Professional Documents

Culture Documents

Finance Project

Uploaded by

Mujtaba Hassan0 ratings0% found this document useful (0 votes)

25 views9 pagesBenz and Ferrari both trace their origins back over 100 years. Benz was founded in 1886 and is headquartered in Stuttgart, Germany. Ferrari was founded in 1929 as a racing team and is an Italian sports car manufacturer. Both companies provide financial analyses including ratios to measure liquidity, credit risk, profitability, and stock valuation. Their current ratios, quick ratios, and cash ratios all indicate strong short-term liquidity positions over the past few years.

Original Description:

Original Title

finance project

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentBenz and Ferrari both trace their origins back over 100 years. Benz was founded in 1886 and is headquartered in Stuttgart, Germany. Ferrari was founded in 1929 as a racing team and is an Italian sports car manufacturer. Both companies provide financial analyses including ratios to measure liquidity, credit risk, profitability, and stock valuation. Their current ratios, quick ratios, and cash ratios all indicate strong short-term liquidity positions over the past few years.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

25 views9 pagesFinance Project

Uploaded by

Mujtaba HassanBenz and Ferrari both trace their origins back over 100 years. Benz was founded in 1886 and is headquartered in Stuttgart, Germany. Ferrari was founded in 1929 as a racing team and is an Italian sports car manufacturer. Both companies provide financial analyses including ratios to measure liquidity, credit risk, profitability, and stock valuation. Their current ratios, quick ratios, and cash ratios all indicate strong short-term liquidity positions over the past few years.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 9

History of Benz

THE HEADQUARTERS IS IN STUTTGART, BADEN-

WÜRTTEMBERG. THE NAME FIRST APPEARED IN 1926

UNDER DAIMLER-BENZ. ... MERCEDES-BENZ TRACES

ITS ORIGINS TO IN 1901 MERCEDES AND KARL BENZ'S

1886 BENZ PATENT-MOTORWAGEN, WHICH IS WIDELY

REGARDED AS THE FIRST GASOLINE-POWERED

AUTOMOBILE.

History of Ferrari

History of Ferrari. Ferrari is an Italian company which has

produced sports cars since 1947, but traces its roots back to

1929 when Enzo Ferrari formed the Scuderia Ferrari racing

team. ... In January 2016, Ferrari officially split off from its

former parent company Fiat Chrysler Automobiles.

Tools of analysis

Dollar and Percentage changes

Trend percentages

Component percentage

Ratios

Dollar and Percentage Changes

Dollar and percentage changes of Benz

years 2017 2016 2015

net income 48,351 45,687 53394

Dollar changes 2,664 -7,707 0

percentage changes 5.83098 -14.4342 0

Dollar and percentage changes of Ferrari

company

net income 46600 38792 38,800

Dollar changes 7808 -8 0

percentage changes 20.12786 -0.02062 0

Trend Percentages

Trend percentage BEnZ company

Years 2017 2016 2015

net sale 365,479 311,445 230,312

trend percentage 158.6886 135.2274 100

net income 46,600 38,792 38,800

trend percentage 120.1031 99.97938 100

Gross profit 238,142 210,129 164,697

trend percentage 144.594 127.5852 100

Trend percentage Ferrari company

net sale 229,234 215,639 233,715

trend percentage 98.08271 92.26579 100

net income 48,351 45687 53394

trend percentage 90.55512 85.56579 100

Gross profit 88,186 84,263 93,626

trend percentage 94.18965 89.99957 100

Component Percentage

component percentage of apple company

years 2016 2015 2014

Revenue: 229,234 215,639 233,715

component percentage 100 100 100

expenses 26,842 24,239 22,396

component percentage 11.70943 11.24055 9.582611

net income 48,351 45,687 53,394

component percentage 21.09242 21.1868 22.84577

Component Percentage

component percentage of Benz

company

years 2017 2016 2015

Revenue: 229,234 215,639 233,715

component percentage 100 100 100

expenses 26,842 24,239 22,396

component percentage 11.70943 11.24055 9.582611

net income 48,351 45,687 53,394

component percentage 21.09242 21.1868 22.84577

component percentage of Ferrari company

years 2017 2016 2015

Revenue: 603,621 521,574 395,009

component percentage 100 100 100

expenses 140,285 121,872 100,834

component percentage 23.24058 23.3662 25.52701

net income 46,600 38,792 38,800

EXCEL SHEET

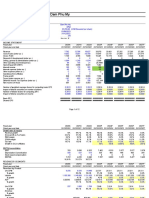

measure of short term liquidity

Benz Ferrari

formula company

2017 2016 2015 2017 2016 2015

current ratio Current assets/cureent liabilites 1.276063 1.352669 1.352669 1.513947 1.485771 1.418663

Quick ratio Current assets-inventries/cureent liabilites 1.227905 1.325811 1 1.617098 1.176599 1.087054

cash ratio cash+ bank balance +marketabale securties/current liablities 3 3.007177 2.551371 0.514258 0.519732 0.519976

reciveable turnover rate net sale/average account recieable 13 15 233,715 9.336096 8.284758

days to collect average accounts recviable 365 days/reciveable turnover rate 28.07692 24.33333 39.31766 44.0568

inventory turnout rate CGS/average inventory 47.21607 101 99 16.80132 17.86755

days to sell average inventory 365/inventory turnover rate 7.765957 3.613861 3.686869 21.72619 20.27778

operating cycle days to sale -days to collect reciveable

free cash flow net cash from operating activites-cash used for investing activites and dividend 17152 19847 24990 71,679 20,694

measure of long term credit risk

debit ratio total liblities/total assets 0.642845 0.601322 0.58892

turn in net cash provided by operating activites

intrest coverage ratio operating income/annual intrest expence 26.40293 41.22527 97.17599

measureof profitability

gross profit ratio dollar gross profit/net sales

operating expence ratio operating expence /net sales 0.117094 0.112405 0.095826

operating income gross profit -operating expences 61344 60024 71230

net income as a percentage of net sales net income/net sales 0.210924 0.211868 0.228458

earning per share net income-prefered devidend/average no of common share outstanding

return on acid operating income/average total assets 1.797895 0.186592 1.961725

return on common stokeholder equity net income -prefered dividend/average of common stockholder equity

measure for evaluasting the current market price of common stock

market value of financial instrument quoted in financial press or disclosed in financial statement

price -earning ratios current stock price /earning per share

dividend yeild annual divedend/current stock price

book value per share common stokeholder equity / shares of common stock outstanding

measure of short term

liquidity

Ferrari

formula Benz

201 201 201 201 201 2014

6 5 4 6 5

1.27 1.35 1.35 1.51 1.48

606 266 266 394 577 1.41

current ratio Current assets/cureent liabilites 3 9 9 7 1 8663

1.22 1.61 1.17

Current assets-inventries/cureent 790 1.32 709 659 1.08

Quick ratio liabilites 5 5811 1 8 9 7054

3.00 2.55 0.51 0.51

cash+ bank balance +marketabale 717 137 425 973 0.51

cash ratio securties/current liablities 3 7 1 8 2 9976

9.33

233, 609 8.28

reciveable turnover rate net sale/average account recieable 13 15 715 6 4758

28.0 24.3 39.3

days to collect average 769 333 176 44.0

accounts recviable 365 days/reciveable turnover rate 2 3 6 568

47.2 16.8

160 013 17.8

inventory turnout rate CGS/average inventory 7 101 99 2 6755

7.76 3.61 3.68 21.7

days to sell average 595 386 686 261 20.2

inventory 365/inventory turnover rate 7 1 9 9 7778

operating cycle days to sale -days to collect reciveable

net cash from operating activites-cash 171 198 249 71,6 20,6

free cash flow used for investing activites and dividend 52 47 90 79 94

You might also like

- Financial Statement: Statement of Cash FlowsDocument6 pagesFinancial Statement: Statement of Cash FlowsdanyalNo ratings yet

- Accounts Company DataDocument9 pagesAccounts Company DataAena KawatraNo ratings yet

- Cafe - Industry ReportsDocument17 pagesCafe - Industry ReportsCristina GarzaNo ratings yet

- EVA ExampleDocument27 pagesEVA Examplewelcome2jungleNo ratings yet

- TVS Motors Live Project Final 2Document39 pagesTVS Motors Live Project Final 2ritususmitakarNo ratings yet

- CAGRDocument7 pagesCAGRAsis NayakNo ratings yet

- KTM AG Achieves Record Growth in 2017 Annual ReportDocument146 pagesKTM AG Achieves Record Growth in 2017 Annual ReportKamran YousafNo ratings yet

- Coffee Shop - Industry ReportsDocument17 pagesCoffee Shop - Industry ReportsCristina Garza0% (1)

- Tarea Heritage Doll CompanyDocument6 pagesTarea Heritage Doll CompanyFelipe HidalgoNo ratings yet

- Exhibit in ExcelDocument8 pagesExhibit in ExcelAdrian WyssNo ratings yet

- Accounting Firm PL and KPIs 1Document6 pagesAccounting Firm PL and KPIs 1Creanga GeorgianNo ratings yet

- DCF 2 CompletedDocument4 pagesDCF 2 CompletedPragathi T NNo ratings yet

- Zara: IT For Fast FashionDocument12 pagesZara: IT For Fast FashionRajalakshmi MuthukrishnanNo ratings yet

- Airthread SolutionDocument30 pagesAirthread SolutionSrikanth VasantadaNo ratings yet

- Análisis Caso New Heritage - Nutresa LinaDocument27 pagesAnálisis Caso New Heritage - Nutresa LinaSARA ZAPATA CANONo ratings yet

- Company Name: Reneta LTD.: Group MemberDocument19 pagesCompany Name: Reneta LTD.: Group MemberMehenaj Sultana BithyNo ratings yet

- Drivers' Company Financial AnalysisDocument15 pagesDrivers' Company Financial AnalysisAtharva OrpeNo ratings yet

- Millat Audit Final ProjectDocument9 pagesMillat Audit Final ProjectIkram MunirNo ratings yet

- Financial Statements Analysis of Apollo and FortisDocument9 pagesFinancial Statements Analysis of Apollo and FortisAnurag DoshiNo ratings yet

- BHEL Valuation of CompanyDocument23 pagesBHEL Valuation of CompanyVishalNo ratings yet

- Total Revenue: Income StatementDocument4 pagesTotal Revenue: Income Statementmonica asifNo ratings yet

- Creative Sports Solution-RevisedDocument4 pagesCreative Sports Solution-RevisedRohit KumarNo ratings yet

- Kuhne NagelDocument133 pagesKuhne NagelKakoNo ratings yet

- Business Analysis and Valuation Using Financial Statements Text and Cases Palepu 5th Edition Solutions ManualDocument19 pagesBusiness Analysis and Valuation Using Financial Statements Text and Cases Palepu 5th Edition Solutions ManualStephanieParkerexbf100% (42)

- Particulars (INR in Crores) FY2015A FY2016A FY2017A FY2018ADocument6 pagesParticulars (INR in Crores) FY2015A FY2016A FY2017A FY2018AHamzah HakeemNo ratings yet

- Financial Statement AnalysisDocument18 pagesFinancial Statement AnalysisSabab ZamanNo ratings yet

- Dokumen - Tips - Interco Case KqfjkniwfDocument17 pagesDokumen - Tips - Interco Case KqfjkniwfFabián AlvaradoNo ratings yet

- 2.1 Financial Model Working - Lecture 26Document51 pages2.1 Financial Model Working - Lecture 26Alfred DurontNo ratings yet

- Gildan Model BearDocument57 pagesGildan Model BearNaman PriyadarshiNo ratings yet

- 6.1 Financial Model Working - Lecture 30Document63 pages6.1 Financial Model Working - Lecture 30Alfred DurontNo ratings yet

- Operating Lease Converter: InputsDocument44 pagesOperating Lease Converter: InputsJosé Manuel EstebanNo ratings yet

- A1.2 Roic TreeDocument9 pagesA1.2 Roic Treesara_AlQuwaifliNo ratings yet

- Pacific Grove Spice CompanyDocument3 pagesPacific Grove Spice CompanyLaura JavelaNo ratings yet

- DataDocument11 pagesDataA30Yash YellewarNo ratings yet

- Referensi Keuangan GreenfreshDocument5 pagesReferensi Keuangan GreenfreshTaufik HidayatNo ratings yet

- Financial Report - ShyamDocument14 pagesFinancial Report - ShyamYaswanth MaripiNo ratings yet

- PGPF - 01 - 017 - CV - Assignment - 5 - Keshav v1Document26 pagesPGPF - 01 - 017 - CV - Assignment - 5 - Keshav v1nidhidNo ratings yet

- DCF Case StudyDocument17 pagesDCF Case StudyVivekananda RNo ratings yet

- 6 Years at A Glance: 2015 Operating ResultsDocument2 pages6 Years at A Glance: 2015 Operating ResultsHassanNo ratings yet

- Alle FSA ExercisesDocument11 pagesAlle FSA Exercisesmsoegaard.kristensenNo ratings yet

- Airthread Acquisition Operating AssumptionsDocument27 pagesAirthread Acquisition Operating AssumptionsnidhidNo ratings yet

- Almarai Company: Consolidated Income StatementDocument11 pagesAlmarai Company: Consolidated Income Statementabdulla mohammadNo ratings yet

- 1233 NeheteKushal BAV Assignment1Document12 pages1233 NeheteKushal BAV Assignment1Anjali BhatiaNo ratings yet

- Gb2016-E WebDocument152 pagesGb2016-E Webshiven jainNo ratings yet

- HABT Model 5Document20 pagesHABT Model 5Naman PriyadarshiNo ratings yet

- BIOCON Ratio AnalysisDocument3 pagesBIOCON Ratio AnalysisVinuNo ratings yet

- DiviđenDocument12 pagesDiviđenPhan GiápNo ratings yet

- Beginner EBay DCFDocument14 pagesBeginner EBay DCFQazi Mohd TahaNo ratings yet

- Radico Khaitan SSGR Report and ForecastDocument38 pagesRadico Khaitan SSGR Report and Forecasttapasya khanijouNo ratings yet

- Tgs Ar2020 Final WebDocument157 pagesTgs Ar2020 Final Webyasamin shajiratiNo ratings yet

- Intrinsic Value Analysis of Tata Motors LtdDocument24 pagesIntrinsic Value Analysis of Tata Motors LtdApurvAdarshNo ratings yet

- Nasdaq Aaon 2018Document92 pagesNasdaq Aaon 2018gaja babaNo ratings yet

- Apple Enterprise financial analysis 2017-2019Document6 pagesApple Enterprise financial analysis 2017-2019jitendra tirthyaniNo ratings yet

- Markaz-GL On Financial ProjectionsDocument10 pagesMarkaz-GL On Financial ProjectionsSrikanth P School of Business and ManagementNo ratings yet

- Air Thread ConnectionsDocument31 pagesAir Thread ConnectionsJasdeep SinghNo ratings yet

- Additional Information Adidas Ar20Document9 pagesAdditional Information Adidas Ar20LT COL VIKRAM SINGH EPGDIB 2021-22No ratings yet

- General Insurance Corporation of IndiaDocument6 pagesGeneral Insurance Corporation of IndiaGukan VenkatNo ratings yet

- IMT CeresDocument7 pagesIMT CeresHarsha HoneyNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Financial Accounting: MGT-322 Final PresentationDocument6 pagesFinancial Accounting: MGT-322 Final PresentationMujtaba HassanNo ratings yet

- The Coca-Cola Company, American Corporation Founded in 1892 and Today EngagedDocument2 pagesThe Coca-Cola Company, American Corporation Founded in 1892 and Today EngagedMujtaba HassanNo ratings yet

- OS Concepts and K-Means Clustering PresentationDocument13 pagesOS Concepts and K-Means Clustering PresentationMujtaba HassanNo ratings yet

- OS Concepts and K-Means Clustering PresentationDocument13 pagesOS Concepts and K-Means Clustering PresentationMujtaba HassanNo ratings yet

- Assignment No 2Document1 pageAssignment No 2Mujtaba HassanNo ratings yet

- Underline The Adjectives in Each Sentence BelowDocument1 pageUnderline The Adjectives in Each Sentence BelowMujtaba HassanNo ratings yet

- Final Exam Theory TemplateDocument1 pageFinal Exam Theory TemplateMujtaba HassanNo ratings yet

- Assignment No 1Document1 pageAssignment No 1Mujtaba HassanNo ratings yet

- Final Exam Theory TemplateDocument1 pageFinal Exam Theory TemplateMujtaba HassanNo ratings yet

- Final Exam Theory TemplateDocument1 pageFinal Exam Theory TemplateMujtaba HassanNo ratings yet

- Accounting 101Document5 pagesAccounting 101Alecks SalvaNo ratings yet

- M&M Company Overview and Financial AnalysisDocument69 pagesM&M Company Overview and Financial AnalysisAnjaliNo ratings yet

- Vikas Ahuja-Equity - Summary - DetailsDocument3 pagesVikas Ahuja-Equity - Summary - DetailsMithlesh BhatnagarNo ratings yet

- Analyze Harem Co's Accounts ReceivableDocument31 pagesAnalyze Harem Co's Accounts ReceivableDaphn CuencaNo ratings yet

- Correspondence With Debenture HolderDocument5 pagesCorrespondence With Debenture Holderatul AgalaweNo ratings yet

- Account Statement From 21 May 2023 To 21 Nov 2023Document15 pagesAccount Statement From 21 May 2023 To 21 Nov 2023ranjeetatirkey1988No ratings yet

- Manufacturing Costs and COGSDocument4 pagesManufacturing Costs and COGSNia BranzuelaNo ratings yet

- Tyco Scandal (2002) : (Acc C607-302A Auditing and Good Governance)Document20 pagesTyco Scandal (2002) : (Acc C607-302A Auditing and Good Governance)Jericho Dupaya100% (2)

- MRP exercise lot sizingDocument3 pagesMRP exercise lot sizingJohnyNo ratings yet

- TLR Shareholder Rights and ActivismDocument109 pagesTLR Shareholder Rights and ActivismAnshul Singh100% (1)

- Pan Europa Foods From Textbook Project Meredith3Document9 pagesPan Europa Foods From Textbook Project Meredith3TrinhNo ratings yet

- Endole Company Report - 09519832Document31 pagesEndole Company Report - 09519832lchenhan94No ratings yet

- Types of Business OrganizationDocument8 pagesTypes of Business OrganizationMa Giselle Saporna Meneses100% (1)

- Prelim Quiz Preparation of Balance Sheet and Income StatementDocument8 pagesPrelim Quiz Preparation of Balance Sheet and Income StatementCHARRYSAH TABAOSARES100% (2)

- Audit 3 Midterm Exam (CH 17,18,19,20 Cabrera)Document3 pagesAudit 3 Midterm Exam (CH 17,18,19,20 Cabrera)Roldan Hiano ManganipNo ratings yet

- PT Vale Indonesia TBK Financial Statements 9M21Document54 pagesPT Vale Indonesia TBK Financial Statements 9M21Seputar InfoNo ratings yet

- Sources of Short-Term Financing: Discussion QuestionsDocument28 pagesSources of Short-Term Financing: Discussion QuestionsДр. ЦчатерйееNo ratings yet

- Identify Indian Industry CaseDocument4 pagesIdentify Indian Industry CaseMrigank MauliNo ratings yet

- FE QUESTION FIN 2224 Sept2021Document6 pagesFE QUESTION FIN 2224 Sept2021Tabish HyderNo ratings yet

- KRISTELENE ARDIENTE - SA No. 3 - Chapter 6Document3 pagesKRISTELENE ARDIENTE - SA No. 3 - Chapter 6Kristelene ArdienteNo ratings yet

- Learning Guide: Accounts and Budget ServiceDocument22 pagesLearning Guide: Accounts and Budget ServicerameNo ratings yet

- Asian Paints-Capital StructureDocument13 pagesAsian Paints-Capital StructurePalak GoelNo ratings yet

- Dissertation 7 HeraldDocument3 pagesDissertation 7 HeraldNaison Shingirai PfavayiNo ratings yet

- Job Order Costing Chapter 2 Test BankDocument67 pagesJob Order Costing Chapter 2 Test BankJanine LerumNo ratings yet

- 5eb88aeed9cfb17c162f9c2a Arnold Reprint v2Document28 pages5eb88aeed9cfb17c162f9c2a Arnold Reprint v2Naman PathaniaNo ratings yet

- Bangladesh Building Systems LimitedDocument116 pagesBangladesh Building Systems Limitedshobu_iuj100% (1)

- Corporate Other Laws MCQ 2 NewDocument7 pagesCorporate Other Laws MCQ 2 Newgvramani51233No ratings yet

- Accounting Software Application Project IIDocument2 pagesAccounting Software Application Project IIAdugna MegenasaNo ratings yet

- Fintech Chapter 13: Startup FinancingDocument28 pagesFintech Chapter 13: Startup FinancingAllen Uhomist AuNo ratings yet

- C. I - A II - C: B. People Prefer To Keep Their Wealth in Relativel !table F Orei"n C#rrencDocument14 pagesC. I - A II - C: B. People Prefer To Keep Their Wealth in Relativel !table F Orei"n C#rrencRica RegorisNo ratings yet