Professional Documents

Culture Documents

UNIT-IV Circular Flow of Income

Uploaded by

sheetal rajput0 ratings0% found this document useful (0 votes)

9 views22 pagesunit 4

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentunit 4

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

9 views22 pagesUNIT-IV Circular Flow of Income

Uploaded by

sheetal rajputunit 4

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 22

UNIT-IV

CIRCULAR FLOW OF INCOME

Introduction

• The term circular flow of income or circular flow of

economic activity refers to a simple economic model

which describes the circulation/flow of income

between producers and consumers.

• In the circular flow model, producer is referred to as

firms and consumer are referred to as households.

• The major exchanges are represented as flows of

money, goods and services, etc.

Determinants

Household Firms

Financial Foreign Sector

Institutions Government

Households

• It is a person or group of people that share their income.

• Require goods and services to satisfy their personal

wants.

• Owns all resources ( i.e. labor, capital, land

enterprise)

• The members of households have two functions.

1. They supply different factors of production.

2. Members of household also work as consumers

Firms

• An organization that produces goods and services for sale.

• Main objective is to maximize profit in the production process

• Uses resources provided by households to products goods

and services

• Sells those good and services for income

• The two main functions are as follows:

1. Produce goods and series and supply them in the market

2. Firms purchase inputs or raw materials from households to use

them in the production process

Government

• Just like households and firms the government also

earns incomes and makes expenses.

• Two major functions are:

1. Government earns revenue from either tax or non tax

sources both from households and firms.

2. Government provides essential public services such as

maintenance of law and order, defence services,

judiciary etc.

Financial Institutions

• Consists of banks and non-bank intermediaries who

engage in the borrowing (savings from households)

and lending of money

• The leakage that financial institutions provide in the

economy is the option for households to save their

money.

Foreign Sector

• It consists of two kinds of international economic

transactions i.e.

1. Export and import of goods and services

2. Inflow and outflow of capital.

MODELS

Three

Two

Secto

secto

r

r

Four Five

Secto Secto

r r

Two Sector Model

• In the basic circular flow of income, or two sector

circular flow of income model, the state of equilibrium

is defined as a situation in which there is no tendency

for the levels of income (Y), expenditure (E) and output

(O) to change, that is:

• Y=E=O

• This means that the expenditure of buyers (households)

becomes income for sellers (firms). The firms then spend

this income on factors of production such as labour,

capital and raw materials, "transferring" their income to

the factor owners. The factor owners spend this income

on goods which leads to a circular flow of income.

Three Sector Model

• It includes household sector, producing sector and

government sector.

• Here flows from household sector and producing

sector to government sector are in the form of taxes.

• The income received from the government sector

flows to producing and household sector in the form

of payments for government purchases of goods and

services as well as payment of subsidies and transfer

payments.

Four Sector Model

• A modern monetary economy comprises a network of four sector

economy these are:

1. Household sector

2. Firms or Producing sector

3. Government sector

4. Financial sector.

• Each of the above sectors receives some payments from the other

in lieu of goods and services which makes a regular flow of goods

and physical services. Money facilitates such an exchange smoothly.

• Financial institutions role it is to accept and protect the savings of

consumers and to make investment funds available to producers

Five Sector Model

• In the five sector model the economy is divided

into five sectors:

1. Household sector

2. Firms or Producing sector

3. Financial sector :

4. Government sector

5. Rest of the world sector: transforms the model from a

closed economy to an open economy.

Leakages and Injections

LEAKAGES INJECTIONS

SAVINGS( S) INVESTMENTS (I)

TAXES ( T) GOVERNMENT SPENDINGS ( G)

IMPORTS (I) EXPORTS (E)

• Leakage means withdrawal from the flow. When

households and firms save part of their incomes it

constitutes leakage. They may be in form of savings,

tax payments, and imports. Leakages reduce the flow

of income.

• Injection means introduction of income into the flow.

When households and firms borrow the savings, they

constitute injections. Injections increase the flow of

income. Injections can take the forms of investment,

government spending and exports.

THE State of Equilibrium

• In terms of the five sector circular flow of income

model the state of equilibrium occurs when the total

leakages are equal to the total injections that occur in

the economy. This can be shown as:

• Savings + Taxes + Imports = Investment +

Government Spending + Exports

• S+T+M=I+G+X

Dis- equilibrim

• If the state of the sum of total leakages does not equal

the sum of total injections it will result in

disequilibrium. Disequilibrium can be shown as:

• Savings + Taxes + Imports ≠ Investment +

Government Spending + Exports

• S+T+M≠I+G+X

Significance

• Measurement of national income - National income is an

estimation of aggregation of any of economic activity of

the circular flow. It is either the income of all the factors of

production or the expenditure of various sectors of

economy.

• Knowledge of interdependence - Circular flow of income

signifies the interdependence of each of activity upon one

another. If there is no consumption, there will be no

demand and expenditure which in fact restricts the

amount of production and income.

• Unending nature of economic activities - It signifies that

production, income and expenditure are of unending

nature, therefore, economic activities in an economy can

never come to a halt. National income is also bound to rise

in future.

You might also like

- Circular FlowDocument25 pagesCircular FlowAbhinav SachdevaNo ratings yet

- Tutorial Cc3 Circular Flow-1Document14 pagesTutorial Cc3 Circular Flow-1sommelierNo ratings yet

- Circular Flow of Income 1.14Document20 pagesCircular Flow of Income 1.14Subham .MNo ratings yet

- Circular Flow of IncomeDocument19 pagesCircular Flow of IncomePooja LakraNo ratings yet

- Circular Flow of Income Model in 40 CharactersDocument19 pagesCircular Flow of Income Model in 40 CharactersHaren ShylakNo ratings yet

- Circular Flow of Income and Expenditure in Two Three & Four SectorDocument23 pagesCircular Flow of Income and Expenditure in Two Three & Four SectorUP 16 GhaziabadNo ratings yet

- Managerial Economics Circular Flow ExplainedDocument12 pagesManagerial Economics Circular Flow ExplainedPrerikaNo ratings yet

- Power Point Circular FlowDocument30 pagesPower Point Circular FlowRoselle Perez- Bariuan75% (4)

- Unit 2 Circular FlowDocument62 pagesUnit 2 Circular Flowk pradeepaNo ratings yet

- Unit 2 Circular FlowDocument62 pagesUnit 2 Circular FlowAnshumaan PatroNo ratings yet

- Intermediate Macro Assignment Pp CopyDocument6 pagesIntermediate Macro Assignment Pp Copyha9443854No ratings yet

- Income Expenditure FlowsDocument20 pagesIncome Expenditure FlowsKurt Geeno Du VencerNo ratings yet

- Chapter Objectives - Chapter 2 Chapter Objectives - Chapter 2Document15 pagesChapter Objectives - Chapter 2 Chapter Objectives - Chapter 2Pratima duaNo ratings yet

- 2 LectureDocument51 pages2 Lecturevisiontanzania2022No ratings yet

- Ecom 1stDocument10 pagesEcom 1stakash hossainNo ratings yet

- Internals 1Document16 pagesInternals 1Pavan H.P.No ratings yet

- Circular Flow of IncomeDocument8 pagesCircular Flow of IncomeAakshaj SharmaNo ratings yet

- Circular Flow of Economic Activity - EconTipsDocument5 pagesCircular Flow of Economic Activity - EconTipsAyush KumarNo ratings yet

- Module 1 - Cirular Flow of IncomeDocument18 pagesModule 1 - Cirular Flow of IncomePrashastiNo ratings yet

- Econ. 101: Basic Economics With Taxation and Agrarian ReformDocument14 pagesEcon. 101: Basic Economics With Taxation and Agrarian ReformAnime&Gaming 07No ratings yet

- Macroeconomics: Dr. Algassim Mohamed Ebrahim University of Khartoum School of Management Studies Undergraduate ProgramDocument30 pagesMacroeconomics: Dr. Algassim Mohamed Ebrahim University of Khartoum School of Management Studies Undergraduate ProgramAmiraNo ratings yet

- Macro Econ MyDocument54 pagesMacro Econ MyAmiraNo ratings yet

- Circular Flow of IncomeDocument32 pagesCircular Flow of IncomeTarun SukhijaNo ratings yet

- Circular FlowDocument10 pagesCircular FlowRosismita BaralNo ratings yet

- IV Concepts of National Income, GDP, GNP, Circular FlowDocument8 pagesIV Concepts of National Income, GDP, GNP, Circular FlowPiyush AneejwalNo ratings yet

- Unit 3Document24 pagesUnit 3Eric Bashi Femi MulengaNo ratings yet

- #1 National IncomeDocument37 pages#1 National Incomerupnath10102002No ratings yet

- Circular Flow of Economic Activity EditedDocument23 pagesCircular Flow of Economic Activity EditedAbhishek Abhiranjan100% (1)

- lecture1Document74 pageslecture1Edward Gabada JnrNo ratings yet

- 4.3 Analyses Alterna Tive Approaches To National Accounti NG Using The Circular Flow of Nat Ional IncomeDocument5 pages4.3 Analyses Alterna Tive Approaches To National Accounti NG Using The Circular Flow of Nat Ional IncomeHiranya DissanayakeNo ratings yet

- Circular Flow of IncomeDocument193 pagesCircular Flow of Incomeallah dittaNo ratings yet

- Lecture 2. Mr. AllicockDocument60 pagesLecture 2. Mr. AllicockPrecious MarksNo ratings yet

- Circular Flow of National IncomeDocument29 pagesCircular Flow of National IncomeRiyaNo ratings yet

- Chapter2 DwivediDocument14 pagesChapter2 Dwivediindrapal kumarNo ratings yet

- 2 Circular FlowDocument28 pages2 Circular Flownainypassi100% (1)

- Theory of National IncomeDocument72 pagesTheory of National IncomeAlex RockNo ratings yet

- Stages of Development of EconomicsDocument37 pagesStages of Development of Economicsaditya mhatreNo ratings yet

- ECO113 Lecture 34 Income Ans ExpDocument47 pagesECO113 Lecture 34 Income Ans ExpShivam YadavNo ratings yet

- Circular Flow of MoneyDocument10 pagesCircular Flow of MoneyMadhumitha BalasubramanianNo ratings yet

- Circular FlowDocument11 pagesCircular Flowyeswanth sai challagollaNo ratings yet

- Circular Flow ModelDocument12 pagesCircular Flow ModelpodderNo ratings yet

- MBA I Unit V Managerial EconomicsDocument11 pagesMBA I Unit V Managerial EconomicsSumitNo ratings yet

- Economics - Four Sector Circular Flow of IncomeDocument6 pagesEconomics - Four Sector Circular Flow of Incomekamalia2308100% (1)

- Economics GR12 StudyguideDocument169 pagesEconomics GR12 StudyguideTina PhakathiNo ratings yet

- Circular Flow of EconomyDocument12 pagesCircular Flow of EconomyGurjyot SinghNo ratings yet

- 14.national IncomeDocument14 pages14.national IncomeSmita AdhikaryNo ratings yet

- Economics Grade 11 Term 1 Week 3 - 2021-1Document4 pagesEconomics Grade 11 Term 1 Week 3 - 2021-1simphiweramagoma22No ratings yet

- Module - 4 National IncomeDocument64 pagesModule - 4 National Incomelakshmi dileepNo ratings yet

- Macroeconomics Review: Mr. Remigio G. TiambengDocument25 pagesMacroeconomics Review: Mr. Remigio G. TiambengPamela EuniseNo ratings yet

- Chapter 7 Measuring National IncomeDocument39 pagesChapter 7 Measuring National Incomehidayatul raihanNo ratings yet

- Unit 5Document13 pagesUnit 5boomeshreddy8No ratings yet

- Revised Supplementary Material Semester 2 2013Document98 pagesRevised Supplementary Material Semester 2 2013HeoHamHốNo ratings yet

- Introduction To MacroeconomicsDocument45 pagesIntroduction To MacroeconomicsAnkita MalikNo ratings yet

- BBAEZ4A CHAPTER 3 Production, Income and Spending in The Mixed EconomyDocument35 pagesBBAEZ4A CHAPTER 3 Production, Income and Spending in The Mixed EconomyEl-rohy KalongoNo ratings yet

- Binder 1Document64 pagesBinder 1El-rohy KalongoNo ratings yet

- Q 7: What Is The Difference Between Open Economy and Close Economy? ExplainDocument4 pagesQ 7: What Is The Difference Between Open Economy and Close Economy? ExplainnickcrokNo ratings yet

- The Circular Flow Model of Income: and ItsDocument36 pagesThe Circular Flow Model of Income: and ItsM Shubaan Nachiappan(Student)No ratings yet

- Circular Flow of EconomicsDocument7 pagesCircular Flow of EconomicsAmandeep sainiNo ratings yet

- Fundamentals of Business Economics Study Resource: CIMA Study ResourcesFrom EverandFundamentals of Business Economics Study Resource: CIMA Study ResourcesNo ratings yet

- Business Economics: Business Strategy & Competitive AdvantageFrom EverandBusiness Economics: Business Strategy & Competitive AdvantageNo ratings yet

- @definition ClausesDocument36 pages@definition Clausessheetal rajputNo ratings yet

- @CPC - Decree and JudgmentDocument28 pages@CPC - Decree and Judgmentsheetal rajputNo ratings yet

- Elderly Rights-LACDocument6 pagesElderly Rights-LACsheetal rajputNo ratings yet

- @CPC IntroductionDocument20 pages@CPC Introductionsheetal rajputNo ratings yet

- Ms Teacher Draft SuchiDocument428 pagesMs Teacher Draft Suchisheetal rajputNo ratings yet

- 5 6298449104406054359Document4 pages5 6298449104406054359sheetal rajputNo ratings yet

- " T 1.) H Of: Ffirf++rq (Document5 pages" T 1.) H Of: Ffirf++rq (sheetal rajputNo ratings yet

- Model Answer Key Economics-IiDocument17 pagesModel Answer Key Economics-Iisheetal rajputNo ratings yet

- Unit - Vii Commercial BanksDocument14 pagesUnit - Vii Commercial Bankssheetal rajputNo ratings yet

- Boost Arya Appeal Against NGT Order on Environmental DamageDocument24 pagesBoost Arya Appeal Against NGT Order on Environmental Damagesheetal rajputNo ratings yet

- Unit-Vii Types of BanksDocument18 pagesUnit-Vii Types of Bankssheetal rajputNo ratings yet

- EAM ODE: 5 Surana & Surana and UILS - National Environmental Law Moot Court Competition, 2023Document27 pagesEAM ODE: 5 Surana & Surana and UILS - National Environmental Law Moot Court Competition, 2023sheetal rajputNo ratings yet

- SyllabusDocument4 pagesSyllabussheetal rajputNo ratings yet

- LAC Report 2021-2022Document29 pagesLAC Report 2021-2022sheetal rajputNo ratings yet

- Gender EqualityDocument8 pagesGender Equalitysheetal rajputNo ratings yet

- Course Outline Economics-IIDocument3 pagesCourse Outline Economics-IIsheetal rajputNo ratings yet

- Right To Education - Speed MentoringDocument16 pagesRight To Education - Speed Mentoringsheetal rajputNo ratings yet

- UNIT-II Macroeconomic School of ThoughtDocument28 pagesUNIT-II Macroeconomic School of Thoughtsheetal rajputNo ratings yet

- Project Topics Constitutional Law IDocument3 pagesProject Topics Constitutional Law Isheetal rajputNo ratings yet

- 7 Hostile Witness Foe or Victim Siddhi Vhora 27218Document15 pages7 Hostile Witness Foe or Victim Siddhi Vhora 27218ManishNo ratings yet

- Sapinda Relationships RulesDocument4 pagesSapinda Relationships RulesRadheyNo ratings yet

- MergedDocument922 pagesMergedsheetal rajputNo ratings yet

- Criminal Law IIDocument96 pagesCriminal Law IImohd sakibNo ratings yet

- 5th GNLU Essay Competition On Law and EconomicsDocument7 pages5th GNLU Essay Competition On Law and Economicssheetal rajputNo ratings yet

- Capital Formation in Agriculture PDFDocument17 pagesCapital Formation in Agriculture PDFArya SenapatiNo ratings yet

- Synopsis ON ": The Indian Aviation Industry "Document4 pagesSynopsis ON ": The Indian Aviation Industry "Niti GaurNo ratings yet

- SOF Tonasa Line X Voy. 86Document81 pagesSOF Tonasa Line X Voy. 86Galy AriyandyNo ratings yet

- E-COMPANY PROFILE KMR 2020-NewDocument10 pagesE-COMPANY PROFILE KMR 2020-NewLeonardoNo ratings yet

- Indian Economy by Ramesh Singh 11 EditionDocument47 pagesIndian Economy by Ramesh Singh 11 Editionanon_726388494No ratings yet

- Rock reinforcement solutions case studyDocument15 pagesRock reinforcement solutions case studySEDIMNo ratings yet

- Sound Transit - Point Defiance Bypass PresentationDocument18 pagesSound Transit - Point Defiance Bypass PresentationThe UrbanistNo ratings yet

- Economy of AustraliaDocument5 pagesEconomy of AustraliaAalok GhoshNo ratings yet

- India Real Estate a Decade From Now 2024 11102 (2)Document40 pagesIndia Real Estate a Decade From Now 2024 11102 (2)c.k.sathiishNo ratings yet

- Business Organization and the Factors of ProductionDocument29 pagesBusiness Organization and the Factors of ProductionKatrina EustaceNo ratings yet

- Technology and Livelihood Education Quarter 1, Wk.2 - Module 2 Afa-Agri Crop Production-Sharpening ToolsDocument12 pagesTechnology and Livelihood Education Quarter 1, Wk.2 - Module 2 Afa-Agri Crop Production-Sharpening Toolsjose ariel barroa jrNo ratings yet

- India's Economy on the Eve of IndependenceDocument38 pagesIndia's Economy on the Eve of IndependenceAlans TechnicalNo ratings yet

- Unifine Richardson Fall 2012 Raw Honey Supply Chain DocumentDocument12 pagesUnifine Richardson Fall 2012 Raw Honey Supply Chain DocumentDeepakSuhagNo ratings yet

- 250 Question Insurance LawDocument43 pages250 Question Insurance LawShivansh MishraNo ratings yet

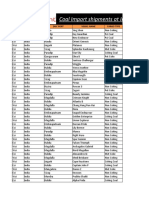

- Coal Import Shipments at India's 32 Major Ports Updated As On 25 Nov, 2020Document17 pagesCoal Import Shipments at India's 32 Major Ports Updated As On 25 Nov, 2020vinod mandalNo ratings yet

- Pakistan's Growing Milk SectorDocument13 pagesPakistan's Growing Milk SectorIbad DesmukhNo ratings yet

- Aia Smart Growth BrochureDocument8 pagesAia Smart Growth BrochurebutterNo ratings yet

- 12 - 13 - Bus Terminal Survey QuestionnaireDocument2 pages12 - 13 - Bus Terminal Survey QuestionnairehariNo ratings yet

- Valuation New 1 PDFDocument1 pageValuation New 1 PDFDnyaneshwar Dattatraya PhadatareNo ratings yet

- Activity 7 International FinancesDocument4 pagesActivity 7 International FinancesJesus DavidNo ratings yet

- Expanding Insurance Access for Low-Income HouseholdsDocument5 pagesExpanding Insurance Access for Low-Income HouseholdsMeshayu RenaNo ratings yet

- Re-Evaluation of The NH-67, Coimbatore-Mettupalayam Bypass ProjectDocument12 pagesRe-Evaluation of The NH-67, Coimbatore-Mettupalayam Bypass ProjectthilagaNo ratings yet

- Cost of Milk Production in NepalDocument27 pagesCost of Milk Production in NepalGaurav PradhanNo ratings yet

- 9116 - วิจัยบท1 5 1Document65 pages9116 - วิจัยบท1 5 1Ning NichakornNo ratings yet

- Deregulation of Petrol PricesDocument16 pagesDeregulation of Petrol PricesKumar AnandNo ratings yet

- Brewed Coffee Routine (Clover) - Quick Reference GuideDocument1 pageBrewed Coffee Routine (Clover) - Quick Reference GuideMr. KhanNo ratings yet

- Daily raw material stock levels at Penden CementDocument1 pageDaily raw material stock levels at Penden CementTenzin WangchukNo ratings yet

- Road Design & Construction GuideDocument19 pagesRoad Design & Construction GuideMonishaNo ratings yet

- AP Human Geography Chapter 12 NotesDocument17 pagesAP Human Geography Chapter 12 NotesSeth Adler86% (72)