Professional Documents

Culture Documents

Mortgages: 7.1 Mortgage Lending 7.2 Mortgage Loan Processing 7.3 Mortgages and The Law 7.4 Government-Backed Loans

Uploaded by

Mohammed waqas0 ratings0% found this document useful (0 votes)

14 views35 pagesCredit Insurance

Original Title

Banking07

Copyright

© © All Rights Reserved

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCredit Insurance

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

14 views35 pagesMortgages: 7.1 Mortgage Lending 7.2 Mortgage Loan Processing 7.3 Mortgages and The Law 7.4 Government-Backed Loans

Uploaded by

Mohammed waqasCredit Insurance

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 35

7 7.

1

MORTGAGES

Mortgage Lending

7.2 Mortgage Loan Processing

7.3 Mortgages and the Law

7.4 Government-Backed Loans

Slide 1 © South-Western Publishing

Lesson 7.1

MORTGAGE LENDING

GOALS

Define the term mortgage

Identify several types of mortgages

Slide 2 © South-Western Publishing

WHAT

WHAT IS

IS A

A MORTGAGE?

MORTGAGE?

Today, a mortgage is a note, usually long-term,

secured by real property.

Essentially, a mortgage places a lien on the

property that is not released until the debt is paid.

If the mortgage is not paid, the creditor seeks a

court-ordered sale of the property called a

foreclosure, and the debt is paid from those funds.

Slide 3 © South-Western Publishing

FIXED

FIXED RATE

RATE MORTGAGES

MORTGAGES

Fixed rate mortgages, also called conventional

mortgages, are loans with a fixed rate of interest

for the life of the loan.

Payments on the loan are set for the life of the

loan.

Terms are set for the life of the loan.

The most common terms are 30- and 15-year

terms.

Slide 4 © South-Western Publishing

BALLOON

BALLOON MORTGAGE

MORTGAGE

In a balloon mortgage, the interest rate and

payment stay fixed, but at some specified point,

the entire remaining balance of the loan is due in

one single “balloon” payment.

Slide 5 © South-Western Publishing

ADJUSTABLE

ADJUSTABLE RATE

RATE MORTGAGES

MORTGAGES

Adjustable rate mortgages (ARMs) are those with rates

that change over the course of the loan.

Usually the interest rate and payments are fixed for some

period of time at the outset but then change according to

some index value.

Some of the things that can vary are:

Interest rate Adjustment interval

Payment Periodic cap

Index Lifetime cap

Formula

Slide 6 © South-Western Publishing

BUY-DOWN

BUY-DOWN MORTGAGE

MORTGAGE

In a buy-down mortgage, the borrower buys

down, or prepays, part of the interest in order to

get a lower rate.

The borrower pays points to the lender at the

outset, and the lender agrees to lower the rate

so much per point.

A point is a value equal to 1 percent of the loan.

Slide 7 © South-Western Publishing

SHARED

SHARED APPRECIATION

APPRECIATION MORTGAGE

MORTGAGE (SAM)

(SAM)

A shared appreciation mortgage can lower

interest rates for borrowers who agree to share

later with the lender some part of the amount the

house appreciates.

Appreciation is the amount that a house

increases in value.

Slide 8 © South-Western Publishing

REFINANCING

REFINANCING

Refinancing is starting over with an entirely new

loan, using part or all of the loan funds to pay off

the old mortgage.

If interest rate are low, consumers save money

by getting new mortgages at lower rates.

Banks and other lenders earn money on fees,

points, and closing costs of the new loan.

Slide 9 © South-Western Publishing

HOME

HOME EQUITY

EQUITY LOANS

LOANS

Equity is the difference between what an item is

worth and what is owed on it.

Homeowners can use the difference between

what they owe and what their homes are worth

to secure a loan.

Slide 10 © South-Western Publishing

REVERSE

REVERSE MORTGAGES

MORTGAGES

A reverse mortgage is not used to purchase a home.

It is a form of consumer loan tied to the appreciated

value of a property.

In most cases, reverse mortgages are limited to

homeowners 62 years or older.

With a reverse mortgage, a homeowner receives a sum

from the lender secured by the value of a home and does

not pay the loan back as long as he or she lives there.

The lender is repaid, including fees and interest, when

the borrower sells or dies.

Slide 11 © South-Western Publishing

Lesson 7.2

MORTGAGE LOAN

PROCESSING

GOALS

Describe the components involved in

obtaining a mortgage

Explain the mortgage approval process

Slide 12 © South-Western Publishing

OBTAINING

OBTAINING A

A MORTGAGE

MORTGAGE

Lenders typically require a down payment of 5,

10, or 20 percent for a mortgage.

A larger down payment lowers the cost of the

monthly payment and may affect how the lender

views the borrower.

Most lenders do not want a person’s housing cost

to exceed 25 to 28 percent of gross monthly

income.

Total debt should not exceed 36 percent.

Slide 13 © South-Western Publishing

MONTHLY

MONTHLY PAYMENTS

PAYMENTS

Monthly payments to the lender usually consist of

PITI or Principal, Interest, Taxes, and Insurance.

Slide 14 © South-Western Publishing

PITI

PITI

Principal is the remaining unpaid balance of the mortgage.

Interest is the amount that goes toward interest.

Taxes include local real estate taxes.

Most lenders require an amount to be paid to them in advance,

called escrow, from which they pay the real estate taxes.

Insurance refers to property insurance and sometimes

private mortgage insurance.

Almost all mortgages require the homeowner to maintain

adequate property insurance.

Private mortgage insurance (PMI) protects the lender against

loan default.

Slide 15 © South-Western Publishing

THE

THE APPROVAL

APPROVAL PROCESS

PROCESS

Application

Documentation

Underwriting

Drawing documents

Closing

Recording

Slide 16 © South-Western Publishing

Lesson 7.3

MORTGAGES AND

THE LAW

GOALS

Describe consumer protection laws that

apply to mortgage lending

Describe laws directly related to mortgage

lending

Slide 17 © South-Western Publishing

CONSUMER

CONSUMER PROTECTION

PROTECTION LEGISLATION

LEGISLATION

Truth in Lending Act (TILA)

Equal Credit Opportunity Act (ECOA)

Fair Credit Reporting Act (FCRA)

Fair Debt Collection Practices Act (FDCPA)

Gramm-Leach-Bliley Act

Slide 18 © South-Western Publishing

MORTGAGE

MORTGAGE LEGISLATION

LEGISLATION

In addition to consumer legislation, other laws

exist that relate directly to mortgage lending.

Complying with this legislation and documenting

compliance requires considerable effort and

expense on the part of the financial institutions.

Slide 19 © South-Western Publishing

COMMUNITY

COMMUNITY REINVESTMENT

REINVESTMENT ACT

ACT

Congress passed the Community Reinvestment Act

(CRA) of 1977 in response to widespread

complaints that some banks refused to lend to

residents of certain neighborhoods, a practice called

redlining.

Slide 20 © South-Western Publishing

HOME

HOME MORTGAGE

MORTGAGE DISCLOSURE

DISCLOSURE ACT

ACT

The Home Mortgage Disclosure Act (HMDA) of

1974 was a forerunner of the CRA.

It requires banks and other financial institutions

to record and report data on home lending in

order to identify possible discriminatory patterns.

Slide 21 © South-Western Publishing

HOME

HOMEOWNERSHIP

OWNERSHIPAND

ANDEQUITY

EQUITYPROTECTION

PROTECTIONACT

ACT

Congress passed the Home Ownership and

Equity Protection Act (HOEPA) in 1994 to

protect consumers against predatory lending.

Provisions of this act also apply to second

mortgages and refinancing.

Slide 22 © South-Western Publishing

REAL

REAL ESTATE

ESTATE SETTLEMENT

SETTLEMENT PROCEDURES

PROCEDURES ACT

ACT

Congress enacted the Real Estate Settlement

Procedures Act (RESPA) of 1974 to protect

consumers from hidden costs or expensive

surprises at closing time.

The law requires disclosures to be provided to

the borrower at various times during the

transaction.

Slide 23 © South-Western Publishing

THE

THE HOMEOWNERS’

HOMEOWNERS’ PROTECTION

PROTECTION ACT

ACT OF

OF 1998

1998

The Homeowners’ Protection Act of 1998 requires

that lenders drop PMI when equity reaches 22

percent in loans closed after July 29, 1999.

Slide 24 © South-Western Publishing

Lesson 7.4

GOVERNMENT-

BACKED LOANS

GOALS

Explain the concept of government-backed

loans

Identify government-backed programs to

encourage home lending

Slide 25 © South-Western Publishing

WHAT

WHAT IS

IS A

A GOVERNMENT-BACKED

GOVERNMENT-BACKED LOAN?

LOAN?

Numerous government programs help banks

help people get loans.

In most of these programs, the banks provide

funding and the government absorbs some of

the risk.

Slide 26 © South-Western Publishing

FEDERAL

FEDERAL MORTGAGE

MORTGAGE PROGRAMS

PROGRAMS

The Federal Housing Administration, established

in 1934, supported both homebuyers and banks

by replenishing funds available for home

lending.

Today, there are many such programs with

varying missions, services, and operations, but

the twin benefits of both supporting homeowners

and backing the banking industry continues.

Slide 27 © South-Western Publishing

FEDERAL

FEDERAL HOUSING

HOUSING ADMINISTRATION

ADMINISTRATION (FHA)

(FHA)

During the Great Depression

Established to help the housing industry get

back on its feet

Guaranteed loans and provided mortgage

insurance

Pioneered long-term loans

Slide 28 © South-Western Publishing

HUD

HUD OFFICE

OFFICE OF

OF HOUSING

HOUSING

Today, what was once the FHA is now the Office

of Housing and is part of the Department of

Housing and Urban Development (HUD).

The Office of Housing continues to guarantee

FHA loans and provide mortgage insurance.

Slide 29 © South-Western Publishing

FANNIE

FANNIE MAE

MAE

The Federal National Mortgage Association

(FNMA) was created in 1938 as part of the FHA.

Fannie Mae is a government-chartered

corporation that buys mortgages from the

originating institutions and either keeps them or

exchanges them for securities which it

guarantees.

Fannie Mae is now an independent corporation.

Slide 30 © South-Western Publishing

FREDDIE

FREDDIE MAC

MAC

The Federal Home Loan Mortgage Corporation

was created in 1970 as a fully independent

corporation.

Freddie Mac buys home mortgages from banks

and other lending institutions and combines

them into large groups, selling interest in the

groups to investors.

Slide 31 © South-Western Publishing

GINNIE

GINNIE MAE

MAE

The Government National Mortgage Association

is part of the Department of Housing and Urban

Development.

Freddie Mac neither buys nor sells mortgages.

It backs securities issued by holders of pools of

mortgages.

Slide 32 © South-Western Publishing

VETERANS

VETERANS ADMINISTRATION

ADMINISTRATION (VA)

(VA)

Loans from the Department of Veterans Affairs

(DVA) have helped millions of service men and

women get government-backed loans with low

down payments.

VA loans allow qualified veterans to buy, build,

remodel, or refinance a home.

Slide 33 © South-Western Publishing

NCHSA

NCHSA

The National Council of State Housing Agencies (NCHSA)

is a national organization of Housing Finance Agencies

(HFAs) throughout the states that provide and administer

programs for lower-income and other people who seek

help at the state level to buy or renovate a home.

There are also 350 affiliated profit and nonprofit agencies

that work in this field.

These agencies and firms have a variety of programs for

affordable housing.

Slide 34 © South-Western Publishing

OTHER

OTHER GOVERNMENT-BACKED

GOVERNMENT-BACKED LOANS

LOANS

There are many other government-backed loan

programs.

It is not easy to find every government loan

program.

The Catalog of Federal Domestic Assistance is

available in government depository libraries and

online at www.cfda.gov

Slide 35 © South-Western Publishing

You might also like

- TrueBeam 2.5 Administration and PhysicsDocument937 pagesTrueBeam 2.5 Administration and PhysicsSandeep Hunjan100% (6)

- (Goldman Sachs) A Mortgage Product PrimerDocument141 pages(Goldman Sachs) A Mortgage Product Primer00aaNo ratings yet

- Penis Enlargement - Get Your Penis Bigger Naturally, Learn Time Tested Techniques and Routines, Last Longer in Bed, and Achieve Supernatural Performance! (PDFDrive)Document44 pagesPenis Enlargement - Get Your Penis Bigger Naturally, Learn Time Tested Techniques and Routines, Last Longer in Bed, and Achieve Supernatural Performance! (PDFDrive)Manoj Malik100% (5)

- Mortgage Markets and Derivatives 2Document35 pagesMortgage Markets and Derivatives 2caballerod0343No ratings yet

- Mortgage MarketsDocument28 pagesMortgage Marketssweya juliusNo ratings yet

- 308 Class5Document71 pages308 Class5Bokul HossainNo ratings yet

- Rakiba Mam AssnDocument9 pagesRakiba Mam AssnFahim IstiakNo ratings yet

- FM6 NFDocument33 pagesFM6 NFBjay AledonNo ratings yet

- Lu 6Document40 pagesLu 6Phetho MachiliNo ratings yet

- Mortgage LoanDocument11 pagesMortgage LoanTam NguyenNo ratings yet

- Saunders 8e PPT Chapter07Document26 pagesSaunders 8e PPT Chapter07sdgdfs sdfsfNo ratings yet

- Mortgage LoanDocument13 pagesMortgage Loanphilip shternNo ratings yet

- Chapter 7: Mortgage Markets: Lecturer: Truong Thi Thuy Trang Email: Truongthithuytrang - Cs2@ftu - Edu.vnDocument43 pagesChapter 7: Mortgage Markets: Lecturer: Truong Thi Thuy Trang Email: Truongthithuytrang - Cs2@ftu - Edu.vnHiếu Nhi TrịnhNo ratings yet

- Today 10.lenderDocument9 pagesToday 10.lenderGamaya EmmanuelNo ratings yet

- Mortgage MarketDocument32 pagesMortgage MarketAnathea Gabrielle OrnopiaNo ratings yet

- Chapter 10 - SummaryDocument4 pagesChapter 10 - SummaryjsgiganteNo ratings yet

- Traditional Knowledge Protection Case StudiesDocument11 pagesTraditional Knowledge Protection Case StudiesFurkhan SyedNo ratings yet

- Steven Glaze Presented How Home Improvement Can Ease Your Pain.Document34 pagesSteven Glaze Presented How Home Improvement Can Ease Your Pain.StevenGlazeKansasCityNo ratings yet

- Mortgage Markets &: Chapter 24 Managing Risk Off The Balance Sheet With Loan Sales and SecuritizationDocument28 pagesMortgage Markets &: Chapter 24 Managing Risk Off The Balance Sheet With Loan Sales and SecuritizationAhmed El KhateebNo ratings yet

- FF Lesson 1 1 1 Residential Mortgage Overview V7 R Final W AudioDocument23 pagesFF Lesson 1 1 1 Residential Mortgage Overview V7 R Final W AudiopraveenhariNo ratings yet

- Mortgage MarketsDocument5 pagesMortgage MarketsCliezel Ugdamen100% (1)

- Part-22: Mortgages & Mortgage-Backed SecuritiesDocument58 pagesPart-22: Mortgages & Mortgage-Backed Securitiesapi-26992387No ratings yet

- Medium Sources of Financing: Prepared by Niki Lukviarman (Derived From Various Sources)Document26 pagesMedium Sources of Financing: Prepared by Niki Lukviarman (Derived From Various Sources)Giffari Ibnu ToriqNo ratings yet

- Chapter 14 The Mortgage MarketsDocument5 pagesChapter 14 The Mortgage Marketslasha Kachkachishvili100% (1)

- Mortgage Loan BasicsDocument11 pagesMortgage Loan BasicsBittu DesignsNo ratings yet

- "A Mortgage Loan Is ADocument14 pages"A Mortgage Loan Is ASUSHILRRAVAL0% (1)

- Mortgage Security Interest Home Insurance Mortgage Insurance BorrowerDocument8 pagesMortgage Security Interest Home Insurance Mortgage Insurance BorrowerCharan Tej RudralaNo ratings yet

- Reverse Mortgages Lifetime Mortgages Home EquityDocument17 pagesReverse Mortgages Lifetime Mortgages Home EquityRebecca JordanNo ratings yet

- Mortgage Loan BasicsDocument7 pagesMortgage Loan BasicsJyoti SinghNo ratings yet

- Mortgage - Unknown - Real Estate TerminologiesDocument5 pagesMortgage - Unknown - Real Estate TerminologiesJaykumar PrajapatiNo ratings yet

- Why Bank Loans Are Enigma To BorrowersDocument3 pagesWhy Bank Loans Are Enigma To BorrowersMohammad Shahjahan SiddiquiNo ratings yet

- Understanding MortgagorsDocument2 pagesUnderstanding MortgagorsDiane ヂエンNo ratings yet

- Mortgage LoanDocument114 pagesMortgage LoanFaquir Sanoar SanyNo ratings yet

- CH 1 - Civil Law Nominated Contract FullDocument164 pagesCH 1 - Civil Law Nominated Contract FullIdiris H. AliNo ratings yet

- Types of BondDocument3 pagesTypes of BondRejuana SultanaNo ratings yet

- RES 3200 Chapter 2 Real Estate FinancingDocument12 pagesRES 3200 Chapter 2 Real Estate FinancingbaorunchenNo ratings yet

- Chapter 23Document24 pagesChapter 23Abdur RehmanNo ratings yet

- Assignment 13 - Mortgage MarketDocument2 pagesAssignment 13 - Mortgage MarketJea Ann CariñozaNo ratings yet

- Rem 7-6Document24 pagesRem 7-6Kevin JugaoNo ratings yet

- MortgagesDocument5 pagesMortgagesKundayi MahembeNo ratings yet

- J&K Bank Housing Loan Scheme and Its Comparison With Other Major Banks Home LoanDocument23 pagesJ&K Bank Housing Loan Scheme and Its Comparison With Other Major Banks Home LoanMir MustafaNo ratings yet

- Rental AssurancesDocument7 pagesRental AssurancesRobert NixonNo ratings yet

- Finance: For Other Uses, SeeDocument9 pagesFinance: For Other Uses, SeeShubham SharmaNo ratings yet

- Valuation Concepts Module 11 PDFDocument4 pagesValuation Concepts Module 11 PDFJisselle Marie CustodioNo ratings yet

- Loan Agreement BinwagDocument6 pagesLoan Agreement BinwagAnn DonatoNo ratings yet

- Real Estate Principles A Value Approach 5th Edition Ling Solutions ManualDocument23 pagesReal Estate Principles A Value Approach 5th Edition Ling Solutions Manualleightonayarza100% (18)

- Real Estate Principles A Value Approach 5Th Edition Ling Solutions Manual Full Chapter PDFDocument19 pagesReal Estate Principles A Value Approach 5Th Edition Ling Solutions Manual Full Chapter PDFoctogamyveerbxtl100% (8)

- Mortgage Loan Basics SUMMARYDocument10 pagesMortgage Loan Basics SUMMARYRebecca JordanNo ratings yet

- Financial Markets (Chapter 10)Document3 pagesFinancial Markets (Chapter 10)Kyla Dayawon100% (1)

- Madura Chapter 9-2 PDFDocument40 pagesMadura Chapter 9-2 PDFMahmoud AbdullahNo ratings yet

- Mortgage Loan CalculatorDocument2 pagesMortgage Loan CalculatorAmerica's Loan AdvisorsNo ratings yet

- EkmofonaDocument5 pagesEkmofonaRajdip MondalNo ratings yet

- Assignement: Subprime LoanDocument10 pagesAssignement: Subprime LoanJS Gowri NandiniNo ratings yet

- Chapter 09 PresentationDocument26 pagesChapter 09 PresentationMega_ImranNo ratings yet

- Loan Terms QUESTIONSDocument13 pagesLoan Terms QUESTIONSPrince EG DltgNo ratings yet

- HandoutsDocument9 pagesHandoutsdianarosesarsalejo19No ratings yet

- Project Report On Convergence of Banking Sector To Housing FinanceDocument4 pagesProject Report On Convergence of Banking Sector To Housing FinanceHari PrasadNo ratings yet

- LMI GuideDocument31 pagesLMI GuideSamir ChitkaraNo ratings yet

- FIN 331 Chapter 10Document12 pagesFIN 331 Chapter 10Mohammed waqasNo ratings yet

- CorporateDocument10 pagesCorporateMohammed waqasNo ratings yet

- Automobile Insurance: Managing The RiskDocument24 pagesAutomobile Insurance: Managing The RiskMohammed waqasNo ratings yet

- Mortgage InsuranceDocument6 pagesMortgage InsuranceMohammed waqasNo ratings yet

- NAME: Sonwalkar Pratik Rohidas Class: 12 R1 Subject: Biology TOPIC: Detailed Study On Infertility Its Causes and TreatmentDocument27 pagesNAME: Sonwalkar Pratik Rohidas Class: 12 R1 Subject: Biology TOPIC: Detailed Study On Infertility Its Causes and TreatmentPratik Sonwalkar0% (1)

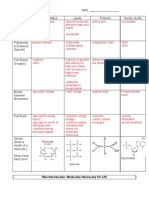

- Macromolecules Worksheet AnswersDocument2 pagesMacromolecules Worksheet AnswersEman RehmanNo ratings yet

- Topic 23 A2 Nuclear Physics NotesDocument9 pagesTopic 23 A2 Nuclear Physics NotesIffahNo ratings yet

- UTM SlideDocument231 pagesUTM SlideAlly RaxaNo ratings yet

- Parts Catalog Cummins, 6LTAA8.9G2 - ESN 82312099 - CPL 3079-9Document1 pageParts Catalog Cummins, 6LTAA8.9G2 - ESN 82312099 - CPL 3079-9Hardiansyah SimarmataNo ratings yet

- Experiment 2 - Enzyme ActivityDocument7 pagesExperiment 2 - Enzyme ActivityFatimatuzzahra' Binti Hardiyono FISNo ratings yet

- 2019 Book DiseasesOfTheChestBreastHeartA PDFDocument237 pages2019 Book DiseasesOfTheChestBreastHeartA PDFAdnan WalidNo ratings yet

- 3161 9711 1 SMDocument3 pages3161 9711 1 SMpuskesmas sidosermoNo ratings yet

- IGCSE Biology NotesDocument21 pagesIGCSE Biology NotesalfaazmcsNo ratings yet

- Jewish Standard, February 26, 1016Document56 pagesJewish Standard, February 26, 1016New Jersey Jewish StandardNo ratings yet

- BEKS - Annual Report - 2017 - Revisi PDFDocument596 pagesBEKS - Annual Report - 2017 - Revisi PDFWilliam WongNo ratings yet

- Audit FundamentalsDocument37 pagesAudit Fundamentalsaqsa palijoNo ratings yet

- Woking Priciple in DCDocument7 pagesWoking Priciple in DCRohit Kumar DasNo ratings yet

- Search For Childcare CentreDocument2 pagesSearch For Childcare CentrefalanksNo ratings yet

- Chapter 1, Unit 2, Human Anatomy and Physiology 1, B Pharmacy 1st Sem, Carewell PharmaDocument5 pagesChapter 1, Unit 2, Human Anatomy and Physiology 1, B Pharmacy 1st Sem, Carewell Pharmatambreen18No ratings yet

- Cupping TherapyDocument8 pagesCupping TherapySaputra Hermawan GabroNo ratings yet

- Bustamante - NSTP100 Essay #9Document1 pageBustamante - NSTP100 Essay #9Jimin ParkNo ratings yet

- BaeS RG-35 6x6Document2 pagesBaeS RG-35 6x6engelbrechtwjNo ratings yet

- The Human Aura: Manual Compiled by DR Gaynor Du PerezDocument33 pagesThe Human Aura: Manual Compiled by DR Gaynor Du Perezdorcas7342100% (2)

- Shellac Nails AmarilloDocument3 pagesShellac Nails AmarilloBnails SalonNo ratings yet

- Lesson 3 The Ideal Gasq PDFDocument4 pagesLesson 3 The Ideal Gasq PDFireneNo ratings yet

- Initial Assessment and Management of Acute Stroke - UpToDateDocument27 pagesInitial Assessment and Management of Acute Stroke - UpToDateDiego VillacisNo ratings yet

- Fire Pump specialities-NFPA20Document23 pagesFire Pump specialities-NFPA20WHITE LOTUS VOICE-OVERNo ratings yet

- TriconexDocument38 pagesTriconexajmalahmed82No ratings yet

- An Exercise On Cost-Benefits Analysis: Category Details Cost in First YearDocument3 pagesAn Exercise On Cost-Benefits Analysis: Category Details Cost in First YearPragya Singh BaghelNo ratings yet

- Farenhiet 451 - EssayDocument5 pagesFarenhiet 451 - Essayapi-275502795No ratings yet

- Arie W. Kruglanski, Ayelet Fishbach, Catalina Kopetz - Goal Systems Theory - Psychological Processes and Applications-Oxford University Press (2023)Document329 pagesArie W. Kruglanski, Ayelet Fishbach, Catalina Kopetz - Goal Systems Theory - Psychological Processes and Applications-Oxford University Press (2023)NoreenNo ratings yet

- Statewise List of FPOs2014Document19 pagesStatewise List of FPOs2014bharatNo ratings yet