Professional Documents

Culture Documents

Basic Accountin For Non Accountant 11 To 21

Uploaded by

Ron0 ratings0% found this document useful (0 votes)

8 views12 pagesOriginal Title

basic accountin for non accountant 11 to 21

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

8 views12 pagesBasic Accountin For Non Accountant 11 To 21

Uploaded by

RonCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 12

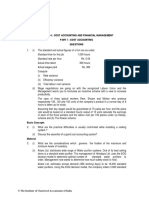

LIABILITIES

• These are obligations that the firm owes to other individuals or

organizations for the acquisition of goods and services. Examples are

account payable , notes payable taxes payable,salaries payable and

others. They are increased when assets or services are purchased on

credit. Liabilities may also be created by accepting payments from

customers for goods to be delivered in the future..

• Liabilities are decreased through payments to creditors.Obligations to

creditors may also be settled through issuance of promissory notes

which actually is another form of liability. The obligations of the

business may also be decreased if owners assumespersonally the

payment of same which will result at the same time an increase in

proprietorship or equity.

CAPITAL OR PROPRIETORSHIP or

OWNER’S EQUITY

• This is the financial interest or claim to , the

owner in the assets of the business. It is

thedifference between the amount of assets

and amount of liabilities.

•Principles of Accounting

The following describe the basic

concepts and principles adapted in

financial accounting;

1. Accounting Entity

is the specific business enterprise separate

and distinct from its owners and other

business unit. For example, cash transactions

of a cooperative are separate and distinct from

cash transaction of its individual owners.

The business enterprise is identified in its

financial statements.

2. Going Concern.

An accounting entity is viewed as continuing

business unit without interruptions in its

operation. It is evidenced by financial reports

showing costs that pertain to future activities

and revenues and costs that are assigned to

current period.

A business entity is no longer considered a

going concern if it is in the process of

dissolution or liquidation.

3. Measurement of economic

resources and obligations.

Only those economic activities

that can be quantified should be

measured and reported in

financial statements.

4. Accounting periods.

The financial report should contain

information about economic activities of an

enterprise for specified time periods,

usually one year, that are shorter than the

life of the enterprise. Reports may also be

prepared on a monthly basis to facilitate

comparisons and process of decision

making.

5. Measurement in terms of money.

Economic resources and obligations

and changes in them must be

measured in terms of the peso and

should be identified in the financial

statements.

6. Accrual.

In determining periodic net surplus

(net income), revenues are

recognized as earned rather than

when cash is received; expenses are

recognized when incurred rather

than when cash is paid.

7. Exchanged price.

Financial accounting

measurements are primarily

based on historical prices at the

time economic resources and

obligations are exchanged.

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- O'Neil William J. - .Article - How To Make Money in Stocks. A Winning System in Good Times or Bad (Third Edition Summary)Document16 pagesO'Neil William J. - .Article - How To Make Money in Stocks. A Winning System in Good Times or Bad (Third Edition Summary)Ioana Ionescu85% (13)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Budgeting & Budgetary ControlDocument28 pagesBudgeting & Budgetary ControlIeymarh FatimahNo ratings yet

- Responsibilityaccounting 160428005250Document16 pagesResponsibilityaccounting 160428005250RajanSharmaNo ratings yet

- A Discrete Question (Divs)Document2 pagesA Discrete Question (Divs)Veeken ChaglassianNo ratings yet

- 12 Lyp Economics Set1Document26 pages12 Lyp Economics Set1Suhail BilalNo ratings yet

- Paper 4Document44 pagesPaper 4Mayuri KolheNo ratings yet

- FIS Treasury and Risk Manager Quantum Edition Product SheetDocument2 pagesFIS Treasury and Risk Manager Quantum Edition Product SheetMohdNo ratings yet

- Housing FinanceDocument33 pagesHousing FinanceShubhendu Mallick88% (8)

- Financial Statement On Sole Trading Ok ProjectDocument51 pagesFinancial Statement On Sole Trading Ok Projectvenkynaidu57% (14)

- Assignment: Individual InsolvencyDocument5 pagesAssignment: Individual InsolvencyKunal ChaudhryNo ratings yet

- Cash Problem 1Document3 pagesCash Problem 1Dawson Dela CruzNo ratings yet

- NCFM Model Test PaperDocument8 pagesNCFM Model Test PapersplfriendsNo ratings yet

- HDFC Top 100 Fund - Patience Pays!Document4 pagesHDFC Top 100 Fund - Patience Pays!Manju Bhashini M RNo ratings yet

- 9e1621df KM BUCKET DraftSummaryDocument4 pages9e1621df KM BUCKET DraftSummaryAmarnath PNo ratings yet

- Chapter 13: Dividend PolicyDocument18 pagesChapter 13: Dividend PolicyRezhel Vyrneth TurgoNo ratings yet

- SAP Cash Bank AccountingDocument5 pagesSAP Cash Bank AccountingHenrique BergerNo ratings yet

- Mock Test Paper 2Document7 pagesMock Test Paper 2FarrukhsgNo ratings yet

- Factors Affecting Credit Card PDFDocument10 pagesFactors Affecting Credit Card PDFAshik Ahmed NahidNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument3 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceNanu PatelNo ratings yet

- Pakistan Synthetics Limited: Condensed Interim Balance Sheet (Unaudited)Document8 pagesPakistan Synthetics Limited: Condensed Interim Balance Sheet (Unaudited)mohammadtalhaNo ratings yet

- Zain Analysis ReportDocument16 pagesZain Analysis ReportaaldrakNo ratings yet

- Cityam 2010-11-09Document36 pagesCityam 2010-11-09City A.M.No ratings yet

- Wire Transfer Form 08Document2 pagesWire Transfer Form 08eghideafesumeNo ratings yet

- Required Returns and The Cost of CapitalDocument51 pagesRequired Returns and The Cost of CapitalSajjad khanNo ratings yet

- Atrill Capital Structure SlidesDocument8 pagesAtrill Capital Structure SlidesEYmran RExa XaYdiNo ratings yet

- Cis Ofis Ip202 25083 7 PDFDocument4 pagesCis Ofis Ip202 25083 7 PDFMloNo ratings yet

- Ai Hidayati Amminy BT Ahmad AmminyDocument6 pagesAi Hidayati Amminy BT Ahmad AmminyhidayatiamminyNo ratings yet

- Sizing Up RepoDocument58 pagesSizing Up RepoJulian OkuyigaNo ratings yet

- Strategic Management Chapter-4Document29 pagesStrategic Management Chapter-4Towhidul HoqueNo ratings yet

- ABL Annual Report 2015 UpdatedDocument266 pagesABL Annual Report 2015 Updatedali.khan10No ratings yet