Professional Documents

Culture Documents

Government Accounting: Accounting For Non-Profit Organizations

Uploaded by

Yuvia Keithleyre0 ratings0% found this document useful (0 votes)

676 views20 pagesOriginal Title

506_136535_lecture-intangible assets

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

676 views20 pagesGovernment Accounting: Accounting For Non-Profit Organizations

Uploaded by

Yuvia KeithleyreCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 20

Government Accounting

&

Accounting for non-profit organizations

by: ZEUS VERNON B. MILLAN

Chapter 11

Intangible Assets

Learning Objectives

1. Define intangible assets.

2. State the recognition, and account for the

initial and subsequent measurements, of

intangible assets.

GOVT ACCTG & ACCTG FOR NPOs by:

Z.B.Millan

Definitions.

• Active Market – is a market in which all the following

conditions exist:

– the items traded in the market are homogeneous,

– willing buyers and sellers can normally be found at

any time; and

– prices are available to the public.

Amortization – is the systematic allocation of the

depreciable amount of an intangible asset over its

useful life.

• Development – is the application of research findings or other knowledge

to a plan or design for the production of new or substantially improved

materials, devices, products, processes, systems, or services before the

start of commercial production or use.

• Intangible Assets – are identifiable non-monetary asset without physical

substance.

• Intangible Heritage Assets – are intangible assets which displayed the

following characteristics:

– Their value in cultural, environmental and historical terms is unlikely to

be fully reflected in a financial value based purely on a market price;

– Legal and/or statutory obligations may impose prohibitions or severe

restrictions on disposal by sale;

– Their value may increase over time; and

– It may be difficult to estimate their useful lives, which in some cases

could be several hundred years.

• Research – is original and planned investigation undertaken with the

prospect of gaining new scientific and technical knowledge and

understanding.

Intangible Assets

• Intangible Assets are identifiable non-

monetary assets without physical

substance.

GOVT ACCTG & ACCTG FOR NPOs by:

Z.B.Millan

Essential elements of an intangible asset

1. Identifiability

a. separable; or

b. arises from binding arrangements

2. Control – the entity has the ability to

benefit from the intangible asset or

prevent others from benefitting from it.

3. Future economic benefits or service

potential

GOVT ACCTG & ACCTG FOR NPOs by:

Z.B.Millan

Examples of Intangible assets

• Computer software

• Patents

• Copyrights

• Franchise

• Motion picture films

• Trademarks or brand names

• Licenses

• Acquired import quotas

• Customer lists

GOVT ACCTG & ACCTG FOR NPOs by:

Z.B.Millan

Recognition

• An intangible asset is recognized if it meets

the definition of an intangible asset and the

recognition criteria for assets.

GOVT ACCTG & ACCTG FOR NPOs by:

Z.B.Millan

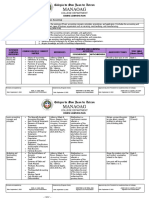

Initial Measurement

• An intangible asset is initially measured at cost.

Mode of Acquisition Measurement of Initial Cost

a. Purchase Purchase price plus Direct costs (including

non-refundable taxes but excluding trade

discounts and rebates).

If payment is deferred, the cost is the cash

price equivalent.

b. Non-exchange fair value at the acquisition date

transaction

c. Exchange With commercial substance:

a. FV of asset given up (+ cash paid/- cash

received).

b. FV of asset received.

c. CA of asset given up (+ cash paid/- cash

received).

Without commercial substance: CA of

asset given up (plus cash paid/minus cash

received).

d. Entity Combination fair value at the acquisition date

GOVT ACCTG & ACCTG FOR NPOs by:

Z.B.Millan

Internal Generation

1. Research – undertaken to gain new knowledge.

Expenditures are recognized as expense.

2. Development – application of research findings to design

new or substantially improved products, processes, or

systems before the start of commercial production or use.

Expenditures are capitalized only if all of the following are

met:

a. Ability to use or sell

b. Intention to complete

c. Technical feasibility

d. Availability of adequate resources

e. probable future Economic benefits

f. Measured reliably

GOVT ACCTG & ACCTG FOR NPOs by:

Z.B.Millan

Other accounting requirements

• If it is not clear whether an expenditure is a research or a

development cost, it is treated as research cost.

• Reinstatement of expenditure previously recognized as an

expense is prohibited.

• Internally generated brands, mastheads, publishing titles,

customer lists, and similar items are not recognized as intangible

assets.

• Selling, administrative and other general overhead, costs of

inefficiencies, initial operating losses, and training costs are

expensed.

• Subsequent expenditures on recognized intangible assets are

generally expensed, unless they meet the definition of an

intangible asset and the asset recognition criteria.

• The accounting for replacement of a part of an intangible asset is

the same as those of PPE and investment property.

Recognition of an Expense

• Expenditure on an intangible item

shall be recognized as an expense

when it is incurred unless it forms part

of the cost of an intangible asset that

meets the recognition criteria

Subsequent Measurement

1. Indefinite life – not amortized but tested for

impairment at least annually.

2. Finite life – amortized using the straight line

method over a period of 2 to 10 years. The

residual value is assumed to be zero except when

the entity has the ability to sell the asset at the

end of its useful life.

GOVT ACCTG & ACCTG FOR NPOs by:

Z.B.Millan

Impairment

• An entity is required to test for impairment an

intangible asset with indefinite useful life or an

intangible asset not yet available for use at least

annually or whenever there is an indication of

impairment.

• An entity shall test for impairment an intangible

asset with definite useful life only when an

indication of impairment exists. Indications of

impairment shall be assessed at each reporting

date.

• The accounting for impairment of intangible assets,

and reversal thereof, is the same as those of

investment property and PPE.

GOVT ACCTG & ACCTG FOR NPOs by:

Z.B.Millan

Derecognition

• An intangible asset is derecognized when it is

disposed or when no future economic benefits or

service potential is expected from the asset.

• On derecognition, the difference between the

carrying amount and the net disposal proceeds, if

any, is recognized as gain or loss in surplus or

deficit.

GOVT ACCTG & ACCTG FOR NPOs by:

Z.B.Millan

Disclosure

• An entity shall disclose the following:

1. Whether the useful lives are indefinite or finite and, if finite, the useful lives or the

amortization rates used;

2. The amortization method used, which is straight line method, for intangible assets

with finite useful lives;

3. The gross carrying amount, any accumulated amortization and any accumulated

impairment losses at the beginning and end of the period;

4. The line item(s) of the statement of financial performance in which any amortization

of intangible assets is included

5. A reconciliation of the carrying amount at the beginning and end of the period

6. For an intangible asset assessed as having an indefinite useful life, the carrying

amount of that asset and the reasons supporting the assessment of an indefinite

useful life

• . A description, the carrying amount, and remaining amortization period of any

individual intangible asset that is material to the entity’s financial statements;

• 8. For intangible assets acquired through a non-exchange transaction and initially

recognized at fair value

Disclosure – cont.

• 9. The existence and carrying amounts of intangible

assets whose title is restricted and the carrying

amounts of intangible assets pledged as security for

liabilities;

• 10.The amount of contractual commitments for the

acquisition of intangible assets;

• 11. The aggregate amount of research and

development expenditure recognized as an expense

during t

Disclosure – cont.

• 12. An entity that recognized intangible heritage assets t must apply the

following disclosure requirements:

•

• The measurement basis used;

• The amortization method used, if any;

• The gross carrying amount;

The accumulated amortization at the end of the period, if any; and

• A reconciliation of the carrying amount at the beginning and end

of the period showing certain components thereof.

• 13. An entity is encouraged, but not required, to disclose the following

information:

• A description of any fully amortized intangible asset that is still in

use; and

• A brief description of significant intangible assets controlled by the

entity but not recognized as assets.

OPEN FORUM

QUESTIONS????

REACTIONS!!!!!

GOVT ACCTG & ACCTG FOR NPOs by:

Z.B.Millan

END

GOVT ACCTG & ACCTG FOR NPOs by: Z.B.Millan

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5796)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Government Accounting: Accounting For Non-Profit OrganizationsDocument42 pagesGovernment Accounting: Accounting For Non-Profit OrganizationsYuvia KeithleyreNo ratings yet

- Private Nor-for-Profit Entities (NPE) : Colleges and Universities, Hospitals, VHWO and Other NPEDocument44 pagesPrivate Nor-for-Profit Entities (NPE) : Colleges and Universities, Hospitals, VHWO and Other NPEYuvia KeithleyreNo ratings yet

- Acctg 8 Notes GAM Government Accounting Manuals For NGA National Government AgencyDocument1 pageAcctg 8 Notes GAM Government Accounting Manuals For NGA National Government AgencyYuvia KeithleyreNo ratings yet

- Integrity of CreationDocument2 pagesIntegrity of CreationYuvia KeithleyreNo ratings yet

- 506 - 581526 - Illustrative Accounting EntriesDocument2 pages506 - 581526 - Illustrative Accounting EntriesYuvia KeithleyreNo ratings yet

- Consignment Agreement: Do Above Stated Actions, We Will Do Legal Actions. ItemsDocument1 pageConsignment Agreement: Do Above Stated Actions, We Will Do Legal Actions. ItemsYuvia KeithleyreNo ratings yet

- Chapter 7 An Introduction To Linear Programming: Learning ObjectivesDocument49 pagesChapter 7 An Introduction To Linear Programming: Learning ObjectivesYuvia KeithleyreNo ratings yet

- Optional Standard DeductionDocument3 pagesOptional Standard DeductionYuvia Keithleyre100% (1)

- The Accounting CycleDocument27 pagesThe Accounting CycleYuvia KeithleyreNo ratings yet

- Chapter 7 An Introduction To Linear Programming: Learning ObjectivesDocument49 pagesChapter 7 An Introduction To Linear Programming: Learning ObjectivesYuvia KeithleyreNo ratings yet

- Southern Nueva Vizcaya Jeepney Operators and Drivers Association Incorporated Comparative Staement of Reciepts & ExpensesDocument4 pagesSouthern Nueva Vizcaya Jeepney Operators and Drivers Association Incorporated Comparative Staement of Reciepts & ExpensesYuvia KeithleyreNo ratings yet

- Kuratko 8e CH 10Document32 pagesKuratko 8e CH 10Yuvia KeithleyreNo ratings yet

- Monopoly of Goverment OfficialsDocument12 pagesMonopoly of Goverment OfficialsYuvia KeithleyreNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- CSR 2Document6 pagesCSR 2Ricci De CastroNo ratings yet

- IAS 37 - Provisions Contingent Assets and LiabilitiesDocument25 pagesIAS 37 - Provisions Contingent Assets and Liabilitiesfarukh.kitchlewNo ratings yet

- Manaoag: Colegio de San Juan de LetranDocument10 pagesManaoag: Colegio de San Juan de LetranFlordeliza HalogNo ratings yet

- Production Controlling Management SystemDocument65 pagesProduction Controlling Management SystemRanjith KumarNo ratings yet

- CANARA Statement 2 May 22 To 1 April 23Document62 pagesCANARA Statement 2 May 22 To 1 April 23Ashwani KumarNo ratings yet

- P To P CycleDocument5 pagesP To P CycleJaved AhmadNo ratings yet

- HRM Practices in NigeriaDocument13 pagesHRM Practices in Nigeriafaith olaNo ratings yet

- Ias 2 Questions and AnswersDocument3 pagesIas 2 Questions and AnswersShameel Irshad75% (8)

- AFAR - Partnership DissolutionDocument2 pagesAFAR - Partnership DissolutionCleofe Mae Piñero AseñasNo ratings yet

- Reg. of Accounting FirmsDocument2 pagesReg. of Accounting FirmsDaniel GalzoteNo ratings yet

- E-Banking Internal and External Stimuli To Improve E-Satisfaction and E-Loyalty M-Banking in IndonesiaDocument8 pagesE-Banking Internal and External Stimuli To Improve E-Satisfaction and E-Loyalty M-Banking in IndonesiaIJAR JOURNALNo ratings yet

- National Taxation System - RamosDocument10 pagesNational Taxation System - RamosAldrich RamosNo ratings yet

- Financial Reporting and Analysis 7th Edition Gibson Test BankDocument25 pagesFinancial Reporting and Analysis 7th Edition Gibson Test BankTiffanyHernandezerij100% (55)

- Australia's Longest Established, Leading TMT Focused M&A Corporate Advisory FirmDocument12 pagesAustralia's Longest Established, Leading TMT Focused M&A Corporate Advisory Firmrumengan kairNo ratings yet

- Brand Protection Across The Enterprise: Toward A Total-Business SolutionDocument14 pagesBrand Protection Across The Enterprise: Toward A Total-Business SolutionBlue moon MediaNo ratings yet

- TradeJournal3.0 - EmptyDocument199 pagesTradeJournal3.0 - EmptySigit KNo ratings yet

- Production SystemDocument100 pagesProduction Systembroshan100% (1)

- Business Mathematics: Quarter 3-Module 1Document43 pagesBusiness Mathematics: Quarter 3-Module 1Shein GonzalesNo ratings yet

- ECON8180 Economic Analysis of The Digital Economy (S1 2020) Take-Home Exam (A3)Document4 pagesECON8180 Economic Analysis of The Digital Economy (S1 2020) Take-Home Exam (A3)Putri Juliana RahayuNo ratings yet

- Management Report On Tesla, Inc.Document7 pagesManagement Report On Tesla, Inc.Naveed IbrahimNo ratings yet

- SPAN Margin System For PlatformsDocument7 pagesSPAN Margin System For Platformsprashantmehra02No ratings yet

- Questionnaire IntactDocument10 pagesQuestionnaire Intact?????No ratings yet

- Bad News MessagesDocument13 pagesBad News MessagesHamza KhalidNo ratings yet

- Pme3701 TL101 - 0 - 2024Document30 pagesPme3701 TL101 - 0 - 2024Themba MaviNo ratings yet

- 7 Certificates of Engineer (Form 2) (Mandatory For Only Ongoing Project)Document5 pages7 Certificates of Engineer (Form 2) (Mandatory For Only Ongoing Project)bennymahaloNo ratings yet

- Control AccountDocument3 pagesControl AccountKady AnnNo ratings yet

- الانجليزية L1 /S2Document15 pagesالانجليزية L1 /S2Rabah SlimaniNo ratings yet

- GS - Global Internet - Ecommerce's Steepening Curve - Raising Global Forecasts & Identifying New WinnersDocument52 pagesGS - Global Internet - Ecommerce's Steepening Curve - Raising Global Forecasts & Identifying New WinnersRojana ChareonwongsakNo ratings yet

- Summative TestDocument7 pagesSummative TestJesse Kent Vincent BernadaNo ratings yet

- PS Prods. v. ContextLogic - ComplaintDocument21 pagesPS Prods. v. ContextLogic - ComplaintSarah BursteinNo ratings yet