Professional Documents

Culture Documents

Acct 20073

Uploaded by

Vrajesh BhavsarOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Acct 20073

Uploaded by

Vrajesh BhavsarCopyright:

Available Formats

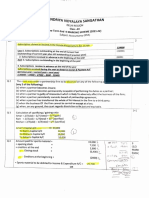

= $181,000

Fair value on 30/06/2011 is $172,000, so, $9000 of lose will be noted. The loss of $9000 represents the difference between the carry

Period 01/07/2011 to 30/06/2012

Now revised Depreciation of for balance for 9 years

= Cost – Depreciation – Revaluation Loss / Balance Years

= 200,000 – 19,000 – 9000 – 10,000 / 9

= $ 162,000/9

=$18,000

Revised Book Value of Machinery on 30.06.12

Date Particulars Debit($) Credit($)

= 200,000 – 19,000 – 9000 – 18,000

01/07/2010 Machinery A/c 200,000

= $154,000 To Cash 200,000

(being paid in cash for machinery)

As booked value and Fair30/06/2011

value marked

on 30/06/2012

Accumulated Depreciation

is same, therefore, no further calculations and entry required.

19,000

Period 01/07/2012 to 31/12/2013 To Machinery (Being

Depreciation Calculated)

19,000

Now revised

Date Depreciation of for balance

for

Revaluation 8

Particulars years

Loss (P/L) on 30/06/2013

9,000

Debit($)

Credit($)

To Machinery A/c (Being

= Cost – Depreciation – Revaluation LossDepreciation

/ofBalance Years 9,000

30/06/2014 25,000

revaluation machinery recorded in P/L)

Accumulated A/c

= 200,000 – 19,000 – 9000 – 18,000 – 18,000 To Equipment A/c 25,000

= $136,000 30/06/2012

Accumulated Depreciation A/c 18,000

= Fair value on 30/06/2013

is $150,000, Losses

Impairment so, $14,000 ToA/c

Machinery ofA/cSurplus will be booked. 18,0000

(Being Depreciation Calculated)

Current revaluation gain is 14,000

Original (150,000

amount To Equipment

*Carrying amount– 136,000) FaceFMV,

is same as A/c Which

Value no need for will reverse

250,000 10,000

previous

revaluation loss (by crediting profit and

Out of $14,000 surplus, we

Date Depreciation

(BeingYear

deduct earlier

Particulars

recognition $9000

of revaluation

loss,

Impairment which of is booked

Equipment) in Depreciation

Profit

Debit & Loss Account.

Credit 10,000 remaining $5000 show

In addition,

01-07-2010 to on 30/06/2013

30-06-2011 25,000

19,000 $

30 June 2015

Cost Of Machinery 31/12/13

on Accumulated impairment loss a/c $8750

Depreciation

01-07-11 to on 30/06/2014

30-06-2012 25,000

18,000 $

30/06/15

30/06/13

Original Cost Depreciation Reversal

Depreciation

of impairment

A/c

$200,000

Accumulated Depreciation

loss a/c

18,000 23,750

$8750

on

(Being 30/06/2015

reversal

01-07-2012 to 30-06-2013 To (Being of

EquipmentTo impairment

Machinery A/c

A/c loss.) 25,000

18,000 $

18,000 23,750

Depreciation on 30/06/2011

Ceiling $19,000 Depreciation Calculated)

01-07-2013 to amount

31-12-2013

$175,000

10,000 $

Revaluation Loss on 30/06/2011 $9,000 Machinery A/c 14,000

9000

Depreciation on 30/06/12 $18,000 To Gain on revaluation (P/L)

To Revaluation on Surplus(OCI) 5000

Depreciation on 30/06/13 $18,000

+ Revaluation Surplus on 30/06/2013 $14,000

31/12/2013

=$150,000

Accumulated depreciation 10,000

Depreciation For 01/07/2013 to 31/12/13

To(6 Month)

Machinery A/c

10,000

Cash 100,000

Revaluation on Surplus(OCI) 5,000

= 150,000-10,000 7 Years * 612 = Loss on sale of Machinery

To machinery A/C

35,000

$10,000

140,000

Therefore there is a loss of $40,000 from the

sale, also we deduct $5,000 from the surplus noted last year 30/06/2012. Hence, tot

Machinery Depreciation Table Straight Line Method:

Journal Entries between 1 July 2010 and 31 December 2013

Part B) Provide any necessary journal entries related to the impairment of the item of equipmen

Calculations:

Impairment of losses will be booked, if recoverable amount is less than carrying amount.

You might also like

- Strategies For Profiting On Every Trade Simple Lessons For Mastering The Market PDFDocument3 pagesStrategies For Profiting On Every Trade Simple Lessons For Mastering The Market PDFasureshit0% (2)

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Far460 - Set 1 - Feb 2021 - Suggested SolutionsDocument8 pagesFar460 - Set 1 - Feb 2021 - Suggested SolutionsRuzaikha razaliNo ratings yet

- Advanced Accounting Part 2 Dayag 2015 Chapter 16Document89 pagesAdvanced Accounting Part 2 Dayag 2015 Chapter 16Mckenzie100% (1)

- Chapter - 7 Departmental Accounting: Mark-Up Accounting Journal EntriesDocument17 pagesChapter - 7 Departmental Accounting: Mark-Up Accounting Journal EntriesAyush AcharyaNo ratings yet

- Test Bank For Economics of Strategy 7th Edition by DranoveDocument14 pagesTest Bank For Economics of Strategy 7th Edition by Dranovewinry100% (1)

- The Structure of The Equity Research ReportDocument14 pagesThe Structure of The Equity Research ReportBALAJI RAVISHANKARNo ratings yet

- Cash Flow Statement ProblemDocument2 pagesCash Flow Statement Problemapi-3842194100% (2)

- Dag 305 Project FinanceDocument133 pagesDag 305 Project Financemulenga lubembaNo ratings yet

- 2020 Sem 1 ACC10007 Discussion Questions (And Solutions) - Topic 2 (Part 3)Document5 pages2020 Sem 1 ACC10007 Discussion Questions (And Solutions) - Topic 2 (Part 3)Renee WongNo ratings yet

- Madaraka Ltd. Statement of Comprehensive Income For The Year Ended 31 March 2020 KES'000' KES'000'Document17 pagesMadaraka Ltd. Statement of Comprehensive Income For The Year Ended 31 March 2020 KES'000' KES'000'Maryjoy KilonzoNo ratings yet

- 14 - Accounting 4 DepreciationDocument22 pages14 - Accounting 4 DepreciationKAMAL POKHRELNo ratings yet

- Accounting For Long Term Assets Property Plant and Equipment (Ias 16)Document7 pagesAccounting For Long Term Assets Property Plant and Equipment (Ias 16)ZAKAYO NJONYNo ratings yet

- M S Accy Pre-Board 1Document7 pagesM S Accy Pre-Board 1Krishna SinghNo ratings yet

- 2020 Sem 1 ACC10007 Discussion Questions (And Solutions) - Topic 2 (Part 2)Document5 pages2020 Sem 1 ACC10007 Discussion Questions (And Solutions) - Topic 2 (Part 2)Renee WongNo ratings yet

- Accountancy 12 - DS2 - Set - 1Document15 pagesAccountancy 12 - DS2 - Set - 1Deepa Saravana KumarNo ratings yet

- Solution Final Mock Paper (Sure Shot Questions) Class 12 - AccountancyDocument10 pagesSolution Final Mock Paper (Sure Shot Questions) Class 12 - AccountancyPratik PrakashNo ratings yet

- Trial Balance 2020Document13 pagesTrial Balance 2020Wilton MwaseNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument12 pages© The Institute of Chartered Accountants of IndiaMiku JainNo ratings yet

- 2022 12 01 Answer Key Additional M6 M7Document15 pages2022 12 01 Answer Key Additional M6 M7Niger RomeNo ratings yet

- BudgetDocument7 pagesBudgetvasanthgurusamynsNo ratings yet

- Suggested Answers Certificate in Accounting and Finance - Spring 2021Document7 pagesSuggested Answers Certificate in Accounting and Finance - Spring 2021Maham IlyasNo ratings yet

- Tutorial 10 CH 5.3.6 SolutionDocument5 pagesTutorial 10 CH 5.3.6 SolutionenglishlessonsNo ratings yet

- Fac2601-2013-6 - Answers PDFDocument9 pagesFac2601-2013-6 - Answers PDFcandiceNo ratings yet

- Group 1 AccountsDocument18 pagesGroup 1 Accountsadityatiwari122006No ratings yet

- LECTURE NOTES-Translation of Foreign FSDocument4 pagesLECTURE NOTES-Translation of Foreign FSGenesis CervantesNo ratings yet

- PRACTICE CLASS 3, 4 and 5Document6 pagesPRACTICE CLASS 3, 4 and 5Zain JamilNo ratings yet

- Analysis of Financial StatementsDocument27 pagesAnalysis of Financial StatementsnickcrokNo ratings yet

- AF210 Unit 4 Tutorial SolutionsDocument5 pagesAF210 Unit 4 Tutorial SolutionsChand DivneshNo ratings yet

- LCCI Level One Final AcctDocument2 pagesLCCI Level One Final AcctStpmTutorialClassNo ratings yet

- Solved Pu 2 Annual QP Accountancy 2024Document10 pagesSolved Pu 2 Annual QP Accountancy 2024tommyvercetti880055No ratings yet

- 72222bos58192 P1aDocument11 pages72222bos58192 P1aSufiyan MominNo ratings yet

- Modul 8 PembahasanDocument12 pagesModul 8 PembahasanAi TanahashiNo ratings yet

- FAR210 Aug 2023 S PDFDocument10 pagesFAR210 Aug 2023 S PDFNUR AYUNI BALQISH AHMAD MULIADINo ratings yet

- Statement of Profit or Loss and Other Comprehensive IncomeDocument4 pagesStatement of Profit or Loss and Other Comprehensive IncomeOnela BriannaNo ratings yet

- Task 3 AccDocument4 pagesTask 3 Accbbang bbyNo ratings yet

- Advanced Accounting Part 2 Dayag 2015 Chapter 16Document90 pagesAdvanced Accounting Part 2 Dayag 2015 Chapter 16MckenzieNo ratings yet

- 5 Income Statament BSE (1A)Document8 pages5 Income Statament BSE (1A)Armaan BalochNo ratings yet

- Aminah Quiz Answer Done by Abdullah Narejo-The Great.Document10 pagesAminah Quiz Answer Done by Abdullah Narejo-The Great.Abdullah NarejoNo ratings yet

- Depreciation of Non-Current Assets - 11Document3 pagesDepreciation of Non-Current Assets - 11Adinda Nathania Damaris SurbaktiNo ratings yet

- Answer BE9-2 Explanation:: Calculation of Book Value and Accumulated Depreciation For Each of The AssetsDocument2 pagesAnswer BE9-2 Explanation:: Calculation of Book Value and Accumulated Depreciation For Each of The AssetsYousuf SiyamNo ratings yet

- PartnersDocument13 pagesPartnersvaloruroNo ratings yet

- 04 Branch Accounts PQ SolDocument24 pages04 Branch Accounts PQ Soltyagivansh1200No ratings yet

- DepreciationDocument21 pagesDepreciationxvfidxwmgNo ratings yet

- Accountancy Answer Key - II Puc Annual Exam March 2019Document8 pagesAccountancy Answer Key - II Puc Annual Exam March 2019Akash kNo ratings yet

- Unit 3 Retirement of A Partner - Problems With AnswersDocument13 pagesUnit 3 Retirement of A Partner - Problems With Answersds1619231No ratings yet

- DepreciationDocument3 pagesDepreciationSumanth KumarNo ratings yet

- Tutorial Pack On PpeDocument14 pagesTutorial Pack On PpeAyandiswa NdebeleNo ratings yet

- 12 - Incomplete Record - With - AnswerDocument13 pages12 - Incomplete Record - With - AnswerAbid faisal AhmedNo ratings yet

- TKDN RW WatesDocument15 pagesTKDN RW WatesAhmad JazuliNo ratings yet

- Case 3.7Document7 pagesCase 3.7Thái SơnNo ratings yet

- Class Examples SolutionsDocument4 pagesClass Examples Solutionsgwbadie7No ratings yet

- IAS 8 Class Example 2 - Suggested SolutionDocument3 pagesIAS 8 Class Example 2 - Suggested SolutionGiven RefilweNo ratings yet

- S20 TX ZAF Sample AnswersDocument8 pagesS20 TX ZAF Sample AnswersKAH MENG KAMNo ratings yet

- Date Particulars: in The Books of XYZDocument23 pagesDate Particulars: in The Books of XYZAnanya ChoudharyNo ratings yet

- Q.4-Question and SolutionDocument4 pagesQ.4-Question and SolutionFIROZ KHANNo ratings yet

- Departmental PEQDocument38 pagesDepartmental PEQRishikaNo ratings yet

- CashFlowStatement ProblemsDocument19 pagesCashFlowStatement Problems8qyyyhy7jdNo ratings yet

- Om 08.12.2022Document18 pagesOm 08.12.2022raviNo ratings yet

- Table of ContentDocument32 pagesTable of ContentRuh DilNo ratings yet

- 1 RevaluationDocument38 pages1 RevaluationAbdul RaufNo ratings yet

- Adjustments To Financial StatementsDocument7 pagesAdjustments To Financial StatementsClemyNo ratings yet

- 13 - PartnershipDocument47 pages13 - Partnershipjyotsanakirad1234No ratings yet

- A Profit and Loss Budget For The 6 Months Ending 31/12/2020Document6 pagesA Profit and Loss Budget For The 6 Months Ending 31/12/2020Miral AqelNo ratings yet

- Treasury Management in Banks - CAIIBDocument157 pagesTreasury Management in Banks - CAIIBAparnaBhattNo ratings yet

- William Thorndike,: The OutsidersDocument17 pagesWilliam Thorndike,: The OutsidersAnkurNo ratings yet

- Japan Outbound M and A 2019 Update - EnglishDocument8 pagesJapan Outbound M and A 2019 Update - EnglishSiddharth PanidapuNo ratings yet

- Interest Free MicrofinanceDocument53 pagesInterest Free MicrofinancejeffNo ratings yet

- TYBAF Black Book TopicDocument2 pagesTYBAF Black Book Topicmahekpurohit1800No ratings yet

- Union Budget Analysis - Feb 2023Document13 pagesUnion Budget Analysis - Feb 2023shwetapradhanNo ratings yet

- Pecos Company and Suaro CompanyDocument4 pagesPecos Company and Suaro CompanyCharlotte0% (1)

- Chapter 2 Accounting For The Service BusinessDocument37 pagesChapter 2 Accounting For The Service BusinessKristel100% (1)

- Brown, Walter W. or Annabelle P. BrownDocument20 pagesBrown, Walter W. or Annabelle P. BrownJan Ellard CruzNo ratings yet

- Financial Management 2Document6 pagesFinancial Management 2Julie R. UgsodNo ratings yet

- CFA Level1 2018 Curriculum UpdatesDocument13 pagesCFA Level1 2018 Curriculum UpdatesTeddy Jain100% (1)

- State Bank of India: The Banker To Every IndianDocument4 pagesState Bank of India: The Banker To Every IndianSrinivas NandikantiNo ratings yet

- Topics SDADocument1 pageTopics SDAThinkLink, Foreign Affairs www.thinklk.comNo ratings yet

- Advantages of Islamic BankingDocument2 pagesAdvantages of Islamic BankingMohd Azrul Dseven83% (6)

- State New Jersey Pension Investments - ReportDocument3 pagesState New Jersey Pension Investments - ReportJohn ProutNo ratings yet

- BBA 4th 2012 Financial Management-204Document2 pagesBBA 4th 2012 Financial Management-204Ríshãbh JåíñNo ratings yet

- Structuralism Vs ReconstructionismDocument3 pagesStructuralism Vs ReconstructionismRupashi GoyalNo ratings yet

- R07 Statistical Concepts and Market Returns IFT Notes1Document27 pagesR07 Statistical Concepts and Market Returns IFT Notes1Rezaul AlamNo ratings yet

- Polycab India LTD AR 2019 20 2 PDFDocument307 pagesPolycab India LTD AR 2019 20 2 PDFSrikanth Reddy SanguNo ratings yet

- Drawing A Fine LineDocument1 pageDrawing A Fine LineShantanuNo ratings yet

- KBC BelgiaDocument2 pagesKBC BelgiaBogdan StanicaNo ratings yet

- SageOne Investor Memo May 2018Document10 pagesSageOne Investor Memo May 2018Akhil ParekhNo ratings yet

- Model Questionnaire 14-03-T20 PDFDocument12 pagesModel Questionnaire 14-03-T20 PDFMADHAN KUMAR PARAMESWARANNo ratings yet

- Social Return On Investment Study in ESAF Microfinance, Kerala, IndiaDocument78 pagesSocial Return On Investment Study in ESAF Microfinance, Kerala, IndiaJaimoenNo ratings yet

- Investment and Portfolio Management 5Document51 pagesInvestment and Portfolio Management 5madihashkh100% (1)

- Firm Investment DecisionsDocument20 pagesFirm Investment DecisionsMaaz WahidNo ratings yet