Professional Documents

Culture Documents

Compare The Company Risk and Return

Compare The Company Risk and Return

Uploaded by

Uswatun Hasanah zaini0 ratings0% found this document useful (0 votes)

2 views3 pagesSealink International Berhad had higher average returns than GD Express Sdn Bhd over the period at 16.89% compared to -0.26%, but also higher risk as evidenced by its higher variance and standard deviation, indicating returns were more dispersed and volatile. Therefore, Sealink stock was considered riskier than GD Express stock due to its potential for higher returns also generating higher risk.

Original Description:

Original Title

security pp

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentSealink International Berhad had higher average returns than GD Express Sdn Bhd over the period at 16.89% compared to -0.26%, but also higher risk as evidenced by its higher variance and standard deviation, indicating returns were more dispersed and volatile. Therefore, Sealink stock was considered riskier than GD Express stock due to its potential for higher returns also generating higher risk.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

2 views3 pagesCompare The Company Risk and Return

Compare The Company Risk and Return

Uploaded by

Uswatun Hasanah zainiSealink International Berhad had higher average returns than GD Express Sdn Bhd over the period at 16.89% compared to -0.26%, but also higher risk as evidenced by its higher variance and standard deviation, indicating returns were more dispersed and volatile. Therefore, Sealink stock was considered riskier than GD Express stock due to its potential for higher returns also generating higher risk.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 3

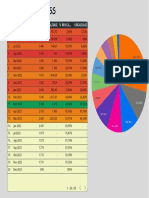

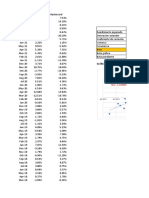

Month Return (GD Express Sdn Bhd) Return (Sealink International Berhad)

Compare the company

risk and return

Sealink return more higher than GD

February 24.14% 14.29%

Express Return, this makes the Sealink

March -4.17% 70.83%

stock more riskier than GD Express stock April -7.25% -14.63%

because higher return generate higher risk. May -10.94% -20%

June -7.02% 21.43%

July 7.55% 26.47%

August 0 34.83%

September 0 50%

October 0 0

November -7.02% -3.45%

December 1.89% -5.95%

Average -0.26% 16.89%

Variance

GD Express Sdn Bhd Sealink International Berhad

Variance : 0.0846 Variance: 0.06670

Standard Deviation

GD Express Sdn Bhd Sealink International Berhad

• 0.09198. • 0.25827.

• Small volatile than Sealink • More volatile than GD Express

stock. stock.

• Less riskier than Sealink • More riskier than GD Express

International Berhad. Sdn Bhd.

• Return less dispersed than • Probability the returns farthest

Sealink Stock. from the mean is high.

You might also like

- Employee Happiness at Work: Employee Well-Being ReportDocument1 pageEmployee Happiness at Work: Employee Well-Being ReportSupreet SinghNo ratings yet

- Alex Sharp's PortfolioDocument6 pagesAlex Sharp's PortfolioFurqanTariqNo ratings yet

- Target Midcap Portfolio PerformanceDocument1 pageTarget Midcap Portfolio PerformanceAnil Kumar Reddy ChinthaNo ratings yet

- Kingfisher School of Business and Finance: Lucao District, Dagupan City, PangasinanDocument8 pagesKingfisher School of Business and Finance: Lucao District, Dagupan City, Pangasinansecret 12No ratings yet

- VIDF - Monthly Returns May 2017Document2 pagesVIDF - Monthly Returns May 2017Ashwin HasyagarNo ratings yet

- Amild KLY PG ReportDocument40 pagesAmild KLY PG ReportIvan HartanaNo ratings yet

- Beta CalculatorDocument19 pagesBeta CalculatorcakartikayNo ratings yet

- Taller Riesgo FroDocument41 pagesTaller Riesgo FroSHARON ARANGONo ratings yet

- Beta Management Company r2Document17 pagesBeta Management Company r2Yash AgarwalNo ratings yet

- Beta Management Company: Case DetailsDocument6 pagesBeta Management Company: Case DetailsAninda DuttaNo ratings yet

- Total Datos 24 Precios Ajustados Fecha Acciones Apple Acciones Baba Acciones Tesla Acciones NetflixDocument12 pagesTotal Datos 24 Precios Ajustados Fecha Acciones Apple Acciones Baba Acciones Tesla Acciones NetflixLorenaNo ratings yet

- Bonos Soberanos en ColombiaDocument5 pagesBonos Soberanos en ColombiaAbel felipe hernandez alfonsoNo ratings yet

- Total: Equity Products Contracts Traded Ibex Products Contracts TradedDocument1 pageTotal: Equity Products Contracts Traded Ibex Products Contracts TradedKarren SVNo ratings yet

- EJERICICIO 3 - Valor en Riesgo (VAR) - SEMANA 12Document299 pagesEJERICICIO 3 - Valor en Riesgo (VAR) - SEMANA 12aidaNo ratings yet

- Asignación Portafolio FEDocument1 pageAsignación Portafolio FEAndrea Torres EchevarríaNo ratings yet

- Exponential Appreciation Fund, LP: December 2021Document2 pagesExponential Appreciation Fund, LP: December 2021Moiz SaeedNo ratings yet

- Rajal 2018Document82 pagesRajal 2018PermataMedikaNo ratings yet

- AMFEIX - Monthly Report (May 2020)Document17 pagesAMFEIX - Monthly Report (May 2020)PoolBTCNo ratings yet

- Alquity Factsheet Africa USD A EnglishDocument3 pagesAlquity Factsheet Africa USD A Englishyomak94018No ratings yet

- Gold's "War-Premium" Rush: Strategic Relevance of GoldDocument4 pagesGold's "War-Premium" Rush: Strategic Relevance of GoldNishant SinhaNo ratings yet

- Curvas de Avance Contractual (C-D)Document2 pagesCurvas de Avance Contractual (C-D)Bernardo PinoNo ratings yet

- Analisis de AeromexicoDocument8 pagesAnalisis de AeromexicoKenia De LeonNo ratings yet

- April 2022 US COVID Sentiment Update ChartsDocument31 pagesApril 2022 US COVID Sentiment Update ChartsEvenwatercanburnNo ratings yet

- Ejercicio Sobre Varianza CarteraDocument15 pagesEjercicio Sobre Varianza CarteraDavid AlejandroNo ratings yet

- Datos Históricos de MDLZ Dow Jones Food Product Makers Historical DataDocument7 pagesDatos Históricos de MDLZ Dow Jones Food Product Makers Historical DataBruno Majail DíazNo ratings yet

- 55 Casas Terrazas de Landa Curva de Avance General: FechasDocument12 pages55 Casas Terrazas de Landa Curva de Avance General: Fechasmarcelo garridoNo ratings yet

- TrabajoDocument3 pagesTrabajoveronica delfinNo ratings yet

- FMI Assignment-8Document3 pagesFMI Assignment-8diveshNo ratings yet

- SP 500 Eps EstDocument43 pagesSP 500 Eps Est이일환No ratings yet

- Average Monthly Returns: Date S&P 500 3 Month T-Bill RJR HasbroDocument16 pagesAverage Monthly Returns: Date S&P 500 3 Month T-Bill RJR HasbroKing CheungNo ratings yet

- Midterm - Invest & Port MGTDocument11 pagesMidterm - Invest & Port MGTMohamed HelmyNo ratings yet

- HDFC Life InsuranceDocument83 pagesHDFC Life InsuranceSanket AndhareNo ratings yet

- Portafolio de InversiónDocument27 pagesPortafolio de InversiónKaren Sofía MurNo ratings yet

- Project Report For Paper Cup MachineDocument22 pagesProject Report For Paper Cup MachineSHRUTI AGRAWALNo ratings yet

- FZ4007 Fase 1Document26 pagesFZ4007 Fase 1thalibritNo ratings yet

- Wilcon Depot Inc.Document9 pagesWilcon Depot Inc.Aleli BaluyoNo ratings yet

- COMMODITIESDocument18 pagesCOMMODITIESArianna CervantesNo ratings yet

- AMFEIX - Monthly Report (March 2020)Document17 pagesAMFEIX - Monthly Report (March 2020)PoolBTCNo ratings yet

- Student Weekly Lesson Completion Sy 2022-23Document2 pagesStudent Weekly Lesson Completion Sy 2022-23api-574053704No ratings yet

- LPRN Harian Bus +mpu 2018Document59 pagesLPRN Harian Bus +mpu 2018Budi SusantoNo ratings yet

- LPRN Bus +mpu +jenis KelaminDocument62 pagesLPRN Bus +mpu +jenis KelaminBudi SusantoNo ratings yet

- Tablas - Informes - Enero 2023Document109 pagesTablas - Informes - Enero 2023Luis IguaranNo ratings yet

- Hedge Fund Statistical Analysis: Prepared ForDocument5 pagesHedge Fund Statistical Analysis: Prepared Forbillroberts981No ratings yet

- Progress S-Curve: Plan % Cum %Document7 pagesProgress S-Curve: Plan % Cum %Yazan Al - HomsiNo ratings yet

- Alex Sharpe - S PortfolioDocument7 pagesAlex Sharpe - S PortfolioPedro José ZapataNo ratings yet

- Efficient Portfolio Case SolutionDocument4 pagesEfficient Portfolio Case SolutionMuhammad AqibNo ratings yet

- Nickel Futures Historical Prices - Investing - Com IndiaDocument3 pagesNickel Futures Historical Prices - Investing - Com IndiavgautambarcNo ratings yet

- Report HRM WWCMDocument1 pageReport HRM WWCMROBBY PPNo ratings yet

- QuanticoDocument7 pagesQuanticoAbdelrahman AkeedNo ratings yet

- % Var - Mastercard: Gráfico de BetaDocument16 pages% Var - Mastercard: Gráfico de BetaMario RefNo ratings yet

- Shivam Khanna BM 019159 FmueDocument10 pagesShivam Khanna BM 019159 FmueBerkshire Hathway coldNo ratings yet

- Shivam Khanna BM 019159 FmueDocument10 pagesShivam Khanna BM 019159 FmueBerkshire Hathway coldNo ratings yet

- Shivangi Rastogi BM 019161Document9 pagesShivangi Rastogi BM 019161Berkshire Hathway coldNo ratings yet

- Dimas Iman - TM3Document12 pagesDimas Iman - TM3dimasiman1992No ratings yet

- Pics For Time SeriseDocument3 pagesPics For Time SeriseAndy AnilNo ratings yet

- Wusen Js ExcelDocument5 pagesWusen Js ExcelDessiree ChenNo ratings yet

- Group 3 Investments ProjectDocument45 pagesGroup 3 Investments ProjectVathsan VenkatNo ratings yet

- Rebalancing Frequency Rebalancing Tolerance Transaction Cost Per $ Transacted (BP) Initial WeightsDocument12 pagesRebalancing Frequency Rebalancing Tolerance Transaction Cost Per $ Transacted (BP) Initial Weightsmorrisonkaniu8283No ratings yet

- RalentíDocument73 pagesRalentíLEONARDO FABIO ESGUERRA OSPINANo ratings yet