Professional Documents

Culture Documents

Financial & Managerial Accounting Decision Makers: Adjusting Accounts For Financial Statements

Uploaded by

Eric GuoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial & Managerial Accounting Decision Makers: Adjusting Accounts For Financial Statements

Uploaded by

Eric GuoCopyright:

Available Formats

FINANCIAL & MANAGERIAL

ACCOUNTING

for Decision Makers 3e

DYCKMAN HANLON MAGEE PFEIFFER HARTGRAVES MORSE

CHAPTER 3

Adjusting Accounts

for Financial Statements

© Cambridge Business Publishers, 2018

Learning Objective 1

Identify the major steps

in the accounting cycle.

© Cambridge Business Publishers, 2018 2

Abbreviated Accounting Cycle

A sequence of activities to accumulate and report financial

statements

Steps in the accounting cycle

Accounting Cycle—Abbreviated

End of Accounting Period

Continuously (Monthly, Quarterly, Annually)

Steps performed daily, monthly, quarterly, or end of fiscal year;

not all at the same time

© Cambridge Business Publishers, 2018 3

Learning Objective 2

Review the process of journalizing

and posting transactions.

© Cambridge Business Publishers, 2018 4

Chart of Accounts

Lists the titles and numbers of all accounts found in the

general ledger

© Cambridge Business Publishers, 2018 5

Review of Accounting Documents

General journal

Tabular, chronological record where business activities are

captured in debits and credits

General ledger

Listing of all accounts and their balances

Accounts are grouped in five elements

Assets

Liabilities

Equity

Revenues

Expenses

© Cambridge Business Publishers, 2018 6

Journalizing and Posting

Journalize

Recording a transaction in a journal

Posting

Occurs after transactions are journalized

Debits

Record in and credits in each journal entry are transferred

Post totothe

their related general ledger accounts

Journal Ledger

© Cambridge Business Publishers, 2018 7

Record a Note Signed

1. On June 1, Jana Juice signed a 2-year note to borrow $12,000 and

agreed to pay 12% annual interest on the first

Balance Sheet

day of each month

Income Statement

with the principal

Transaction

Cash

+ due= at

Noncash the +end

Liabilities of two

Contrib.

+ years.

Earned

Revenues – Expenses = Net

Asset Asset Capital Capital Income

Signed note +12,000 = +12,000 – =

and received Cash Notes

$12,000 cash Payable

(1) Cash (+A) 12,000

Notes payable (+L) 12,000

Borrow $12,000 on a 2-year note.

Cash (A) Notes Payable (L)

(1) 12,000 12,000 (1)

© Cambridge Business Publishers, 2018 8

Record Purchase of Long-Term Assets

2. On June 1, Jana Juice purchased and installed new fixtures and

equipment for $10,200.

Balance Sheet Income Statement

Cash Noncash Contrib. Earned Net

Transaction Asset + Asset = Liabilities + Capital + Capital Revenues – Expenses = Income

Pay $10,200 cash –10,200 +10,200 = – =

for fixtures and Cash Fixtures &

equipment Equipment

(2) Fixtures & Equipment (+A) 10,200

Cash (–A) 10,200

Purchase fixtures and equipment for cash.

Fixtures & Equipment (A) Cash (A)

(2) 10,200 10,200 (2)

© Cambridge Business Publishers, 2018 9

Record Advertising Expense

3. On June 8, Jana Juice paid $800 in cash to advertise in the local

newspaper for June. Balance Sheet Income Statement

Cash Noncash Contrib. Earned Net

Transaction Asset + Asset = Liabilities + Capital + Capital Revenues – Expenses = Income

Paid $800 cash –800 = –800 – +800 = -800

for advertising Cash Retained Advertising

Earnings Expense

(3) Advertising Expense (+E, –SE) 800

Cash (–A) 800

Purchase advertising for June.

Advertising Expense (E) Cash (A)

(3) 800 800 (3)

© Cambridge Business Publishers, 2018 10

Paid Suppliers for Inventory

4. On June 10, Jana Juice paid $500 in cash to its suppliers for

inventory delivered during May.

Balance Sheet Income Statement

Cash Noncash Contrib. Earned Net

Transaction Asset + Asset = Liabilities + Capital + Capital Revenues – Expenses = Income

Paid $500 cash –500 = –500 – =

for accounts Cash Accounts

payable Payable

(4) Accounts payable (–L) 500

Cash (–A) 500

Paid $500 of accounts payable for inventory.

Accounts Payable (L) Cash (A)

(4) 500 500 (4)

© Cambridge Business Publishers, 2018 11

Purchasing Inventory

5. On June 15, Jana Juice purchased inventory on account for

$2,600. Balance Sheet Income Statement

Cash Noncash Contrib. Earned Net

Transaction Asset + Asset = Liabilities + Capital + Capital Revenues – Expenses = Income

Purchased $2,600 +2,600 = +2,600 – =

of inventory on Inventory Accounts

account Payable

(5) Inventory (+A) 2,600

Accounts payable (+L) 2,600

Purchase inventory on account.

Inventory (A) Accounts Payable (L)

(5) 2,600 2,600 (5)

© Cambridge Business Publishers, 2018 12

Record Sale of Products

6a. During June, Jana Juice sold energy drinks costing $600 to retail

customers for $3,100 cash.Sheet

Balance Income Statement

Cash Noncash Contrib. Earned Net

Transaction Asset + Asset = Liabilities + Capital + Capital Revenues – Expenses = Income

Sold $3,100 of +3,100 = +3,100 +3,100 – = +3,100

products for cash Cash Retained Sales Net

Earnings Revenue Income

(6a) Cash (+A) 3,100

Sales revenue (+R, +SE) 3,100

To record sales during June.

Cash (A) Sales Revenue (R)

(6a) 3,100 3,100 (6a)

© Cambridge Business Publishers, 2018 13

Record Cost of Sales

6b. During June, Jana Juice recorded the $600 of expense for the

sale of inventory in Transaction

Balance Sheet 5. Income Statement

Cash Noncash Contrib. Earned Net

Transaction Asset + Asset = Liabilities + Capital + Capital Revenues – Expenses = Income

Record $600 for –600 = –600 – +600 = –600

cost of inventory Inventory Retained Cost of

sold Earnings Goods Sold

(6b) Cost of goods sold (+E, SE) 600

Inventory (–A) 600

Record cost of merchandise sold as expense.

Cost of Goods Sold (E) Inventory (A)

(6b) 600 600 (6b)

© Cambridge Business Publishers, 2018 14

Sell Products on Account

7a. During June, Jana Juice sold $1,100 of energy drinks on account

for $4,400. Balance Sheet Income Statement

Cash Noncash Contrib. Earned Net

Transaction Asset + Asset = Liabilities + Capital + Capital Revenues – Expenses = Income

Sold $4,400 of +4,400 = +4,400 +4,400 – = +4,400

energy drinks on Accounts Retained Sales

account Receivable Earnings Revenue

(7a) Accounts receivable (+A) 4,400

Sales revenue (+R, +SE) 4,400

Sell products on account.

Accounts Receivable (A) Sales Revenue (R)

(7a) 4,400 4,400 (7a)

© Cambridge Business Publishers, 2018 15

Record Cost of Sales

7b. During June, Jana Juice recorded the $1,100 cost of sales for

inventory sold in Transaction

Balance Sheet7a. Income Statement

Cash Noncash Contrib. Earned Net

Transaction Asset + Asset = Liabilities + Capital + Capital Revenues – Expenses = Income

Record $1,100 for –1,100 = –1,100 – +1,100 = –1,100

cost of inventory Inventory Retained Cost of

sold Earnings Goods Sold

(7b) Cost of goods sold (+E, –SE) 1,100

Inventory (–A) 1,100

Sell products on account.

Cost of Goods Sold (E) Inventory (A)

(7b) 1,100 1,100 (7b)

© Cambridge Business Publishers, 2018 16

Sold Membership

to Online Health Program

8. During June, Jana Juice received an additional $600 from

customers in exchange for a 3-month membership

Balance Sheet

(July, August,

Income Statement

and September)

Transaction

Cash

+ to an= online

Noncash

Liabilities +health program.

Contrib.

+

Earned

Revenues – Expenses = Net

Asset Asset Capital Capital Income

Sold $600 of +600 = +600 – =

3-month online Cash Unearned

memberships Revenue

(8) Cash (+A) 600

Unearned revenue (+L) 600

Sold online memberships.

Cash (A) Unearned Revenue (L)

(8) 600 600 (8)

© Cambridge Business Publishers, 2018 17

Record Wages Paid

Balance Sheet Income Statement

9.Transaction

During June,

Cash Jana Juice paid wages

Noncash Contrib. of $1,400

Earned to employees. Net

Asset + Asset = Liabilities + Capital + Capital Revenues – Expenses = Income

Paid $1,400 for –1,400 = –1,400 – –1,400 = –1,400

wages Cash Retained Wages

Earnings Expense

(9) Wages expense (+E, –SE) 1,400

Cash (–A) 1,400

Pay wages to employees.

Wages Expense (E) Cash (A)

(9) 1,400 1,400 (9)

© Cambridge Business Publishers, 2018 18

Received Cash from Customers

10. During June, Jana Juice received $2,000 cash from customers

who purchased on credit.

Balance Sheet Income Statement

Cash Noncash Contrib. Earned Net

Transaction Asset + Asset = Liabilities + Capital + Capital Revenues – Expenses = Income

Received $2,000 +2,000 –2,000 = – =

cash from Cash Accounts

customers Receivable

(10) Cash (+A) 2,000

Accounts receivable (–A) 2,000

Received cash payments from customers on account.

Cash (A) Accounts Receivable(A)

(10) 2,000 2,000 (10)

© Cambridge Business Publishers, 2018 19

Paying Rent

11.

On June 30, Jana Juice

Cash Noncash

paid

Balance $700

Sheet in

Contrib.

rent expense

Earned

for

Income June. Net

Statement

Transaction Asset + Asset = Liabilities + Capital + Capital Revenues – Expenses = Income

Paid $700 rent for –700 = –700 – +700 = –700

June Cash Retained Rent

Earnings Expense

(11) Rent expense (+E, –SE) 700

Cash (–A) 700

Record payment of rent.

Rent Expense (E) Cash (A)

(11) 700 700 (11)

© Cambridge Business Publishers, 2018 20

Paying Dividends to Shareholders

12. On June 30, Jana Juice paid $100 in cash dividends to

Balance Sheet Income Statement

shareholders.

Transaction Cash + Noncash = Liabilities + Contrib. + Earned

Revenues – Expenses = Net

Asset Asset Capital Capital Income

Paid $100 cash –100 = –100 – =

dividends to Cash Retained

shareholders Earnings

(12) Retained earnings ( –SE) 100

Cash (–A) 100

Pay a cash dividend.

Retained Earnings (SE) Cash (A)

(12) 100 100 (12)

© Cambridge Business Publishers, 2018 21

General Ledger Before Adjustments

Cash (A) Accounts Payable (L) Common Stock (SE)

Bal. 6,460 500 Bal. 10,000 Bal.

(1) 12,000 10,200 (2) (4) 500 2,600 (5) 10,000 Bal.

(6a) 3,100 800 (3) 2,600 Bal.

(8) 600 500 (4) Retained Earnings (SE)

Equity

(10) 2,000 1,400 (9) Unearned Revenue (L) (12) 100 660 Bal.

700 (11) 300 Bal. 560 Bal.

100 (12) 600 (8)

10,460 900 Bal. Sales Revenue (R )

3,100 (6a)

Assets

Accounts Receivable (A) Note Payable (L) 4,400 (7a)

Bal. 1,700 12,000 (1) 7,500 Bal.

(7a) 4,400 2,000 (10)

Bal. 4,100 12,000 Bal. Cost of Goods Sold (E)

(6b) 600

Inventory (A) (7b) 1,100

Bal. 700

Liabilities Bal. 1,700

(5) 2,600 600 (6b)

1,100 (7b) Wages Expense (E)

Bal. 1,600 (9) 1,400

Income Statement Bal. 1,400

Prepaid Insurance (A) accounts

Bal. 800 Rent Expense (E)

Bal. 800 (11) 700

Bal. 700

Security Deposit (A)

Bal. 1,800 Advertising Expense (E)

Bal. 1,800 (3) 800

Bal. 800

Fixtures and Equipment (A)

(2) 10,200

10,200

© Cambridge Business Publishers, 2018 22

Learning Objective 3

Describe the adjusting process

and illustrate adjusting entries.

© Cambridge Business Publishers, 2018 23

The Adjusting Process

Account balances must be reviewed to determine if

adjustments are required

Caused by accrual accounting

Adjusting occurs before the financial statements are

prepared

After all regular transactions

ADJUSTINGhave been recorded and posted

ENTRIES

Almost never affect Cash, and

Usually affect at least one balance sheet and one income statement

account

© Cambridge Business Publishers, 2018 24

Unadjusted Trial Balance

First Step in Adjusting Process

What is a trial balance?

A list of all general ledger accounts with their respective

balances

Unadjusted means prior to completing the adjusting

entries

Purpose

To be sure the general ledger is in balance before adjusting

the accounts

Listing all accounts in one place eases the review of

accounts in determining which need adjustment

© Cambridge Business Publishers, 2018 25

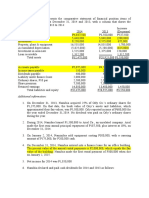

Preparing an Unadjusted Trial Balance

Jana Juice

Unadjusted Trial Balance

30-June-16

Debit Credit

Cash $10,460

Accounts Receivable 4,100 Accounts must be listed

Inventory 1,600

in accounting equation

Prepaid Insurance 800

Security Deposit 1,800 order.

Fixtures and Equipment 10,200

Accounts Payable $ 2,600

1. Assets

Unearned Revenue 900 2. Liabilities

Long-term Notes Payable 12,000

Common Stock 10,000 3. Equities

Retained Earnings 560

4. Revenues

Sales Revenue 7,500

Cost of Goods Sold 1,700 5. Expenses

Wages Expense 1,400

Rent Expense 700

Advertising Expense 800 The totals of debits and

Totals $33,560 $33,560

credits must be equal.

© Cambridge Business Publishers, 2018 26

Types of Adjustments

Deferrals Accruals

Deals with an amount

Deals with an amount

NOT previously recorded

previously recorded in a

in a balance sheet

balance sheet account

account

Decreases a balance sheet

Increases both a balance

account and increases an

income statement account sheet account and an

income statement account

Both types allow a period’s revenues and expenses

to be measured properly.

© Cambridge Business Publishers, 2018 27

Four Types of Adjustments

© Cambridge Business Publishers, 2018 28

Deferred Revenue

The process of allocating unearned revenue to revenue

Amounts received in advance are recorded as liabilities

Because an obligation exists to provide future services or

assets (such as inventory or a refund of cash)

Situations requiring adjusting entries:

Prepaid property casualty insurance is earned over time

Subscriptions to newspaper and magazines received in

advance are earned

© Cambridge Business Publishers, 2018 29

Allocating Unearned Revenue to Revenue

— Example —

a. In May, customers prepaid $300 for a 3-month membership

(June, July, August) to an online health program.

Balance Sheet

One month of

Income Statement

this prepaid

Transaction

Cash membership

+

Noncash was

= Liabilities + earned

Contrib.

+ in June.

Earned

Revenues – Expenses = Net

Asset Asset Capital Capital Income

Adjust to recognize = –100 +100 +100 – = +100

earned revenue Unearned Retained Sales

from online Revenue Earnings Revenue

memberships

(a) Unearned revenue (–L) 100

Sales revenue (+R, +SE) 100

To record earned membership revenue.

Unearned Revenue (L) Sales Revenue (R)

(a) 100 100 (a)

© Cambridge Business Publishers, 2018 30

Prepaid Expenses

The process of allocating prepaid assets to expenses

Amounts paid in advance of using assets that benefit

more than one period

Situations requiring adjusting entries

Equipment, buildings, or vehicles become used up over time

Prepayment of advertising, insurance, or rent becomes used

up over time

Supplies are used over time

Purchased intangibles may be used over time

© Cambridge Business Publishers, 2018 31

Allocating Assets to Expenses

— Example: Prepaid Insurance —

b. One month of Jana Juice’s insurance expired during June. The

original payment wasBalance$800Sheet covering June through

September

Income Statement

($800 / 4Cash

Transaction months

+ = $200).

Noncash

= Liabilities +

Contrib.

+

Earned

Revenues – Expenses = Net

Asset Asset Capital Capital Income

Adjust for –200 = –200 – +200 = –200

expiration of one Prepaid Retained Insurance

month of Insurance Earnings Expense

insurance

(b) Insurance expense (+E, –SE) 200

Prepaid insurance (–A) 200

To record insurance expense for June.

Insurance Expense (E) Prepaid Insurance (A)

(b) 200 200 (b)

© Cambridge Business Publishers, 2018 32

Depreciation

The process of allocating equipment, buildings, and

vehicles to expenses

The asset cost must be allocated to accounting periods

that the cost benefits

Annual straight-line depreciation

Asset cost

Annual depreciation expense =

Estimated useful life

Accumulated depreciation

Special account used instead of reducing the asset account

directly

Considered a contra asset account

© Cambridge Business Publishers, 2018 33

Allocating Assets to Expenses

— Example: Depreciation —

c. Jana Juice’s equipment

Depreciation originally

expense = $10,200cost $10,200

÷ 5 years and

× 1/12 was expected

= $170

to benefit the company for five years.

Balance Sheet Income Statement

Cash Noncash Contra Contrib. Earned Net

Transaction + - = Liabilities + + Revenues – Expenses =

Asset Asset Asset Capital Capital Income

Adjust for +170 ‒170 +170 ‒170

depreciation – Accumulated = Retained – Depreciation =

on fixtures & Depreciation Earnings Expense

equipment

(c) Depreciation expense ―fixtures & equipment (+E, –SE) 170

Accumulated depreciation―fixtures & equipment (+XA, –A) 170

To record depreciation expense for June.

Depreciation Expense Accumulated Depreciation

Fixtures & Equipment (E) Fixtures & Equipment (XA)

(c) 170 170 (c)

© Cambridge Business Publishers, 2018 34

Depreciation and Related Assets

on the Balance Sheet

Book Value of Long-term Assets at June 30, 2016

Fixtures and Equipment $10,200

Less: Accumulated depreciation 170

Fixtures and Equipment, net $10,030

Net book value of assets

Portion of the equipment’s cost that has been

allocated to expense since acquired

Accumulated depreciation increases and the net book

value declines over the life of the equipment.

© Cambridge Business Publishers, 2018 35

Accrued Revenues

The process of recognizing amounts

earned before the cash is received.

Amounts earned from providing services or selling

products must be recognized in the period earned

Creates an increase in an asset and an increase in

revenues

Examples requiring adjusting entries

Completed services or delivered goods that, for any number

of reasons, have not been billed to customers

A company earned interest revenue from the bank on its

checking account and had not yet recorded it

© Cambridge Business Publishers, 2018 36

Accruing Revenues

— Example —

d. At the end of June, Jana Juice learned that its bank has decided

to provide interest on checking accounts for small businesses.

The interest is paid into the checking account on the 5th day of

the following month.Balance

JanaSheet

Juice earned $60 interest

Income in June.

Statement

Cash + Noncash = Liabilities + Contrib. + Earned Revenues – Expenses = Net

Capital

Transaction

Asset Asset Capital Income

Adjust for +60 = +60 +60 – = +60

interest income Interest Retained Interest

earned Receivable Earnings Income

(d) Interest receivable (+A) 60

Interest income (+R, +SE) 60

To record accrued interest income.

Interest Receivable (A) Interest Income (R)

(d) 60 60 (d)

© Cambridge Business Publishers, 2018 37

Accruing Expenses

The process of recognizing expenses

before the cash is paid.

Examples requiring adjusting entries

Utility bill received in the mail for the month just completed

Employees earned wages before the month ended, to be

paid in the following month

Amounts borrowed from a bank have interest that is not due

until the note is paid off

Income taxes are paid quarterly and the company earned a

profit during the first month of the quarter

© Cambridge Business Publishers, 2018 38

Accruing Expenses

— Example: Wages —

e. Jana Juice’s employees earned $550 during the last week of

Balance Sheet Income Statement

June thatCash

will be paid

Noncash

on July 6.

Contrib. Earned Net

Capital

Transaction + = Liabilities + + Revenues – Expenses =

Asset Asset Capital Income

Adjust for accrued = +550 -550 – +550 = -550

wages expense Wages Retained Wages

Payable Earnings Expense

(e) Wages expense (+E, –SE) 550

Wages payable (+L) 550

To record accrued wages earned for the last week of June.

Wages Expense (E) Wages Payable (L)

(e) 550 550 (e)

© Cambridge Business Publishers, 2018 39

Accruing Expenses

— Example: Interest —

f. The $12,000 loanexpense

Interest borrowed by Jana

= $12,000 Juice

× 12% on =June

x 1/12 $1201 carries a

12% annual interest rate.

Balance Sheet Income Statement

Cash Noncash Contrib. Earned Net

Transaction Asset + Asset = Liabilities + Capital + Capital Revenues – Expenses = Income

Adjusting entry = +120 -120 – +120 = -120

to record Interest Retained Interest

interest owed Payable Earnings Expense

not yet paid

(f) Interest expense (+E, –SE) 120

Interest payable (+L) 120

To record accrued wages earned for the last week of June.

Interest Expense (E) Interest Payable (L)

(f) 120 120 (f)

© Cambridge Business Publishers, 2018 40

Calculating Income Before Taxes

Revenue and expense account balances prior to

accruing

income taxes:

Sales Revenue (R ) Cost of Goods Sold (E) Wages Expense (E)

7,500 Bal. Bal. 1,700 Bal. 1,400

100 (a) (e) 550

7,600 Adj.Bal Adj. Bal 1,700 Adj.Bal 1,950

Rent Expense (E) Advertising Expense (E) Insurance Expense (E)

Bal. 700 Bal. 800 (b) 200

Adj.Bal 700 Adj. Bal 800 Adj.Bal 200

Depreciation Expense (E) Interest Income (R) Interest Expense (E)

(c) 170 60 (d) (f) 120

Adj.Bal 170 60 Adj. Bal Adj. Bal 120

Income before taxes:

$7,600 ‒ $1,700 ‒ $1,950 ‒ $700 ‒ $800 ‒ $200 ‒ $170 + 60 ‒ $120 =

$2,020

© Cambridge Business Publishers, 2018 41

Calculating Income Tax Expense

To determine income tax expense:

Step 1: Journalize all adjusting entries (except for

income taxes) and post to T-accounts.

Income before taxes = $2,020

Step 2: Calculate income

From the revenue before

and expense taxes(on

T-accounts based on the

the previous slide):

balances of the revenue and expense accounts.

Step 3: Multiply income before taxes by the income tax

rate, in this case, 30%:

$2,020 × 30%* = $606 *Assumed tax rate

Net income = $2,020 - $606 = $1,414

© Cambridge Business Publishers, 2018 42

Accruing Expenses

— Example: Income Taxes —

g. Income taxes are paid during the month after accrual, and have

Balance Sheet Income Statement

not

Transaction

been paid

Cash +

for June.

Noncash = Liabilities + Contrib. + Earned

Revenues – Expenses = Net

Asset Asset Capital Capital Income

Adjust for taxes = +606 -606 – +606 = -606

owed but not yet Income Tax Retained Income Tax

paid Payable Earnings Expense

(g) Income tax expense (+E, –SE) 606

Income tax payable (+L) 606

To record estimated income tax for the month of June.

Income Tax Expense (E) Income Tax Payable (L)

(g) 606 606 (g)

© Cambridge Business Publishers, 2018 43

Summary of Adjustments

© Cambridge Business Publishers, 2018 44

Ethics and Adjusting Entries

Adjusting entries are dependent upon estimates.

Management’s estimates are affected by corporate

pressures.

Desire to meet analysts expectations

Desire to disguise a planned course of action

Controls are imposed by the financial reporting

environment.

© Cambridge Business Publishers, 2018 45

Learning Objective 4

Prepare financial statements

from adjusted accounts.

© Cambridge Business Publishers, 2018 46

Preparing an Adjusted Trial Balance

Unadjusted Balances Adjustments Adjusted Trial Balance

Debit Credit Debit Credit Debit Credit

Cash 10,460 10,460

Accounts Receivable 4,100 4,100

Inventory 1,600 1,600

Prepaid Insurance 800 (b) 200 600 Lists all ledger

Interest Receivable (d) 60 60

Security Deposit 1,800 1,800

balances after

Fixtures and Equipment

Accum. Depr - Fixt. & equip.

10,200

( c) 170

10,200

170

adjustments

Accounts Payable 2,600 2,600

Unearned Revenue 900 (a) 100 800 Prepared from

Wages Payable (e) 550 550

Interest Payable (f) 120 120

the balances

Income Tax Payable

Long-Term Notes Payable 12,000

(g) 606 606

12,000

in the general

Common Stock 10,000 10,000 ledger accounts

Retained Earnings 560 560

Sales Revenue 7,500 (a) 100 7,600

Interest Income (d) 60 60

Cost of Goods Sold 1,700 1,700

Wages Expense 1,400 (e) 550 1,950

Rent Expense 700 700 T-Accounts

Advertising Expense 800 800

Insurance Expense (b) 200 200 supporting the

Depreciation Expense ( c) 170 170 balances are

Interest Expense (f) 120 120

Income Tax Expense (g) 606 606

found on the

Totals $33,560 $33,560 $1,806 $1,806 $35,066 $35,066 next three slides.

© Cambridge Business Publishers, 2018 47

Summary of T-Accounts

Cash (A) Inventory (A)

Bal. 700 600 (6b)

Bal. 6,460 (5) 2,600 1,100 (7b)

(1) 12,000 10,200 (2) Adj. Bal. 1,600

(6a) 3,100 800 (3)

Security Deposit (A)

(8) 600 500 (4) Bal. 1,800

(10) 2,000 1,400 (9) Adj. Bal. 1,800

Assets

700 (11)

Fixtures and Equipment (A)

100 (12) (2) 10,200

Adj Bal 10,460 Adj. Bal. 10,200

Accumulated Depreciation (XA)

Accounts Receivable (A) 170 (c)

Bal. 4,100 170 Adj. Bal.

Adj.Bal. 4,100

Interest Receivable (A)

(d) 60

Prepaid Insurance (A) Adj. Bal. 60

Bal. 800 200 (b)

Adj. Bal. 600

© Cambridge Business Publishers, 2018 48

Summary of T-Accounts

Accounts Payable (L) Income Tax Payable (L)

(4) 500 500 Bal. 606 (g)

2,600 (5) 606 Adj. Bal.

2,600 Adj.Bal.

Notes Payable (L)

Unearned Revenue (L) 12,000 (1)

300 Bal.

Liabilities

(a) 100and Equities

600 (8)

12,000 Adj. Bal.

800 Adj.Bal. Common Stock (SE)

10,000 Bal.

Wages Payable (L) 10,000 Adj. Bal.

550 (e)

550 Adj.Bal. Retained Earnings (SE)

(12) 100 660 Bal.

Interest Payable (L) 560

120 (f)

120 Adj. Bal.

© Cambridge Business Publishers, 2018 49

Summary of T-Accounts

Sales Revenue (R) Wages Expense (E)

7,500 Bal. 1,400

100 (a) (e) 550

7,600 Adj. Bal. Adj. Bal. 1,950

Rent Expense (E) Advertising Expense (E)

Bal. 700 Bal. 800

Adj. Bal. 700 Adj. Bal. 800

Revenues and Expenses Insurance Expense (E)

Depreciation Expense (E)

(c) 170 (b) 200

Adj. Bal. 170 Adj. Bal. 200

Cost of Goods Sold (E) Interest Expense (E)

Bal. 1,700 (f) 120

Adj. Bal. 1,700 Adj. Bal. 120

Interest Income (R) Income Tax Expense (E)

60 (d) (g) 606

60 Adj. Bal. Adj. Bal. 606

© Cambridge Business Publishers, 2018 50

Preparing Financial Statements

© Cambridge Business Publishers, 2018 51

Income Statement

Jana Juice

Income Statement

For Month Ended June 30, 2016

Revenues

Sales revenue $7,600.

Expenses

Cost of goods sold $1,700

The income statement is prepared first.

Wages expense

Rent expense

1,950

700

Advertising expense 800

Insurance expense 200

Depreciation expense 170

Operating expenses 5,520.

Income from operations 2,080.

Interest expense (120) Jana Juice reported

Interest income 60. net income of $1,414

Income before taxes 2,020.

Income tax expense 606.

for the month ending

Net income $1,414. June 30, 2016.

© Cambridge Business Publishers, 2018 52

Statement of Stockholders’ Equity

Contributed Earned Total

Capital Capital Equity

Balance, June 1, 2016 $10,000 $ 660. $10,660.

The amount of net income from the

Net income income statement

1,414. 1,414.

isCommon

linked toissued

stock the statement of stockholders’ equity.

―.

Cash dividends (100) (100)

Balance, June 30, 2016 $10,000 $1,974. $11,974.

© Cambridge Business Publishers, 2018 53

Balance Sheet

Jana Juice

Balance Sheet

June 30, 2016

Assets Liabilities

Cash $10,460 Accounts payable $ 2,600

The amount of retained earnings from the statement

Accounts receivable

Interest receivable

4,100

60

Unearned revenue

Wages payable

800

550

of stockholders’ equity is linked to the balance sheet.

Inventory 1,600 Interest payable 120

Prepaid insurance 600 Income tax payable 606

Security deposit 1,800 Current liabilities 4,676

Current assets 18,620 Notes payable 12,000

Fixtures and equipment $10,200 Total liabilities 16,676

Less: Accum. depreciation― Fixtures

& equipment (170) Equity

Equipment, net 10,030 Common stock 10,000

Total assets $28,650 Retained earnings 1,974

Total liabilities & equity $28,650

© Cambridge Business Publishers, 2018 54

Statement of Cash Flows

Cash flows from operating activities

Cash flows

Cash from are reported

the company’s in three

transactions primary

and events business

that relate to

primary operations

activities:

Cash flows from investing activities

Cash from the acquisitions and divestitures of investments and

long-term assets

Cash flows from financing activities

Cash from issuances of and payments toward equity, borrowings,

and long-term debt

© Cambridge Business Publishers, 2018 55

Statement of Cash Flows

Jana Juice

Statement of Cash Flows

For Month Ended June 30, 2016

Cash Flows from Operating Activities

Cash received from customers $ 5,700.

Cash paid for inventory (500)

Cash paid for wages (1,400)

Cash paid for rent (700)

Cash paid for advertising (800)

Net cash provided by operating activities 2,300.

Cash Flows from Investing Activities

Cash paid for fixtures and equipment (10,200)

Net cash used by investing activities (10,200)

Cash Flows from Financing Activities

Cash received from loans 12,000. The amount of

Cash paid for dividends (100)

Net cash provided by financing activities 11,900. cash at June 30

Net change in cash 4,000. is linked to the

Cash balance, June 1, 2016 6,460.

Cash balance, June 30, 2016 $ 10,460.

balance sheet.

© Cambridge Business Publishers, 2018 56

Learning Objective 5

Describe the process of closing

temporary accounts.

© Cambridge Business Publishers, 2018 57

Closing Temporary Accounts

Closing process

Occurs at the end of the accounting period

Balances in temporary accounts are transferred to

permanently update Retained Earnings.

© Cambridge Business Publishers, 2018 58

Closing Temporary Accounts

Two transactions to close temporary accounts:

1. Close revenue accounts

Debit each revenue account for an amount equal to its balance,

and credit Retained Earnings for the total of revenues.

2. Close expense accounts

Credit each expense account for an amount equal to its

balance, and debit Retained Earnings for the total of expenses.

© Cambridge Business Publishers, 2018 59

Closing Process

Individual Expenses Individual Revenues

Credit to Close Debit to Close

2 Retained Earnings

1

Close expenses Close revenues

to to

Retained Earnings Retained Earnings

Retained earnings is a permanent account reported on the balance sheet.

© Cambridge Business Publishers, 2018 60

Closing Jana Juice’s Accounts

June 30 Sales revenue (–R) 7,600 Sales Revenue (R )

Interest income (-R) 60 7,600 7,600 Adj.Bal

Retained earnings (+SE) 7,660 Interest Income (R )

60 60 Adj.Bal

June 30 Retained earnings (–SE) 6,246

Cost of Goods Sold (E)

Cost of goods sold (–E) 1,700 Adj.Bal 1,700 1,700

Wages expense (–E) 1,950

Rent expense (–E) 700 Wages Expense (E)

Advertising expense (–E) 800 Adj.Bal 1,950 1,950

Insurance expense (–E) 200

Depreciation expense (–E) 170 Rent Expense (E)

Adj.Bal 700 700

Interest expense (–E) 120

Income tax expense (–E) 606

Advertising Expense (E)

Adj.Bal 800 800

Interest Expense (E) Retained Earnings (SE)

Adj.Bal 120 120 Insurance Expense (E)

(12) 100 660 Beg.Bal Adj.Bal 200 200

Income Tax Expense (E) 6,246 7,660

Adj.Bal 606 606 1,974 Depreciation Expense (E)

Adj.Bal 170 170

© Cambridge Business Publishers, 2018 61

Preparing a Post-Closing Trial Balance

Jana Juice

Post-Closing Trial Balance

June 30, 2016

Debit Credit

Prepared

Cash after

Accounts Receivable

the closing

$10,460 process

4,100

Inventory 1,600 All temporary accounts

Prepaid Insurance 600

Interest Receivable 60 have zero balances

Security Deposit 1,800

Fixtures and Equipment 10,200 Contains only

Accum. Depreciation-Fixtures & equip. $ 170

Accounts Payable 2,600

balance sheet

Unearned Revenue 800 (permanent) accounts

Wages Payable 550

Interest Payable 120

Income Tax Payable 606

Notes Payable 12,000

Common Stock 10,000

Retained Earnings 1,974

Totals $28,820 $28,820

© Cambridge Business Publishers, 2018 62

Summarizing the Accounting Cycle

Accounting Cycle

Occurs each fiscal year (period)

Represents a systematic process for accumulating and

reporting a company’s financial data

© Cambridge Business Publishers, 2018 63

Learning Objective 6

Analyze changes in

balance sheet accounts.

© Cambridge Business Publishers, 2018 64

Using Information on Levels and Flows

Levels

Portrayed on the balance sheet as levels of resources and

claims to those resources

Point in time

Flows

Portrayed on the income statement as changes in the levels

of resources

Period of time

© Cambridge Business Publishers, 2018 65

Using Information on Levels and Flows

Suppose a service business has an inventory of office supplies:

On July 1, an inventory count determines $2,400 of supplies on hand.

During the third quarter, office supplies costing $5,700 were purchased and

received.

On Sept 30, an inventory count determines $1,900 of supplies on hand.

What amount of supplies expense should be recognized for the

quarter?

6,200

6,200

6,200

© Cambridge Business Publishers, 2018 66

The End

You might also like

- Oct. 31 CineworldDocument96 pagesOct. 31 CineworldTHROnlineNo ratings yet

- Journal Entry ExampleDocument52 pagesJournal Entry Examplesriram998983% (6)

- Fundamentals of Accounting 2 Draft PDFDocument123 pagesFundamentals of Accounting 2 Draft PDFCzaeshel Edades100% (5)

- Additional InformationDocument6 pagesAdditional InformationBabylyn NavarroNo ratings yet

- Sales Questions GroupDocument8 pagesSales Questions GroupJymldy Encln100% (1)

- 35 Basic Accounting Test QuestionsDocument9 pages35 Basic Accounting Test QuestionsDenny OctavianoNo ratings yet

- Eh 401 SG Mod 4 Complete Oblicon Rev TransDocument45 pagesEh 401 SG Mod 4 Complete Oblicon Rev TransEfrean BianesNo ratings yet

- Chap 002Document41 pagesChap 002Kevin ChanNo ratings yet

- Chapter 12 ReviewDocument14 pagesChapter 12 ReviewDonna Mae HernandezNo ratings yet

- Chapter 2 AccountingDocument12 pagesChapter 2 Accountingmoon loverNo ratings yet

- Exercises P Class2-2022Document9 pagesExercises P Class2-2022Angel MéndezNo ratings yet

- Excercise Sheet Lectures 1 and 2 Spring 2022Document16 pagesExcercise Sheet Lectures 1 and 2 Spring 2022Mohamed ZaitoonNo ratings yet

- Chapter 12 Review Updated 11th EdDocument13 pagesChapter 12 Review Updated 11th Edangelsalvador05082006No ratings yet

- SOAL AkuntansiDocument13 pagesSOAL AkuntansiArum MashitoNo ratings yet

- Recording Business TransactionsDocument36 pagesRecording Business Transactionsnorman.washington378100% (10)

- ACC113 - Chapter 16Document20 pagesACC113 - Chapter 16Zeba LubabaNo ratings yet

- Examples of Journal EntriesDocument7 pagesExamples of Journal Entriesnaimdelhi100% (1)

- Solutions Totutorial 1-Fall 2022Document8 pagesSolutions Totutorial 1-Fall 2022chtiouirayyenNo ratings yet

- Accounting Tutorials Day 1Document8 pagesAccounting Tutorials Day 1Richboy Jude VillenaNo ratings yet

- Week 9 - Chapter 8Document60 pagesWeek 9 - Chapter 8Dre ThathipNo ratings yet

- Understanding Financial Statements: Student - Feedback@sti - EduDocument6 pagesUnderstanding Financial Statements: Student - Feedback@sti - Eduvince mendozaNo ratings yet

- The Balance Sheet and Profit and Loss StatementDocument28 pagesThe Balance Sheet and Profit and Loss StatementNguyễn DũngNo ratings yet

- Basic Financial StatementsDocument20 pagesBasic Financial StatementsRumel DeyNo ratings yet

- Financial Accounting Week 2Document5 pagesFinancial Accounting Week 2Siva PraveenNo ratings yet

- Lecture 1 - Revision - Accrual Accounting ConceptsDocument46 pagesLecture 1 - Revision - Accrual Accounting ConceptsMuzzamil YounusNo ratings yet

- Acctg ConstantinoDocument6 pagesAcctg ConstantinoKyla Lyn OclaritNo ratings yet

- Fundamental Accounting Principles By: Wild Larson ChiappettaDocument25 pagesFundamental Accounting Principles By: Wild Larson ChiappettaMuseera IffatNo ratings yet

- Camtasia Comprehensive Review Problem 4-1Document30 pagesCamtasia Comprehensive Review Problem 4-1AC ConNo ratings yet

- Chapter 1 Problems and Solutions EnglishDocument6 pagesChapter 1 Problems and Solutions EnglishyandaveNo ratings yet

- What Is Accounting?: Is A Process of Three Activities: Identifying Recording CommunicatingDocument41 pagesWhat Is Accounting?: Is A Process of Three Activities: Identifying Recording CommunicatingMd. Haseeb KhanNo ratings yet

- Mock Midterm Exam - Financial AccountingDocument3 pagesMock Midterm Exam - Financial Accountinglamvolamvo0912No ratings yet

- Cashflow StatementDocument40 pagesCashflow StatementJUAN ANTONIO CERON CRUZNo ratings yet

- 2nd Summative TestDocument2 pages2nd Summative Testje-ann montejoNo ratings yet

- Book 1Document11 pagesBook 1Marc VelasquezNo ratings yet

- 2-Balance Sheet PDFDocument44 pages2-Balance Sheet PDFDiane ApostolNo ratings yet

- Topic: Financial Management: Juan CerónDocument25 pagesTopic: Financial Management: Juan CerónJUAN ANTONIO CERON CRUZNo ratings yet

- BBAW2103 Tutorial 1-2Document69 pagesBBAW2103 Tutorial 1-2haniffNo ratings yet

- Xid-47772944 1Document25 pagesXid-47772944 1Chung AliciaNo ratings yet

- Review Questions Financial Accounting 1 StudentsDocument5 pagesReview Questions Financial Accounting 1 StudentsNancy VõNo ratings yet

- CH 02Document5 pagesCH 02Tien Thanh Dang0% (1)

- ACC101 Chapter1newDocument16 pagesACC101 Chapter1newtazebachew birkuNo ratings yet

- Topic 1 - The Accounting EquationDocument10 pagesTopic 1 - The Accounting Equationgabriellemorgan714No ratings yet

- Тasks for individual workDocument7 pagesТasks for individual workДарина БережнаяNo ratings yet

- Chapter 2Document47 pagesChapter 2Kei HanzuNo ratings yet

- Exercises AccountingTransactionsDocument4 pagesExercises AccountingTransactionsRuneet Kaur AroraBD21036No ratings yet

- Financial Accounting Cash Flow ActivityDocument2 pagesFinancial Accounting Cash Flow ActivityAshantee TabannorNo ratings yet

- Solutions To Exercises P Class2-2022Document7 pagesSolutions To Exercises P Class2-2022Angel MéndezNo ratings yet

- ACCY901 Accounting Foundations For Professionals: Topic 3 Accrual Accounting and Adjusting EntriesDocument35 pagesACCY901 Accounting Foundations For Professionals: Topic 3 Accrual Accounting and Adjusting Entriesvenkatachalam radhakrishnan100% (1)

- Business Transactions and Their Analysis As Applied To Service BusinessDocument57 pagesBusiness Transactions and Their Analysis As Applied To Service BusinessRhona Primne ServañezNo ratings yet

- Brief Exercises PDFDocument6 pagesBrief Exercises PDFRamzan AliNo ratings yet

- Chapter 2 - The Accounting Cycle: During The Period: Click On LinksDocument24 pagesChapter 2 - The Accounting Cycle: During The Period: Click On LinksABDULLAH ALSHEHRINo ratings yet

- ACT103 - Topic 2Document9 pagesACT103 - Topic 2Juan FrivaldoNo ratings yet

- Accounting MidtermDocument14 pagesAccounting Midtermazade azamiNo ratings yet

- 1 Accounting Equation UniqueDocument3 pages1 Accounting Equation UniqueSohan AgrawalNo ratings yet

- Accounting IDocument18 pagesAccounting IMohammed mostafaNo ratings yet

- AssessmentDocument20 pagesAssessmentJenecil JavierNo ratings yet

- Chapter 2Document15 pagesChapter 2emanmamdouh596No ratings yet

- Exam Revision - 3 & 4 SolDocument6 pagesExam Revision - 3 & 4 SolNguyễn Minh ĐứcNo ratings yet

- Exam Revision - Chapter 3 4Document6 pagesExam Revision - Chapter 3 4Vũ Thị NgoanNo ratings yet

- CH 2 Accounting 2Document45 pagesCH 2 Accounting 2EmadNo ratings yet

- Lecture 04 PRE-Lecture SlidesDocument31 pagesLecture 04 PRE-Lecture SlidesChan YiEnNo ratings yet

- Principles of Accounting 5th Edition Smart Solutions ManualDocument9 pagesPrinciples of Accounting 5th Edition Smart Solutions Manualspaidvulcano8wlriz100% (19)

- Principles of Accounting Second Year, Semester 1Document38 pagesPrinciples of Accounting Second Year, Semester 1Sara Abdelrahim MakkawiNo ratings yet

- This Study Resource Was: A. B. C. D. E. F. G. H. I. J. K. LDocument4 pagesThis Study Resource Was: A. B. C. D. E. F. G. H. I. J. K. LRian RorresNo ratings yet

- Zhangyanbo142 5Document3 pagesZhangyanbo142 5Eric GuoNo ratings yet

- Financial & Managerial Accounting Decision Makers: Reporting and Analyzing Cash FlowsDocument62 pagesFinancial & Managerial Accounting Decision Makers: Reporting and Analyzing Cash FlowsEric GuoNo ratings yet

- Financial & Managerial Accounting Decision MakersDocument85 pagesFinancial & Managerial Accounting Decision MakersEric GuoNo ratings yet

- Financial & Managerial Accounting Decision Makers: Analyzing and Interpreting Financial StatementsDocument65 pagesFinancial & Managerial Accounting Decision Makers: Analyzing and Interpreting Financial StatementsEric GuoNo ratings yet

- Financial & Managerial Accounting Decision Makers: Reporting and Analyzing Cash FlowsDocument62 pagesFinancial & Managerial Accounting Decision Makers: Reporting and Analyzing Cash FlowsEric GuoNo ratings yet

- Financial & Managerial Accounting Decision MakersDocument57 pagesFinancial & Managerial Accounting Decision MakersEric Guo100% (1)

- Financial & Managerial Accounting Decision Makers: Adjusting Accounts For Financial StatementsDocument67 pagesFinancial & Managerial Accounting Decision Makers: Adjusting Accounts For Financial StatementsEric GuoNo ratings yet

- Financial & Managerial Accounting Decision Makers: Analyzing and Interpreting Financial StatementsDocument65 pagesFinancial & Managerial Accounting Decision Makers: Analyzing and Interpreting Financial StatementsEric GuoNo ratings yet

- Financial & Managerial Accounting Decision MakersDocument85 pagesFinancial & Managerial Accounting Decision MakersEric GuoNo ratings yet

- Financial & Managerial Accounting Decision MakersDocument57 pagesFinancial & Managerial Accounting Decision MakersEric Guo100% (1)

- Class 1 Introduction To Statistics For BlackboardDocument33 pagesClass 1 Introduction To Statistics For BlackboardEric GuoNo ratings yet

- Public DebtDocument3 pagesPublic DebtMohamed AzmyNo ratings yet

- UntitledDocument13 pagesUntitledShubham KumarNo ratings yet

- The Doctrine of Lifting The Corporate VeilDocument17 pagesThe Doctrine of Lifting The Corporate VeilUday singh cheemaNo ratings yet

- SBI eDFS UndertakingDocument3 pagesSBI eDFS UndertakingVikram SinghNo ratings yet

- V. Guaranty A. Arts. 2047 To 2081, Civil CodeDocument12 pagesV. Guaranty A. Arts. 2047 To 2081, Civil CodeMunchie MichieNo ratings yet

- Mas - MB (2013)Document13 pagesMas - MB (2013)AzureBlazeNo ratings yet

- My Property II OutlineDocument31 pagesMy Property II OutlineBilly Alvarenga GuzmanNo ratings yet

- Mathematics: Pre-Leaving Certificate Examination, 2015 Triailscrúdú Na Hardteistiméireachta, 2015Document24 pagesMathematics: Pre-Leaving Certificate Examination, 2015 Triailscrúdú Na Hardteistiméireachta, 2015Cameron LooneyNo ratings yet

- Sevice Entity Module - 695420894Document95 pagesSevice Entity Module - 695420894Kent Justine AbegoniaNo ratings yet

- Accountancy (055) Set 67-3-1,2,3 Marking Scheme 2020Document89 pagesAccountancy (055) Set 67-3-1,2,3 Marking Scheme 2020Mrityunjay KumarNo ratings yet

- Rules of Debit and CreditDocument4 pagesRules of Debit and CreditKen DiNo ratings yet

- Banking and Insurance Law NotesDocument164 pagesBanking and Insurance Law NotesFaisal KhanNo ratings yet

- Capital Market-Md SameerDocument50 pagesCapital Market-Md Sameeraurorashiva1No ratings yet

- Ch2 + 5 ExercisesDocument9 pagesCh2 + 5 ExercisesMunira AlfaizNo ratings yet

- Civil Law Review 2 - Quiz AnnaDocument2 pagesCivil Law Review 2 - Quiz AnnaErwin April MidsapakNo ratings yet

- LIberty Power Tech - RR - 74 - 10861 - 10-Nov-22Document5 pagesLIberty Power Tech - RR - 74 - 10861 - 10-Nov-22Kristian MacariolaNo ratings yet

- Cap. 2 Accounting Fundamentals ReviewDocument36 pagesCap. 2 Accounting Fundamentals Reviewdianelys alejandroNo ratings yet

- Far 4104Document8 pagesFar 4104Alrahjie AnsariNo ratings yet

- Income Deemed To Be Accrue or Arise in India Interest, Royalty, FTSDocument13 pagesIncome Deemed To Be Accrue or Arise in India Interest, Royalty, FTSVicky DNo ratings yet

- MARIA M Case Study03..Document3 pagesMARIA M Case Study03..Charrie Faye Magbitang HernandezNo ratings yet

- CmregionsstatementDocument1 pageCmregionsstatementDae MacNo ratings yet

- WSJ 0107Document54 pagesWSJ 0107Kushal AkbariNo ratings yet

- Current Assets & Current LiabilitiesDocument11 pagesCurrent Assets & Current LiabilitiesRoshni ChhabriaNo ratings yet

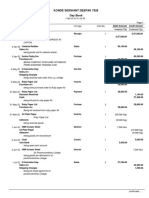

- Konde Siddhant Deepak 7926 Day Book: Particulars Credit Amount Debit AmountDocument5 pagesKonde Siddhant Deepak 7926 Day Book: Particulars Credit Amount Debit AmountSiddhant KondeNo ratings yet

- Pc101 Applicationactivity Managingfinances Template 2Document4 pagesPc101 Applicationactivity Managingfinances Template 2Nancy Carolina Caceres TaboraNo ratings yet