Professional Documents

Culture Documents

Financial Literacy: Making Sense of Your Dollars and Cents

Uploaded by

abdisamed0 ratings0% found this document useful (0 votes)

22 views17 pagesabdisamed allaale

Original Title

Chapter 7 - Business

Copyright

© © All Rights Reserved

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentabdisamed allaale

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

22 views17 pagesFinancial Literacy: Making Sense of Your Dollars and Cents

Uploaded by

abdisamedabdisamed allaale

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 17

Chapter 6

Financial Literacy

Making Sense of your Dollars and Cents

Definitions You Should Know

• Literacy:

Having an expanse of

knowledge in a certain

subject

• Finance:

The management of

money

MoneyCounts: A Financial Literacy Series

How Does Financial Literacy Affect

You Today?

• You can never learn

something overnight.

An education on a

subject needs to grow

with time.

• If you learn about

money management

now, you will be

prepared in your

future.

MoneyCounts: A Financial Literacy Series

Does What You Know Now, Affect

Your Future?

• Of course what you know

today affects tomorrow

– You couldn’t drive a car

without a license

• That’s why you need to

begin learning about how

to spend your money

wisely today

MoneyCounts: A Financial Literacy Series

What Are The Differences Between Savers

• Spenders: and Spenders?

– Receive short term satisfaction by getting an object

they want immediately.

• Savers:

– Save for items and appreciate them forever.

• Spenders:

– Have little money in the bank, because they spend

their money on pricey items. Often are in debt, and

have no money set aside for the inevitable “rainy

day.”

• Savers:

– Have money in the bank because they knew how to

manage their money. Prepared for financial

emergencies.

MoneyCounts: A Financial Literacy Series

Financial Literacy…What is it?

Financial literacy is the ability to understand

• How money works in the world.

• How someone earns money

• How someone manages money

• How he/she invests it (turn it into more)

More specifically, it refers to the set of skills and

knowledge that allows an individual to make

informed and effective decisions with all of their

financial resources

MoneyCounts: A Financial Literacy Series

What is Financial Literacy?

What is a Financial Literacy?

Financial Literacy is the ability to use knowledge and skills to

manage financial resources effectively for a lifetime of financial

wellbeing

The foundation for Money Management

The Knowledge behind Personal and Consumer Finance

Deals with budgeting, saving, investing, debts and risk

management

MoneyCounts: A Financial Literacy Series

Principles of Financial Literacy

Ten (10) Principles of

Financial Literacy

MoneyCounts: A Financial Literacy Series

Principles of Financial Literacy

1-Map Your Financial Future

2- Your Take Home NET PAY

3- Budget Your Money (Expenses = Revenue )

4- A Healthy Budget Sample

5- Pay Yourself First

6- Save and Invest at early AGE

7- Needs Versus Wants

8-Don’t Borrow What you Can’t Pay Back

9- Protect your credit history

10-Stay Insured

MoneyCounts: A Financial Literacy Series

Stay Insured

MoneyCounts: A Financial Literacy Series

Financial Literacy

Step 1: Create a Budget-Expenses

• What do you want vs. what do you really need? Start with your

mandatory expenses on a monthly basis. Add them up.

Example:

My Monthly expenses are/will be:

1. Rent $_________

2. Utilities $_________

3. Food $_________

4. Transportation $_________

5. Other Bills $__________

(include: credit cards, loans, cell phone, internet, etc…)

6. Other expenses $_________

(include: eating out, clothes, movie tickets, etc…)

MoneyCounts: A Financial Literacy Series

Financial Literacy

Step 1: Create a Budget-Income

• Next you want to determine your monthly income.

Example:

My Monthly Income will be:

1. Wages/Salary $_________

2. Business Income $_________

3. Other $_________

• TOTAL MONTHLY INCOME $__________

MoneyCounts: A Financial Literacy Series

Financial Literacy

Step 2: Assess, Adjust and Make a Plan

• Next you want to subtract your total monthly expenses from your

total income.

Example:

• Total Monthly Income $________

• Total Monthly Expenses $________

• TOTAL SAVINGS $________

*If your expenses exceeds your income, prioritize your expenses and

look for ways to cut back on spending*

The rule is that your expenses should not exceed

your income and there should be at least 3 months living

expenses in your savings.

Assess your income and expenses, make a plan

MoneyCounts: A Financial Literacy Series

Financial Literacy

Step 3: Start a Weekly Log of

Flexible Expenses

Example:

My Weekly expenses are/will be:

1. Fuel $_________

2. Groceries $_________

3. Dining Out/Take-Out $_________

4. Clothing/Shopping $_________

5. Entertainment $_________

6. Other $_________

Total- $_________

These are items that should be monitored and assessed to determine if

over-spending is occurring.

MoneyCounts: A Financial Literacy Series

Financial Literacy

Step 4: Create a Calendar of Fixed Expense Due

Dates and Income Received

This will ensure payments are made on their due date to protect your housing,

food supply, transportation and line of credit.

MoneyCounts: A Financial Literacy Series

Healthy Relationship with Money

• In summary, financial well-being can

be defined as a state of being

wherein a person can fully meet

current and ongoing financial

obligations, can feel secure in their

financial future, and is able to make

choices that allow enjoyment of life.

MoneyCounts: A Financial Literacy Series

THE END

......... THE END..

MoneyCounts: A Financial Literacy Series

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5796)

- Thesis Slides 2022Document13 pagesThesis Slides 2022abdisamedNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Thesis Guidlines For LUCDocument19 pagesThesis Guidlines For LUCabdisamedNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- SeizureDocument16 pagesSeizureabdisamedNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Effect of Motivation On Employee Performance 2022Document60 pagesThe Effect of Motivation On Employee Performance 2022abdisamedNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Chapter OneDocument14 pagesChapter OneabdisamedNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Research Format-2Document3 pagesResearch Format-2abdisamedNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Thesis Slides 2022 (1) Fadlan AqriDocument14 pagesThesis Slides 2022 (1) Fadlan AqriabdisamedNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Chapter 1 Food Processing and PackagingDocument17 pagesChapter 1 Food Processing and PackagingabdisamedNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- Group7: - Umalkhyr Nimcan - Umalkhyr Omer - Samsam Ahmed Daahir - Salma Cilmi - Siraaj OmerDocument15 pagesGroup7: - Umalkhyr Nimcan - Umalkhyr Omer - Samsam Ahmed Daahir - Salma Cilmi - Siraaj OmerabdisamedNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Sunlight Medical College: Department of Health ScienceDocument9 pagesSunlight Medical College: Department of Health ScienceabdisamedNo ratings yet

- Chapter - 5-Constraint Satisfaction Problems-CspDocument25 pagesChapter - 5-Constraint Satisfaction Problems-CspabdisamedNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Amoud University Artificial Intelligence: Introduction: Chapter 1Document24 pagesAmoud University Artificial Intelligence: Introduction: Chapter 1abdisamedNo ratings yet

- Chapter 9 FermentationDocument10 pagesChapter 9 FermentationabdisamedNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Chap 4 BudgetingDocument39 pagesChap 4 BudgetingabdisamedNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Sunlight Medical College: VaccinationDocument17 pagesSunlight Medical College: VaccinationabdisamedNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Assignment: Power PointDocument10 pagesAssignment: Power PointabdisamedNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- 4-Systematic Surgery Abdominal HerniaDocument44 pages4-Systematic Surgery Abdominal HerniaabdisamedNo ratings yet

- At The End of This Lesson, Students Will Be Able ToDocument9 pagesAt The End of This Lesson, Students Will Be Able ToFida FahmiNo ratings yet

- Order FL0369625242: Mode of Payment: CODDocument1 pageOrder FL0369625242: Mode of Payment: CODBaba TataNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Statement of Comprehensive IncomeDocument33 pagesStatement of Comprehensive IncomeMJ TobiasNo ratings yet

- Visual Merchandising of Pantaloons by - Priya SharanDocument22 pagesVisual Merchandising of Pantaloons by - Priya Sharanpriya sharan100% (1)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- 31 Outward OrientationDocument45 pages31 Outward Orientationandhy kamaseNo ratings yet

- Unit 7 - Zakupy I Usługi KartkówkaDocument1 pageUnit 7 - Zakupy I Usługi KartkówkaAgnieszka MuszerNo ratings yet

- Cbse Class 10 SST AssignmentDocument1 pageCbse Class 10 SST AssignmentJenneil CarmichaelNo ratings yet

- Partnership Liquidation - Lump-Sum Exercise 6-1Document23 pagesPartnership Liquidation - Lump-Sum Exercise 6-1Norleen Rose S. AguilarNo ratings yet

- DPD Invoice SampleDocument18 pagesDPD Invoice SamplelarisaNo ratings yet

- Bill PDFDocument1 pageBill PDFrezolfNo ratings yet

- Int Bus CH 9Document10 pagesInt Bus CH 9carolorhurNo ratings yet

- Major Forces of GlobalizationDocument5 pagesMajor Forces of GlobalizationSoumi KhanNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

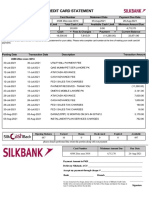

- Credit Card StatementDocument3 pagesCredit Card StatementSaifullah Saifi0% (1)

- Market Segments: (Structure of FX Market)Document4 pagesMarket Segments: (Structure of FX Market)Leo the BulldogNo ratings yet

- Comprehensive ReceivablesDocument41 pagesComprehensive ReceivablesddalgisznNo ratings yet

- Nism Xvi - Commodity Derivatives Exam - Practice Test 2Document27 pagesNism Xvi - Commodity Derivatives Exam - Practice Test 2Sohel KhanNo ratings yet

- PRICE ACTION REPORT - ADocument15 pagesPRICE ACTION REPORT - Achags usNo ratings yet

- International Economics, 7e (Husted/Melvin) Chapter 14 Prices and Exchange Rates: Purchasing Power ParityDocument17 pagesInternational Economics, 7e (Husted/Melvin) Chapter 14 Prices and Exchange Rates: Purchasing Power Parityjermaine brownNo ratings yet

- Research Proposal MaK IRfDocument14 pagesResearch Proposal MaK IRfMayank GuptNo ratings yet

- Purolator Service Guide EnglishDocument38 pagesPurolator Service Guide EnglishParker333No ratings yet

- Accounting AssignmentsDocument4 pagesAccounting AssignmentsIshan KumarNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Governance and SwotDocument3 pagesGovernance and SwotKevin Cordova HidalgoNo ratings yet

- Chapter 4. Time Value of MoneyDocument49 pagesChapter 4. Time Value of MoneyThu PhươngNo ratings yet

- Cambridge O Level: ECONOMICS 2281/21Document8 pagesCambridge O Level: ECONOMICS 2281/21Fred SaneNo ratings yet

- IE & TA - Regional Integration BlocsDocument35 pagesIE & TA - Regional Integration BlocsTapesh SharmaNo ratings yet

- Difference Between Bulk and Break BulkDocument17 pagesDifference Between Bulk and Break BulkHarun Kınalı0% (1)

- GMATH Module 6Document15 pagesGMATH Module 6michaela mascarinasNo ratings yet

- 1INDEA2022001Document90 pages1INDEA2022001Renata SilvaNo ratings yet

- BSP Circular 1107Document7 pagesBSP Circular 1107Maya Julieta Catacutan-EstabilloNo ratings yet

- Ebook Company Accounting 11Th Edition Leo Solutions Manual Full Chapter PDFDocument67 pagesEbook Company Accounting 11Th Edition Leo Solutions Manual Full Chapter PDFJenniferLeexdte100% (8)