Professional Documents

Culture Documents

Employee Benefits: PMV Dept Acc Msu 1

Uploaded by

LUKE MAKAMBAIRE0 ratings0% found this document useful (0 votes)

2 views45 pagesOriginal Title

IAS 19-employee benefits

Copyright

© © All Rights Reserved

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

2 views45 pagesEmployee Benefits: PMV Dept Acc Msu 1

Uploaded by

LUKE MAKAMBAIRECopyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 45

Employee benefits

PMv Dept Acc MSU 1

DEFINITIONS

• Employee benefits comprise all forms of

consideration given by an entity in exchange for

services rendered by employees or for termination

of their services

Employee benefits include settlements made to

employees, both past and present

• The standard should be applied to all employee

benefits, except for share-based payments within

the scope of IFRS 2

PMv Dept Acc MSU 2

DEFINITIONS [cont’d]

Employees include all categories: full-time, part-

time, permanent, casual, temporary,

management, directors as well as their spouses or

dependants where the benefits are paid to them

PMv Dept Acc MSU 3

Short-term employee benefits

Short term employee benefits

- Are employee benefits (excluding termination

benefits) that are:

. due to be settled wholly within 12 months

. after the end of period in which

employee

rendered related service

PMv Dept Acc MSU 4

Examples

- Salaries

- Short term paid absences

- Profit-sharing and bonus plans

- Non- monetary benefits (e.g. medical care, cars,

housing)

PMv Dept Acc MSU 5

Short-term employee benefits [cont’d]

Recognition and measurement - All short-

term employee benefits:

- Recognise when employee renders service

(accrual concept)

- Recognise the undiscounted amount as an

expense /liability when employee renders ,i.e.

. no actuarial assumptions are required

. no discounting is applied

PMv Dept Acc MSU 6

Short-term employee benefits [cont’d]

Short term compensated absences :

- can be accumulating or non-accumulating

Accumulating :

- can be carried to future periods if not fully

utilised in current period.

- can be either vesting or non-vesting

- vesting – entitled to cash payment on leaving

entity - raise entire liability

PMv Dept Acc MSU 7

Short-term employee benefits [cont’d]

- non-vesting – not entitled to cash payment on

leaving entity - raise liability for amount that

will be probably be “paid” if leave is taken

(because it is accumulating).

N.B. – Absences taken in year granted

- cost of this short-term absence is recognised as

party of salary (no separate adjustment is

required)

PMv Dept Acc MSU 8

Short-term employee benefits [cont’d]

Non-accumulating

- cannot be carried to future periods if not full

utilised in current period (forfeited)

- entity has no obligation to allow employee to

take the forfeited leave in future

- since there is no obligation, the definition of

liability is not met.

- therefore no provision of unused leave

PMv Dept Acc MSU 9

Short-term employee benefits [cont’d]

Profit sharing & bonus plans

• If given to employee as reward for services

rendered – considered to be to be employee benefit

• If payable within 12 months of year end –

considered short-term employee benefit (otherwise

– other long-term employee benefits)

• Recognise only when:

- there is a present obligation at year-end

- resulting from a past event

PMv Dept Acc MSU 10

Short-term employee benefits - Profit

sharing & bonus plans [cont’d]

- the obligation can be reliably estimated

• Obligation can either be legal or constructive

- a legal obligation would arise if the

employment contract incorporates the

profit-sharing or bonus arrangement

- a constructive obligation could arise as a result

of the entity’s past practices, policies or public

announcements

PMv Dept Acc MSU 11

Short-term employee benefits - Profit

sharing & bonus plans [cont’d]

• A reliable estimate of the expense associated with the

legal or constructive obligation under profit- sharing

or bonus plan can be made, when & only when:

- terms of the formal plan contain a formula for

determining the amount of the benefit;

- entity calculates the amounts to be paid before

authorisation of financial statements for issue;

or;

PMv Dept Acc MSU 12

- past practice gives clear evidence of the amount

of the entity’s constructive obligation

• Where a profit –sharing or bonus plan requires an

employee to remain in the entity’s service for a

specified period, there may be partial entitlement

or forfeiture.

• This probability must be factored into calculations

PMv Dept Acc MSU 13

Short-term employee benefits - Profit

sharing & bonus plans [cont’d]

Bonus schemes that are either:

- settled in the entity’s own shares; or

- based on, or determined on the entity’s share

price are not within the scope of IAS19, but

IFRS2

PMv Dept Acc MSU 14

Post-employment benefits

• Are employee benefits (excluding termination

and short-term benefits)

- payable after the completion of employment.

- it is the service that employee renders whilst

employed that gives entitlement

- to these benefits (past event)

- thus employee benefit expense (Dr) & post

employment benefit (Cr)

PMv Dept Acc MSU 15

Post-employment benefits [cont’d]

- are recognised as and when employee provides

services

can be either :

- defined contribution plan; or

- defined benefit plan;

- depending on whether the entity has obligation

to fund any possible short-fall the plan might

experience.

PMv Dept Acc MSU 16

Post-employment benefits [cont’d]

Defined contribution plan (DCP)

- are post-employment plans under which

- amounts to be paid as retirement benefits

- are determined by reference

- to cumulative total contributions to a fund

- by both employer & employee

- + investment earnings thereon.

- employer liability limited to contributions

PMv Dept Acc MSU 17

Post-employment benefits [cont’d]

payable to the separate fund

- risk that benefits will be less than expected

(actuarial risk) , &

- the risk that the assets invested will be

insufficient

- to meet expected benefits (investment risk)

- fall on the employee.

PMv Dept Acc MSU 18

Post-employment benefits [cont’d]

Recognition and Measurement

Defined contribution plans

- recognise an expense (Dr: Employee benefit

expense ) and

- liability (Cr: Contributions payable )

- when the employee render service

- no actuarial assumptions are need &

- normally undiscounted (if within 12 months)

PMv Dept Acc MSU 19

Post-employment benefits [cont’d]

Defined benefit plan (DBP)

- are post-employment benefit plans

- under which amounts to be paid as retirement

benefits

- to current & retired employees

- are determined using a formula

- usually based

- on employees’ remuneration/ years of service.

PMv Dept Acc MSU 20

Post-employment benefits [cont’d]

- risk that benefits will be less than expected

(actuarial risk) , &

- the risk that the assets invested will be

insufficient

- to meet expected benefits (investment risk)

- fall on the employer.

- the obligation of the entity is to provide agreed

benefits

PMv Dept Acc MSU 21

Post-employment benefits [cont’d]

- to finance the agreed upon benefits

- the entity uses assets set aside for this purpose

(plan assets)

- plan assets are financed from

- contributions by the employer & employees

- + investment returns on accumulated

contributions

PMv Dept Acc MSU 22

Post-employment benefits [cont’d]

When recognising a DBP, recognise both:

- the plan obligation (PO)(i.e. benefits owed to

employees)

- the plan assets (PA) (those set aside to settle

obligation)

- in FSs present net defined benefit plan asset or

- net defined benefit plan liability

- surplus recognised limited to asset ceiling

PMv Dept Acc MSU 23

Post-employment benefits [cont’d]

Asset ceiling is:

- the present value

- of any economic benefits available in the form

of:

. refunds from the plan, or

. reductions in future contributions to the

plan

- i.e. net defined plan asset limited to PV of

amounts actually receivable

PMv Dept Acc MSU 24

Post-employment benefits [cont’d]

amounts actually receivable by the entity

Future refunds are measured as:

- the surplus:

. FV of plan assets

. less PV of defined benefit obligations

- less any associated costs

- availability of a refund depends on rules of

the fund.

PMv Dept Acc MSU 25

Post-employment benefits [cont’d]

Future expected reductions in contributions are

measures at the lower of:

- the surplus; &

- PV of the estimated:

. Service cost to the entity for future service;

. Less minimum funding contributions

needed for the future accrual of benefits

PMv Dept Acc MSU 26

Post-employment benefits [cont’d]

Determining estimated obligation

Step 1

- use the projected unit credit method

- to make a reliable estimate of

- the promised benefit-actuarial assumptions

Step 2

- discount promised benefit

- to determine PV defined benefit obligation

PMv Dept Acc MSU 27

Post-employment benefits [cont’d]

- as well as current service cost

- N.B. current service cost is the increase

in the PV of defined benefit obligation

(DPO) resulting from employee service in the current period.

• Step 3

- determine FV of plan assets

- used to service the obligation to employees

mm

PMv Dept Acc MSU 28

Post-employment benefits [cont’d]

- N.B. plan assets are those assets set

aside to settle the obligation & comprise

. Assets held by an independently

administered fund

. Qualifying insurance policies (i.e

issued by insurer not a related

party)

PMv Dept Acc MSU 29

Post-employment benefits [cont’d]

Step 4

- determine amount recognised in profit or

loss:

. current service cost+ net interest+

past service cost

. N.B. past service cost is change in

PV of DBO resulting from

employee service in prior periods

due to:

PMv Dept Acc MSU 30

Post-employment benefits [cont’d]

- plan amendment(changes to

plan): or

- curtailment (significant

reduction in no. of employees covered by the plan)

. N.B. net interest is comprised of:

- interest income on plan assets

- interest expense on DBO

- interest effect of asset ceiling

PMv Dept Acc MSU 31

Post-employment benefits [cont’d]

Step 5

- determine amounts recognised in other

comprehensive income:

. actuarial gains or losses on plan obligation . return

on plan assets, excluding amounts already included

in net interest on net defined benefit liability/

asset

. changes in effect of asset ceiling.

PMv Dept Acc MSU 32

Post-employment benefits [cont’d]

. N.B. actuarial gains & losses result from:

- difference between calculated &

- actuarially-determined

- PV of DBO due to

- changes in actuarial assumptions

(demographic & financial variables)

&

- experience adjustments

PMv Dept Acc MSU 33

Post-employment benefits [cont’d]

. Return on plan assets represent:

- interest, dividends or other income

- received from plan assets &

- includes realised &

- unrealised gains & losses but

- deduct cost of managing plan assets

&

- any tax paid by the plan itself.

PMv Dept Acc MSU 34

Post-employment benefits [cont’d]

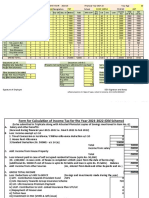

Ledger accounts necessary to account for DBP

plan asset a/c; plan obligation a/c; asset ceiling

a/c; employee benefit expense a/c (various sub

a/csa); & remeasurement a/c (various sub a/cs)

PMv Dept Acc MSU 35

Post-employment benefits [cont’d]

Plan asset a/c (summary of basic movements)

- Opening balance

- interest income (contra – EBE)

- Contributions by employer (contra - Bank)

- Contributions by employee (contra – Bank)

- less benefits paid (contra – Plan obligation)

- Return on plan assets (Balancing figure)

- Closing figure (FV of plan assets at year-end)

PMv Dept Acc MSU 36

Post-employment benefits [cont’d]

N.B.

- Plan asset balance is measured as:

. FV at year-end.

- Plan assets must:

. be held by a separate legal entity

. only be available to pay or fund employee

benefits; or

. be qualifying insurance policies

PMv Dept Acc MSU 37

Post-employment benefits [cont’d]

The plan obligation account (summary )

- b/f (PV of future obligations based on actuarial

assumptions at end of prior yr)

- Int. exp. (b/f PV x discount rate end prior yr)

- Service cost (+ in oblig. due to employee service)

- less benefits paid (actual payments made)

- actuarial gain/loss (balancing figure)

- c/f (PV of future oblig. based on end current yr

actuarial assumptions

PMv Dept Acc MSU 38

Post-employment benefits [cont’d]

Plan asset ceiling a/c (summary)

- b/f (PV of the adjustments at end prior yr)

- int. exp. (b/f (PV) x discount rate end prior yr)

- re-measurement adj. to current yr asset ceiling

at yr-end (current yr adj.)

- c/f (PV of adj, at end current yr

PMv Dept Acc MSU 39

Post-employment benefits [cont’d]

DBP employee benefit expense a/cs

- employee benefit expense includes only:

. interest on plan obligation , plan

asset & asset ceiling

. current & past service costs

. all other re-measurements are recognised

in OCI

PMv Dept Acc MSU 40

Post-employment benefits [cont’d]

DBP re-measurement a/cs

- re-measurements

. are recognised in OCI

. may never be reclassified to P/L

. a number of re-measurements possible

. each of which must be

. accounted for

. in separate ac/s for disclosure requirements

PMv Dept Acc MSU 41

Other long term benefits

Definition : All employee benefits other than

short-term, post-employment and termination

benefits

- Examples

. long-term paid absence

. jubilee and other long service benefits

. long-term disability benefits

PMv Dept Acc MSU 42

Recognition and measurement

Amount recognised in profit or loss

Current service cost + net interest + actuarial gains/

losses + past service cost + return on plan assets

Amount recognised in Statement of Financial

Position

PV of defined benefit obligation-FV of plan assets

PMv Dept Acc MSU 43

Termination Benefits

Definition :

- Employee benefits payable

- either as a result of the entity decision

- to terminate employment

- before the normal retirement age or

- the employee’s decision

- to accept voluntary redundancy offer

PMv Dept Acc MSU 44

Termination Benefits

Recognition and measurement

Recognise an expense and a liability when the

entity when the entity can no longer withdraw the

termination plan or restructuring provision in

terms of IAS 37 ( Including termination benefits )

is made. If benefits will not be settled wholly

within 12 months after the reporting date,

accounting is similar to other long-term benefits

(i.e. discounted)

PMv Dept Acc MSU 45

You might also like

- IAS 19 Employee BenefitsDocument22 pagesIAS 19 Employee Benefitsanon_419651076No ratings yet

- Ias 19-Employee BenefitsDocument3 pagesIas 19-Employee Benefitsbeth alviolaNo ratings yet

- FR17 - Employee Benefits (Stud) .Document45 pagesFR17 - Employee Benefits (Stud) .duong duongNo ratings yet

- BSA2201 - BED - Natividad, Jane Kyl G. - Exercise 1-Employee Benefits - Definition of TermsDocument3 pagesBSA2201 - BED - Natividad, Jane Kyl G. - Exercise 1-Employee Benefits - Definition of TermsKyla Gacula NatividadNo ratings yet

- IPSAS 25 Employees BenefitsDocument38 pagesIPSAS 25 Employees BenefitsREJAY89No ratings yet

- Actuarial Valuation of Employee Benefits Under Ifrs: 12 June 2009Document29 pagesActuarial Valuation of Employee Benefits Under Ifrs: 12 June 2009Akomolafe AdetutuNo ratings yet

- EXERCISE 1 (Intermediate Accounting 3)Document2 pagesEXERCISE 1 (Intermediate Accounting 3)Kyla Gacula NatividadNo ratings yet

- IAS 19 - Employee BenefitDocument49 pagesIAS 19 - Employee BenefitShah Kamal100% (2)

- IAS 19 SummaryDocument6 pagesIAS 19 SummaryMuchaa VlogNo ratings yet

- Handout 3.0 ACC 226 Sample Problems Employee BenefitsDocument12 pagesHandout 3.0 ACC 226 Sample Problems Employee BenefitsLyncee BallescasNo ratings yet

- Actuarial Valuation of Employee Benefits Under Ifrs: 12 June 2009Document29 pagesActuarial Valuation of Employee Benefits Under Ifrs: 12 June 2009Aadi BuilderNo ratings yet

- Module 11 - Employee BenefitsDocument8 pagesModule 11 - Employee BenefitsLuiNo ratings yet

- SBR - Chapter 5Document6 pagesSBR - Chapter 5Jason KumarNo ratings yet

- Employee BenefitDocument32 pagesEmployee BenefitnatiNo ratings yet

- Objectives: Chapter 5 - Employee Benefits - Ias 19Document82 pagesObjectives: Chapter 5 - Employee Benefits - Ias 19Tram NguyenNo ratings yet

- Ias 19 Employee BenefitsDocument43 pagesIas 19 Employee BenefitsHasan Ali BokhariNo ratings yet

- PAS 19 Employee Benefits: Short-Term Employee Benefits Are Employee Benefits (Other Than Termination BenDocument5 pagesPAS 19 Employee Benefits: Short-Term Employee Benefits Are Employee Benefits (Other Than Termination BenKaila Clarisse CortezNo ratings yet

- Lesson Employee BenefitDocument18 pagesLesson Employee BenefitDesiree GalletoNo ratings yet

- PAS 19 Employee BenefitsDocument62 pagesPAS 19 Employee BenefitsBenj FloresNo ratings yet

- MODULE Midterm FAR 3 EmpBenefitsDocument15 pagesMODULE Midterm FAR 3 EmpBenefitsKezNo ratings yet

- Employee BenefitsDocument9 pagesEmployee BenefitstinydmpNo ratings yet

- IAS 19 Employee Benefits (2021)Document6 pagesIAS 19 Employee Benefits (2021)Tawanda Tatenda Herbert100% (1)

- Employee Benefits Pas 19Document44 pagesEmployee Benefits Pas 19Joanne Rey OcanaNo ratings yet

- Employee BenefitsDocument9 pagesEmployee BenefitstinydmpNo ratings yet

- MODULE Midterm FAR 3 EmpBenefitsDocument15 pagesMODULE Midterm FAR 3 EmpBenefitsJohn Mark FernandoNo ratings yet

- Chapter 6 Employee Benefits (Part 2)Document21 pagesChapter 6 Employee Benefits (Part 2)not funny didn't laughNo ratings yet

- CFAS NotesDocument27 pagesCFAS NotesMikasa AckermanNo ratings yet

- PSAK 24-Imbalan KerjaDocument57 pagesPSAK 24-Imbalan KerjaMutiara RamadhantiNo ratings yet

- IAS 19 Employee Benefits StudentDocument40 pagesIAS 19 Employee Benefits StudentYI WEI CHANGNo ratings yet

- Ind-AS 19Document42 pagesInd-AS 19amarNo ratings yet

- Ias 19 Employee BeneftDocument24 pagesIas 19 Employee Beneftesulawyer2001No ratings yet

- Lecture Notes - IAS 19Document14 pagesLecture Notes - IAS 19Muhammed NaqiNo ratings yet

- LKAS 19 2021 UploadDocument31 pagesLKAS 19 2021 Uploadpriyantha dasanayake100% (1)

- Revised PAS 19 (PAS 19R) Employee Benefits Technical SummaryDocument4 pagesRevised PAS 19 (PAS 19R) Employee Benefits Technical SummaryJBNo ratings yet

- 19 Employee Benefits s22 - tesFINALDocument16 pages19 Employee Benefits s22 - tesFINALasiphileamagiqwa25No ratings yet

- Employee Benefits Related Standards: Pas 19 - Employee Benefits Pas 26 - Accounting & Reporting by Retirement Benefit PlansDocument10 pagesEmployee Benefits Related Standards: Pas 19 - Employee Benefits Pas 26 - Accounting & Reporting by Retirement Benefit PlansallyssajabsNo ratings yet

- IAS 19 Employee BenefitsDocument32 pagesIAS 19 Employee BenefitsTamirat Eshetu WoldeNo ratings yet

- M3L1 Employee Benefits: For Q3Document5 pagesM3L1 Employee Benefits: For Q3NaddieNo ratings yet

- Lecture # 11: Employee Benefits IAS-19Document3 pagesLecture # 11: Employee Benefits IAS-19ali hassnainNo ratings yet

- Ias 19Document5 pagesIas 19Tope JohnNo ratings yet

- Revised PAS 19Document2 pagesRevised PAS 19jjmcjjmc12345No ratings yet

- Employee Benefit (Ias 19) FinalDocument36 pagesEmployee Benefit (Ias 19) FinalKanbiro OrkaidoNo ratings yet

- IAS 19 Employee BenefitsDocument5 pagesIAS 19 Employee Benefitshae1234No ratings yet

- Liabilities - Debt RestructuringDocument4 pagesLiabilities - Debt RestructuringChinchin Ilagan DatayloNo ratings yet

- Chapter 5 Employee Benefit Part 1Document9 pagesChapter 5 Employee Benefit Part 1maria isabellaNo ratings yet

- IAS 19 - Employee BenefitsDocument1 pageIAS 19 - Employee BenefitsClarize R. MabiogNo ratings yet

- EmployeebenefitsreportDocument172 pagesEmployeebenefitsreportMikaela LacabaNo ratings yet

- Employer Benefit - Part 2Document9 pagesEmployer Benefit - Part 2Julian Adam PagalNo ratings yet

- Employee BenefitsDocument15 pagesEmployee BenefitsmengistuNo ratings yet

- Employee Benefits: PAS 19, PAS 20, PAS 23, and PAS 24 Philippine Accounting Standards 19 (PAS 19)Document10 pagesEmployee Benefits: PAS 19, PAS 20, PAS 23, and PAS 24 Philippine Accounting Standards 19 (PAS 19)Mica DelaCruzNo ratings yet

- MFRS 119 Employee BenefitsDocument38 pagesMFRS 119 Employee BenefitsAin YanieNo ratings yet

- April 7 - CH 20 Part IDocument21 pagesApril 7 - CH 20 Part IMichael NguyenNo ratings yet

- Pas 19Document38 pagesPas 19Justine VeralloNo ratings yet

- Lesson Six: Accounting For Employee BenefitsDocument27 pagesLesson Six: Accounting For Employee BenefitssamclerryNo ratings yet

- CH20 PDFDocument81 pagesCH20 PDFelaine aureliaNo ratings yet

- Ias 19 - Employee BenefitsDocument6 pagesIas 19 - Employee BenefitsIfyNo ratings yet

- CPA Review Notes 2019 - Audit (AUD)From EverandCPA Review Notes 2019 - Audit (AUD)Rating: 3.5 out of 5 stars3.5/5 (10)

- Mega Project Assurance: Volume One - The Terminological DictionaryFrom EverandMega Project Assurance: Volume One - The Terminological DictionaryNo ratings yet

- ch02 - Financial Planning Skills-Tb - Mckeown - 2eDocument18 pagesch02 - Financial Planning Skills-Tb - Mckeown - 2e李佳南No ratings yet

- Can Indonesia Reform Its Tax System? Problems and Options: Tulane Economics Working Paper SeriesDocument46 pagesCan Indonesia Reform Its Tax System? Problems and Options: Tulane Economics Working Paper SeriesSwastik GroverNo ratings yet

- 4 Direct Tax RevisionDocument149 pages4 Direct Tax RevisionDeep MehtaNo ratings yet

- FAR Problem SET A PDFDocument11 pagesFAR Problem SET A PDFNicole Aragon0% (1)

- Government Public Works Department Establishment Branch: of West BengalDocument1 pageGovernment Public Works Department Establishment Branch: of West BengalKalyan ProdhanNo ratings yet

- Fixed Medical AllowanceDocument1 pageFixed Medical Allowancev.s.r.srikanth08No ratings yet

- Conceptual Framework: & Accounting StandardsDocument61 pagesConceptual Framework: & Accounting StandardsAmie Jane Miranda100% (1)

- TDS TRS GST (2) 20211228151919Document38 pagesTDS TRS GST (2) 20211228151919Rishi PriyadarshiNo ratings yet

- Co Ownership Estates and TrustsDocument26 pagesCo Ownership Estates and TrustsMa. Angelica Celina MoralesNo ratings yet

- Income Taxation of IndividualsDocument26 pagesIncome Taxation of Individualsarkisha100% (1)

- Corporate Income TaxDocument24 pagesCorporate Income TaxRIRI RUMAIZHANo ratings yet

- Concentrix Daksh Services India Private Limited Payslip For The Month of May - 2022Document1 pageConcentrix Daksh Services India Private Limited Payslip For The Month of May - 2022Sayan DasNo ratings yet

- 23.2 Refr. Pass - Leave RuleDocument79 pages23.2 Refr. Pass - Leave RuleSantosh KumarNo ratings yet

- City of Naples & IAFF (Firefighters) Negotiation Minutes - Nov. 9, 2021Document2 pagesCity of Naples & IAFF (Firefighters) Negotiation Minutes - Nov. 9, 2021Omar Rodriguez OrtizNo ratings yet

- Maple Leaf Garden - Case AnalysisDocument11 pagesMaple Leaf Garden - Case AnalysisagawlickaNo ratings yet

- P AccoDocument9 pagesP Acco224252No ratings yet

- Pelenio - Abm 12-ADocument2 pagesPelenio - Abm 12-AAAAAANo ratings yet

- Rule-Eng 6 2014-2-13 298Document63 pagesRule-Eng 6 2014-2-13 298utsavgautamNo ratings yet

- Updated Corecopy Fy 2021-22Document4 pagesUpdated Corecopy Fy 2021-22PriyanshuNo ratings yet

- IT II AnswerDocument4 pagesIT II AnswerChandhini RNo ratings yet

- 4.2 Home Assignment Questions - Income From SalaryDocument3 pages4.2 Home Assignment Questions - Income From SalaryAashi Gupta100% (1)

- Government Schemes Marathon - FinalDocument82 pagesGovernment Schemes Marathon - FinalabhishekNo ratings yet

- Accounting For State and Local Governmental Units - Proprietary and Fiduciary FundsDocument52 pagesAccounting For State and Local Governmental Units - Proprietary and Fiduciary FundsElizabeth StephanieNo ratings yet

- CPF Annual Report 2020Document22 pagesCPF Annual Report 2020AlioNo ratings yet

- Pay Slip 17623 March, 2022Document1 pagePay Slip 17623 March, 2022Abrham TadesseNo ratings yet

- MPU3353-Quiz 4 QuestionsDocument2 pagesMPU3353-Quiz 4 QuestionsRishiaendra CoolNo ratings yet

- Payslip Nov - Sailu1Document2 pagesPayslip Nov - Sailu1Christine Hall0% (1)

- Monthly Salary & Other Income Statement: 2008-09Document26 pagesMonthly Salary & Other Income Statement: 2008-09api-26910047No ratings yet

- Paying Your Income Taxes Note Taking GuideDocument4 pagesPaying Your Income Taxes Note Taking GuideMaggie ScottNo ratings yet

- Bill of Supply For Electricity: Due DateDocument1 pageBill of Supply For Electricity: Due DateDivyanshu GuptaNo ratings yet