Professional Documents

Culture Documents

Business Finance: Chapter 1: Introduction To Financial Management

Business Finance: Chapter 1: Introduction To Financial Management

Uploaded by

Melvin J. ReyesOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Business Finance: Chapter 1: Introduction To Financial Management

Business Finance: Chapter 1: Introduction To Financial Management

Uploaded by

Melvin J. ReyesCopyright:

Available Formats

BUSINESS FINANCE

Chapter 1: Introduction to Financial

Management

This chapter introduces the students with the overriding objective of managers in

managing a company. It also gives an overview of the financial system which

includes the players and the different financial instruments that are available in the

market. This chapter also discusses organizational chart and highlights the roles of a

Vice President for Finance.

ACTIVITY

Students will be group into 4 groups

Each group will be given 10 minutes to cite their

expectation on the subject as a group.

Every one is encouraged to contribute on the given task.

Write your answer on a piece of crosswise paper.

Select 1 member of the group who will going to present

the finished group task.

Introduction to Financial Management

Financial management starts with a plan.

From the perspective of a corporation, financial management deals with

the decisions that are supposed to maximize the value of shareholder’s

wealth. This means maximizing the market value of the shares of stocks.

Shares of stocks represent the form of ownership in a corporation.

Philippine Stock Exchange (PSE) – Where the shares are actively traded.

profit maximization should NOT be the overriding objective of company’s

management.

Introduction to Financial Management

The Changes on the price of a stock can be confluence of

many factors:

Profitable operation

Nature of the business

Prospects of the business Shares closed at P2,200 on April 25,2016

Projected earnings and timeframe Total shares outstanding was

Ability to meet maturing obligations P132,742,402.00

Appropriate capital structure What will be the market value of the shares

Dividend policies on that date?

Investing decisions

The market value was computed as follows:

Management

P2,200 x P132,742,402.00 = P292,033,284,400.00

Market sentiment

Introduction to Financial Management

SHAREHOLDER’S WEALTH MAXIMIZATION

Maximizing shareholder’s wealth through

maximization of stock price should be the overriding

objective of management as it covers the different

facets of operating a company and it considers the

different stakeholders of the company.

It motivates members of top management to develop a

longer perspective for the company that they manage.

The interest of the employees has to be considered in

managing a company. They will protect the interest of

the company. In Filipino culture it is called malasakit.

Introduction to Financial Management

SHAREHOLDER’S WEALTH MAXIMIZATION FINANCIAL SYSTEM

Paying suppliers and creditors on time is a good Links the savers and users of fund.

business practice that will improve relationships with

Savings can come from households, individuals,

these parties.

companies, government agencies, or any other entity

Compliance with the requirements of regulatory whose cash inflows are greater than their cash

agencies also ensures more smooth operations. outflows.

Supporting the community where the company This system, through financial intermediaries provides

operates, in whatever capacity it can, increases the a mechanism by which these savings can be channeled

company’s chances of continuous operations in the to users of funds, borrowers and investors.

area.

Corporate bonds and government debt securities can

be traded through the Philippine Dealing &

Exchange Corp. (PDEx).

Introduction to Financial Management

FINANCIAL SYSTEM

Financial Intermediaries Users of funds

Savers Borrowers/Investors

• Banks

• Households • Households

• Insurance Companies

• Individuals • Individuals

• Stock exchange

• Corporations/Co • Corporations/Compa

• Stock brokerage firms

mpanies nies

• Mutual funds

• Government • Government

• Other financial institutions

Agencies Agencies

Figure 1: Overview of the Financial System

Introduction to Financial Management

FINANCIAL

Financial intermediaries at its functions

SYSTEM 2. Live Brokers – uses telephone to call brokers and

place orders.

1. Bank Provide mechanism where savers can put

their excess funds through deposits. Have to be 5. Mutual Funds investments are pooled and the

regulated by Bangko Sentral ng Pilipinas funds are invested by professional managers for a

fee.

2. Insurance Companies Offers life and non-life

products. Regulated by Insurance Commission To invest in a Mutual fund,, he has to buy

shares of the mutual fund and the buying price

3. Stock Exchange provides a system for the depends on the net asset value (NAV) of that fund

trading of equity securities of publicly listed when the purchase is made.

companies.

6. Other Financial Institutions include pension

4. Stock Brokerage firms includes online brokers funds like GSIS and SSS, investment banks, and

and live brokers credit unions.

1. Online Brokers – one can trade in stock market

through the internet.

Introduction to Financial Management

FINANCIAL Debt securities

INSTRUMENTS

Two major categories: The Treasury bonds and Treasury bills issued by the

Equity securities – it includes… National Treasury are forms of indebtedness of the

National Government.

Common Stocks

Treasury bills – in the tenors of 91 days, 182 days and 360

Preferred Stocks days are auctioned at the National Treasury every Monday

to accredited dealers.

Retail treasury bonds – normally in multiplies of P5,000.

coupon interest is paid quarterly.

Treasury bonds – coupon interest is paid semi-annually.

Corporate bonds – the tenors are usually 5 yrs., 7 yrs., and

10 yrs. Offers slightly higher interest rates than govt.

securities.

Introduction to Financial Management

ORGANIZATIONAL CHART AND THE ROLES OF

THE VP FOR FINANCE

Board of

Directors

President

VP for Sales & VP for

VP for Finance VP for Production

Marketing Administration

Figure 2: Organizational Chart

Introduction to Financial Management

ORGANIZATIONAL CHART AND THE ROLES OF President – Their roles in a corporation may vary from one

THE VP FOR FINANCE company to another.

Board of Directors – is the highest policy making body in a Responsibilities:

corporation.

Overseeing the operations of the company and ensuring

Responsibilities: that the strategies as approved by the board are

Setting policies on investments, capital structure and implemented as planned.

dividends. Performing all areas of management: planning,

Approving company’s strategies, goals and budgets. organizing, staffing, directing and controlling.

Appointing and removing members of the top Representing the company in professional, social and

management including the president. civic activities.

Determining top management’s compensation

Approving the information and other disclosures

reported in the financial statements.

Introduction to Financial Management

ORGANIZATIONAL CHART AND THE ROLES OF

THE VP FOR FINANCE

VP for Sales and Marketing VP for Production

Responsibilities: Responsibilities:

Formulating marketing strategies and plans Ensuring production meets customer demands

Directing and coordinating company sales Identifying production technology/process that

minimizes production cost and makes the company cost

Performing market and competitor analysis

competitive.

Analyzing and evaluating the effectiveness and cost of Coming up with the production plan that maximizes the

marketing methods applied.

utilization of the company’s production facilities.

Conducting or directing research that will allow the Identifying adequate and competitively priced raw

company to identify new marketing opportunities.

material suppliers.

Promoting good relationships with customers and

distributors

Introduction to Financial Management

ORGANIZATIONAL CHART AND THE ROLES OF

THE VP FOR FINANCE

VP for Administration VP for Finance

Responsibilities:

Coordinating the functions of administration, finance Financing

and sales and marketing departments.

Assisting other departments in hiring employees.

Investing

Providing assistance in payroll preparation. Operating

Determining the location and the maximum amount of Dividend Policies

office space needed by the company.

Identifying means, processes or systems that will

minimize the operating costs of the company. Figure 3: Functions of VP for Finance

Introduction to Financial Management

ORGANIZATIONAL CHART AND THE ROLES OF

THE VP FOR FINANCE

VP for Finance

Operating decisions

Financing decisions Deal with the daily operations of the company

Include making decisions as to how to finance long-term The role of the VP for finance is determining how to

investments and working capital which deals with the

finance working capital accounts such as accounts

day-to-day operations of the company.

receivable and inventories.

This responsibility is crucial. The company can get Short term or long term sources of funds to finance

bankrupt because of too much debt.

accounts receivable and inventories?

Investing decisions

Dividend Policies

Requires forecasting the cost of investment and the Two conditions must exist before a company can declare

streams of cashflows expected to be generated from the

cash dividends:

investment.

1. The company must have enough retained earnings to

Long term investments have to be supported by a capital

support cash dividend declaration.

budgeting analysis.

2. The company must have cash.

Introduction to Financial Management

ORGANIZATIONAL CHART AND THE ROLES OF

THE VP FOR FINANCE

Factors to consider in declaring cash dividends:

1. AVAILABILITY OF INVESTMENT

OPPORTUNITIES ANY QUESTIONS?

2. ACCES TO LONG TERM SOURCE OF FUNDS.

3. CAPITAL STRUCTURE.

CLARIFICATIONS?

VIOLENT

REACTIONS?

Get ¼ sheet piece of paper and get ready for a short

quiz.

Introduction to Financial Management

SHORT QUIZ

1. Philippine Stock Exchange is where the shares are actively traded. True or false?

2. Shareholders and Stockholders are the same. True or false? If false why? All shareholders are stake holders but not all

stakeholders are shareholders.

3. From the perspective of a corporation, financial management deals with the decisions that are supposed to maximize

the value of shareholder’s wealth.

4. Savings can come from households, individuals, companies, government agencies, or any other entity whose cash inflows are

greater than their cash outflows.

5 - 7Enumerate the 3 components of financial system: savers, financial intermediaries and Users of funds

8. Board of Directors – is the highest policy making body in a corporation.

9. This responsibility of VF for Finance is crucial. The company can get bankrupt because of too much debt. Financing

decisions

10. Deal with the daily operations of the company. Operating Decisions

You might also like

- Business FinanceDocument17 pagesBusiness FinanceRhyme CabangbangNo ratings yet

- Business Finance ModuleDocument41 pagesBusiness Finance ModulerhyzeNo ratings yet

- Financial ManagementDocument886 pagesFinancial ManagementKRISHNA PRASAD SAMUDRALANo ratings yet

- Introduction To Philosophy of The Human Person: Presented By: Mr. Melvin J. Reyes, LPTDocument27 pagesIntroduction To Philosophy of The Human Person: Presented By: Mr. Melvin J. Reyes, LPTMelvin J. Reyes100% (2)

- Business Finance Introduction To Financial ManagementDocument22 pagesBusiness Finance Introduction To Financial ManagementMelvin J. ReyesNo ratings yet

- Two-Tier Mudarabah As A Mode of Islamic Financial IntermediationDocument31 pagesTwo-Tier Mudarabah As A Mode of Islamic Financial IntermediationMaas Riyaz Malik100% (7)

- Business Finance Introduction To Financial Management 05Document24 pagesBusiness Finance Introduction To Financial Management 05Melvin J. ReyesNo ratings yet

- Business FinanceDocument90 pagesBusiness FinanceSandara beldo100% (1)

- Business Finance Introduction To Financial Management 07Document41 pagesBusiness Finance Introduction To Financial Management 07Melvin J. ReyesNo ratings yet

- IntAcc-1 Accounting For ReceivablesDocument13 pagesIntAcc-1 Accounting For ReceivablesShekainah BNo ratings yet

- Business FinanceDocument18 pagesBusiness FinanceFriedrich Mariveles100% (1)

- Money As A Social InstitutionDocument209 pagesMoney As A Social InstitutionHandiyonoNo ratings yet

- Module 4 - Financial Instruments (Assets)Document9 pagesModule 4 - Financial Instruments (Assets)Luisito CorreaNo ratings yet

- Human Person in The EnvironmentDocument24 pagesHuman Person in The EnvironmentMelvin J. ReyesNo ratings yet

- Realize That All Actions Have ConsequencesDocument28 pagesRealize That All Actions Have ConsequencesMelvin J. Reyes100% (3)

- Bsa Online Quiz 1 - Overview of AccountingDocument9 pagesBsa Online Quiz 1 - Overview of AccountingRyzeNo ratings yet

- Insular Investment and Trust Corporation Vs Capital OneDocument2 pagesInsular Investment and Trust Corporation Vs Capital OneLucille ArianneNo ratings yet

- Chapter 1 - Introduction To Financial ManagementDocument28 pagesChapter 1 - Introduction To Financial ManagementArminda Villamin100% (1)

- Notes For BFDocument14 pagesNotes For BFReymart SaladasNo ratings yet

- Module 1 - BFDocument13 pagesModule 1 - BFAustin MauzarNo ratings yet

- Lesson+1 +Introduction+to+Financial+Management - FinalDocument33 pagesLesson+1 +Introduction+to+Financial+Management - Finalweird childNo ratings yet

- Slide 1Document24 pagesSlide 1Akash SinghNo ratings yet

- Corporate Finance: Suresh HerurDocument49 pagesCorporate Finance: Suresh Herurlove_abhi_n_22No ratings yet

- Introduction To Business FinanceDocument28 pagesIntroduction To Business Financeloucyjay04No ratings yet

- CityU - Chapter 1 Intro To CF - STDDocument34 pagesCityU - Chapter 1 Intro To CF - STDNguyễn Đăng HiếuNo ratings yet

- Fundamentals of Financial Management: R.P. RustagiDocument16 pagesFundamentals of Financial Management: R.P. Rustagiimranrog11No ratings yet

- Xfinmar - PrelimsDocument22 pagesXfinmar - PrelimsAndrea CuiNo ratings yet

- FM Introduction Reference MaterialDocument16 pagesFM Introduction Reference MaterialVipul MehtaNo ratings yet

- FINMAR - Introduction To Financial Management and Financial MarketsDocument8 pagesFINMAR - Introduction To Financial Management and Financial MarketsLagcao Claire Ann M.No ratings yet

- CHP 1 NTRO ADVANCED FINANCIAL MANAGEMENTDocument4 pagesCHP 1 NTRO ADVANCED FINANCIAL MANAGEMENTcuteserese roseNo ratings yet

- 1 Financial SystemDocument13 pages1 Financial SystemAlbert CobicoNo ratings yet

- Bme 5 PrelimsDocument4 pagesBme 5 PrelimsIrish DionisioNo ratings yet

- Business-Finance ReviewerDocument7 pagesBusiness-Finance ReviewerRed TigerNo ratings yet

- ABM NotesDocument9 pagesABM Notesdanie.hermosaNo ratings yet

- Business Finance - INTRODUCTION-TO-FINANCIAL-MANAGEMENTDocument4 pagesBusiness Finance - INTRODUCTION-TO-FINANCIAL-MANAGEMENTArtemis LyNo ratings yet

- Introduction and Overview Corporate FinanceDocument28 pagesIntroduction and Overview Corporate Financelinda zyongweNo ratings yet

- 01 Introduction To Business FinanceDocument33 pages01 Introduction To Business FinanceLizbethHazelRiveraNo ratings yet

- Financial Management Lecture 3rdDocument19 pagesFinancial Management Lecture 3rdMansour NiaziNo ratings yet

- Applied Corporate FinanceDocument258 pagesApplied Corporate Financesirkoywayo6628No ratings yet

- CF (Collected)Document92 pagesCF (Collected)Akhi Junior JMNo ratings yet

- 1 IntroductionDocument51 pages1 IntroductionKrishnakant MishraNo ratings yet

- Finance PointersDocument8 pagesFinance PointersMgrace arendaknNo ratings yet

- Finmar Final Handouts 1 PDFDocument3 pagesFinmar Final Handouts 1 PDFAcissejNo ratings yet

- BFN Note CombineDocument50 pagesBFN Note CombineTimilehin GbengaNo ratings yet

- BF3326 Corporate Finance: Introduction To Financial ManagementDocument33 pagesBF3326 Corporate Finance: Introduction To Financial ManagementAmy LimnaNo ratings yet

- Business Finance-Lesson-2 Financial SystemDocument5 pagesBusiness Finance-Lesson-2 Financial SystemkellybetonioNo ratings yet

- Introduction To Financial SystemDocument37 pagesIntroduction To Financial SystemPauline BiancaNo ratings yet

- Chapter 1 Introduction To FinanceDocument22 pagesChapter 1 Introduction To FinanceDiemhel GadorNo ratings yet

- The Scope of Corporate Finance: Answers To Concept Review QuestionsDocument4 pagesThe Scope of Corporate Finance: Answers To Concept Review QuestionsHuu DuyNo ratings yet

- FM 01 Intro To Finance-StudentDocument58 pagesFM 01 Intro To Finance-StudentFaith LeNo ratings yet

- Financial Management Introduction Lecture#1Document12 pagesFinancial Management Introduction Lecture#1Rameez Ramzan AliNo ratings yet

- IE - 2016 - Intro To Investment FundsDocument30 pagesIE - 2016 - Intro To Investment Fundsjhonatan velandia medinaNo ratings yet

- Presentation 2Document23 pagesPresentation 2adeoghariaNo ratings yet

- Financing and Asset Management DecisionsDocument7 pagesFinancing and Asset Management DecisionsMelissa Abdul KarimNo ratings yet

- L.Chapter 1. Overview of CF (New) - SVDocument51 pagesL.Chapter 1. Overview of CF (New) - SVGiang Thái HươngNo ratings yet

- Manajemen Keuangan - SulisytandariDocument115 pagesManajemen Keuangan - SulisytandariTrianto SatriaNo ratings yet

- Asignación 1 (RMF FM)Document14 pagesAsignación 1 (RMF FM)Elia SantanaNo ratings yet

- Econ 371 Business Finance 1: Pirapa TharmalingamDocument26 pagesEcon 371 Business Finance 1: Pirapa TharmalingamSamantha YuNo ratings yet

- FIN101PRELIMSDocument6 pagesFIN101PRELIMSEmily ResuentoNo ratings yet

- Define Finance: Debt Financing Equity FinancingDocument6 pagesDefine Finance: Debt Financing Equity FinancingJackie Lou SantosNo ratings yet

- L.chapter 1. Overview of CF (New) - SVDocument51 pagesL.chapter 1. Overview of CF (New) - SVĐỗ Bùi GiangNo ratings yet

- Note Topic 1Document2 pagesNote Topic 1ModraNo ratings yet

- The Financial System: Centre For Financial Management, BangaloreDocument26 pagesThe Financial System: Centre For Financial Management, BangaloreRaj KumarNo ratings yet

- MBM 507 - Financial Management ReviewerDocument10 pagesMBM 507 - Financial Management ReviewerEdson FenequitoNo ratings yet

- GEC Elect 2 Module 4Document10 pagesGEC Elect 2 Module 4Aira Mae Quinones OrendainNo ratings yet

- IFM (1) Fundamentals of Financial ManagementDocument75 pagesIFM (1) Fundamentals of Financial ManagementJannik KuechlerNo ratings yet

- Task-1 Good Investment Decision Make Investor Earn More Profits Explain. Meaning of InvestmentDocument12 pagesTask-1 Good Investment Decision Make Investor Earn More Profits Explain. Meaning of InvestmentthakuranitaNo ratings yet

- Let's Know: Learning Activity SheetDocument8 pagesLet's Know: Learning Activity SheetWahidah BaraocorNo ratings yet

- Business Finance Module 1Document10 pagesBusiness Finance Module 1CESTINA, KIM LIANNE, B.No ratings yet

- Lecture 1 The Scope of Corporate FinanceDocument12 pagesLecture 1 The Scope of Corporate FinanceDung PhamNo ratings yet

- FM - 2Document14 pagesFM - 2akesingsNo ratings yet

- Business Finance Introduction To Financial Management 03Document26 pagesBusiness Finance Introduction To Financial Management 03Melvin J. ReyesNo ratings yet

- Business Finance Introduction To Financial Management 02Document19 pagesBusiness Finance Introduction To Financial Management 02Melvin J. ReyesNo ratings yet

- Business Finance Introduction To Financial Management 04Document60 pagesBusiness Finance Introduction To Financial Management 04Melvin J. ReyesNo ratings yet

- Socio Economic AspectDocument13 pagesSocio Economic AspectMelvin J. ReyesNo ratings yet

- Welcome To S.Y. 2019-2020: Introduction To Philosophy of The Human PersonDocument6 pagesWelcome To S.Y. 2019-2020: Introduction To Philosophy of The Human PersonMelvin J. ReyesNo ratings yet

- Business Ethics and Social ResponsibilityDocument27 pagesBusiness Ethics and Social ResponsibilityMelvin J. ReyesNo ratings yet

- Problem Set 2Document2 pagesProblem Set 2laibaNo ratings yet

- SMChap 004Document49 pagesSMChap 004Rola KhouryNo ratings yet

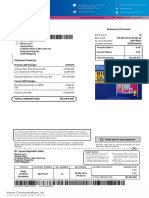

- Current Account 0 - 2022 - 5 - 4735Document5 pagesCurrent Account 0 - 2022 - 5 - 4735Dob CrisNo ratings yet

- Primer of Financial RatiosDocument2 pagesPrimer of Financial RatiosBeauNo ratings yet

- Acc 3013 - Fwa Revision AnswersDocument15 pagesAcc 3013 - Fwa Revision Answersfalnuaimi001No ratings yet

- Session 11,12&13 AssignmentDocument3 pagesSession 11,12&13 AssignmentMardi SutiosoNo ratings yet

- Recent Development in Indian Capital Market: Shaik Mohammad Imran, A Nadia, N.Saradamma, M.AmbikaDocument8 pagesRecent Development in Indian Capital Market: Shaik Mohammad Imran, A Nadia, N.Saradamma, M.AmbikadeviNo ratings yet

- Public SectorDocument2 pagesPublic SectorDarlyn CarelNo ratings yet

- CH 6 Investment NotesDocument3 pagesCH 6 Investment NotesWalid Mohamed AnwarNo ratings yet

- Bellevue: Pricing GuideDocument8 pagesBellevue: Pricing GuidejesiloretaNo ratings yet

- Part 1: Reviewer#5: Midterm Quiz 9fundamentals of Accounting 1 & 2)Document5 pagesPart 1: Reviewer#5: Midterm Quiz 9fundamentals of Accounting 1 & 2)annedanyle acabadoNo ratings yet

- Capitalism With DerivativesDocument3 pagesCapitalism With DerivativesSarah WilliamsonNo ratings yet

- About PMSPDocument5 pagesAbout PMSPAnshul PalNo ratings yet

- Long Term Sources of FinanceDocument23 pagesLong Term Sources of Financehitisha agrawalNo ratings yet

- Unit 3: Indian Accounting Standard 7: Statement of Cash FlowsDocument37 pagesUnit 3: Indian Accounting Standard 7: Statement of Cash Flowspulkitddude_24114888No ratings yet

- Managerial Accounting and Control ABMDocument27 pagesManagerial Accounting and Control ABMGovindNo ratings yet

- CH 01 The Investment SettingDocument56 pagesCH 01 The Investment Settingdwm1855100% (1)

- Financial Statement Analysis Study Guide Solutions Fill-in-the-Blank EquationsDocument26 pagesFinancial Statement Analysis Study Guide Solutions Fill-in-the-Blank EquationsSajawal KhanNo ratings yet

- Chapter-5 Introduction To Accounting StandardsDocument9 pagesChapter-5 Introduction To Accounting Standardslenovo lenovoNo ratings yet

- Statement of Account 16 06 Mar 22 To 05 Apr 22 887719317 (2) 79160448Document2 pagesStatement of Account 16 06 Mar 22 To 05 Apr 22 887719317 (2) 79160448Edward Montinola BularioNo ratings yet

- Business, Administration and Finance: Edexcel Principal LearningDocument8 pagesBusiness, Administration and Finance: Edexcel Principal Learningboho14No ratings yet

- Online Banking (Project)Document26 pagesOnline Banking (Project)Epsita PaulNo ratings yet

- Sharda-Cropchem-Limited 204 InitiatingCoverageDocument4 pagesSharda-Cropchem-Limited 204 InitiatingCoveragelkamalNo ratings yet

- Session - 046Document8 pagesSession - 046Abcdef GhNo ratings yet