Professional Documents

Culture Documents

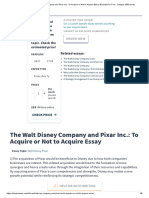

Disney's Perspective: Advantages Disadvantages

Uploaded by

Muskan ValbaniOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Disney's Perspective: Advantages Disadvantages

Uploaded by

Muskan ValbaniCopyright:

Available Formats

Ally or Acquire

Disney’s

The Need Perspective

Alternative Advantages Disadvantages

Acquisition of Pixar -Sequential synergy between companies (Pixar’s CG production -Cultural differences in the two companies (such as the impact of Steve Job’s

and Disney’s marketing) personality of the Disney boardroom)

-No problems regarding revenue sharing, rights management etc. -Impact of Pixar’s P/E ratio diluting Disney’s healthy P/E ratio

-Establishment of Disney in the CG market without having to spend

time or money on establishment of CG technology

-Positive industry associations (most notably Apple)

-Weakening of competitors eager to collaborate with Pixar

Strategic Alliance with -A less risky proposition with risk divided between Pixar and -Pixar’s terms of renegotiation would cause Disney to lose out on revenue it was

Disney entitled to in the previous deal

Pixar -Cheaper than an acquisition -Pixar was adamant for a new revenue-sharing agreement to get more than the 40%

-Familiarity of operations within Pixar would help Disney of the movie revenue it was getting

-Pixar would be free to pursue projects with other studios

-Disney wouldn’t have satisfactory in-house CG expertise

Pixar’s Perspective

Alternative Advantages Disadvantages

Allowing Acquisition -Access to Disney’s IP and creative muscle would allow more -Uncertainty about the impact of the acquisition on culture

and better movies to be made -Lack of creative freedom

-Disney’s marketing and merchandising would ensure greater

returns

-Would allow Jobs to remain part of Pixar without the

pressure and time constraints of being CEO of two major

companies at once

Alliance -Preservation of company culture -Possible dearth of tome given to Pixar by Steve Jobs due to

-Creative freedom commitment to Apple

-Option to work with other studios if need/situation arises -Lower barrier of entry into CG technology would mean more

competition increasing risk

You might also like

- Disney and Pixar MergerDocument4 pagesDisney and Pixar MergerAshish123X100% (6)

- Disney Pixar Acquisition AnalysisDocument4 pagesDisney Pixar Acquisition AnalysisÁlvaroDeLaGarza50% (4)

- Disney Pixar Case AnalysisDocument4 pagesDisney Pixar Case AnalysiskbassignmentNo ratings yet

- Disney Pixar Case AnalysisDocument4 pagesDisney Pixar Case AnalysisRohit Kumbhar67% (3)

- The Walt Disney Company and Pixar Inc.: To Acquire or Not To Acquire?Document14 pagesThe Walt Disney Company and Pixar Inc.: To Acquire or Not To Acquire?Financially YoursNo ratings yet

- PESTLE Analysis of India's Footwear IndustryDocument7 pagesPESTLE Analysis of India's Footwear IndustryMuskan Valbani0% (1)

- Case AnalysisDocument22 pagesCase AnalysisNitesh Raj100% (1)

- Q2 - Disney PixarDocument1 pageQ2 - Disney PixarishaNo ratings yet

- Disney's Acquisition of Pixar: Benefits, Risks and ChallengesDocument9 pagesDisney's Acquisition of Pixar: Benefits, Risks and ChallengesUpveen Tameri100% (2)

- The Walt Disney Company and Pixar Inc - Team3Document15 pagesThe Walt Disney Company and Pixar Inc - Team3Akshaya LakshminarasimhanNo ratings yet

- Walt Disney Case SolutionDocument5 pagesWalt Disney Case Solutiontsjakab100% (4)

- Disney - Building Billion-Dollar FranchisesDocument17 pagesDisney - Building Billion-Dollar FranchisesSarah Nabilla Yasmin Riza100% (2)

- Creating and Using a Business Case for IT Projects GuideDocument60 pagesCreating and Using a Business Case for IT Projects GuideOso JimenezNo ratings yet

- Case3-Walt Disney and PixarDocument5 pagesCase3-Walt Disney and PixarMukul KhuranaNo ratings yet

- Disney Pixar Acquisition Pros and ConsDocument3 pagesDisney Pixar Acquisition Pros and ConsAarushiNo ratings yet

- Group 8 Disney Pixar FinalDocument9 pagesGroup 8 Disney Pixar FinalFinancially YoursNo ratings yet

- Walt Disney Company and Pixar Inc.: Case AnalysisDocument10 pagesWalt Disney Company and Pixar Inc.: Case AnalysisFinancially YoursNo ratings yet

- Walt Disney and PixarDocument2 pagesWalt Disney and PixarAnurag JainNo ratings yet

- Should Pixar Get Acquired by DisneyDocument9 pagesShould Pixar Get Acquired by DisneyAmbrish ChaudharyNo ratings yet

- EOS - Disney Pixar - Group 7Document9 pagesEOS - Disney Pixar - Group 7Amod VelingkarNo ratings yet

- Should Disney Buy Pixar for its Animation Tech and CultureDocument1 pageShould Disney Buy Pixar for its Animation Tech and CultureishaNo ratings yet

- DisneyPixar Case WriteupDocument1 pageDisneyPixar Case Writeupreganhines100% (1)

- Case Analysis Disney PixarDocument3 pagesCase Analysis Disney PixargueigunNo ratings yet

- Evaluation of Disney - Pixar AcquisitionDocument4 pagesEvaluation of Disney - Pixar AcquisitionHelloNo ratings yet

- Evaluation of Disney - Pixar AcquisitionDocument4 pagesEvaluation of Disney - Pixar AcquisitionHelloNo ratings yet

- Disney - Pixar Merger Response HBSDocument7 pagesDisney - Pixar Merger Response HBSAmy EntinNo ratings yet

- The Walt Disney Company and Pixar Inc. - To Acquire or Not To Acquire Essay Example For Free - Sample 1590 Words PDFDocument6 pagesThe Walt Disney Company and Pixar Inc. - To Acquire or Not To Acquire Essay Example For Free - Sample 1590 Words PDFAnurag JainNo ratings yet

- Walt Disney & Pixar GroupDocument8 pagesWalt Disney & Pixar GroupSatyaki DuttaNo ratings yet

- Disney Pixar Merger Strategic AnalysisDocument5 pagesDisney Pixar Merger Strategic AnalysisNishaNo ratings yet

- Walt Disney Case StudyDocument4 pagesWalt Disney Case StudyAbhay KumarNo ratings yet

- Reason For Choosing The Topic. Structure of The PresentationDocument7 pagesReason For Choosing The Topic. Structure of The PresentationNguyễn HiềnNo ratings yet

- 1 DisneyPixarPPTDocument21 pages1 DisneyPixarPPTNguyen Duy LongNo ratings yet

- Group 3 - The Walt Disney Company and Pixar IncDocument9 pagesGroup 3 - The Walt Disney Company and Pixar IncTanya YadavNo ratings yet

- Disney - PixarDocument4 pagesDisney - PixaraccessabhinavNo ratings yet

- Building Billion-Dollar Franchises Through DiversificationDocument18 pagesBuilding Billion-Dollar Franchises Through DiversificationMichael AndyNo ratings yet

- Pixar Disney - Group 8 - Section ADocument6 pagesPixar Disney - Group 8 - Section AFinancially YoursNo ratings yet

- Disney PixarDocument17 pagesDisney PixarBriyith Tatiana Torres PinedaNo ratings yet

- The Vertical Merger Between Walt Disney and PixarDocument3 pagesThe Vertical Merger Between Walt Disney and PixarAyush SinghNo ratings yet

- Paper - Disney PixarDocument13 pagesPaper - Disney PixarNguyen Duy LongNo ratings yet

- Disneyvspixar CasestudyDocument9 pagesDisneyvspixar Casestudyyounes seffahiNo ratings yet

- Should Disney Acquire PixarDocument2 pagesShould Disney Acquire PixarHarsh PatelNo ratings yet

- Disney Pixar Case ReportDocument6 pagesDisney Pixar Case ReportprsntNo ratings yet

- Disney and PixarDocument15 pagesDisney and PixarNisha George PaulNo ratings yet

- Disney PixarDocument18 pagesDisney PixarIsha GoyalNo ratings yet

- Walt Disney & Pixar - KevinDocument9 pagesWalt Disney & Pixar - Kevinkevin juanNo ratings yet

- Disney and PixarDocument17 pagesDisney and Pixarazrenn75% (4)

- End Term Project - HRMA - FOREDocument22 pagesEnd Term Project - HRMA - FORESakshee SinghNo ratings yet

- QuestionsDocument1 pageQuestionsAwais Shah BokhariNo ratings yet

- Do You Think Partnership Mode Was The Only Option Available To Disney? JustifyDocument1 pageDo You Think Partnership Mode Was The Only Option Available To Disney? Justifydasarup24123No ratings yet

- Pixar Case: (Source: Diagram of Open Communication at Pixar Adapted From The Case Study)Document8 pagesPixar Case: (Source: Diagram of Open Communication at Pixar Adapted From The Case Study)CDTNo ratings yet

- 01 Pràctica - Amortitzacions (Enunciats)Document2 pages01 Pràctica - Amortitzacions (Enunciats)MANUEL GONZÁLEZNo ratings yet

- Disneyvspixar CasestudyDocument9 pagesDisneyvspixar CasestudyNGA HUYNH THI THUNo ratings yet

- Disney PixarDocument24 pagesDisney PixarAmal AugustineNo ratings yet

- Does the Disney-Pixar deal meet the "better off" and "ownershipDocument1 pageDoes the Disney-Pixar deal meet the "better off" and "ownershipishaNo ratings yet

- Flaccavento Section7 DisneyHW PDFDocument1 pageFlaccavento Section7 DisneyHW PDFmeliflaNo ratings yet

- Pixar PresentationDocument49 pagesPixar PresentationMuneeraAmer100% (1)

- Disney Pixar CIADocument4 pagesDisney Pixar CIAMridul LuthraNo ratings yet

- CDMA - Group Assignment 1Document1 pageCDMA - Group Assignment 1Chetna VirmaniNo ratings yet

- Presentation Team-7 FinalDocument8 pagesPresentation Team-7 FinalTeja Sai PavanNo ratings yet

- Case DisneyDocument11 pagesCase DisneyEmily GevaertsNo ratings yet

- Summary, Analysis & Review of Lawrence Levy's To Pixar and Beyond by InstareadFrom EverandSummary, Analysis & Review of Lawrence Levy's To Pixar and Beyond by InstareadNo ratings yet

- Creativity, Inc. (Review and Analysis of Catmull and Wallace's Book)From EverandCreativity, Inc. (Review and Analysis of Catmull and Wallace's Book)No ratings yet

- EOS Disney FinancialsDocument12 pagesEOS Disney FinancialsMuskan ValbaniNo ratings yet

- uSER PERSONA FOR MESS ACCOUNTDocument1 pageuSER PERSONA FOR MESS ACCOUNTMuskan ValbaniNo ratings yet

- Sustainability and Business: Global Reporting Initiatives of P&GDocument3 pagesSustainability and Business: Global Reporting Initiatives of P&GMuskan ValbaniNo ratings yet

- All Equity Financing: Particulars ($000) 2001 2002 E 2003 E 2004E 2005E 2006 EDocument7 pagesAll Equity Financing: Particulars ($000) 2001 2002 E 2003 E 2004E 2005E 2006 EMuskan ValbaniNo ratings yet

- Therefore Which Side Should Be Subsidized-Wherever Propensity To Change Behavior With Prices Is HighDocument2 pagesTherefore Which Side Should Be Subsidized-Wherever Propensity To Change Behavior With Prices Is HighMuskan ValbaniNo ratings yet

- uSER PERSONA FOR MESS ACCOUNTDocument1 pageuSER PERSONA FOR MESS ACCOUNTMuskan ValbaniNo ratings yet

- Therefore Which Side Should Be Subsidized-Wherever Propensity To Change Behavior With Prices Is HighDocument2 pagesTherefore Which Side Should Be Subsidized-Wherever Propensity To Change Behavior With Prices Is HighMuskan ValbaniNo ratings yet

- Ikea Vision - The Evolution and The Role of Leadership: Create A Better Everyday Life For The Many PeopleDocument2 pagesIkea Vision - The Evolution and The Role of Leadership: Create A Better Everyday Life For The Many PeopleMuskan ValbaniNo ratings yet

- Pod ProDocument1 pagePod ProMuskan ValbaniNo ratings yet

- SESS - Group 7 - Sec H-ModifiedDocument4 pagesSESS - Group 7 - Sec H-ModifiedMuskan ValbaniNo ratings yet

- Coding and Labelling - Group7Document16 pagesCoding and Labelling - Group7Muskan ValbaniNo ratings yet

- CV ASSIGNMENT1 MuskanDocument1 pageCV ASSIGNMENT1 MuskanMuskan ValbaniNo ratings yet

- uSER PERSONA FOR MESS ACCOUNTDocument1 pageuSER PERSONA FOR MESS ACCOUNTMuskan ValbaniNo ratings yet

- Positioning Reliance Fresh On The Digital MatrixDocument1 pagePositioning Reliance Fresh On The Digital MatrixMuskan ValbaniNo ratings yet

- Project Feasibility Study: Prepared By: IS Group 10 DateDocument13 pagesProject Feasibility Study: Prepared By: IS Group 10 DateMuskan Valbani100% (1)

- Aangan Bplan FinalDocument66 pagesAangan Bplan FinalMuskan ValbaniNo ratings yet

- Exhibit 4 Pixar Financials ($ Millions)Document13 pagesExhibit 4 Pixar Financials ($ Millions)Muskan ValbaniNo ratings yet

- Fin Design Rpt: Suraj Vaidyanathan Assignment 1Document1 pageFin Design Rpt: Suraj Vaidyanathan Assignment 1Muskan ValbaniNo ratings yet

- Commercial Bank Management: Assignment 1 Shubham Agrawal - PGP/24/4 Muskan Valbani - PGP/24/456Document1 pageCommercial Bank Management: Assignment 1 Shubham Agrawal - PGP/24/4 Muskan Valbani - PGP/24/456Muskan ValbaniNo ratings yet

- EOS Disney FinancialsDocument12 pagesEOS Disney FinancialsMuskan ValbaniNo ratings yet

- Assignment 2: Corporate Valuation Muskan Valbani - PGP/24/456Document1 pageAssignment 2: Corporate Valuation Muskan Valbani - PGP/24/456Muskan ValbaniNo ratings yet

- 456 Muskan Valbani CBexercise1Document4 pages456 Muskan Valbani CBexercise1Muskan ValbaniNo ratings yet

- 453 Muskan Valbani Voluntary AssignmentDocument3 pages453 Muskan Valbani Voluntary AssignmentMuskan ValbaniNo ratings yet

- 456 Muskan Valbani CBexercise1Document4 pages456 Muskan Valbani CBexercise1Muskan ValbaniNo ratings yet

- CV Assignment3 MuskanDocument12 pagesCV Assignment3 MuskanMuskan ValbaniNo ratings yet

- Starbucks invests in Brightloom to drive digital transformation in restaurantsDocument2 pagesStarbucks invests in Brightloom to drive digital transformation in restaurantsMuskan ValbaniNo ratings yet

- CV ASSIGNMENT1 MuskanDocument1 pageCV ASSIGNMENT1 MuskanMuskan ValbaniNo ratings yet

- Basic Assumptions: Particulars ($000) 2001 2002 E 2003 EDocument7 pagesBasic Assumptions: Particulars ($000) 2001 2002 E 2003 EMuskan ValbaniNo ratings yet

- Consumer Perception Towards Coffee Houses in India: Marketing ResearchDocument51 pagesConsumer Perception Towards Coffee Houses in India: Marketing ResearchgarimaamityNo ratings yet

- 13238-Kota Pnbe Exp Sleeper Class (SL)Document1 page13238-Kota Pnbe Exp Sleeper Class (SL)Naresh SarswatNo ratings yet

- Practical Guide to Plant Turnaround ManagementDocument11 pagesPractical Guide to Plant Turnaround Managementt_saumitra100% (2)

- Audit: Airline CompanyDocument4 pagesAudit: Airline CompanyArianna Maouna Serneo BernardoNo ratings yet

- Epc KpiDocument118 pagesEpc KpiLaurentius Pramono100% (3)

- Cash basis PPE accountingDocument6 pagesCash basis PPE accountingCristine MayNo ratings yet

- FWAP ULIP Leaflet RevisedDocument16 pagesFWAP ULIP Leaflet Revisedmantoo kumarNo ratings yet

- Financial Accounting 1a (AFE 3691) Partnerships (Changes in ownership structuresDocument6 pagesFinancial Accounting 1a (AFE 3691) Partnerships (Changes in ownership structuresPetrinaNo ratings yet

- Hard Rock Café2Document2 pagesHard Rock Café2Maviel Maratas SarsabaNo ratings yet

- Issue of Debentures Redemption of Debentures UnderwrtingDocument47 pagesIssue of Debentures Redemption of Debentures UnderwrtingKeshav PantNo ratings yet

- G11 Abma ManuscriptDocument47 pagesG11 Abma Manuscriptaiox huxedoNo ratings yet

- Internal Analysis: Resources, Capabilities, and Core CompetenciesDocument40 pagesInternal Analysis: Resources, Capabilities, and Core Competenciesmuhammad omerNo ratings yet

- CAF5 Financial Accounting and Reporting I - Studytext PDFDocument348 pagesCAF5 Financial Accounting and Reporting I - Studytext PDFYousuf Rahman100% (4)

- IGCSE Accounting - Revision NotesDocument42 pagesIGCSE Accounting - Revision Notesfathimath ahmedNo ratings yet

- Inventory EstimationDocument4 pagesInventory EstimationShy Ng0% (1)

- Amazon Go: Venturing Into Traditional Retail: Report by - Epgp-Batch-14B - Group-2Document7 pagesAmazon Go: Venturing Into Traditional Retail: Report by - Epgp-Batch-14B - Group-2Virender SinghNo ratings yet

- Campus Recruitment ProposalDocument2 pagesCampus Recruitment ProposalAmit Mitra100% (1)

- Training Needs Assessment of LGUs On The Project Management of Local Infrastructure - FinalDocument6 pagesTraining Needs Assessment of LGUs On The Project Management of Local Infrastructure - Finalaeron antonioNo ratings yet

- Lesson Plan Example: Subject Lesson Title Lesson SynopsisDocument2 pagesLesson Plan Example: Subject Lesson Title Lesson SynopsisJaysonGayumaNo ratings yet

- Tally 1Document2 pagesTally 1Anushka TiwariNo ratings yet

- Global Pharma Enterprise Systems Drive ComplianceDocument23 pagesGlobal Pharma Enterprise Systems Drive ComplianceEvenwatercanburnNo ratings yet

- Product & Service Strategy: Core Elements for SuccessDocument28 pagesProduct & Service Strategy: Core Elements for SuccessAhmad Widhi Haryo Yudhanto100% (1)

- Camel AnalysisDocument12 pagesCamel AnalysisvineethkmenonNo ratings yet

- A Comparative Financial Analysis of Commercial Banks in NepalDocument122 pagesA Comparative Financial Analysis of Commercial Banks in NepalPushpa Shree PandeyNo ratings yet

- BUSINESS STUDIES (Code No. 054) : RationaleDocument8 pagesBUSINESS STUDIES (Code No. 054) : RationaleAyesha QureshiNo ratings yet

- Tri 4 Time TableDocument1 pageTri 4 Time TableRaja Babu SharmaNo ratings yet

- International FinanceDocument68 pagesInternational FinanceVenkata Raman RedrowtuNo ratings yet

- Chapter 4 Internal ControlDocument55 pagesChapter 4 Internal ControlHussien AdemNo ratings yet

- DTU Software Engineering 8th Sem Result 2020Document2 pagesDTU Software Engineering 8th Sem Result 2020Romesh RajputNo ratings yet