Professional Documents

Culture Documents

Distinction Between Hire-Purchase and Other Similar Transactions.

Uploaded by

omorolayo ogedengbe0 ratings0% found this document useful (0 votes)

509 views19 pagesDffffffxgu tdhurxh ttbgeex

Original Title

DISTINCTION BETWEEN HIRE-PURCHASE AND OTHER SIMILAR TRANSACTIONS.

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentDffffffxgu tdhurxh ttbgeex

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

509 views19 pagesDistinction Between Hire-Purchase and Other Similar Transactions.

Uploaded by

omorolayo ogedengbeDffffffxgu tdhurxh ttbgeex

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 19

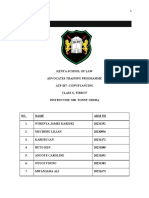

COURSE TITLE: COMMERCIAL LAW

LECTURER: DR. D.O AKABUIRO.

DEPARTMENT: FACULTY OF LAW.

SCHOOL: LEAD CITY UNIVERSITY

• Sale and Hire-Purchase: Contracts of sale resemble contracts of

hire-purchase very closely, and indeed the real object of a

contract of hire-purchase is ultimately the possible sale of goods.

• Where goods are delivered to the hirer under the hire-purchase

agreement, he only takes possession of them as a bailee; it

follows that he cannot pass a valid title to any third party. All he

has is possession of goods plus an option to purchase.

• It is only when he exercises his option to purchase that he

becomes a person who has agreed to buy under Section 1 of the

Goods Act and can exercise the right of a buyer in possession

under Section 25 (2) of the Sale of Goods Act.

• In the case of a sale, however, it is a contract whereby

the seller transfers or agrees to transfer property in

the goods to the buyer for a monetary consideration

called the price.

• The above definition identifies two types of sales, an

outright sale or an agreement to sell which could be a

conditional sale.

• Where it is an outright sale, the property in the goods

passes immediately the contract is made by virtue of

Section 18 Rule 1 of the Sales of Goods Act.

• In the case of a conditional sale, the property in the goods will

not pass until certain conditions are fulfilled in consonance with

the agreement. The rules relating to passing of property in the

goods are reflected in Section 16 to 20 of the Sales of Goods

Act (SGA).

• If the conditions are fulfilled by the seller, there is an obligation

on the buyer to accept and retain the goods under Section 27 of

the Sales of Goods Act (SGA).

• Unlike hire-purchase, no formality or strict procedure is required

for entry into a contract of sale of goods; it may be entered into

orally or in writing or could be inferred from the conduct of the

parties and the surrounding circumstances.

• In JOE ALEEN & CO LTD v SARI ADEWALE & ANOR

the court emphasized this distinction as follows: the

test to be applied is whether or not the party

receiving the goods has the legal right to return

them at his own option and thereupon to cease

paying instalment. If he has, the agreement is an

agreement to hire with possibly an option to

purchase. If he has not, the agreement is an

agreement to sell. The owner is is bound to collect

the goods, if the hirer wishes to return them.

• Credit Sale and Hire-Purchase: A credit sale is an

agreement whereby a seller agrees to sell goods and

receive payments subsequently by way of instalments.

• A credit sale under common law simply implies sale on

credit. Thus, where instalmental payment is allowed,

although it has the resemblance of hire-purchase

agreements, it is a credit sale.

• A buyer in a credit sale can confer a valid title on a

third party who buys the goods before completing

payment of the purchase price.

• The buyer here is under an obligation to complete the full

purchase price since ownership was conferred on him at

the time of contract if he complied with the terms of the

contract.

• In hire-purchase, what is conferred at the time of contract

is the option to purchase which may be exercised one way

or the other.

• Section 20 (1) HPA defines a credit sale as an agreement

under which the whole or part of the purchase price is

payable by five or more instalments. See JAJIRA v.

NORTHERN BREWERY (1972) NCLR 313.

• What distinguishes a credit sale from the a hire-

purchase is that in a credit sale, the parties are

aware from the beginning of the contract that

the property has or will eventually pass to the

buyer upon the fulfillment of the agreed

condition, while in the case of hire-purchase,

there is no agreement to the effect that property

would pass. Whether property passes or not is

strictly dependent on the hirer’s exercise option.

• A seller under a credit sale is a person who has

transferred or agreed to transfer property in the goods

to the buyer, and the buyer is a person who has bought

or agreed to buy within the meaning of Factors Act 1889

and Sale of Goods Act 1893.

• Even if the buyer is in the default of payment, the seller

can enforce the rights to compel payment and will not

have automatic rights to recover the goods as in hire-

purchase transaction, where the title is reserved in the

owner until the hirer’s exercise of option.

• Bill of Sale and Hire-Purchase: A bill of sales is a document

evidencing the title of the seller to the goods in the buyer’s

possession. Here, the buyer who has become the owner of goods and

has taken delivery gives the seller a right to seize them upon his

default of payment of the unpaid purchase price.

• Under the bill of sale, the transferor, as in the case of sale of goods is

interested in having his entitlements all paid to him. To ensure this,

the goods are used as some part of security for payment.

• If the transferee defaults in the repayment of loan, the transferor can

recover the goods used as security for the loan. If it was a transaction

under the sale of goods, the seller could retain title under Section 19

of the Act until price is paid and if the buyer defaults, the seller can

recover his goods.

• A bill of sale merely evidences the fact that there is an actual sale

situation but that title does not pass until all the instalmental

payments have been made.

• In the case of hire-purchase, the agreement is for bailment and not

the sales of goods. The issue of sale can only arise when the hirer

exercises his option to purchase.

• Section 5 (4) of the Bill of Sales Act defines a bill of sale as including

a wide variety of instruments used in connection with dealing in

personal property. For example, assignments, transfers, assurances

on personal chattels, licenses to take possession of personal chattels

as security for any debt and any agreement by which a right in

equity to any personal charge or security thereon shall be conferred.

• The wide definition of a bill of sale made it applicable to a wide

range of transactions. Debtors and borrowers, however, began

to find the publicity given by registration uncomfortable and

cumbersome. This discomfort led to a search for another legal

form of sale which could enable the seller to retain ownership of

the goods while parting with possession and at the same time

giving protection against bona fide purchase from the buyer.

• They found their answer in the hire-purchase which places no

obligation on any hirer to purchase but gives him an option to

do so if he wishes to. If at the end of the period he intends to

purchase then he must communicate such interest by exercising

his option to purchase.

• Conditional Sale and Hire-Purchase: A conditional sale agreement is a

contract whereby the transfer of the property in the goods is subject

to some conditions to be fulfilled subsequently by the buyer. The

condition are usually in relation to the payment of the purchase price.

• Section 1 (3) SGA allows transfer of property in the goods to take

place at a future time to conditions to be fulfilled after.

• The buyer in a conditional sale holds the property as a buyer in

possession under S. 25 (2) SGA and can pass valid title as an exception

to the nemo dat quod rule.

• In a hire-purchase, the hirer only holds a bailee and not as a buyer. It

means he only has a right to take possession and use the goods during

the period of contract.

• In AMAO V. AJIBADE & ORS (1955-56) WRNLR

121, the buyer was allowed possession of goods

upon payment of a deposit of 400 pounds. The

agreement provided that the balance had to be

paid in three equal installments and that the

owner was to retain ownership until the full

purchase price of 11045 pounds. It was held

that the agreement was a conditional sale and

not a hire-purchase agreement.

• Lease and Hire-Purchase: A lease has been

defined by Black’s Dictionary as:

“A contract by which a rightful possessor of

real property conveys the right to use and

occupy the property in exchange for

consideration, usually rent. The lease term can

be life, for a fixed period terminate at will.”

• When the word ‘lease’ is used with reference to equipment, the word means

a contract by which one owning such property grants to another, the right to

possess, use and enjoy it for a specific period of time, in exchange for

periodic payment of a stipulated price referred to as rent.

• The hire purchase agreement is similar to lease in that the owner parts with

possession of goods in return for a rental but in addition to a mere right to

use, the hirer is given an option to purchase the goods at the end of the

contract period.

• In AKIBIYA V SAMBO (unreported), the plaintiff entered into an agreement

to lease a motor vehicle for 12 months. The agreement was renewable for a

further 12 months after which the lessee was to return the goods. The

parties described the agreement as a hire-purchase. It was held that the

transaction was a lease which only conferred on the lessee a right to use the

goods and return it after the expiration of the lease.

• Hire-purchase differs from lease in the following ways:

a. Hire-purchase contemplates eventual sale while lease

does not.

b. Hire-purchase is fully regulated while lease is not and

is subject to individual contract.

c. While goods involved in equipment leasing are

capital goods those in hire-purchase are consumable

not exceeding two thousand naira unless they are

vehicles.

• Hire and Hire-Purchase: A hire is a kind of

bailment under which a bailee called the hirer is

given possession of an article, for use only during

a particular period under a hiring agreement.

• A hire agreement can be defined as obtaining the

temporally use of a thing for a rental payment.

• The hirer is bound to return the goods after the

hire period and has no option as is the case with

hire-purchase agreement to purchase the goods.

• Loan and Hire-Purchase: Black’s Law Dictionary defines a loan as an

act of lending; a grant of something for temporary use. Mostly sums

of money are lent at an interest rate.

• Where the sum involved is large, the lender may require the

borrower to provide security for the loan. A borrower may therefore

charge or mortgage his goods to the lender as security for such loan.

• Unlike a hire-purchase, a borrower need not part with possession of

his goods during the period of the loan agreement. Unless he is in

default of the payment and the lender exercises his right to enforce

the security, the lender may not really have recourse to the

borrower’s goods. See JAJIRA V. NORTHERN BREWERY CO LTD

(1973) NMLR 29.

You might also like

- Basic Understanding of Financial Investment, Book 6- For Teens and Young AdultsFrom EverandBasic Understanding of Financial Investment, Book 6- For Teens and Young AdultsNo ratings yet

- Hire Purchase Agreements Main Clauses Rights LiabilitiesDocument8 pagesHire Purchase Agreements Main Clauses Rights LiabilitiesSaurabh Krishna SinghNo ratings yet

- Hire Purchase Law RevisedDocument46 pagesHire Purchase Law RevisedBilliee ButccherNo ratings yet

- Sale Agreement - Allie LimitedDocument18 pagesSale Agreement - Allie LimitedRachael MboyaNo ratings yet

- Agreement For Lease AmendedDocument23 pagesAgreement For Lease AmendedEmeka NkemNo ratings yet

- Draft Lease Cum Development AgreementDocument42 pagesDraft Lease Cum Development AgreementAbdullah NasiruddinNo ratings yet

- Kenya - Company Draft LeaseDocument14 pagesKenya - Company Draft LeasepeeteoNo ratings yet

- TA Template (Clean Sample)Document10 pagesTA Template (Clean Sample)Wei Han FooNo ratings yet

- Sale and Purchase Agreement SummaryDocument11 pagesSale and Purchase Agreement SummarySYNo ratings yet

- Commercial Lease AgreementDocument3 pagesCommercial Lease AgreementBHAVIN BHANSALINo ratings yet

- Deed of Exchange, Where One Property Is Subject To A MortgageDocument2 pagesDeed of Exchange, Where One Property Is Subject To A MortgageAnony mousNo ratings yet

- Essential guide to title deed verificationDocument5 pagesEssential guide to title deed verificationapoorvaNo ratings yet

- Section 62. Effect of Novation, Rescission and Alteration of The ContractDocument10 pagesSection 62. Effect of Novation, Rescission and Alteration of The ContractSambridh GhimireNo ratings yet

- Wills Under Muslim LawDocument9 pagesWills Under Muslim LawAtulNo ratings yet

- Hire Purchase Agreement 5Document4 pagesHire Purchase Agreement 5Samuel MaduekeNo ratings yet

- Nairobi Commercial Offices Lease Advisory NoteDocument6 pagesNairobi Commercial Offices Lease Advisory Notemnene01No ratings yet

- Draft Agreement For Sale-SteveDocument3 pagesDraft Agreement For Sale-SteveTrapmaniaNo ratings yet

- Office Lease: Premises: Office NO.: Landlord: TenantDocument6 pagesOffice Lease: Premises: Office NO.: Landlord: Tenantادزسر بانديكو هادولهNo ratings yet

- Periodic TenancyDocument1 pagePeriodic TenancygogoggooNo ratings yet

- Auction: SampleDocument6 pagesAuction: SampleOctavian CiceuNo ratings yet

- Sale Deed 1Document9 pagesSale Deed 1smalhotra2414100% (1)

- Commercial Tenancy AgreementDocument3 pagesCommercial Tenancy AgreementgrandoverallNo ratings yet

- Commercial Lease Agreement SummaryDocument2 pagesCommercial Lease Agreement SummaryAndreea ConstantinNo ratings yet

- Special Power of Attorney: ELIZABETH C. ABARABAR, of Legal Age, Married, Filipino and ADocument4 pagesSpecial Power of Attorney: ELIZABETH C. ABARABAR, of Legal Age, Married, Filipino and ANicolo Jay PajaritoNo ratings yet

- Gift Deed Sample FormatDocument3 pagesGift Deed Sample FormatSameerNo ratings yet

- PPA1M Tenancy AgreementDocument13 pagesPPA1M Tenancy AgreementCK LiewNo ratings yet

- Demand Notice Breach of Contract Zechariah Wakili MsomiDocument2 pagesDemand Notice Breach of Contract Zechariah Wakili MsomiKELVIN A JOHNNo ratings yet

- Earnest Money ContractDocument3 pagesEarnest Money ContractKapil KaroliyaNo ratings yet

- Agreement of Sale of House PropertyDocument2 pagesAgreement of Sale of House PropertyGaurav ChaturvediNo ratings yet

- L.3 (Indemnity & Guarantee, Bailment & Pledge)Document16 pagesL.3 (Indemnity & Guarantee, Bailment & Pledge)nomanashrafNo ratings yet

- New Commercial Tenancy AgreementDocument4 pagesNew Commercial Tenancy AgreementHills JoshNo ratings yet

- Lease Agreement PDFDocument7 pagesLease Agreement PDFXplore RealtyNo ratings yet

- Commercial Lease For EpcDocument4 pagesCommercial Lease For Epchamza tariqNo ratings yet

- Draft Tenancy Agreement (Revised)Document10 pagesDraft Tenancy Agreement (Revised)Emeka NkemNo ratings yet

- The Ebook On Landlords and TenantsDocument25 pagesThe Ebook On Landlords and TenantsAnalytics GuruNo ratings yet

- Assignment of An Agreement For Sale: Form No. 7Document2 pagesAssignment of An Agreement For Sale: Form No. 7Sudeep Sharma100% (1)

- Dated This Day of 200: MR (The Landlord)Document11 pagesDated This Day of 200: MR (The Landlord)koupiri5021No ratings yet

- Fitzroy v. CaveDocument2 pagesFitzroy v. CavecrlstinaaaNo ratings yet

- Uganda Rental AgreementDocument5 pagesUganda Rental AgreementProsper WabwireNo ratings yet

- The Republic of Uganda The Registration of Titles Act (Cap. 230) AND The Land Act (Cap. 227)Document5 pagesThe Republic of Uganda The Registration of Titles Act (Cap. 230) AND The Land Act (Cap. 227)Kal AnzieNo ratings yet

- Tenancy Agreemen2222Document8 pagesTenancy Agreemen2222Samuel Chukwuma100% (1)

- Rent Agreement FormatDocument2 pagesRent Agreement Formatkaushal sharmaNo ratings yet

- Irrevocable Power of Attorney UploadDocument5 pagesIrrevocable Power of Attorney Uploadchijioke chineloNo ratings yet

- Millington Vs FoxDocument8 pagesMillington Vs FoxRajesureshNo ratings yet

- Laws of Guyana Landlord and Tenant Act SummaryDocument44 pagesLaws of Guyana Landlord and Tenant Act SummaryVladim Romello PersaudNo ratings yet

- Essential elements of a contract of sale under the Sale of Goods ActDocument19 pagesEssential elements of a contract of sale under the Sale of Goods ActAlbert Venn DiceyNo ratings yet

- Draft Lease DeedDocument14 pagesDraft Lease Deediona_hegdeNo ratings yet

- Lease AgreementsDocument14 pagesLease AgreementsRaisa Kaniedood Shafudah0% (1)

- Atp 107 - Conveyancing - Assignment-Off Plan V Sale AgreementDocument7 pagesAtp 107 - Conveyancing - Assignment-Off Plan V Sale AgreementSir Robert Nyachoti100% (1)

- Addendum To LeaseDocument1 pageAddendum To LeaseNick VidoniNo ratings yet

- Tenancy Agreement MalaysiaDocument64 pagesTenancy Agreement MalaysiaInaz IdNo ratings yet

- Landlords and Rent ArrearsDocument13 pagesLandlords and Rent ArrearsRussell SmithNo ratings yet

- Release Deed SummaryDocument4 pagesRelease Deed SummaryVeeraNo ratings yet

- Sample AgreementDocument8 pagesSample AgreementBrittneyNo ratings yet

- Affidavit of Reconciliation of NameDocument1 pageAffidavit of Reconciliation of NameIsrael Adodo0% (1)

- Sample - Trading of Housewares Tenancy AgreementDocument13 pagesSample - Trading of Housewares Tenancy AgreementDarul Ulum Al MunawwarahNo ratings yet

- Illinois Property Management Agreement PDFDocument3 pagesIllinois Property Management Agreement PDFDrake MontgomeryNo ratings yet

- Gazette Notice Law Society or KenyaDocument12 pagesGazette Notice Law Society or KenyaCaren MurandaNo ratings yet

- Residential Property Lease Deed DraftDocument6 pagesResidential Property Lease Deed DraftmanjulaNo ratings yet

- Legal Service AgreementDocument2 pagesLegal Service Agreementgmrp gmpNo ratings yet

- Legal Notice Rent EvictionDocument2 pagesLegal Notice Rent EvictionDisha SachdevaNo ratings yet

- 3 - Law of Carriage, Unit-I, PPT-02Document49 pages3 - Law of Carriage, Unit-I, PPT-02Ila SinghNo ratings yet

- PAJUYO V CA and GUEVARRADocument2 pagesPAJUYO V CA and GUEVARRAAngela Marie AlmalbisNo ratings yet

- Employment Contract LogisticsDocument3 pagesEmployment Contract LogisticsAniyi ChoosyNo ratings yet

- 050 Sulo Sa Nayon V Nayong Pilipino FoundationDocument2 pages050 Sulo Sa Nayon V Nayong Pilipino FoundationFrancisCarloL.FlameñoNo ratings yet

- G.R. No. 205657, March 29, 2017Document10 pagesG.R. No. 205657, March 29, 2017Jaeby DuqueNo ratings yet

- Volenti Non Fit InjuriaDocument2 pagesVolenti Non Fit InjuriaHaru RodriguezNo ratings yet

- Actual or Compensatory DamagesDocument2 pagesActual or Compensatory DamagesLindsay Mills100% (1)

- Free ConsentDocument17 pagesFree ConsentHarishNo ratings yet

- The Insurance Code - CODALDocument10 pagesThe Insurance Code - CODALiamcayen100% (1)

- Obligations and Contracts: Atty. Rheneir P. Mora, CPADocument55 pagesObligations and Contracts: Atty. Rheneir P. Mora, CPARheneir MoraNo ratings yet

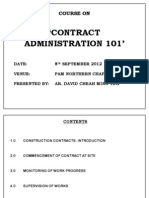

- Contract Admin 101Document56 pagesContract Admin 101c_mc2100% (1)

- Escano and Silos v. OrtigasDocument3 pagesEscano and Silos v. OrtigasRaffyLaguesma100% (2)

- Utopia-Law On Sales Reviewer by X.B.K. BataanDocument68 pagesUtopia-Law On Sales Reviewer by X.B.K. BataanXavier BataanNo ratings yet

- Salomon V A SalomonDocument4 pagesSalomon V A SalomonJansar Akhtar100% (1)

- Superintendent ContractDocument1 pageSuperintendent ContractNik StrengNo ratings yet

- A. Common Carrier in General (Cases)Document81 pagesA. Common Carrier in General (Cases)paoNo ratings yet

- 5paisa Capital Ltd.Document6 pages5paisa Capital Ltd.Shakshi SharmaNo ratings yet

- Contracts 1Document23 pagesContracts 1Mani RajNo ratings yet

- Heirs of Balite Vs Rodrigo Lim December 10, 2004 (DIGEST)Document2 pagesHeirs of Balite Vs Rodrigo Lim December 10, 2004 (DIGEST)Glen BasiliscoNo ratings yet

- Bar Exam Q&a W10Document5 pagesBar Exam Q&a W10Klio GamingNo ratings yet

- Insurable Interest Requirements and Beneficiary RightsDocument12 pagesInsurable Interest Requirements and Beneficiary Rightsaudreydql5No ratings yet

- Case Digest 072530Document6 pagesCase Digest 072530nodnel salonNo ratings yet

- Procedure For The Closure of The Limilted Liability Partnership Suo MotoDocument2 pagesProcedure For The Closure of The Limilted Liability Partnership Suo MotoDivesh GoyalNo ratings yet

- Republic Act 4726Document5 pagesRepublic Act 4726Jewel CantileroNo ratings yet

- CBBL01 eDocument1 pageCBBL01 ejoanna supresenciaNo ratings yet

- Maceda Law CSV CalculationDocument2 pagesMaceda Law CSV CalculationAlyssa TordesillasNo ratings yet

- Board of Directors, Trustees and Officers PartDocument15 pagesBoard of Directors, Trustees and Officers PartAmie Jane MirandaNo ratings yet

- Andres v. PNB (Civil Subject)Document2 pagesAndres v. PNB (Civil Subject)ELIZA FE ROJAS100% (2)