Professional Documents

Culture Documents

Accounting for Depreciation Journal Entries

Uploaded by

KAMAL POKHRELOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounting for Depreciation Journal Entries

Uploaded by

KAMAL POKHRELCopyright:

Available Formats

CHAPTER

14

Accounting for Depreciation

CW 1___________

Here,

Depreciation = = = = 27,000 per annum.

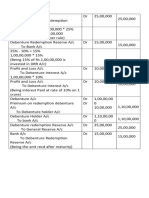

a) JOURNAL ENTRIES

Date Particulars L/F Dr. Amount Cr. Amount

1/1/2059 Plant A/c Dr 1,50,000

To Bank A/c 1,50,000

(Being purchased plant)

31/12/059 Depreciation A/c Dr 27,000

To Plant A/c 27,000

(Being depreciation charged)

31/12/059 P/L A/c Dr 27,000

To Depreciation A/c 27,000

(Being Depreciation transferred to P/L A/c)

31/12/060 Depreciation A/c Dr 27,000

To Plant A/c 27,000

(Being depreciation charged)

31/12/060 P/L A/c Dr 27,000

To Depreciation A/c 27,000

(Being Depreciation transferred to P/L A/c)

31/12/061 Depreciation A/c Dr 27,000

To Plant A/c 27,000

(Being depreciation charged)

31/12/061 P/L A/c Dr 27,000

To Depreciation A/c 27,000

(Being Depreciation transferred to P/L A/c)

Total 3,12,000 3,12,000

b)

Dr. PLANT ACCOUNT Cr.

Date Particulars JF Amount Date Particulars JF Amount

1/1/059 To bank 1,50,000 31/12/059 By Depreciation 27,000

31/12/059 By Balance c/d 1,23,000

1,50,000 1,50,000

Principles of Accounting – I 118

1/1/060 To Balance b/d 1,23,000 31/12/060 By Depreciation 27,000

31/12/060 By Balance c/d 96,000

1,23,000 1,23,000

1/1/061 To Balance b/d 96,000 31/12/061 By Depreciation 27,000

31/12/061 By Balance c/d 69,000

96,000 96,000

1/1/062 To Balance b/d 69,000

CW 2___________

Here,

Cost of machine = 70,000

Freight of charge = 2,000

Installation Charge = 6,000

Salvage value = 12,000

Estimated life =5

Total cost of machine = Cost of machine + Freight + Installation = 70,000 + 2,000 + 6,000 = 78,000

Annual Depreciation = = = = Rs. 13,200 per annum

Dr. MACHINERY ACCOUNT Cr.

Date Particulars JF Amount Date Particulars JF Amount

1/7/2001 To bank 78,000 30/6/2002 By Depreciation 13,200

30/6/2002 By Balance c/d 64,800

78,000 78,000

1/7/2002 To Balance b/d 64,800 30/6/2003 By Depreciation 13,200

30/6/2003 By Balance c/d 51,600

64,800 64,800

1/7/2003 To Balance b/d 51,600 30/6/2004 By Depreciation 13,200

30/6/2004 By Balance c/d 38,400

51,600 51,600

1/7/2004 To Balance b/d 38,400

CW 3_______________

Year 1st Machine 2nd Machine 3rd Machine Total

40,000

2000 2,000 2,000

38,000 45,000 83,000

2001 4,000 4,400 8,400

34,000 40,600 12,600 87,200

2002 4,000 4,400 600 9,000

30,000 36,200 12,000 78,200

Dr. MACHINERY ACCOUNT Cr.

Date Particulars JF Amount Date Particulars JF Amount

1/7/2000 To bank 40,000 31/12/2000 By Depreciation 2,000

31/12/2000 By Balance c/d 38,000

40,000 40,000

1/1/2001 To Balance b/d 38,000 31/12/2001 By Depreciation 8,400

1/1/2001 To bank 45,000 31/12/2001 By Balance c/d 74,600

83,000 83,000

1/1/2002 To Balance b/d 74,600 31/12/2002 By Depreciation 9,000

1/7/2002 To bank 12,600 31/12/2002 By Balance c/d 78,200

87,200 87,200

1/1/2003 To Balance b/d 78,200

119 Accounting for Depreciation

CW 4___________

Here ,

Depreciation for 1st X-ray machine = = = 1,26,000

Year 1st Machine 2nd Machine Total

7,00,000

2060 31,500 31,500

6,68,500

2061 1,26,000 1,26,000

5,42,500 9,00,000

2062 35,500 1,35,000 1,66,500

5,11,000 7,65,000

DR. X- RAY MACHINERY ACCOUNT CR.

Date Particulars JF Amount Date Particulars JF Amount

1/10/2060 To Bank 7,00,000 30/12/2060 By Depreciation 31,500

30/12/2060 By Balance c/d 6,68,500

7,00,000 7,00,000

1/1/2061 To Balance b/d 6,68,500 30/12/2061 By Depreciation 1,26,000

30/12/2061 By Balance c/d 5,42,500

6,68,500 6,68,500

1/1/2062 To Balance b/d 5,42,500 1/4/2062 By Depreciation 31,500

1/4/2062 To Bank 9,00,000 1/4/2062 By bank (sale) 3,00,000

1/4/2062 By P/L a/c (loss) 2,11,000

30/12/2062 By Depreciation 1,35,000

30/12/2062 By Balance c/d 7,65,500

14,42,500 14,42,500

1/10/2000 To Balance b/d 7,65,500

CW 5___________

1st Machine

Cost (c) = 2,00,000

Depreciation = 6,00,000 × 20/100 = 1,20,000

2nd Machine

Cost (c) = 2,20,000

Depreciation = 20% of 2,20,000 = 44,000

Dr. MACHINERY ACCOUNT Cr.

[Under 1st Line Method]

Date Particulars Amount Date Particulars Amount

1st April 1999 To Cash a/c 6,00,000 31st Dec1999 By Depreciation a/c 90,000

31st Dec1999 By Balance c/d 5,10,000

6,00,000 6,00,000

1st Jan 2000 To Balance b/d 5,10,000 31st Dec2000 By Depreciation a/c 1,20,000

By Balance c/d 3,90,000

5,10,000 5,10,000

1st Jan 2000 To Balance b/d 3,90,000 31st Dec2001 By Depreciation a/c 1,21,000

1st Oct 2001 To Cash a/c 2,20,000 31st Dec2001 By Cash a/c 90,000

31st Dec2001 By Profit & Loss 10,000

31st Dec2001 By Balance c/d 3,89,000

6,10,000 6,10,000

1st Jan 2001 To Balance b/d 3,89,000

Principles of Accounting – I 120

CW 6___________

Depreciation chart

Year 1st Van 2nd Van 3rd Van Total

4,92,500

1998 49,250 49,250

4,43,250 6,25,000

1999 49,250 31,250 80,500

3,94,000 5,93,750 5,37,500

2000 24,625 62,500 26,875 24,624 + 89,375

3,69,375 5,31,250 5,10,625

Dr. DELIVERY VAN ACCOUNT Cr.

Date Particulars JF Amount Date Particulars JF Amount

1/1/1998 To bank (Purchase) 4,50,000 31/12/1998 By Depreciation 49,250

1/1/1998 To bank (repair) 42,500 31/12/1998 By Balance c/d 4,43,250

4,92,500 4,92,250

1/1/1999 To Balance b/d 4,43,250 31/12/1999 By Depreciation 80,500

1/7/1999 To bank 6,25,000 31/12/1999 By Balance c/d 9,87,750

10,68,250 10,68,250

1/1/2000 To Balance b/d 9,87,750 1/7/2000 By depreciation 24,625

1/7/2000 To bank 5,37,500 1/7/2000 By bank (sale) 82,500

1/7/2000 By P/L a/c (loss) 2,86,875

31/12/2000 By Depreciation 89,375

30/12/2000 By Balance c/d 10,41,875

15,25,250 15,25,250

1/1/2001 To Balance b/d 10,41,875

Dr. DEPRECIATION ACCOUNT Cr.

Date Particulars JF Amount Date Particulars JF Amount

31/12/1998 To delivery van 49,250 31/12/1998 By P/L a/c 49,250

49,250 49,250

31/12/1999 To delivery van 80,500 31/12/1999 By P/L a/c 80,500

80,500 80,500

1/7/2000 To delivery van 24,625 31/12/2000 By P/L a/c 1,14,000

31/12/2000 To delivery van 89,375

1,14,000 1,14,000

Total Cost = 4,50,000 + 42,500 = 4,92,500

CW 7___________

Total cost = 2,00,000 × 3 = Rs. 6,00,000

Year 1st car 2nd car 3rd car 4th car Total

2,00,000 2,00,000 2,00,000

1999 30,000 30,000 30,000 90,000

1,70,000 1,70,000 1,70,000

2000 40,000 40,000 40,000 1,20,000

1,30,000 1,30,000 1,30,000 2,20,000

2001 30,000 40,000 40,000 11,000 30,000 + 91,000

1,00,000 90,000 90,000 2,09,000

121 Accounting for Depreciation

Dr. CAR ACCOUNT Cr.

Date Particulars JF Amount Date Particulars JF Amount

1/4/1999 To bank 2,00,000 31/12/1999 By Depreciation 90,000

1/4/1999 To bank 2,00,000 31/12/1999 By Balance c/d 5,10,000

1/4/1999 To bank 2,00,000

6,00,000 6,00,000

1/1/2000 To Balance b/d 5,10,000 31/12/2000 By Depreciation 1,20,000

31/12/2000 By Balance c/d 3,90,000

5,10,000 5,10,000

1/1/2001 To Balance b/d 3,90,000 1/10/2001 By depreciation 30,000

1/1/2001 To bank 2,20,000 1/10/2001 By bank 90,000

1/10/2001 By P/L a/c (loss) 10,000

31/12/2001 By Depreciation 91,000

31/12/2001 By Balance c/d 3,89,000

6,10,000 6,10,000

1/1/2002 To Balance b/d 3,89,000

CW 8_______________

Year 1st Machine 2nd Machine 3rd Machine Total

75,000

25,000 50,000 50,000

2058 1,875 3,750 1,250 6,875

23,125 46,250 48,750 25,000

2059 2,500 5,000 5,000 1,250 13,750

20,625 41,250 43,750 23,750

2060 625 5,000 5,000 2,500 625 + 12,500

20,000 36,250 38,750 21,250

Dr. MACHINERY ACCOUNT Cr.

Date Particulars JF Amount Date Particulars JF Amount

1/4/2058 To bank (Purchase) 75,000 31/12/2058 By Depreciation 6,875

1/10/2058 To bank (Purchase) 50,000 31/12/2058 By Balance c/d 1,18,125

1,25,000 1,25,000

1/1/2059 To Balance b/d 1,18,125 31/12/2059 By Depreciation 13,750

1/7/2059 To bank (Purchase) 25,000 31/12/2059 By Balance c/d 1,29,375

1,43,125 1,43,125

1/1/2060 To Balance b/d 1,29,375 31/3/2060 By depreciation 625

31/3/2060 To P/L a/ (Profit) 1,600 31/3/2060 By bank (sale) 21,600

31/12/2060 By Depreciation 12,500

31/12/2060 By Balance c/d 96,250

1,30,975 1,30,975

1/1/2061 To Balance b/d 96,250

CW 9___________

Let the original cost of the Delivery van be Rs. x

Depreciation for 1996 = 10% of x × 1 =

Depreciation for 1997 = 20% of x × 1 =×x =

Now,

x– – = 1,75,000

Principles of Accounting – I 122

or, 10x – x – 2x = 17,50,000

or, 7x = 17,50,000

x = 2,50,000

The original cost of the machine purchased on 1st July 1996 is Rs. 2,50,000.

Year 1st Machine 2nd Machine 3rd Machine Total

1,75,000 2,16,300

1998 50,000 32,445 82,445

1,25,000 1,83,855 1,72,000

1999 50,000 43,260 11,466.60 1,04,726.60

75,000 1,40,595 1,60,533.40

2000 50,000 43,260 34,400 1,27,660

25,000 97,335 93,688.40

Dr. DELIVERY VAN ACCOUNT Cr.

Date Particulars JF Amount Date Particulars JF Amount

1/1/1998 To Balance b/d 1,75,000 31/12/1998 By Depreciation 82,445

31/3/1998 To bank (Purchase) 2,16,300 31/12/1998 By Balance c/d 3,08,855

3,91,300 3,91,300

1/1/1999 To Balance b/d 3,08,855 31/12/1999 By Depreciation 1,04,726.67

1-9-1999 To bank (Purchase) 1,72,000 31/12/1999 By Balance c/d 3,76,128.33

4,80,855 4,80,855

1/1/2000 To Balance b/d 3,76,128.33 31/12/2000 By Depreciation 1,27,660

31/12/2000 By Balance c/d 2,48,468.33

3,76,128.33 3,76,128.33

1/1/2062 To Balance b/d 2,48,468.33

CW 10______________

Year Machine Total

70,000

2059 - 7,000 7,000

63,000

2060 - 6,300 6,300

56,700

2061 - 5,670 5,670

51,030

Dr. MACHINERY ACCOUNT Cr.

Year Particular JF Amount Date Particular JF Amount

1/1/2059 To Bank (purchase) 70,000 31/12/2059 By Depreciation 70,000

3112/2059 By Balance c/d 63,000

70,000 70,000

1/1/2060 To Balance b/d 63,000 31/12/2060 By Depreciation 6,300

31/12/2060 By Balance c/d 56,700

63,000 63,000

1/1/2061 To Balance b/d 56,700 31/12/2061 By Depreciation 5,670

31/12/2061 By Balance c/d 51,030

56,700 56,700

1/1/2062 To Balance b/d 51,030

Dr. DEPRECIATION ACCOUNT Cr.

Date Particular JF Amount Date Particular JF Amount

13/12/2059 To Machinery 7,000 31/12/2059 By P/L A/c 7,000

123 Accounting for Depreciation

7,000 7,000

31/12/2060 To Machinery 6,300 31/12/2060 By P/L A/c 6,300

6,300 6,300

31/12/2061 To Machinery 5,670 31/12/2060 By P/L A/c 5,670

CW 11______________

Year 1st Machine 2nd Machine 3rd Machine Total

10000

2000 - 375 375

9625 6,000

2001 - 1443075 - 450 1,893.75

8181.25 5,550 5,000

2002 - 1227.18 - 832.5 - 187.5 2,247.18

6954.07 4,717.5 4,812.5

a)

Dr. MACHINERY ACCOUNT Cr.

Date Particular JF Amount Date Particular JF Amount

1/10/2000 To Bank(purchase) 10,000 31/12/2000 By Depreciation 375

31/12/2000 By Balance c/d 9,625

10,000 10,000

1/1/2001 To Balance b/d 9,625 31/12/2001 By Depreciation 1,893.75

1/7/2001 To Bank (purchase) 6,000 31/12/2001 By Balance c/d 13,731.25

15,625 15,625

1/1/2002 To Balance b/d 13,731.25 31/12/2002 By Depreciation 2,247.18

1/10/2002 To Bank (purchase) 5,000 31/12/2002 By Balance c/d 16,484.07

18,731.25 18,731.25

1/1/2003 To Balance b/d 16,484.07

b)

Dr. DEPRECIATION ACCOUNT Cr.

Date Particulars JF Amount Date Particulars JF Amount

31/12/2000 To Machinery 375 31/12/2000 By P/L A/c 375

375 375

31/12/2001 To Machinery 1,893.75 31/12/2001 By P/L A/c 1,893.75

1,893.75 1,893.75

31/12/2002 To Machinery 2,247.18 31/12/2002 By P/L A/c 2,247.18

2,247.18 2,247.18

CW 12______________

Year 1st Machine 2nd Machine 3rd Machine Total

60,000

2058 -6,000 6,000

54,000 25,000

2059 - 5,400 - 1,250 6,650

48,600 23,750 22,500

2060 - 3,645 - 2,375 - 5,62.5 6,582.5

44,955 2,13,375 2,1937.5

2061 - 21,37.5 - 2,193.75 4,331.25

19,237.5 19,743.75

Dr. MACHINERY ACCOUNT Cr.

Principles of Accounting – I 124

Date Particulars JF Amount Date Particulars JF Amount

1/1/2059 To Balance b/d 54,000 31/12/2059 By Depreciation 6,650

1/7/2059 To Bank (purchase) 25,000 31/12/2059 By Balance c/d 72,350

79,000 79,000

1/1/2060 To Balance b/d 72,350 31/9/2060 By Depreciation 3,645

1/10/2060 To Bank (purchase) 22,500 31/9/2060 By Bank (sale) 16,500

31/9/2060 By P/L A/c (loss) 28,455

31/12/2060 By Depreciation 2,937.50

31/12/2060 By Balance c/d 43,312.50

1/1/2061 To Balance b/d 43,312.50 31/12/2061 By Depreciation 4,331.25

31/12/2061 By Balance c/d 38,981.25

43,312.50 43,312.50

1/1/2062 To Balance b/d 38,981.25

CW 13______________

Year 1st Machine 2nd Machine 3rd Machine Total

40,000

2000 - 2,000 2,000

38,000 30,000

2001 - 3,800 - 2,250 6,050

34,200 27,750 30,000

2002 - 3,420 - 2,081.25 - 750 2,081.25+4,170

30,780 25,668.75 2,92,750

Dr. MACHINERY ACCOUNT Cr.

Date Particulars JF Amount Date Particulars JF Amount

1/7/2000 To Bank (purchase) 40,000 31/12/2000 By Depreciation 2,000

31/12/2000 By Balance c/d 38,000

40,000 40,000

1/1/2001 To Balance b/d 38,000 31/12/2001 By Depreciation 6,050

1/4/2001 To Bank (purchase) 30,000 31/12/2001 By Balance c/d 61,950

68,000 68,000

1/1/2002 To Balance b/d 61,950 1/10/2002 By Depreciation 2,081.25

1/10/2002 To Bank (purchase) 30,000 1/10/2002 By Bank (sale) 16,000

1/10/2002 By P/L A/c (loss) 9,668.75

31/12/2002 By Depreciation 4,170

31/12/2002 By Balance c/d 60,030

91,950 91,950

1/1/2003 To Balance b/d 60,030

CW 14__________

Working Table

I 1/4 I 3/4 II

2000 1 July – 20,000 1 July 60,000

Dep 1,000 Dep 3,000

2001 1 Jan 19,000 1 Jan 57,000

Dep 1,900 Dep 5,700

2002 1 Jan 17,100 1 Jan 51,300 31 October 30,000

Dep 1,425 Dep 5,130 Dep 500

Book Value 15,675

125 Accounting for Depreciation

Sale 19,500

Profit 3,825

MACHINERY ACCOUNT

Dr. [Under written Down Value Method] Cr.

Date Particulars Amount Date Particulars Amount

1st July 2000 To Bank a/c 80,000 21st Dec By Depreciation a/c 4,000

2000

By Balance c/d 76,000

80,000 80,000

1st Jan, 2001 To Balance b/d 76,000 31st Dec By Depreciation a/c 7,600

2001

By Balance c/d 68,400

76,000 76,000

1st Jan 2002 To Balance b/d 68,400 31st Oct 2002 By Depreciation a/c

[68,400×1/4×10/100×10/12] 1,425

31st Oct 2002 To Profit & Loss a/c 3,825 31st Oct 2002 By Bank a/c (SP)

[Sales of 1/4the Magh] 19,500

31st Oct 2002 To Bank a/c 30,000 31st Dec By Depreciation a/c

2002 [68,400–17,100 × 10/100] 5,130

31st Dec By Depreciation a/c

2002 [30,000 × 10/100 × 2/12] 500

31st Dec By Balance c/d 75,670

2002

1,02,225 1,02,225

18th Jan2003 To Balance b/d 75,670

CW 15__________

Let the original cost be Rs x

Then,

In 1996, 10% of x = x =

Dep. In 1997 = x - = 10% of = × =

We have,

X- - = 4,05,000

Or, 100x – 10x – 9x = 4,05,00,000

Or, 81x = 4,05,00,000

x = 5,00,000

Year 1ST Machine 2nd Machine Total

1996 1,04,000 3,96,000

-10,400 -39,600

1997 93,600 3,56,400

-9,360 -35,640

1998 84,240 3,20,760

-8,424 -32,076 40,500

1999 75,816 2,88,684 1,20,000+16,400

-3,790.8 -28,864.4 -6,820 3,790.8+34,868.4

2000 72,025.2 2,59,815.6 1,29,580

-25,981.56 -12,958 37,381.56

2,33,834.04 1,16,622

Dr. MACHINERY ACCOUNT Cr.

Date Particulars JF Amount Date Particulars JF Amount

1/1/1998 To Balance b/d 4,05,000 31/12/1998 By Depreciation 40,500

31/12/1998 By Balance c/d 3,64,500

Principles of Accounting – I 126

4,05,000 4,05,000

1/1/1999 To Balance b/d 3,64,500 1/7/1999 By Depreciation 3,790.8

1/7/1999 To Bank (purchase) 1,20,000 1/7/1999 By Bank (sale) 36,000

1/7/1999 To Bank (installation) 1/7/1999 By P/L A/c 36,025.2

31/12/1999 By Depreciation 35,688.4

31/12/1999 By Balance c/d 3,89,395.6

5,00,900 5,00,900

1/1/2000 To Balance b/d 3,89,395.6 31/12/2000 By Depreciation 38,939.56

31/12/2000 By Bal c/d 3,50,456.04

1/1/2001 To Balance b/d 3,50,456.04

CW 16__________

a) Here,

Original Price (P) = 40,000 + 2,000 = 42,000

Depreciated Price (D) = 21,504

Rate (R) =?

No. of Years (n) =3

We have,

D =P

Or, 21504 = 42000x

Or, 512000 = (100 – R) 3

Or, 80 = 100 – R

R = 20%

Year Machine Total

42,000

2000 - 8,400 8,400

33,600

2001 - 6,720 6,720

26,880

2002 - 5,376 5,376

21,504

b)

Dr. MACHINERY ACCOUNT Cr.

Date Particulars JF Amount Date Particulars JF Amount

1/1/2000 To Bank (purchase) 40,000 31/12/2000 By Depreciation 8,400

1/1/2000 To Bank (erection) 2,000 31/12/2000 By Balance c/d 33,600

42,000 42,000

1/1/2001 To Balance b/d 33,600 31/12/2001 By Depreciation 6,720

31/12/2001 By Balance c/d 26,880

33,600 33,600

1/1/2002 To Balance b/d 26,880 31/12/2002 By Depreciation 5,376

31/12/20002 By Balance c/d 21,504

26,880 26,880

1/1/2002 To Balance b/d 21,504

c)

Dr. DEPRECIATION ACCOUNT Cr.

Date Particulars JF Amount Date Particulars JF Amount

31/12/2000 To Machinery 8,400 31/12/2000 By P/L A/c 8,400

8,400 8,400

31/12/2001 To Machinery 6,720 31/12/2001 By P/L A/c 6,720

127 Accounting for Depreciation

6,720 6,720

31/12/2002 To Machinery 5,376 31/12/2002 By P/L A/c 5,376

5,376 5,376

HW 1___________

Annual Depreciation of Plant = = = Rs.7,200

Dr JOURNAL ENTRIES Cr

Date Particulars LF Dr. Amount Cr. Amount

2059-01-01 Plant a/c................................................................................

Dr 40,000

To Bank a/c 40,000

(Being plant purchase)

2059-12-31 Depreciation a/c...............................................................Dr 7,200

To Plant a/c 7,200

(Being Depreciation charge on plant)

2061-12-31 Depreciation a/c...............................................................Dr 7,200

To Plant a/c 7,200

(Being Depreciation charge on plant)

2062-12-31 Depreciation a/c............................................................... 7,200

To Plant a/c 7,200

(Being Depreciation charge on plant)

2063-12-31 Depreciation a/c............................................................... 7,200

To Plant a/c 7,200

(Being Depreciation charge on plant)

2064-12-31 Depreciation a/c...............................................................Dr 7,200

To Plant a/c 7,200

(Being Depreciation charge on plant)

b)

Dr. PLANT ACCOUNT Cr.

Date Particulars Amount Date Particulars Amount

2059-01-01 To Bank a/c 40,000 2059-12-31 By Depreciation a/c 7,200

By Balance c/d 32,800

40,000 40,000

2060-01-01 To Balance b/d 32,800 2060-12-31 By Depreciation a/c 7,200

By Balance c/d 25,600

32,800 32,800

2061-01-01 To Balance b/d 25,600 2061-12-31 By Depreciation a/c 7,200

By Balance c/d 18,400

25,600 25,600

2062-01-01 To Balance b/d 18,400 2062-12-31 By Depreciation a/c 7,200

By Balance c/d 11,200

18,400 18,400

2063-01-01 To Balance b/d 11,200 2063-12-31 By Depreciation a/c 7,200

By Balance c/d 4,000

11,200 11,200

2064-01-01 To Balance b/d 4,000

HW 2___________

Here,

Cost of machine = Rs. 20,000

Overhauling cost = Rs. 6,000

Principles of Accounting – I 128

Scrap value = Rs. 1,000

Estimated life (Years) =5

Now,

Total cost of machine = Cost of machine + Overhauling cost = Rs. 20,000 + Rs. 6,000 = Rs. 26,000

Annual Depreciation = = = = Rs. 5,000 per annum

DR. MACHINERY ACCOUNT CR.

Date Particulars JF Amount Date Particulars JF Amount

1/1/2001 To bank 26,000 31/12/2001 By Depreciation 5,000

31/12/2001 By Balance c/d 21,000

26,000 26,000

1/1/2002 To Balance b/d 21,000 31/12/2002 By Depreciation 5,000

31/12/2002 By Balance c/d 16,000

21,000 21,000

1/1/2003 To Balance b/d 16,000 31/12/2003 By Depreciation 5,000

31/12/2003 By Balance c/d 11,000

16,000 16,000

1/1/2004 To Balance b/d 11,000

HW 3___________

Here ,

Depreciation for 1st X-ray machine = = = 72000 per annum

Year 1st Machine 2nd Machine Total

4,50,000

2059 54,000 54,000

3,96,000

2060 72,000 72,000

3,24,000 6,00,000

2061 60,000 60,000

5,40,000

Dr. X- RAY MACHINERY ACCOUNT Cr.

Date Particulars JF Amount Date Particulars JF Amount

1/4/2059 To bank 4,50,000 30/12/2059 By Depreciation 54,000

30/12/2059 By Balance c/d 3,96,000

4,50,000 4,50,000

1/1/2060 To Balance b/d 3,96,000 30/12/3060 By Depreciation 72,000

30/12/2060 To P/L A/c (Gain) 26,000 30/12/2060 By Bank (sale) 3,50,000

30/12/2060 To bank 6,00,000 30/12/2060 By Balance c/d 6,00,000

10,22,000 10,22,000

1/1/2061 To Balance b/d 6,00,000 30/12/2061 By Depreciation 60,000

30/12/2061 By Balance c/d 5,40,000

6,00,000 6,00,000

1/10/2000 To Balance b/d 5,40,000

HW 4___________

I) Annual Depreciation of Machine = =

= = 12,000

II) Annual Depreciation of Machine = =

= = 11,000

129 Accounting for Depreciation

MACHINERY ACCOUNT

Dr Straight Line Method Cr

Date Particulars Amount Date Particulars Amount

2058-01-01 To Bank a/c 40,000 2058-12-31 By Depreciation a/c 3,000

By Balance c/d 37,000

40,000 40,000

2059-01-01 To Balance b/d 37,000 2059-12-31 By Depreciation a/c 17,500

2059-07-01 To Bank a/c 60,000 By Balance c/d 79,500

97,000 97,000

2060-01-01 To Balance b/d 79,500 2059-12-31 By Depreciation a/c 11,000

To Profit & Loss a/c 1,500 2059-01-01 By Bank a/c 26,500

(1st Machine sold

By Balance c/d 43500

81,000 81,000

2061-01-01 To Balance b/d 43,500

HW 5_______________

Year 1st Machine 2nd Machine 3rd Machine Total

60,000

2000 3,000 3,000

57,000 45,000

2001 6,000 4,400 10,400

51,000 40,600 32,600

2002 6,000 4,400 1,550 11,950

45,000 36,200 31,050 78,200

2003 4,400 3,100 7,500

Dr. MACHINERY ACCOUNT Cr.

Date Particulars JF Amount Date Particulars JF Amount

1/7/2000 To bank 60,000 31/12/2000 By Depreciation 3,000

31/12/2000 By Balance c/d 57,000

60,000 60,000

1/1/2001 To Balance b/d 57,000 31/12/2001 By Depreciation 10,400

1/1/2001 To bank 45,000 31/12/2001 By Balance c/d 91,600

1,02,000 1,02,000

1/1/2002 To Balance b/d 91,600 31/12/2002 By Depreciation 11,950

1/7/2002 To bank 32,600 31/12/2002 By bank (sale) 46,200

31/12/2002 To P/L a/c (Gain) 1,200 31/12/2002 By Balance c/d 67,250

1,25,400 1,25,400

1/1/2003 To Balance b/d 67,250

HW 6_______________

Year 1st Machine 2nd Machine 3rd Machine Total

60,000

1998 3,000 3,000

57,000

1999 6,000 6,000

51,000 40,000 60,000

2000 4,500 2,000 1,500 4,500 + 3,500

Principles of Accounting – I 130

38,000 58,500

Dr MACHINERY ACCOUNT Cr

Date Particulars JF Amount Date Particulars JF Amount

1/7/1998 To bank (Purchase) 40,000 31/12/1998 By Depreciation 3,000

To bank (Overhaul) 20,000 31/12/1998 By Balance c/d 57,000

60,000 60,000

1/1/2001 To Balance b/d 57,000 31/12/1999 By Depreciation 6,000

31/12/1999 By Balance c/d 51,000

57,000 57,000

1/1/2000 To Balance b/d 51,000 1/10/2000 By Depreciation 4,500

1/7/2000 To bank 40,000 1/10/2000 By bank 10,000

1/10/2000 To bank 60,.000 1/10/2000 By P/L A/c (loss) 36.500

31/12/2000 By Depreciation 3,500

31/12/2000 By Balance c/d 96,500

1,51,000 1,51,000

1/1/2001 To Balance b/d 96,500

HW 7_______________

Year 1st Machine 2nd Machine Total

30,000 60,000

30,000 60,000 50,000

1998 2,250 4,500 1,250 8,000

27,750 55,500 48,750

1999 3,000 6,000 5,000 14,000

24,750 49,500 43,750

2000 1,500 6,000 5,000 1,500 + 11,000

23,250 43,500 38,750

Dr. MACHINERY ACCOUNT Cr.

Date Particulars JF Amount Date Particulars JF Amount

1/4/1998 To bank (Purchase) 90,000 31/12/1998 By Depreciation 8,000

1/10/1998 To bank (Purchase) 50,000 31/12/1998 By Balance c/d 1,32,000

1,40,000 1,40,000

1/1/1999 To Balance b/d 1,32,000 31/12/1999 By Depreciation 14,000

31/12/1999 By Balance c/d 1,18,000

1,32,000 1,32,000

1/1/2000 To Balance b/d 1,18,000 1/7/2000 By depreciation 1,500

1/7/2000 To P/L a/ (Profit) 4,250 1/7/2000 By bank (sale) 27,500

31/12/2000 By Depreciation 11,000

31/12/2000 By Balance c/d 82,250

1,22,250 1,22,250

1/1/2061 To Balance b/d 82,250

HW 8_______________

Year I II III IV V VI Total

3,00,000 3,00,000 3,00,000 3,00,000 3,00,000

2059 45,000 45,000 45,000 45,000 45,000 2,25,000

2,55,000 2,55,000 2,55,000 2,55,000 2,55,000 4,00,000

2060 60,000 60,000 60,000 60,000 45,000 20,000 45,000 + 2,60,000

131 Accounting for Depreciation

1,95,000 1,95,000 1,95,000 1,95,000 2,10,000 3,80,000

2000 60,000 60,000 60,000 60,000 80,000 3,20,000

1,35,000 1,35,000 1,35,000 1,35,000 3,00,000

Dr. MACHINERY ACCOUNT Cr.

Date Particulars JF Amount Date Particulars JF Amount

1/4/2059 To bank (Purchase) 15,00,000 31/12/2059 By Depreciation 2,25,000

31/12/2059 By Balance c/d 12,75,000

15,00,000 15,00,000

1/1/2060 To Balance b/d 12,75,000 1/10/2060 By Depreciation 45,000

1/10/2060 To bank (Purchase) 4,00,000 1/10/2060 By bank 1,20,000

1/10/2060 By P/L a/c (loss) 90,000

31/12/2060 By Depreciation 2,60,000

31/12/2060 By Balance c/d 11,60,000

16,75,000 16,75,000

1/1/2061 To Balance b/d 11,60,000 31/12/2061 By Depreciation 3,20,000

31/12/2061 By Balance c/d 8,40,000

11,60,000 11,60,000

1/1/2062 To Balance b/d 8,40,000

HW 9___________

Let the original cost be Rs x

Given,

Dep. In 1998 = 10% of x = x =

Dep. In 1999 = 20% of x = x =

Dep. In x- = 42000

Or, 10x – x-2x = 420000

The original cost of the machine purchased on July 1998 is Rs 60000

Year 1st machine 2nd machine 3rd machine Total

42,000

2000 - 12,000 12,000

30,000 50,000

2001 - 12,000 - 7,500 19,500

18,000 42,500 90,000

2002 - 12,000 - 10,000 - 6,000 28,000

6,000 32,500 84,000

Dr. MACHINERY ACCOUNT Cr.

Date Particular JF Amount Date Particular JF Amount

1/1/2000 To Balance b/d 42,000 31/12/2000 By Depreciation 12,000

31/12/2000 By Balance c/d 30,000

42,000 42,000

1/1/2001 To Balance b/d 3,000 31/12/2001 By Depreciation 19,500

1/3/2001 To Back (purchase) 50,000 31/12/2001 By Balance c/d 60,500

80,000 80,000

1/1/2002 To Balance b/d 60,500 31/12/2002 By Depreciation 28,000

1/9/2002 To Bank (purchase) 90,000 31/12/2002 By Balance c/d 1,22,500

1,50,500 1,50,500

1/1/2003 To Balance b/d 1,22,500

HW 10__________

Let the original cost of the machine be Rs. X

Then,

Principles of Accounting – I 132

Dep. in 1996 = 10% of x = x =

Dep. in 1997 = 10% of x = x =

Now,

x- = 64,000

or,10x-2x = 6,40,000

8x = 64,000

x = Rs. 80,000

The original cost of the machine purchased on 1st Jan. 1996 is Rs 80,000

Year 1st Machine 2nd Machine Total

20,000 60,000

1996 -2,000 -6,000

18,000 54,000

1997 -2,000 -6,000

16,000 48,000

1998 -2,000 -6,000 8,000

14,000 42,000 60,000

1999 -1,000 -6,000 -3,000 1,000+9,000

13,000 36,000 57,000

2000 -6,000 -6,000 12,000

30,000 51,000

Dr. MACHINERY ACCOUNT Cr.

Date Particulars JF Amount Date Particular JF Amount

1/1/1998 To Balance b/d 64,000 31/12/1998 By Depreciation 8,000

31/12/1998 By Balance c/d 56,000

64,000 64,000

1/1/1999 To Balance b/d 56,000 31/12/1999 By Depreciation 1,000

1/7/1999 To Bank (purchase) 60,000 1/7/1999 By Bank (sale) 13,500

1/7/1999 To P/L a/c (gain) 500

31/12/1999 By Depreciation 9,000

1/12/1999 By Balance c/d 93,000

1,16,500 1,16,500

1/1/2000 To Balance b/d 93,000 31/12/2000 By Depreciation 12,000

31/12/2000 By Balance c/d 81,000

93,000 93,000

1/1/2001 To Balance b/d 81,000

HW 11__________

Dr. MACHINERY ACCOUNT Cr.

Date Particulars Amount Date Particulars Amount

01/01/59 To Bank a/c 100,000 31/12/059 By Depreciation 10,000

31/12/059 By Balance c/d 90,000

100,000 100,000

01/01/060 To Balance b/d 90,000 31/12/060 By Depreciation 9,000

31/12/060 By Balance c/d 81,000

90,000 90,000

01/01/061 To Balance b/d 81,000 31/12/061 By Depreciation 81,000

By Balance c/d 72,900

81,000 81,000

01/11/062 To Balance b/d 72,900

HW 12______________

Year 1st Machine 2nd Machine 3rd machine Total

133 Accounting for Depreciation

33,000

2059 -3,712.50 3,712.50

29,287.50 22,000

2060 -4,393.125 -1,650 6,043.12

24,894.375 20,350 11,000

2061 -3,734.16 -3,052.50 -412.50 7,199.16

21,160.21 17,297.50 10,587.5

Dr. MACHINERY ACCOUNT Cr.

Date Particulars JF Amount Date Particulars JF Amount

1/4/2059 To Bank (purchase) 33,000 31/12/2059 By Depreciation 3,712.50

31/12/2059 By Balance c/d 29,287.50

33,000 33,000

1/1/2060 To Balance b/d 29,287.50 31/12/2060 By Depreciation 6,043.12

1/7/2060 To Bank (purchase) 20,000 31/12/2060 By Balance c/d 45,244.38

1/7/2060 To Bank (erection) 2,000

51,287.50 51,287.50

1/1/2061 To Balance b/d 45,244.38 31/12/2061 By Depreciation 7,199.16

1/10/2061 To Bank (purchase) 10,000 31/12/2061 By Balance c/d 49,045.22

1/10/2061 To Bank (erection) 1,000

56,244.38 56,244.38

1/1/2062 To Balance b/d 49,045.22

Dr. DEPRECIATION ACCOUNT Cr.

Date Particulars JF Amount Date Particulars JF Amount

31/12/2059 To Machine 3712.50 31/12/2059 By P/L A/c 3712.50

3712.50 3712.50

31/12/2060 To Machine 6043.12 31/12/2060 By P/L A/c 6043.12

6043.12 6043.12

31/12/2061 To machine 7199.16 31/12/2061 By P/L A/c 7199.16

7199.6 7199.6

HW 13______________

Year 1st Building 2nd Building 3rd Building Total

6,48,000

2059 - 64,800 64,800

5,83,200 4,00,000

2060 - 58,320 - 30,000 88,320

5,24,880 3,70,000 2,50,000

2061 - 52,488 - 37,000 - 6,250 95,738

4,72,392 3,33,000 2,43,750

BUILDING ACCOUNT

Date Particulars JF Amount Date Particulars JF Amount

1/1/2059 To Balance b/d 6,48,000 31/12/2059 By Depreciation 64,800

31/12/2059 By Balance c/d 5,83,200

6,48,000 6,48,000

1/1/2060 To Balance b/d 5,83,200 31/12/2060 By Depreciation 88,320

1/4/2060 To Bank 4,00,000 31/12/2060 By Balance c/d 8,94,880

9,83,200 9,83,200

1/1/2061 To Balance b/d 8,94,880 31/12/2061 By Depreciation 95,738

30/9/2061 To Bank 2,50,000 31/12/2061 By Balance c/d 10,49,142

Principles of Accounting – I 134

11,44,880 11,44,880

1/1/2062 To Balance b/d 10,49,142

HW 14______________

Date 1st Machine 2nd Machine 3rd Machine

2058 1 Baisakh 80,000

Depreciation 8,000

2059 1 Baisakh 72,000 1 Kartik 30,000

Depreciation 7,200 Depreciation 1,500

2060 1 Baisakh 64,800 1 Baisakh 28,500 1 Shrawan 60,000

Depreciation 6,480 Depreciation 712.50 Depreciation 4,500

27,787.50

Sale 26,500

Loss 1,287.50

2061 1 Baisakh 58320 1 Baisakh 55,500

Depreciation 5832 Depreciation 5,550

2062 1 Baisakh 52488 1 Baisakh 49,950

Dr. MACHINERY ACCOUNT Cr.

Date Particulars Amount Date Particulars Amount

01/01/058 To Balance a/c 80,000 31/12/058 By Depreciation a/c 8,000

By Balance c/d 72,000

80,000 80,000

01/01/059 To Balance b/d 72,000 31/12/059 By Depreciation a/c 8700

01/07/059 To Balance a/c 30,000 By Balance c/d 93,300

1,02,000 1,02,000

01/01/060 To Balance c/d 93,300 31/12/059 By Depreciation a/c 11,692.50

01/04/060 To Bank a/c 60,000 (6,480 + 71,250 + 4,500)

By Cash (sale) 26,500

By P/L a/c (loss) 1,287.50

By Balance c/d 1,13,820

1,53,300 1,53,300

01/01/061 To Balance b/d 1,13,820 31/12/061 By Depreciation 11,382

By Balance c/d 1,02,438

1,13,820 1,13,820

01/01/062 To Balance b/d 1,02,438

HW 15__________

DEPRECIATION TABLE

Yr I Sold I Unsold II III

2000 1 April 18,000 1 April 72,000 1 October 60,000

Depreciation 1,350 Depreciation 54,000 Depreciation 1,500

2001 1 January 16,650 1 January 66600 1 October 58500 1 July 100000

Depreciation 1,248.75 Depreciation 6660 Depreciation 5850 Depreciation 5000

BV 15,401.25

CV 5,600

Loss 9,801.25

135 Accounting for Depreciation

2002 1 January 59,940 1 October 52,650 1 January 95000

Depreciation 5,994 Depreciation 5,265 Depreciation 9500

2003 1 January 59,946 1 October 47,385 1 January 85,500

Dr. MACHINERY ACCOUNT Cr.

Date Particulars Amount Date Particulars Amount

01/04/2000 To Bank a/c 90,000 31/12/2000 By Depreciation 8,250

01/07/2000 To Bank a/c 60,000 By Balance c/d 1,41,750

1,50,000 1,50,000

01/01/2001 To Balance b/d 1,41,750 31/12/2001 By Depreciation 18,758.75

01/07/2001 To Bank a/c 1,00,000 By Balance a/c (sale) 5,600

By P/L a/c (loss) 9801.25

By Balance c/d 2,07,590

2,41,750 2,71,750

01/01/2002 To Balance b/d 2,07,590 31/12/2002 By Depreciation a/c 20,759

By Balance c/d 1,86,831

2,07,590 2,07,590

01/01/2003 To Balance b/d 1,86,831

HW 16______________

Year 1st Machine 2nd Machine Total

20,000 60,000

1999 -1,000 -3,000 4,000

19,000 57,000

2000 -1,900 -5,700 7,600

17,100 51,300 60,000

2001 -1,282.5 -5,130 -1,500 6,630+1,282.5

15,817.50 46,170 58,500

2002 -4,617 -5,850 10,467

Dr. MACHINERY ACCOUNT Cr.

Date Particulars JF Amount Date Particulars JF Amount

1/7/1999 To Bank (purchase) 80,000 31/12/1999 By Depreciation 4,000

31/12/1999 By Balance c/d 76,000

80,000 80,000

1/1/2000 To Balance b/d 76,000 31/12/2000 By Depreciation 7,600

31/12/2000 By Balance c/d 68,400

76,000 76,000

1/1/2001 To Balance b/d 68,400 1/10/2001 By Depreciation 1,282.50

1/10/2001 To Bank (purchase) 60,000 1/10/2001 By Bank (sale) 9,500

1/10/2001 By P/L A/c (loss) 6,317.50

31/12/2001 By Depreciation 6,630

31/12/2001 By Balance c/d 1,04,676

1,28,400 1,28,400

1/1/2002 To Balance b/d 1,04,676 31/12/2002 By Depreciation 10,467

31/12/2002 By Balance c/d 94,203

1,04,616 1,04,616

1/1/2002 To Balance b/d 94,203

HW 17______________

Year 1st Machine 2nd Machine Total

20,000 40,000 80,000

Principles of Accounting – I 136

2000 -1,000 -2,000 -1,333.33 4,333.33

19,000 38,000 78,666.67

2001 -1,900 -3,800 -7,866.67 13,566.67

17,100 34,200 70,800

2002 -427.5 -3,420 -7,080 427.5+10,500

1,66,72.5 30,780 63,720

Dr. MACHINERY ACCOUNT Cr.

Date Particulars JF Amount Date Particulars JF Amount

1/7/2000 To Bank (purchase) 60,000 31/12/2000 By Depreciation 4,333.33

1/10/2000 To Bank (purchase) 80,000 31/12/2000 By Balance c/d 1,35,666.67

1,40,000 1,40,000

1/1/2001 To Balance b/d 1,35,666.67 31/12/2001 By Depreciation 13,566.67

31/12/2001 By Balance c/d 1,22,100

1,35,666.67 1,35,666.67

1/12002 To Balance b/d 1,22,100 31/3/2002 By Depreciation 427.5

31/3/2002 By Bank (sale) 11,600

31/3/2002 By P/L A/c (loss) 5,072.50

31/12/2002 By Depreciation 10,500

31/12/2002 By Balance c/d 94,500

1,22,100 1,22,100

1/1/2003 To Balance b/d 94,500

HW 18__________

Let Original cost on 1 July 1998 = Rs.100

Depreciation for 1998 for 6 months = 10% of 100 × = Rs.5

Depreciation for 1999 for 1 year = (100 – 5) × 10% = 9.5

Depreciation value on 1 Jan 2000 = 100 – 5 – 9.5 = 85.5

DV Original cost

85.5 100

85500 ?

= 100 × = Rs.100,000

DEPRECIATION TABLE

Year I Sold I Unsold II

1998 1 July 20,000 1 July 80,000

Depreciation 1,000 Depreciation 4,000

1999 1 January 19,000 1 January 76,000

Depreciation 1,900 Depreciation 7,600

2000 1 January 17,100 1 January 68,400 1 October 50,000

Depreciation 1,282.50 Depreciation 8,640 Depreciation 1,250

15,817.50

Sale 13,500

Loss 2,317.50

2001 1 January 61,560 1 January 48,750

Depreciation 6,156 Depreciation 4,875

2002 1 January 55,404 1 January 43,875

Depreciation 5,540.4 Depreciation 4,875

2003 49,863.60 39,487.50

Dr. MACHINERY ACCOUNT Cr.

Date Particulars Amount Date Particulars Amount

01/01/2000 To Balance b/d 85,500 31/12/2000 By Depreciation a/c 9,372.5

01/09/2000 To Bank a/c 50,000 By Bank a/c (sale) 13,500

137 Accounting for Depreciation

By P/L a/c (loss) 2,317.50

By Balance c/d 1,10,310

1,35,500 1,35,500

01/01/2001 To Balance b/d 1,10,310 31/12/2001 By Depreciation a/c 11,031

By Balance c/d 99,279

1,10,310 1,10,310

01/01/2002 To Balance b/d 99,279 31/12/2002 By Depreciation a/c 9,927.90

By Balance c/d 89,351.10

99,279 99,279

01/01/2003 To Balance b/d 89,351.10

HW 19__________

Here

Let the Original Price be Rs. X

In 2057, 10% of X x = x x =

In 2058, Book Value =x- =

10% of = x =

Now, - =

We have, = 166500

Or, 333x = 66600000

x = Rs. 200000

Year 1st Machine 2nd machine Total

40,000 1,60,000

2057 -3,000 -12,000 15,000

37,000 1,48,000

2058 -3,700 -14,800 18,500

33,300 1,33,200

2059 -3,330 -13,320 16,650

29,970 1,19,880

2060 -2,997 -11,988 14,985

26,973 1,07,892 50,000

2061 -1,348.65 -10,789.2 -2,500 1,348.65+13,289.2

25,624.35 97,102.8 47,500

Dr. MACHINERY ACCOUNT Cr.

Date Particulars JF Amount Date Particulars JF Amount

1/1/2059 To Balance b/d 1,66,500 31/12/2059 By Depreciation 16,650

31/12/2059 By Balance c/d 149,850

1,66,500 1,66,500

1/1/2060 To Balance b/d 1,49,850 31/12/2060 By Depreciation 14,985

31/12/2060 By Balance c/d 1,34,865

1,49,850 1,49,850

1/1/2061 To Balance b/d 1,34,865 1/7/2061 By Depreciation 1,348.65

1/7/2061 To P/L A/c (gain) 875.65 1/7/2061 By Bank (sale) 26,500

1/7/2061 To Bank (purchase) 50,000 31/12/2061 By Depreciation 13,289.2

31/12/2061 By Balance c/d 1,44,602.8

1,85,740.65 1,85,740.65

1/1/2062 To Balance b/d 1,44,602.8

Principles of Accounting – I 138

HW 20__________

a) Original Cost (P) = Rs.6,500 + 1,500

Depreciated Value (D) = Rs.8,000

Rate (R) =?

No. of years (N) =3

We have,

D =P

2,744 = 8,000

2,744 = 8,000

2,744 × 100 × 100 × 100 = 8,000 (100 – R)3

343000 = (100 – R)3

703 = (100 – R)3

70 = 100 – R

R = 30%

b)

Dr. MACHINERY ACCOUNT Cr.

Date Particulars Amount Date Particulars Amount

1st Year To Bank a/c 8,000 1st Year By Depreciation 2,400

By Balance c/d 5,600

8,000 8,000

2nd Year To Balance b/d 5,600 2nd Year By Depreciation 1680

By Balance c/d 3,920

5,600 5,600

3rd Year To Balance b/d 3,920 3rd Year By Depreciation 1176

By Balance c/d 2744

3,920 3,920

4th Year To Balance b/d 2,744

139 Accounting for Depreciation

You might also like

- Economics of Climate Change Mitigation in Central and West AsiaFrom EverandEconomics of Climate Change Mitigation in Central and West AsiaNo ratings yet

- BudgetDocument7 pagesBudgetvasanthgurusamynsNo ratings yet

- 72222bos58192 P1aDocument11 pages72222bos58192 P1aSufiyan MominNo ratings yet

- Answers To NavneetDocument12 pagesAnswers To NavneetPawan TalrejaNo ratings yet

- 5.3 Depreciation Soln To Practice QuestionsDocument18 pages5.3 Depreciation Soln To Practice Questionsdivya shindeNo ratings yet

- Solution Ultimate Sample Paper 2Document7 pagesSolution Ultimate Sample Paper 2Nitin KumarNo ratings yet

- Retirement Tulsians NewDocument13 pagesRetirement Tulsians Newastitvasingh193No ratings yet

- Test Your Knowledge - 7Document2 pagesTest Your Knowledge - 7narangdiya602No ratings yet

- M/S Azad Trading Company: Below Jain Mandir, Lal Kuan BULANDSHAHR (U.P.) - 203001 Pan No - ABSPJ1368DDocument18 pagesM/S Azad Trading Company: Below Jain Mandir, Lal Kuan BULANDSHAHR (U.P.) - 203001 Pan No - ABSPJ1368DBhaveshNo ratings yet

- Adv. Accounting Test-2 CH-3 SolutionsDocument13 pagesAdv. Accounting Test-2 CH-3 SolutionsNITIN JAINNo ratings yet

- PRACTICE CLASS 3, 4 and 5Document6 pagesPRACTICE CLASS 3, 4 and 5Zain JamilNo ratings yet

- Journal Date Particulars L.F. Amt. (DR.) Amt. (CR.) : Solution Class 11 - Accountancy Test 2Document9 pagesJournal Date Particulars L.F. Amt. (DR.) Amt. (CR.) : Solution Class 11 - Accountancy Test 2BHS PRAYAGRAJNo ratings yet

- Solved Pu 2 Annual QP Accountancy 2024Document10 pagesSolved Pu 2 Annual QP Accountancy 2024tommyvercetti880055No ratings yet

- FAR Revision Questions - ICAEWDocument16 pagesFAR Revision Questions - ICAEWEduskill Learning CentreNo ratings yet

- Madaraka Ltd. income statement and financialsDocument17 pagesMadaraka Ltd. income statement and financialsMaryjoy KilonzoNo ratings yet

- Acct 20073Document1 pageAcct 20073Vrajesh BhavsarNo ratings yet

- CLASS WORK 2 (7 DEC) CHP 6Document10 pagesCLASS WORK 2 (7 DEC) CHP 6Isha KatiyarNo ratings yet

- Analysis of Financial StatementsDocument27 pagesAnalysis of Financial StatementsnickcrokNo ratings yet

- FA-Depreciation - Inventory SolvedDocument13 pagesFA-Depreciation - Inventory SolvedAdhiraj MukherjeeNo ratings yet

- Inventory and Depreciation MethodsDocument13 pagesInventory and Depreciation MethodsAdhiraj MukherjeeNo ratings yet

- CCP402Document19 pagesCCP402api-3849444No ratings yet

- Consignment Accounting Journal Entries and Ledger AccountsDocument7 pagesConsignment Accounting Journal Entries and Ledger AccountsLavisha GoyalNo ratings yet

- Working Papers Presentation-Ap-NpDocument6 pagesWorking Papers Presentation-Ap-NpAngelica Mae MarquezNo ratings yet

- Paper2_Set1_SolutionDocument5 pagesPaper2_Set1_Solutionadityatiwari122006No ratings yet

- Journal Problems For AssignmentDocument2 pagesJournal Problems For AssignmentMD. Arif HossainNo ratings yet

- Ch4 Completing The Accounting Cycle ACC101Document9 pagesCh4 Completing The Accounting Cycle ACC101Muhammad KridliNo ratings yet

- Ia 2 AssignmentDocument8 pagesIa 2 AssignmentJotaro KujoNo ratings yet

- In The Books of Anshal LTD Date Particulars JournalDocument10 pagesIn The Books of Anshal LTD Date Particulars JournalANISH DUA IPM 2019-24 BatchNo ratings yet

- Departmental accounts solutionsDocument10 pagesDepartmental accounts solutionsMINTU SARAFNo ratings yet

- DepreciationDocument21 pagesDepreciationxvfidxwmgNo ratings yet

- Opening Entries - Closing Entries - Transfer Entries Part 2Document5 pagesOpening Entries - Closing Entries - Transfer Entries Part 2Odirile MasogoNo ratings yet

- Solution Final Mock Paper (Sure Shot Questions) Class 12 - AccountancyDocument10 pagesSolution Final Mock Paper (Sure Shot Questions) Class 12 - AccountancyPratik PrakashNo ratings yet

- Dey's Solution Book Accountancy XII Part-A 2021-22 EditionDocument56 pagesDey's Solution Book Accountancy XII Part-A 2021-22 Editionmanoj jainNo ratings yet

- Jagjeet NotesDocument12 pagesJagjeet NotesPawan TalrejaNo ratings yet

- CA Foundation Accounts A MTP 2 June 2023Document12 pagesCA Foundation Accounts A MTP 2 June 2023Vranda RastogiNo ratings yet

- Funds Flow Sums & SolutionDocument23 pagesFunds Flow Sums & SolutionMoun DeepaNo ratings yet

- Cash Flow SolutionsDocument49 pagesCash Flow Solutionsdivya shindeNo ratings yet

- Branch AccountsDocument9 pagesBranch AccountsKalpana SinghNo ratings yet

- 2014 Final Exam SolutionsDocument6 pages2014 Final Exam SolutionsAyaan Ahaan Malik-WilliamsNo ratings yet

- ACC 1 Quiz No. 12 Answer KeyDocument17 pagesACC 1 Quiz No. 12 Answer Keynicole bancoroNo ratings yet

- Paper2 Set2 SolutionDocument7 pagesPaper2 Set2 Solutionadityatiwari122006No ratings yet

- Financial Reporting in HyperinflationDocument12 pagesFinancial Reporting in HyperinflationShane KimNo ratings yet

- Pe2 Acc Nov05Document19 pagesPe2 Acc Nov05api-3825774No ratings yet

- Accounts Class 12Document167 pagesAccounts Class 12Utkarsh Navandar100% (1)

- Ultimate Accountancy Class 12 Sample Paper SolutionsDocument8 pagesUltimate Accountancy Class 12 Sample Paper SolutionsBeena ShibuNo ratings yet

- FA MMS-FA-pg 107-114Document8 pagesFA MMS-FA-pg 107-114rohit shahNo ratings yet

- Accounts Ans MTP 2 NOV 2018Document10 pagesAccounts Ans MTP 2 NOV 2018backuphpdv6No ratings yet

- Provision of DepreciationDocument3 pagesProvision of DepreciationNaveedNo ratings yet

- Company Final Accounts: Solutions To Assignment ProblemsDocument9 pagesCompany Final Accounts: Solutions To Assignment ProblemsPalavesa KrishnanNo ratings yet

- RTP Group IDocument202 pagesRTP Group Iravi_bansal85No ratings yet

- Problems Based On Ledger's Preparation P: Roblem 11Document28 pagesProblems Based On Ledger's Preparation P: Roblem 11Anonymous ameerNo ratings yet

- Revaluation, Retirement and Partnership ChangesDocument11 pagesRevaluation, Retirement and Partnership ChangesDheerNo ratings yet

- Saurabh Company A/C Trial Balance: 1-Apr-2020 To 1-Apr-2021 Particulars Closing Balance Credit DebitDocument1 pageSaurabh Company A/C Trial Balance: 1-Apr-2020 To 1-Apr-2021 Particulars Closing Balance Credit DebitAviral Pratap Singh -4 CNo ratings yet

- Accountancy 12 - DS2 - Set - 1Document15 pagesAccountancy 12 - DS2 - Set - 1Deepa Saravana KumarNo ratings yet

- Cash Flow Statement ProblemDocument2 pagesCash Flow Statement Problemapi-3842194100% (2)

- DebentureDocument3 pagesDebentureKevin DsilvaNo ratings yet

- Capital AllowancesDocument106 pagesCapital AllowancesAwaiZ zahidNo ratings yet

- Depreciation Solution PDFDocument10 pagesDepreciation Solution PDFDivya PunjabiNo ratings yet

- NK Associates transaction report Jan-Dec 2022Document1 pageNK Associates transaction report Jan-Dec 2022Naeem MalikNo ratings yet

- Financial Position of Nepal SBI BankDocument33 pagesFinancial Position of Nepal SBI BankKAMAL POKHRELNo ratings yet

- In Partial Fulfillment of The Requirement For The Degree of Master's in Business Studies (M.B.S)Document12 pagesIn Partial Fulfillment of The Requirement For The Degree of Master's in Business Studies (M.B.S)KAMAL POKHRELNo ratings yet

- Office On Operation Covering 68 Districts Including Achham, Banke, BardiyaDocument4 pagesOffice On Operation Covering 68 Districts Including Achham, Banke, BardiyaKAMAL POKHRELNo ratings yet

- Analysis of Growth Rates in Bank Deposits and LoansDocument10 pagesAnalysis of Growth Rates in Bank Deposits and LoansKAMAL POKHRELNo ratings yet

- Risk and Return Analysis of Commercial BDocument92 pagesRisk and Return Analysis of Commercial BSubhamUpretyNo ratings yet

- Rofitability Position of Sanakishan Kirsi Sahakari Santha, Kailali, NepalDocument32 pagesRofitability Position of Sanakishan Kirsi Sahakari Santha, Kailali, NepalKAMAL POKHRELNo ratings yet

- Office On Operation Covering 68 Districts Including Achham, Banke, BardiyaDocument4 pagesOffice On Operation Covering 68 Districts Including Achham, Banke, BardiyaKAMAL POKHRELNo ratings yet

- Deposit Collection of Nepal Sbi Bank Limited: A Project Work ReportDocument29 pagesDeposit Collection of Nepal Sbi Bank Limited: A Project Work ReportKAMAL POKHRELNo ratings yet

- UntitledDocument1 pageUntitledKAMAL POKHRELNo ratings yet

- B.A.2078-079 Title TableDocument6 pagesB.A.2078-079 Title TableKAMAL POKHRELNo ratings yet

- A Proposal For The Study of Customer Satisfaction of The Customers of Jojo's Restaurant and Lounge in TamghasDocument6 pagesA Proposal For The Study of Customer Satisfaction of The Customers of Jojo's Restaurant and Lounge in TamghasKAMAL POKHRELNo ratings yet

- Equity Share Analysis of Nabil Bank Limited and Himalayan Bank LimitedDocument20 pagesEquity Share Analysis of Nabil Bank Limited and Himalayan Bank LimitedKAMAL POKHRELNo ratings yet

- Gorkhal Yoddha Security Guard Attendance SheetDocument1 pageGorkhal Yoddha Security Guard Attendance SheetKAMAL POKHRELNo ratings yet

- Social Networking SiteDocument1 pageSocial Networking SiteKAMAL POKHRELNo ratings yet

- Resunga Multiple Campus: Resunga Municipality, Gulmi Internal Examination - 2079Document2 pagesResunga Multiple Campus: Resunga Municipality, Gulmi Internal Examination - 2079KAMAL POKHRELNo ratings yet

- Resunga Multiple Campus: Resunga Municipality, Gulmi Internal Examination - 2079Document2 pagesResunga Multiple Campus: Resunga Municipality, Gulmi Internal Examination - 2079KAMAL POKHRELNo ratings yet

- Moonlight of NepalDocument20 pagesMoonlight of NepalKAMAL POKHRELNo ratings yet

- 1.1 Background of The Study: Vision MissionDocument34 pages1.1 Background of The Study: Vision MissionKAMAL POKHRELNo ratings yet

- Why was Ganesh expelled from schoolDocument5 pagesWhy was Ganesh expelled from schoolKAMAL POKHRELNo ratings yet

- Mamata Kumari BhandariDocument21 pagesMamata Kumari BhandariNa Ge Sh100% (1)

- UntitledDocument1 pageUntitledKAMAL POKHRELNo ratings yet

- Accounting for Incomplete RecordsDocument7 pagesAccounting for Incomplete RecordsKAMAL POKHRELNo ratings yet

- Vishal PorDocument7 pagesVishal PorKAMAL POKHRELNo ratings yet

- Credit Risk Management Proposal for Shine Resunga Development BankDocument7 pagesCredit Risk Management Proposal for Shine Resunga Development BankKAMAL POKHRELNo ratings yet

- 16 - Accounting 4 Non-Trading ConcernsDocument17 pages16 - Accounting 4 Non-Trading ConcernsKAMAL POKHRELNo ratings yet

- Journal Voucher EntriesDocument17 pagesJournal Voucher EntriesKAMAL POKHRELNo ratings yet

- Resunga Multiple Campus HRM ExamDocument1 pageResunga Multiple Campus HRM ExamKAMAL POKHRELNo ratings yet

- Background of StudyDocument5 pagesBackground of StudyKAMAL POKHRELNo ratings yet

- Resunga Kha FkgihfhigDocument7 pagesResunga Kha FkgihfhigKAMAL POKHRELNo ratings yet

- Issues in Income DeterminationDocument8 pagesIssues in Income DeterminationLyk Comment ShareNo ratings yet

- Induction TestDocument3 pagesInduction TestNeelesh KumarNo ratings yet

- Afm MCQDocument10 pagesAfm MCQJibu MathewNo ratings yet

- Ratios Analysis Case For FNFMDocument3 pagesRatios Analysis Case For FNFMsaikumarNo ratings yet

- Financial Analysis Project FinishedDocument33 pagesFinancial Analysis Project Finishedapi-312209549No ratings yet

- Download ebook Financial Accounting Ii Paperback Hanif Mukherjee Pdf full chapter pdfDocument67 pagesDownload ebook Financial Accounting Ii Paperback Hanif Mukherjee Pdf full chapter pdfjulie.morrill858100% (26)

- Impairment of AssetsDocument21 pagesImpairment of AssetsSteffanie Granada50% (2)

- 2607y Maliyyə Hesabatı SABAH (En)Document34 pages2607y Maliyyə Hesabatı SABAH (En)leylaNo ratings yet

- Accounts Compiler by Rahul Malkan SirDocument301 pagesAccounts Compiler by Rahul Malkan SirKarthik Ram100% (1)

- R12 Overview of Oracle Asset ManagementDocument36 pagesR12 Overview of Oracle Asset ManagementIvo Huaynates100% (1)

- MODADV1 Corporate Liquidation - Statement of AffairsDocument2 pagesMODADV1 Corporate Liquidation - Statement of AffairsRedNo ratings yet

- Module 1 Introduction To Accounting For BSOA &1BSENTREPDocument21 pagesModule 1 Introduction To Accounting For BSOA &1BSENTREPjilliantrcieNo ratings yet

- Intermediate Accounting 1&2Document8 pagesIntermediate Accounting 1&2Inzaghi CruiseNo ratings yet

- Modernization Volume 1 Final PDFDocument135 pagesModernization Volume 1 Final PDFDaniel100% (1)

- Compagnie Du FroidDocument18 pagesCompagnie Du FroidSuryakant Kaushik0% (3)

- Fraud Schemes & Detection TechniquesDocument31 pagesFraud Schemes & Detection TechniquesJosephine CristajuneNo ratings yet

- FA2 Kaplan Exam KitDocument232 pagesFA2 Kaplan Exam Kit465jgbgcvf100% (1)

- Accounting EquationDocument10 pagesAccounting EquationMimi Adriatico JaranillaNo ratings yet

- Chapter 4Document3 pagesChapter 4José LuisNo ratings yet

- SAP FICO End To End MastersheetDocument8 pagesSAP FICO End To End MastersheetPradeep JagirdarNo ratings yet

- Finance Chart of AccountsDocument1 pageFinance Chart of AccountscahyoNo ratings yet

- Elements of Corporate FinanceDocument9 pagesElements of Corporate FinanceReiki Channel Anuj Bhargava100% (1)

- Upwork FinancialDocument19 pagesUpwork FinancialVvb SatyanarayanaNo ratings yet

- Financial Reporting 1 1Document551 pagesFinancial Reporting 1 1kimNo ratings yet

- Theory of Accounts - Exam2Document1 pageTheory of Accounts - Exam2Enges FormulaNo ratings yet

- MGT 305 - Entrepreneurial Management 1st Semester AY 2021-2022Document5 pagesMGT 305 - Entrepreneurial Management 1st Semester AY 2021-2022Andrea DionidoNo ratings yet

- PEBOOK - 5.1 尽调清单 - 预尽调资料需求清单(英文版)Document2 pagesPEBOOK - 5.1 尽调清单 - 预尽调资料需求清单(英文版)jingfeng huangNo ratings yet

- Global CityDocument16 pagesGlobal CityDaisy MallariNo ratings yet

- Inventory Valuation Work Sheet 2023Document5 pagesInventory Valuation Work Sheet 2023Risha OsfordNo ratings yet

- Chapter 3-Valuation of GoodwillDocument12 pagesChapter 3-Valuation of GoodwillnabhayNo ratings yet