Professional Documents

Culture Documents

Income From House Property-1

Uploaded by

Aaditya Bhardwaj0 ratings0% found this document useful (0 votes)

44 views18 pagesIncome from House property in taxation for MBAs

Original Title

Income from House Property-1

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentIncome from House property in taxation for MBAs

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

44 views18 pagesIncome From House Property-1

Uploaded by

Aaditya BhardwajIncome from House property in taxation for MBAs

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 18

Income from House Property

Annual value of any property comprising of building and land

attached thereto of which the assessee is the owner is chargeable

to tax under the head “ Income from House Property ”

The assessee should be the owner of the house property

The annual value of property used by the assessee for his

business or profession is not chargeable to tax.

The amount chargeable to tax is the annual value of the house

property

House Property may be :

a) Let out House Property ( LOP )

b) Self Occupied House Property (SOP )

c) Deemed to be let out House Property (DLOP)

Property income exempt from tax

Income from farm house

Annual value of any one palace of an ex-ruler

Property income of local authority / university/

hospital/trade union /approved scientific research

association / political party

One self occupied property

Computation of income from let out property

Gross Annual value xxx

Less : Municipal taxes paid xxx

Net Annual Value xxx

Less: Deductions u/s 24

Standard deduction (30% of NAV) xxx

Interest on borrowed capital xxx

Income from house property xxx

Gross Annual value ( GAV ) refers to the capacity of the house

property to yield income.

a) Reasonably Expected Rent ( RER ) or

b) Actual Rent Received (ARR)* whichever is higher

RER

Fair rent or Municipal Value whichever is higher subject to Standard

Rent ( RER cannot be more than Standard Rent )

If ARR is lower than RER due to the house property remaining

vacant for a part of the year, then ARR is taken as GAV.

Loss due to vacancy can be deducted from higher of RER or ARR as

calculated above

Interest on borrowed loans

-Upto Rs.200000 for SOP ( In case loan is for repairs, renovation etc.

Rs.30000)

-No limit for LOP ( loss from house property due to interest limited to

200000)

Additional deduction for individuals ( Sec 80EE)

For first time home buyers, additional deduction of Rs.50000 interest

per financial year till the loan is repaid.

Conditions for claiming deduction:

Maximum value of the HP- Rs.50 lacs ,

Maximum loan –Rs.35 lacs

The assessee does not own any other residential house property.

Mr. Arvind submits the following details w.r.t house property.

Determine Income from House Property

Annual rent – Rs.240000/-

Fair rent – Rs.250000/-

Municipal value – Rs. 220000/-

Standard rent – Rs.260000/-

Municipal taxes paid – Rs3000/-

Interest paid on loan taken for purchase of house property –

Rs.300000/-

1. GAV = RER or ARR whichever is higher

a)RER = Rs.250000/- or Rs.220000/- whichever is higher

subject to Rs.260000/- = Rs.250000/-

b) ARR = Rs.240000/-

Hence GAV = Rs.250000/-

Gross Annual value (GAV) 250000

Less : Municipal taxes paid 3000

Net Annual Value (NAV) 247000

Less: Deductions u/s 24

Standard deduction (30% of NAV) 74100

Interest on borrowed capital 300000 374100

Income from house property (127100)

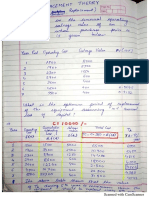

Adjustment for vacancy loss

Particulars Case 1 Case 2 Case 3 Case 4

Municipal Value (annual) 75000 60000 75000 75000

Fair Rent (annual) 105000 65000 120000 65000

Standard Rent (annual) 100000 70000 - 70000

Actual Rent Received/ Receivable 120000 120000 105000 120000

(annual)

Vacancy period nil nil 2 months 2 months

RER 100000 65000 120000 70000

ARR ( w/o adjusting vacancy ) 120000 120000 105000 120000

Higher of the two 120000 120000 120000 120000

Less: loss due to vacancy nil nil 17500 20000

GAV 120000 120000 112500 100000

Kapil owns a house property which has a fair rental value of

Rs.350000/-. The property was given on rent @ Rs. 30000 p.m,

however the tenant vacated it on 30/08/19. The property was

then rented to another tenant from Jan 2020 onwards @

Rs.40000 p.m. Determine the income taxable under House

Property.

The Annual Value of SOP is taken as nil

Computation of income from Self Occupied Property

Gross Annual value Nil

Less : Municipal taxes paid Nil

Net Annual Value Nil

Less: Deductions u/s 24

Standard deduction (30% of NAV) Nil

Interest on borrowed capital ( upto Rs.2lacs) xxx

Income from house property ( xxx )

If the assessee has one SOP , then

i. If one property is used for self residence – nothing

is taxable

ii. If one property is not used for residence on account

of employment/business – nothing is taxable

iii. If one part of property is used for self residence and

other part is let out – Self occupied part will not be

taxed and the let out part will taxed as per

provisions for LOP

iv. If the property is self occupied for part of the year

and let out for remaining part of the year – no

concession. The house will be taxed as LOP.

If the assessee has two SOPs , then

i. If property is used for self residence – nothing is

taxable

ii. If property is not used for residence on account of

employment/business – nothing is taxable

iii. If part of property is used for self residence and other

part is let out – Self occupied part will not be taxed

and the let out part will taxed as per provisions for

LOP

iv. If the property is self occupied for part of the year

and let out for remaining part of the year – no

concession. The house will be taxed as LOP.

If the assessee has more than two SOPs , then Only two

houses as per the choice of the taxpayer is treated as SOP.

Other remaining property will be treated as Deemed to be

Let Out and income will be calculated as per the provisions

for LOP

1. Mudra owns a residential house in Pune which is let out on a

monthly rent of Rs.45000/- . She incurs the following expenses on

the house :

Municipal tax – Rs.3400

Repairs – Rs.7800

Painting – Rs.4000

Watchman’s salary – Rs.12000

Interest on loan taken from HDFC for the house – Rs.260000

Principal amount repayment of the loan – Rs.120000

Determine Income from house property assuming that RER of the

house is Rs.450000.

2. Arun owns a house used for his self residence. The RER of

the house is Rs.280000. He paid municipal taxes of

Rs.15000 during the year. Other expenses incurred by him

: Repairs : Rs.5600, Fire insurance – Rs.4500, Interest on

loan taken for construction of the house : Rs.200000.

Determine his income from house property

3.Dilip owns a big house 50% of which is let out on a monthly

rent of Rs 22000. The remaining part of the house is used by

him for his residence.

Fair rent of the house : 470000

Municipal taxes paid : Rs.17000

Repairs : Rs.30000

Interest on loan taken for purchase of the house : Rs.230000

Determine his income from house property

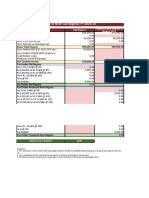

ns three houses – two in Mumbai and other in Delhi.

e used by him for self residence.

hich property should be considered as DLOP

come from house property from the following data :

House 1 House 2 House 3

450000 600000 800000

id 20000 30000 35000

15000 10000 5000

n 24000 30000 2000

- 225000 400000

You might also like

- Income Under The Head "Income From House Property" and Its ComputationDocument20 pagesIncome Under The Head "Income From House Property" and Its ComputationAanchal SinghalNo ratings yet

- Income from House PropertyDocument7 pagesIncome from House Propertysb_jainNo ratings yet

- Unit 2 (Income From House Property)Document13 pagesUnit 2 (Income From House Property)Vijay GiriNo ratings yet

- Income from house property guideDocument47 pagesIncome from house property guideforamsssNo ratings yet

- Income from House Property CalculationDocument14 pagesIncome from House Property CalculationSarvar Pathan100% (3)

- RPD-Taxation of House Property IncomeDocument2 pagesRPD-Taxation of House Property IncomedeshpanderpNo ratings yet

- Income From House PropertyDocument6 pagesIncome From House PropertyPraveen EkkaNo ratings yet

- Income From House PropertyDocument32 pagesIncome From House PropertyhanumanthaiahgowdaNo ratings yet

- HP 2016-17Document14 pagesHP 2016-17Bhaskar KrishnappaNo ratings yet

- Income From House Property KarthikDocument56 pagesIncome From House Property KarthikVandana PanwarNo ratings yet

- Income From House PropertyDocument27 pagesIncome From House PropertyPARTH NAIKNo ratings yet

- Income From House PropertyDocument27 pagesIncome From House PropertyJames Anderson0% (1)

- Annual Value of House PropertyDocument3 pagesAnnual Value of House PropertyAyub ChowdhuryNo ratings yet

- Assignment - 1 1. What Do You Mean by "Gross Annual Value"? How To Calculate The Income Under The Head "Income From House Property"?Document11 pagesAssignment - 1 1. What Do You Mean by "Gross Annual Value"? How To Calculate The Income Under The Head "Income From House Property"?Khushi ChadhaNo ratings yet

- Unit 3 (Income From House Property) - 1Document5 pagesUnit 3 (Income From House Property) - 1Vijay GiriNo ratings yet

- House PropertyDocument11 pagesHouse PropertyMadhusudana p nNo ratings yet

- House PropertyDocument33 pagesHouse PropertypriyaNo ratings yet

- Session 11-12 Income From House PropertyDocument7 pagesSession 11-12 Income From House PropertyNoob GamerNo ratings yet

- Tax H.P CompilorDocument6 pagesTax H.P CompilorKaran GuptaNo ratings yet

- 02 House Property Notes 23Document14 pages02 House Property Notes 23Hritik HarlalkaNo ratings yet

- House Property IncomeDocument21 pagesHouse Property IncomekhNo ratings yet

- Legal and Taxation Aspect: House PropertyDocument2 pagesLegal and Taxation Aspect: House PropertyPranav ShrivastavaNo ratings yet

- Income From House Property: Annual ValueDocument6 pagesIncome From House Property: Annual ValueSaddam KhanNo ratings yet

- Classification of TaxpayersDocument5 pagesClassification of TaxpayersfarnajNo ratings yet

- Tax ManagementDocument31 pagesTax ManagementrakeshkakaniNo ratings yet

- ATax - 04 - Property UpdatedDocument17 pagesATax - 04 - Property UpdatedHaseeb Ahmed ShaikhNo ratings yet

- Income From House Property PracticalDocument52 pagesIncome From House Property PracticalShreekanta DattaNo ratings yet

- Chapter-8 (House Property)Document40 pagesChapter-8 (House Property)BoRO TriAngLENo ratings yet

- House Property TaxationDocument13 pagesHouse Property TaxationAnupam BaliNo ratings yet

- Income From House PropertyDocument5 pagesIncome From House PropertyParas SinghNo ratings yet

- Income Tax Question BankDocument8 pagesIncome Tax Question Banksurya.notes19No ratings yet

- Income From House PropertyDocument31 pagesIncome From House PropertyAarti SainiNo ratings yet

- 2 - House Property Problems 22-23Document5 pages2 - House Property Problems 22-2320-UCO-517 AJAY KELVIN ANo ratings yet

- House Property PDFDocument43 pagesHouse Property PDFK Vijay Bhaskar ReddyNo ratings yet

- Income Under The Head House PropertyDocument17 pagesIncome Under The Head House PropertystudywagishaNo ratings yet

- Income from House Property ExplainedDocument69 pagesIncome from House Property ExplainedSresth VermaNo ratings yet

- Tax ProjectDocument40 pagesTax ProjectGunaNo ratings yet

- Income From House PropertyDocument6 pagesIncome From House Propertypardeep bainsNo ratings yet

- CH 11 Income On House PropertyDocument11 pagesCH 11 Income On House PropertyJewelNo ratings yet

- Income From House Property (Practical)Document52 pagesIncome From House Property (Practical)Bogadala Kirti RaoNo ratings yet

- Direct Tax-1Document17 pagesDirect Tax-1Akash GholapNo ratings yet

- Whethe: R Cash or in Kind???Document61 pagesWhethe: R Cash or in Kind???Varun SinghviNo ratings yet

- PrintDocument28 pagesPrintTanvir MahmudNo ratings yet

- House PropertyDocument14 pagesHouse Property083 Ronak ShahNo ratings yet

- House PropertyDocument36 pagesHouse PropertyRahul Tanver0% (1)

- Income From Bnvvbhouse Property SakshamDocument25 pagesIncome From Bnvvbhouse Property SakshamRohit KumarNo ratings yet

- CHP 3Document23 pagesCHP 3Laiba SadafNo ratings yet

- Income From House PropertyDocument74 pagesIncome From House PropertyHarshit YNo ratings yet

- Principles of Taxation M. Khalid Petiwala: Income From PropertyDocument8 pagesPrinciples of Taxation M. Khalid Petiwala: Income From PropertyosamaNo ratings yet

- Mr. Shankar's Income from Self Occupied PropertyDocument5 pagesMr. Shankar's Income from Self Occupied PropertySiva SankariNo ratings yet

- 5.2 Home Assignment Questions - House PropertyDocument2 pages5.2 Home Assignment Questions - House PropertyAashi GuptaNo ratings yet

- Income From House Property PracticalDocument52 pagesIncome From House Property Practicalvivek raiNo ratings yet

- Heads of Income Income From House PropertyDocument32 pagesHeads of Income Income From House PropertyAnshu kumarNo ratings yet

- Computation of Income From House PropertDocument20 pagesComputation of Income From House PropertSIDDHART BHANSALINo ratings yet

- Chapter - 8 - TAXDocument11 pagesChapter - 8 - TAXAshek AHmedNo ratings yet

- UNIT 3 Income From House PropertyDocument104 pagesUNIT 3 Income From House Propertydob BoysNo ratings yet

- Income From House PropertyDocument35 pagesIncome From House PropertyroopamNo ratings yet

- Income From House Property and TaxesDocument14 pagesIncome From House Property and Taxesanam goyalNo ratings yet

- Homeowner's Simple Guide to Property Tax Protest: Whats key: Exemptions & Deductions Blind. Disabled. Over 65. Property Rehabilitation. VeteransFrom EverandHomeowner's Simple Guide to Property Tax Protest: Whats key: Exemptions & Deductions Blind. Disabled. Over 65. Property Rehabilitation. VeteransNo ratings yet

- International Marketing - AmazonDocument7 pagesInternational Marketing - AmazonAaditya BhardwajNo ratings yet

- Marketing Metrics: Prof. Rashmi JainDocument51 pagesMarketing Metrics: Prof. Rashmi JainAaditya BhardwajNo ratings yet

- Indian Companies Hiring During Covid-19 PDFDocument116 pagesIndian Companies Hiring During Covid-19 PDFshrijit “shri” tembheharNo ratings yet

- Airport Retailing in PandemicDocument26 pagesAirport Retailing in PandemicAaditya BhardwajNo ratings yet

- Presentation On OTT PlatformDocument10 pagesPresentation On OTT PlatformAaditya BhardwajNo ratings yet

- Consumer Buying BehaviourDocument36 pagesConsumer Buying BehaviourAaditya BhardwajNo ratings yet

- Replacement TheoryDocument7 pagesReplacement TheoryAaditya BhardwajNo ratings yet

- Communication & Consumer BehaviorDocument25 pagesCommunication & Consumer BehaviorAaditya BhardwajNo ratings yet

- incomeFromBusiness PDFDocument9 pagesincomeFromBusiness PDFAaditya BhardwajNo ratings yet

- incomeFromBusiness PDFDocument9 pagesincomeFromBusiness PDFAaditya BhardwajNo ratings yet

- CBIC Civil List As On 01.01.2022Document568 pagesCBIC Civil List As On 01.01.2022रुद्र प्रताप सिंह ८२No ratings yet

- Understanding The Basics of GSTDocument2 pagesUnderstanding The Basics of GSTAishwarya ShelarNo ratings yet

- TP StatDocument7 pagesTP Statமணிகண்டன் பிரியாNo ratings yet

- Telangana Budget Analysis 2022-23Document7 pagesTelangana Budget Analysis 2022-23AN NETNo ratings yet

- Midterm Exam: Questions: ScoreDocument2 pagesMidterm Exam: Questions: ScoreLiza Magat MatadlingNo ratings yet

- Kotak Mahindra Life Insurance Company LTD Lta Claim FormDocument2 pagesKotak Mahindra Life Insurance Company LTD Lta Claim FormCricket KheloNo ratings yet

- PwcSalesInvoiceReport DesignJCDocument2 pagesPwcSalesInvoiceReport DesignJCCHOTINo ratings yet

- Income TaxationDocument13 pagesIncome TaxationJpagNo ratings yet

- A Study On Impact of Implementation of Goods and Service Tax Among Retailers in Warora CityDocument11 pagesA Study On Impact of Implementation of Goods and Service Tax Among Retailers in Warora Cityप्रेम हेNo ratings yet

- 2 Topic2 Residence StatusDocument19 pages2 Topic2 Residence StatusIskandar Zulkarnain KamalluddinNo ratings yet

- H02 - Taxes, Tax Laws and Tax AdministrationDocument10 pagesH02 - Taxes, Tax Laws and Tax Administrationnona galidoNo ratings yet

- Philippine Tax System and Income Taxation Business Administration MidtermDocument2 pagesPhilippine Tax System and Income Taxation Business Administration MidtermMark John Malong CallorinaNo ratings yet

- Salary Slip NovemberDocument1 pageSalary Slip NovemberGowtham ReddyNo ratings yet

- 16 18 20 21Document21 pages16 18 20 21jhouvan100% (1)

- Speedy Delivery Service Payroll RecordsDocument10 pagesSpeedy Delivery Service Payroll RecordsRishma Jane ValenciaNo ratings yet

- Nbaa C4 Public Finance and Taxation IiDocument246 pagesNbaa C4 Public Finance and Taxation IiERICK MLINGWA100% (1)

- Indian Income Tax Return Acknowledgement 2022-23: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2022-23: Assessment YearSagar GargNo ratings yet

- Wa0006. - 1Document1 pageWa0006. - 1RJ Nerdy ZoneNo ratings yet

- Hillsborough County Real Estate A0214340000 2020 Annual BillDocument1 pageHillsborough County Real Estate A0214340000 2020 Annual BillFaro farakNo ratings yet

- 1 - PRELIMINARY-Q - As - AFTER SESSION 4Document6 pages1 - PRELIMINARY-Q - As - AFTER SESSION 4Mighty SinghNo ratings yet

- ADP Pay Stub TemplateDocument1 pageADP Pay Stub Templateenudo Solomon67% (3)

- Annexure BDocument11 pagesAnnexure BSonu JainNo ratings yet

- Tax On Corp. Sample ProblemsDocument2 pagesTax On Corp. Sample ProblemsWenjunNo ratings yet

- Session 6 Exercise DrillDocument3 pagesSession 6 Exercise DrillAbigail Ann PasiliaoNo ratings yet

- Readings in Philippine History - Taxation - DahansorianoDocument20 pagesReadings in Philippine History - Taxation - DahansorianoKimmehhloves VlogxxxNo ratings yet

- Bir 33-00Document3 pagesBir 33-00Lauren KeiNo ratings yet

- Chap 12Document38 pagesChap 12mo hongNo ratings yet

- Public Expenditure Management OverviewDocument48 pagesPublic Expenditure Management Overviewmohamed100% (1)

- 3 - CREATE Sample Problem Tax On Domestic CorporationsDocument2 pages3 - CREATE Sample Problem Tax On Domestic CorporationsZenNo ratings yet

- Hax To Save Tax Income Tax Calculator by Labour Law AdvisorDocument15 pagesHax To Save Tax Income Tax Calculator by Labour Law AdvisorponmaniNo ratings yet