Professional Documents

Culture Documents

2020-08 Marginal and Absorption Costing

Uploaded by

Denis González0 ratings0% found this document useful (0 votes)

4 views6 pagesThe document compares the profit calculated using marginal costing versus absorption costing. Under marginal costing, the company anticipates a profit of $90,000 using only variable costs, while absorption costing which includes fixed costs estimates the profit at $153,297. Absorption costing provides a more accurate picture of profitability by fully allocating total production costs rather than just variable costs.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document compares the profit calculated using marginal costing versus absorption costing. Under marginal costing, the company anticipates a profit of $90,000 using only variable costs, while absorption costing which includes fixed costs estimates the profit at $153,297. Absorption costing provides a more accurate picture of profitability by fully allocating total production costs rather than just variable costs.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

4 views6 pages2020-08 Marginal and Absorption Costing

Uploaded by

Denis GonzálezThe document compares the profit calculated using marginal costing versus absorption costing. Under marginal costing, the company anticipates a profit of $90,000 using only variable costs, while absorption costing which includes fixed costs estimates the profit at $153,297. Absorption costing provides a more accurate picture of profitability by fully allocating total production costs rather than just variable costs.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 6

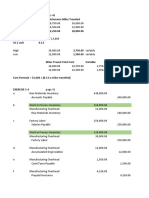

Anticipated profit using marginal cost

Particulars Sold units Cost/Price Total

Total Revenue 75,000 36 2,700,000

Less: Variable costs

Direct material 75,000 13 975,000

Direct labour 75,000 9 675,000

Variable selling & distribution 75,000 5 375,000

Other variable production overhead 75,000 3 225,000

Variable costs 2,250,000

Gross profit 450,000

Fixed costs 360,000

Anticipated profit 90,000

Steps Calculation a full cost using absorption costing

1 Revenue

Sold units x Sales pricing = Total revenue

2 Cost of goods sold

Sold units x Direct material = Direct material Cost

Sold units x Direct labour = Direct labour Cost

Sold units x Variable selling & distribution = Variable selling & distribution Cost

Sold units x Other variable production overhead = Other variable production overhead Cost

Fixed costs Total fixed costs

3 Total production costs SUM(Costs)

Unit cost = Total production costs ÷ Actual produced units

Ending inventory = (Actual produced units - Sold units) x Unit cost

Cost of goods sold = Total production costs - Ending inventory

3 Profit (loss) = Total revenue - Cost of goods sold

Absorption costing

Given data:

Budgeted produced units 90,000

Actual produced units 91,000

Direct material 13

Direct labour 9

Variable selling & distribution 5

Other variable production overhead 3

Sold units 75,000

Selling price unit 36

Ending inventory 16,000

Statement of profit (loss):

Revenue:

Sales 2,700,000

Cost of goods sold:

Direct material 1,183,000

Direct labour 819,000

Variable selling & distribution 455,000

Other variable production overhead 273,000

Total variable costs 2,730,000

Fixed costs 360,000

Total production costs 3,090,000

Unit cost 33.956

Less: Ending inventory 543,297

Cost of goods sold 2,546,703

Profit (loss) before taxes 153,297

Particulars Marginal Cost Absorption Costing

Produced units 91,000 91,000

Sold Units 75,000 75,000

Revenue 2,700,000 2,700,000

Variable costs 2,250,000 2,730,000

Fixed costs 360,000 360,000

Total production costs 2,250,000 3,090,000

Unit cost 30 33.956

Less: Ending inventory 543,297

Cost of goods sold 2,546,703

Net Profit (loss) 90,000 153,297

Difference 63,297

Price based on full-cost plus Price based on marginal-cost plus

Cost-plus pricing = Break-even pricing x Mark-up value Particulars

Break-even pricing 2,160,000 Direct material

Mark-up value 30% Direct labour

Cost-plus pricing 2,808,000 Variable selling & distribution

Sold units 75,000 Other variable production overhead

Price per unit (30% mark-up) 37.44 Total costs increased

Actual price per unit 36 Price per unit

Profit per unit 1.44 Profit per unit increased

Sold units 75,000 Sold units

Increase on Profit 108,000 Increase on Profit

Revenue 2,808,000 Revenue

Actual Increase 30%

13 16.9

9 11.7

5 6.5

3 3.9

39

36 46.8

7.8

75,000

585,000

2,700,000 3,285,000

You might also like

- 2020-08 Marginal and Absorption CostingDocument10 pages2020-08 Marginal and Absorption CostingDenis GonzálezNo ratings yet

- Jawaban Soal ExerciseDocument13 pagesJawaban Soal Exerciseqinthara alfarisiNo ratings yet

- CCCAC Chapter 3Document10 pagesCCCAC Chapter 3rochelle lagmayNo ratings yet

- HAslam - SolutionDocument12 pagesHAslam - SolutionSANA SAEEDNo ratings yet

- Chapter 1-3Document21 pagesChapter 1-3Alexsandra GarciaNo ratings yet

- 03 Income StatementDocument14 pages03 Income StatementapiNo ratings yet

- Problem 8-41 1Document3 pagesProblem 8-41 1Jey JNo ratings yet

- Discussed Solutions 2Document18 pagesDiscussed Solutions 2Christy HabelNo ratings yet

- Drill12 Drill13 Manufacturing BusinesDocument6 pagesDrill12 Drill13 Manufacturing BusinesAngelo FelizardoNo ratings yet

- Group 5Document16 pagesGroup 5Amelia AndrianiNo ratings yet

- Accounting For Managers Canadian 1st Edition Collier Solutions ManualDocument17 pagesAccounting For Managers Canadian 1st Edition Collier Solutions Manualnicholassmithyrmkajxiet100% (25)

- Marginal Costing Values Inventory at The Total Variable Production Cost of A UnitDocument3 pagesMarginal Costing Values Inventory at The Total Variable Production Cost of A UnitNiomi GolraiNo ratings yet

- Masterpad Solution PresentationDocument19 pagesMasterpad Solution PresentationnoursfoodforthoughtNo ratings yet

- Absorption & Direct CostingDocument22 pagesAbsorption & Direct CostingMuhammad azeemNo ratings yet

- ACC60181H619 Managerial AccountingDocument9 pagesACC60181H619 Managerial AccountingaksNo ratings yet

- Chapter 5 Variable Costing: Contains Fixed Manufacturing OverheadDocument26 pagesChapter 5 Variable Costing: Contains Fixed Manufacturing Overheadreza swastikaNo ratings yet

- End Answers Chapter 2,3,4,7-1 Managerial Accounting Hilton PlattDocument14 pagesEnd Answers Chapter 2,3,4,7-1 Managerial Accounting Hilton PlattShivani TannuNo ratings yet

- Inventory IllustrationDocument6 pagesInventory IllustrationVatchdemonNo ratings yet

- 102,000.00 Prime Cost 102,000.00 147,000.00 Conversion Cost 147,000.00 197,000.00Document4 pages102,000.00 Prime Cost 102,000.00 147,000.00 Conversion Cost 147,000.00 197,000.00Darasin, Mhirasol B.No ratings yet

- Management AccountingDocument11 pagesManagement AccountingMd. Showkat IslamNo ratings yet

- Soultions - Chapter 3Document8 pagesSoultions - Chapter 3Naudia L. TurnbullNo ratings yet

- CMA Garrison SuggestedSolutions Chap2Document12 pagesCMA Garrison SuggestedSolutions Chap2PIYUSH SINGHNo ratings yet

- Fma Assignment 3Document5 pagesFma Assignment 3Abdul AhmedNo ratings yet

- Basic Cost Accounting DefinitionsDocument8 pagesBasic Cost Accounting Definitionsbritonkariuki97No ratings yet

- 1Document8 pages1Indu DahalNo ratings yet

- Absorption Costing - Diego Company ManufacturesDocument2 pagesAbsorption Costing - Diego Company ManufacturesIshanNo ratings yet

- Spring 2018 Mgt402 1 SolDocument3 pagesSpring 2018 Mgt402 1 SolSyed Ali HaiderNo ratings yet

- Unit - Ii Cost and Management AccountingDocument17 pagesUnit - Ii Cost and Management AccountingRamakrishna RoshanNo ratings yet

- Lecture 7Document14 pagesLecture 7marwanfathy002No ratings yet

- Case - II Baldwin Bicycle Case: Submitted by Group - 6Document5 pagesCase - II Baldwin Bicycle Case: Submitted by Group - 6sonatukunNo ratings yet

- Tami Tyler Opened Tami's Creations, IncDocument11 pagesTami Tyler Opened Tami's Creations, Inclaale dijaanNo ratings yet

- Practice For Chapter 7 and 8 Standard CostingDocument12 pagesPractice For Chapter 7 and 8 Standard CostingNCT33% (3)

- Managerial Accounting Chapter 8 & 9 SolutionsDocument8 pagesManagerial Accounting Chapter 8 & 9 SolutionsJotham NyanjeNo ratings yet

- Joint Product and by Product Costing For Online TeachingDocument9 pagesJoint Product and by Product Costing For Online Teachingfaith olaNo ratings yet

- Chapter 9Document6 pagesChapter 9Khoa VoNo ratings yet

- Cost Accounting Ass 1Document7 pagesCost Accounting Ass 1lordNo ratings yet

- Kunci Jawaban Lab Chapter 3: Build A Spreadsheet 03-34Document3 pagesKunci Jawaban Lab Chapter 3: Build A Spreadsheet 03-34RantiyaniNo ratings yet

- TUTORIAL Manufacturing With SolutionDocument10 pagesTUTORIAL Manufacturing With SolutionmaiNo ratings yet

- CVP - GitttDocument15 pagesCVP - GitttFarid RezaNo ratings yet

- Allocation of Joint CostsDocument4 pagesAllocation of Joint CostsNereah DebrahNo ratings yet

- Acccob3 HW9Document33 pagesAcccob3 HW9Reshawn Kimi SantosNo ratings yet

- ASsignemts SCIDocument25 pagesASsignemts SCIPedro PelaezNo ratings yet

- Assignment 1: Variable CostingDocument4 pagesAssignment 1: Variable CostingWinoah HubaldeNo ratings yet

- Assignment 1: Variable CostingDocument4 pagesAssignment 1: Variable CostingWinoah HubaldeNo ratings yet

- Assignment 1: Variable CostingDocument4 pagesAssignment 1: Variable CostingWinoah HubaldeNo ratings yet

- Jawaban Perhitungan Dan Akumulasi BiayaDocument7 pagesJawaban Perhitungan Dan Akumulasi BiayaEka OematanNo ratings yet

- Management Accounting 1Document4 pagesManagement Accounting 1Tax TrainingNo ratings yet

- 21.08.2020 L11-12Document10 pages21.08.2020 L11-12sajedulNo ratings yet

- Average Payable 365 Average Payable Period Annual Purchase Average Inventory 365 Inventory Holding Period Cogs Average Receivable 365 Receivable Collection Period Annual SalesDocument10 pagesAverage Payable 365 Average Payable Period Annual Purchase Average Inventory 365 Inventory Holding Period Cogs Average Receivable 365 Receivable Collection Period Annual SalessajedulNo ratings yet

- 21.08.2020 L11-12Document10 pages21.08.2020 L11-12sajedulNo ratings yet

- Week 67 and 9 Absorption Costing Vs Marginal Costing Costing MethodDocument31 pagesWeek 67 and 9 Absorption Costing Vs Marginal Costing Costing MethodMai LyNo ratings yet

- Hassan Exame 21 AugustrDocument4 pagesHassan Exame 21 Augustrsardar hussainNo ratings yet

- CA Past Year 2020 Ans (ZW)Document7 pagesCA Past Year 2020 Ans (ZW)zhaoweiNo ratings yet

- Code 4Document8 pagesCode 4Đỗ Hải MyNo ratings yet

- Flexed Budgets and Variances - TemplateDocument6 pagesFlexed Budgets and Variances - TemplateKyawtNo ratings yet

- Acco 20073 Discussion Sy2122 (Bsma 2-4)Document81 pagesAcco 20073 Discussion Sy2122 (Bsma 2-4)Paul BandolaNo ratings yet

- Villanueva, JaneDocument14 pagesVillanueva, JaneVillanueva, Jane G.No ratings yet

- MGT Accounting, Intermideiate-SolutionsDocument31 pagesMGT Accounting, Intermideiate-SolutionsRONALD SSEKYANZINo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Fixed Cost: Areas of ConfusionDocument7 pagesFixed Cost: Areas of ConfusionDahshilla JunejoNo ratings yet

- Assignment Micro 2Document13 pagesAssignment Micro 2Nguyên BảoNo ratings yet

- EC120 CheatSheetMidtermDocument3 pagesEC120 CheatSheetMidtermdylan8939No ratings yet

- 02 AKL BDP OTKP. 2021 - PTS - PKK KELAS 12 AKL DAN 12 OTKP SMT 1 (Hasil)Document67 pages02 AKL BDP OTKP. 2021 - PTS - PKK KELAS 12 AKL DAN 12 OTKP SMT 1 (Hasil)Muhamamd Badru Tamam100% (1)

- Cost Acct Answer KeyDocument95 pagesCost Acct Answer KeyCarlaNo ratings yet

- Economics For Today 5th Edition Layton Test BankDocument33 pagesEconomics For Today 5th Edition Layton Test Bankcassandracruzpkteqnymcf100% (28)

- Cost Accounting MidtermsDocument5 pagesCost Accounting MidtermsJerico Mamaradlo0% (3)

- 1Document3 pages1Flordeliza VidadNo ratings yet

- Solved Questions On Chapter 13Document8 pagesSolved Questions On Chapter 13Bishoy EmileNo ratings yet

- Chapter 13 The Costs of ProductionDocument30 pagesChapter 13 The Costs of ProductionHang N Quynh Anh100% (1)

- Theory of Production and Costs - 4Document15 pagesTheory of Production and Costs - 4TharshiNo ratings yet

- Microeconomics 4Th Edition Krugman Solutions Manual Full Chapter PDFDocument36 pagesMicroeconomics 4Th Edition Krugman Solutions Manual Full Chapter PDFbushybuxineueshh100% (10)

- Excercise On Inventory Chapter TwoDocument2 pagesExcercise On Inventory Chapter TwoBee TadeleNo ratings yet

- 13 Eco6e Ev EdmsDocument38 pages13 Eco6e Ev EdmsamnatariqshahNo ratings yet

- The Cost of ProductionDocument75 pagesThe Cost of Productionmuhammadtaimoorkhan100% (4)

- Chapter 3Document54 pagesChapter 3Enges Formula100% (1)

- Analisis Penerapan Metode Full Costing Dalam Perhitungan Harga Pokok Produksi Untuk Penetapan Harga JualDocument6 pagesAnalisis Penerapan Metode Full Costing Dalam Perhitungan Harga Pokok Produksi Untuk Penetapan Harga Jualindonesia haiNo ratings yet

- 4 and 5Document3 pages4 and 5Mela carlonNo ratings yet

- Chapter 3 Production and CostDocument19 pagesChapter 3 Production and CostWANG RUIQINo ratings yet

- Activity On Short Run Costs and Output DecisionDocument5 pagesActivity On Short Run Costs and Output DecisionJane ButterfieldNo ratings yet

- Cost CurveDocument8 pagesCost CurveBimbo GrilloNo ratings yet

- Cost Analysis PresentationDocument43 pagesCost Analysis Presentationabhishekanshul100% (1)

- Excercise 1-5 - VenesiaAbigaelNagara (1832088)Document3 pagesExcercise 1-5 - VenesiaAbigaelNagara (1832088)Nessa AbigaelNo ratings yet

- Cosman 3Document3 pagesCosman 3Stella SabaoanNo ratings yet

- Martinez Company's Relevant Range of Production IsDocument3 pagesMartinez Company's Relevant Range of Production Islaale dijaan0% (1)

- Job Order CostingDocument10 pagesJob Order CostingGennelyn Grace Penaredondo100% (1)

- Group 7 - Excel Solution For 7 QuestionsDocument8 pagesGroup 7 - Excel Solution For 7 QuestionsJESWIN BENNY 1928517No ratings yet

- Ap Chap 13 THQDocument9 pagesAp Chap 13 THQEricNo ratings yet

- Fin. Anal RafaelDocument6 pagesFin. Anal RafaelMarjonNo ratings yet

- Assignment# 3 CompleteDocument13 pagesAssignment# 3 CompleteASAD ULLAHNo ratings yet