Professional Documents

Culture Documents

STD Costing Lecture 2

Uploaded by

Sajid Zeb0 ratings0% found this document useful (0 votes)

16 views10 pagesCost Accounting

Original Title

STD COSTING LECTURE 2

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCost Accounting

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

16 views10 pagesSTD Costing Lecture 2

Uploaded by

Sajid ZebCost Accounting

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 10

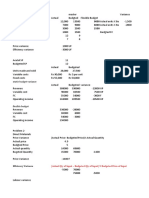

Q#2: Following is the information of Zafar corporation for the month of January 2019.

Variance

STANDARD ACTUAL

ITEMS

COST COST Favourable UnFavourable

Rs. Rs. Rs. Rs.

D.Material ? 90,000

Price Variance 7,000

Quantity Variance 5,000

Direct Labour ? 160,000

Rate Variance 4,500

Efficiency Variance 10,500

FOH cost 160,000 ?

Controllable variance 10,000

Volume Variance 16,000

REQUIRED:-

•Find out the missing figure of the table

•Record journal entries and close variance accounts.

Material

Actual Cost 90,000

Add: Material Price Variance (Fav) 7,000

Less: Material Quantity Variance (U.Fav) (5,000)

Standard Cost 92,000

LAbour

Actual Cost 160,000

Add: Labour Efficiency Variance (Fav) 10,500

Less: Labour Rate Variance (U.Fav) (4,500)

Standard Cost 166,000

Factory Overhead

Standard Cost 160,000

Add: Volume Variance (U.Fav) 16,000

Less: Controllable Variance (Fav) (10,000)

Actual Cost 166,000

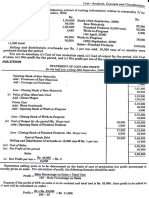

M/s Zafar Corporations

JOURNAL ENTRIES

DATE PARTICULARS P/R DEBIT CREDIT

Work In Process (M)

01

92,000

(U.Fav)

Material Quantity Variance

5,000

Variance (Fav)

Material Price

7,000

R.Material

90,000

To record material variance

02 Work In Process (L)

166,000

Labour Rate Variance (U.Fav)

4,500

Labour Efficiency Variance (Fav)

10,500

Accrued Payroll 160,000

To record Labour variance

03

Work In Process (F) 160,000

Volume Variance (U.Fav) 16,000

Controllable Variance ( Fav) 10,000

Factory Overhead

166,000

To record FOH variance

M/s Zafar Corporations

JOURNAL ENTRIES

DATE PARTICULARS P/R DEBIT CREDIT

Material price Variance (Fav)

04

7,000

Labour Efficiency Variance (Fav)

10,500

Controllable Variance (Fav)

10,000

Cost Of Goods Sold

8,000

Material Quantity Variance (U.Fav)

5,000

Labour Rate Variance (U.Fav) 4,500

Volume Variance (U.Fav) 10,000

To record Close variances

Q#3: The Accountant of ABC Company extracted the following information regarding standard

cost and actual cost of Factory overhead of the product manufactured in June 2019.

STANDARD: Rs.9,000 fixed cost and Rs.5,000 variable cost for 10,000 units of normal

volume.

ACTUAL: Rs.9,000 fixed cost and Rs.4,500 variable cost for 8,000 units of Actual Production.

Required:-

Compute Controllable and volume variance from the given information.

FACTORY OVERHEAD

Standard Variable Cost Per Unit = Std Variable Cost ÷ Std T.Qty

Standard Variable Cost Per Unit = 5,000 ÷ 10,000

Standard Variable Cost Per Unit = 0.5 Per Unit

Budgeted/Estimated FOH = Fixed Cost + Variable Cost(Std V.Cost per unit

× Actual total

Quantity)

Budgeted/Estimated FOH = 9,000 + (0.5 × 8,000)

Budgeted/Estimated FOH = 9,000 + 4,000

Budgeted/Estimated FOH = 13,000

Standard FOH Cost Per Unit = Std FOH Cost ÷ Std T.Qty

Standard FOH Cost Per Unit = 14000 ÷ 10,000

Standard FOH Cost Per Unit = 1.4

Applied/Standard FOH on actual output = Standard FOH Cost Per Unit × Actual Qty

Applied/Standard FOH on actual output = 1.4 × 8,000

Applied/Standard FOH on actual output = 11,200

Volume/ Idle Capacity Variance :

Applied/Standard FOH on actual output 11,200

Less: Budgeted/Estimated FOH (13,000)

Volume/ Idle Capacity Variance (1,800)

Controllable Variance :

Budgeted/Estimated FOH 13,000

Less: Actual FOH (14,500)

Controllable Variance (1,500)

You might also like

- Standard Actual R. Material D. Labour FOHDocument10 pagesStandard Actual R. Material D. Labour FOHSajid ZebNo ratings yet

- Standard Costing - 08 January 2022Document6 pagesStandard Costing - 08 January 2022Emmanuel VillafuerteNo ratings yet

- Variances in ExcelDocument5 pagesVariances in Excelbiasab123No ratings yet

- Kelompok 8 (Raw)Document5 pagesKelompok 8 (Raw)RezaNo ratings yet

- CH 22 Wiley Kimmel Quiz HomeworkDocument8 pagesCH 22 Wiley Kimmel Quiz Homeworkmki100% (1)

- Ac417 Solution R174903ZDocument5 pagesAc417 Solution R174903ZPresident MusukiNo ratings yet

- Class Exercises 11Document2 pagesClass Exercises 11revu_87No ratings yet

- COST MANAGEMENT AND CONTROL CIA - Sheet1Document6 pagesCOST MANAGEMENT AND CONTROL CIA - Sheet1neha konarNo ratings yet

- Exercise 12B-2 - Kelompok 1Document2 pagesExercise 12B-2 - Kelompok 1Lucky esteritaNo ratings yet

- RAT/AC/2018/F/0008: Budgeted Profit StatementDocument8 pagesRAT/AC/2018/F/0008: Budgeted Profit StatementumeshNo ratings yet

- AC Manufacting Jobs Job 01 Assembling Job 02 Wiring Job 03 CoveringDocument9 pagesAC Manufacting Jobs Job 01 Assembling Job 02 Wiring Job 03 CoveringSaqib AliNo ratings yet

- John's Plant Cost Variance ReportDocument8 pagesJohn's Plant Cost Variance ReportJeanDianeJoveloNo ratings yet

- Standard Cost Under Absorption and Variable CostingDocument4 pagesStandard Cost Under Absorption and Variable CostingMeghan Kaye LiwenNo ratings yet

- Variable Costing April Revenues 8,400,000Document10 pagesVariable Costing April Revenues 8,400,000Hiền NguyễnNo ratings yet

- Job Order Costing Practice and Lecture QuestionDocument10 pagesJob Order Costing Practice and Lecture QuestionManaal HussainNo ratings yet

- 03 Mock Test AnswerDocument22 pages03 Mock Test AnswerKSNo ratings yet

- KTQT-2 C10Document5 pagesKTQT-2 C10Huệ ĐặngNo ratings yet

- Variances Working Sheet CDocument12 pagesVariances Working Sheet CHitesh YadavNo ratings yet

- Standard Production 10000units Standard Usage For 10000 Units 1lb/ Unit 10000 LbsDocument16 pagesStandard Production 10000units Standard Usage For 10000 Units 1lb/ Unit 10000 LbsAleena AmirNo ratings yet

- Sp. Order Costing Lecture 2Document7 pagesSp. Order Costing Lecture 2Sajid ZebNo ratings yet

- Variance Analysis Problems With AnswersDocument5 pagesVariance Analysis Problems With AnswersMaricon Berja67% (3)

- Prepared By: Homam Atif Abbas Elhassan VariancesDocument5 pagesPrepared By: Homam Atif Abbas Elhassan VariancesMustafa AroNo ratings yet

- Local Media1729003455024620414Document8 pagesLocal Media1729003455024620414Jovie LynnNo ratings yet

- Variance Analysis - 084249Document20 pagesVariance Analysis - 084249Adams JoshuaNo ratings yet

- Acca107 Oh Variance Quiz Oct 25 2021 Solution - Sheet1Document9 pagesAcca107 Oh Variance Quiz Oct 25 2021 Solution - Sheet1Mary Kate OrobiaNo ratings yet

- Under And: Variable CostingDocument11 pagesUnder And: Variable CostingNazmul-Hassan SumonNo ratings yet

- Labor VariancesDocument4 pagesLabor VariancesMeghan Kaye LiwenNo ratings yet

- 2) Solution To Problem No 2 On Flexible BudgetDocument7 pages2) Solution To Problem No 2 On Flexible BudgetVikas guptaNo ratings yet

- Cost Accounting Practical Problems 1Document25 pagesCost Accounting Practical Problems 1Rishika MadhukarNo ratings yet

- Homework No.12Document6 pagesHomework No.12Danna ClaireNo ratings yet

- Budgetary ControlDocument7 pagesBudgetary ControlKuldeep NNo ratings yet

- PM January 2021 Lecture 4 Worked Examples Questions (Drury (2012), P. 451, 17.17)Document6 pagesPM January 2021 Lecture 4 Worked Examples Questions (Drury (2012), P. 451, 17.17)KAY PHINE NGNo ratings yet

- 1-25a MACHINE A: Breakeven Analysis Cost vs. RevenueDocument22 pages1-25a MACHINE A: Breakeven Analysis Cost vs. RevenueMuhammad AliNo ratings yet

- Standard Costing Presentation 091951Document5 pagesStandard Costing Presentation 091951Sofia BaguinatNo ratings yet

- Template For Standard Costing - For BA StudentDocument9 pagesTemplate For Standard Costing - For BA StudentBetchang AquinoNo ratings yet

- Jawaban No 4Document2 pagesJawaban No 4diaheka1712No ratings yet

- CostingDocument56 pagesCostingKartNo ratings yet

- Financial Statement Analysis Current RatioDocument8 pagesFinancial Statement Analysis Current RatioAdrian MontemayorNo ratings yet

- 17 - Billing Rate Edit (OK)Document16 pages17 - Billing Rate Edit (OK)Mike RidyawatiNo ratings yet

- Problem Fitzhugh CompanyDocument15 pagesProblem Fitzhugh CompanyJerome Norbe Salangad0% (1)

- Manpower Complementreport 4th QTR 2016Document1 pageManpower Complementreport 4th QTR 2016LGU PadadaNo ratings yet

- Chapter16 Substantive Tests of Income Statement Accounts - Unlocked PDFDocument7 pagesChapter16 Substantive Tests of Income Statement Accounts - Unlocked PDFabc xyzNo ratings yet

- Accounting Khalil 198Document11 pagesAccounting Khalil 198Khalil JuttNo ratings yet

- Ma Lesson 05 Oh Cost VarianceDocument7 pagesMa Lesson 05 Oh Cost VarianceDamith SarangaNo ratings yet

- Kate CompanyDocument3 pagesKate CompanyLucile Lleva80% (5)

- Net Variance 16 290UDocument2 pagesNet Variance 16 290UKent LumanasNo ratings yet

- Day 4 (My)Document11 pagesDay 4 (My)Jhilmil JeswaniNo ratings yet

- Standard Cost Card: Raw Materials Cost in Flexible Budget 24,000 Units X 6 Pounds X $8 Per Pound $1,152,000Document4 pagesStandard Cost Card: Raw Materials Cost in Flexible Budget 24,000 Units X 6 Pounds X $8 Per Pound $1,152,000Duyên HồNo ratings yet

- Gross Profit Variation Analysis-EXERCISE-1-3Document3 pagesGross Profit Variation Analysis-EXERCISE-1-3Trisha MaeNo ratings yet

- Intersol GL FinacleDocument31 pagesIntersol GL FinacleManish WaniNo ratings yet

- Assignment: AnswerDocument6 pagesAssignment: AnswerumeshNo ratings yet

- IntercomDocument2 pagesIntercomLukshi Sandika KrishnarathnaNo ratings yet

- Exercise 1 5Document1 pageExercise 1 5lheamaecayabyab4No ratings yet

- Tugas Week 11Document2 pagesTugas Week 11Rifda AmaliaNo ratings yet

- Session 7Document20 pagesSession 7Hamza BennisNo ratings yet

- Gabuya, Christine EDocument4 pagesGabuya, Christine Echristine gabuyaNo ratings yet

- Order No. REF ParticularsDocument21 pagesOrder No. REF ParticularsMohammad Aarif100% (1)

- Module 5 AssignmentDocument5 pagesModule 5 AssignmentMayNo ratings yet

- Planning & Operational VariancesDocument14 pagesPlanning & Operational VariancesAku PaulNo ratings yet

- SD Unit 3Document6 pagesSD Unit 3Sajid ZebNo ratings yet

- 4 29 4upDocument4 pages4 29 4upSajid ZebNo ratings yet

- The Business Vision & Mission: Strategic Management: Concepts & Cases 10 Edition Fred DavidDocument15 pagesThe Business Vision & Mission: Strategic Management: Concepts & Cases 10 Edition Fred DavidSajid ZebNo ratings yet

- Lecture 1 SecurityDocument18 pagesLecture 1 SecuritySajid ZebNo ratings yet

- Security Attacks Lecture 2Document21 pagesSecurity Attacks Lecture 2Sajid ZebNo ratings yet

- PSO Final Report-Strategic ManagementDocument65 pagesPSO Final Report-Strategic ManagementSajid ZebNo ratings yet

- Strategic ManagementDocument5 pagesStrategic ManagementSajid ZebNo ratings yet

- Course Title: Data Communication and Networks Instructor Name: Muhammad Farhan Siddiqui Lecture / Week No.5Document38 pagesCourse Title: Data Communication and Networks Instructor Name: Muhammad Farhan Siddiqui Lecture / Week No.5Sajid ZebNo ratings yet

- Mission Vision StatementDocument3 pagesMission Vision StatementSajid ZebNo ratings yet

- Sp. Order Costing Lecture 2Document7 pagesSp. Order Costing Lecture 2Sajid ZebNo ratings yet

- Programmatic PosterDocument2 pagesProgrammatic PosterBorderBRENo ratings yet

- Quality Function of The Deployment NewDocument22 pagesQuality Function of The Deployment NewMuhammad IrfanNo ratings yet

- Details FM DATADocument212 pagesDetails FM DATAAbhishek MishraNo ratings yet

- 273 277, Tesma508, IJEASTDocument5 pages273 277, Tesma508, IJEASTYassin DyabNo ratings yet

- Motorola - Strategic OverviewDocument18 pagesMotorola - Strategic OverviewjklsdjkfNo ratings yet

- Designing Successful Go To Market SrategiesDocument21 pagesDesigning Successful Go To Market Srategiessaurav_edu67% (3)

- Marketing - Module 9 The Marketing Mix - PROMOTIONDocument12 pagesMarketing - Module 9 The Marketing Mix - PROMOTIONKJ Jones100% (3)

- B2B Marketing 1-1 1-Few and 1 To ManyDocument4 pagesB2B Marketing 1-1 1-Few and 1 To ManyAjitesh AbhishekNo ratings yet

- Marketing 3.0: Dr. (Prof.) Philip KotlerDocument9 pagesMarketing 3.0: Dr. (Prof.) Philip KotleroutkastedNo ratings yet

- DHFL Pramerica Deep Value Strategy PMSDocument4 pagesDHFL Pramerica Deep Value Strategy PMSAnkurNo ratings yet

- Decision-Making ToolsDocument17 pagesDecision-Making ToolsLovely Bueno Don-EsplanaNo ratings yet

- Virtusa Pegasystems Engagement Success StoriesDocument20 pagesVirtusa Pegasystems Engagement Success StoriesEnugukonda UshasreeNo ratings yet

- Mini Project ON "Amazon - In": Future Institute of Management & Technology Bareilly - Lucknow Road Faridpur, BareillyDocument44 pagesMini Project ON "Amazon - In": Future Institute of Management & Technology Bareilly - Lucknow Road Faridpur, BareillyImran AnsariNo ratings yet

- 10-1 - Developing An Effective Business PlanDocument21 pages10-1 - Developing An Effective Business PlanZameer AbbasiNo ratings yet

- Managing Key Business ProcessesDocument12 pagesManaging Key Business ProcessesMNo ratings yet

- GARGAR - PARTNERSHIP DISSOLUTION - LongQuizDocument5 pagesGARGAR - PARTNERSHIP DISSOLUTION - LongQuizSarah GNo ratings yet

- Taylor Nelson Sofres: From Wikipedia, The Free EncyclopediaDocument4 pagesTaylor Nelson Sofres: From Wikipedia, The Free EncyclopediaMonique DeleonNo ratings yet

- Types of Maintenance and Their Characteristics: Activity 2Document7 pagesTypes of Maintenance and Their Characteristics: Activity 2MusuleNo ratings yet

- Difference Between Verification and ValidationDocument3 pagesDifference Between Verification and Validationsdgpass2585100% (1)

- Word DiorDocument3 pagesWord Diorlethiphuong15031999100% (1)

- MKT MGT - Sju - W1BDocument20 pagesMKT MGT - Sju - W1BCamelia MotocNo ratings yet

- @magzrock Dalal Street Invest Jour - June - 2017Document69 pages@magzrock Dalal Street Invest Jour - June - 2017Srinivasulu MachavaramNo ratings yet

- Functional RequirementDocument6 pagesFunctional RequirementmanishNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Syed SameerNo ratings yet

- QuestionnaireDocument5 pagesQuestionnaireNouman ShahNo ratings yet

- Chapter 1 - Indian Financial System - IntroductionDocument26 pagesChapter 1 - Indian Financial System - IntroductionsejalNo ratings yet

- Swiggy Refine - AswathyUdhayDocument6 pagesSwiggy Refine - AswathyUdhayAswathy UdhayakumarNo ratings yet

- Temporary Works ManagementDocument15 pagesTemporary Works ManagementHasitha Athukorala50% (2)

- Tesco 14 FullDocument4 pagesTesco 14 FullBilal SolangiNo ratings yet

- Annual Return of A Company (Other Than A Company Limited by Guarantee)Document5 pagesAnnual Return of A Company (Other Than A Company Limited by Guarantee)ramiduyasanNo ratings yet