Professional Documents

Culture Documents

Learning Target: Identify The Steps of Selling

Uploaded by

Cherielee Fabro0 ratings0% found this document useful (0 votes)

71 views17 pagesOriginal Title

calculating_payroll

Copyright

© © All Rights Reserved

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

71 views17 pagesLearning Target: Identify The Steps of Selling

Uploaded by

Cherielee FabroCopyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 17

Learning Target

Identify the steps of Selling.

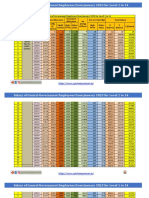

Gross Pay

Find the gross pay per paycheck based on

salary.

Find the gross pay per weekly paycheck based

on hourly wage.

Find the gross pay per paycheck based on

piecework wage.

Find the gross pay per paycheck based on

commission.

Find the gross pay per paycheck

based on salary

Pay periods

Weekly: once a week or 52 times a year.

Biweekly: every two weeks or 26 times a

year.

Semimonthly: twice a month or 24 times a

year.

Monthly: once a month or 12 times a year.

Find the gross earnings

per pay period.

Ruth earns $36,000 a year. If she is paid on a

weekly basis, what is her gross pay per week?

Divide $36,000 by 52 pay periods.

$692.31

What if she is paid on a semimonthly basis?

$1,500.00

Try these examples.

Find the gross earnings for:

Carolyn, who earns $15,000 a year and is paid

weekly.

$288.46

Martha, who earns $48,000 a year and is paid

biweekly.

$1,846.15

Bill, who earns $35,000 a year and is paid

semimonthly.

$1,458.33

Key Terms

Gross earnings (gross pay): the amount

earned before deductions.

Net earnings (net pay/take-home pay): the

amount of your paycheck.

Key Terms

Hourly rate or hourly wage: the amount of pay

per hour worked based on a standard 40 hour

work week.

Overtime rate: rate of pay for hours worked

that exceed 40 hours per week.

Time and a half: standard overtime rate that is

1½ (or 1.5) times an hourly rate.

Key Terms

Regular pay: earnings based on an hourly

rate of pay.

Overtime pay: earnings based on overtime

rate of pay.

Find the gross pay per week based

on hourly wages.

1. Find the regular pay by multiplying the number

of hours (40 or less) by the hourly wage.

2. Find the overtime pay by multiplying the hourly

rate by the overtime rate (usually 1.5) and then

multiply that rate by the number of hours that

exceed 40.

3. Add the figures from steps 1 and 2.

Here’s an example.

Theresa worked 45 hours last week. If her

hourly rate is $10.50 per hour, find her total

gross earnings.

Multiply 40 x $10.50 = $420.00

To calculate the overtime amount, multiply her

hourly rate by 1.5: $10.50 x 1.5 = $15.75.

Multiply the overtime rate ($15.75) x the number

of overtime hours (5): $15.75 x 5 = $78.75.

Add the regular and overtime pay: $498.75

10

Try these examples.

The regular hourly rate in the production

department for these employees is $6.50.

Overtime is paid at 1.5

Find the weekly earnings for these employees:

Marcus worked 48 hours.

$338

Allison worked 44 hours.

$299

.3 Find the gross pay per paycheck

based on piecework.

Piecework rate: amount of pay for each

acceptable item produced.

Straight piecework rate: piecework rate where

the pay per piece is the same no matter how

many items are produced.

Differential piece rate (escalating piece rate):

piecework rate that increases as more items are

produced.

Here’s an example

Jorge assembles microchip boards. He is paid

on a differential piecework basis.

Rates are as follows:

From 1-100 $1.32 per board

From 101-300 $1.42 per board

301 and over $1.58 per board

If he assembles 317 boards how much will he

earn?

Jorge’s earnings

100 x $1.32 = $132.00

101-300 x $1.42= $284.00

17 x $1.58 = $ 26.86

Total earnings: $442.86

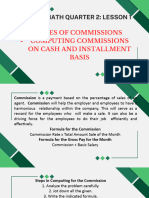

Find the gross pay per paycheck

based on commission

Commission: earnings based on sales.

Straight commission: entire pay based on sales.

Salary plus commission: a set amount of pay plus an

additional amount based on sales.

Commission rate: percent of sales that are eligible for

a commission.

Quota: a minimum amount of sales that is required

before a commission is applicable.

Here’s an example.

Shirley Garcia is a restaurant supplies salesperson

and receives 5% of her total sales as

commission. Her sales totaled $15,000 during a

given week. Find her gross earnings.

P = 0.05 x $15,000 = $750.

Shirley’s earnings equal $750.

Try this example.

Melanie Brooks works for a cosmetics company

and earns $200 a week in salary plus 30%

commission on all sales over $500. If she had

sales of $1,250 last week, how much were her

total earnings?

Her salary would be $200 plus any applicable

commission.

The commission would be calculated at 30% on

$750 in sales or $225. Add this amount to her

base salary and the total is $425.

You might also like

- Payslip: Satender Sharma:: Tool Room:: Incharge::: Payslip For May - 2008Document10 pagesPayslip: Satender Sharma:: Tool Room:: Incharge::: Payslip For May - 2008vntkhatri50% (6)

- Chapter 1 Earning MoneyDocument34 pagesChapter 1 Earning MoneyAaron KirkNo ratings yet

- Test Review Gross Pay AnswersDocument5 pagesTest Review Gross Pay Answersapi-298444780No ratings yet

- Earning Money HSCDocument34 pagesEarning Money HSCTracy LeeNo ratings yet

- Wages WorksheetDocument4 pagesWages WorksheetPeter-John HydeNo ratings yet

- Module in Payroll, Commissions and TaxesDocument10 pagesModule in Payroll, Commissions and TaxesAvigail Beltran75% (4)

- Employee Salary and Benefits GuideDocument32 pagesEmployee Salary and Benefits GuideWendy Marquez Tababa75% (8)

- 03 DevMath 04 TXT - Ebook Earning and Saving MoneyDocument22 pages03 DevMath 04 TXT - Ebook Earning and Saving Money2qncki2bwbckaNo ratings yet

- Central Investigation & Security Services LTD Security Guard Board Rates For Mumbai & Thane DistDocument2 pagesCentral Investigation & Security Services LTD Security Guard Board Rates For Mumbai & Thane DistPradeep PanigrahiNo ratings yet

- 2023 - Minneapolis PD Wage Comparison DataDocument2 pages2023 - Minneapolis PD Wage Comparison DataWCCO - CBS MinnesotaNo ratings yet

- Manpower quotation cost component U.PDocument5 pagesManpower quotation cost component U.PAmar Rajput100% (2)

- Salary PracticeDocument4 pagesSalary PracticebreNo ratings yet

- 8A - Gross Pay LessonDocument10 pages8A - Gross Pay LessonVee FelicianoNo ratings yet

- Calculating GrossDocument5 pagesCalculating GrossJosh LeBlancNo ratings yet

- What Is The Major Reason People Work?Document17 pagesWhat Is The Major Reason People Work?YogeshNo ratings yet

- PayrollDocument6 pagesPayrollAlireza T.No ratings yet

- Busmath CH 01Document36 pagesBusmath CH 01Da Harlequin GalNo ratings yet

- MQ q3 ch01Document46 pagesMQ q3 ch01Lee DickensNo ratings yet

- Calculate Gross Pay for Hourly and Salaried EmployeesDocument36 pagesCalculate Gross Pay for Hourly and Salaried EmployeesquincyNo ratings yet

- Employees Gross Earnings and Incentive Pay Plan ExplainedDocument17 pagesEmployees Gross Earnings and Incentive Pay Plan ExplainedErickajean Cornelio LabradorNo ratings yet

- Chapter 18 - Recording Payroll TransactionsDocument64 pagesChapter 18 - Recording Payroll Transactionsshemida100% (2)

- L3- 3.3 PayrollDocument5 pagesL3- 3.3 PayrollLovely ParkNo ratings yet

- Philippine High School Self-Learning Homework on Salaries, Wages, Income and BenefitsDocument7 pagesPhilippine High School Self-Learning Homework on Salaries, Wages, Income and BenefitsZia Belle Bedro - LuardoNo ratings yet

- CH10 PPTDocument42 pagesCH10 PPTAnonymous rWn3ZVARLgNo ratings yet

- SCH 6Document10 pagesSCH 6ludy louisNo ratings yet

- Gross EarningsDocument27 pagesGross EarningsAin lorraine BacaniNo ratings yet

- Olivier Business Math Chapter 4 Unit 2Document50 pagesOlivier Business Math Chapter 4 Unit 2Ashleigh VeronicaNo ratings yet

- Calculating Your Paycheck - Hourly and Overtime Pay Version 2Document3 pagesCalculating Your Paycheck - Hourly and Overtime Pay Version 2Keri-ann MillarNo ratings yet

- New Century Math Yr 9 - Chapter05 Earning MoneyDocument36 pagesNew Century Math Yr 9 - Chapter05 Earning MoneyPung Kang QinNo ratings yet

- Business Mathematics: PayrollDocument19 pagesBusiness Mathematics: Payrollmhl scrnnnNo ratings yet

- Business Math G12 - Week9 Employee Compensation Payroll Deductions PPTX 1Document16 pagesBusiness Math G12 - Week9 Employee Compensation Payroll Deductions PPTX 1KeiNo ratings yet

- Business MathUSlem Q2week3Document10 pagesBusiness MathUSlem Q2week3Rex MagdaluyoNo ratings yet

- Business MathDocument4 pagesBusiness MathShekinah HuertaNo ratings yet

- Employee Compensation + Payroll DeductionsDocument14 pagesEmployee Compensation + Payroll Deductionsrommel legaspi25% (4)

- Chapter 05Document36 pagesChapter 05Sonny Jim100% (1)

- Gross Pay CalculationsDocument2 pagesGross Pay CalculationsMary100% (3)

- Principles of Accounts February 2, 2021 Grade 11 Name: - Topic: PayrollDocument3 pagesPrinciples of Accounts February 2, 2021 Grade 11 Name: - Topic: PayrollTerriNo ratings yet

- Salaries and WagesDocument37 pagesSalaries and WagesMarvin ManuelNo ratings yet

- Percent (%) : When We Say "Percent", We Are Really Saying "Per 100". One Percent (1%) Means 1 Per 100Document17 pagesPercent (%) : When We Say "Percent", We Are Really Saying "Per 100". One Percent (1%) Means 1 Per 100Khaing PhyuNo ratings yet

- Commissions - Sample Math Practice Problems: Complexity 1, Mode SimpleDocument6 pagesCommissions - Sample Math Practice Problems: Complexity 1, Mode Simplearthur guil-anNo ratings yet

- BonusesDocument3 pagesBonuses08chloe.tanNo ratings yet

- BM-Q2W3 W CorrectionsDocument9 pagesBM-Q2W3 W CorrectionsRui Isaac FernandoNo ratings yet

- Commission Notes: Key Words For Word ProblemsDocument2 pagesCommission Notes: Key Words For Word ProblemsGrace JosephNo ratings yet

- Business Math Report WEEK 1Document25 pagesBusiness Math Report WEEK 1HOney Mae Alecida OteroNo ratings yet

- Lesson 10 Simple InterestDocument73 pagesLesson 10 Simple Interestapi-240701242No ratings yet

- Lesson 4 Salries Income and WagesDocument28 pagesLesson 4 Salries Income and WagesSylph BabyNo ratings yet

- A Wage Is A CompensationDocument14 pagesA Wage Is A CompensationAkshay BadheNo ratings yet

- Business Math 11 - 12 q2 Clas 3 Joseph AurelloDocument10 pagesBusiness Math 11 - 12 q2 Clas 3 Joseph AurelloKim Yessamin Madarcos100% (1)

- Business Math 11 - 12 q2 Clas 3 Joseph AurelloDocument10 pagesBusiness Math 11 - 12 q2 Clas 3 Joseph AurelloKim Yessamin Madarcos100% (1)

- Salaries and Wages: Salary Is The Compensation UsuallyDocument7 pagesSalaries and Wages: Salary Is The Compensation UsuallyJulius LitaNo ratings yet

- Salary Wage Income BenefitsDocument23 pagesSalary Wage Income BenefitsIan SumastreNo ratings yet

- Accounting for Labour CostsDocument26 pagesAccounting for Labour CostsAsal Islam100% (1)

- Interest & CommissionDocument18 pagesInterest & CommissionAndrea GalangNo ratings yet

- Q2 - Business Math LAS3 FOR PRINTING - 230517 - 092725Document5 pagesQ2 - Business Math LAS3 FOR PRINTING - 230517 - 092725yenny lynNo ratings yet

- 20211WEMT CourseGrade4Week5Supplementary MathsCommonDocument10 pages20211WEMT CourseGrade4Week5Supplementary MathsCommonMidnight OceanNo ratings yet

- Presentation 22Document8 pagesPresentation 22hae tee Seo100% (1)

- Application of PercentDocument4 pagesApplication of PercentWendell Kim LlanetaNo ratings yet

- Handout Business Mathematics - ABM-diamondDocument21 pagesHandout Business Mathematics - ABM-diamondShela RamosNo ratings yet

- Banking and Finance Lesson 6-1 Classroom AssignmentDocument2 pagesBanking and Finance Lesson 6-1 Classroom Assignmentumaddox2425No ratings yet

- Business Math Midterm Reviewer Session 8 Introduction To Salaries and WagesDocument8 pagesBusiness Math Midterm Reviewer Session 8 Introduction To Salaries and WagesJwyneth Royce DenolanNo ratings yet

- Cost Benefit AnalysisDocument3 pagesCost Benefit AnalysisSourav SinglaNo ratings yet

- CommissionsDocument21 pagesCommissionskristylabelidoNo ratings yet

- businessmath_lesson1_quarter2Document18 pagesbusinessmath_lesson1_quarter2Lynn DomingoNo ratings yet

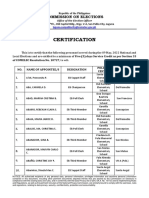

- COMELEC Certification of Personnel Service for Laguna ElectionsDocument92 pagesCOMELEC Certification of Personnel Service for Laguna ElectionsCherielee FabroNo ratings yet

- Teachers ScheduleDocument17 pagesTeachers ScheduleCherielee FabroNo ratings yet

- BanksssDocument21 pagesBanksssCherielee FabroNo ratings yet

- Book 3Document10 pagesBook 3Cherielee FabroNo ratings yet

- SF 9 G12 ABMDocument5 pagesSF 9 G12 ABMCherielee FabroNo ratings yet

- 2015 SALN Additional SheetsDocument4 pages2015 SALN Additional Sheetsrickymalubag0140% (1)

- BF2 - AnswerDocument34 pagesBF2 - AnswerCherielee FabroNo ratings yet

- Best Among The BestDocument18 pagesBest Among The BestCherielee FabroNo ratings yet

- MARIVIC LoiDocument1 pageMARIVIC LoiCherielee FabroNo ratings yet

- Best Among The BestDocument1 pageBest Among The BestCherielee FabroNo ratings yet

- Caraan, Hans Blix N. - ResumeDocument2 pagesCaraan, Hans Blix N. - ResumeCherielee FabroNo ratings yet

- 12 Pyth 1st QuarterDocument51 pages12 Pyth 1st QuarterCherielee FabroNo ratings yet

- John Aldrich S. Magpantay ResumeDocument1 pageJohn Aldrich S. Magpantay ResumeCherielee FabroNo ratings yet

- CASTRO, Patrick Gabriel MagpantayDocument2 pagesCASTRO, Patrick Gabriel MagpantayCherielee FabroNo ratings yet

- Defining and Describing Accounting and Its HistoryDocument9 pagesDefining and Describing Accounting and Its HistoryCherielee FabroNo ratings yet

- Masayang: Interpersonal RelationshipDocument16 pagesMasayang: Interpersonal RelationshipCherielee FabroNo ratings yet

- Labour Market Impact Assessment by Province and Program StreamDocument937 pagesLabour Market Impact Assessment by Province and Program Streamsan cristobalNo ratings yet

- Sample PayrollDocument6 pagesSample PayrollDeborah Fajardo ManabatNo ratings yet

- Ot Form 2022Document1 pageOt Form 2022Vhing ResurreccionNo ratings yet

- Whelshay Salary BreakupDocument16 pagesWhelshay Salary Breakuprahul.kNo ratings yet

- March Payroll 2022 F FFFDocument45 pagesMarch Payroll 2022 F FFFJale Ann A. EspañolNo ratings yet

- Maternity Calculation - BanglaDocument5 pagesMaternity Calculation - Banglasurkhela4No ratings yet

- Mygov 16614940281Document25 pagesMygov 16614940281Kiran N S GowdaNo ratings yet

- Payroll Register PD11-14-14 PDFDocument33 pagesPayroll Register PD11-14-14 PDFJoseph ManriquezNo ratings yet

- Dashboard Excel Recursos HumanosDocument13 pagesDashboard Excel Recursos Humanoskyo2104No ratings yet

- 4 Summary of Current Regl MWRs Non Agri and Agri by Region As of April 2023Document1 page4 Summary of Current Regl MWRs Non Agri and Agri by Region As of April 2023Balindoa JomNo ratings yet

- Comp. Analysis of Min. Wages With Other RefineriesDocument10 pagesComp. Analysis of Min. Wages With Other RefineriesDebasmita DasNo ratings yet

- RRD Services PayslipDocument14 pagesRRD Services PayslipNur Sharmila NordinNo ratings yet

- Ncwa 7Document63 pagesNcwa 7Ramlal GhasilNo ratings yet

- Payroll Warrant for Deceased EmployeesDocument4 pagesPayroll Warrant for Deceased Employeeskim berlyNo ratings yet

- Nagaraja Salary SlipDocument7 pagesNagaraja Salary SlipAnand SaminathanNo ratings yet

- Expense Category Amount (RM) Quantity Total Amount (RM) Sallary: Ceo: 10,000.00Document3 pagesExpense Category Amount (RM) Quantity Total Amount (RM) Sallary: Ceo: 10,000.00Mohd Hafizul Abdul KalamNo ratings yet

- Salary From January 2023 With 42% DA by GE NewsDocument22 pagesSalary From January 2023 With 42% DA by GE NewsAditya Prasad MishraNo ratings yet

- Cost Accounting Labour Class OutlineDocument16 pagesCost Accounting Labour Class OutlineBushra ChowdhuryNo ratings yet

- Ma Lesson 03 Labour CostDocument15 pagesMa Lesson 03 Labour CostDamith SarangaNo ratings yet

- DetailedAttendanceReport Aug 2021 1628105868630Document7 pagesDetailedAttendanceReport Aug 2021 1628105868630eduguideNo ratings yet

- Rate Break Up 15500Document1 pageRate Break Up 15500Yash Raj Bhardwaj100% (1)

- CEO Remuneration & BenefitsDocument3 pagesCEO Remuneration & BenefitsmahmudursngNo ratings yet

- Revised Financial Cost BreakupDocument13 pagesRevised Financial Cost BreakupNeeraj SinghNo ratings yet

- WAGE RATES OnlyDocument1 pageWAGE RATES OnlyMiguel Anas Jr.No ratings yet

- Form GDocument1 pageForm GSatyam mishraNo ratings yet

- DGR Wages Rate A B C New Revised Rate 1-10-2021Document13 pagesDGR Wages Rate A B C New Revised Rate 1-10-2021pcnishantNo ratings yet