Professional Documents

Culture Documents

Governmental Accounting: Mr. Ismail Ibrahim Duale Contact Details: Phone: 00252634601580 Whats App: 00252659917146

Uploaded by

JamaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Governmental Accounting: Mr. Ismail Ibrahim Duale Contact Details: Phone: 00252634601580 Whats App: 00252659917146

Uploaded by

JamaCopyright:

Available Formats

GOVERNMENTAL

ACCOUNTING

Mr. Ismail Ibrahim Duale

Contact Details:

Phone: 00252634601580

Whats app: 00252659917146

Email: ismailduale523@gmail.com

Mr. Ismail Ibrahim Duale

MBA, and BA iin Accounting and Finance

CHAPTER ONE

OVERVIEW OF

GOVERNMENTAL

ACCOUNTING

Mr. Ismail Ibrahim Duale

MBA, and BA iin Accounting and Finance

INTRODUCTION

There are organizations whose object is not to

make profit.

These not-for-profit organizations account their

resources and financial activities under different

accounting system.

Every organization wants to be successful, of

course In order to know if it is successful,

“success” must be defined in terms of goals.

And then it needs some means to measure its

results against its goals.

Mr. Ismail Ibrahim Duale

MBA and BA in Accounting and Finance

Measuring success is often thought of in

terms of effectiveness (achieving the goal

at the highest level) and efficiency

(achieving the goal through using the least

amount of resources.

For profit seeking organizations(F.P.) or

organizations whose objective is to make profit,

both efficiency and effectiveness can easily be

measured with financial statement.

Mr. Ismail Ibrahim Duale

MBA and BA in Accounting and Finance

USES AND USERS OF FINANCIAL REPORTS OF

GOVERNMENTAL UNITS

The objective of financial reporting by

governments reflects the information needs of

those who use these reports and the distinctive

character of the governmental operations.

The principal users of external financial reports

by governments are:

1.The citizenry;

2. Legislative and other oversight bodies; and

3. Creditors and investors in securities issued by

the government.

Mr. Ismail Ibrahim Duale

MBA, and BA iin Accounting and Finance

Citizens, legislators, and other oversight

officials use financial reports to access

Accountability, that is, to access whether the

government has operated in a Responsible

manner.

Creditors and Investors in government

securities use financial reports to access a

government’s financial condition and its

compliance with financial laws and

regulations.

Mr. Ismail Ibrahim Duale

MBA, and BA iin Accounting and Finance

Financial Reporting Objectives:

1. Financial reporting should assist in fulfilling

government’s duty to be publicly accountable

and should enable users to assess that

accountability by:

a)Providing information to determine whether

current year revenues were sufficient to pay for

current year services;

b)Demonstrating whether resources were

obtained and used in accordance with entity’s

legally adopted budget, and demonstrating

compliance with other finance related legal or

contractual requirements;

Mr. Ismail Ibrahim Duale

MBA, and BA iin Accounting and Finance

c) Providing information to assist users in

assessing the service efforts, costs, and

accomplishments of the governmental entity.

2. Financial reporting should assist users in

evaluating the operating results of the

governmental entity for the year by:

a)Providing information about sources and uses of

financial resources;

b)Providing information about how it financed its

activities and met its cash requirements;

c) Providing information necessary to determine

whether its financial position improved or

deteriorated as a result of the year’s operations

Mr. Ismail Ibrahim Duale

MBA, and BA iin Accounting and Finance

3. Financial reporting should assist users in

assessing the level of services that can be

provided by the governmental entity and its

liability to meet its obligations as they become

due by:

a)Providing information about its financial position

and condition;

b)Providing information about its physical and

other non financial resources having useful lives

that extend beyond the current year, including

information that can be used to assess the

service potential of those resources;

c) Disclosing legal or contractual restrictions on resources

and the risk of potential loss of resources.

Mr. Ismail Ibrahim Duale

MBA, and BA iin Accounting and Finance

It can be understood from the statement that

Accountability is the cornerstone of all financial

reporting in government.

Accountability requires governments to answer

to the citizens, to justify the raising of public

resources and the purposes for which they are

used.

Governmental accountability is based on the

belief that citizenry has a “right to know” a right

to receive openly declared facts that may lead to

public debate by the citizens and their elected

representatives.

Mr. Ismail Ibrahim Duale

MBA, and BA iin Accounting and Finance

Financial reporting plays a major role in fulfilling

governments duty to be publicly accountable in a

democratic society.

the GASB believe that inter period equity is a

significant part of accountability and is

fundamental to public administration.

It therefore needs to be considered when

establishing financial reporting objectives.

In short financial reporting should help users

assess whether current year revenues are

sufficient to pay for services provided that year

and whether future taxpayers will be required to

assume burdens for services previously

provided.

Mr. Ismail Ibrahim Duale

MBA, and BA iin Accounting and Finance

Financial reports of Non profit organizations-

Voluntary health and welfare organizations,

college and universities, Hospitals, religious

organizations and others- have similar uses but,

in recognition of the fact that the financial

operations of NFPs are generally not subject to

as detailed legal restrictions as are those of

governments

The financial accounting standards board

believes the financial reports for not-for-profit

organizations should provide:

Mr. Ismail Ibrahim Duale

MBA, and BA iin Accounting and Finance

1. Information useful in making resource

allocations decisions;

2. Information useful in assessing services and

ability to provide services;

3. Information useful in assessing management

stewardship and performance; and

4. Information about economic resources,

obligations, net resources and changes in them.

Mr. Ismail Ibrahim Duale

MBA, and BA iin Accounting and Finance

Financial Reporting Entity

Financial reporting entity for a state and local

governments consists of a primary government

and its components and its units.

The financial reporting entity also includes

related organizations that do not qualify as

component units; they are “other organizations

for which the nature and significance of their

relationship with the primary government are

such that exclusion would cause the reporting

entity’s financial statements to be misleading or

incomplete.

Mr. Ismail Ibrahim Duale

MBA, and BA iin Accounting and Finance

ISSUES: A CITY’S REPORTING ENTITY

In addition to other operations of a municipality,

Capital City is associated with a university

located in the city. The university was once a city

college wholly owned and operated by the city,

twenty years ago, the state added the university

to its higher education system and began

subsidizing the university according to a formula

applied to all universities in the state system.

The state subsidy represents about 60% of the

university’s total revenue.

The remaining 40% is split about equally between

student tuition and endowment income.

Mr. Ismail Ibrahim Duale

MBA, and BA iin Accounting and Finance

The university is administered by a board of nine

trustees – three elected by residents of the city,

three appointed by the mayor and three

appointed by the state governor.

The university operates several book stores

organized as a separate nonprofit corporation;

they are wholly owned by the university, and the

considerable profits are invested in a scholarship

endowment fund.

One could argue that the university is a

component unit of the city and, therefore, should

be included in the city’s financial reporting entity

because six of the nine trustees come from the

city.

Mr. Ismail Ibrahim Duale

MBA, and BA iin Accounting and Finance

However, one could also argue that only three of the

trustees really come from the city government (the other

three come from the electorate), making control of the

board by the government far from assured.

Thus, although the university is related to the city, it is

not a component organization of the city.

We lack sufficient information to resolve this matter, and

the university may be either a component unit of the city

or merely a related organization.

In In either case, however, it is likely that the nonprofit

corporation operating the books would be a component

unit of the university.

Mr. Ismail Ibrahim Duale

MBA, and BA iin Accounting and Finance

FUND ACCOUNTING SYSTEM

The accounts of a governmental unit are

partitioned into segments called “Funds”, and

separate financial statements are prepared for

each fund.

Definition of Fund:

A fund is defined as a distinct accounting entity

“with a self-balancing set of accounts and other

financial resources, together with all related

liabilities and residual equities or balances and

changes there in”.

Mr. Ismail Ibrahim Duale

MBA, and BA iin Accounting and Finance

It has key phrases indicating the following

points; It is by itself is an entity, having its own

accounting existence and a self balancing set of

books(double entry system).

That set of books is established for recording a

specific financial activity.

The establishment of the fund will attain a

specific objective and will have regulations,

restrictions or limitations.

Mr. Ismail Ibrahim Duale

MBA, and BA iin Accounting and Finance

TYPES OF FUNDS

The accounting system of a government is

composed of as many funds as are required by

law or deemed appropriate by the government

itself for sound financial administration.

There are three types of funds with sub funds of

each type.

1. Governmental Funds

2. Proprietary Funds.

3. Fiduciary Funds.

Mr. Ismail Ibrahim Duale

MBA, and BA iin Accounting and Finance

Governmental Funds

General Fund: to account for financial resources except

those required to be accounted for in another fund.

Special Revenue Funds: to account for the proceeds of

specific revenue sources (other than expendable trusts,

or for major capital projects) that are legally restricted to

expenditure for specified purposes.

Capital Project Funds: to account for financial

resources to be used for the acquisition or construction

of major capital facilities (other than those financed by

proprietary funds and trust funds).

Debt Service Funds: to account for the accumulation of

resources for, and the payment of general long-term

debt principal and interest.

Mr. Ismail Ibrahim Duale

MBA, and BA iin Accounting and Finance

Proprietary Funds

a) Enterprise Funds: to account for operations:

That are financed and operated in a manner similar to

private business enterprises where the intent of the

governing body is that the cost (expenses, including

depreciation) of providing goods or services to the

general public on a continuing basis be financed or

recovered primarily through user charges, or

Where the governing body has decided that periodic

determination of revenues earned, expenses incurred,

and/or net income is appropriate for capital maintenance,

public policy, management control, accountability, or

other purposes.

Mr. Ismail Ibrahim Duale

MBA, and BA iin Accounting and Finance

b) Internal Service Funds: to account for the

financing of goods or services provided by one

department or agencies of the governmental

unit, or to other governmental units, on a cost

reimbursement basis.

Fiduciary Funds

a)Trust and Agency Funds: to account for assets held by

a governmental unit in a trustee capacity or as an agent

for individuals, private organizations, other governmental

units, and/or other funds. These include

1. Expendable Trust Funds;

2. None Expendable Trust Funds;

3. Pension Trust Funds;

4. Agency Funds.

Mr. Ismail Ibrahim Duale

MBA, and BA iin Accounting and Finance

MEASUREMENT AND RECOGNITION

Two measurements must be in order to describe an

accounting system

1. What resources are measured?; and

2. When are the effects of transactions on those resources

recognized?

Accounting for governmental funds has a much narrower

focus than accounting for businesses.

Whereas the focus of business accounting is all

resources or assets of a business, the focus of

governmental fund accounting, which is called the “follow

of financial resources focus”, is just the financial

resources of the fund:

Cash, Claims to cash (securities and receivables), Claims

to goods or service (prepayments), Consumable goods

(supplies inventories) and Equity securities

Mr. Ismail Ibrahim Duale

MBA, and BA iin Accounting and Finance

MEASUREMENT AND RECOGNITION OF

REVENUE

Most government fund revenues do not arise

from exchange transactions; consequently a

different revenue recognition principle is

required.

Most government fund revenues arise from

taxation and other non exchange transactions

including fines, license, fees and donations.

Such revenues are typically recognized when

they become measurable and available for

expenditure.

Mr. Ismail Ibrahim Duale

MBA, and BA iin Accounting and Finance

TAX REVENUES

Under GASB Statement No. 11, Tax revenues

should be recognized when

1. The underlying transaction or event has taken

place and

2. The government has demanded the taxes from

the tax payer by establishing a due date; these

two conditions are evidence that the government

has obtained financial resources, regardless of

when cash is received (GASB Statement No. 11

pars. 40 and 144).

Mr. Ismail Ibrahim Duale

MBA, and BA iin Accounting and Finance

Sales and Income Tax Revenues

Application of these criteria to sales and income taxes

results in the recognition of tax revenues in the period

during which the related sales or income earnings

occurs.

Property Taxes Revenues

Application of these criteria to property taxes usually

results in recognition of tax revenues in the period in

which the taxes are billed.

Non Tax Revenues

Nontax revenues arising in non exchange transactions

including revenues from fines, licenses and permits, and

donations should be recognized “when the underlying

event takes place and the government has an

enforceable legal claim to the amounts, regardless of

when received. Mr. Ismail Ibrahim Duale

MBA, and BA iin Accounting and Finance

MEASUREMENT AND RECOGNITION OF EXPENDITURE

As a consequent of the flow of financial

resources measurement focus, governmental

funds use expenditure accounting rather than

expense accounting.

Unlike expense accounting, expenditure

accounting does not entail the matching of

expenditure with related revenues.

In general, expenditures are “recognized when

transactions or events that result in claims

against the financial resources take place,

regardless of when cash is paid (GASB

Statement No. 11 par.73).

Mr. Ismail Ibrahim Duale

MBA, and BA iin Accounting and Finance

In most cases, a government recognizes expenditure

when it receives goods and services to be paid for at

later time.

Thus, expenditures for salaries should be recognized

when the related work is performed, and expenditures

for utilities should be recognized when utility services are

used.

CAPITAL EXPENDITURES

Capital expenditures result from the acquisition of capital

assets through purchase, construction, or capital lease.

Such expenditures should be recognized when the

capital asset is acquired. T

Thus, the full cost of an asset is included in expenditures

for the period of its acquisition

Mr. Ismail Ibrahim Duale

MBA, and BA iin Accounting and Finance

BUDGETS AND EXPENDITURES CONTROL

Government accounting systems frequently

record “Budgeted Revenues and

Expenditures” as well as “Actual Revenues

and Expenditures”.

The dual recording makes possible a continuing

comparison of actual and budgeted items

throughout the year, thus serving as an aid to

effective budgetary control and accountability.

Control of expenditures is particularly important

in governments, as the following issues section

indicates.

Mr. Ismail Ibrahim Duale

MBA, and BA iin Accounting and Finance

APPROPRIATION AND EXPENDITURES

Capital city, population 200,000 employs a widely used

budgetary process to control expenditures.

The process begins with preparation of a budget.

The city’s budget officer assembles the budget requests

and prepares the budget document, which is submitted to

the city council for possible modification, adoption

and final enactment.

The budget includes estimates of revenues from such

sources as property taxes, income taxes, licenses and

permits, fines, intergovernmental grants, and shared

revenues.

The expenditure budget, once modified and adopted by

the council, is enacted into law by the passage of an

appropriation ordinance.

Mr. Ismail Ibrahim Duale

MBA, and BA iin Accounting and Finance

The appropriation authorizes the various city

departments to make expenditures and to incur

obligations up to the maximum level specified by the

appropriation.

Expenditures in excess of the appropriation are illegal

unless a supplemental appropriation to cover the excess

is later approved by the council.

Statutes applicable to Capital City direct that

unexpended appropriations lapse at the end of the

budget period.

In some cities however, unexpended appropriations do

not lapse and continue as authority to make

expenditures in the subsequent period.

Mr. Ismail Ibrahim Duale

MBA, and BA iin Accounting and Finance

To illustrate, assume that a general fund begins

1995 with no assets or liabilities. The budget for

1995 shows estimated revenues of $100,000 and

other financing sources (operating transfer in) of

$20,000, and authorized expenditures of $95,000

and estimated other financing uses (operating

transfer out) of $10,000. To simplify this

illustration, assume that all revenues of the fund

are received in cash and all expenditures are

paid in cash. Actual revenues and expenditures

for 1995 were $96,000 and $94,500,

respectively. The actual operating transfers in

and out were equal to the budget amounts.

Mr. Ismail Ibrahim Duale

MBA, and BA iin Accounting and Finance

Recording the Annual Budget

Dr. Cr.

1. Est. Revenues

Control …………………….$100,000

Est. Other financing

source control ………......…$20,000

Appropriations Control ………………….. $95,000

Est. other financing

uses control ……………………………….. $10,000

Budgetary fund balance ………..………… $15,000

Mr. Ismail Ibrahim Duale

MBA, and BA iin Accounting and Finance

Recording Actual Sources and Uses of Funds

Dr. Cr.

2. Cash ………….. …….$116,000

Revenues Control ………………….. $96,000

Other financing

sources control ..……………………. $20,000

3. Expenditures control …. $94,500

Other financing

uses control ……………$10,000

Cash ………………………….. $104,500

Mr. Ismail Ibrahim Duale

MBA, and BA iin Accounting and Finance

CLOSING ENTRIES

In order to prepare the accounts for the next

year, the current year’s budget must be removed

from the records and the accounts for actual

sources and uses of resources must be closed

to the unreserved fund balances.

This two step closing process is accomplished

by the following entries:

Mr. Ismail Ibrahim Duale

MBA, and BA iin Accounting and Finance

Dr. Cr.

Appropriations control …….. $95,000

Estimated other financing

uses control …………………. $10,000

Budgetary fund balance …….$15,000

Estimated revenues control ……………. $100,000

Estimated other financing

sources control ………………………..….. $20,000

Mr. Ismail Ibrahim Duale

MBA, and BA iin Accounting and Finance

Dr. Cr.

Revenues control ….. $96,000

Other financing

sources control ……… $20,000

Expenditure control.……………….. $94,500

Other financing uses

control ………………………………. $10,000

Unreserved fund balance .………... $11,500

Mr. Ismail Ibrahim Duale

MBA, and BA iin Accounting and Finance

Encumbrance Accounting

A governmental unit often makes a commitment to future

expenditures prior to the time it is legally obligated to pay the

expenditures.

Such commitments, which are called encumbrances, take in

the form of purchase orders, purchase agreements, or other

unperformed (executor) contracts for goods and services.

The amount available for future expenditure is the excess of

the appropriations over the sum of both encumbrances and

expenditures.

In order to avoid exceeding appropriation limits, encumbrances

are recorded in the expenditure subsidiary accounts as well as

in the encumbrances control account.

The recording of encumbrances is particularly appropriate in

general funds, special revenue funds, and capital project

funds.

Mr. Ismail Ibrahim Duale

MBA, and BA iin Accounting and Finance

Recording Encumbrances

Encumbrances are frequently recorded before the amount of

the related future expenditure is known with precision.

Consequently, the recording of encumbrances does not

replace the recording of expenditures.

Consider a purchase in the general fund of police

department supplies; the 1995 budget for such supplies

is $1,200.

On January 15, 1995, a purchase order is issued for the

acquisition of supplies with an estimated cost of $500.

On February 20, 1995, the supplies are received,

together with an invoice giving their cost as $512.

Mr. Ismail Ibrahim Duale

MBA, and BA iin Accounting and Finance

General fund entry to record encumbrance – January 15, 1995

Description Debit Credit

Encumbrance control – police department supplies $500

Fund balance reserved for encumbrance $500

General fund entry to record reversal of encumbrances –

February 20, 1995

Description Debit Credit

Fund balance reserved for encumbrances $500

Encumbrance control – police department $500

supplies

Mr. Ismail Ibrahim Duale

MBA, and BA iin Accounting and Finance

General fund entry to record expenditures – February 20, 1995

Description Debit Credit

Expenditure control – police department supplies $512

Vouchers Payable $512

Recording Encumbrances

Encumbrances are not expenditures.

Encumbrances lead to expenditures, but the two amounts must

be distinguished from one another.

The balance of encumbrances at year end should not be

combined with expenditures in operating statements.

Mr. Ismail Ibrahim Duale

MBA, and BA iin Accounting and Finance

REPORTING A FUND BALANCE RESERVED FOR

At year end, the debitENCUMBRANCES

balance of the encumbrances control

account equals the credit balance of the fund balance reserved

for encumbrances account.

Moreover, the reciprocal balances are artifacts of the budgetary

control system; and strictly speaking, neither account is reported

in the financial statements of the related fund.

Although neither account is reported, as such, a segregation of

the fund’s equity balance, under the circumstances described

subsequently, may be required in the amount of the outstanding

encumbrance, for example, when appropriations do not lapse (or

when the unencumbered portion of the appropriation lapses), the

encumbered portion of the appropriation continues to be effective

after year end and confers authority on the governmental unit to

complete transactions in process at year end.

Mr. Ismail Ibrahim Duale

MBA, and BA iin Accounting and Finance

In such cases, fund balance reserved for encumbrances

should be established to indicate a commitment to make an

expenditure in the subsequent year.

Suppose that $30,000 of encumbrance had been outstanding

at the end of the year:

Description Debit Credit

Fund balance reserved for encumbrance $30,000

Encumbrance control – supplies $30,000

Description Debit Credit

Unreserved fund balance $30,000

Fund balance reserved for encumbrances $30,000

Mr. Ismail Ibrahim Duale

MBA, and BA iin Accounting and Finance

RECORDING EXPENDITURES RELATED TO

ENCUMBRANCES OF PRIOR YEAR

As indicated previously, when appropriations related to year

end encumbrances do not lapse, or only unencumbered

appropriations lapse, the fund balance reserved for

encumbrances is appropriately carried forward to the next

year as a segregation of the fund balance.

On the first day of the subsequent year (1996), the

encumbrances control account for the $30,000 encumbrances

shown in the above example should be reestablished by the

following entries:

Mr. Ismail Ibrahim Duale

MBA, and BA iin Accounting and Finance

Description Debit Credit

Fund balance reserved for encumbrances $30,000

Unreserved fund balance $30,000

Description Debit Credit

Encumbrance control $30,000

Fund balance reserved for encumbrances $30,000

When invoice was received in 1996 for the supplies, the

reversal of the encumbrances of $30,000 and the actual cost of

$31,000 would be recorded in the general fund by the following

entries:

Mr. Ismail Ibrahim Duale

MBA, and BA iin Accounting and Finance

Description Debit Credit

Fund balance reserved for encumbrances $30,000

Encumbrances control – supplies $30,000

Description Debit Credit

Expenditure control – supplies $31,000

Vouchers payable $31,000

Mr. Ismail Ibrahim Duale

MBA, and BA iin Accounting and Finance

Accounting for the General Fund

The general fund accounts for the general operations of a

governmental unit that is the general fund accounts for all

financial resources that are not accounted for in another fund.

The accounting system for every governmental unit contains at

least one general fund.

In addition, of course, the governmental unit may also employ

other funds for specific purpose.

Let us illustrate the accounting entries and financial statements

prepared for a general fund by reference to the city of

Hargeisa. Hargeisa was incorporated in 1996, and its

accounting system includes the following funds and account

groups:

On December 15, 1996, the city council of Hargeisa adopted

the 1996 budget for the city government. The budgeted

estimated revenues, authorized expenditures, and estimates

other financing uses are as follows:

Mr. Ismail Ibrahim Duale

MBA, and BA iin Accounting and Finance

General Fund Budget for 1996

Estimated Revenues:

Property tax (net) $258,000

Interest and penalties on delinquent taxes (net) 400

Others 63,600

Total estimated revenues $322,000

Appropriations – Expenditures:

Supplies $21,000

Salaries 122,000

Transportation equipment 14,300

Interest 250

Other 150,450

Total estimated expenditures $308,000

Estimated other financing uses – operating transfers out 10,000

(To debt service fund)

Total appropriations and estimated other financing uses $318,000

Excess of est. revenues over appropriations and other est. financing uses $4,000

Mr. Ismail Ibrahim Duale

MBA, and BA iin Accounting and Finance

In addition to providing for estimated revenues and

appropriating amounts for various expenditures, the budget

provides for a transfer of cash from the general fund to the

debt service fund.

The transfer to the debt service fund will be used to pay

matured principal and interest on long-term debt.

On December 31 1996, the general fund had the following

balance sheet:

Mr. Ismail Ibrahim Duale

MBA, and BA iin Accounting and Finance

City of Hargeisa

General Fund Balance sheet

At December 31, 1995

Assets

Cash $8,400

Taxes Receivable – delinquent $2,400

Less: allowance for uncollectible 1,000 1,400

Total Assets $9,800

Liabilities and Fund balance

Voucher Payable $420

Unreserved fund balance 9,380

Total liabilities and unreserved fund balance $9,800

Mr. Ismail Ibrahim Duale

MBA, and BA iin Accounting and Finance

Recording the Budget

Description Debit Credit

Estimated Revenue Control $322,000

Appropriation Control $308,000

Estimated other financing use control 10,000

Budgetary fund balance 4,000

2. On January 1, 1996, property taxes are levied in the actual

amount of $272,000, which includes $14,000 estimated to be

uncollectible.

Description Debit Credit

Tax Receivable – current $272,000

Revenues Control – property taxes $258,000

Allowance for uncollectible – current taxes 14,000

Mr. Ismail Ibrahim Duale

MBA, and BA iin Accounting and Finance

3. Delinquent property taxes in the amount of $1,500 are

collected on January 12, 1996, and the remainder of prior year’s

delinquent taxes is judged to be uncollectible.

a)Cash $1,500

taxes receivable – delinquent $1,500

b) Allowance for uncollectible – delinquent taxes $900

taxes receivable – delinquent $900

c) Allowance for uncollectible – delinquent taxes $100

revenues control – property taxes $100

Mr. Ismail Ibrahim Duale

MBA, and BA iin Accounting and Finance

4. To provide operating resources prior to collection of the 1996

tax levy, the general fund borrows $50,000 from a local bank on

a tax anticipation notes payable on January 15, 1996. The face

of the note and $250 in interest are paid to the bank on July 15,

1996.

a)Cash $50,000

tax anticipation notes payable $50,000

b) Tax anticipation notes payable $50,000

Expenditure control – interest 250

Cash $50,250

Mr. Ismail Ibrahim Duale

MBA, and BA iin Accounting and Finance

5. Current property taxes in the amount of $255,600 are collected,

and current taxes in the amount of $9,900 are written off as

uncollectible. Uncollected taxes become delinquent at December 5

of each year. An allowance for uncollectible delinquent taxes in the

amount of $3,280 is provided at December 5, 1996.

a)Cash $255,600

Taxes receivable – current $255,600

b) Allowance for uncollectible – current taxes $9,900

Taxes receivable – current $9,900

c) Taxes receivable – delinquent $6,500

Taxes receivable – current $6,500

d) Allowance for uncollectible – current taxes $4,100

Revenue control – property taxes $820

Allowance for uncollectible – delinquent taxes 3,280

Mr. Ismail Ibrahim Duale

MBA, and BA iin Accounting and Finance

6. At December 31, 1996, interest and penalties accrued on

delinquent taxes amount to $450; of this amount, $50 is

estimated to be uncollectible.

interest and penalties receivable on taxes $450

Revenues control – interest $ penalties on

delinquent taxes $400

Allowance for uncollectible 50

7. Revenues other than property taxes are collected in the total

amount of $56,000.

Cash $56,000

Revenue control – other $56,000

Mr. Ismail Ibrahim Duale

MBA, and BA iin Accounting and Finance

8. Encumbrances for supplies and other expenditure are

recorded in the amount of $176,250.

Encumbrance control $176,250

Fund balance reserved for encumbrance $176,250

9. During 1996, vouchers totaling $175,000 (these had been

encumbered for $175,800), were approved for payments of

enumerated expenditures as follows: supplies, $20,000,

transportation equipment, $15,000, and other expenditures,

$140,000. Vouchers totaling $132,000 were approved for

payment of unencumbered expenditures as follows: Salaries,

$120,000, and other expenditures of $12,000. In addition, cash

of $10,000 was transferred to the debt service fund.

Mr. Ismail Ibrahim Duale

MBA, and BA iin Accounting and Finance

a) Fund balance reserved for encumbrance $175,800

Encumbrance control $175,800

b) Expenditure control $175,000

Voucher payable $175,000

c) Expenditure control 132,000

Voucher payable 132,000

d) Other financing use control – operating transfer out

(to debt service fund) 10,000

Due to debt service fund 10,000

e) Due to debt service fund 10,000

Voucher payable 10,000

Mr. Ismail Ibrahim Duale

MBA, and BA iin Accounting and Finance

10. Vouchers totaling $315,200 are paid including vouchers payable at

January 1, 1996.

Voucher payable $315,200

Cash $315,200

11. At December 31, 1996 supplies on hand total $3,800, the inventory is

judged to be material, and the fund balance is reserved in the amount of

$3,800. The general fund uses the purchase method of accounting for

inventories.

Inventory of supplies $3,800

fund balance reserved for encumbrance of supplies $3,800

12. On December 31, 1996, the general fund establishes a petty cash fund

in the amount of $2,000.

a)Petty cash 2,000

Cash 2,000

b)Unreserved fund balance 2,000

Fund balance reserved for petty cash 2,000

Mr. Ismail Ibrahim Duale

MBA, and BA iin Accounting and Finance

13. On June 15, the general fund borrows $15,000 from the

utility (enterprise) fund. The amount is repaid on August 15

together with $250 interest ( no purchase order or voucher is

prepared for this payment).

a)Cash $15,000

Due to utility fund $15,000

b) Due to utility fund 15,000

Expenditure control 250

Cash 15,250

14. On December 31, 1996, equipment carried in the general

fixed assets group at a cost of $7,500 is sold as scrap for $100.

Cash 100

Revenue control – other 100

Mr. Ismail Ibrahim Duale

MBA, and BA iin Accounting and Finance

END…

Mr. Ismail Ibrahim Duale

MBA, and BA iin Accounting and Finance

You might also like

- Space Hulk - WDDocument262 pagesSpace Hulk - WDIgor Baranenko100% (1)

- Accounting For Non-Profit OrganizationsDocument39 pagesAccounting For Non-Profit Organizationsrevel_13193% (29)

- The Essentials of Finance and Accounting for Nonfinancial ManagersFrom EverandThe Essentials of Finance and Accounting for Nonfinancial ManagersRating: 5 out of 5 stars5/5 (1)

- Accounting For Non-Profit OrganizationsDocument38 pagesAccounting For Non-Profit Organizationsrevel_131100% (1)

- Jesus Prayer-JoinerDocument13 pagesJesus Prayer-Joinersleepknot_maggotNo ratings yet

- Lesson I - The Role and Scope of Public FinanceDocument3 pagesLesson I - The Role and Scope of Public Financemarygracepronquillo100% (10)

- Roleplayer: The Accused Enchanted ItemsDocument68 pagesRoleplayer: The Accused Enchanted ItemsBarbie Turic100% (1)

- 1.technical Specifications (Piling)Document15 pages1.technical Specifications (Piling)Kunal Panchal100% (2)

- Government Accountant: Federal Accounting Standards Advisory Board (FASB) - Government Accounting Standards Board (GASB)Document5 pagesGovernment Accountant: Federal Accounting Standards Advisory Board (FASB) - Government Accounting Standards Board (GASB)Glaiza GiganteNo ratings yet

- Modulo EminicDocument13 pagesModulo EminicAndreaNo ratings yet

- GOVERNMENT ACCOUNTING - Accounting Responsibilities.Document19 pagesGOVERNMENT ACCOUNTING - Accounting Responsibilities.Hannah Verano86% (7)

- Sindi and Wahab in 18th CenturyDocument9 pagesSindi and Wahab in 18th CenturyMujahid Asaadullah AbdullahNo ratings yet

- From Philo To Plotinus AftermanDocument21 pagesFrom Philo To Plotinus AftermanRaphael888No ratings yet

- Public Sector Accounting: Mr. Evans AgalegaDocument50 pagesPublic Sector Accounting: Mr. Evans AgalegaElvis Yarig100% (2)

- E Flight Journal Aero Special 2018 Small PDFDocument44 pagesE Flight Journal Aero Special 2018 Small PDFMalburg100% (1)

- Accounting NotesDocument22 pagesAccounting NotesVinay ChawlaNo ratings yet

- Checklist & Guideline ISO 22000Document14 pagesChecklist & Guideline ISO 22000Documentos Tecnicos75% (4)

- of Thesis ProjectDocument2 pagesof Thesis ProjectmoonNo ratings yet

- Finance for Nonfinancial Managers: A Guide to Finance and Accounting Principles for Nonfinancial ManagersFrom EverandFinance for Nonfinancial Managers: A Guide to Finance and Accounting Principles for Nonfinancial ManagersNo ratings yet

- Govt & NFP Accounting - Ch2Document70 pagesGovt & NFP Accounting - Ch2Fãhâd Õró ÂhmédNo ratings yet

- Chapter 1Document6 pagesChapter 1Dùķe HPNo ratings yet

- Ipsas ExitDocument24 pagesIpsas ExitAbdiNo ratings yet

- AfPS&CS Ch-01Document10 pagesAfPS&CS Ch-01Amelwork AlchoNo ratings yet

- Summary 2Document5 pagesSummary 2Karin NafilaNo ratings yet

- Ch-1 Acct For P&CSDocument7 pagesCh-1 Acct For P&CSDawit NegashNo ratings yet

- PublicDocument66 pagesPublicObsa QabaadhuNo ratings yet

- Public Sector Handout 222Document29 pagesPublic Sector Handout 222HarusiNo ratings yet

- Homework PsaDocument8 pagesHomework PsaainNo ratings yet

- 1 Chapter One Govt and NFPDocument27 pages1 Chapter One Govt and NFPantex nebyu100% (1)

- Full Download Government and Not For Profit Accounting Concepts and Practices 7th Edition Granof Solutions ManualDocument36 pagesFull Download Government and Not For Profit Accounting Concepts and Practices 7th Edition Granof Solutions Manualwelked.gourami8nu9d100% (42)

- NFP Chapter 1-9 2023 EditedDocument63 pagesNFP Chapter 1-9 2023 Editednegamedhane58No ratings yet

- Psa Class Notes Daf 2020-21Document22 pagesPsa Class Notes Daf 2020-21kitderoger_391648570No ratings yet

- Chapter 1 Governmental AccountingDocument12 pagesChapter 1 Governmental AccountingMoh ShiineNo ratings yet

- Public Sector Accounting Chapter 1Document7 pagesPublic Sector Accounting Chapter 1Phil SatiaNo ratings yet

- Fge Group Assignment No.1&2Document6 pagesFge Group Assignment No.1&2Emebet TesemaNo ratings yet

- The Environment of Financial Accounting and ReportingDocument59 pagesThe Environment of Financial Accounting and ReportingHeisei De LunaNo ratings yet

- Chapter One Accounting Principles and Professional PracticeDocument22 pagesChapter One Accounting Principles and Professional PracticeHussen Abdulkadir100% (1)

- Chapter 1Document10 pagesChapter 1abdirazakhNo ratings yet

- Chapter OneDocument14 pagesChapter OneChera HabebawNo ratings yet

- Report On Public Sector AccountingDocument2 pagesReport On Public Sector AccountingBELENGA GEOFREYNo ratings yet

- Governmental and Not Profit AccountingDocument4 pagesGovernmental and Not Profit AccountingPahladsingh100% (1)

- Accounting Assignment - 1Document9 pagesAccounting Assignment - 1Idah MutekeriNo ratings yet

- Accounting Principle - CHAPTER - 1&2 HanaDocument20 pagesAccounting Principle - CHAPTER - 1&2 HanaNigussie BerhanuNo ratings yet

- Full Download Solution Manual For Government and Not For Profit Accounting Concepts and Practices 8th Edition H Granof PDF Full ChapterDocument36 pagesFull Download Solution Manual For Government and Not For Profit Accounting Concepts and Practices 8th Edition H Granof PDF Full Chapterbedyebromlifedirkr100% (18)

- Chapter 2 BRANCHES OF ACCOUNTINGDocument20 pagesChapter 2 BRANCHES OF ACCOUNTINGmarkalvinlagunero1991No ratings yet

- Acc For Public Sector CH 1-6 (3) - CompressedDocument266 pagesAcc For Public Sector CH 1-6 (3) - CompressedmooyiboonnameeNo ratings yet

- EN The Development of Accounting EducationDocument7 pagesEN The Development of Accounting EducationTullah AlvaroNo ratings yet

- Corporate Financial ReportingPPT 2003Document14 pagesCorporate Financial ReportingPPT 2003ashish3009No ratings yet

- Discuss The Users of Financial Information Internal UsersDocument6 pagesDiscuss The Users of Financial Information Internal UsersStephen Pilar PortilloNo ratings yet

- Public SectorDocument66 pagesPublic Sectormelat felekeNo ratings yet

- CHP 1 Abdur Rahman Abdur Raheem Introduction To Islamic Accounting Practice and Theory 9 32Document24 pagesCHP 1 Abdur Rahman Abdur Raheem Introduction To Islamic Accounting Practice and Theory 9 32Asfa AsfiaNo ratings yet

- Afin321 FPD 4 2015 2Document27 pagesAfin321 FPD 4 2015 2Thomas nyadeNo ratings yet

- Resume PSA Group 8Document4 pagesResume PSA Group 820312472No ratings yet

- Uses of Financial Reporting Accountability and Interperiod EquityDocument4 pagesUses of Financial Reporting Accountability and Interperiod EquityTekaling NegashNo ratings yet

- ACCTNG 5568 Homework 1Document5 pagesACCTNG 5568 Homework 1Sanjida DorothiNo ratings yet

- Haji Mizan ExamDocument2 pagesHaji Mizan ExamMd. Borhan UddinNo ratings yet

- Indian Financial SystemDocument24 pagesIndian Financial SystemParth GuptaNo ratings yet

- Government and Not For Profit Accounting Concepts and Practices Granof 6th Edition Solutions ManualDocument36 pagesGovernment and Not For Profit Accounting Concepts and Practices Granof 6th Edition Solutions Manualsnudge.argoanvpvqu100% (39)

- Full Download Government and Not For Profit Accounting Concepts and Practices Granof 6th Edition Solutions Manual PDF Full ChapterDocument36 pagesFull Download Government and Not For Profit Accounting Concepts and Practices Granof 6th Edition Solutions Manual PDF Full Chapterowch.lactamduwqu100% (18)

- FINANCIAL STATEMENT ANALYSIS Sessions 1 - 10Document20 pagesFINANCIAL STATEMENT ANALYSIS Sessions 1 - 10Bhagwat BalotNo ratings yet

- Government Accounting Is A System of Analyzing, Recording, Classifying and Summarizing TransactionsDocument12 pagesGovernment Accounting Is A System of Analyzing, Recording, Classifying and Summarizing TransactionsGelyn RaguinNo ratings yet

- Lecture 1 Introduction To Financial AccountingDocument8 pagesLecture 1 Introduction To Financial AccountingIRUNGU BRENDA MURUGINo ratings yet

- Mawlana Bhashani Science and Technology UniversityDocument20 pagesMawlana Bhashani Science and Technology UniversitySabbir Ahmed100% (1)

- Ethics in Public Sector Accounting PracticeDocument11 pagesEthics in Public Sector Accounting PracticeAulia AlfianitaNo ratings yet

- Chapter One Overview of Governmental and Not For Profit Organizations 1.0. Learning ObjectivesDocument24 pagesChapter One Overview of Governmental and Not For Profit Organizations 1.0. Learning ObjectivesshimelisNo ratings yet

- Accounting For Public Sector and Civic SocietyDocument65 pagesAccounting For Public Sector and Civic Societynunyatzewdie1No ratings yet

- Fiscal Management ReviewerDocument4 pagesFiscal Management ReviewerSham Cervantes LopezNo ratings yet

- Beechy 7e Tif ch11Document5 pagesBeechy 7e Tif ch11mashta04No ratings yet

- Mohawk Valley Community College Utica and Rome, New York School of Business and Hospitality Course OutlineDocument2 pagesMohawk Valley Community College Utica and Rome, New York School of Business and Hospitality Course OutlineAttyNo ratings yet

- Audit ReportsDocument46 pagesAudit ReportsJamaNo ratings yet

- Chapter Two Public Revenue and Its Sources: Course Title: PFM and Taxation Lecturer: Mohamed IbrahimDocument8 pagesChapter Two Public Revenue and Its Sources: Course Title: PFM and Taxation Lecturer: Mohamed IbrahimJamaNo ratings yet

- Measure of Project Worth: Project Planning and AnalysisDocument36 pagesMeasure of Project Worth: Project Planning and AnalysisJamaNo ratings yet

- Chapter 3 - Aspects of Project Preparation and AnalysisDocument31 pagesChapter 3 - Aspects of Project Preparation and AnalysisJamaNo ratings yet

- This Chapter For The Course Public Finance Focuses OnDocument19 pagesThis Chapter For The Course Public Finance Focuses OnJamaNo ratings yet

- Chapter One: Introduction: Prepared By: Abdi Shakur M. Hussein ElmiDocument21 pagesChapter One: Introduction: Prepared By: Abdi Shakur M. Hussein ElmiJamaNo ratings yet

- Identifying Project Costs and Benefits and Financial Aspect of Project AnalysisDocument30 pagesIdentifying Project Costs and Benefits and Financial Aspect of Project AnalysisJamaNo ratings yet

- Application Form National Staff SomaliaDocument6 pagesApplication Form National Staff SomaliaJamaNo ratings yet

- CH04 The Capital Budgeting DecisionDocument31 pagesCH04 The Capital Budgeting DecisionJamaNo ratings yet

- Lesson 6 ComprogDocument25 pagesLesson 6 ComprogmarkvillaplazaNo ratings yet

- MGMT Audit Report WritingDocument28 pagesMGMT Audit Report WritingAndrei IulianNo ratings yet

- Turning PointsDocument2 pagesTurning Pointsapi-223780825No ratings yet

- LEIA Home Lifts Guide FNLDocument5 pagesLEIA Home Lifts Guide FNLTejinder SinghNo ratings yet

- Rockaway Times 11818Document40 pagesRockaway Times 11818Peter J. MahonNo ratings yet

- Aptitude Number System PDFDocument5 pagesAptitude Number System PDFharieswaranNo ratings yet

- Working With Difficult People Online WorksheetDocument4 pagesWorking With Difficult People Online WorksheetHugh Fox IIINo ratings yet

- Application Activity Based Costing (Abc) System As An Alternative For Improving Accuracy of Production CostDocument19 pagesApplication Activity Based Costing (Abc) System As An Alternative For Improving Accuracy of Production CostM Agus SudrajatNo ratings yet

- PM CH 14Document24 pagesPM CH 14phani chowdaryNo ratings yet

- Ricoh IM C2000 IM C2500: Full Colour Multi Function PrinterDocument4 pagesRicoh IM C2000 IM C2500: Full Colour Multi Function PrinterKothapalli ChiranjeeviNo ratings yet

- Ob NotesDocument8 pagesOb NotesRahul RajputNo ratings yet

- LTE Networks Engineering Track Syllabus Overview - 23 - 24Document4 pagesLTE Networks Engineering Track Syllabus Overview - 23 - 24Mohamed SamiNo ratings yet

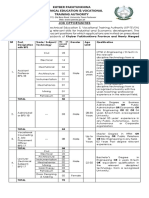

- KP Tevta Advertisement 16-09-2019Document4 pagesKP Tevta Advertisement 16-09-2019Ishaq AminNo ratings yet

- Prelim Examination MaternalDocument23 pagesPrelim Examination MaternalAaron ConstantinoNo ratings yet

- Outdoor Air Pollution: Sources, Health Effects and SolutionsDocument20 pagesOutdoor Air Pollution: Sources, Health Effects and SolutionsCamelia RadulescuNo ratings yet

- Developing Paragraphs: Test Section - Writing Task 2Document11 pagesDeveloping Paragraphs: Test Section - Writing Task 2Cengizhan AkdağNo ratings yet

- Homework 1 W13 SolutionDocument5 pagesHomework 1 W13 SolutionSuzuhara EmiriNo ratings yet

- SMR 13 Math 201 SyllabusDocument2 pagesSMR 13 Math 201 SyllabusFurkan ErisNo ratings yet

- Lec 33 - Householder MethodDocument11 pagesLec 33 - Householder MethodMudit SinhaNo ratings yet

- Quick Help For EDI SEZ IntegrationDocument2 pagesQuick Help For EDI SEZ IntegrationsrinivasNo ratings yet