Professional Documents

Culture Documents

Parking Cases

Uploaded by

Mahindra Deshmukh0 ratings0% found this document useful (0 votes)

17 views1 page.

Original Title

Parking cases

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

17 views1 pageParking Cases

Uploaded by

Mahindra Deshmukh.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 1

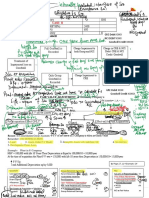

Case 1 Case 2 Case 3

GST of 18% is applicable GST of 18% is applicable

GST of 18% is not applicable

If said parking charges are inclusive of GST If said parking charges are inclusive of GST

Parking charges are not inclusive of GST vendor will also be paid GST as per share

Asssume parking charge collected 100 Rs Asssume parking charge collected 100 Rs

Asssume parking charge collected 100 Rs

Split of 100Rs as GST of 18% is inclusive Split of 100Rs as GST of 18% is inclusive

Actual fees collected 84.75

Actual fees collected 84.75

18% GST 15.25 Split of 100Rs as GST is not applicable 18% GST 15.25

Total 100 Actual fees collected 100 Total 100

Vendor will collect all money and deposite in

Vendor will collect all money and deposite in ESCROW

ESCROW account including collected GST. PCMC will Total 100 account including collected GST. PCMC will pay vendor

pay vendor share by deducting pcmc share share by deducting pcmc share

In this case PCMC suppose to pay all collected GST to Vendor will collect all money and deposite in ESCROW In this case PCMC suppose to only pay GST of their own

centeral government account. PCMC will pay vendor share by deducting pcmc share and handover GST of vendor share

share

Vendor has agreed to share 20% of revenue with

PCMC In referance with Section 243W being government entity Vendor has agreed to share 20% of revenue

Total fees collected with GST 100 GST on parking is nill. Refer Notifcation 12/2017 with PCMC

Actual Collected fees 84.75

PCMC Share 20% 16.95 Total fees collected with GST 100

Vendor share 80% 67.8 Vendor has agreed to share 20% of revenue with PCMC

With GST Actual GST

Total fees without GST 100 PCMC Share 20% 20 16.95 3.05

As Municipality is exempted from paying GST to

service provided As per the Notification No. 12/2017- Actual Collected fees 100 Vendor share 80% 80 67.8 12.2

Central Tax (Rate) Hence PCMC will not pay GST to PCMC Share 20% 20

vendor whereas vendor has to pay GST on other Vendor share 80% 80

purchases where entity can not opt for reverse GST

setup Effective share loss due to GST on 100Rs if GST

As Municipality is exumpted from paying GST to service not paid to vendor

provided aAs per the Notification No. 12/2017- Central Without

Tax (Rate) Hence PCMC will not pay GST to vendor With GST GST Loss

whereas vendor has to pay GST on other purchases PCMC 16.95 20 3.05

where entity can not opt for reverse GST setup Vendor 67.8 80 12.2

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Chapter 12 v2Document18 pagesChapter 12 v2Sheilamae Sernadilla GregorioNo ratings yet

- Ratio AnalysisDocument26 pagesRatio AnalysisPratibha ChandilNo ratings yet

- Cir vs. Pineda, 21 Scra 105Document1 pageCir vs. Pineda, 21 Scra 105Jo DevisNo ratings yet

- Business Plan For HotelDocument17 pagesBusiness Plan For HotelAnkita Singh100% (6)

- Mahindra SMKC CVDocument4 pagesMahindra SMKC CVMahindra DeshmukhNo ratings yet

- NSK SmaPTDocument62 pagesNSK SmaPTMahindra DeshmukhNo ratings yet

- Nashi TDocument94 pagesNashi TMahindra DeshmukhNo ratings yet

- Invoice 4538735820Document1 pageInvoice 4538735820Mahindra DeshmukhNo ratings yet

- WSP Future Ready Kerbside 2020Document62 pagesWSP Future Ready Kerbside 2020Mahindra DeshmukhNo ratings yet

- NimaniDocument1 pageNimaniMahindra DeshmukhNo ratings yet

- 1 CMPDocument592 pages1 CMPMahindra DeshmukhNo ratings yet

- Chatrapati Shivaji Maharaj Chowk: Phase 1 Phase 2 Phase 3Document3 pagesChatrapati Shivaji Maharaj Chowk: Phase 1 Phase 2 Phase 3Mahindra DeshmukhNo ratings yet

- ROAD-64: Produced by An Autodesk Student VersionDocument1 pageROAD-64: Produced by An Autodesk Student VersionMahindra DeshmukhNo ratings yet

- 988 File7766620253 PDFDocument318 pages988 File7766620253 PDFMahindra DeshmukhNo ratings yet

- Item Rate Boq: Validate Print HelpDocument1 pageItem Rate Boq: Validate Print HelpMahindra DeshmukhNo ratings yet

- Mahindra Deshmukh CVDocument6 pagesMahindra Deshmukh CVMahindra DeshmukhNo ratings yet

- RFP PDFDocument33 pagesRFP PDFMahindra DeshmukhNo ratings yet

- FWD: Extension To Tender: Founder/Principal EngineerDocument2 pagesFWD: Extension To Tender: Founder/Principal EngineerMahindra DeshmukhNo ratings yet

- Malegaon PDFDocument1 pageMalegaon PDFMahindra DeshmukhNo ratings yet

- Parking ECS ListDocument2 pagesParking ECS ListMahindra DeshmukhNo ratings yet

- FWD: Requesting To Extend Submission For Apointment of Agency For Operation of On-Street & Off-Street Smart Parking On Selected Locations in PCMC For Package 1 To6Document2 pagesFWD: Requesting To Extend Submission For Apointment of Agency For Operation of On-Street & Off-Street Smart Parking On Selected Locations in PCMC For Package 1 To6Mahindra DeshmukhNo ratings yet

- %of DMP Fatalities by Urban Fatalities by Collision TypesDocument2 pages%of DMP Fatalities by Urban Fatalities by Collision TypesMahindra DeshmukhNo ratings yet

- FWD: Request For Tender Submission Date Extension: Founder/Principal EngineerDocument1 pageFWD: Request For Tender Submission Date Extension: Founder/Principal EngineerMahindra DeshmukhNo ratings yet

- Annexure 6: Instructions For BoqDocument1 pageAnnexure 6: Instructions For BoqMahindra DeshmukhNo ratings yet

- FWD: PCMC Parking Tenders 1-6 Extension Request From Multiple BiddersDocument1 pageFWD: PCMC Parking Tenders 1-6 Extension Request From Multiple BiddersMahindra DeshmukhNo ratings yet

- FWD: Extension To Tender: V.bhojane@pcmcindia - Gov.inDocument2 pagesFWD: Extension To Tender: V.bhojane@pcmcindia - Gov.inMahindra DeshmukhNo ratings yet

- Degree of Saturation: Site: 101v (Nimani - Right Turn Bann)Document1 pageDegree of Saturation: Site: 101v (Nimani - Right Turn Bann)Mahindra DeshmukhNo ratings yet

- Common Set of Deviation For PCMC's On-Street & Off-Street Parking Projects (For Packages 1 To 6)Document60 pagesCommon Set of Deviation For PCMC's On-Street & Off-Street Parking Projects (For Packages 1 To 6)Mahindra DeshmukhNo ratings yet

- Package 1 AnnexureDocument51 pagesPackage 1 AnnexureMahindra DeshmukhNo ratings yet

- Common Set of Deviation For PCMC's On-Street & Off-Street Parking Projects (For Packages 1 To 6)Document60 pagesCommon Set of Deviation For PCMC's On-Street & Off-Street Parking Projects (For Packages 1 To 6)Mahindra DeshmukhNo ratings yet

- Signalized Junctions Analysis ReportDocument1 pageSignalized Junctions Analysis ReportMahindra DeshmukhNo ratings yet

- Site Layout: Site: 101v (Nimani - Right Turn Bann)Document1 pageSite Layout: Site: 101v (Nimani - Right Turn Bann)Mahindra DeshmukhNo ratings yet

- Lane Level of Service: Site: 101v (Nimani - Right Turn Bann)Document2 pagesLane Level of Service: Site: 101v (Nimani - Right Turn Bann)Mahindra DeshmukhNo ratings yet

- Delay (Control) : Site: 101v (Nimani - Right Turn Bann)Document2 pagesDelay (Control) : Site: 101v (Nimani - Right Turn Bann)Mahindra DeshmukhNo ratings yet

- Fedex TigerDocument7 pagesFedex TigerMurti Kusuma Dewi100% (1)

- Financial Statement AnalysisDocument40 pagesFinancial Statement AnalysisLu CasNo ratings yet

- Internship Report On Meezan Bank Limited Mansehra Road Branch Abbottabad (1501)Document9 pagesInternship Report On Meezan Bank Limited Mansehra Road Branch Abbottabad (1501)Faisal AwanNo ratings yet

- LAPD-TAdm-G02 - Comprehensive Guide To Advance Tax RulingsDocument64 pagesLAPD-TAdm-G02 - Comprehensive Guide To Advance Tax RulingsKriben RaoNo ratings yet

- Case: Ii: Lecturer: Mr. Shakeel BaigDocument2 pagesCase: Ii: Lecturer: Mr. Shakeel BaigKathleen De JesusNo ratings yet

- Working Capital MGTDocument68 pagesWorking Capital MGTSidd MishraNo ratings yet

- Lecture 7 - Closing EntriesDocument14 pagesLecture 7 - Closing EntriesMeer SadaqatNo ratings yet

- CIR Vs Gen FoodsDocument12 pagesCIR Vs Gen FoodsOlivia JaneNo ratings yet

- Questionnaire On Customer Perception in Ulips PlanDocument3 pagesQuestionnaire On Customer Perception in Ulips PlanKavi ArasanNo ratings yet

- Beximco PHARMACEUTICALS LTD ISDocument2 pagesBeximco PHARMACEUTICALS LTD ISSuny ChowdhuryNo ratings yet

- Intro To Business Activity 1Document2 pagesIntro To Business Activity 1Roudha AlhosaniNo ratings yet

- Solution Manual For Government and Not For Profit Accounting Concepts and Practices 5th Edition by GranofDocument13 pagesSolution Manual For Government and Not For Profit Accounting Concepts and Practices 5th Edition by Granofa658506100No ratings yet

- CIPDocument3 pagesCIPLaurence GuevarraNo ratings yet

- York, 15 Justice Frankfurter, After Referring To It As An 1, Unfortunate Remark Characterized It As "ADocument20 pagesYork, 15 Justice Frankfurter, After Referring To It As An 1, Unfortunate Remark Characterized It As "AShaiNo ratings yet

- Balnce Sheet Sam 3Document2 pagesBalnce Sheet Sam 3Samuel DebebeNo ratings yet

- CE Principles of Accounts 1998 PaperDocument8 pagesCE Principles of Accounts 1998 Paperapi-3747191No ratings yet

- Analyzing Transaction Through Source DocumentsDocument13 pagesAnalyzing Transaction Through Source Documentsnegi_hinataNo ratings yet

- Gr.1 Report Hedging Foreign CurrencyDocument54 pagesGr.1 Report Hedging Foreign CurrencyJeanette FormenteraNo ratings yet

- ch15 EquityDocument80 pagesch15 EquityAnggrainiNo ratings yet

- Vedanta ResourcesDocument6 pagesVedanta ResourcesKeokWee ChengNo ratings yet

- Apendix and CasesDocument302 pagesApendix and CaseschelintiNo ratings yet

- Motivation, Budgets and Responsibility AccountingDocument5 pagesMotivation, Budgets and Responsibility AccountingDesak Putu Kenanga PutriNo ratings yet

- Ashoka Buildcon Limited: Healthy Business Outlook StaysDocument6 pagesAshoka Buildcon Limited: Healthy Business Outlook StaysdarshanmadeNo ratings yet

- Sample Exam - Chapter 2Document11 pagesSample Exam - Chapter 2Harold Cedric Noleal OsorioNo ratings yet

- VICKY SHARMA Bio-Data 2019Document2 pagesVICKY SHARMA Bio-Data 2019Vicky SharmaNo ratings yet

- Taxation - Income TaxDocument158 pagesTaxation - Income Taxnaren197667% (6)