0% found this document useful (0 votes)

237 views22 pagesInvestor Perception on Investment Products

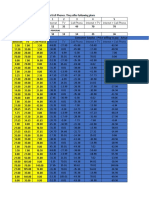

The document summarizes an internship presentation on understanding investor perceptions of various investment products. It includes sections on introduction, literature review, objectives, methodology, the company ABSLI, observations from a survey, findings, and conclusions. The introduction discusses interacting with individuals to understand preferences. The literature review covers past research finding mutual funds are tax saving and return oriented. The objectives are to examine investment avenues and study perceptions. The methodology involved a qualitative and quantitative survey of 60 individuals of various demographics in Pune. Key observations from the survey are presented in charts and interpreted.

Uploaded by

Mrunal WaghchaureCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PPTX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

237 views22 pagesInvestor Perception on Investment Products

The document summarizes an internship presentation on understanding investor perceptions of various investment products. It includes sections on introduction, literature review, objectives, methodology, the company ABSLI, observations from a survey, findings, and conclusions. The introduction discusses interacting with individuals to understand preferences. The literature review covers past research finding mutual funds are tax saving and return oriented. The objectives are to examine investment avenues and study perceptions. The methodology involved a qualitative and quantitative survey of 60 individuals of various demographics in Pune. Key observations from the survey are presented in charts and interpreted.

Uploaded by

Mrunal WaghchaureCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PPTX, PDF, TXT or read online on Scribd