Professional Documents

Culture Documents

Completing The Tests in The Acquisition and Payment Cycle: Verification of Selected Accounts

Uploaded by

Angel Febiyanti0 ratings0% found this document useful (0 votes)

128 views31 pagesOriginal Title

arens_aud16_inppt19.pptx

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

128 views31 pagesCompleting The Tests in The Acquisition and Payment Cycle: Verification of Selected Accounts

Uploaded by

Angel FebiyantiCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 31

COMPLETING THE

TESTS IN THE

ACQUISITION AND

PAYMENT CYCLE:

VERIFICATION OF

SELECTED ACCOUNTS

CHAPTER 19

Copyright © 2017 Pearson Education, Ltd. 19-1

CHAPTER 19 LEARNING OBJECTIVES

19-1 Recognize the many accounts in the acquisition and

payment cycle.

19-2 Design and perform audit tests of property, plant,

and equipment

and related accounts.

19-3 Design and perform audit tests of prepaid expenses.

19-4 Design and perform audit tests of accrued liabilities.

19-5 Design and perform audit tests of income and

expense accounts.

Copyright © 2017 Pearson Education, Ltd. 19-2

OBJECTIVE 19-1

Recognize the many accounts in the

acquisition and payment cycle.

Copyright © 2017 Pearson Education, Ltd. 19-3

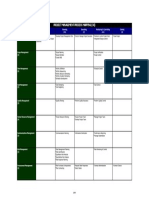

TYPES OF OTHER ACCOUNTS IN THE ACQUISITION

AND PAYMENT CYCLE

There are many accounts associated with the acquisition and

payment cycle. Some of the other key accounts are:

• Property, plant, and equipment

• Prepaid expenses

• Other liabilities

• Income and expense accounts

A comprehensive list of the accounts associated with the

acquisition and payment cycle is included in Table 19-1.

Copyright © 2017 Pearson Education, Ltd. 19-4

Copyright © 2017 Pearson Education, Ltd. 19-5

OBJECTIVE 19-2

Design and perform audit tests of

property, plant, and equipment

and related accounts.

Copyright © 2017 Pearson Education, Ltd. 19-6

AUDIT OF PROPERTY, PLANT, AND EQUIPMENT

Property, plant, and equipment are assets that have expected

lives of more than one year, are used in the business, and are

not acquired for resale.

Classifications of property, plant, and equipment are detailed

in Table 19-2.

Overview of Equipment-Related Accounts: The primary

accounting records for equipment and other property, plant,

and equipment accounts is generally a fixed asset master file.

Equipment and related accounts are illustrated in Figure

19-1.

Copyright © 2017 Pearson Education, Ltd. 19-7

Copyright © 2017 Pearson Education, Ltd. 19-8

Copyright © 2017 Pearson Education, Ltd. 19-9

AUDIT OF PROPERTY, PLANT, AND EQUIPMENT (CONT.)

In the audit of equipment and related accounts, it is helpful to

separate the tests into the following categories:

• Perform substantive analytical procedures.

• Verify current year acquisitions.

• Verify current year disposals.

• Verify the ending balance in the asset account.

• Verify depreciation expense.

• Verify the ending balance in accumulated depreciation.

Copyright © 2017 Pearson Education, Ltd. 19-10

AUDIT OF PROPERTY, PLANT, AND EQUIPMENT (CONT.)

Perform Substantive Analytical Procedures: Most are used to

assess the likelihood of material misstatement in depreciation

expense and accumulated depreciation.

These tests are presented in Table 19-3.

Verify Current Year Acquisitions: The balance-related audit

objectives and tests of details of balances for equipment additions

are presented in Table 19-4.

Copyright © 2017 Pearson Education, Ltd. 19-11

Copyright © 2017 Pearson Education, Ltd. 19-12

Copyright © 2017 Pearson Education, Ltd. 19-13

AUDIT OF PROPERTY, PLANT, AND EQUIPMENT (CONT.)

Verify Current Year Disposals: Failure to record disposals can

significantly affect the financial statements. The search for

unrecorded disposals is essential.

This search involves the following steps:

• Review whether newly acquired assets replace existing assets.

• Analyze gains and losses on the disposal of assets and miscellaneous

income for receipts from asset disposals.

• Review plant modifications and changes in product line, property taxes,

and insurance coverage for indications of deletions of equipment.

• Make inquiries of management and production personnel about

disposal of assets.

Copyright © 2017 Pearson Education, Ltd. 19-14

AUDIT OF PROPERTY, PLANT, AND EQUIPMENT (CONT.)

Verify Ending Balance of Asset Account: The auditor’s objectives when

auditing the ending balance in the equipment account are:

1. All recorded equipment physically exists on the balance sheet date

(existence).

2. All equipment owned is recorded (completeness).

Verify Depreciation Expense: The most important balance-related audit

objective for depreciation expense is accuracy. In determining accuracy, the

auditor must consider:

3. The useful life of current year acquisitions

4. The method of depreciation

5. The estimated salvage value

6. The policy of depreciating assets in the year of acquisition and disposal

Copyright © 2017 Pearson Education, Ltd. 19-15

AUDIT OF PROPERTY, PLANT, AND EQUIPMENT (CONT.)

Verify Ending Balance in Accumulated Depreciation: Debits to

accumulated depreciation are normally tested as part of the audit

of disposals of assets, whereas credits are verified as part of

depreciation expense.

Two objectives are usually emphasized in the audit of the ending

balance in accumulated depreciation:

1. Accumulated depreciation as stated in the property master file

agrees with the general ledger.

2. Accumulated depreciation in the master file is accurate.

Copyright © 2017 Pearson Education, Ltd. 19-16

OBJECTIVE 19-3

Design and perform audit tests of

prepaid expenses.

Copyright © 2017 Pearson Education, Ltd. 19-17

AUDIT OF PREPAID EXPENSES

Prepaid expenses, deferred charges, and intangibles are

assets that vary in life from several months to several years.

These include:

Prepaid insurance is found in most audits and is representative

of this group of accounts.

Overview of Prepaid Insurance: The accounts typically

used for prepaid insurance are illustrated in Figure 19-2.

Copyright © 2017 Pearson Education, Ltd. 19-18

Copyright © 2017 Pearson Education, Ltd. 19-19

AUDIT OF PREPAID INSURANCE (CONT.)

Internal Controls: This includes controls over the acquisition and

recording of insurance, controls over the insurance register, and

controls over the charge-off of insurance expense.

Audit Tests: The auditor obtains a schedule from the client that lists

for each policy in force:

• Policy information, including policy number, amount of coverage, and

annual premium

• Beginning prepaid insurance balance

• Payment of policy premiums

• Amount charged to insurance expense

• Ending prepaid insurance balance

Copyright © 2017 Pearson Education, Ltd. 19-20

AUDIT OF PREPAID INSURANCE (CONT.)

Audit Tests (cont.): Analytical procedures for prepaid insurance:

• Compare total prepaid insurance and insurance expense with previous

years.

• Compare the ratio of prepaid insurance to insurance expense and

compare it with previous years.

• Compare the individual insurance policy coverage on the schedule with

the preceding year.

• Compare the computed prepaid insurance balance for the current year

on a policy-by-policy basis with that of the preceding year.

• Review the insurance coverage listed on the schedule with an

appropriate client official or insurance broker for adequacy of coverage.

Copyright © 2017 Pearson Education, Ltd. 19-21

AUDIT OF PREPAID INSURANCE (CONT.)

Audit Tests (cont.): Tests for balance-related objectives:

Insurance policies in the prepaid insurance schedule exist and existing

policies are listed (Existence and Completeness).

The client had rights to all insurance policies in the prepaid insurance

schedule (Rights).

Prepaid amounts on the schedule are accurate and the total is correctly

added and agrees with the general ledger (Accuracy and Detail Tie-In).

The insurance expense related to prepaid insurance is correctly

classified (Classification).

Insurance transactions are recorded in the correct period (Cutoff).

Copyright © 2017 Pearson Education, Ltd. 19-22

OBJECTIVE 19-4

Design and perform audit tests of

accrued liabilities.

Copyright © 2017 Pearson Education, Ltd. 19-23

AUDIT OF ACCRUED LIABILITIES

Accrued liabilities are estimated unpaid obligations for services

or benefits that have been received before the balance sheet

date.

Common accrued liabilities include:

A second type of accrual involves estimates where the amount of

the obligation is uncertain such as warranty costs and accrued

pension benefits.

Copyright © 2017 Pearson Education, Ltd. 19-24

AUDIT OF ACCRUED LIABILITIES (CONT.)

Auditing Accrued Property Taxes: The accounts typically used by

companies for accrued property taxes are illustrated in Figure

19-3.

When verifying accrued property taxes, the two most significant

balance-related audit objectives are:

1. Existing properties for which accrual of taxes is appropriate

are on the accrual schedule (Completeness).

2. Accrued property taxes are accurately recorded and the

treatment is consistent from year to year (Accuracy).

Copyright © 2017 Pearson Education, Ltd. 19-25

Copyright © 2017 Pearson Education, Ltd. 19-26

OBJECTIVE 19-5

Design and perform audit tests of

income and expense accounts.

Copyright © 2017 Pearson Education, Ltd. 19-27

AUDIT OF INCOME AND EXPENSE ACCOUNTS

The following two concepts are essential in the audit of

income and expense accounts:

1. The matching of periodic income and expense is necessary

for a correct determination of operating results.

2. The consistent application of accounting principles for

different periods is necessary for comparability.

Approach to Auditing Income and Expense Accounts:

• Substantive analytical procedures

• Tests of controls and substantive tests of transactions

• Tests of details of account balances

Copyright © 2017 Pearson Education, Ltd. 19-28

AUDIT OF INCOME AND EXPENSE ACCOUNTS (CONT.)

Substantive Analytical Procedures: A few substantive analytical

procedures for income and expense accounts are shown in Table 19-5.

Tests of Controls and Substantive Tests of Transactions: These

simultaneously verify balance sheet and income statement accounts.

Tests of Details of Account Balances—Expense Analysis: A typical

schedule showing expense analysis for legal expenses is shown in Figure

19-4.

Tests of Details of Account Balances—Allocation: Several expense

accounts result from allocation of accounting data rather than discrete

transactions, such as depreciation, depletion, and amortization.

Copyright © 2017 Pearson Education, Ltd. 19-29

Copyright © 2017 Pearson Education, Ltd. 19-30

Copyright © 2017 Pearson Education, Ltd. 19-31

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Audit Firm Size and Quality: Does Audit Firm Size Influence Audit Quality in The Libyan Oil Industry?Document14 pagesAudit Firm Size and Quality: Does Audit Firm Size Influence Audit Quality in The Libyan Oil Industry?Zaid SoufianeNo ratings yet

- AIS BookDocument593 pagesAIS BookKlyndzu SandraNo ratings yet

- MnemonicsDocument4 pagesMnemonicsgrindmastah100% (1)

- Internal Quality Audit Rev 00Document26 pagesInternal Quality Audit Rev 00Keith AmorNo ratings yet

- Gs Operation ManualDocument324 pagesGs Operation ManualMohammad Ainuddin100% (3)

- Tsige Semachew PDFDocument57 pagesTsige Semachew PDFbelayneh bekeleNo ratings yet

- Developing Operational Review Programmes For Managerial and Audit USEDocument10 pagesDeveloping Operational Review Programmes For Managerial and Audit USElhea Shelmar Cauilan100% (1)

- Key Performance IndicatorsDocument102 pagesKey Performance IndicatorsEka Rahma Paramita100% (1)

- Sophie Return PolicyDocument9 pagesSophie Return PolicyRick Jazon TorresNo ratings yet

- Work ImmersionDocument20 pagesWork ImmersionRhaquel TeñosoNo ratings yet

- Explanation of BenefitsDocument1 pageExplanation of Benefitsmohamed hamedNo ratings yet

- Illegal Acts by Clients Statement On Auditing Standards 017Document10 pagesIllegal Acts by Clients Statement On Auditing Standards 017Christian M Nino-Moris FANo ratings yet

- Performance Measurement Framework: Public Financial ManagementDocument74 pagesPerformance Measurement Framework: Public Financial ManagementAsghar Ali RanaNo ratings yet

- List of Audit Firms Approved by ICAP 31st October 2016Document2 pagesList of Audit Firms Approved by ICAP 31st October 2016RomeelNo ratings yet

- SIP Report PDFDocument31 pagesSIP Report PDFAnushka MadanNo ratings yet

- Information Technology Control and Audit, Fifth Edition 2018Document511 pagesInformation Technology Control and Audit, Fifth Edition 2018ronNo ratings yet

- Introduction To Management AccountingDocument33 pagesIntroduction To Management Accountingsimranarora2007100% (1)

- Good Leader - Heidi MendozaDocument3 pagesGood Leader - Heidi MendozaJomar SolomonNo ratings yet

- No - CE/T&S/NSK/GAD/Depttl - Exam./2236 Date: 22.12.2009 Sub: Syllabus of All Departmental Examinations .Document19 pagesNo - CE/T&S/NSK/GAD/Depttl - Exam./2236 Date: 22.12.2009 Sub: Syllabus of All Departmental Examinations .kbl11794100% (1)

- Objectives, Role and Scope of Management Accounting: Week 1Document12 pagesObjectives, Role and Scope of Management Accounting: Week 1Aki Stephy100% (1)

- Introduction To Cost AccountingDocument21 pagesIntroduction To Cost AccountingkakaoNo ratings yet

- Iso 10011-2Document10 pagesIso 10011-2adrien_ducaillouNo ratings yet

- Chapter 9 Test BankDocument67 pagesChapter 9 Test BankDom RiveraNo ratings yet

- Project Management Process Mapping AMMDocument1 pageProject Management Process Mapping AMMprerna93No ratings yet

- How To Write A Structured Abstract (New)Document3 pagesHow To Write A Structured Abstract (New)wulanNo ratings yet

- 2015 Winter DatelineDocument24 pages2015 Winter DatelineindydentalsocietyNo ratings yet

- Introduction To Transaction ProcessingDocument78 pagesIntroduction To Transaction ProcessingNurAuniNo ratings yet

- SQL Server Security Database and OS Level AuditDocument19 pagesSQL Server Security Database and OS Level AuditKoduriLalNo ratings yet

- 1.160 ATP 2023-24 GR 11 Acc FinalDocument4 pages1.160 ATP 2023-24 GR 11 Acc FinalsiyabongaNo ratings yet

- Accounting Information Systems - CourseWork - 2023-2024Document2 pagesAccounting Information Systems - CourseWork - 2023-2024jasminekaur2023No ratings yet