Professional Documents

Culture Documents

Cash Budget: - This Budget Represents The Anticipated Receipts and

Uploaded by

Christine JamesOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cash Budget: - This Budget Represents The Anticipated Receipts and

Uploaded by

Christine JamesCopyright:

Available Formats

Cash Budget

• This budget represents the anticipated receipts and

payments of cash during the budget period.

Payments Receipts

(1) Cash Purchase (1) Cash Sales

(2) Payment to Creditors (2) Credit Sales

(3) Payment of Wages (3) Collection from Sundry Debtors

(4) Payments relate to Production (4) Bills Receivable

Expenses (5) Interest Received

(5) Payments relate to Office and (6) Income from Sale of Investment

Administrative Expenses (7) Commission Received

(6) Payments relate to Selling and (8) Dividend Received

Distribution Expenses (9) Income from Non-Trading

(7) Any other payments relate to Operations etc.

Revenue and Capital Expenditure

(8) Income Tax Payable, Dividend

Payable etc.

Dr. B. Janarthanan, DoMS, NITT 1

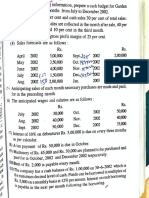

Cash Budget – Exercise 1

• A company is expecting to have Rs. 25,000 cash in hand on 1st April

2020 and it requires you to prepare an estimate of cash position in

respect of the projects given for the three months from April to June

2020, from the information given below :

In Thousands

Sales (́₹) Purchase (́₹) Wages (́₹) Expenses

(́₹)

February 70 40 8 6

March 80 50 8 7

April 92 52 9 7

May 100 60 10 8

June 120 55 12 9

Dr. B. Janarthanan, DoMS, NITT 2

Additional Information :

(a) Period of credit allowed by suppliers - two months.

(b) 25 % of sale is for cash and the period of credit allowed to

customer for credit sale one month.

(c) Delay in payment of wages and expenses one month.

(d) Income Tax Rs. 25,000 is to be paid in June 2020.

Dr. B. Janarthanan, DoMS, NITT 3

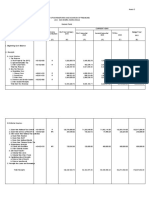

Exercise 2

• Mr. Rajinikanth wishes to prepare cash budget from January.

Prepare a cash budget for the first six months from the following

estimated revenue and expenses:

In Thousands In One’s

Sales Materials (́₹) Wages (́₹) Production S&D

(́₹) Overheads Overheads

(́₹) (₹)

January 10 10 2 1.60 400

February 11 7 2.2 1.65 450

March 14 7 2.3 1.70 450

April 18 11 2.3 1.75 500

May 15 10 2.0 1.60 450

June 20 12.5 2.5 1.80 600

Dr. B. Janarthanan, DoMS, NITT 4

• Additional Information:

1. Cash balance on 1st January was Rs. 5,000. A new machinery

is to be installed at Rs. 10,000 on credit, to be repaid by two

equal installments in March and April.

2. Sales commission @ 5 % on total sales is to be paid within a

month of following actual sales.

3. Rs. 5,000 being the amount of 2nd call may be received in

March. Share Premium amounting to Rs. 1,000 is also obtainable

with the 2nd call.

4. Period of credit allowed by suppliers - 2 months.

5. Period of credit allowed to customers - 1 month.

6. Delay in payment of overheads - 1 month.

7. Delay in payment of wages – (I/2) month.

8. Assume cash sales to be 50 % of total sales.

Dr. B. Janarthanan, DoMS, NITT 5

You might also like

- Lecture 1 - Obligation and ContractsDocument2 pagesLecture 1 - Obligation and ContractsChriselda CabangonNo ratings yet

- QuestionPaperDec 2010Document50 pagesQuestionPaperDec 2010Md.Reza HussainNo ratings yet

- Cash Budget:: (A) Receipts & Payments MethodDocument6 pagesCash Budget:: (A) Receipts & Payments MethodGabriel BelmonteNo ratings yet

- Master BudgetDocument10 pagesMaster BudgetFareha Riaz0% (1)

- CPA 1 - Financial Accounting-1Document9 pagesCPA 1 - Financial Accounting-1LYNETTE NYAKAISIKI50% (2)

- Financials Training DAX2012Document274 pagesFinancials Training DAX2012eater PeopleNo ratings yet

- 6a. Cash BudgetDocument4 pages6a. Cash BudgetMadiha JamalNo ratings yet

- Exam 1 - Key AnswersDocument23 pagesExam 1 - Key Answersarlynajero.ckcNo ratings yet

- Rattiner's Review for the CFP Certification Examination, Fast Track, Study GuideFrom EverandRattiner's Review for the CFP Certification Examination, Fast Track, Study GuideRating: 4.5 out of 5 stars4.5/5 (2)

- University MCQs SAMPLE For Project ManagementDocument11 pagesUniversity MCQs SAMPLE For Project Managementasit kandpalNo ratings yet

- Months: Sales Purchases Wages ExpensesDocument2 pagesMonths: Sales Purchases Wages Expensespranay639No ratings yet

- Cash BudgetDocument4 pagesCash BudgetSANDEEP SINGH0% (1)

- OwnCase DigestsDocument4 pagesOwnCase DigestsMaelleNo ratings yet

- Cash ManagementDocument16 pagesCash ManagementdhruvNo ratings yet

- Cash ManagementDocument17 pagesCash ManagementSiddarthSaxenaNo ratings yet

- Q.P. Code: 62202: Managerial AccountingDocument6 pagesQ.P. Code: 62202: Managerial Accountinganshul bhutangeNo ratings yet

- MQP - MBA - Sem1 - Financial and Management Accounting (DMBA104)Document5 pagesMQP - MBA - Sem1 - Financial and Management Accounting (DMBA104)Rohit SoodNo ratings yet

- CH18601 FM - II Model PaperDocument5 pagesCH18601 FM - II Model PaperKarthikNo ratings yet

- AFM-CM-Cash BudgetDocument9 pagesAFM-CM-Cash BudgetCharith shettigarNo ratings yet

- Mcom AnnualDocument140 pagesMcom AnnualKiran TakaleNo ratings yet

- Management Accounting and Finance: Level Iii Examination - January 2021Document9 pagesManagement Accounting and Finance: Level Iii Examination - January 2021Rajendran KajananthanNo ratings yet

- M5 Management of Cash Pract. ProbDocument5 pagesM5 Management of Cash Pract. ProbAmruta PeriNo ratings yet

- Cash Management NumericalsDocument5 pagesCash Management NumericalsAnjali Jain100% (1)

- Cash Budget Problems and SolutionsDocument6 pagesCash Budget Problems and Solutionstamberahul1256No ratings yet

- MCS-035-Accountancy and Financial ManagementDocument5 pagesMCS-035-Accountancy and Financial ManagementShainoj KunhimonNo ratings yet

- Master Budget .. Feb 2020Document9 pagesMaster Budget .. Feb 2020신두No ratings yet

- 5 6305198873144984587 PDFDocument112 pages5 6305198873144984587 PDFNbut ddgfNo ratings yet

- Suggested CAP II Group II June 2023Document61 pagesSuggested CAP II Group II June 2023pratyushmudbhari340No ratings yet

- June2023 - Dec 2020 FinanceDocument105 pagesJune2023 - Dec 2020 FinancebinuNo ratings yet

- Acc 3 Revision Questions 18Document6 pagesAcc 3 Revision Questions 18Danielle WatsonNo ratings yet

- Gujarat Technological UniversityDocument3 pagesGujarat Technological UniversityRenieNo ratings yet

- Class 11 Acc FinalDocument3 pagesClass 11 Acc Finalmnmehta1990No ratings yet

- Suggested - Answer - CAP - II - June - 2011 4Document64 pagesSuggested - Answer - CAP - II - June - 2011 4Dipen Adhikari100% (1)

- ISC Accounts 11Document2 pagesISC Accounts 11Sriyaa SunkuNo ratings yet

- Cash Budgeting Notes and QuestionsDocument39 pagesCash Budgeting Notes and Questions邹尧No ratings yet

- Cash and Liquidity Management: February 2011Document44 pagesCash and Liquidity Management: February 2011Bulls Bears FinancialsNo ratings yet

- Cashflowstatement 150402074118 Conversion Gate01Document30 pagesCashflowstatement 150402074118 Conversion Gate01vini2710No ratings yet

- Gujarat Technological UniversityDocument3 pagesGujarat Technological UniversityMehul VarmaNo ratings yet

- A A AaaaaaaaaaaaDocument3 pagesA A AaaaaaaaaaaaRoshan SahooNo ratings yet

- 3562 Question PaperDocument3 pages3562 Question PaperKimberly MataruseNo ratings yet

- Budget and Budgetary Control - Mba Ca. Asim K. Biswas: Question # 1Document7 pagesBudget and Budgetary Control - Mba Ca. Asim K. Biswas: Question # 1Suraj KumarNo ratings yet

- Formatted Brgy. Forms EditDocument21 pagesFormatted Brgy. Forms EditJoshua AssinNo ratings yet

- Mock Test Q1 PDFDocument4 pagesMock Test Q1 PDFManasa SureshNo ratings yet

- 5 FSA&RatiosDocument19 pages5 FSA&RatiosSohanNo ratings yet

- Cash Management QuestionsDocument5 pagesCash Management QuestionsManasi Jamsandekar100% (1)

- Civil and Water Individual Assign Dec 2015Document5 pagesCivil and Water Individual Assign Dec 2015Shepherd NhangaNo ratings yet

- Exam PaperDocument4 pagesExam PaperSonam Dema DorjiNo ratings yet

- Repayment Schedule - 164916682Document1 pageRepayment Schedule - 164916682Shivashakthi MaheshNo ratings yet

- F19 Chapter 18 Working CapitalDocument2 pagesF19 Chapter 18 Working CapitalAshwin MenghaniNo ratings yet

- Cash Management: ProblemsDocument4 pagesCash Management: ProblemsPoojitha ReddyNo ratings yet

- 218bfm Model Test Paper - PDocument13 pages218bfm Model Test Paper - PHimanshu Kr SinhaNo ratings yet

- Test Paper Ca FoundDocument5 pagesTest Paper Ca FoundSarangapani KaliyamoorthyNo ratings yet

- Non Trading OrganisationDocument70 pagesNon Trading OrganisationDivyansh TripathiNo ratings yet

- T1-June 2015 QnAnsDocument20 pagesT1-June 2015 QnAnsBiplob K. SannyasiNo ratings yet

- Adobe Scan Apr 13, 2023Document6 pagesAdobe Scan Apr 13, 2023Mansi SinghNo ratings yet

- Rohit TestDocument9 pagesRohit TestRohitNo ratings yet

- Class Work & Home Work Question of Final Account of Banking Conpany 22-23Document23 pagesClass Work & Home Work Question of Final Account of Banking Conpany 22-23DARK KING GamersNo ratings yet

- 547 Abr 0000000083Document6 pages547 Abr 0000000083BERNACRIS REYESNo ratings yet

- Accounts Test 23 Mar QPDocument3 pagesAccounts Test 23 Mar QPnavyabearad2715No ratings yet

- Profit PlanningDocument14 pagesProfit PlanningSantosh BaralNo ratings yet

- RAGHU-33: 506-A Advance Accounting-I (835061) Total Pages: 5) Time: 2 Hours Max. Marks: 60 NoteDocument5 pagesRAGHU-33: 506-A Advance Accounting-I (835061) Total Pages: 5) Time: 2 Hours Max. Marks: 60 NoteRishikesh KalantriNo ratings yet

- Accounting 22 - Final Exam - 2023Document9 pagesAccounting 22 - Final Exam - 2023LaurenNo ratings yet

- Amity MBA 1 ST Sem ASODL AccountingDocument12 pagesAmity MBA 1 ST Sem ASODL AccountingBhavna Jain67% (9)

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020From EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020No ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- 5 Amalgamation, Absorption and External Reconstruction - HomeworkDocument21 pages5 Amalgamation, Absorption and External Reconstruction - HomeworkYash ShewaleNo ratings yet

- Impor Akun Acc OnlineDocument8 pagesImpor Akun Acc Onlinee s tNo ratings yet

- SLM GM11 Quarter2 Week6Document28 pagesSLM GM11 Quarter2 Week6Jed JedNo ratings yet

- Quiz #2 - CH 4 & 5: Question 1 (48 Marks)Document2 pagesQuiz #2 - CH 4 & 5: Question 1 (48 Marks)JamNo ratings yet

- PVR RatioDocument14 pagesPVR RatioApurwa SawarkarNo ratings yet

- Lecture 8Document48 pagesLecture 8Zixin GuNo ratings yet

- Concept of Financial Statement and Financial RatiosDocument28 pagesConcept of Financial Statement and Financial RatiosPalash DongreNo ratings yet

- Unit 4 - Provision For Doubtful Debts - Adjustments at The End of An Accounting PeriodDocument6 pagesUnit 4 - Provision For Doubtful Debts - Adjustments at The End of An Accounting PeriodRealGenius (Carl)No ratings yet

- ABM 1 Chapter 1Document6 pagesABM 1 Chapter 1Ruby Liza CapateNo ratings yet

- CH 07Document8 pagesCH 07Saleh RaoufNo ratings yet

- Faq's For F &aDocument17 pagesFaq's For F &amcaviimsNo ratings yet

- BNK602SEM: Legal Aspects of Banking: TOPIC 7: Nature of SecurityDocument36 pagesBNK602SEM: Legal Aspects of Banking: TOPIC 7: Nature of SecurityaliaNo ratings yet

- Assessing Financial Health (Part-A)Document17 pagesAssessing Financial Health (Part-A)kohacNo ratings yet

- I.D The Capital Structure Puzzle Another Look at The Evidence (2021)Document15 pagesI.D The Capital Structure Puzzle Another Look at The Evidence (2021)Toledo VargasNo ratings yet

- Uses, Classification of CreditDocument29 pagesUses, Classification of CreditEi-Ei EsguerraNo ratings yet

- Plagiarism Declaration Form (T-DF)Document8 pagesPlagiarism Declaration Form (T-DF)Nur HidayahNo ratings yet

- Ms8-Set C Midterm - With AnswersDocument5 pagesMs8-Set C Midterm - With AnswersOscar Bocayes Jr.No ratings yet

- What Informal Remedies Are Available To Firms in Financial Distress inDocument1 pageWhat Informal Remedies Are Available To Firms in Financial Distress inAmit PandeyNo ratings yet

- CH 2 Problem SolutionsDocument23 pagesCH 2 Problem SolutionsFrancisco PradoNo ratings yet

- 204 Financial Accounting & Costing FY BCOMDocument6 pages204 Financial Accounting & Costing FY BCOMTejas DasnurkarNo ratings yet

- An Anlysis On Financial and Capital Structure of Oil and Gas Industry - A Case Study of Ongc Videsh LimitedDocument14 pagesAn Anlysis On Financial and Capital Structure of Oil and Gas Industry - A Case Study of Ongc Videsh LimitedDedipyaNo ratings yet

- Assignment No 1 Name: Zarish Akram Registration ID: 10731 Course: Islamic Banking and Applied Finance Examples of Riba and GhararDocument3 pagesAssignment No 1 Name: Zarish Akram Registration ID: 10731 Course: Islamic Banking and Applied Finance Examples of Riba and GhararZarish AkramNo ratings yet

- Accounts 2023 AnsDocument42 pagesAccounts 2023 AnsAshish YadavNo ratings yet

- An Analysis of Working Capital Management of Tata Motors LimitedDocument9 pagesAn Analysis of Working Capital Management of Tata Motors LimitedAyeesha K.s.No ratings yet

- Chapter 1. L1.2 Principles of LendingDocument5 pagesChapter 1. L1.2 Principles of LendingvibhuNo ratings yet