Professional Documents

Culture Documents

Capital Budgeting and Cost Analysis

Uploaded by

Nuke Sekuntum Hariyani0 ratings0% found this document useful (0 votes)

6 views37 pagesOriginal Title

320C21

Copyright

© © All Rights Reserved

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views37 pagesCapital Budgeting and Cost Analysis

Uploaded by

Nuke Sekuntum HariyaniCopyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 37

Capital Budgeting

and

Cost Analysis

Copyright © 2015 Pearson Education, Inc. All Rights Reserved

1. Understand the five stages of capital

budgeting for a project

2. Use and evaluate the two main discounted

cash flow (DCF) methods: the net present

value (NPV) method and the internal rate-

of-return (IRR) method

3. Use and evaluate the payback and

discounted payback method

4. Use and evaluate the accrual accounting

rate-of-return (AARR) method

Copyright © 2015 Pearson Education, Inc. All Rights Reserved

21-2

5. Identify relevant cash inflows and outflows

for capital budgeting decisions

6. Understand issues involved in implementing

capital budgeting decisions and evaluating

managerial performance

7. Explain how managers can use capital

budgeting to achieve their firms’ strategic

goals

Copyright © 2015 Pearson Education, Inc. All Rights Reserved

21-3

Working closely with accountants, top

executives have to figure out how and when to

best allocate the firm’s financial resources

among alternative opportunities to create

future value for the company. Because it is

hard to know what the future holds and how

much projects will ultimately cost, this can be

a challenging task, but it is one that managers

must constantly confront.

This chapter explains the different methods

managers use to get the “biggest bang” for the

firm’s “buck” in terms of the projects they

undertake.

Copyright © 2015 Pearson Education, Inc. All Rights Reserved

21-4

Capital budgeting is the process of making

long-run planning decisions for investments in

projects.

In much of accounting, income is calculated on

a period-by-period basis.

In choosing investments, managers make a

selection from among multiple projects each

of which may span several different periods.

Copyright © 2015 Pearson Education, Inc. All Rights Reserved

21-5

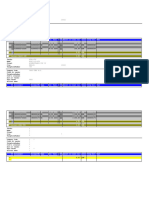

Horizontally across is the project dimension,

and

Vertically upward is the accounting-period

dimension.

To make capital budgeting decisions,

managers must analyze each project by

considering all the life-span cash flows from

its initial investment through its termination.

Copyright © 2015 Pearson Education, Inc. All Rights Reserved

21-6

Copyright © 2015 Pearson Education, Inc. All Rights Reserved

21-7

1. Identify projects—identify potential

capital investments that agree with the

organization’s strategy.

2. Obtain information—gather information

from all parts of the value chain to

evaluate alternative projects.

3. Make predictions—forecast all potential

cash flows attributable to the

alternative projects.

Copyright © 2015 Pearson Education, Inc. All Rights Reserved

21-8

4. Make Decisions by Choosing Among

Alternatives - Determine which

investment yields the greatest benefit

and least cost to the organization.

5. Implement the decision, evaluate

performance and learn (generally

separated into two phases):

I. Obtain funding and make the investment selected

in stage 4.

II. Track realized cash flows, compare against

estimated numbers and revise plans if necessary.

Copyright © 2015 Pearson Education, Inc. All Rights Reserved

21-9

New projects often require additional

investments in current assets, such as

inventories and receivables. Working capital

in this chapter refers to the difference

between current assets and current

liabilities. Any additional investment

required for a project will be included in

that project’s cash flows.

Copyright © 2015 Pearson Education, Inc. All Rights Reserved

21-10

1. Net present value (NPV)

2. Internal rate of return (IRR)

3. Payback period

4. Accrual accounting rate of return (AARR)

Methods 1 and 2 (NPV and IRR) are

discounted cash flow (DCF) methods.

Copyright © 2015 Pearson Education, Inc. All Rights Reserved

21-11

Discounted cash flow (DCF) methods measure

all expected future cash inflows and outflows

of a project discounted back to the present

point in time.

The key feature of DCF methods is the time

value of money which means that a dollar

received today is worth more than a dollar

received at any future time.

The reason is that $1 received today could be

invested at, say, 10% per year so that it grows

to $1.10 at the end of one year.

Copyright © 2015 Pearson Education, Inc. All Rights Reserved

21-12

The time value of money is the opportunity

cost from not having the money today.

DCF methods use the required rate of return

(RRR), which is the minimum acceptable

annual rate of return on an investment.

RRR is internally set, usually by upper

management, and typically represents the

return that an organization could expect to

receive elsewhere for an investment of

comparable risk.

RRR is also called the discount rate, hurdle

rate, cost of capital, or opportunity cost of

capital.

Copyright © 2015 Pearson Education, Inc. All Rights Reserved

21-13

The NPV method calculates the expected

monetary gain or loss from a project by

discounting all expected future cash inflows

and outflows back to the present point in

time, using the RRR.

Based on financial factors alone, only

projects with a zero or positive NPV are

acceptable.

We’ll use three steps for the NPV method.

Copyright © 2015 Pearson Education, Inc. All Rights Reserved

21-14

1. Draw a sketch of the relevant cash

inflows and outflows. (see right side of

next slide)

2. Discount the Cash Flows using the

Correct Compound Interest Table from

Appendix A and Sum Them.

3. Make the Project Decision on the Basis

of the Calculated NPV (zero or positive

should be accepted because the

expected rate of return equals (zero) or

exceeds the required rate of return.)

Copyright © 2015 Pearson Education, Inc. All Rights Reserved

21-15

Copyright © 2015 Pearson Education, Inc. All Rights Reserved

21-16

The IRR Method calculates the discount rate

at which an investment’s present value of all

expected cash inflows equals the present

value of its expected cash outflows.

We are looking here for the rate of return

that makes NPV = 0.

A project is accepted only if the IRR equals

or exceeds the RRR.

Copyright © 2015 Pearson Education, Inc. All Rights Reserved

21-17

Managers or analysts solving capital

budgeting problems typically use a

calculator or computer program to provide

the internal rate of return, but a more

manual trial and error approach can also

provide the answer.

Trial and error approach:

Use a discount rate and calculate the project’s NPV.

Goal: find the discount rate for which NPV = 0

1. If the calculated NPV is greater than zero, use a

higher discount rate.

2. If the calculated NPV is less than zero, use a lower

discount rate.

3. Continue until NPV = 0.

Copyright © 2015 Pearson Education, Inc. All Rights Reserved

21-18

Copyright © 2015 Pearson Education, Inc. All Rights Reserved

21-19

NPV is generally preferred because its use

leads to shareholder value maximization.

NPV is expressed in dollars, not in

percentages; IRR projects cannot be added

or averaged to represent the IRR of a

combination of projects.

The NPV value can always be computed for a

project.

NPV method can be used when the RRR

varies over the life of the project.

Copyright © 2015 Pearson Education, Inc. All Rights Reserved

21-20

IRR is more prone (than NPV) to indicate

erroneous decisions.

IRR implicitly assumes that project cash flows

can be reinvested at the project’s rate of return.

NPV accurately assumes that project cash flows

can only be reinvested at the company’s

required rate of return.

Still, the IRR method is widely used.

Copyright © 2015 Pearson Education, Inc. All Rights Reserved

21-21

The Payback method measures the time it will take

to recoup, in the form of expected future cash

flows, the net initial investment in a project.

Like the NPV and IRR methods, the payback method

does not distinguish among the sources of cash

flows.

Shorter payback period are preferable.

Organizations choose an acceptable project

payback period. Generally, the greater the risk,

the shorter the payback period should be.

The payback method is easy to understand.

The two weaknesses of the payback method are:

Fails to recognize the time value of money.

Doesn’t consider the cash flow beyond the payback point.

Copyright © 2015 Pearson Education, Inc. All Rights Reserved

21-22

With uniform cash flows:

Payback Net Initial Investment

Period = Uniform Increase in Annual Future Cash Flows

With non-uniform cash flows:

add cash flows period-by-period until the initial investment is

recovered; count the number of periods included for payback

period.

It is relatively simple to adjust the payback method to

incorporate the time value of money by discounting the

expected future cash flows before performing the

calculations.

Copyright © 2015 Pearson Education, Inc. All Rights Reserved

21-23

The AARR method divides the average annual

[accrual accounting] income of a project by a

measure of the investment in it.

That “measure of the investment” in the

project can vary company by company.

Also called the accounting rate of return.

The AARR method is similar to the IRR method

in that both calculate a rate-of-return

percentage; however, the IRR method is

generally regarded as better than the AARR.

Copyright © 2015 Pearson Education, Inc. All Rights Reserved

21-24

Increase in Expected Average

Accrual Accounting Annual After-Tax Operating Income

Rate of Return = Net Initial Investment

Remember that the value used for the denominator can vary so be

sure you understand how the AARR is defined in each individual

situation.

Copyright © 2015 Pearson Education, Inc. All Rights Reserved

21-25

Firms vary in how they calculate AARR.

Easy to understand, and uses numbers

reported in financial statements.

Does not track cash flows.

Ignores time value of money.

When different methods lead to different

rankings of projects, more weight should be

given to the NPV method because the

assumptions made by the NPV method are

most consistent with making decisions that

maximize a company’s value.

Copyright © 2015 Pearson Education, Inc. All Rights Reserved

21-26

One of the biggest challenges in capital budgeting,

particularly DCF analysis, is determining which cash

flows are relevant in making an investment selection.

Relevant cash flows are the differences in expected

future cash flows as a result of making the investment.

A capital investment project typically has three

categories of cash flows:

1. Net initial investment.

2. After-tax cash flow from operations.

3. After-tax cash flow from terminal disposal of an asset

and recovery of working capital.

Copyright © 2015 Pearson Education, Inc. All Rights Reserved

21-27

We’ll look at each category, but let’s be sure

we understand the effect that taxes can have

on the cash flows.

Copyright © 2015 Pearson Education, Inc. All Rights Reserved

21-28

Three components of net-initial

investment cash flows:

1. Initial machine investment.

2. Initial working capital investment.

3. After-tax cash flow from current disposal

of old machine.

Copyright © 2015 Pearson Education, Inc. All Rights Reserved

21-29

Two components of cash flow from

operations:

1. Annual after-tax cash flow from operations

(excluding the depreciation effect).

2. Income tax cash savings from annual

depreciation deductions.

For economic-policy reasons, tax laws specify

which depreciation methods and which

depreciable lives are permitted. When there

is a legal choice, take the depreciation sooner

rather than later because this will increase a

project’s NPV.

Copyright © 2015 Pearson Education, Inc. All Rights Reserved

21-30

Two components of Terminal Disposal of

Investment:

1. After-tax cash flow from terminal disposal

of asset (investment).

2. After-tax cash flow from recovery of

working capital (liquidating receivables

and inventory that was needed to support

the project).

Copyright © 2015 Pearson Education, Inc. All Rights Reserved

21-31

We have looked at ways to identify relevant cash

flows and techniques to analyze them. Our final

stage of capital budgeting (stage 5) is the

implementation and control of the project, and

the evaluation of performance.

Implementation and control:

Management of the investment activity itself.

Management control of the project as a whole.

A post-investment audit may be done to provide

management with feedback about the performance

of a project so that management can compare

actual results to the costs and benefits expected at

the time the project was selected.

Copyright © 2015 Pearson Education, Inc. All Rights Reserved

21-32

A post-investment audit may prevent managers from

overstating the expected cash inflows from projects

and accepting projects they should reject.

Companies should perform post-investment audits

with thought and care and only after the project

outcomes are fully known.

There is an inconsistency between using the NPV

method as best for capital budgeting decisions and

then using a different method to evaluate

performance. Even though NPV is the best for capital

budgeting decisions, managers will be tempted to

make the decisions based on the method on which

they will be evaluated.

Copyright © 2015 Pearson Education, Inc. All Rights Reserved

21-33

A company’s strategy is the source of its

strategic capital budgeting decisions.

Managers can use the framework described in

this chapter for project evaluation and also to

make strategic decisions about which customers

to invest in.

Some firms regard R&D projects as important

strategic investments.

Copyright © 2015 Pearson Education, Inc. All Rights Reserved

21-34

TERMS TO LEARN PAGE NUMBER REFERENCE

Accrual accounting rate-of- Page 814

return (AARR) method

Capital budgeting Page 803

Cost of capital Page 806

Discount rate Page 806

Discounted cash flow (DCF) Page 806

methods

Discounted payback method Page 813

Hurdle rate Page 806

Inflation Page 827

Internal rate-of-return (IRR) Page 808

method

Copyright © 2015 Pearson Education, Inc. All Rights Reserved

21-35

TERMS TO LEARN PAGE NUMBER REFERENCE

Net present value (NPV) method Page 806

Nominal rate of return Page 827

Opportunity cost of capital Page 806

Payback method Page 811

Real rate of return Page 827

Required rate of return (RRR) Page 806

Time value of money Page 806

Copyright © 2015 Pearson Education, Inc. All Rights Reserved

21-36

Copyright © 2015 Pearson Education, Inc. All Rights Reserved

37

You might also like

- Chapter 10Document42 pagesChapter 10LBL_LowkeeNo ratings yet

- Significance of Capital Budgeting: Discounted Cash Flow MethodDocument8 pagesSignificance of Capital Budgeting: Discounted Cash Flow MethodSarwat AfreenNo ratings yet

- Review Q'S Fima (Chap 10)Document3 pagesReview Q'S Fima (Chap 10)Katrina PaquizNo ratings yet

- Capital Investment Decisions: Chapte RDocument95 pagesCapital Investment Decisions: Chapte RMohammad Salim HossainNo ratings yet

- Capital Budgeting at Birla CementDocument61 pagesCapital Budgeting at Birla Cementrpsinghsikarwar0% (1)

- Guideline Answers To The Concept Check Questions Chapter 8: Capital BudgetingDocument8 pagesGuideline Answers To The Concept Check Questions Chapter 8: Capital BudgetingDawn CaldeiraNo ratings yet

- Financial Policy and PlanningDocument16 pagesFinancial Policy and Planninggunaseelan_pnb7566No ratings yet

- Int AudDocument3 pagesInt Audkyra inarsolinNo ratings yet

- BUS - 539 Capital - Budgeting - Wk.5Document10 pagesBUS - 539 Capital - Budgeting - Wk.5TimNo ratings yet

- CH04 The Capital Budgeting Decision-UoHDocument31 pagesCH04 The Capital Budgeting Decision-UoHNimao SaedNo ratings yet

- Capital Budgeting TechniquesDocument26 pagesCapital Budgeting TechniquesMahima GirdharNo ratings yet

- Capital Budgeting: Exclusive ProjectsDocument6 pagesCapital Budgeting: Exclusive ProjectsMethon BaskNo ratings yet

- CH 08 Capital BudgetingDocument51 pagesCH 08 Capital BudgetingLitika SachdevaNo ratings yet

- Techniques of Investment AnalysisDocument32 pagesTechniques of Investment AnalysisPranjal Verma0% (1)

- DR - Naushad Alam: Capital BudgetingDocument38 pagesDR - Naushad Alam: Capital BudgetingUrvashi SinghNo ratings yet

- Capital Budgeting: Net Present ValueDocument3 pagesCapital Budgeting: Net Present Valuepratibha2031No ratings yet

- Chapter 6: Introduction To Capital BudgetingDocument3 pagesChapter 6: Introduction To Capital BudgetingDeneree Joi EscotoNo ratings yet

- Chapter 6: Introduction To Capital BudgetingDocument3 pagesChapter 6: Introduction To Capital BudgetingDeneree Joi EscotoNo ratings yet

- Investment Appraisal TechniquesDocument6 pagesInvestment Appraisal TechniquesERICK MLINGWANo ratings yet

- Topic VII Capital Budgeting TechniquesDocument16 pagesTopic VII Capital Budgeting TechniquesSeph AgetroNo ratings yet

- Capital Budgeting & Cost Analysis: OutlineDocument15 pagesCapital Budgeting & Cost Analysis: OutlineKim Chi LeNo ratings yet

- Seminar Manajemen KeuanganDocument8 pagesSeminar Manajemen KeuangannoviyanthyNo ratings yet

- SBL Financial AnalysisDocument26 pagesSBL Financial AnalysisDr Kennedy Amadi.PhDNo ratings yet

- CORP FIN Final TheoryDocument5 pagesCORP FIN Final Theoryjesin.estiana09No ratings yet

- Capital Budgeting (Or Investment Appraisal) Is The Planning Process Used To Determine Whether A Firm'sDocument4 pagesCapital Budgeting (Or Investment Appraisal) Is The Planning Process Used To Determine Whether A Firm'spavanbhatNo ratings yet

- Capital BudgetingDocument16 pagesCapital BudgetingNikhil BapnaNo ratings yet

- Capital Budgeting Notes (MBA FA - 2023)Document10 pagesCapital Budgeting Notes (MBA FA - 2023)kavyaNo ratings yet

- CH04 The Capital Budgeting DecisionDocument31 pagesCH04 The Capital Budgeting DecisionJamaNo ratings yet

- Chapter 9 Capital BudgetinDocument184 pagesChapter 9 Capital BudgetinKatherine Cabading InocandoNo ratings yet

- Definitions:: - T. HorngreenDocument9 pagesDefinitions:: - T. Horngreenkurtieee21No ratings yet

- Capital Budgeting Techniques: All Rights ReservedDocument43 pagesCapital Budgeting Techniques: All Rights Reservedred8blue8No ratings yet

- The Basics of Capital BudgetingDocument5 pagesThe Basics of Capital BudgetingChirrelyn Necesario SunioNo ratings yet

- Module 2Document7 pagesModule 2Harsh PatelNo ratings yet

- Document (1) (3) .EditedDocument7 pagesDocument (1) (3) .EditedMoses WabunaNo ratings yet

- Dr. Sandeep Malu Associate Professor SVIM, IndoreDocument14 pagesDr. Sandeep Malu Associate Professor SVIM, Indorechaterji_aNo ratings yet

- Dr. Sandeep Malu Associate Professor SVIM, IndoreDocument14 pagesDr. Sandeep Malu Associate Professor SVIM, Indorechaterji_aNo ratings yet

- Capital Budgeting & Cost Analysis: OutlineDocument15 pagesCapital Budgeting & Cost Analysis: OutlineLưu Hồng Hạnh 4KT-20ACNNo ratings yet

- Capital Budgeing ReviewDocument20 pagesCapital Budgeing ReviewBalakrishna ChakaliNo ratings yet

- Risk and Refinements in Capital BudgetingDocument75 pagesRisk and Refinements in Capital BudgetingdhfbbbbbbbbbbbbbbbbbhNo ratings yet

- CH 13 SolDocument32 pagesCH 13 SolSungho LeeNo ratings yet

- Capital BudgetingDocument9 pagesCapital BudgetingchabeNo ratings yet

- Financial ManagementDocument20 pagesFinancial ManagementGAURAV SHARMA100% (1)

- 8-Capital BudgetingDocument89 pages8-Capital BudgetingJohn Francis IdananNo ratings yet

- L1R32 Annotated CalculatorDocument33 pagesL1R32 Annotated CalculatorAlex PaulNo ratings yet

- FMTII Session 4&5 Capital BudgetingDocument56 pagesFMTII Session 4&5 Capital Budgetingbhushankankariya5No ratings yet

- BF 14Document5 pagesBF 14zhairenaguila22No ratings yet

- Capital Budgeting Techniques: Prof. Nidhi BandaruDocument28 pagesCapital Budgeting Techniques: Prof. Nidhi Bandaruhashmi4a4No ratings yet

- FM AssignmentDocument5 pagesFM AssignmentMuhammad Haris Muhammad AslamNo ratings yet

- Capital BudgetingDocument11 pagesCapital BudgetingShane PajaberaNo ratings yet

- Case 5: The Investmen Detective: BackgroundDocument5 pagesCase 5: The Investmen Detective: BackgroundMuhamad GilangNo ratings yet

- The Basics of Capital Budgeting: Answers To End-Of-Chapter QuestionsDocument46 pagesThe Basics of Capital Budgeting: Answers To End-Of-Chapter QuestionsAndrew ChipwaluNo ratings yet

- Chap 11 Problem SolutionsDocument46 pagesChap 11 Problem SolutionsNaufal FigoNo ratings yet

- Assignment - Capital BudgetingDocument9 pagesAssignment - Capital BudgetingSahid KarimbanakkalNo ratings yet

- Multinational Capital BudgetingDocument26 pagesMultinational Capital BudgetingDishaNo ratings yet

- Capital Budgeting: Questions & Answers Q18.1Document38 pagesCapital Budgeting: Questions & Answers Q18.1Japhary Shaibu67% (3)

- Applied Corporate Finance. What is a Company worth?From EverandApplied Corporate Finance. What is a Company worth?Rating: 3 out of 5 stars3/5 (2)

- Discounted Cash Flow Budgeting: Simplified Your Path to Financial ExcellenceFrom EverandDiscounted Cash Flow Budgeting: Simplified Your Path to Financial ExcellenceNo ratings yet

- Decoding DCF: A Beginner's Guide to Discounted Cash Flow AnalysisFrom EverandDecoding DCF: A Beginner's Guide to Discounted Cash Flow AnalysisNo ratings yet

- Discounted Cash Flow Demystified: A Comprehensive Guide to DCF BudgetingFrom EverandDiscounted Cash Flow Demystified: A Comprehensive Guide to DCF BudgetingNo ratings yet

- GL Account Balance - Latihan Materi 2Document1 pageGL Account Balance - Latihan Materi 2Nuke Sekuntum HariyaniNo ratings yet

- Material ListDocument1 pageMaterial ListNuke Sekuntum HariyaniNo ratings yet

- Vendor BalanceDocument2 pagesVendor BalanceNuke Sekuntum HariyaniNo ratings yet

- Stock OverviewDocument1 pageStock OverviewNuke Sekuntum HariyaniNo ratings yet

- Material ListDocument1 pageMaterial ListNuke Sekuntum HariyaniNo ratings yet

- Hca15 PPT ch04-1Document37 pagesHca15 PPT ch04-1Van Frederick PortugalNo ratings yet

- Horgren CH 03Document29 pagesHorgren CH 03Nuke Sekuntum HariyaniNo ratings yet

- Hca15 PPT ch05Document32 pagesHca15 PPT ch05حسينالربابعهNo ratings yet

- Chapter 1 The Manager and Management AccountingDocument6 pagesChapter 1 The Manager and Management AccountingZam100% (1)

- Chapter 1 The Manager and Management AccountingDocument6 pagesChapter 1 The Manager and Management AccountingZam100% (1)

- Unit 6 Listening Practice OUT AND ABOUT 1Document1 pageUnit 6 Listening Practice OUT AND ABOUT 1Marta Sampedro GonzalezNo ratings yet

- Summary of All Sequences For 4MS 2021Document8 pagesSummary of All Sequences For 4MS 2021rohanZorba100% (3)

- Reading #2: Participatory Action ResearchDocument45 pagesReading #2: Participatory Action Researchapi-3723169100% (2)

- Ra 9048 Implementing RulesDocument9 pagesRa 9048 Implementing RulesToffeeNo ratings yet

- Literacy Block Lesson PlanDocument5 pagesLiteracy Block Lesson Planapi-286592038No ratings yet

- Foreign Policy During Mahathir EraDocument7 pagesForeign Policy During Mahathir EraMuhamad Efendy Jamhar0% (1)

- What If The Class Is Very BigDocument2 pagesWhat If The Class Is Very BigCamilo CarantónNo ratings yet

- Nursing Informatics: Sanil VargheseDocument55 pagesNursing Informatics: Sanil VarghesePalwasha KhanNo ratings yet

- Blind Chinese SoldiersDocument2 pagesBlind Chinese SoldiersSampolNo ratings yet

- Law On Common Carriers: Laws Regulating Transportation CompaniesDocument3 pagesLaw On Common Carriers: Laws Regulating Transportation CompaniesLenoel Nayrb Urquia Cosmiano100% (1)

- Handling Qualites of CanardDocument49 pagesHandling Qualites of CanardUsman GhummanNo ratings yet

- English VowelDocument6 pagesEnglish Vowelqais yasinNo ratings yet

- 17PME328E: Process Planning and Cost EstimationDocument48 pages17PME328E: Process Planning and Cost EstimationDeepak MisraNo ratings yet

- Analysis of The SPM QuestionsDocument5 pagesAnalysis of The SPM QuestionsHaslina ZakariaNo ratings yet

- List of Naruto Char.Document40 pagesList of Naruto Char.Keziah MecarteNo ratings yet

- The First Quality Books To ReadDocument2 pagesThe First Quality Books To ReadMarvin I. NoronaNo ratings yet

- How To Manage Asthma: A GuideDocument44 pagesHow To Manage Asthma: A GuideSrinivas YerriboinaNo ratings yet

- The Impact of Climatic and Cultural Factors On Openings in Traditional Houses in MaharashtraDocument14 pagesThe Impact of Climatic and Cultural Factors On Openings in Traditional Houses in Maharashtracoldflame81No ratings yet

- The Intelligent Investor NotesDocument19 pagesThe Intelligent Investor NotesJack Jacinto100% (6)

- The Novel TodayDocument3 pagesThe Novel Todaylennon tanNo ratings yet

- Beginner Levels of EnglishDocument4 pagesBeginner Levels of EnglishEduardoDiazNo ratings yet

- G.R. No. 205307 PEOPLE Vs EDUARDO GOLIDAN y COTO-ONGDocument24 pagesG.R. No. 205307 PEOPLE Vs EDUARDO GOLIDAN y COTO-ONGRuel FernandezNo ratings yet

- Short Tutorial On Recurrence RelationsDocument13 pagesShort Tutorial On Recurrence RelationsAbdulfattah HusseinNo ratings yet

- Speakout Language BankDocument7 pagesSpeakout Language BankСаша БулуєвNo ratings yet

- Direct RetainerDocument186 pagesDirect RetainerAngkita KalitaNo ratings yet

- 4 Problem GamblingDocument14 pages4 Problem GamblingLee Jia HuiNo ratings yet

- SakalDocument33 pagesSakalKaran AsnaniNo ratings yet

- Investment Opportunities: Equity MarketsDocument38 pagesInvestment Opportunities: Equity MarketsRanjeet SinghNo ratings yet

- FS 1 Activity 3.3Document6 pagesFS 1 Activity 3.3HYACINTH GALLENERONo ratings yet

- FP010CALL Trabajo CO Ardila Jaime Molina PiñeyroDocument12 pagesFP010CALL Trabajo CO Ardila Jaime Molina PiñeyroRomina Paola PiñeyroNo ratings yet