Professional Documents

Culture Documents

Case - II Baldwin Bicycle Case: Submitted by Group - 6

Uploaded by

sonatukun0 ratings0% found this document useful (0 votes)

78 views5 pagesThis document summarizes the profitability and costs associated with producing 25,000 Baldwin bicycles. It finds that under variable costs, the profit per unit is $23.09 with a total incremental contribution of $577,250. When considering full costs in the first year, the profit per unit is $8.34. The total working capital needed is $735,510.96 and additional asset-related costs bring the total investment to $767,311.76. The return on this incremental investment is calculated to be 75.2%.

Original Description:

Original Title

Baldwin 1

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document summarizes the profitability and costs associated with producing 25,000 Baldwin bicycles. It finds that under variable costs, the profit per unit is $23.09 with a total incremental contribution of $577,250. When considering full costs in the first year, the profit per unit is $8.34. The total working capital needed is $735,510.96 and additional asset-related costs bring the total investment to $767,311.76. The return on this incremental investment is calculated to be 75.2%.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

78 views5 pagesCase - II Baldwin Bicycle Case: Submitted by Group - 6

Uploaded by

sonatukunThis document summarizes the profitability and costs associated with producing 25,000 Baldwin bicycles. It finds that under variable costs, the profit per unit is $23.09 with a total incremental contribution of $577,250. When considering full costs in the first year, the profit per unit is $8.34. The total working capital needed is $735,510.96 and additional asset-related costs bring the total investment to $767,311.76. The return on this incremental investment is calculated to be 75.2%.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 5

Case – II

Baldwin Bicycle case

Submitted by

Group - 6

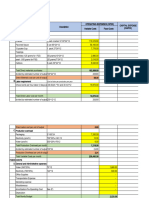

Profitability under variable and full

cost

Amounts in dollar (per unit)

Direct material 39.80

Direct labor 19.60

Mfg overhead (variable part) 09.80

Total variable cost 69.20

Selling price 92.29

Profitability 23.09

Incremental contribution (25000 units) 577250

For100,000 units

Full cost in the first year 8395000

Selling price 9229000

Profitability (per unit) 8.34

Calculation for working capital

Particulars For 25000 units Amounts in dollar

Direct material 4166 * 39.80 165806.80

WIP 1000 * (39.8+19.6/2+9.8/2) 54500

Finished goods 500 * 69.2 34600

Accounts receivables 92.29 * 25000/12 192270.83

Inventory ( Before Hi-value 25000/6 * 69.20 288333.33

taking the title)

Total 735510.96

Asset related cost

Particulars Amount in dollar

Record keeping for inventory and 7355

receivables

Inventory insurance 1629.72

State inventory tax 3802.68

Inventory handling cost 16297.20

Inventory pilferage,breakage etc 2716.2

Total 31800.80

Total investment required 767311.76

(including working capital)

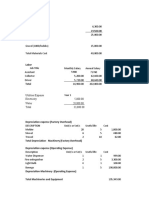

Calculation for ROI

Particulars Amount in dollar

Incremental revenue 577250

Incremental investment 767311.76

(735510.96+31800.80)

ROI 75.2%

You might also like

- 05 Wilkerson Company Solution - StudentsDocument9 pages05 Wilkerson Company Solution - StudentsVinyabhooshan Bajpai PGP 2022-24 Batch100% (1)

- Universiti Utara Malaysia Bwff2043 Advanced Financial Management (Group A) SECOND SEMESTER SESSION 2019/2020 (A192)Document10 pagesUniversiti Utara Malaysia Bwff2043 Advanced Financial Management (Group A) SECOND SEMESTER SESSION 2019/2020 (A192)Hirosha VejianNo ratings yet

- Model Chapter 12 - ThipDocument14 pagesModel Chapter 12 - ThipThipparatM60% (5)

- Sneaker 2013Document13 pagesSneaker 2013Hirosha Vejian100% (2)

- Chapter 1-2 COST Accounting AND Control BY DE LEON 2019 Chapter 1-2 COST Accounting AND Control BY DE LEON 2019Document10 pagesChapter 1-2 COST Accounting AND Control BY DE LEON 2019 Chapter 1-2 COST Accounting AND Control BY DE LEON 2019somethingNo ratings yet

- Power Markets and Economics: Energy Costs, Trading, EmissionsFrom EverandPower Markets and Economics: Energy Costs, Trading, EmissionsNo ratings yet

- Baldwin Bicycle CompanyDocument7 pagesBaldwin Bicycle CompanyIndustry ReportNo ratings yet

- Tami Tyler Opened Tami's Creations, IncDocument11 pagesTami Tyler Opened Tami's Creations, Inclaale dijaanNo ratings yet

- Group 2 - Baldwin Bicycle Company (BBC)Document8 pagesGroup 2 - Baldwin Bicycle Company (BBC)wenablesNo ratings yet

- 2020-08 Marginal and Absorption CostingDocument6 pages2020-08 Marginal and Absorption CostingDenis GonzálezNo ratings yet

- 1.5 manact เฉลย file 1.2 extra class 2-2022Document32 pages1.5 manact เฉลย file 1.2 extra class 2-2022Chokthawee RattanawetwongNo ratings yet

- Hassan Exame 21 AugustrDocument4 pagesHassan Exame 21 Augustrsardar hussainNo ratings yet

- Full Cost of Product Per Unit 170Document5 pagesFull Cost of Product Per Unit 170Shafaq ZafarNo ratings yet

- Video Case CH 15Document3 pagesVideo Case CH 15Panji Yudha SanjayaNo ratings yet

- 4 51Document3 pages4 51Achmad Faizal AzmiNo ratings yet

- Acctg523-B1-Practice Midterm-W2022-SolutionDocument8 pagesAcctg523-B1-Practice Midterm-W2022-Solutionmakan94883No ratings yet

- 2m00154 S.y.b.com - Bms Sem Ivchoice Based 78512 Group A Finance Strategic Cost Management Q.p.code53273Document5 pages2m00154 S.y.b.com - Bms Sem Ivchoice Based 78512 Group A Finance Strategic Cost Management Q.p.code53273Navira MirajkarNo ratings yet

- Best Financial Forecast FinalDocument13 pagesBest Financial Forecast Finalitsmethird.26No ratings yet

- Answers To 11 - 16 Assignment in ABC PDFDocument3 pagesAnswers To 11 - 16 Assignment in ABC PDFMubarrach MatabalaoNo ratings yet

- Cost DJB - ICAI Mat Additional QuestionsDocument29 pagesCost DJB - ICAI Mat Additional QuestionsSrabon BaruaNo ratings yet

- Chapter 4-Test Material 4 1Document6 pagesChapter 4-Test Material 4 1Marcus MonocayNo ratings yet

- Budget InformationDocument10 pagesBudget InformationIsabella BattiataNo ratings yet

- Masterpad Solution PresentationDocument19 pagesMasterpad Solution PresentationnoursfoodforthoughtNo ratings yet

- Sabit FSDocument8 pagesSabit FSMilagrosa VillasNo ratings yet

- Hydrochem AnalysisDocument7 pagesHydrochem AnalysisSaransh Kejriwal100% (2)

- Hydrochem PDFDocument7 pagesHydrochem PDFSaransh KejriwalNo ratings yet

- Development Appraisal - Example 4 - Residual ApproachDocument1 pageDevelopment Appraisal - Example 4 - Residual ApproachIQC solutionsNo ratings yet

- ACC60181H619 Managerial AccountingDocument9 pagesACC60181H619 Managerial AccountingaksNo ratings yet

- Management Accounting 1Document4 pagesManagement Accounting 1Tax TrainingNo ratings yet

- Property, Plant and Equipment (Part 2) : Problem 1: True or FalseDocument13 pagesProperty, Plant and Equipment (Part 2) : Problem 1: True or FalseJannelle SalacNo ratings yet

- Joint Product & By-Product ExamplesDocument15 pagesJoint Product & By-Product ExamplesMuhammad azeemNo ratings yet

- MA MathDocument16 pagesMA MathAvijit SahaNo ratings yet

- Soultions - Chapter 3Document8 pagesSoultions - Chapter 3Naudia L. TurnbullNo ratings yet

- This Examples Are Adapted FROM Cost and Management Accounting (1996) Prentice Hall ISBN 0-13-205923-1Document10 pagesThis Examples Are Adapted FROM Cost and Management Accounting (1996) Prentice Hall ISBN 0-13-205923-1pandy1604No ratings yet

- 2020-08 Marginal and Absorption CostingDocument10 pages2020-08 Marginal and Absorption CostingDenis GonzálezNo ratings yet

- Assignment - 1 (MGT 402) Name: Mohsin Id: Mc190202341Document3 pagesAssignment - 1 (MGT 402) Name: Mohsin Id: Mc190202341MOHSIN AKHTARNo ratings yet

- Solution Financial Accounting FundamentalsDocument7 pagesSolution Financial Accounting Fundamentalsone thymeNo ratings yet

- Managerial Final Project Study NotesDocument8 pagesManagerial Final Project Study NotesShawn KPNo ratings yet

- Activity Based-WPS (Number 1 C)Document9 pagesActivity Based-WPS (Number 1 C)Takudzwa BenjaminNo ratings yet

- Relevant Cost Exercise SolutionDocument14 pagesRelevant Cost Exercise SolutionHimadri DeyNo ratings yet

- Afm Project On Annual Report: Section - E Group No - 09 Name of The Company - Raymond LTDDocument33 pagesAfm Project On Annual Report: Section - E Group No - 09 Name of The Company - Raymond LTDApoorva PattnaikNo ratings yet

- Requirement 1:: (Leave No Cells Blank - Be Certain To Enter "0" Wherever Required. Omit The "$" Sign in Your Response.)Document5 pagesRequirement 1:: (Leave No Cells Blank - Be Certain To Enter "0" Wherever Required. Omit The "$" Sign in Your Response.)Md AlimNo ratings yet

- Soltion of Chemalite BDocument13 pagesSoltion of Chemalite BAITHARAJU SAI HEMANTHNo ratings yet

- Master Budget Illustrationv2Document16 pagesMaster Budget Illustrationv2Rianne NavidadNo ratings yet

- AnswersDocument9 pagesAnswersĐào Thị Thu ThủyNo ratings yet

- Finch Excel ReportDocument15 pagesFinch Excel ReportshuvorajbhattaNo ratings yet

- Group 5Document16 pagesGroup 5Amelia AndrianiNo ratings yet

- Baldwin Bicycle Company - Final Assignment - Group F - 20210728Document4 pagesBaldwin Bicycle Company - Final Assignment - Group F - 20210728ApoorvaNo ratings yet

- Total Annual Overhead CostsDocument3 pagesTotal Annual Overhead CostsJEYASHREE ESTEBANNo ratings yet

- CMA Garrison SuggestedSolutions Chap2Document12 pagesCMA Garrison SuggestedSolutions Chap2PIYUSH SINGHNo ratings yet

- Jawaban Soal ExerciseDocument13 pagesJawaban Soal Exerciseqinthara alfarisiNo ratings yet

- Management AccountingDocument6 pagesManagement AccountingBornyNo ratings yet

- Emmppe Associates. Monthly Efficiency of PRODUCTION APRIL 2019-2020Document10 pagesEmmppe Associates. Monthly Efficiency of PRODUCTION APRIL 2019-2020dsivakumarNo ratings yet

- Ice Make Refrigeration LimitedDocument8 pagesIce Make Refrigeration LimitedPositive ThinkerNo ratings yet

- Homework Chapter 2 - Phuong AnhDocument5 pagesHomework Chapter 2 - Phuong AnhNguyễn Ánh NgọcNo ratings yet

- PRM41 Sec-D D3 AnalysisDocument6 pagesPRM41 Sec-D D3 AnalysisAnushree PareekNo ratings yet

- Question 2 FR April 2022 Question 2 CaputDocument6 pagesQuestion 2 FR April 2022 Question 2 CaputLaud ListowellNo ratings yet

- Chapter 1-3Document21 pagesChapter 1-3Alexsandra GarciaNo ratings yet

- Sol CH 6Document9 pagesSol CH 6jxjjdNo ratings yet