

Carrying amount(CA)=Cost – Accumulated Depreciation – Accumulated

Impairment loss

Recoverable Amount(RA)=Higher of Assets Net selling price(NSP) and Its value

in use(VIU)

NSP= Fair market value of the asset less cost to sell

VIU=Present value of future cash flows

How to calculate(cont…)

Recoverable(RA)=8m

NSP=7m Higher of VIU=8m

When to Perform impairment test

At each balance sheet date review all assets for any indication that an

asset may be impaired.

Indicators

1-Internal Sources

Asset is damaged

Forecast goes wrong

2-External Sources

Adverse Economic conditions

Market value of the asset dropped

Market interest rate increase

Company stock prices goes below book value

Recognition of Impairment loss-Journal Entry

If asset is carried at cost model

Profit/loss account(debit) 2m

Accumulated Impairment loss account(credit) 2m

If asset is carried at revaluation model

And let say our asset in above example was revalued upward by 1m

Revaluation reserve account (debit) 1m

Profit/loss account(debit) 1m

Accumulated Impairment loss account(credit) 2m

Cash generating unit-CGU(group of assets)

Examples:

A tour operator: Group of assets will include assets such as busses,

operating license, Road license

A Pizza Shop: Group of assets will include assets such as furniture,

delivery vans, equipment’s

A mining company: Group of assets will include assets such as railway

track and train, mining equipment, mining license

How to calculate?

If Carrying Amount(CA) of CGU+ Goodwill(GW) > Recoverable

Amount(RA) CGU

CA of CGU including goodwill-RA of CGU=Impairment Loss(IL)

Allocation of the loss will be in following order

First charge loss to goodwill if any

Then remaining loss to other assets on pro rata basis(Proportional

basis)

Example-CGU Impairment

CGU

Goodwill =15m

Machine A =40m

Machine B =40m

CA =95m

RA =75m

IL=CA-RA=20m

Allocation of Impairment loss

Working:

Total impairment loss 20m

Less:

Allocation to goodwill 15

Machine A 2.5

Machine B 2.5 20m

NIL

Working-1 Allocation of Remaining

Impairment loss to other assets-Pro rata basis

Allocation:

Machine A(40/80**x5*) 2.5m

Machine B(40/80**x5*) 2.5m

*Remaining Impairment loss after allocation to goodwill=20-15=5m

**Net carrying amount of CGU excluding goodwill

Machine A=40m

Machine B=40m

Recognition of Impairment loss-Journal Entry

Profit/Loss Account (debit) 20m

Accumulated Impairment loss Machine-A (Credit) 2.5 m

Accumulated Impairment loss Machine-B (Credit) 2.5 m

Goodwill A/c 15m

You might also like

- CPA Review Notes 2019 - BEC (Business Environment Concepts)From EverandCPA Review Notes 2019 - BEC (Business Environment Concepts)Rating: 4 out of 5 stars4/5 (9)

- Auditing Theory 01Document30 pagesAuditing Theory 01ralphalonzoNo ratings yet

- Wiley CMAexcel Learning System Exam Review 2017: Part 1, Financial Reporting, Planning, Performance, and Control (1-year access)From EverandWiley CMAexcel Learning System Exam Review 2017: Part 1, Financial Reporting, Planning, Performance, and Control (1-year access)No ratings yet

- 41-Trading The Golden RatioDocument5 pages41-Trading The Golden RatioparirahulNo ratings yet

- Key STQ-6 Valuation Fall 2021Document2 pagesKey STQ-6 Valuation Fall 2021Bilal AfzalNo ratings yet

- ACCA F2 December 2015 NotesDocument188 pagesACCA F2 December 2015 NotesOpenTuition.com100% (2)

- Notes VarianceDocument37 pagesNotes Variancezms240No ratings yet

- ANSWER Key For BDFFDocument25 pagesANSWER Key For BDFFEmman Elago100% (1)

- IAS 1 Presentation of Financial StatementsDocument74 pagesIAS 1 Presentation of Financial StatementsCandyNo ratings yet

- A Study On Bank of Maharashtra: Commercial Banking SystemDocument13 pagesA Study On Bank of Maharashtra: Commercial Banking SystemGovind N VNo ratings yet

- Steps of Sap FicoDocument10 pagesSteps of Sap FicoAniruddha Chakraborty100% (1)

- Chap 008Document26 pagesChap 008Citra Dewi WulansariNo ratings yet

- ImpairmentDocument45 pagesImpairmentnati100% (1)

- Impairment of Assets - SolutionsDocument7 pagesImpairment of Assets - SolutionsGeorge Buliki100% (6)

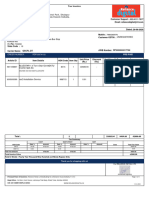

- Invoice RelianceDigitalDocument1 pageInvoice RelianceDigitalspandyno1No ratings yet

- BMS SSF 2009-10Document46 pagesBMS SSF 2009-10Nitin GoriNo ratings yet

- PPTDocument33 pagesPPTanis solihah0% (1)

- Chap 11 KTTC2Document9 pagesChap 11 KTTC2Viet Ha HoangNo ratings yet

- 7 - Ias 36 - Impairment of AssetsDocument4 pages7 - Ias 36 - Impairment of AssetsRaza MalikNo ratings yet

- Lecture Notes Chapter 10 (2022) - Student VerDocument50 pagesLecture Notes Chapter 10 (2022) - Student VerThương Đỗ100% (1)

- FR - Accounting For Transactions in Financial Statements: Impairment of Assets - IAS36 - Part 4Document3 pagesFR - Accounting For Transactions in Financial Statements: Impairment of Assets - IAS36 - Part 4User Upload and downloadNo ratings yet

- Advance Management Accounting Test 2 130520200212Document7 pagesAdvance Management Accounting Test 2 130520200212PrinceNo ratings yet

- Methodology For Computation Declaration of Normal Rate - DSM Regulations 2022Document7 pagesMethodology For Computation Declaration of Normal Rate - DSM Regulations 2022LakshminarayanNo ratings yet

- Impairment of AssetsDocument3 pagesImpairment of AssetsNathania PriscillaNo ratings yet

- Lecture 12 Impairment of Non-Current Assets and GoodwillDocument23 pagesLecture 12 Impairment of Non-Current Assets and GoodwillWinston 葉永隆 DiepNo ratings yet

- Inventory Valuation Semester 1Document36 pagesInventory Valuation Semester 1Ankita SinghNo ratings yet

- Accounting Standard 28 CA Prajakta SangoramDocument43 pagesAccounting Standard 28 CA Prajakta SangoramASHIMA GUPTANo ratings yet

- Calculation Result For 194-T-110 - 2Document21 pagesCalculation Result For 194-T-110 - 2RizkiNo ratings yet

- Plant Assets, Intangibles, and Long-Term Investments Chapter 8Document67 pagesPlant Assets, Intangibles, and Long-Term Investments Chapter 8Rupesh PolNo ratings yet

- Aps Failure DescriptionDocument3 pagesAps Failure DescriptionRahul SharmaNo ratings yet

- Intermediate Accounting Canadian Canadian 6th Edition Beechy Solutions ManualDocument59 pagesIntermediate Accounting Canadian Canadian 6th Edition Beechy Solutions Manualconatusimploded.bi6q100% (23)

- Day1 IAS-16Document44 pagesDay1 IAS-16tariq hassaNo ratings yet

- Intermediate Financial Accounting Study NotesDocument23 pagesIntermediate Financial Accounting Study NotesSayTing ToonNo ratings yet

- Material of As 28Document48 pagesMaterial of As 28emmanuel JohnyNo ratings yet

- IAS 36 Impairment of AssetsDocument29 pagesIAS 36 Impairment of AssetsziyuNo ratings yet

- 2decision Theory HODocument14 pages2decision Theory HOadesh guliaNo ratings yet

- T8. IAS 36 - 2016 - RevisedDocument34 pagesT8. IAS 36 - 2016 - RevisedCavipsotNo ratings yet

- NCA SummaryDocument5 pagesNCA Summary465jgbgcvfNo ratings yet

- IAS 36-Impairment: Nguyễn Đình Hoàng UyênDocument31 pagesIAS 36-Impairment: Nguyễn Đình Hoàng UyênHồ Đan ThụcNo ratings yet

- IAS 36 Additional Question SolutionsDocument9 pagesIAS 36 Additional Question SolutionsTatenda Webster MushaurwiNo ratings yet

- Prepare Financial Reports Edited HAND OUT1Document34 pagesPrepare Financial Reports Edited HAND OUT1getachewhabtamu361No ratings yet

- Capital Recovery % Annual WorthDocument3 pagesCapital Recovery % Annual WorthTien-Thinh NguyenNo ratings yet

- Chapter 1 IAS 36 Impairment of Assets PDFDocument11 pagesChapter 1 IAS 36 Impairment of Assets PDFGAIK SUEN TANNo ratings yet

- Depreciation in Final AccountsDocument26 pagesDepreciation in Final Accountsndagarachel015No ratings yet

- BUU33532 - Financial Accounting II - HT - WK3 - 08.02.22Document3 pagesBUU33532 - Financial Accounting II - HT - WK3 - 08.02.22simiNo ratings yet

- Beechy7e Vol 1 SM Ch08Document59 pagesBeechy7e Vol 1 SM Ch08Aayush AgarwalNo ratings yet

- Exam KeyDocument8 pagesExam KeyrudypatilNo ratings yet

- Ind As 16Document27 pagesInd As 16Dinesh TokasNo ratings yet

- CH 4 Theory Prodn & CostDocument15 pagesCH 4 Theory Prodn & CostMuhammad AdibNo ratings yet

- About SapDocument34 pagesAbout SapKotireddy DeviNo ratings yet

- Lecture Slides After-Tax AnalysisDocument13 pagesLecture Slides After-Tax AnalysisfathimashariffdeenNo ratings yet

- Topic 3 - IAS 36-SVDocument36 pagesTopic 3 - IAS 36-SVHONG NGUYEN THI KIMNo ratings yet

- IAS-36 (Impairment of Assets)Document10 pagesIAS-36 (Impairment of Assets)Nazmul HaqueNo ratings yet

- PE 2023 Lecture 3Document32 pagesPE 2023 Lecture 3Kiara RamdhawNo ratings yet

- CAPMDocument19 pagesCAPMRamesh KalwaniyaNo ratings yet

- Cost Report GuidelinesDocument22 pagesCost Report GuidelineskrishNo ratings yet

- IAS 36 - ImpairmentDocument4 pagesIAS 36 - ImpairmentAiman TuhaNo ratings yet

- IAS 36 - ImpairmentDocument4 pagesIAS 36 - ImpairmentAiman TuhaNo ratings yet

- PPE WESM Billing, Settlement, & Metering (Document)Document17 pagesPPE WESM Billing, Settlement, & Metering (Document)Darelle David MalacaNo ratings yet

- P2Document11 pagesP2AbdulHameedAdamNo ratings yet

- Ind As - 16Document11 pagesInd As - 16OopsbymistakeNo ratings yet

- Fa MCQDocument6 pagesFa MCQBhavesh GuravNo ratings yet

- Ias 16Document3 pagesIas 16CandyNo ratings yet

- Chapter 11 Pas 36 Impairment of AssetsDocument7 pagesChapter 11 Pas 36 Impairment of AssetsJoelyn Grace MontajesNo ratings yet

- PPE WESM Billing, Settlement, & Metering PresentationDocument31 pagesPPE WESM Billing, Settlement, & Metering PresentationDarelle David MalacaNo ratings yet

- Property, Plant and Equipment: By:-Yohannes Negatu (Acca, Dipifr)Document37 pagesProperty, Plant and Equipment: By:-Yohannes Negatu (Acca, Dipifr)Eshetie Mekonene AmareNo ratings yet

- Ias 16 PpeDocument168 pagesIas 16 PpeValeria PetrovNo ratings yet

- Accounting For Government Grants and Disclosure For Government Assistance Effective 1 January 1984Document8 pagesAccounting For Government Grants and Disclosure For Government Assistance Effective 1 January 1984HunairArshadNo ratings yet

- Group Accounts: IFRS 10 Consolidated Financial StatementsDocument9 pagesGroup Accounts: IFRS 10 Consolidated Financial StatementsHunairArshadNo ratings yet

- Accounting Policies, Changes in Accounting Estimates and ErrorsDocument15 pagesAccounting Policies, Changes in Accounting Estimates and ErrorsHunairArshadNo ratings yet

- Corporate Financial ReportingDocument18 pagesCorporate Financial ReportingHunairArshadNo ratings yet

- Business Proposal Beef JerkyDocument11 pagesBusiness Proposal Beef JerkyHunairArshad50% (2)

- NSDL Conversion Request FormDocument1 pageNSDL Conversion Request FormDream11 TeamNo ratings yet

- SPYKAR JEANS (1) ................ WordDocument21 pagesSPYKAR JEANS (1) ................ WordNishant Bhimraj Ramteke75% (4)

- Transactions For 50100036654971 From 2022-08-01 To 2023-02-06Document39 pagesTransactions For 50100036654971 From 2022-08-01 To 2023-02-06Vadivel Kumar TNo ratings yet

- Institutional Alternatives For Development FinalDocument33 pagesInstitutional Alternatives For Development FinalMeliaGrinaNo ratings yet

- REVISED APPLICATION FOR GRANTs 2023-2024 (1) - 240201 - 064357Document7 pagesREVISED APPLICATION FOR GRANTs 2023-2024 (1) - 240201 - 064357ezekielolunga2017No ratings yet

- Causes of The French RevolutionDocument1 pageCauses of The French Revolutionapi-214096171No ratings yet

- Ifrs 16 Example Initial Measurement of Right-Of-use Asset and Lease LiabilityDocument4 pagesIfrs 16 Example Initial Measurement of Right-Of-use Asset and Lease Liabilityaldwin006No ratings yet

- Step by Step Guide To Nestle SWOT AnalysisDocument7 pagesStep by Step Guide To Nestle SWOT AnalysisSherren Marie NalaNo ratings yet

- Anti Money Laundering (Document5 pagesAnti Money Laundering (krishmasethi100% (2)

- deeganAFA 7e ch28 ReducedDocument19 pagesdeeganAFA 7e ch28 Reducedmail2manshaaNo ratings yet

- Morning Star Hedge Fund Database UpdateDocument1 pageMorning Star Hedge Fund Database Updatehttp://besthedgefund.blogspot.comNo ratings yet

- Adjustment Entries I Accounting Workbooks Zaheer SwatiDocument6 pagesAdjustment Entries I Accounting Workbooks Zaheer SwatiZaheer Swati100% (1)

- ACCT3109 Assignment Discussion Q Ch6Document2 pagesACCT3109 Assignment Discussion Q Ch6Ailsa MayNo ratings yet

- Agreement This Agreement Is Made This Day of June 13, 2007 BetweenDocument3 pagesAgreement This Agreement Is Made This Day of June 13, 2007 BetweenCA Arpit YadavNo ratings yet

- ITM MaricoDocument8 pagesITM MaricoAdarsh ChaudharyNo ratings yet

- KFin Technologies - Flash Note - 12 Dec 23Document6 pagesKFin Technologies - Flash Note - 12 Dec 23palakNo ratings yet

- FIN630-FinalTerm-By Rana Abubakar Khan PDFDocument10 pagesFIN630-FinalTerm-By Rana Abubakar Khan PDFHassan BilalNo ratings yet

- Main ReporttDocument45 pagesMain ReporttSapana HiraveNo ratings yet

- 14 Shareholders' EquityDocument10 pages14 Shareholders' Equityrandomlungs121223No ratings yet

- Turkey GenDocument285 pagesTurkey GenMuhammad Talha TalhaNo ratings yet

- System of Absolute CommunityDocument17 pagesSystem of Absolute CommunitylitoingatanNo ratings yet