Professional Documents

Culture Documents

Chap04 Risk Assessment

Uploaded by

des arellanoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chap04 Risk Assessment

Uploaded by

des arellanoCopyright:

Available Formats

Auditing and Assurance Services

A Systematic Approach

Eleventh Edition

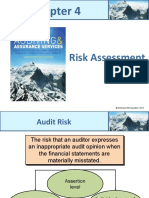

CHAPTER 4

Risk Assessment

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution

without the prior written consent of McGraw-Hill Education.

Learning Objective 04-1

Audit Risk

The risk that an auditor expresses an inappropriate audit

opinion when the financial statements are materially

misstated.

Assertion

level

Individual

Financial account

statement balance or

level disclosure

level

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution

without the prior written consent of McGraw-Hill Education. 4-2

Learning Objective 04-2

The Audit Risk Model (1 of 2)

Susceptibility of an assertion in an account or disclosure

Inherent to a misstatement due to error or fraud that could be

Risk material, before consideration of any related controls

Risk that a misstatement that could occur in an assertion

Control about an account or disclosure and that could be material

Risk will not be prevented, or detected and corrected, on a

timely basis by the entity’s internal control

Risk that the procedures performed by the auditor to

Detection reduce audit risk to an acceptable low level will not

Risk detect misstatements that exist and could be material

• Inappropriate audit procedure

• Misinterpreting audit evidence

• Failure to recognize a misstatement or deviation

• Nonsampling risk

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution

without the prior written consent of McGraw-Hill Education. 4-3

Learning Objective 04-2

The Audit Risk Model (2 of 2)

Inherent Risk and Control Risk = Risk of Material Misstatement

Audit Risk = IR x CR x DR

Nonsampling Sampling

OR risk risk

Audit Risk = RMM x DR

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution

without the prior written consent of McGraw-Hill Education. 4-4

Learning Objective 04-2

Engagement Risk

Litigation

An auditor’s exposure

to financial loss and

damage to

professional reputation

Or other events arising

in connection with

Adverse

the audited financials publicity

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution

without the prior written consent of McGraw-Hill Education. 4-5

Learning Objective 04-3

Using the Audit Risk Model (1 of 2)

1 Setting a planned level of audit risk

2 Assessing the risk of material misstatement (IR x CR)

3 Determining the appropriate level of detection risk:

AR = IR × CR × DR

AR

DR =

IR × CR

Auditors use this level of detection risk to design audit

procedures that will reduce audit risk to an acceptable level.

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution

without the prior written consent of McGraw-Hill Education. 4-6

Learning Objective 04-3

Using the Audit Risk Model (2 of 2)

Example AR RMM DR

1 Very low High Low

2 Low Moderate Moderate

3 Low Low High

Auditors assess each component of the audit

risk model using either quantitative or

qualitative terms

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution

without the prior written consent of McGraw-Hill Education. 4-7

Learning Objective 04-3

Knowledge Assessment

Example AR RMM DR

3 Low Low High

For Example 3 in the table above, why is the auditor setting

DR at high? What does a high assessment of DR mean in

terms of the level of audit testing?

(Stop and Think p. 101)

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution

without the prior written consent of McGraw-Hill Education. 4-8

Learning Objective 04-3

Knowledge Assessment

Example AR RMM DR

3 Low Low High

For Example 3 in the table above, why is the auditor setting

DR at high? What does a high assessment of DR mean in

terms of the level of audit testing?

DR is set high because there is a low risk that a

material misstatement is present in the financial

statements and, as a result, the auditor needs to

gather less evidences.

(Stop and Think p. 101)

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution

without the prior written consent of McGraw-Hill Education. 4-9

Learning Objective 04-3

FIGURE 4-1 The Relationship of the Entity’s

Business Risks to the Audit Risk Model

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution

without the prior written consent of McGraw-Hill Education. 4-10

Learning Objective 04-3

Limitations of the Audit Risk Model

The audit risk model is a planning tool, but it has

some limitations that must be considered when the

model is used to revise an audit plan or to evaluate

audit results:

• The model is only as good as the judgements and

assessments used as inputs (e.g. it does not

consider potential auditor error

• The desired level of audit risk may not actually be

achieved

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution

without the prior written consent of McGraw-Hill Education. 4-11

Learning Objective 04-4

The Auditor’s Risk Assessment

Process

Auditors perform risk assessment procedures to

obtain an understanding of the entity and its

environment.

This understanding helps the auditor identify

business risks and understand the potential

misstatements that may result.

Considering the response of the entity to the

business risk leads the auditor to assess the risk of

material misstatement at the financial statement

and assertion level

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution

without the prior written consent of McGraw-Hill Education. 4-12

Learning Objective 04-4

FIGURE 4-2 An Overview of the Auditor’s Risk

Assessment Process

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution

without the prior written consent of McGraw-Hill Education. 4-13

Learning Objective 04-4

Auditor’s Risk Assessment Procedures

(How do we gather this evidence?)

Inquires of

management,

Observation

other entity Analytical and

personnel, Procedures inspection

and others

outside the

entity

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution

without the prior written consent of McGraw-Hill Education. 4-14

Learning Objective 04-4

Understanding the Entity and Its

Environment

Industry, Regulatory,

Nature of the entity

and External Factors

Objectives, strategies,

Internal Control

and business risks

Entity Performance

Measures

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution

without the prior written consent of McGraw-Hill Education. 4-15

Learning Objective 04-4

Nature of the Entity (1 of 2)

To understand the nature of the entity, the auditor

should obtain information about the entity’s:

• Business Operations

– The nature of revenue sources, products and services, and

markets; the conduct of operations; alliances, joint ventures,

and outsourcing activities; location of production facilities,

warehouses, and offices; and key customers and important

suppliers of goods and services

• Ownership and Governance Structures

• Investments and Investment Activities

– Planned or recent acquisitions or divestitures; investments and

dispositions of securities and loans; capital investment

activities; and investments in partnerships and joint ventures

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution

without the prior written consent of McGraw-Hill Education. 4-16

Learning Objective 04-4

Nature of the Entity (2 of 2)

• Financing and Financing Activities

– Major subsidiaries and associated entities; debt structure;

leasing arrangements; related parties; and the use of derivative

financial instruments

• Financial Reporting

– Accounting principles and industry-specific practices; revenue

recognition practices; accounting for fair values; and accounting

for unusual or complex transactions

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution

without the prior written consent of McGraw-Hill Education. 4-17

Learning Objective 04-4

Knowledge Assessment

Consider an entity that sells goods to a declining customer

base. What risks does this entity face? How will these risks

impact the audit?

(Stop and Think p. 102)

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution

without the prior written consent of McGraw-Hill Education. 4-18

Learning Objective 04-4

Industry, Regulatory, and Other

External Factors (Table 4-1)

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution

without the prior written consent of McGraw-Hill Education. 4-19

Learning Objective 04-4

Objectives, Strategies, and

Related Business Risks

The auditor must identify and understand:

Business risks

Strategies

Entity’s associated with

used to

objectives those

achieve its

objectives and

objectives

strategies

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution

without the prior written consent of McGraw-Hill Education. 4-20

Learning Objective 04-4

Internal Control

The auditor needs to understand and assess

the effectiveness of internal control in order to:

Identify the

types of potential

It also assists in

misstatements

designing

and factors that

appropriate

affect the risks of

audit procedures

material

misstatement

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution

without the prior written consent of McGraw-Hill Education. 4-21

Learning Objective 04-5

Assessing the Risk of Material

Misstatement (1 of 5)

Errors are unintentional misstatements of

amounts or disclosures in the financial statements.

Fraud refers to an intentional act by one or more

among management, those charged with

governance, employees, or third parties, involving

the use of deception that results in a misstatement

in the financial statements.

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution

without the prior written consent of McGraw-Hill Education. 4-22

Learning Objective 04-5

Assessing the Risk of Material

Misstatement (2 of 5)

Examples of misstatements include:

● An inaccuracy in gathering or processing data from

which financial statements are prepared.

● An omission of an amount or disclosure.

● A financial statement disclosure that is not presented in

accordance with GAAP.

● An incorrect accounting estimate arising from

overlooking or clear misinterpretation of facts.

● Judgments of management concerning accounting

estimates that the auditor considers unreasonable or

accounting policies that the auditor considers

inappropriate.

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution

without the prior written consent of McGraw-Hill Education. 4-23

Learning Objective 04-6

Assessing the Risk of Material

Misstatement (3 of 5)

Fraud involves

intentional misstatements.

Fraudulent Misappropriation

financial reporting of assets

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution

without the prior written consent of McGraw-Hill Education. 4-24

Learning Objective 04-5

Assessing the Risk of Material

Misstatement (4 of 5)

Misappropriation of assets involves the theft of

an entity’s assets to the extent that financial

statements are misstated.

Examples include:

• Stealing assets

• Paying for goods and services not received by the company

• Embezzling cash received

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution

without the prior written consent of McGraw-Hill Education. 4-25

Learning Objective 04-5

Assessing the Risk of Material

Misstatement (5 of 5)

Fraudulent financial reporting includes acts

such as the following:

• Manipulation, falsification, or alteration of accounting

records or supporting documents used to prepare

financial statements.

• Misrepresentation in, or intentional omission from, the

financial statements of events, transactions, or

significant information.

• Intentional misapplication of accounting principles

relating to amount, classification, manner of

presentation, or disclosure.

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution

without the prior written consent of McGraw-Hill Education. 4-26

Learning Objective 04-6

The Fraud Risk Assessment

Process

The fraud risk identification process includes:

Sources of information about possible fraud―

▪ Discussion among the audit team

▪ Inquiries of management and others

▪ Analytical procedures

▪ Investigation of unexpected period-end adjustments

▪ Identification of fraud risk factors

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution

without the prior written consent of McGraw-Hill Education. 4-27

Learning Objective 04-6

Conditions Indicative of Fraud and

Fraud Risk Factors

Three conditions usually exist when fraud occurs.

Incentive or Opportunity to

pressure to carry out the

perpetrate fraud Fraud fraud

Risk

Triangle

Attitude or

rationalization to

justify fraud

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution

without the prior written consent of McGraw-Hill Education. 4-28

Learning Objective 04-6

Risk Factors Relating to Incentive/Pressure

(See Table 4-2)

Fraudulent Financial Reporting

Risk Factors Relating to Incentive/Pressure include:

Excessive Management’s

pressure for Financial

personal

management to stability or

financial

meet third party profitability is

situation is

expectations threatened

threatened

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution

without the prior written consent of McGraw-Hill Education. 4-29

Learning Objective 04-6

Risk Factors Relating to Opportunities

(See Table 4-3)

Fraudulent Financial Reporting

Risk Factors Relating to Opportunities include:

Nature of the Complex or

Industry or unstable

entity’s organizational

operations structure

Ineffective Deficient

monitoring of internal

management control

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution

without the prior written consent of McGraw-Hill Education. 4-30

Learning Objective 04-6

Risk Factors Relating to

Attitudes/Rationalizations (See Table 4-4)

Fraudulent Financial Reporting

Risk Factors Relating to Attitudes/Rationalizations include:

Nonfinancial management’s Ineffective communication of ethical

excessive participation in selection of standards or selection of

accounting principles and estimates inappropriate ethical standards

Recurring attempts to justify

Excessive interest by management in

marginal or inappropriate accounting

stock prices and earning trends

based on materiality

Committing to aggressive or History of violations of securities laws

unrealistic forecasts or allegations of fraud

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution

without the prior written consent of McGraw-Hill Education. 4-31

Learning Objective 04-6

TABLE 4-5 Risk Factors Relating to the

Misappropriation of Assets

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution

without the prior written consent of McGraw-Hill Education. 4-32

Learning Objective 04-6

Knowledge Assessment

Which of the following is an example of fraudulent financial

reporting?

A. Company management falsifies the inventory count, thereby overstating

ending inventory and understating cost of sales.

B. An employee diverts customer payments to his personal use, concealing

his actions by debiting an expense account, thus overstating expenses.

C. An employee steals inventory, and the shrinkage is recorded as cost of

goods sold.

D. An employee borrows small tools from the company and neglects to

return them; the cost is reported as a miscellaneous operation expense.

(MC Question 4-20)

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution

without the prior written consent of McGraw-Hill Education. 4-33

Learning Objective 04-6

Knowledge Assessment

Which of the following is an example of fraudulent financial

reporting?

A. Company management falsifies the inventory count, thereby

overstating ending inventory and understating cost of sales.

B. An employee diverts customer payments to his personal use, concealing

his actions by debiting an expense account, thus overstating expenses.

C. An employee steals inventory, and the shrinkage is recorded as cost of

goods sold.

D. An employee borrows small tools from the company and neglects to

return them; the cost is reported as a miscellaneous operation expense.

(MC Question 4-20)

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution

without the prior written consent of McGraw-Hill Education. 4-34

Learning Objective 04-7

FIGURE 4-3 The Process of Responding to the Risk of

Material Misstatement and the Design and Performance of

Audit Procedures

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution

without the prior written consent of McGraw-Hill Education. 4-35

Learning Objective 04-7

Auditor’s Response to the Risk

Assessment Results

To respond appropriately to financial statement level

risks, the auditor may do the following:

● Assign more experienced personnel or those with

specialized knowledge.

● Evaluate the selection and application of accounting

policies to identify earnings management or bias

that may create a material misstatement.

● Incorporate additional elements of unpredictability

in the selection of audit procedures.

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution

without the prior written consent of McGraw-Hill Education. 4-36

Learning Objective 04-8

Evaluation of Audit Test Results

(1 of 2)

At the completion of the audit, the auditor should

consider:

● 1. Whether the total misstatements cause the financial

statements to be materially misstated.

● THEN …

● If the financial statements are materially misstated, the

auditor should:

● 1. Request management to eliminate the material

misstatement, or

● 2. If management does not make needed adjustments, the

auditor should issue a qualified or adverse opinion.

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution

without the prior written consent of McGraw-Hill Education. 4-37

Learning Objective 04-8

Evaluation of Audit Test Results

(2 of 2)

If the auditor determines that the misstatement is or may

be the result of fraud, and has determined that the effect

could be material, the auditor should:

● Attempt to obtain audit evidence to determine whether, in

fact, material fraud has occurred and, if so, its effect.

● Consider the implications for other aspects of the audit.

● Discuss the matter and the approach to further investigation

with an appropriate level of management that is at least one

level above those involved in committing the fraud and with

senior management.

● Suggest that the appropriate level of management consult

with legal counsel.

● Consider withdrawing from the engagement.

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution

without the prior written consent of McGraw-Hill Education. 4-38

Learning Objective 04-9

Documentation of the Auditor’s

Risk Assessment

The auditor should document:

● Discussions among engagement personnel.

● Procedures performed to identify and assess the risks of

material misstatement due to error or fraud.

● Fraud risks or other conditions that result in additional

audit procedures.

● The nature, timing, and extent of procedures performed

in response to fraud risks identified and the results of

that work.

● The nature of the communications about error or fraud

made to management, the audit committee, and others.

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution

without the prior written consent of McGraw-Hill Education. 4-39

Learning Objective 04-10

Communications about Fraud

(1 of 2)

Whenever the auditor has found evidence that a fraud

may exist, that matter should be brought to the

attention of an appropriate level of management. Fraud

involving senior management and fraud that causes a

material misstatement of the financial statement should

be reported directly to the audit committee.

The auditor should reach an understanding with the

audit committee regarding the expected nature and

extent of communications about misappropriations

perpetrated by lower-level employees.

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution

without the prior written consent of McGraw-Hill Education. 4-40

Learning Objective 04-10

Communications about Fraud

(2 of 2)

The disclosure of fraud to parties other than the client’s

senior management and its audit committee ordinarily is

not part of the auditor’s responsibility and ordinarily would

be precluded by the auditor’s ethical or legal obligations of

confidentiality, except when the following conditions exist:

● To comply with certain legal and regulatory

requirements.

● To a successor auditor when the successor makes

inquiries of the predecessor auditor about the client.

● In response to a subpoena.

● To a funding agency or other specified agency in

accordance with requirements for the audits of entities

that receive governmental financial assistance.

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution

without the prior written consent of McGraw-Hill Education. 4-41

You might also like

- How to Measure Training Results: A Practical Guide to Tracking the Six Key IndicatorsFrom EverandHow to Measure Training Results: A Practical Guide to Tracking the Six Key IndicatorsRating: 5 out of 5 stars5/5 (3)

- Eilifsen 3rd Chap04 PPTDocument46 pagesEilifsen 3rd Chap04 PPTtahani almuqatiNo ratings yet

- Risk Assessment and MaterialityDocument17 pagesRisk Assessment and Materialityងួន ម៉េងសុងNo ratings yet

- Chapter 03 PP T InternationalDocument30 pagesChapter 03 PP T InternationalJohn Churchill Gil SaducosNo ratings yet

- Chapter 1 MessierDocument37 pagesChapter 1 MessierbongzhiqiNo ratings yet

- Auditing and Assurance ServicesDocument53 pagesAuditing and Assurance Servicesdes arellanoNo ratings yet

- Messier 11e Chap05Document56 pagesMessier 11e Chap05Thanushasree VellaisamyNo ratings yet

- Togdher University: Course: Audit Instructor: Abdihakim Tiyari (BA, MBA) Credit Hour: 3 HrsDocument36 pagesTogdher University: Course: Audit Instructor: Abdihakim Tiyari (BA, MBA) Credit Hour: 3 HrsCabdixakiim-Tiyari Cabdillaahi AadenNo ratings yet

- Risk Assessment: © Mcgraw-Hill Education 2014Document35 pagesRisk Assessment: © Mcgraw-Hill Education 2014NaeemNo ratings yet

- Ar 09Document48 pagesAr 09carter PadNo ratings yet

- CHAPTER 1B Risk Based AuditDocument5 pagesCHAPTER 1B Risk Based AuditLydelle Mae CabaltejaNo ratings yet

- Risk Register TemplateDocument20 pagesRisk Register TemplatesavasgNo ratings yet

- Risk Assessment and Materiality: Mcgraw-Hill/IrwinDocument38 pagesRisk Assessment and Materiality: Mcgraw-Hill/IrwinZi VillarNo ratings yet

- Kitcb D01.nhóm 7Document44 pagesKitcb D01.nhóm 7Mạnh hưng LêNo ratings yet

- TOPIC 3e - Risk and MaterialityDocument33 pagesTOPIC 3e - Risk and MaterialityLANGITBIRUNo ratings yet

- CH 07Document3 pagesCH 07Minh Thu Võ NgọcNo ratings yet

- Auditing and Assurance Services: The Financial Statement Auditing EnvironmentDocument38 pagesAuditing and Assurance Services: The Financial Statement Auditing EnvironmentIman NessaNo ratings yet

- Risk Assesment by Program AreaDocument7 pagesRisk Assesment by Program AreaJoanne PerandoNo ratings yet

- RisksDocument7 pagesRisksJaden EuNo ratings yet

- Audit Planning and Materi-AlityDocument47 pagesAudit Planning and Materi-Alityaster sebsbeNo ratings yet

- Aud15 PPT 09 GeDocument47 pagesAud15 PPT 09 GeNermin Ramadan Naser MohamedNo ratings yet

- Risk Identification & Analysis: Qualitative Techniques Are Used First Like High, Medium and LowDocument37 pagesRisk Identification & Analysis: Qualitative Techniques Are Used First Like High, Medium and LowHenry dragoNo ratings yet

- Advanced Auditing Chapter FourDocument52 pagesAdvanced Auditing Chapter FourmirogNo ratings yet

- Arens - Aud16 - Inppt09 (Sesi 10)Document44 pagesArens - Aud16 - Inppt09 (Sesi 10)Denisse Aretha LeeNo ratings yet

- 09 Risk ManagementDocument6 pages09 Risk ManagementEmamoke AgbaudutaNo ratings yet

- Chapter 9 Financial Auditing SlidesDocument15 pagesChapter 9 Financial Auditing SlidesLuong Thao LinhNo ratings yet

- Lecture 2 3 Recap Audit ProcessDocument34 pagesLecture 2 3 Recap Audit ProcessSourav MahadiNo ratings yet

- Procedure Risk and OpportunitiesDocument5 pagesProcedure Risk and Opportunitiesamyn_s100% (2)

- Book - Ch12 An Alternative View of Risk - 12eDocument26 pagesBook - Ch12 An Alternative View of Risk - 12eMhmood Al-saadNo ratings yet

- Lecture 4 Risks of Material MisstatementsDocument27 pagesLecture 4 Risks of Material Misstatementsshajea aliNo ratings yet

- Audit Tutorial 7Document9 pagesAudit Tutorial 7Chong Soon KaiNo ratings yet

- BM 523 Module 12 Business Risk ManagementDocument5 pagesBM 523 Module 12 Business Risk ManagementJasper BulaongNo ratings yet

- Lecture 3 - Project Risk Management BasicsDocument42 pagesLecture 3 - Project Risk Management Basicsjaveria zahidNo ratings yet

- Info Sheet Assessing RiskDocument5 pagesInfo Sheet Assessing RiskalkalkiaNo ratings yet

- AKSK Pertemuan 4Document26 pagesAKSK Pertemuan 4ErikaNo ratings yet

- Chapter 04Document39 pagesChapter 04LouiseNo ratings yet

- Boutique Build Australia: Risk Management PlanDocument3 pagesBoutique Build Australia: Risk Management PlanSubash UpadhyayNo ratings yet

- Fraud Risk FormDocument2 pagesFraud Risk FormShelvy SilviaNo ratings yet

- Pmi RMP PRSNT MSTR NuDocument18 pagesPmi RMP PRSNT MSTR Nugulam mustafaNo ratings yet

- Larson17ce - PPT - V1 - Ch07 (2023 - 01 - 09 00 - 10 - 56 UTC)Document91 pagesLarson17ce - PPT - V1 - Ch07 (2023 - 01 - 09 00 - 10 - 56 UTC)rbasaiti1No ratings yet

- AuditingDocument99 pagesAuditingWen Xin GanNo ratings yet

- Compliance Auditing: 4 Annual Pharmaceutical Regulatory and Compliance Congress and Best Practices ForumDocument35 pagesCompliance Auditing: 4 Annual Pharmaceutical Regulatory and Compliance Congress and Best Practices ForumShah Maqsumul Masrur TanviNo ratings yet

- Arens Aud16 Inppt09Document33 pagesArens Aud16 Inppt09euncieNo ratings yet

- 4 5850471109056532138Document39 pages4 5850471109056532138Yehualashet MulugetaNo ratings yet

- Bus 303 Final Assignment DoneDocument10 pagesBus 303 Final Assignment DonePorosh Uddin Ahmed TaposhNo ratings yet

- AF W12 - Fraud Risk Assessment - ENGDocument17 pagesAF W12 - Fraud Risk Assessment - ENGjokitugasbro.idNo ratings yet

- Chapter 3 - : - Risk Assessment and Internal ControlDocument26 pagesChapter 3 - : - Risk Assessment and Internal ControlTamanna AroraNo ratings yet

- Exam Technique For Advanced Audit and AssuranceDocument5 pagesExam Technique For Advanced Audit and AssurancebunipatNo ratings yet

- The Ultimate Guide To Implementing An Effective Anti-Bribery and Corruption ProgramDocument30 pagesThe Ultimate Guide To Implementing An Effective Anti-Bribery and Corruption Programmichael christopherNo ratings yet

- Group 1 Auditing RISK AUDITDocument24 pagesGroup 1 Auditing RISK AUDITFlamive VongNo ratings yet

- OTQMDocument42 pagesOTQMChabelita Calledo CristinoNo ratings yet

- Module 3 CG 2022Document18 pagesModule 3 CG 2022Parikshit MishraNo ratings yet

- Risk Management CertificationDocument21 pagesRisk Management CertificationvinayNo ratings yet

- PP IA Presnetation VIew ModeDocument11 pagesPP IA Presnetation VIew ModeNicholas CoxNo ratings yet

- 2 Combined Risk AssesmentDocument15 pages2 Combined Risk AssesmentChaitra Kshathriya MNo ratings yet

- Risk Management PlanDocument8 pagesRisk Management PlanHARDEEP KAURNo ratings yet

- ACCA AA Audit Risk - Technical ArticleDocument5 pagesACCA AA Audit Risk - Technical Articlesaleema ohabNo ratings yet

- Tutorial 10Document4 pagesTutorial 10musicslave96No ratings yet

- Audit Risk: Risk Assessment Test of Controls Substantive ProceduresDocument17 pagesAudit Risk: Risk Assessment Test of Controls Substantive ProceduresUsama RajaNo ratings yet

- Audit Evidence and DocumentationDocument14 pagesAudit Evidence and DocumentationAlyssa Hallasgo-Lopez AtabeloNo ratings yet

- Chapter 10: Cash and Financial InvestmentsDocument13 pagesChapter 10: Cash and Financial Investmentsdes arellanoNo ratings yet

- Franchise Accounting PDF FreeDocument5 pagesFranchise Accounting PDF Freedes arellanoNo ratings yet

- 6process Costing Cost of Goods Sold InventoryDocument10 pages6process Costing Cost of Goods Sold Inventorydes arellanoNo ratings yet

- Acct 311 Exam 2 Practice: Attempt HistoryDocument27 pagesAcct 311 Exam 2 Practice: Attempt Historydes arellanoNo ratings yet

- Thanks For Your Interest in RevDocument1 pageThanks For Your Interest in Revdes arellanoNo ratings yet

- Enron: The Accounting ScandalDocument20 pagesEnron: The Accounting Scandaldes arellanoNo ratings yet

- Cir Vs First Express PawnshopDocument16 pagesCir Vs First Express Pawnshopjan panerioNo ratings yet

- Project On Comparison Between Stock BrokersDocument15 pagesProject On Comparison Between Stock BrokersankitsawhneyNo ratings yet

- CompensationDocument17 pagesCompensationConie BabierraNo ratings yet

- Using WBS To Decompose Specific Project TasksDocument9 pagesUsing WBS To Decompose Specific Project TaskswinsomeNo ratings yet

- Corporate Finance StrategyDocument498 pagesCorporate Finance StrategyBanh MatNo ratings yet

- United Paragon Mining Corporation SEC 17 Q June302020Document51 pagesUnited Paragon Mining Corporation SEC 17 Q June302020Jon DonNo ratings yet

- Using Value Stream Mapping ToDocument12 pagesUsing Value Stream Mapping ToAlexanderHFFNo ratings yet

- ADB Financial Governance ManagementDocument582 pagesADB Financial Governance ManagementSyed NaeemNo ratings yet

- Exercise - IAS 23 Borrowing CostsDocument6 pagesExercise - IAS 23 Borrowing CostsMazni Hanisah100% (1)

- Gartner Business FrameworkDocument23 pagesGartner Business Frameworkcorneliuskoo75% (4)

- Assessing Financial Health (Part-A)Document17 pagesAssessing Financial Health (Part-A)kohacNo ratings yet

- Talent Acquisition and RetentionDocument15 pagesTalent Acquisition and RetentionSwati BagariaNo ratings yet

- Loan Functions of BanksDocument6 pagesLoan Functions of BanksMark AmistosoNo ratings yet

- Mckinsey Solution SellingDocument16 pagesMckinsey Solution SellingProjectSoul100% (11)

- Xi3 RM Sap HR Ug enDocument694 pagesXi3 RM Sap HR Ug enMukkusrikanthreddy ReddyNo ratings yet

- 20 AnnexureDocument7 pages20 AnnexureAfreen ShaikhNo ratings yet

- Range Accrual Swaps - A Dangerous Game - LinkedInDocument10 pagesRange Accrual Swaps - A Dangerous Game - LinkedInmeshael FahadNo ratings yet

- Group 2 - Assignment 3 - Ethics and Social ResponsibilityDocument6 pagesGroup 2 - Assignment 3 - Ethics and Social ResponsibilityDarshan BhavsarNo ratings yet

- Iso 14001Document17 pagesIso 14001vishnu m v100% (3)

- Sample USA ResumeDocument2 pagesSample USA ResumeJutt JuttNo ratings yet

- A Study of Warehouse Management System in SingaporeDocument8 pagesA Study of Warehouse Management System in SingaporeRaj PalNo ratings yet

- This Study Resource Was: (Question)Document3 pagesThis Study Resource Was: (Question)Mir Salman AjabNo ratings yet

- Accounting CycleDocument37 pagesAccounting CycleAaron Aivan Ting100% (2)

- Spark Research 18 June 2018 PDFDocument37 pagesSpark Research 18 June 2018 PDFAdroit WaterNo ratings yet

- Presentation Induction Quaity NewDocument31 pagesPresentation Induction Quaity Newkbldam67% (6)

- MIS Hotel ManagementDocument27 pagesMIS Hotel Managementyogesh_sherla87% (15)

- Real Property Tax Audit With Management Comment and ExhibitsDocument29 pagesReal Property Tax Audit With Management Comment and ExhibitsDaily FreemanNo ratings yet

- Chapter 13 Motivation at WorkDocument7 pagesChapter 13 Motivation at WorkVincent ChurchillNo ratings yet

- Change Request (CR) / Request For Information (RFI)Document8 pagesChange Request (CR) / Request For Information (RFI)krmchariNo ratings yet

- Term Paper On IbblDocument37 pagesTerm Paper On Ibblreza786No ratings yet