Professional Documents

Culture Documents

Department Order No. 19 S. 1993: Guidelines Governing The Employment of Workers in The Construction Industry

Uploaded by

Princess Gueriba100%(1)100% found this document useful (1 vote)

76 views19 pagesThis document outlines guidelines for the employment of workers in the Philippine construction industry. It defines project employees as those employed for a specific construction project, and non-project employees as those without reference to a particular project. It also covers workers' basic rights such as security of tenure, hours and wages, safe working conditions, and organization and bargaining rights. The document is intended to provide guidance to both construction workers and employers on labor regulations.

Original Description:

Original Title

GLS DO 19 cfv

Copyright

© © All Rights Reserved

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document outlines guidelines for the employment of workers in the Philippine construction industry. It defines project employees as those employed for a specific construction project, and non-project employees as those without reference to a particular project. It also covers workers' basic rights such as security of tenure, hours and wages, safe working conditions, and organization and bargaining rights. The document is intended to provide guidance to both construction workers and employers on labor regulations.

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

100%(1)100% found this document useful (1 vote)

76 views19 pagesDepartment Order No. 19 S. 1993: Guidelines Governing The Employment of Workers in The Construction Industry

Uploaded by

Princess GueribaThis document outlines guidelines for the employment of workers in the Philippine construction industry. It defines project employees as those employed for a specific construction project, and non-project employees as those without reference to a particular project. It also covers workers' basic rights such as security of tenure, hours and wages, safe working conditions, and organization and bargaining rights. The document is intended to provide guidance to both construction workers and employers on labor regulations.

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 19

DEPARTMENT ORDER NO. 19 S.

1993

Guidelines Governing the Employment of

Workers in the Construction Industry

Constante F. Viloria, PME

OSH Consultant

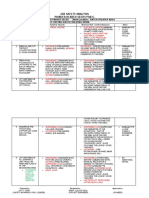

Classification of employees.

Project employees – those employed in

connection with a particular construction

project or phase thereof and whose

employment is co-terminus with each

project or phase of the project to which

they are assigned.

Indicators of Project Employment

1. Duration of work is determinable

2. Duration of specific work is in the employment

agreement and clear to employee

3. Work/service is connected to the project

4. Employee is free to offer his services to others

while not employed or awaiting agreement

5. Termination of employment is reported to

DOLE

6. Completion Bonus in the employment contract

Classification of employees.

Non-project employees – those employed

without reference to any particular

construction project or phase of a project.

Type of Non-project employees

1. Probationary – entitled to regularization after

completion of probationary period.

2. Regular – Those who filled up or hired for

regular positions.

3. Casual – Those employed to work but not

related to main line of business. Must be

regularized if rendered service is at least 1

year , whether continuous or broken.

Contracting & Subcontracting

Contracting out of certain phases of the

project is recognized by law

Worker’s Basic Rights

1. Security of Tenure

Workers cannot be dismissed without

just and authorized causes and due

process.

Workers shall be made regular after 6

months probation.

Worker’s Basic Rights

2. Hours of Work

Normal working hours of 8 hours a day

Meal and rest period: meal break of less than

one hour and short rest periods shall be

considered compensable work time.

3. Weekly Rest Day

A day-off of 24 consecutive hours after 6

days of work should be scheduled by the

employer upon consultation with the

workers.

4. Wage and Wage Related Benefits

Minimum wage in the region/sector or more.

Holiday pay: One day pay for every regular

holiday even if unworked subject to certain

conditions.

Premium pay for work within 8 hours on a

Special or rest day: plus 30% of basic daily

rate

Rest day falling on a special day: plus 50% of

basic daily rate.

Rest day falling on a regular holiday: plus

30% of 200% of basic daily rate.

Overtime Pay for work in excess of 8 hours

on:

Ordinary days: plus 25% of basic hourly rate.

Special days, rest days, and holidays: plus

30% of the regular hourly rate on said days.

Nightshift differential pay: plus 10% of the

basic/regular rate for work between 10pm – 6am.

Service Incentive Leave: 5 days with pay per

year of service.

Maternity leave: 105 days for married women;

120 days for single/unmarried women

Paternity leave: 7 calendars days with full pay to

lend support to his wife during her period of

recovery and/or nursing her newborn child.

Parental leave for Solo Parents: 7 workdays

every year with full pay for any solo parent

employee.

VAWC leave: 10 days with pay per year of

service for women employees who are victims

as defined in RA 9262. The leave shall cover the

days that the woman employee has to attend to

medical and legal concerns.

Special leave for women: 2 months leave with

full pay based on her gross monthly

compensation due to gynecological surgery.

13th month pay: 1/12 of the total basic salary

earned within the calendar year.

Separation pay: Minimum of ½ month pay for

every year of service for authorized causes of

separation.

Retirement pay: 22.5 days salary for every year

of service for optional retirement at 60 under RA

7641 or under applicable agreement.

5. Payment of Wages

Wages shall be paid in cash, legal tender at or

near the place of work

Payment may be made through a bank upon

written petition of majority of the workers in

establishments with 25 or more employees

and within one kilometer radius to a bank

Payment shall be made directly to the

employees

Wages shall be given not less than once every

two weeks or twice a month at intervals not

exceeding 16 days

Preference of workers’ money claims over

government and other creditors in case of

bankruptcy or liquidation of business

Labor-only contracting is prohibited and the

person/contractor is considered merely as an

agent of the employer

6. Safe and Healthful Conditions of Work and

Welfare services

Proper illumination and ventilation, fire exits

and extinguishers, occupational health

personnel and services, family welfare/family

planning services at the workplace, etc.

7. Self-Organization and Collective Bargaining

8. Labor Education Thru Seminars, Dialogs and

Information, Education and Communication

Materials

11. Peaceful Concerted Activities in Accordance

With Law

12. Participation in Policy and Decision-Making

Processes Affecting Their Rights and

Benefits

13. Free Access to the Courts and Quasi-Judicial

Bodies and Speedy Disposition of Their

Cases

9. ECC Benefits for Work-Related Contingencies

Medical benefits for sickness/injuries

Disability benefits

Rehabilitation benefits

Death and funeral benefits

Pension benefits

10. SSS Benefits

Maternity, sickness, disability, retirement,

death and pension benefits

Bureau of Working Conditions

Department of Labor and Employment

3/F DOLE Bldg., Muralla St., Intramuros, Manila

Tel. Nos. 527-3000

Email : dole.bwc@gmail.com

Website: BWC.DOLE.GOV.PH

You might also like

- Real Estate Mortgage AgreementDocument3 pagesReal Estate Mortgage AgreementClint M. Maratas100% (6)

- Agoda General Terms and ConditionsDocument24 pagesAgoda General Terms and ConditionsDonni AhmadNo ratings yet

- 1904 Davis AgreementDocument2 pages1904 Davis Agreementapi-479258990No ratings yet

- Equalities PolicyDocument4 pagesEqualities Policymanager100% (1)

- Benefits Summary PhilippinesDocument2 pagesBenefits Summary PhilippinesRose GeeNo ratings yet

- KRH - Misrepresented KRH Employment Contract-ITTDocument2 pagesKRH - Misrepresented KRH Employment Contract-ITTTrafficked_by_ITTNo ratings yet

- D.O 118-12Document10 pagesD.O 118-12Mariel GatpolintanNo ratings yet

- OSH Orientation Tupad-Street SweeperDocument35 pagesOSH Orientation Tupad-Street SweeperMichael DatucamilNo ratings yet

- Appreciation Course Manual - FinalDocument84 pagesAppreciation Course Manual - FinalHaniel GANo ratings yet

- Republic Act No. 10721Document26 pagesRepublic Act No. 10721angela lindleyNo ratings yet

- Sources of Revenues of Local Government Units Sources of Revenues of Local Government UnitsDocument73 pagesSources of Revenues of Local Government Units Sources of Revenues of Local Government Unitsaige mascodNo ratings yet

- Flexible Work ArrangementDocument5 pagesFlexible Work ArrangementMj RudioNo ratings yet

- Performance - Management - Centre For Good Governance HyderabadDocument20 pagesPerformance - Management - Centre For Good Governance HyderabadGarvit GoelNo ratings yet

- Circular Letter: Department OF Budget AND ManagementDocument5 pagesCircular Letter: Department OF Budget AND ManagementjoancuteverNo ratings yet

- FWP Reporting FormDocument6 pagesFWP Reporting FormCfc-sfc Naic ChapterNo ratings yet

- Primer On GrievanceDocument102 pagesPrimer On GrievanceLoury LuzadioNo ratings yet

- Dole vs. Kentex ManufacturingDocument9 pagesDole vs. Kentex ManufacturingRodney AtibulaNo ratings yet

- Workplace Policy and Program On Sexual Harrasment Policies and ProceduresDocument10 pagesWorkplace Policy and Program On Sexual Harrasment Policies and ProceduresjovNo ratings yet

- R&R For Private Recruitment and Placement Agency For Local EmploymentDocument14 pagesR&R For Private Recruitment and Placement Agency For Local EmploymentjoNo ratings yet

- Civil Service CommissionDocument14 pagesCivil Service CommissionShenette Duriens100% (2)

- E-Governance in India: International Journal of Computing & Business Research ISSN (Online) : 2229-6166Document12 pagesE-Governance in India: International Journal of Computing & Business Research ISSN (Online) : 2229-6166Deep SanNo ratings yet

- Q and A On Child LaborDocument7 pagesQ and A On Child Laborymervegim02No ratings yet

- National College of Public Administration and GovernanceDocument11 pagesNational College of Public Administration and GovernanceIvan Harris TanyagNo ratings yet

- HIV AIDS Workplace PolicyDocument4 pagesHIV AIDS Workplace PolicyMareices DominiqueNo ratings yet

- Department of Education: Republic of The PhilippinesDocument16 pagesDepartment of Education: Republic of The PhilippinesGodofredo CualterosNo ratings yet

- NEW Unsafe Act and Unsafe Condition (BC)Document68 pagesNEW Unsafe Act and Unsafe Condition (BC)Rachelle Marie TacolaoNo ratings yet

- Rule 1020 and AepDocument20 pagesRule 1020 and AepNikko RubioNo ratings yet

- Drug-Free Workplace Policy: Purpose and GoalDocument6 pagesDrug-Free Workplace Policy: Purpose and Goaldatabasetechnology collegeNo ratings yet

- Safety Milestone (Smile) RecognitionDocument2 pagesSafety Milestone (Smile) RecognitionvengielNo ratings yet

- SBN-1006: Salary Standardization Law VDocument8 pagesSBN-1006: Salary Standardization Law VRalph Recto100% (1)

- Participatory Governance by Sec. Jesse RobredoDocument8 pagesParticipatory Governance by Sec. Jesse RobredoPhilippine Navy Center for Naval Leadership & ExcellenceNo ratings yet

- Safe Space Harassment 1Document3 pagesSafe Space Harassment 1Louise Ann ValenaNo ratings yet

- Memo 486 SUNDAY & Special Non Working Work PDFDocument1 pageMemo 486 SUNDAY & Special Non Working Work PDFIt's VerielNo ratings yet

- Lactation Workplace Policy and ProgramDocument3 pagesLactation Workplace Policy and ProgramDarryl RoblesNo ratings yet

- Local GovDocument28 pagesLocal GovHiroshi CarlosNo ratings yet

- WEB-Expanded Meternity Leave Law (EMLL)Document33 pagesWEB-Expanded Meternity Leave Law (EMLL)Jenny EspanoNo ratings yet

- About Ambisyon Natin 2040Document6 pagesAbout Ambisyon Natin 2040Ronie ApellidoNo ratings yet

- MPA - Labor Management RelationsDocument65 pagesMPA - Labor Management RelationsReina Chiara Garcia MagcamitNo ratings yet

- Code of ConductDocument4 pagesCode of Conducts.manoprabha3604No ratings yet

- May 2016 Handbook of Statutory Monetary BenefitsDocument78 pagesMay 2016 Handbook of Statutory Monetary Benefitsattyjecky100% (6)

- Budget Circular No 2023 1 Dated November 10 2023Document10 pagesBudget Circular No 2023 1 Dated November 10 2023erica pejiNo ratings yet

- DO 19-93 (Construction Industry)Document6 pagesDO 19-93 (Construction Industry)Sara Dela Cruz AvillonNo ratings yet

- Benefits: 13th Month PayDocument3 pagesBenefits: 13th Month Paycream oNo ratings yet

- Answer Key Midterm ExamDocument2 pagesAnswer Key Midterm ExamCyril Ann IriberriNo ratings yet

- Comprehensive Safety and Health Program ConstructionDocument29 pagesComprehensive Safety and Health Program ConstructionStephanie P. MorandarteNo ratings yet

- Incident ReportDocument2 pagesIncident Reportאניל מאשאדוNo ratings yet

- Workplace Policy and Program On Tuberculosis (TB) Prevention and ControlDocument4 pagesWorkplace Policy and Program On Tuberculosis (TB) Prevention and ControlJane LahoraNo ratings yet

- DOLE v. KentexDocument7 pagesDOLE v. KentexRae100% (1)

- Day 3 - Accident InvestigationDocument38 pagesDay 3 - Accident InvestigationRaDaCa CabsNo ratings yet

- What Is The Rationalization PlanDocument2 pagesWhat Is The Rationalization PlanJenielyn Madarang100% (1)

- Public ExpenditureDocument4 pagesPublic ExpenditureadityatnnlsNo ratings yet

- NDRRMP PrimerDocument10 pagesNDRRMP PrimerKyla MatiasNo ratings yet

- 5 Sexual Harrassment PolicyDocument4 pages5 Sexual Harrassment PolicyLloyd Arnold CatabonaNo ratings yet

- Sample Leave FormDocument1 pageSample Leave FormBobec TungolNo ratings yet

- 2018 ILS Journal Vol1No2 PDFDocument174 pages2018 ILS Journal Vol1No2 PDFjonathan quibanNo ratings yet

- CSC Citizen CharterDocument85 pagesCSC Citizen Charterページ ダーリーン100% (1)

- El Ciello y La TierraDocument3 pagesEl Ciello y La TierraRuel R. PungosNo ratings yet

- Public Administration FinalDocument18 pagesPublic Administration FinalDon Jeffrey100% (1)

- Rules and Regulations On The Granting, UtilizationDocument5 pagesRules and Regulations On The Granting, UtilizationJesse JamesNo ratings yet

- The Father of Scientific ManagementDocument35 pagesThe Father of Scientific ManagementsatkaurchaggarNo ratings yet

- Labor Laws and Legislation - Note 2 FinalsDocument5 pagesLabor Laws and Legislation - Note 2 FinalsMargarette Rose RamosNo ratings yet

- Employment Contract SmallBusinessDocument6 pagesEmployment Contract SmallBusinessKristie Sanguyo CastilloNo ratings yet

- Labor LawDocument21 pagesLabor Lawletisha BellyNo ratings yet

- Machine (White Color) PE 1000 0.053 KG: ADAPTER 25 Mm. 40 X 40Document1 pageMachine (White Color) PE 1000 0.053 KG: ADAPTER 25 Mm. 40 X 40Princess GueribaNo ratings yet

- EDGE ISO 13715: Where Not Indicated, A 0.7 of Minimum Thickness To Be Welded CornerDocument4 pagesEDGE ISO 13715: Where Not Indicated, A 0.7 of Minimum Thickness To Be Welded CornerPrincess GueribaNo ratings yet

- Construction Safety and Health - IIEE - SPECSDocument52 pagesConstruction Safety and Health - IIEE - SPECSPrincess GueribaNo ratings yet

- Jsa For Dismantling Batch Treating DrumDocument2 pagesJsa For Dismantling Batch Treating DrumPrincess GueribaNo ratings yet

- ISO 9001:2015 As A Business Improvement ModelDocument72 pagesISO 9001:2015 As A Business Improvement ModelPrincess GueribaNo ratings yet

- II. Part B Employer Employee RelationshipDocument358 pagesII. Part B Employer Employee RelationshipPio Vincent BuencaminoNo ratings yet

- Code of Professional Prac, Fees & AgreementDocument15 pagesCode of Professional Prac, Fees & AgreementNiharika ModiNo ratings yet

- Date of CommencementDocument3 pagesDate of CommencementSolei SashNo ratings yet

- FIRM PROFILE - (Gitonga, Kinyanjui & Co.) 2011Document9 pagesFIRM PROFILE - (Gitonga, Kinyanjui & Co.) 2011Mopa MpknNo ratings yet

- Const. Mgmt. Chp. 12 - Cost Control, Monitoring and AccountingDocument33 pagesConst. Mgmt. Chp. 12 - Cost Control, Monitoring and AccountingFaiz Ahmad100% (1)

- Katrina S. DiplomaDocument7 pagesKatrina S. DiplomaTrinca DiplomaNo ratings yet

- Vibhor Increment Letter Principal EngineerDocument3 pagesVibhor Increment Letter Principal EngineerVibhor IyerNo ratings yet

- CONTRACT OF LEASE MandaluyongDocument5 pagesCONTRACT OF LEASE MandaluyongRegine PalomoNo ratings yet

- Maternity Benefit ActDocument12 pagesMaternity Benefit ActAkshat YadavNo ratings yet

- Chapter 1 (Introduction)Document20 pagesChapter 1 (Introduction)RASHWINDER KAURNo ratings yet

- Llobrera v. Fernandez G.R. No. 142882. May 2, 2006. (MAG) FactsDocument2 pagesLlobrera v. Fernandez G.R. No. 142882. May 2, 2006. (MAG) FactsAnn MarieNo ratings yet

- 125080-1997-Carungcong v. National Labor Relations20190521-5466-1w8k0ahDocument11 pages125080-1997-Carungcong v. National Labor Relations20190521-5466-1w8k0ahTrisNo ratings yet

- Notes (PatentDocument26 pagesNotes (PatentTan Han ShenNo ratings yet

- Republic V PNBDocument4 pagesRepublic V PNBTats YumulNo ratings yet

- Paz v. Northern Tobacco Redrying Co., IncDocument3 pagesPaz v. Northern Tobacco Redrying Co., IncDemi PigNo ratings yet

- WARNER, BARNES & CO., LTD. vs. DIONISIO INZADocument2 pagesWARNER, BARNES & CO., LTD. vs. DIONISIO INZAKiethe MyraNo ratings yet

- (G.R. No. 153832. March 18, 2005) : The FactsDocument5 pages(G.R. No. 153832. March 18, 2005) : The FactsKCCNo ratings yet

- Questions For A Job Interview (HK)Document2 pagesQuestions For A Job Interview (HK)Anonymous Bc21pMNo ratings yet

- Week 8 - Transaction ExposureDocument35 pagesWeek 8 - Transaction Exposurewinfld0% (1)

- Dynasty Elite Rules With Images PDFDocument6 pagesDynasty Elite Rules With Images PDFAndrew ArnoldNo ratings yet

- Acp CPGDocument4 pagesAcp CPGRuab PlosNo ratings yet

- Vda. de Maglana Vs ConsolacionDocument2 pagesVda. de Maglana Vs ConsolacionNC BergoniaNo ratings yet

- Downsizing and RestructuringDocument24 pagesDownsizing and RestructuringPreeti BhaskarNo ratings yet

- 2017 UPBOC Taxation Law PDFDocument288 pages2017 UPBOC Taxation Law PDFGrace Robes HicbanNo ratings yet

- Wwus Contract - Team Pie - Team Ian (2) - 1Document5 pagesWwus Contract - Team Pie - Team Ian (2) - 1Rohanna DagsNo ratings yet

- Types of BondsDocument11 pagesTypes of BondsAnthony John Santidad100% (1)